“Success is the sum of small efforts – repeated day in and day out.”

– Robert Collier

Jobs Update

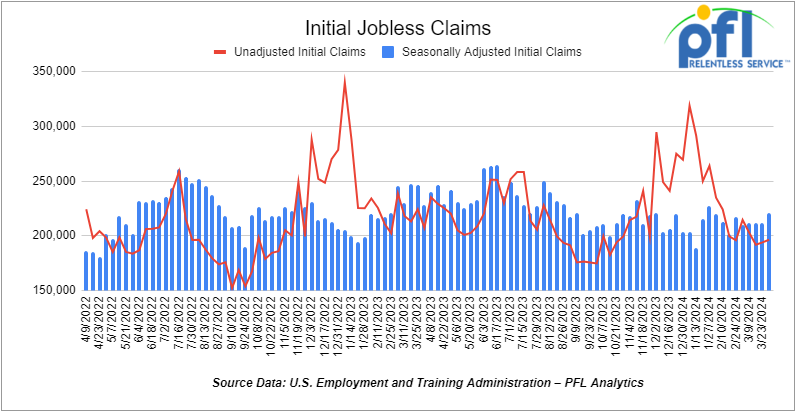

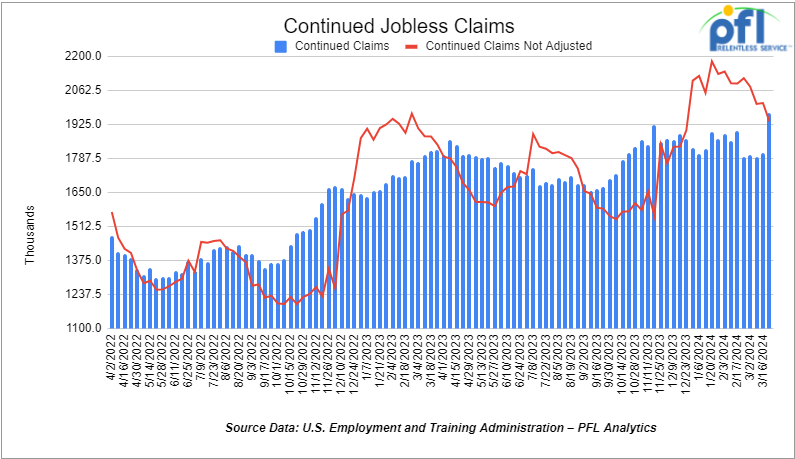

- Initial jobless claims seasonally adjusted for the week ending March 30th, 2023 came in at 221,000, up 9,000 people week-over-week.

- Continuing jobless claims came in at 1.971 million people, versus the adjusted number of 1.81 million people from the week prior, up 161,000 people week-over-week.

Stocks closed higher on Friday of last week, but lower week over week

The DOW closed higher on Friday of last week, up 307.06 points (0.8%), closing out the week at 38,907.04, down -903.33 points week-over-week. The S&P 500 closed higher on Friday of last week, up 57.13 points (1.11%), and closed out the week at 5,204.34, down -50.01 points week-over-week. The NASDAQ closed higher of last week, up 199.44 points (1.22%), and closed out the week at 16,248.52, down -130.94 points week-over-week.

In overnight trading, DOW futures traded lower and are expected to open at 39,214 this morning down 9 points.

Crude oil closed higher on Friday of last week and higher week over week.

WTI traded up $0.32 per barrel (0.37%) to close at $86.91 per barrel on Friday of last week, up $3.74 per barrel week-over-week. Brent traded up US$0.52 per barrel (0.57%) on Friday of last week, to close at US$91.17 per barrel, up US$4.17 per barrel week-over-week.

One Exchange WCS WCS (Western Canadian Select) for May delivery settled Friday at US$13.00 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$72.81 per barrel. On Thursday, it settled at US$12.70 below the WTI-CMA for May delivery. The implied value was US$72.84 per barrel.

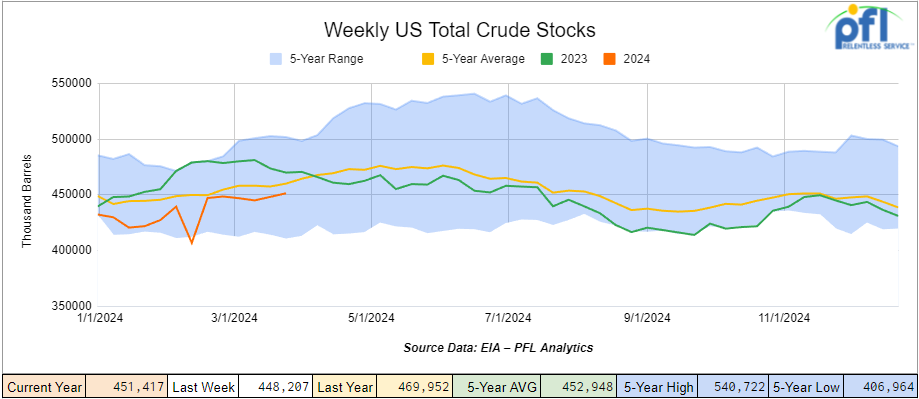

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 3.2 million barrels week-over-week. At 451.4 million barrels, U.S. crude oil inventories are 2% below the five-year average for this time of year.

