“Every man’s work, whether it be literature, or music or pictures or architecture or anything else, is always a portrait of himself.”

– Samuel Butler

Jobs Update

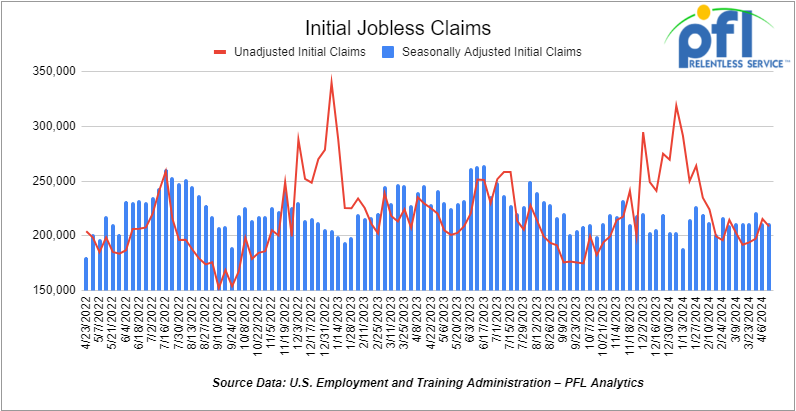

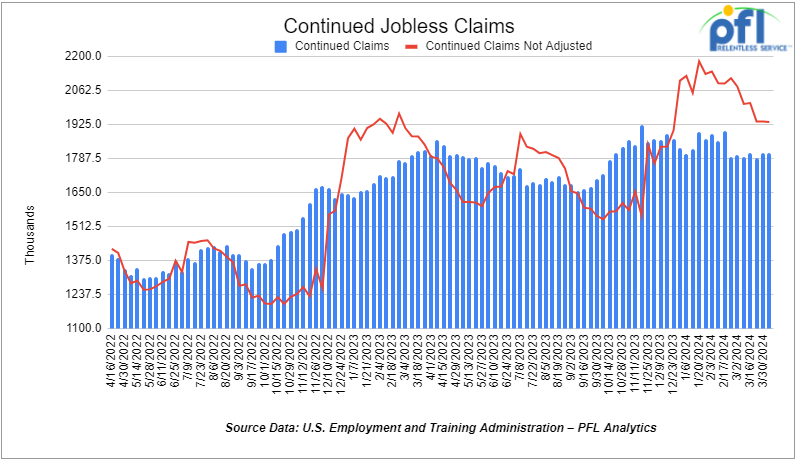

- Initial jobless claims seasonally adjusted for the week ending April 13th, 2023 came in at 212,000, flat week-over-week.

- Continuing jobless claims came in at 1.812 million people, versus the adjusted number of 1.810 million people from the week prior, up 2,000 people week-over-week.

Stocks closed mixed on Friday of last week, mostly lower week over week

The DOW closed higher on Friday of last week, up 211.02 points (0.56%), closing out the week at 37,986.4, up 3.16 points week-over-week. The S&P 500 closed lower on Friday of last week, down -43.89 points (-0.88%), and closed out the week at 4,967.23, down -156.18 points week-over-week. The NASDAQ closed lower last week, down -319.49 points (-1.98%), and closed out the week at 15,282.01, down -893.08 points week-over-week.

In overnight trading, DOW futures traded higher and are expected to open at 38,373 this morning up 165 points.

Crude oil closed higher on Friday of last week, but lower week over week.

WTI traded up $0.41 per barrel (0.5%) to close at $83.14 per barrel on Friday of last week, down -$2.52 per barrel week-over-week. Brent traded up US$0.18 per barrel (0.21%) on Friday of last week, to close at US$87.29 per barrel, down -US$3.16 per barrel week-over-week.

One Exchange WCS (Western Canadian Select) for June delivery settled Friday at US$11.90 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$69.45 per barrel. On Thursday, it settled at US$11.90 below the WTI-CMA for June. The implied value was US$69.40 per barrel.

