“You never really learn much from hearing yourself speak.” ― George Clooney

Jobs Update

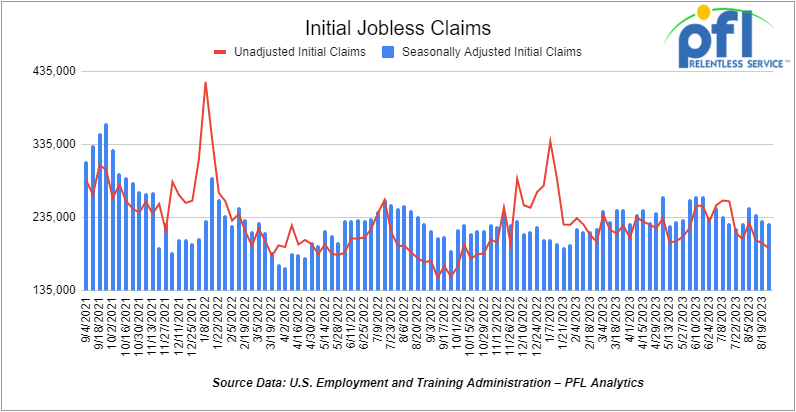

- Initial jobless claims for the week ending August 26th, 2023 came in at 228,000, down -4,000 people week-over-week.

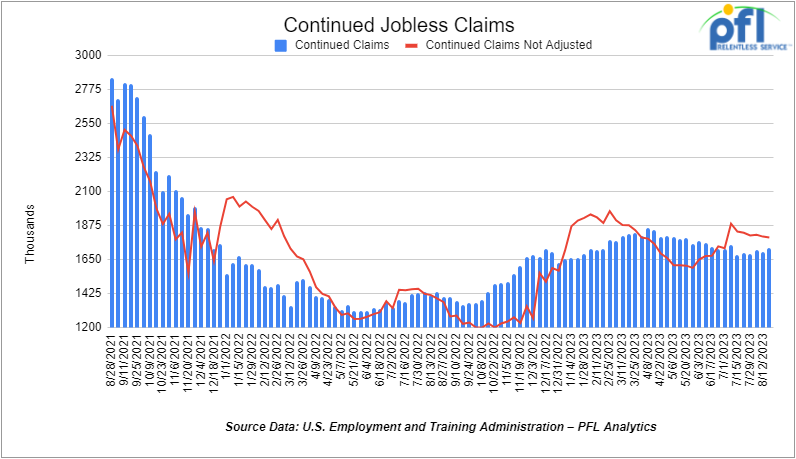

- Continuing jobless claims came in at 1.725 million people, versus the adjusted number of 1.697 million people from the week prior, up 28,000 people week-over-week.

Stocks closed mixed on Friday of last week, but higher week over week

The DOW closed higher on Friday of last week, up 115.8 points (+0.33%), closing out the week at 34,837.71, up +490.81 points week-over-week. The S&P 500 closed higher on Friday of last week, up 8.11 points (+0.18%), and closed out the week at 4,515.77, up +110.06 points week-over-week. The NASDAQ closed lower on Friday of last week, down -3.15 points (-0.02%), and closed the week at 14,031.81, up +441.16 points week-over-week.

In overnight trading, DOW futures traded lower and are expected to open at 34,870 this morning down -12 points.

Crude oil closed higher on Friday of last week and up week over week

WTI traded up $1.39 per barrel (+1.7%) to close at $85.02 per barrel on Friday of last week up $5.19 per barrel week-over-week. Brent traded up US$1.66 per barrel (+1.9%) on Friday of last week, to close at US$88.49 per barrel, up US$4.01 per barrel week-over-week.

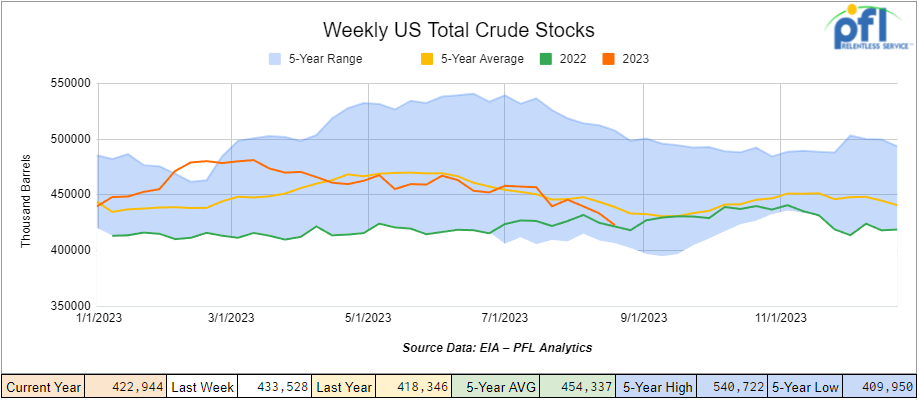

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 10.6 million barrels week-over-week. At 422.9 million barrels, U.S. crude oil inventories are 3% below the five-year average for this time of year.