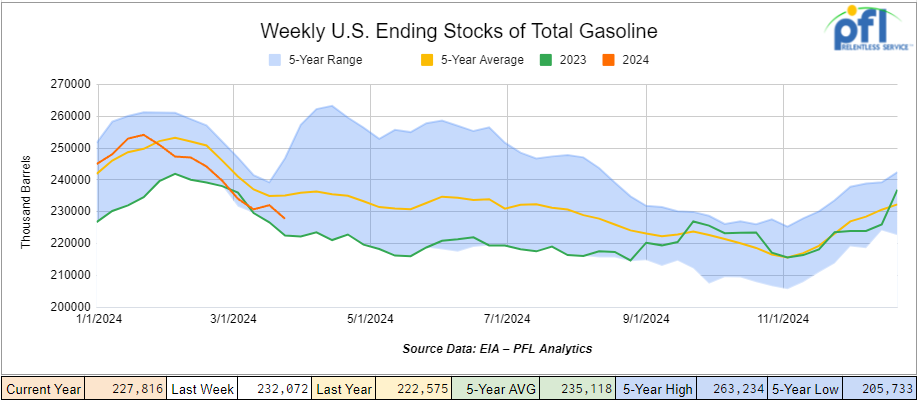

Total motor gasoline inventories decreased by 4.3 million barrels week-over-week and are 3% below the five-year average for this time of year.

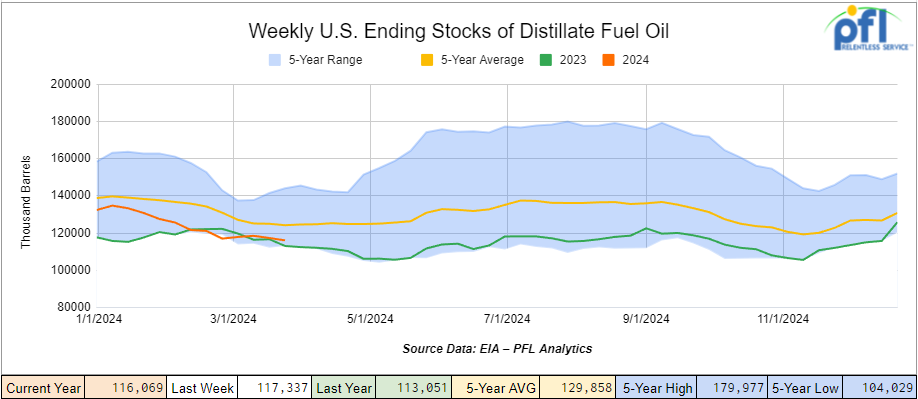

Distillate fuel inventories decreased by 1.3 million barrels week-over-week and are 7% below the five-year average for this time of year.

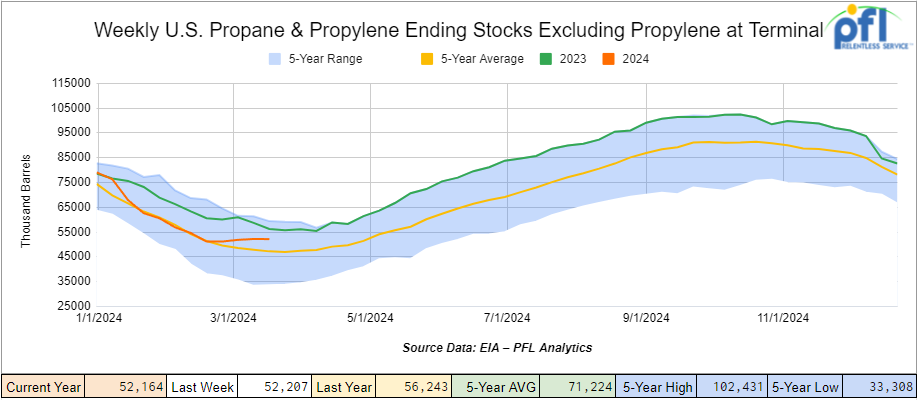

Propane/propylene inventories decreased by 400,000 barrels week-over-week and are 10% above the five-year average for this time of year.

