“Everyone wants to live on top of the mountain, but all the happiness and growth occurs while you’re climbing it.”

– Andy Rooney

COVID 19 and Markets Update

At the time of writing this the United States has 6,708,458 confirmed COVID–19 cases and 198,520 confirmed deaths.

Jobless Claims

The U.S. Labor Department stated on Thursday of the prior week that U.S. workers filed an additional 884,000 initial jobless claims, bringing the total initial claims since the COVID19 pandemic began to nearly 60 million. The previous week’s new jobless claims were upwardly revised slightly to 884,000, from the 881,000 previously reported, matching last week’s initial jobless claims. This marked the first time since March that jobless claims came in below 1 million for back-to-back weeks.

DOW and Nasdaq

The DOW closed higher on Friday, up 131.06 points (+0.48%) to finish out the week at 27,665.64 down 467.67 points week over week. The S&P 500 traded higher 1.78 points (+0.05%) on Friday, closing at 3,340.97 down 85.99 points week over week. The Nasdaq finished Friday’s session lower, losing 66.05 points (-0.60%) closing out the week at 10,853.54 down 460.60 points week over week. In overnight trading, DOW futures traded higher and are expected to open up this morning 293 points.

Crude Markets

West Texas Intermediate (WTI) traded down $1.60 to close at $39.77 on Friday of last week on the New York Mercantile Exchange, a loss of $3.20 per barrel week over week.

Brent traded down $0.73 to close at $40.06 on Friday of last week, a loss of $2.60 per barrel week over week.

U.S. crude inventories increased by 2 MM/bbls last week and now stand at 500.45 MM/bbls according to the EIA. This was a surprise build as consensus was for a 1.3 million barrel draw. Although crude oil production was shut in so were refineries. Gasoline inventories were down by 3 MM/bbls. Distillate stocks had a draw of 1.7MM/bbls. The market is now in contango and commodity houses are increasing their bookings of tankers to store crude oil and diesel. Diesel prices have skyrocket in the U.S. and it makes sense for diesel to come from Europe to the U.S.

Oil is lower in overnight trading and, as of the writing of this report, WTI is poised to open at 37.07 down .26 cents per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were up 7.6% year over year in week 36 (U.S. +8.6%, Canada +5.6%, Mexico +1.4%), resulting in quarter to date volumes that are down 6.7% and year to date volumes that are down 10.5% (U.S. -11.3%, Canada -8.2%, Mexico -9.5%). 7 of the AAR’s 11 major traffic categories posted year over year increases with the largest increases coming from intermodal (+20.8%), grain (+31.2%) and farm products & food (+9.0%). The largest decreases came from coal (-23.1%), petroleum (-20.7%) and nonmetallic minerals (-6.3%). The timing of Labor Day was a tailwind this week.

In the East

CSX’s total volumes were up 11.3%, with the largest increases coming from intermodal (+30.6%) and chemicals (+16.1%). The largest decrease came from coal (-28.0%). NC’s total volumes were up 11.3%, with the largest increase coming from intermodal (+26.2%). The largest decrease came from coal (-17.2%).

In the West

BN’s total volumes were up 0.4%, with the largest increases coming from intermodal (+14.2%) and grain (+33.5%). The largest decreases came from coal (-25.2%), stone sand & gravel (-49.0%) and petroleum (-32.3%). UP’s total volumes were up 8.5%, with the largest increases coming from intermodal (+26.9%) and grain (+38.9%). The largest decreases came from coal (-18.6%), chemicals (-8.7%) and petroleum (-28.2%).

In Canada

CN’s total volumes were up 3.4% with the largest increases coming from intermodal (+13.2%) and grain (+63.1%). The largest decrease came from petroleum (-28.5%). RTMs were up 0.8%. CP’s total volumes were up 7.6%, with the largest increases coming from chemicals (+24.4%) and intermodal (+7.1%). The largest decrease came from petroleum (-32.4%). RTMs were up 10.3%.

Kansas City Southern

KCS’s total volumes were down 3.3%, with the largest decrease coming from grain (-23.8%)

Source: Stephens

Traffic is Increasing

Folks, this latest report on rail traffic is good news. We have always said that rail traffic is a good economic indicator as to the state of the overall economy and week 36 is a good indicator, now lets just hope it lasts. Our analysts are seeing intermodal traffic increase across the board which means consumers and or business are spending. Last week in our Rail Report we touched briefly on some key economic indicators that showed that in spite of consumer confidence being down, manufacturing is picking up here in the US. Also in last week’s monthly rail car storage report we saw a net outflow of 20,000 railcars out of storage.