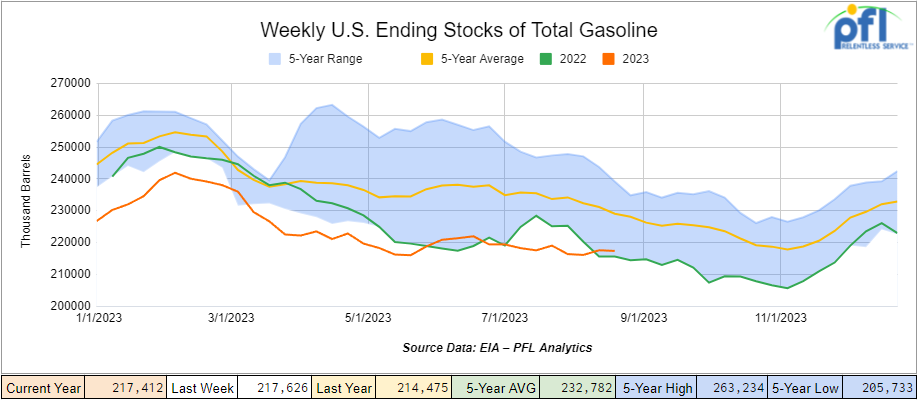

Total motor gasoline inventories decreased by 200,000 barrels week-over-week and are 5% below the five-year average for this time of year.

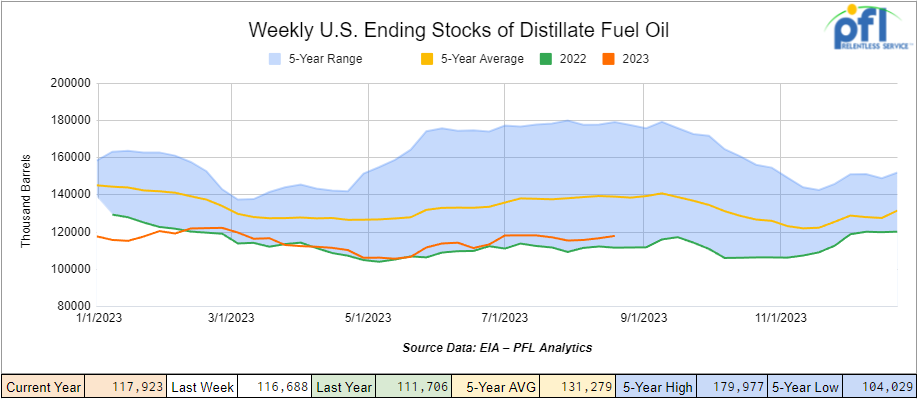

Distillate fuel inventories increased by 1.2 million barrels week-over-week and are 15% below the five-year average for this time of year.

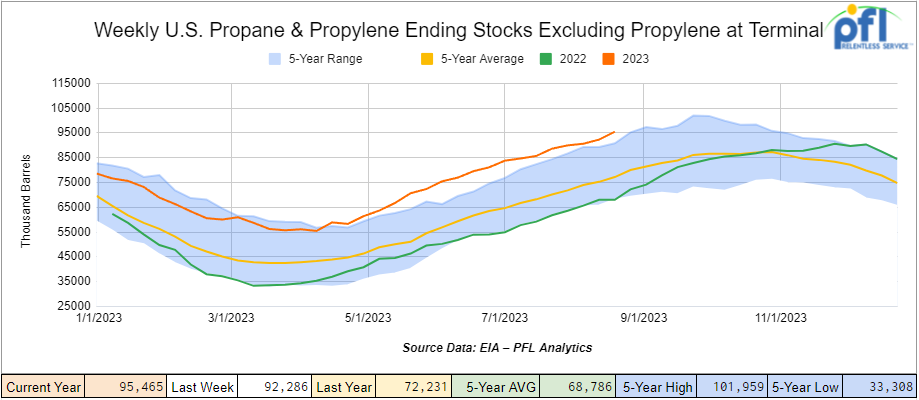

Propane/propylene inventories increased 3.2 million barrels week-over-week and are 21% above the five-year average for this time of year.