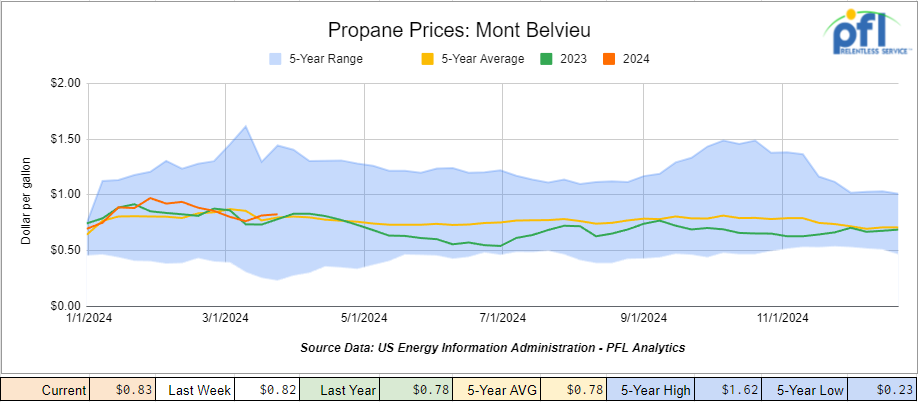

Propane prices closed at 83 cents per gallon, up 1 cent per gallon week-over-week and up 5 cents per gallon year-over-year.

Overall, total commercial petroleum inventories decreased by 2.2 million barrels during the week ending March 30th, 2024.

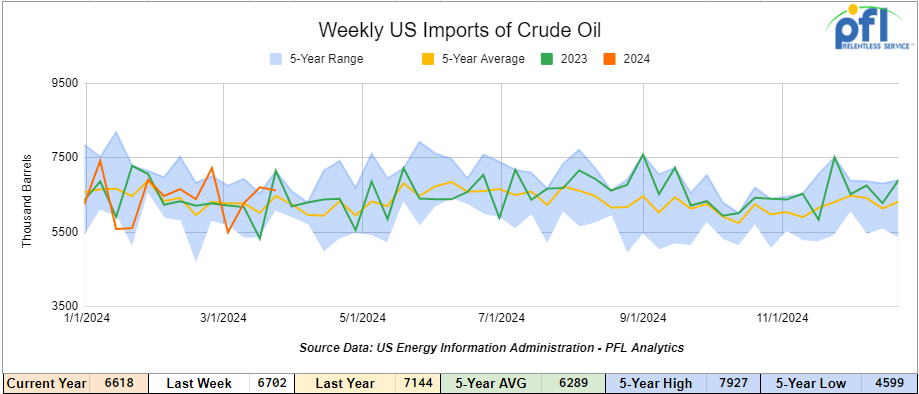

U.S. crude oil imports averaged 6.6 million barrels per day during the week ending March 30th, 2024, a decrease of 85,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.3 million barrels per day, 0.9% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 488,000 barrels per day, and distillate fuel imports averaged 104,000 barrels per day during the week ending March 30th, 2024.

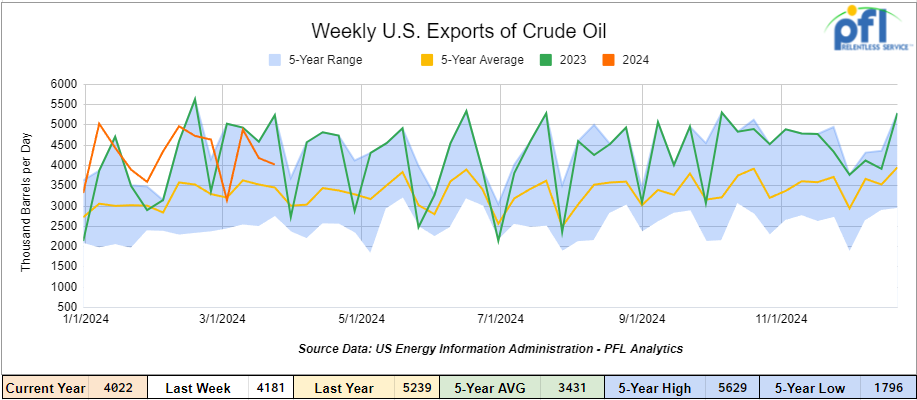

U.S. crude oil exports averaged 4.022 million barrels per day for the week ending March 30th, 2024, a decrease of 159,000 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 4.058 million barrels per day.