Containers from China are flooding into California ports as a result Asia-U.S. West Coast spot rates have soared. They blew past $3,000 per forty-foot equivalent unit in early August and have been climbing ever since and have recently topped $3,700. No one predicted that the container industry would be doing this well, this quickly.

The Bear and the Bull

The bullish view is that import demand will continue to surprise to the upside. Ocean rates evidence a U.S. economic rebound. COVID erased demand for some products and services, but increased demand for other products. It is believed by some that Storefront sales will not recover, but e-commerce sales will offset any storefront losses. Government support will counter the shutdown fallout.

The bearish view is that the economic-fallout shoe has yet to drop. Demand for ocean container transport is being temporarily juiced by the tail-end of waning government support and a switch to higher inventory levels which could be a headwind for intermodal traffic in the days to come.

Things we are keeping an eye on:

- Wild Fires in the West – It is a mess in the West and rail traffic is getting impacted. In Oregon, 36 fires have charred 863,794 acres, according to state data Friday. Thousands have been evacuated from their homes and at least thirty-three people have died since late August because of the fires. Officials in Oregon are preparing for a “mass fatality incident” as deadly wildfires continued to burn, the state’s emergency management director, Andrew Phelps, warned late Friday as firefighters continued to battle massive blazes. “There are going to be a number of fatalities, folks who just couldn’t get warning in time and evacuate their homes.

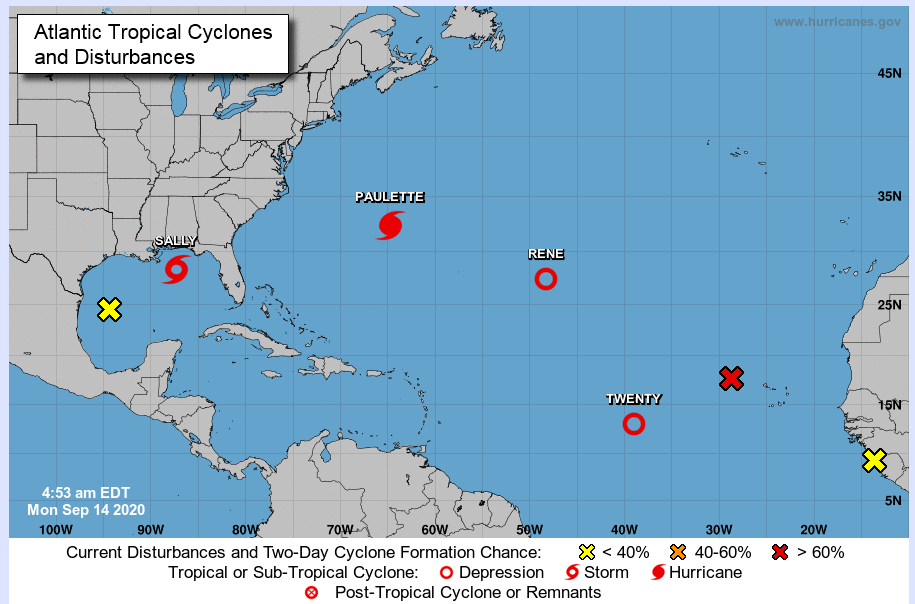

- Hurricanes – As Hurricane Paulette batters Bermuda Tropical Sally is making its way towards the Louisiana/Mississippi border. It is expected that Tropical Storm Sally will be upgraded to a Category 1 Hurricane later today. There is allot of activity in the Atlantic right now.

- Enbridge Line 5 – Is in full operations as of Thursday of last week. In a press release on September 9th, Enbridge said it will restart the east segment of Line 5 in the Straits of Mackinac after receiving authorization from the Pipeline and Hazardous Materials Safety Administration (PHMSA) and approval from the Michigan Circuit Court. Vern Yu, Executive Vice President and President of Liquids Pipelines said, “The decision to allow the restart of the east segment of Line 5 is very positive for the many residents and businesses in Michigan and the Great Lakes region who depend on the energy Line 5 delivers. Enbridge will continue to focus on the safe operation of the dual Line 5 pipelines at the Straits of Mackinac, ensuring the Great Lakes are protected while also reliably delivering the energy and feedstock that helps to fuel Michigan’s and the region’s economy.” Following a review of the data from an in-line inspection of the east segment in the area around the damaged screw anchor, PHMSA indicated in a letter to Enbridge dated September 4, 2020, that, “The review by PHMSA and its independent third-party expert did not identify any integrity issues. As no integrity issues have been identified in the area around the displaced anchor, PHMSA has no objection to Enbridge restarting the east leg of Line 5.” The west segment returned to operation in July.

