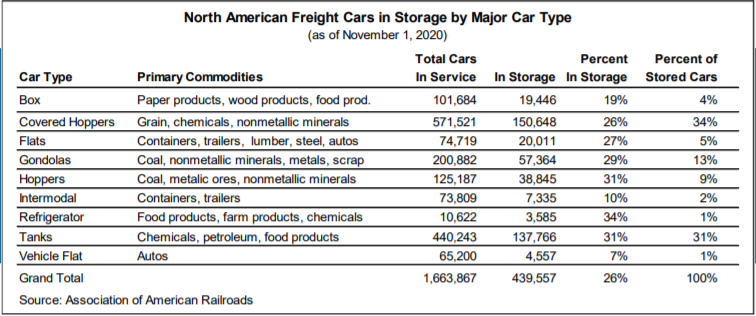

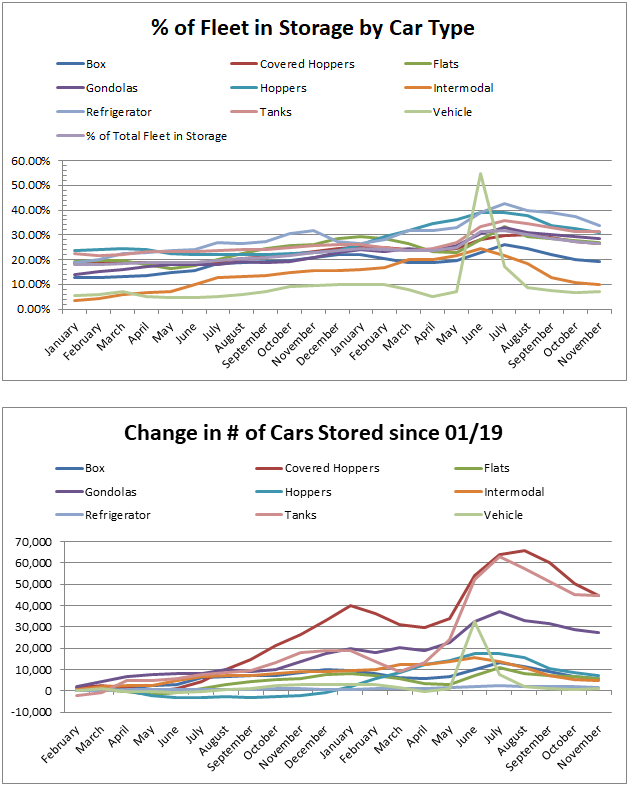

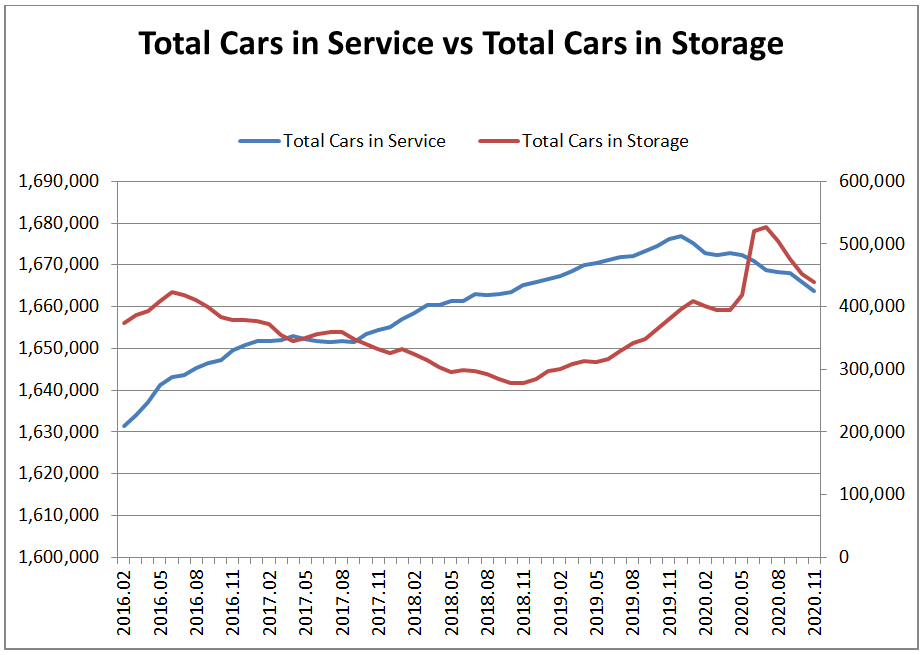

As of November 1st, the total number of cars in storage continued to decline for the fourth consecutive month, to 439,557 cars in storage. This represented a month over month decline of 12,224 stored cars or -2.71%. This is on par with our thesis that the number of cars in storage would continue to normalize but likely at a slower pace as we head through the end of the year. The number of cars in storage remains 59,561 cars (15.67%) higher than this time last year, but improved from 88,141 cars higher year over year at the start of October. Despite total cars in service continuing to decrease, the percentage of the total fleet in storage declined to 26.42% from 27.12% last month. We still have a ways to go as this time last year 22.67% of the total fleet was in storage. Finally, looking at pre-pandemic levels, we are 45,707 cars (11.61%) higher than where we were on March 1, 2020.