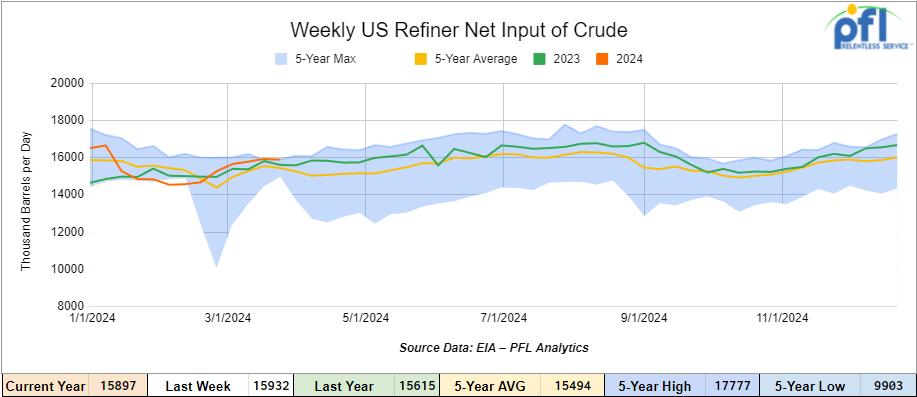

U.S. crude oil refinery inputs averaged 15.9 million barrels per day during the week ending March 30th, 2024, which was 35,000 barrels per day less than the previous week’s average.

WTI is poised to open at $86.44, down $0.47 per barrel from Friday’s close.

North American Rail Traffic

Week Ending April 3rd, 2024.

Total North American weekly rail volumes were up (2.48%) in week 14, compared with the same week last year. Total carloads for the week ending on April 3rd were 343,588, up (2.48%) compared with the same week in 2023, while weekly intermodal volume was 317,485, down (1.96%) compared to the same week in 2023. 7 of the AAR’s 11 major traffic categories posted year-over-year increases. The most significant decrease came from Coal, which was down (-19.32%). The most significant increase came from Grains which was up (+12.6%).

In the East, CSX’s total volumes were up (1.76%), with the largest decrease coming from Grains, down (-19.12%) while the largest increase came from Petroleum and Petroleum Products (21.89%). NS’s volumes were up (3.99%), with the largest increase coming from Coal (+20.11%) while the largest decrease came from Petroleum and Petroleum Products (-21.91%).

In the West, BN’s total volumes were up (6.63%), with the largest increase coming from Grain (+26.71%) while the largest decrease came from Coal, down (-33.11%). UP’s total rail volumes were up (0.01%) with the largest decrease coming from Coal, down (-36.05%) while the largest increase came from Grain which was up (19.42%).

In Canada, CN’s total rail volumes were down (2.41%) with the largest decrease coming from Other, down (-41.73%) while the largest increase came from Nonmetallic Minerals, up (+19.20%). CP’s total rail volumes were up (+19.21%) with the largest increase coming from Intermodal (+107.31%) while the largest decrease came from Other, down (-77.78%).

KCS’s total rail volumes were down (-12.16%) with the largest decrease coming from Coal (-34.84%) and the largest increase coming from Farm Products (+35.64%).

Source Data: AAR – PFL Analytics

Rig Count

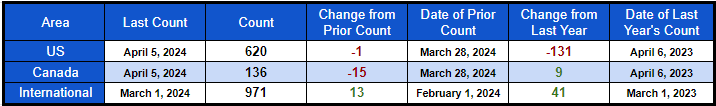

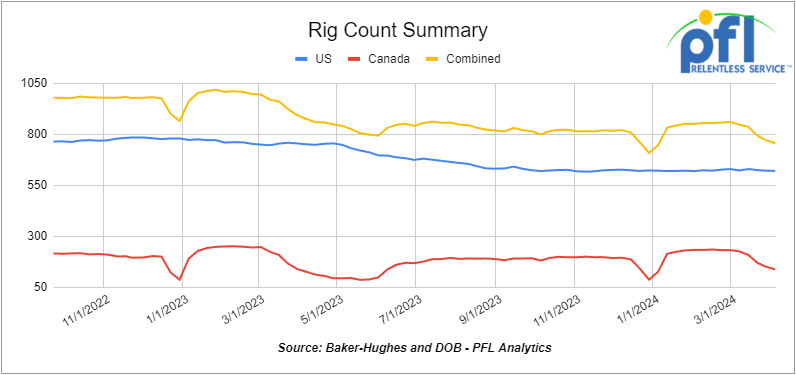

North American rig count was down by -16 rigs week-over-week. U.S. rig count was down by -1 rig week-over-week, and down by -131 rigs year-over-year. The U.S. currently has 620 active rigs. Canada’s rig count was down by -15 rigs week-over-week, but up by 9 rigs year-over-year. Canada’s overall rig count is 136 active rigs. Overall, year-over-year, we are down -122 rigs collectively.

International rig count was up by 13 rigs month-over-month and up 41 rigs year-over-year. Internationally there are 971 active rigs.

North American Rig Count Summary

A few things we are watching:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 28,299 from 28,461 which was a loss of 162 rail cars week-over-week. Canadian volumes were lower. CPKC’s shipments were lower by -0.2% week over week. CN’s volumes were lower by -1.9% week-over-week. U.S. shipments were mostly higher. The UP was the sole decliner and was down by -4.8%. The BN had the largest percentage increase and was up by 8.2%

We are watching Trans Mountain Pipeline in Canada

In the latest and greatest Trans Mountain Corp. said last week that it expects to begin commercial operation of 590,000-b/d crude oil pipeline expansion on May 1, 2024, and anticipates providing service for all contracted volumes in May.