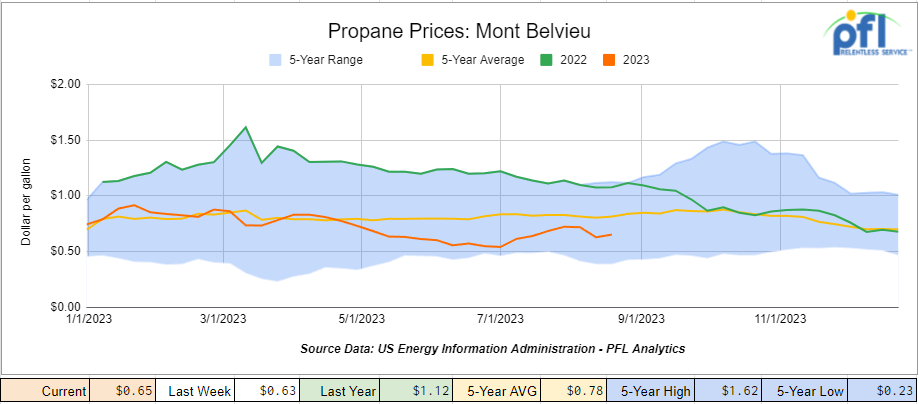

Propane prices closed at 65 cents per gallon, up 2 cents week-over-week but down -47 cents per gallon year-over-year,

Overall, total commercial petroleum inventories decreased by 8 million barrels. during the week ending August 25th, 2023.

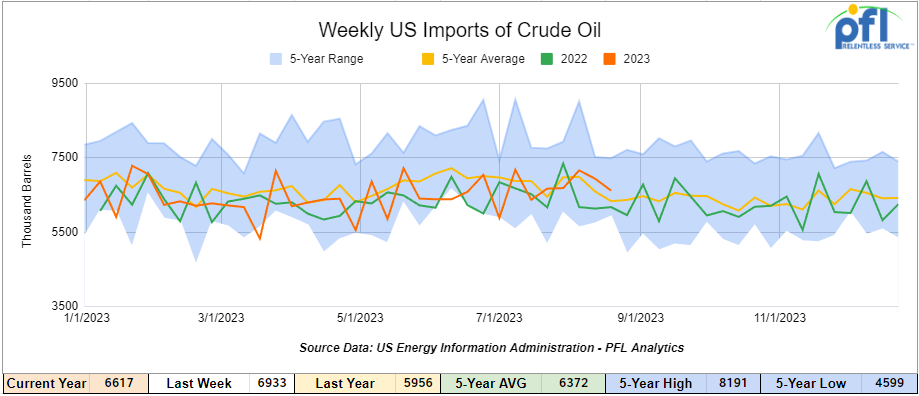

U.S. crude oil imports averaged 6.6 million barrels per day during the week ending August 25th, 2023, a decrease of 316,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.8 million barrels per day, 12.1% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 848,000 barrels per day, and distillate fuel imports averaged 163,000 barrels per day during the week ending August 25th, 2023.

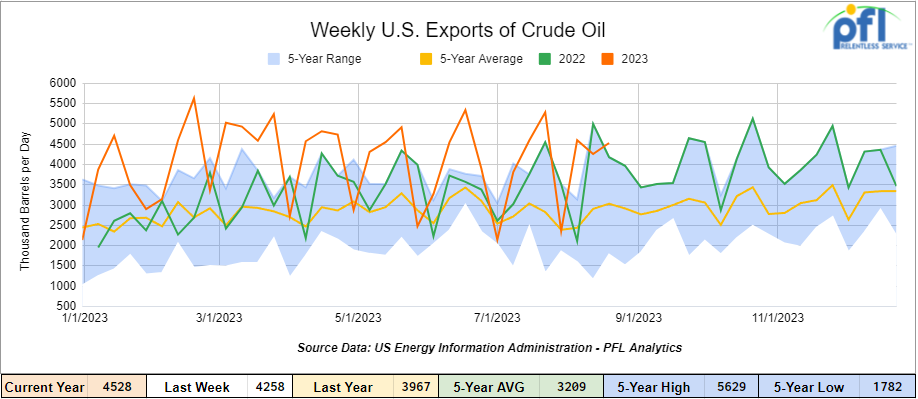

U.S. crude oil exports averaged 4.528 million barrels per day for the week ending August 25th, 2023, an increase of 270,000 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 3.936 million barrels per day.

