“There are many qualities which we need in order to gain success, but the three above all—for the lack of which no brilliancy and no genius can atone—are Courage, Honesty and Common Sense.” – Theodore Roosevelt

COVID 19

The United States currently has 10,288,480 confirmed COVID 19 cases and 243,768 confirmed deaths.

US Jobless Claims

The U.S. Labor Department stated on Thursday of last week that U.S. workers filed an additional 751,000 initial jobless claims. The number of first-time filers for unemployment benefits were higher than expected and were estimated to come in at 741,000. This was the third straight week that claims were below 800,000, and the four-week moving average fell to 787,000.

The Bureau of Labor Statistics reported on November 6 that a preliminary 638,000 net new jobs were added in October 2020. That’s the sixth straight month with employment gains, but it’s the smallest gain in those six months. Some economists think the slowdown in job gains is a sign that firms have, by and large, rehired the workers they need to meet current demand. Still, private sector job gains in October – 906,000 were more than most economists expected. Gains in October included 271,000 in leisure and hospitality (mostly restaurants); 104,000 retail workers; and 84,000 construction workers. Government employment fell by 268,000 and wasled by a loss of 147,000 temporary 2020 Census workers. In March and April, a net 22.2 million jobs were lost. In the six months since then, 12.1 million jobs were gained, leaving a remaining net loss of 10.0 million.

The official unemployment rate was 6.9% for October, down from 7.9% in September and down from a peak of 14.7% in April.

Dow Wraps Up a Strong Week

The Dow closed lower on Friday, down 66.78 points (-0.03%) closing out the week at 28,323.4 points but up a whopping 1,821.80 points week over week in a post-election relief rally. It is highly likely that the GOP will retain the senate making it tougher for the DEMS to institute some of their policies such as the green new deal. The S&P 500 closed lower on Friday as well, down 1.01 points closing out the week at 3,509.44 points, up 239.48 points week over week . The Nasdaq Composite closed higher on Friday, up 4.3 points (0.04%) closing out the week at 11,895.23 points up 983.64 points week over week.

In overnight trading, DOW futures traded higher and are expected to open down this morning 1,400 points.

Oil Ends the Week Weaker

Oil dropped 4.3 percent on Friday, the largest one-day decline in more than a week. Increasing expectations over OPEC+ delaying its planned output increase in January and a post-election rally in equities helped crude prices with a strong start to the week. But a string of renewed lockdowns in Europe and record case counts in the U.S. kept any upward price momentum in check. West Texas Intermediate for December delivery fell $1.65 on Friday of last week to end the session at US$37.14/bbl, but up 3.8% week over week.

Brent for January settlement lost $1.48 to end the Friday’s session at U.S $39.45/bbl. Brent gained 5.3% week over week.

U.S. crude inventories decreased by 8.0/MMbbls last week and now stand at 484 MM/bbls, according to the EIA. Crude oil inventories remain above the five-year average for this time of the year when demand tends to be weaker. Refinery utilization was up 0.7% Refineries in the prior week processed 13.6 million bpd of crude oil, operating at 75.3 percent of capacity. U.S. gasoline inventories increased by 1.5/MMbbls last week and now stand at 257.624 MM/bbl. Gasoline production averaged 9.1 million bpd last week, slightly down from the previous week. U.S. distillate inventories were down by -1.6MM/bbls and now stands at 154.625 MM/bbls.

Oil is higher in overnight trading and, and WTI is poised to open at $37.90, up 76 cents per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were up 2.1% year over year in week 44 (U.S. +2.1%, Canada +5.8%, Mexico -11.9%), resulting in quarter to date volumes that are up 1.8% and year to date volumes that are down 8.7% (U.S. -9.3%, Canada -6.2%, Mexico -10.9%). 3 of the AAR’s 11 major traffic categories posted year over year increases with the largest increases coming from intermodal (+10.8%) and grain (+18.4%). The largest decrease came from coal (-17.6%).