The company completed the pipe pullback for the Mountain 3 Horizontal Directional Drill (HDD) in the Fraser Valley between Hope and Chilliwack, BC, on Mar. 29, 2024.

Several steps remain to complete the expansion project, including obtaining outstanding approvals from the Canada Energy Regulator (CER), the company said in the Apr. 3 update.

With the appropriate approvals and completion of remaining construction activity, Trans Mountain will commence transporting crude oil on the expanded system, which when complete, will increase the pipeline’s capacity to 890,000 b/d.

After it begins transporting crude oil on the system, Trans Mountain will continue cleanup, reclamation, road, and civil work, it said.

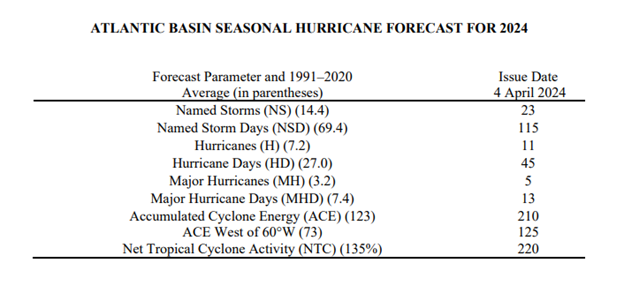

We are watching Hurricane Season

That’s right Folks – Hurricane season begins on June 1. Colorado State University hurricane researchers are predicting an extremely active Atlantic hurricane season in their initial 2024 forecast in a press release on April 4th. The team cites record warm tropical and eastern subtropical Atlantic sea surface temperatures as a primary factor for their prediction of 11 hurricanes this year. See table below:

Source Data: University of Colorado – PFL Analytics

To read the full report please click this link:

We are watching The Biden Administration Failing to Replenish Our Oil Reserves

The Department of Energy (DOE) halted purchases to replenish the Strategic Petroleum Reserve (SPR) in August and September – even though the emergency oil stockpile is only about half full. Prices they say are too high – go figure we should have told them you can’t control oil prices. What a waste of time, energy, and money!

The Biden administration made the largest withdrawal in SPR history – 180 million barrels – in the spring 2022 to curb oil and gasoline prices (so they said) following Russia’s invasion of Ukraine. That withdrawal came on the heels of a 50-million-barrel release from the SPR in November 2021.

We are watching Ford as it delays start of EV production at Oakville, Ontario Canada plant until 2027

Ford Motor Co. is delaying the start of electric vehicle production at its plant in Oakville, Ontario Canada by two years.

The U.S. automaker had planned to start production at the Canadian plant, which employs 2,700 workers, in 2025 and is pushing that out until to 2027.

Ford announced plans last year to spend $1.8 billion to transform its Oakville assembly plant into a hub for electric vehicle manufacturing including vehicle and battery pack assembly.

It says work to overhaul the plant will begin in the second quarter of this year as planned, but the launch of the new three-row electric vehicles to be produced at the factory will no begin until 2027.

The delay will give the consumer market more time to develop, the company said, and allow for further development of EV battery technology. Looks like a bunch of people are going to lose their jobs this quarter and environmentally unfriendly EV’s that no one wants to buy is going to be forced upon us whether we like it or not. Ford of course was paid a bunch of money from both the Government of Canada and the U.S. government to convert the Oakville Canada plant! (our tax dollars at work)

We are watching a Potential Rail Strike in Canada

Hopefully we avoid this one folk but the Teamsters in Canada are threating to strike – it is the last thing we need right now. The union representing CN and CPKC engineers and conductors in Canada has authorized a strike vote as labor and management remain far apart on new contracts.

Leaders of the Teamsters Canada Rail Conference told their members that a strike vote will be held from April 8 to May 1. If the rank and file vote to authorize a strike, the earliest a walkout or lockout could occur on CN and CPKC in Canada is May 22.

A strike would halt the shipment of $1 billion worth of goods in Canada per day, according to RailState, a company that monitors freight trends across Canada using a network of sensors located near CN and CPKC main lines. Stay tuned to PFL on this one. From what we know it will effect rail originating from Canada or going to Canada.

We are watching the FRA

The Federal Railroad Administration has issued its final rule on train crew safety requirements, which generally mandates a second crew member on Class I freight and passenger trains, U.S. Transportation Secretary Pete Buttigieg announced it last week.

“The minimum crew-size rule is long overdue”, Buttigieg said in a press release on Tuesday of last week.

The final rule contains some differences from the initial notice of proposed rulemaking in how it treats freight railroads, especially short lines and regionals. In limited cases, the rule permits exceptions for smaller railroads to continue or initiate certain one-person train crew operations by notifying FRA and complying with new federal safety standards.