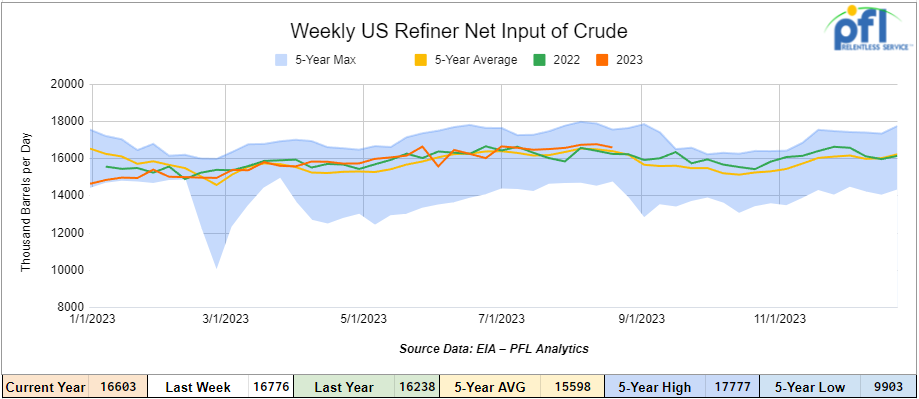

U.S. crude oil refinery inputs averaged 16.6 million barrels per day during the week ending August 25, 2023, which was 173,000 barrels per day less week-over-week.

WTI is poised to open at $85.49, down -6 cents per barrel from Friday’s close.

North American Rail Traffic

Week Ending August 30th, 2023.

Total North American weekly rail volumes were down (-7.51%) in week 34, compared with the same week last year. Total carloads for the week ending on August 30th, 2023 were 341,714, down (-5.18%) compared with the same week in 2022, while weekly intermodal volume was 307,381, down (-9.97%) compared to the same week in 2022. 9 of the AAR’s 11 major traffic categories posted year-over-year decreases with the most significant decrease coming from Grain (-20.79%). The largest increase came from Other (+11.05%).

In the East, CSX’s total volumes were down (-2.51%), with the largest decrease coming from Grain (-43.79%) and the largest increase from Metallic Ores and Metals (+14.86%). NS’s volumes were down (-5.74%), with the largest decrease coming from Petroleum and Petroleum Products (-14.84%) and the largest increase from Other (+18.87%).

In the West, BN’s total volumes were down (-3.6%), with the largest decrease coming from Forest Products (-13.61%), and the largest increase coming from Other (+31.62%). UP’s total rail volumes were down (-7.97%) with the largest decrease coming from Grain (-35.09%) and the largest increase coming from Petroleum and Petroleum Products (+8.91%).

In Canada, CN’s total rail volumes were down (-14.93%) with the largest increase coming from Other (+20.87%) and the largest decrease coming from Intermodal (-38.27%). CP’s total rail volumes were down (-4.47%) with the largest decrease coming from Forest Products (-21.03%) and the largest increase coming from Motor Vehicles and Parts (+78.35%).

KCS’s total rail volumes were up (1.57%) with the largest decrease coming from Other (-40.72%) and the largest increase coming from Grain (+25.86%).

Source Data: AAR – PFL Analytics

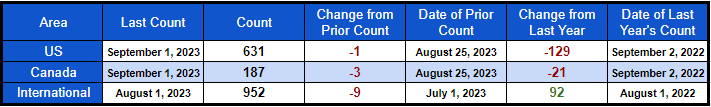

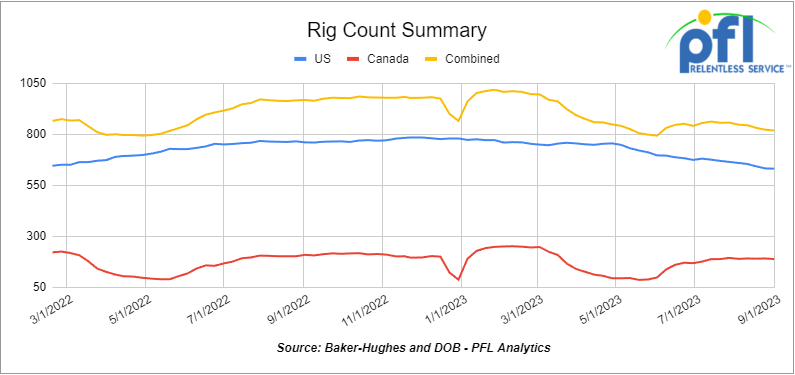

Rig Count

North American rig count was down by -4 rigs week-over-week. U.S. rig count was down by -1 rig week-over-week and down by -129 rigs year-over-year. The U.S. currently has 631 active rigs. Canada’s rig count was down by -3 rigs week-over-week, and down by -21 rigs year over year. Canada’s overall rig count is 187 active rigs. Overall, year-over-year, we are down -150 rigs collectively.