In the East

CSX’s total volumes were up 2.9%, with the largest increase coming from intermodal (+13.4%). The largest decreases came from coal (-17.3%) and stone sand & gravel (-22.5%). NS’s total volumes were down 1.9%, with the largest decreases coming from coal (-17.3%), petroleum (-51.2%) and motor vehicles & parts (-13.7%). The largest increase came from intermodal (+6.0%).

In the West

BN’s total volumes were down 1.1%, with the largest decreases coming from coal (-26.0%) and petroleum (-34.0%). The largest increases came from intermodal (+9.5%) and grain (+25.0%). UP’s total volumes were up 2.0%, with the largest increases coming from intermodal (+11.0%) and grain (+38.9%). The largest decreases came from coal (-17.1%) and petroleum (-38.9%).

In Canada

CN’s total volumes were up 4.1% with the largest increases coming from intermodal (+24.8%) and grain (+37.8%). The largest decreases came from metallic ores (-39.1%), petroleum (-26.2%) and motor vehicles & parts (-24.1%). RTMs were up 9.2%. CP’s total volumes were up 5.8%, with the largest increases coming from intermodal (+9.9%) and farm products (+76.3%). The largest decrease came from petroleum (-26.6%). RTMs were up 5.9%.

Kansas City Southern

KCS’s total volumes were up 0.1%, with the largest increase coming from petroleum (+31.0%). The largest decrease came from intermodal (-7.6%).

Changes in energy markets continue to pressure carloads of coal, petroleum products, and frac sand, holding back total carloads. Excluding those three categories, U.S. rail traffic looks great and would be up year over year.

Source: Stephens

Things we are keeping an eye on

1) We are watching the post-election craziness – It seems very likely that our new President will be Joe Biden despite President Trump challenging the outcome in the courts. Biden addressed the country Saturday night wanting to unite the country.Assuming Biden wins, he will take office with a divided government. He will have little wiggle room in Congress without Republican support, and he will also have his hands full with multiple crises – the pandemic, unemployment and deep political division. We expect to see executive actions poking their head once again as former President Obama and President Trump used them liberally during their terms. It seems to us that we will rejoin the Paris Climate agreement; Keystone Pipeline could be in trouble yet again as well as the Dakota access pipeline. This could be a possible tailwind for crude by rail as shippers will have to find alternative ways to get their crude oil to market.

2) Petroleum by Rail –The four-week rolling average of petroleum carried on the largest North American railroads declined to 22,703 compared with 22,709 the prior week. CP shipments fell by 0.4% and CN volumes declined by 8%. In the U.S., the BN had the largest percentage increase at 3.1% while the NS had the largest percentage loss at -13%.

3) Army Corps of Engineers warns of DAPL review delay –A new environmental review of DAPL Energy Transfers 570,000 barrels per day is seeing further headwinds as plans to double its capacity is causing the Army Corps to redo some aspects of its environmental review. U.S. government attorney James Maysonett said the review may take longer than anticipated. The pipeline was ordered to shut down pending the environmental review, but appealed by Energy Transfer and currently is in front of the courts.

4) Royal Dutch Shell said on Thursday of last week that it is closing its refinery in Convent, La., the first on the U.S. Gulf Coast to shut down since the coronavirus pandemic devastated worldwide demand. The shutdown will occur this month after Shell failed to find a buyer. The refinery is the ninth in North America targeted for a shutdown or to be idled since the pandemic, which has dealt a heavy blow to fuel demand globally. The United States is the world’s largest fuel consumer. Shell said it failed to find a buyer for the 211,000-bbl-per-day refinery after announcing its plans to sell it in July. Refining margins have been down substantially since the pandemic started. The gasoline refining margin is currently at $8.79/bbl, below the threshold where most refiners can make a profit. Once the shutdown is complete, Shell will continue to try to divest the refinery, the company said. It expects to sell all but six (6) refineries and chemical plants globally and is considering closing facilities it cannot sell, the company told investors on its quarterly earnings call last week. The Shell closure follows a string of refineries that have either announced their closure or are planning on it including Philadelphia Energy Solutions at 335,000 b/d. A 130,000 b/d refinery in Newfoundland was closed earlier this year; Marathon Petroleum has shut two refineries with total capacity of about 190,000 b/d; Phillips 66 shut a California plant; and a small Wyoming refinery was closed but converted to making renewable diesel. Get ready at some point to pay more for fuel at the pump as capacity continues to dwindle.

