News Flash: Dow Jones futures plummeted Sunday night in overseas trading, along with S&P 500 futures and Nasdaq futures, as an all-out crude oil price war adds to coronavirus fears. Trading in S&P futures was halted in overnight trading once levels hit the maximum allowed drop of 5%. Covid-19 cases are increasing rapidly in the U.S. and Europe, with northern Italy on lockdown. Meanwhile, crude oil futures are crashing as Saudi Arabia ramped up production following Friday’s OPEC+ collapse. Treasury yields plunged to fresh record lows, approaching near zero yields.

Storage continues to be active and we are now seeing pressure cars making their way to storage due to the warm winter. Demand destruction and unfavorable price spreads have caused an increase in loaded storage across various energy products. PFL stands ready to accommodate your storage needs both loaded and empty across every major region in the US and Canada. Crude by rail in Alberta hit a snag this past week as WCS basis fell to -13.50 against WTI in Edmonton versus -$6.00 in the Gulf leaving not much room to get the product there. This resulted in cars being parked and waiting for margins to improve.

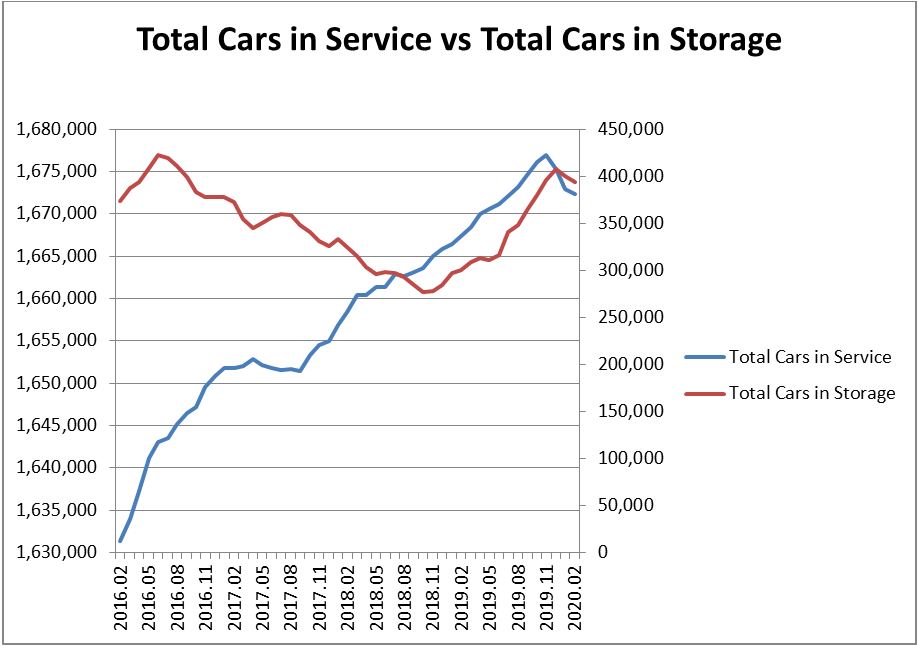

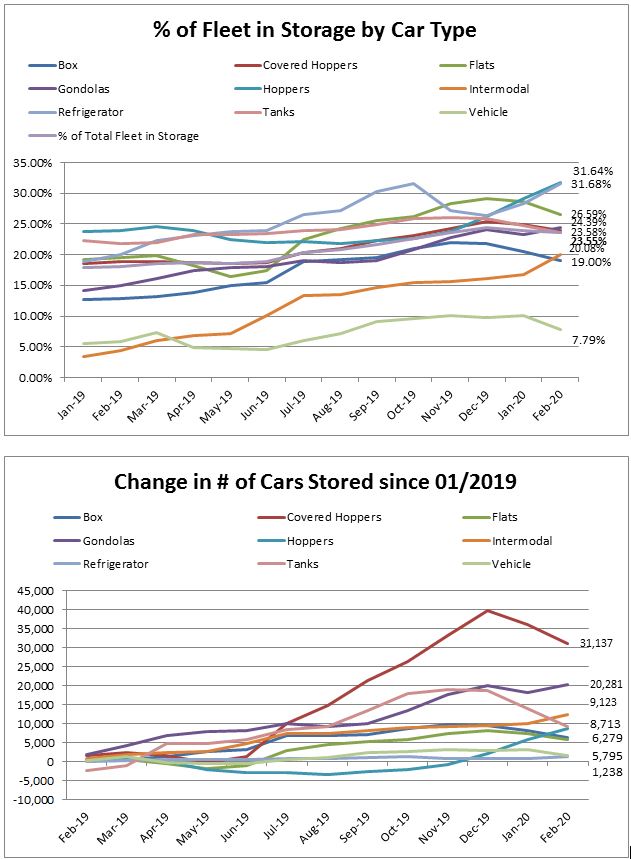

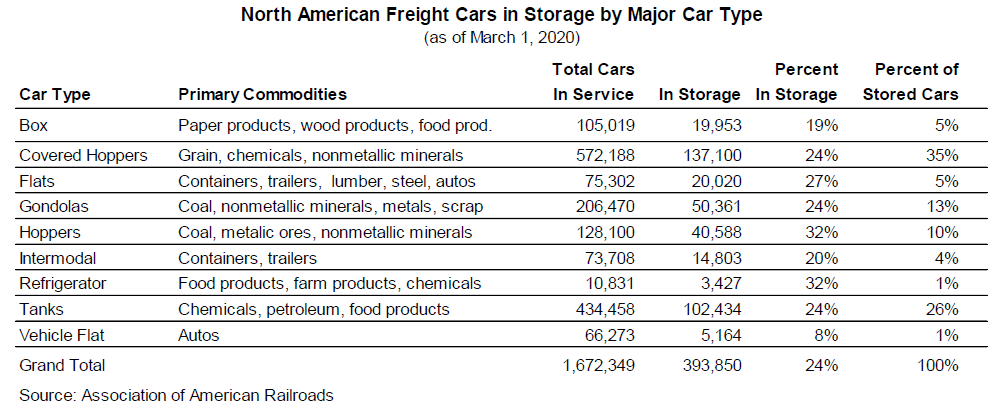

The AAR just released its monthly Rail Time Indicators report in which it reports railcars in storage. As of March 1, 2020, there were 393.9K empty railcars in storage, representing 23.6% of the North American fleet. This represented a 6,400 unit decrease (-1.6%) from last month and an 85,500K unit increase year over year (+27.7%). The decline was primarily driven by covered hoppers and tank cars. We believe this month’s decline is primarily due to a deterioration in rail service in February (train speeds -4% month over month, dwell +4% month over month) as network fluidity was negatively impacted by disruptions related to weather and rail blockades in Canada. Railcar demand will also remain muted in the near term from a combination of soft rail volumes and PSR implementation. So while this month’s report is somewhat of a positive data point for the railcar manufacturers car owners and lessors, with service levels starting to rebound and 26.3% of the fleet still in storage, we have a cautious outlook for railcar demand in light of the enormous activity seen this past week in energy markets deteriorating and other factors relating to demand destruction relating to the Coronus virus.

If you need of have storage available, have a project and need to perform maintenance, clean cars or reposition cars in a cost effective manner, call PFL today to trouble shoot your situation – we have solutions for you!

Loaded storage for energy products is still available, so please give PFL a call today