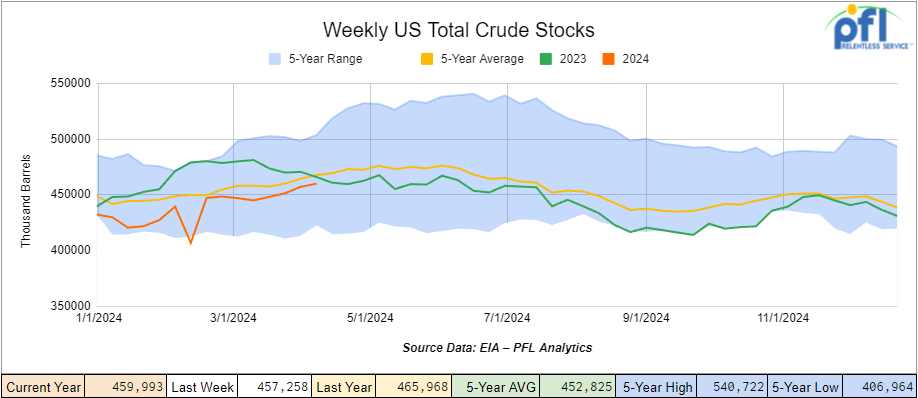

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 2.7 million barrels week-over-week. At 460.0 million barrels, U.S. crude oil inventories are 1% below the five-year average for this time of year.

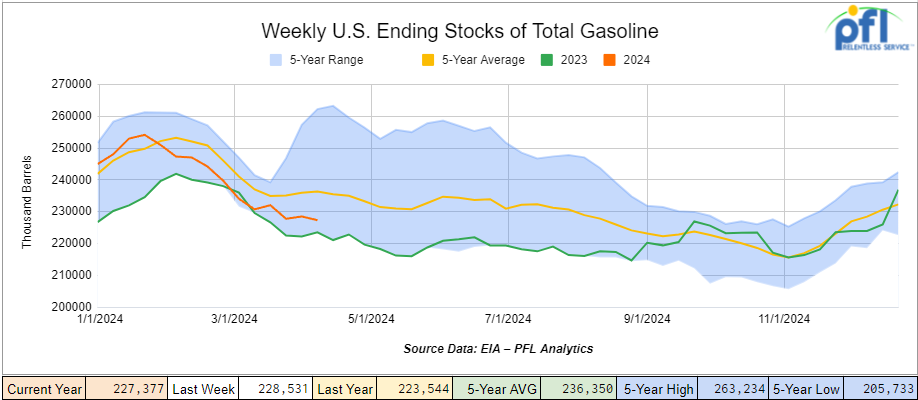

Total motor gasoline inventories decreased by 1.2 million barrels week-over-week and are 4% below the five-year average for this time of year.

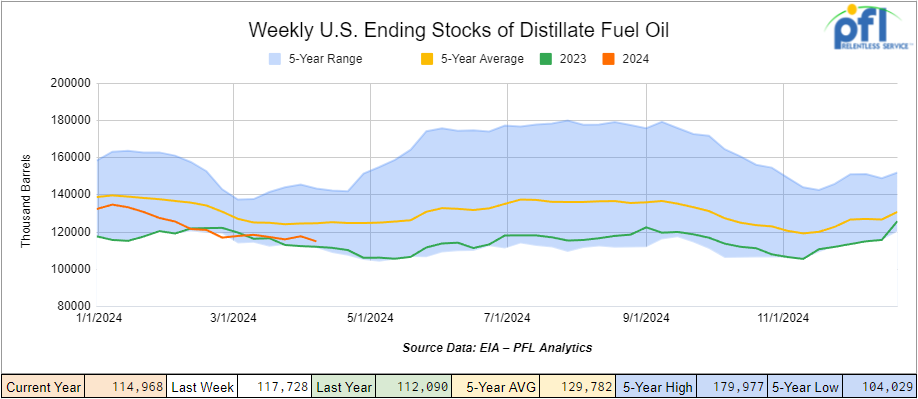

Distillate fuel inventories decreased by 2.8 million barrels week-over-week and are 7% below the five-year average for this time of year.

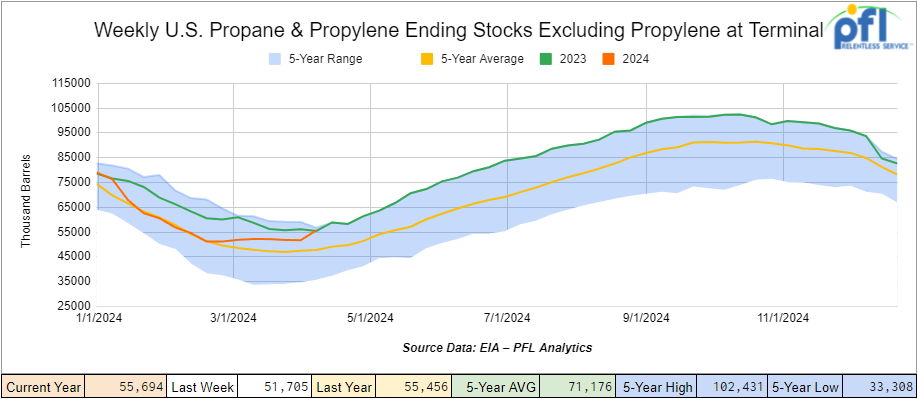

Propane/propylene inventories increased by 4 million barrels week-over-week and are 16% above the five-year average for this time of year.