5) We are watching Several economic indicators:

a) Rail cars in storage – continues to decline – As of November 1st, the total number of cars in storage continued the downtrend to 439,557 from 451,781 cars, representing a month over month decline of 12,224 rail cars. Please see PFL’s storage report for further details to be released this morning.

b) U.S. Housing Starts – Total U.S. housing starts in September were a preliminary and seasonally adjusted annual rate of 1.42 million, up 1.9% over August 2020 and up 11.1% over September 2019. Single-family housing starts were a preliminary 1.11 million in September, the most since June 2007.

c) Vehicle Sales – New light vehicle sales were an annualized and seasonally adjusted 16.2 million in October 2020. That’s their second straight month over 16 million and not far from the 16.8-16.9 million in January and February this year. Sales might have been higher the past couple of months if not for extremely tight inventory levels on many dealer lots.

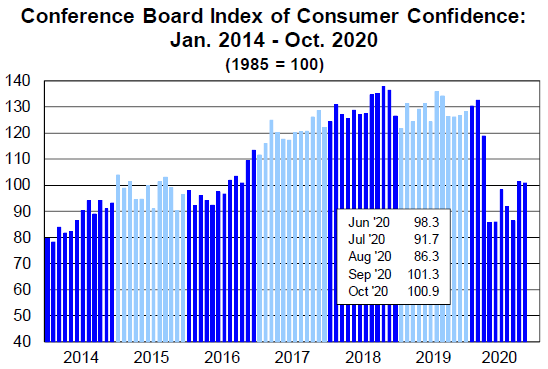

d) Consumer Confidence – The Conference Board’s index of consumer confidence index ticked slightly lower to 100.9 in October from 101.3 in September. The conference board’s index collapsed with the onslaught of COVID and has been slowly climbing back. In August, consumer confidence was at 86.3 and pre-COVID was 132 to put it in perspective. (See chart below)

e) Consumer Spending – Total U.S. consumer spending rose a preliminary 1.4% in September 2020 from August 2020. That’s a bit higher than most economists expected and is the fifth straight monthly increase, but the pace of growth in the final three months of that stretch has been much slower (average of 1.3%) than the first two months (average of 7.6%). Consumer spending accounts for around 70% of the economy, so it is pretty much impossible for the overall economy to be doing really well if consumers are not spending.

Rig Count

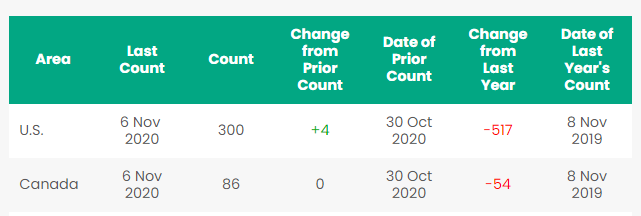

North America rig count is up 4 Rigs week over week. The U.S. gained 4 rigs week over week with 300 active rigs. Canada’s rig count was flat week over week and Canada’s overall rig count is 86 active rigs. Year over year we are down 628 rigs collectively.

North American Rig Count Summary

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Railcar Markets

PFL is seeking:

- 2 Covered hoppers for purchase 5500 series, for storage at plant site in the Chicago area, BN or NS connection,

- 20 117R’s 30,000 gallon cars needed for alcohol service cars have to be non -lined

- 340W’s LPG pressure cars for various locations and lease terms,

- 17 30.3 gal for lease in New Mexico 1 year crude

- 5-15 6000+ high sided gons, no interior bracing for purchase off the CN or CP Ontario destination,

- 200 117Rs 30K plus Diesel or Gas Houston dirty – negotiable

- 100 CPC 1232 31.8 prior gasoline service for 3-6 month lease (extendable with mutual agreement) in Texas.