International rig count which is reported monthly was down by -9 rigs month-over-month but up 92 rigs year-over-year. Internationally there are 952 active rigs.

North American Rig Count Summary

A few things we are watching:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 25,859 from 25,940, which was a loss of -81 rail cars week-over-week. Canadian volumes were mixed. CPKC’s shipments decreased by -9.7% week over week, and CN’s volumes were higher by 0.2% week-over-week. U.S. shipments were also mixed. The BN had the largest percentage increase and was up by 16.2% week-over-week. The CSX had the largest percentage decrease and was down by -2.8% week-over-week.

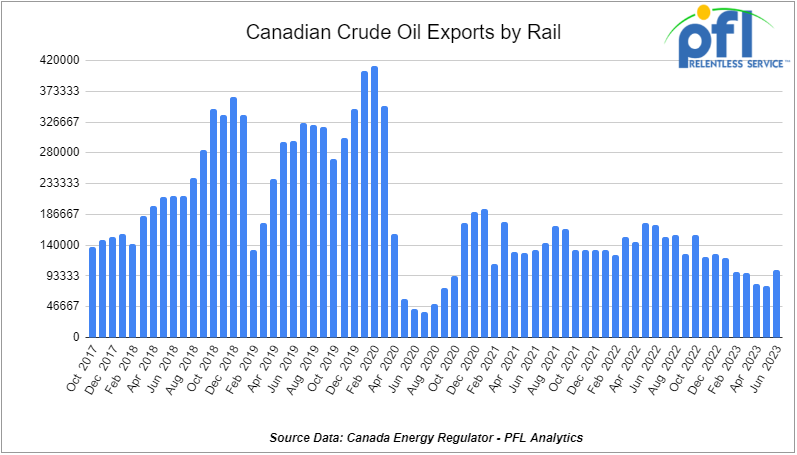

We are watching Crude by Rail Out of Canada

The Canadian Energy Regulator (“CER”) updated its monthly crude by rail numbers on August 28, 2023. For June 2023, Canada exported 102,735 barrels per day by rail (up by +23,988 barrels per day month over month) which is the largest showing since February of 2023, breaking a 4-month losing streak.

We were expecting to see volumes increase as we headed into the month of July, as the weather warmed up and producers started to build inventory. In addition, basis numbers were starting to look favorable for Rail at least for the time being. One Exchange’s Western Canadian Select Contract (WCS) for October delivery settled on Friday of last week at US$17.75 per barrel below the WTI-CMA. (“West Texas Intermediate – Calendar Month Average”) The implied value was US$66.73 per barrel. On Thursday, it settled at US$16.40 per barrel below the WTI-CMA for October delivery. The implied value was US$66.34 per barrel.

With the Trans Mountain Expansion right around the corner of 590,000 barrels per day (pending any delays) and line pack needing to be filled for that new pipe, we don’t expect a meaningful crude by rail bounce in the short term. Transmountain pipeline, however, did announce a delay in boring through a mountain, and a workaround that they contemplated is receiving pushback from indigenous groups. It is a hard market to read and plan for this 10 seconds with significant governmental, environmental, and indigenous interference. Let’s hope a workaround is reached in an expeditious manner. In the long term, we are bullish on crude by rail out of Alberta. USD’s and Gibson Bitumen Hardisty expansion and Cenovus’ new Bitumen planned facility will take a significant amount of coiled and isolated cars off the market. Crude by rail out of Alberta and Saskatchewan is popular for raw Bitumen (no diluent added), as it can be shipped as a non-hazmat product resulting in lower shipping costs that are competitive with pipelines.