The Association of American Railroads blasted the final rule, saying the FRA adopted it without the lack of evidence connecting crew size to safety. The AAR also noted that the FRA dropped a similar rule in 2019. At that time, the FRA was run by the Trump administration. The consumer will obviously end up paying for the added bodies increasing average everyday costs once again.

We are watching some Key Economic Indicators

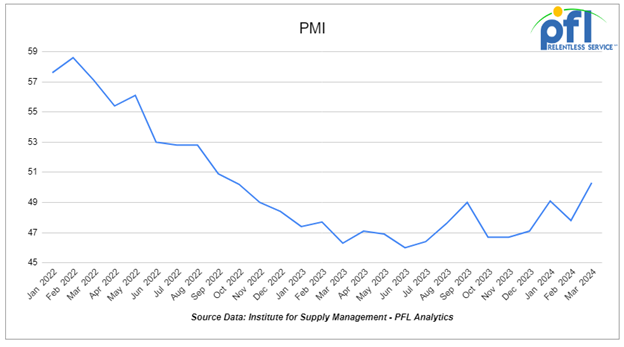

Purchasing Managers Index (PMI)

The Institute for Supply Management releases two PMI reports – one covering manufacturing and the other covering services. These reports are based on surveys of supply managers across the country and track changes in business activity. A reading above 50% on the index indicates expansion, while a reading below 50% signifies contraction, with a faster pace of change the farther the reading is from 50. the overall Manufacturing PMI was 50.3% in March, up from 47.8% in February and the first time it’s been above 50% since September 2022 — 18 months ago. The new orders subindex also rose, from 49.2% in February to 51.4% in March.

The Services PMI is like the Manufacturing PMI except it covers services, which as a share of the U.S. economy are several times manufacturing’s share. The Services PMI® fell to 51.4% in March, down from 52.6% in February and 53.4% in January. The services sector is still expanding, but at a slower pace. The new orders subindex of the Services PMI was 54.4% in March, down from 56.1% in February and 55.0% in January.

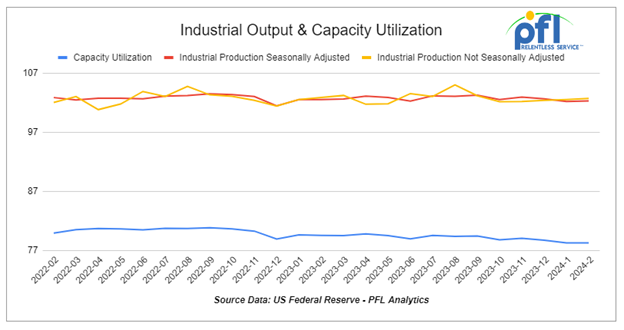

Industrial Output & Capacity Utilization

According to preliminary and seasonally adjusted data released on March 15, total U.S. manufacturing output in February 2024 rose 0.8% over January 2024 (in part due to recovery from weather-related declines in January) but was down 0.7% from February 2023. Manufacturing output has been down on a year-over-year basis in 11 of the past 12 months.

Manufacturing accounts for around 75% of total U.S. industrial output — utilities and mining (including oil and gas extraction) account for the rest. Preliminary data say total industrial output rose 0.1% in February 2024 over January 2024 but was down 0.2% from February 2023. Total output would have risen by more in February if not for a big decline in utility output due to a big reduction in demand for heat as unusually cold January temperatures gave way to more normal February temperatures.

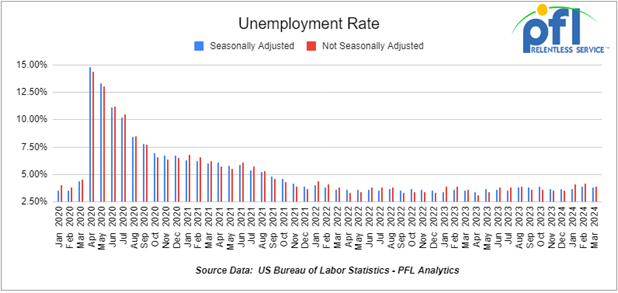

U.S Unemployment

According to the Bureau of Labor Statistics (BLS), a preliminary 303,000 net new jobs were created in March 2024.

Of the 829,000 net new jobs created in 2024 through March, 197,000 (24%) were in health care 194,000 (23%) were government, 91,000 (11%) were in construction; and 57,000 (7%) were retail trade. Manufacturing lost 4,000 net jobs in the first quarter. Transportation and warehousing overall gained 20,000 jobs in the first quarter, mainly couriers and messengers (8,000) and trucking (7,000).

The official unemployment rate in March dipped slightly to 3.83% from 3.86% in February.