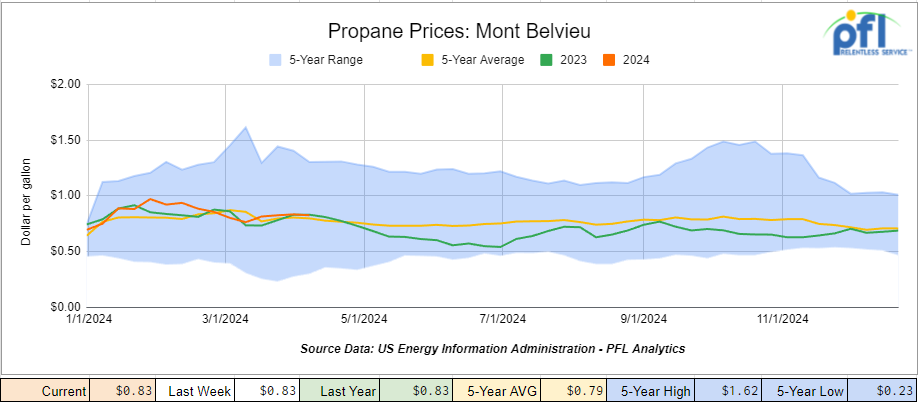

Propane prices closed at 83 cents per gallon, flat week-over-week and flat year-over-year.

Overall, total commercial petroleum inventories increased by 10 million barrels during the week ending April 12th, 2024.

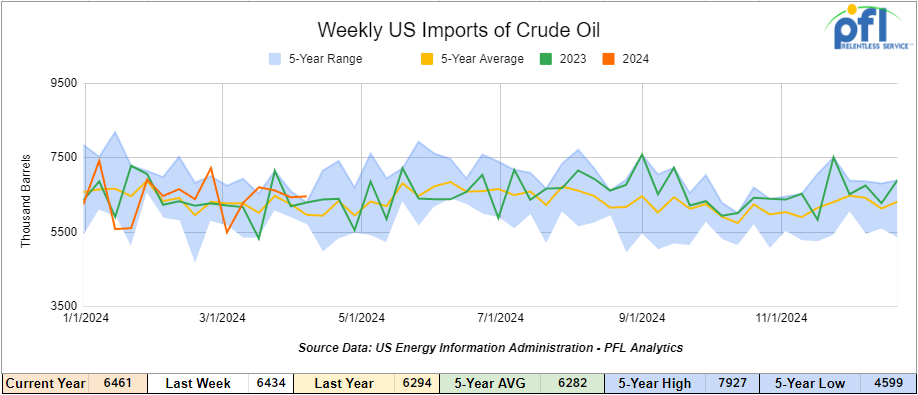

U.S. crude oil imports averaged 6.5 million barrels per day during the week ending April 12th, 2024, an increase of 27,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.6 million barrels per day, 5.0% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 709,000 barrels per day, and distillate fuel imports averaged 149,000 barrels per day during the week ending April 12th, 2024.

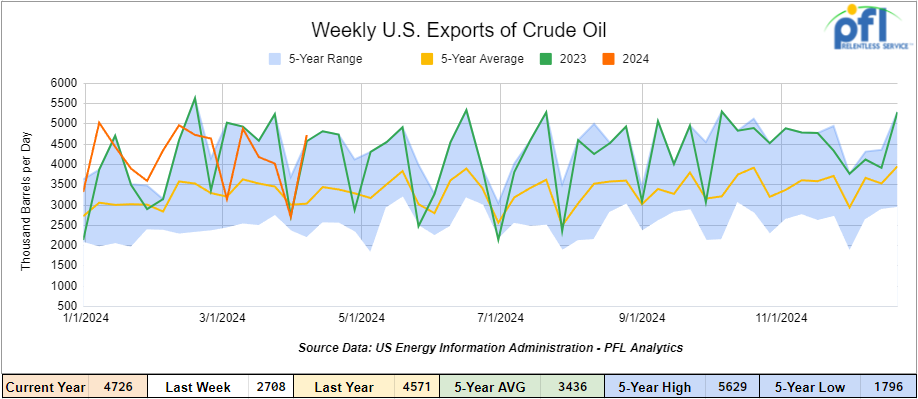

U.S. crude oil exports averaged 4.726 million barrels per day for the week ending April 12th, 2024, an increase of 2.018 million barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 3.909 million barrels per day.