- Petroleum By Rail -The four-week rolling average of petroleum carried on the largest North American railroads rose to 21,231 compared with 21,064 the prior week. Canadian volumes rose. CP shipments rose by 21.4% and CN volumes rose by 20%.

- Alberta – Canadian heavy basis closed at -$8 per barrel on Friday as Imperial oil 240,000 barrel per day Kearl project remains off line following a diluent leak on Polaris Diluent Pipeline on August 29, 2020. The pipeline’s partial closure was triggered by a diluent leak east of the Fort McMurray Airport, said pipeline operator Inter Pipeline. The diluent, which is mostly condensate, is blended with the heavy oil sands to prepare the crude for pipeline transport. There’s no estimated timeline yet for the pipeline’s restart, Inter Pipeline said. There has been no updates provided on the full restart from Inter Pipeline since September 3 where it said in statement “At the incident site, located on the western side of the Polaris system, clean-up efforts are progressing well. Inter Pipeline’s top priority is to ensure the safety of the public, its workers and protection of the environment. Wildlife monitoring also continues throughout the area. Inter Pipeline continues to investigate the cause of the release and will provide an update on the timeline for restart when available”.

In California, smoke caused the skies of Northern California to turn an apocalyptic orange (see below)

The state’s wildfire-fighting agency, CalFire, said the enormous blaze so far torched 252,500 acres, and was just 23% contained as of late Friday. It’s one of 28 major wildfires burning across the state.

Source: National Hurricane Center

Rig Count

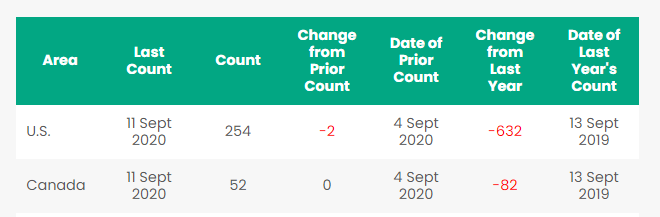

North America rig count is down two rigs week over week. The U.S. lost 2 rigs week over week with 254 active rigs. Canada was flat week over week and Canada’s overall rig count remains at 52 active rigs. Year over year we are down 714 rigs collectively.

North American Rig Count Summary

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Railcar Markets

PFL is seeking:

- 2 Covered hoppers for purchase 5500 series, for storage at plant site in the Chicago area, BN or NS connection,

- LPG pressure cars for various locations and lease terms,

- 5-15 6000+ high sided gons, no interior bracing for purchase off the CN or CP Ontario destination,

- 5-10 31.8s food grade needed in the Midwest for service in Mexico, 5 year lease,

- 10 syrup cars are needed in the Midwest,

- 200 steel coal gons for purchase,

- 100 4750’s for grain service in the Midwest, one year lease,

- 50-90 263 or 286 GRL needed for corn syrup for purchase,

- 50-60 Sulfuric acid cars 13.6 for purchase,

- 40-50 molten Sulfur Cars 13.8 for purchase,

- 50 Veg Oil cars 29.2 12 month lease SD or MI location,

- 200 cars for light oil 6 months to 2 year lease GP30 or similar off the NS in Utica dirty to customer wants cars dirty and will return dirty,

- 10 20K to 23.5 coiled and insulated for lease one year for ethylene glycol,

- 10 CPC 1232 or other for industrial alcohol use in Indiana off the NS for 6 months: lessee would take ethanol cars clean then use for industrial alcohol service and deliver the cars back with industrial alcohol heals.

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil. Lease terms negotiable,

- Short and long term opportunities available clean cars are available 1-5 years scattered across the country. Leases on 117Js and 117Rs, dirty to dirty for sublease,

- 455 117Js cleaned and relined for sale or lease in Texas,

- 207 CPC -1232’s for sale or lease in Texas,

- 61 ft. bulkhead flat cars, lease only,

- 200 30K tankers cleaned and ready for service, for sale or lease,

- 100 5650 PD hoppers brand new 65 ft, lease only, available in 30 days,

- 218 73 ft 286 GRL riserless deck, center part for sale,

- 28 auto-max II automobile carrier racks – tri-level for sale,

- 100 65’ 100 ton log cars for sale, various locations,

- 10 food grade 14.3 tanks lined for phosphoric acid for sale in Louisiana,

- 49 60’ Box cars 286 EOL refurbished in Tenn.,

- 20 low sided gons for lease in NJ 2743 cu ft,

- PFL has a number of steel and aluminum hoppers for various commodities for sale,

- Sand cars, box cars, coal cars and hoppers including sugar covered hoppers and plastic pellet cars, are also available for sale and lease in various locations.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. We also assist fleets and lessors with leases and sales and offer Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. By doing so we will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS. WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|