We are watching Renewables

In Ethanol, a big supply draw spurred a month-long rally. Ethanol spot markets had a difficult time finding traction through most of August as late summertime demand appeared to wind down and corn futures tended to offer little support, but a steep, second-week-in-row draw on ethanol stockpiles reported last week appeared to encourage spot buying that rallied prices to the highest values since July. Chicago bulk ethanol transfers available over the first week of September traded over $2.265 per gallon by the middle of last week and touched $2.27 on Thursday of last week prices rallied more than a dime week over week, to reach the highest prices of August. Ethanol ended the month even higher at $2.28 per gallon. As a result, railcar demand for Ethanol followed suit. With the phase-out of DOT 111 GP 30 and the unavailability of R’s or J’s there is not a non-coiled car available out there for ethanol forcing shippers to settle for coiled and insulated cars to ship ethanol – not ideal but a temporary needed bandage.

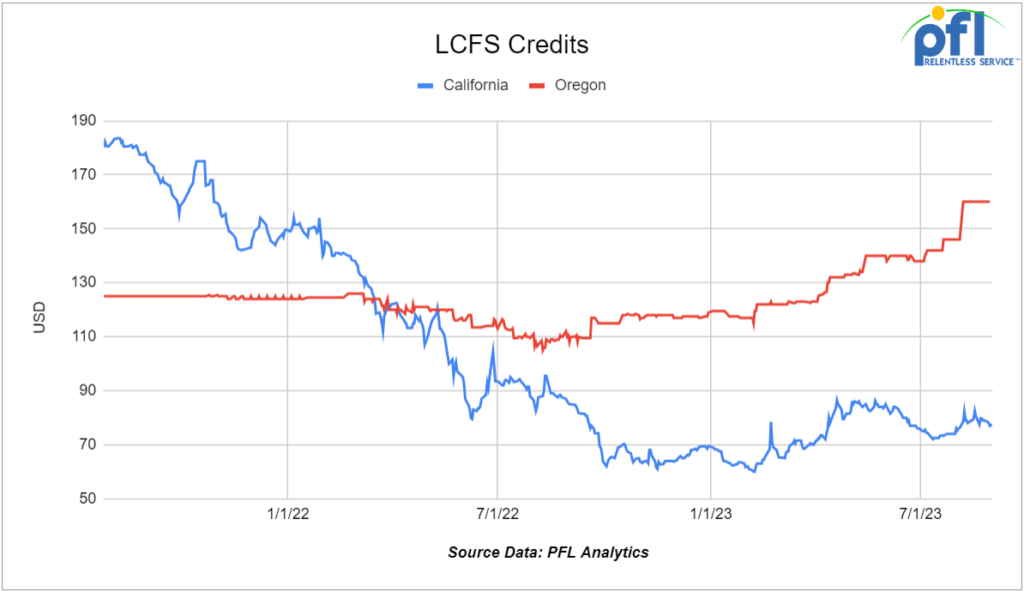

LCS credits in California had a rough time this past month as more renewable diesel is hitting the market or about to. See chart below:

As it relates to rail cars, shippers of tallow and other renewable diesel feedstocks are lapping up coiled and insulated cars to ship feedstock to newly constructed renewable diesel facilities. As production comes online expect the C/I car availability to tighten. In fact, it is almost a perfect storm, barring a recession or other geopolitical events that are impossible to predict we have not only the renewable folks eyeing the C/I car because of the factors previously mentioned but crude could come into temporary play yet again (crude guy always wins – when they want cars they just lift offers – refineries have to be fed at any price)