- 100 4750’s for grain service in the Midwest, one year lease,

- 50-90 263 or 286 GRL needed for corn syrup for purchase,

- 50-60 Sulfuric acid cars 13.6 for purchase,

- 40-50 molten Sulfur Cars 13.8 for purchase,

- 100 coal gons for lease

- 15 500W tanks for CO2 use for lease 6-12 months

- 10 20K to 23.5 coiled and insulated for lease one year for ethylene glycol,

- 100 1232 tanks for crude 8 month lease in Edmonton CA

- 10 23-25.5 for glycerin 6-12 months UP or CN MO to WY

- 200 1232 25.5K Gal Texas UP BN 2 years fuel oil

- 19 117R 28.3 Gal Texas Class One Open 2-5 years Diesel

- 6 31.8 Gal tanks Ohio 3-5 years Noneno

- 10 CPC 1232 needed in Montreal 25.5 on the CN dirty to dirty negotiable

- 12 CPC 1232 needed in Georgia 25.5 on the CSX dirty to dirty negotiable

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable,

- 60 340W Pressure cars in VA – last Ammonia dirty 12-18 mos NS or CSX

- 50 CPC 1232 cars in Texas clean last petroleum lease negotiable

- 10-20 340W pressure cars in Miss. – last butane – dirty lease negotiable

- Short and long term opportunities available clean cars are available 1-5 years scattered across the country. Various last commodities. Leases on 117Js and 117Rs, dirty to dirty for sublease,

- 450 117Js 28.3 C/I for sale or lease in Texas

- 50 CPC 1232 28.3 tanks clean last veg oil various locations negotiable

- 200 CPC 1232 Compliant 25.5’s C/I for sale or lease

- 100 65 ft. bulkhead flat cars, for sale or lease

- 200 30K tankers cleaned and ready for service, for sale or lease,

- 100 5650 PD hoppers brand new 65 ft, lease only, available in 30 days,

- 218 73 ft 286 GRL riserless deck, center part for sale,

- 28 auto-max II automobile carrier racks – tri-level for sale,

- 100 65’ 100 ton log cars for lease, various locations,

- 10 food grade 14.3 tanks lined for phosphoric acid for sale in Louisiana,

- 49 60’ Box cars 286 EOL refurbished in Tenn.,

- 132 286 GRL DOT111s coiled and insulated 29K Gal for sale

- 20 low sided gondolas for lease in NJ 2743 cu ft,

- 100 34.2 Gallon Dot 111 for lease great for Ethanol or Alcohol

- 20 food grade stainless steel cars

- 30 340W dirty propane or butane west coast negotiable

- 50-80 117J or Rs 28K BN, UP, CN, Diesel dirty multiple locations negotiable

- 100 CPC1232 28.3 gal in Montana crude dirty BNSF negotiable

- 30 111A 30K clean Texas BNSF last ethanol negotiable

- 30 CPC 1232 25.5K Pennsylvania NS clean negotiable

- 10 CPC 1232 23.5 K W Michigan Calcium Chloride dirty negotiable

- 175 117R s or Js 30K Diesel or gasoline dirty to dirty Texas lease negotiable

- 50 300 series Pressure cars

- 100 CPC1232 28K Crude dirty to dirty CN Alberta lease negotiable

- 40 GP 20K in Southeast CSX clean last soap negotiable

- PFL has a number of steel and aluminum hoppers for various commodities for sale,

- Sand cars, box cars, coal cars and hoppers including sugar-covered hoppers and plastic pellet cars, are also available for sale or lease in various locations.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

A sign of things getting better – leasing activity and inquiries have continued to be strong

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|