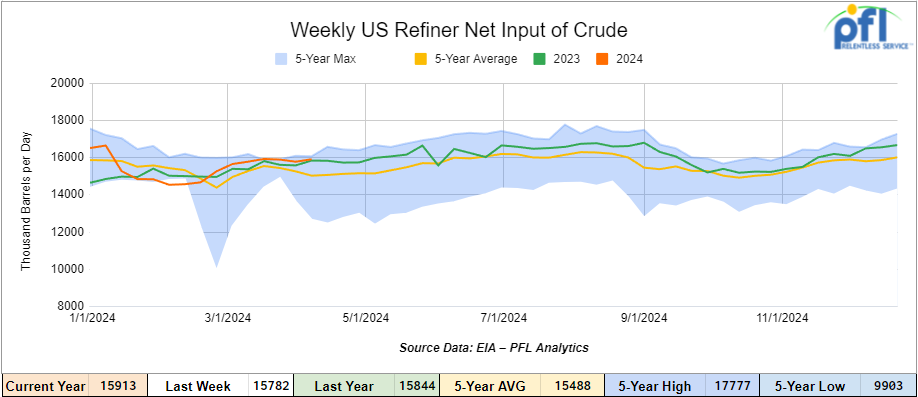

U.S. crude oil refinery inputs averaged 15.9 million barrels per day during the week ending April 12, 2024, which was 131,000 barrels per day more week-over-week.

WTI is poised to open at $82.83, down -0.31 per barrel from Friday’s close.

North American Rail Traffic

Week Ending April 10th, 2024.

Total North American weekly rail volumes were up (2.21%) in week 15, compared with the same week last year. Total carloads for the week ending on April 10th were 333,225, down (1.71%) compared with the same week in 2023, while weekly intermodal volume was 304,055, up (6.89%) compared to the same week in 2023. 7 of the AAR’s 11 major traffic categories posted year-over-year increases. The most significant decrease came from Coal, which was down (-22.95%). The most significant increase came from Grains which was up (+19.36%).

In the East, CSX’s total volumes were up (1.36%), with the largest decrease coming from Other, down (-11.04%) while the largest increase came from Petroleum and Petroleum Products (22.02%). NS’s volumes were up (6.18%), with the largest increase coming from Metallic Ores and Minerals (+18.78%) while the largest decrease came from Chemicals (-4.43%).

In the West, BN’s total volumes were up (+4.94%), with the largest increase coming from Grain (+34.52%) while the largest decrease came from Coal, down (-31.34%). UP’s total rail volumes were down (-4.32%) with the largest decrease coming from Coal, down (-41.75%) while the largest increase came from Other which was up (+7.16%).

In Canada, CN’s total rail volumes were up (+5.08%) with the largest decrease coming from Other, down (-28.18%) while the largest increase came from Chemicals, up (+12.28%). CP’s total rail volumes were up (+8.42%) with the largest increase coming from Grain (+76.82%) while the largest decrease came from Coal, down (-59.15%).KCS’s total rail volumes were up (0.75%) with the largest decrease coming from Coal (-25.73%) and the largest increase coming from Grain (+39.85%).