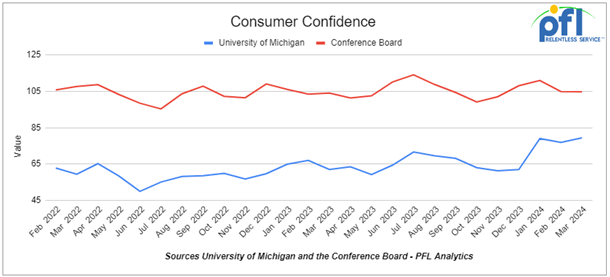

Consumer Confidence

The Conference Board’s Index of Consumer Confidence remained relatively flat at 104.7 in March from a revised 104.8 in February.

The University of Michigan’s Index of Consumer Sentiment rose to 79.4 in March from 76.9 in February.

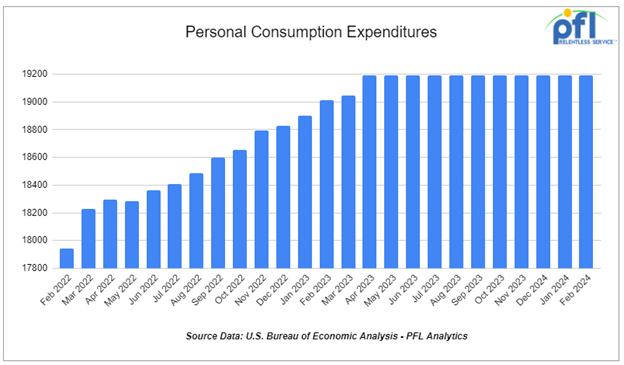

Consumer Spending

In February 2024, total consumer spending adjusted for inflation rose a preliminary 0.4% month over month. Adjusted for inflation, spending on services in January and February was up 0.4% and 0.6%, respectively. Spending on goods, which is more important for transportation providers like railroads, rose 0.1% adjusted for inflation in February versus the 1.3% decline in January.

We have been extremely busy at PFL with return-on-lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs at 239-390-2885

Lease Bids

- 30, 29K 117J Tanks needed off of BN or CN in Houston or Edmonton for 1-2 Year. Cars are needed for use in Biodiesel service.

- 200-400, 30K DOT 111 Tanks needed off of UP or BN in Houston for 2 Year. Cars are needed for use in Gas/Diesel service. 1-2 Year

- 10, 25.5K-28.3K DOT 111 Tanks needed off of UP or BN in Houston for 2 Year. Cars are needed for use in Resin service.

- 100-200, 5200 Covered Hoppers needed off of UP, BNSF in Gulf area for 1-2 years. Cars are needed for use in Petcoke service. Open to smaller cube or longer term

- 10, 28.3K 117J Tanks needed off of UP or BN in Texas for 3 Year.

- 25-30, 23.5K or 25.5K Dot 111 or CPC 1232 Tanks needed off of UP or BN in TX, OK, or AR for 3-5 Years. Cars are needed for use in Asphalt service. Needed ASAP., Lined or Unlined. Splash Load

- 100, 30K Dot 111, CPC 1232, DOT 117R, DOT 117J Tanks needed off of CP or CN in Edmonton for 1 Year. Cars are needed for use in Diesel service.

- 250, 4000 Rapid Hoppers needed off of BNSF in TX IL for 5 years. Cars are needed for use in Coal service. in rotary/rapid cars with the electric dumping shoe

- 4, 6260 Covered Hoppers needed off of CSX in Bostick, NC for 2-4 Years. Cars are needed for use in Polypropene Pellets service.

- 80, 30K 117R or 117J Tanks needed off of UP in Nebraska for 12 Months. Cars are needed for use in Ethanol service.

- 100, 30K Dot 111 or CPC 1232 Tanks needed off of UP or BN in New Orleans/Pasadena for 6-12 Months. Cars are needed for use in Gasoline/Diesel service.

- 80, 29k 117R or 117J Tanks needed off of Any Class 1 in Kentucky for 1-5 Years. Cars are needed for use in Crude service.

- 50, 19k DOT111 Tanks needed off of UP or BN in Nevada or CA for 1 year. Cars are needed for use in Sulfuric Acid service. March or April

- 8, 28-30K Any Tanks needed off of UP BN in Texas and Gulf for 5 years. Cars are needed for use in Chlorobenzene service. Need Magrods

- 14, 23.5K DOT111 Tanks needed off of UP in Morrilton, AR for 1 year. Cars are needed for use in Turpentine service.

- 10, 30k any Tanks needed off of UP BN in Texas for 1 year plus. Cars are needed for use in Fuel Oil service.

- 25-50, 5000CF-5100CF Covered Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in Dry sugar service. 3 bay gravity dump, Hempel 37700

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 50, 23.5-25.5 DOT111 Tank s needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

- 25, 30K Any Tanks needed off of in Houston for December -June. Cars are needed for use in Diesel service.