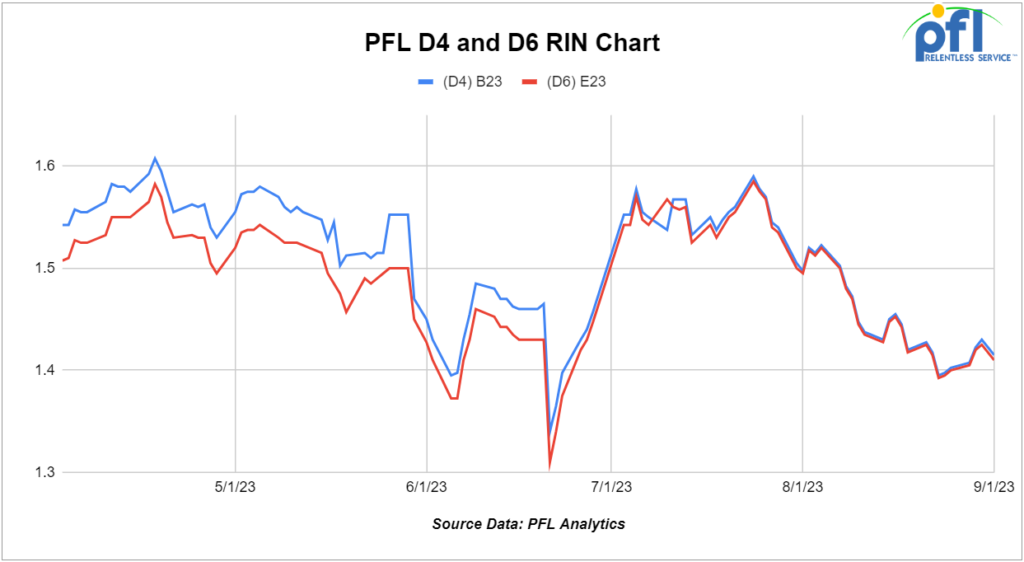

Lastly, ethanol demand and Biodiesel demand under the RFS have caused RIN prices to again retreat – this politically driven market is almost as volatile as crude itself. See chart below:

We are Watching LNG by Rail

Folks because it is so difficult to build and transport natural gas via pipeline from a regulatory standpoint from one State to another for either in-state consumption or export some thought it would be a good idea to compress natural gas onsite liquefy it and throw it on a rail car. While it may sound like a good idea on the surface and would be good for rail traffic, it is not the best idea. Loading end is really expensive to build and the rail cars to transport liquefied natural gas (“LNG”) are $250K+ making it pretty much not economically viable. The Pipeline and Hazardous Materials Safety Administration (PHMSA), in its wisdom in coordination with the Federal Railroad Administration, has issued a final rule that suspends a rule that would have allowed LNG transportation by rail.

The rule had been on hold after environmental groups and 14 states filed lawsuits to challenge it. However, it will be officially suspended so that the safety of LNG-by-rail can be further tested and studied, according to a PHMSA notice published on Friday of last week in the Federal Register. Our question is why are we wasting taxpayer dollars to even study this craziness? Let’s build some pipelines and burn clean-burning natural gas!

We have been extremely busy at PFL with return-on-lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs at 239-390-2885

Lease Bids

- 20-25, 30 or 31.8K Tanks needed off of in Texas for 1-5 Years. Cars are needed for use in VGO service. NC/NI

- 3, 30 or 31.8K Tanks needed off of in Texas for 1-5 Years. Cars are needed for use in Naphtha service. NC/NI

- 10-20, 30 or 31.8K Tanks needed off of in Texas for 1-2 Years. Cars are needed for use in Diesel service. NC/NI

- 1, 30 or 31.8K Tanks needed off of in Texas for 6-12 Months. Cars are needed for use in Mono-Propylene Glycol service. NC/NI

- 30-100, 31.8K CPC 1232 Tanks needed off of UP or BN in Texas for Purchase or Lease. Cars are needed for use in refined products service.

- 100, 6300 Covered Hoppers needed off of BN in South Dakota for 3-6 Months. Cars are needed for use in DDG service.

- 15, 30K 117 Tanks needed off of NS in SouthEast for 1 Year. Cars are needed for use in Diesel service.

- 25, 33K 340W Pressure Tanks needed off of UP or BN in Midwest for Oct-March. Cars are needed for use in Propane service.

- 20-25, 30K 117 Tanks needed off of UP or BN in Illinois for 5 Years. Cars are needed for use in Ethanol service.

- 100, 28.3K DOT 111/117 Tanks needed off of UP or BN in Midwest/Texas for 5 Years. Cars are needed for use in Veg Oils / Biodiesel service. Need to be Unlined

- 25-50, 33K 400W Pressure Tanks needed off of CN or CP in Canada for Short Term. Cars are needed for use in Propylene service.

- 50-100, 4550 Covered Hoppers needed off of UP or BN in Texas for 5 Years. Cars are needed for use in Grain service.

- 10, 33K 340W Pressure Tanks needed off of CN in LA for 1 Year. Cars are needed for use in Butane service.

- 25, 20.5K CPC1232 or 117J Tanks needed off of BNSF or UP in the west for 3-5 Year. Cars are needed for use in Magnesium chloride service. SDS onhand

- 25-50, 25.5K 117J Tanks needed off of NS CSX in Northeast for 5 Years. Cars are needed for use in Asphalt / Heavy Fuel Oil service.

- 30-50, 33K 340W Pressure Tanks needed off of any class 1 in any location for 6-12 Months. Cars are needed for use in Propane service.

- 60-150, 30K 117J Tanks needed off of TYR, UP in Corpus Christi, TX for 1 year. Cars are needed for use in Diesel service.