Every category we track saw a 3rd consecutive month over month decline in the number of cars in storage except for vehicle cars, which increased by roughly 300 cars. PFL will be keeping a close eye on this category as it was one of the first and the hardest hit coming into the pandemic, and also one of the first to recover. The number of vehicle cars in storage is a good proxy for the overall economy because it is an indicator of domestic consumption. The number of them in storage is still pretty normal by historical standards but readers should also take into account that over 1000 have been removed from service since March. Evidence of this continued downtrend (except in Vehicle cars) is in the charts below.

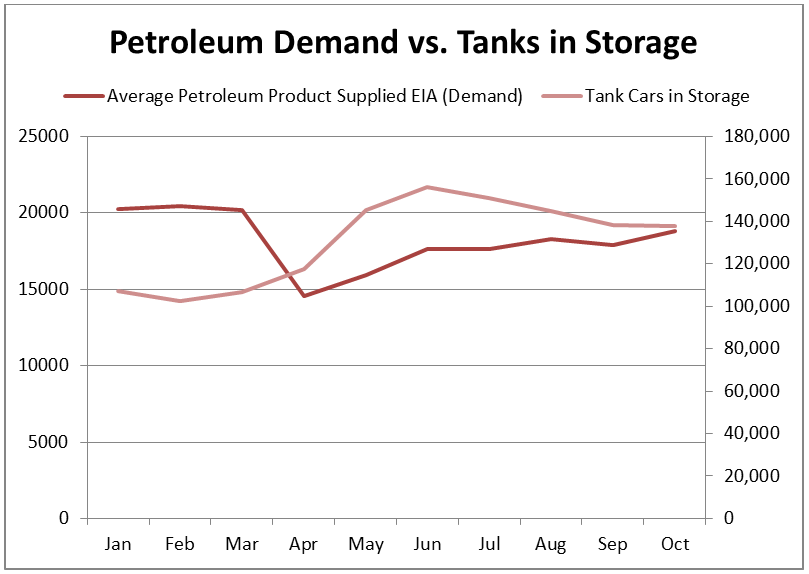

The percentage of tank cars in storage was nearly flat Month over Month declining by just under .2%. The number of tanks in storage had been declining by roughly 6000 cars per month for the last three months, and this month declined by just 600. When tracking the number of tanks in storage it is important to note that Petroleum and Petroleum product carloads were down by 21.9% in week 44. This is still one of the hardest hit traffic categories more than 7 months into the pandemic. Although petroleum demand still remains to be a big unknown, we expect this will have a major influence on the number of tank cars in storage.

Railroads and railcar leasing companies are beginning to shift their tones to be more optimistic, especially as railroad traffic has experienced 4 straight weeks of year over year traffic growth. This improvement is an encouraging sign not seen since the beginning of 2019. On improving traffic, Jean Savage, the new Chief Executive of Trinity said: “I think this has us all thinking maybe it’s going in the right direction there.” She added, “And then we’ve had 75,000 cars come out of storage in the last quarter. So, that’s also a great indicator that things might be heading up. So we may have bottomed and started the upturn.” Greenbrier is also optimistic, but cautious. “Economic uncertainty persists across all our end markets, but there are pockets of recovery if longer-term trends are favorable,” said Greenbrier CEO Bill Furman. Both companies spoke of an increased pipeline of inquiries for new and existing rail equipment.

On the manufacturing side, it looks like we are headed for a contraction of the number of cars in service for the first time in 10 years. Trinity’s Jean Savage said “That’s also a benefit for getting some cars out of the system and then opening up the need for new railcar deliveries”. Trinity is estimating that for the industry to get to the point where there is demand to replace railcars, about 85%-87% of the US fleet needs to be moving. We are currently at 73.58% of the total fleet in service. With roughly 55,000 cars estimated to be scrapped, and 31,000 estimated new deliveries, that would be a net of 24,000 cars removed from the total fleet.

Call PFL For All Your Railcar Storage Needs Today – We have spaces to offer you North America Wide 239-390-2885

If you are need of or have storage available or if you need maintenance, the cleaning of cars or are looking to reposition cars in a cost effective manner, call PFL today! We can trouble shoot your situation and work diligently to find a solution for you!

If you are a leasing company and having cars being returned on lease call PFL today to secure a return on lease location.

Live Railcar Storage Availability

As a storage operator or a user of storage, PFL can help maximize your profitability. PFL offers turn-key solutions to operators and users alike. PFL Field Services LLC is preforming work inside many storage operations and short lines. PFL Field Services will clean railcars, service railcars cars and scrap cars on a mobile basis with a PFL Guarantee and has crews available ready to serve you today no matter where you are at in the country. We have acquired top rated, brand new equipment to service you the customers. PFL Field Services also offers inspection services from top rated qualified inspectors now full time at PFL. Call us today to book a time! Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs onsite at a storage facility. Saving a user empty moves to a shop. Not only is it more efficient saving time and money for the car owner or lessee and lessor but retains the short lines storage customer at the facility over the long term. PFL handles loaded storage, empty storage mobile railcar cleaning, blasting, mobile railcar repair and scrapping of all railcars at storage facilities across the country. If you are an operator and have cars onsite that your customers need to have work done let them know you can do it via PFL Field Services. We can assist on return on lease scenarios saving Lessor and Lessee thousands of dollars. Call the desk today 239-390-2885.