- 75, 30K Any Tanks needed off of Any Class 1 in Chicago for December 23-May 24. Cars are needed for use in Gasoline service.

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 20-25, 30K DOT117 Tanks needed off of UP or BN in Illinois for 5 years. Cars are needed for use in Ethanol service.

- 50-100, 4550 Covered Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in Grain service.

- 10, 33K 340W Pressure Tanks needed off of CN in LA for 1 year. Cars are needed for use in Butane service.

- 25, 20.5K CPC1232 or DOT117J Tanks needed off of BNSF or UP in the west for 3-5 years. Cars are needed for use in Magnesium chloride service. SDS onhand

- 25-50, 25.5K DOT117J Tanks needed off of NS CSX in Northeast for 5 years. Cars are needed for use in Asphalt / Heavy Fuel Oil service.

- 15, 28.3K DOT117J Tanks needed off of any class 1 in any location for 3 years. Cars are needed for use in Glycerin & Palm Oil service.

- 30, 17K-20K DOT117J Tanks needed off of UP or BN in Midwest/West Coast for 3-5 years. Cars are needed for use in Caustic service.

- 150, 23.5K DOT111 Tanks needed off of any class 1 in LA for 2-3 years. Cars are needed for use in Fluid service. Needed July

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

Sales Bids

- 5, 23,5K DOT 111 Tanks needed off of any class 1 in Texas. Negotiable

- 5, 30K DOT 111 Tanks needed off of in US. Cars are needed for use in Fuels service.

- 20-30, Open Top Hoppers needed off of NS or CSX in Northeast. Cars are needed for use in aggregate service. Gravity dump

- 5, 3400CF Covered Hoppers needed off of any class 1 in Ohio. Cars are needed for use in Sand service.

- 20, 2770-3400 Mill Gondolas needed off of any class 1 in South Texas. Cars are needed for use in scrap metal service.

- 10, 6400 Open Top Hoppers needed off of CSX in the northeast. Cars are needed for use in wood chip service. Open top hopper, flat bottom

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 200+, 5000cf Covered Hoppers needed off of any class 1 in various locations.

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Sand service.

- 2-4, 28K DOT111 Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

- 20-30, 3000 – 3300 PD Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 100, 15.7K DOT111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

- 20, 2770 Mill Gondolas needed off of CSX in the northeast. Cars are needed for use in non-haz soil service. 52-60 ft

- 10, 4000 Open Top Hoppers needed off of CSX in the northeast. Cars are needed for use in scrap metal service. Open top hopper

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 8, 5200 Covered Hoppers needed off of various class 1s in various locations. Cars are needed for use in Plastic Pellet service.

Lease Offers

- 38, 4750 plus, 3-4 Hatch Gravity Covered Hopperss located off of CSX CN CP in Florida. Sub-lease 12-18 months

- 200-500, 5200, Covered Hoppers located off of CN and NS in Moving on CN and NS. Cars were last used in Grain. Lease available until Fall.

- 50, 33K, 340W Pressures located off of in Moving. Cars were last used in Propane. 1 year lease

- 100, 33K, 340W Pressures located off of CN or CP in Canada. Cars are clean

- 10, 28.3K, DOT117R Tanks located off of All Class Ones in St Louis. Cars are clean Call 239-390-2885 for more information

- 10, 21.9K, Tanks located off of UP in Longview, TX. Cars are clean CO2 Cars. Brand New. 2-5 Year Lease

- 125, 28.3K, 117J Tanks located off of Various Class 1s in Multiple locations. Cars are clean Long Term Lease, 5 Years +

- 50, 28.3K, AAR 211 Tanks located off of BN in Moving. Cars were last used in Biodiesel. 1 Year Lease; Free Move on BN

- 15, 29.2, DOT 111 Tanks located off of UP or BN in Houston. Cars were last used in Sunflower Oil. 1 Year

- 15, 25.5, DOT 111 Tanks located off of UP or BN in Houston. Cars were last used in Sunflower Oil. 1 Year

- 100+, 29K, 117R Tanks located off of All Class Ones in St Louis. Cars were last used in Veg Oils. Up to 4 Years

- 100+, 29K, 117R Tanks located off of All Class Ones in St Louis. Cars are clean Up to 4 Years

Sales Offers

- 20, Refer, Box Boxcars located off of UP in ID.

- 100-300, 3400, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 100, 28.3K, DOT117J Tanks located off of various class 1s in multiple locations.

- 100, 17K, DOT111 Tanks located off of various class 1s in multiple locations.

- 100, 19K, DOT111 Tanks located off of various class 1s in multiple locations.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|

PFL will be at the Following Conferences

- Attending: Curtis Chandler (239.405.3365) David Cohen (954-729-4774)

- Conference Website

- Where: Moody Gardens Hotel and Convention Center

- Attending: Curtis Chandler (239.405.3365) David Cohen (954-729-4774)

- Conference Website