- 15, 28.3K 117J Tanks needed off of any class 1 in any location for 3 year. Cars are needed for use in Glycerin & Palm Oil service.

- up to 50, 31.8K 117J, 117R, CPC 1232 Tanks needed off of any class 1 in Texas or Ohio for 1-3 years. Cars are needed for use in Diesel / Gasoline service.

- 45, 3000 cf PDs Hoppers needed off of any class 1 in Texas for 3 years. Cars are needed for use in Any service.

- 30, 17K-20K 117J Tanks needed off of UP or BN in Midwest/West Coast for 3-5 Years. Cars are needed for use in Caustic service.

- 10, 286K 15.7K Tanks needed off of KCS in Texas for 1 Year. Cars are needed for use in Sulfuric Acid service. Needed Next few months

- 150, 23.5K DOT 111 Tanks needed off of any class 1 in LA for 2-3 Year. Cars are needed for use in Fluid service. Needed July

- 25-50, 32K 340W Pressure Tanks needed off of NS or CSX in Marcellus for 1-2 Years. Cars are needed for use in Propane service.

- 25-50, 30K DOT 111, 117, CPC 1232 Tanks needed off of CN or CP in WI, Sarnia for 1-2 Years. Cars are needed for use in Diesel service.

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

- 70, 32K 340W Pressure Tanks needed off of CP or CN in Edmonton for 3 Years. Cars are needed for use in Propane service.

- 30-40, 286K DOT 113 Tanks needed off of CN or CP/ UP in Canada/MM for 5 Years. Cars are needed for use in CO2 service. Q1

- 30, 30K DOT 111 Tanks needed off of UP in Texas for 1-3 Years. Cars are needed for use in Diesel service.

- 5-7, 28.3K 117R Tanks needed off of NS or CSX in NC for 1 Year. Cars are needed for use in UCO service.

- 25-50, 5000CF-5100CF Lined Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in Dry sugar service. 3 bay gravity dump

- 10, any capacity Stainless Steel Tanks needed off of any class 1 in Canada for 5-10 years. Cars are needed for use in Alcohol service.

- 100, 33K 340W Pressure Tanks needed off of CN in Canada for 3-5 Years. Cars are needed for use in Propane service.

- Up to 60, 5150cf Covered Hoppers needed off of CN, CSX, NS in the east or midwest for 3 years. Cars are needed for use in Fertilizer service. 3-4 hatch gravity dumps

- 20-30, 14k Any Tanks needed off of BNSF, UP in Texas for 1-3 Years. Cars are needed for use in HCl service. Call for more details

Sales Bids

- 100, Plate F Boxcars needed off of BN or UP in Texas.

- 20, 2770 Mill Gondolas needed off of CSX in the northeast. Cars are needed for use in non-haz soil service. 52-60 ft

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 20, 2770-3400 Mill Gondolas needed off of any class 1 in South Texas. Cars are needed for use in scrap metal service.

- 8, 5200 Covered Hoppers needed off of various class 1s in various locations. Cars are needed for use in Plastic Pellet service.

- 10, 4000 Open Hoppers needed off of CSX in the northeast. Cars are needed for use in scrap metal service. Open top hopper

- 20-30, 3000 – 3300 PDs Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Sand service.

- 45, 3000 cf PD Hoppers needed off of any class 1 in Texas. Negotiable

- 200+, 5000cf Covered Hoppers needed off of any class 1 in various locations.

- 10, 6400 Open Hoppers needed off of CSX in the northeast. Cars are needed for use in wood chip service. Open top hopper, flat bottom

- 20, 17K DOT 111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 100, 15.7K DOT 111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT 111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

Lease Offers

- 70, 25.5K, 117J Tanks located off of UP in Texas. Cars are clean Call for more information

- 25-100, 17.6K, DOT111 Tanks located off of UP or BN in Midwest. Cars were last used in Fertilizer / Corn Syurp. Free move available

- 20, 20k, DOT111 Tanks located off of CSX in GA. Cars are clean

- 2, 20K, DOT111 Tanks located off of UP in TX. Cars are clean

- 5, 20K, DOT111 Tanks located off of UP in TX. Cars were last used in Sulfuirc Acid. Free move available

Sales Offers

- 100-200, 31.8K, CPC 1232 Tanks located off of BN in Chicago. Dirty/Clean

- 100, 28.3K, 117J Tanks located off of various class 1s in multiple locations.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|