Source Data: AAR – PFL Analytics

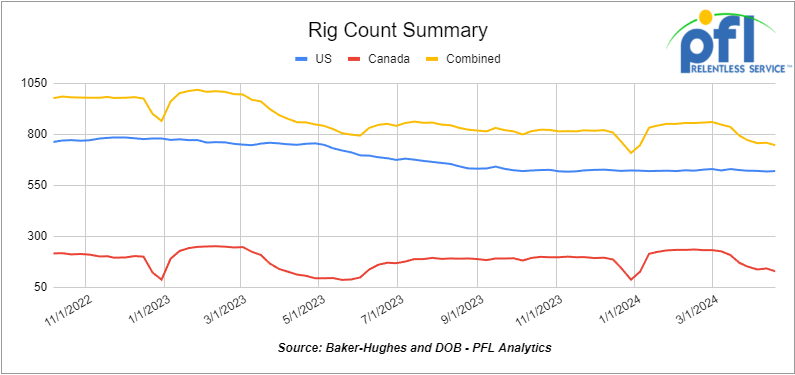

Rig Count

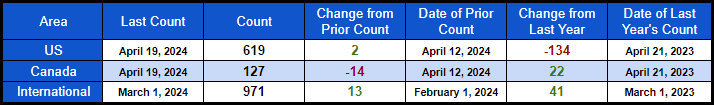

North American rig count was down by -12 rigs week-over-week. U.S. rig count was up by 2 rigs week-over-week, and down by -134 rigs year-over-year. The U.S. currently has 619 active rigs. Canada’s rig count was down by -14 rigs week-over-week, and up by 22 rigs year-over-year. Canada’s overall rig count is 127 active rigs. Overall, year-over-year, we are down -112 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 27,869 from 28,199, which was a loss of 330 rail cars week-over-week. This was the seventh consecutive week over week decline. Canadian volumes were little changed. CPKC’s shipments were lower by -4.8% week over week. CN’s volumes were higher by +4.9% week-over-week. U.S. shipments were mostly higher. The UP had the largest percentage increase and was up by +4.7%. The CSX was the sole decliner and was down -4.4%.

We are watching the Biden Administration – Tough to fixed Stupid Folks When it comes to Energy Policy

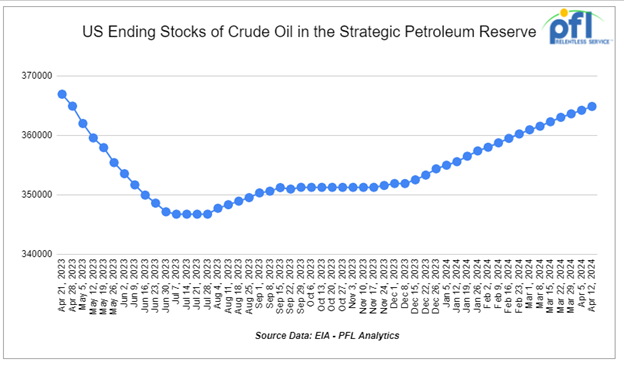

Because it worked so well last time, the Biden Administration seems to be considering releasing more crude oil from our already depleted oil reserves to keep a lid on gas prices during this summer’s driving season ahead of November’s election.

In 2022, the administration of President Joe Biden announced a sale of 180 million barrels of oil over six months from the reserve, the largest ever SPR sale, in an attempt to lower gasoline prices after Russia invaded Ukraine. The DOE also conducted a sale of 38 million barrels in 2022 that had been mandated by Congress. Meanwhile, the U.S. Department of Energy this month paused its oil repurchase for the SPR due to high oil prices.

U.S. President Joe Biden will do what he can to ensure affordable gasoline prices, White House senior adviser John Podesta said at an industry conference on Tuesday of last week, when he was asked about future releases of crude oil from the Strategic Petroleum Reserve (SPR). A long way to go until we are full as it is – why we would even consider releasing more is mind-boggling..

If the Biden administration is doing whatever it can do to curb gasoline prices, why did they, on the same day, (Tuesday of last week) ban oil and gas drilling on 13.3 million acres in the National Petroleum Reserve (NPR – A) on Alaska’s North Slope?

“I am proud that my Administration is taking action to conserve more than 13 million acres in the Western Arctic and to honor the culture, history, and enduring wisdom of Alaska Natives who have lived on and stewarded these lands since time immemorial,” President Joe Biden said in a statement. He said the decision was part of his administration’s push to “meet the urgency of the climate crisis.”

Dustin Meyer, senior vice-president for policy at the American Petroleum Institute called the rule “another step in the wrong direction,” particularly as “the world is looking for American energy leadership.”

“This misguided rule from the Biden Administration sharply limits future oil and natural gas development in Alaska’s National Petroleum Reserve, a region explicitly intended by Congress to bolster America’s energy security while generating important economic growth and revenue for local Alaskan communities,” Meyer said in a statement.

We are watching Canada’s Potential Rail Strike – Farmers in Canada Concerned – PFL has your Back

Members of the Teamsters Canada Rail Conference (TCRC) are in the middle of a strike vote. The vote comes after three collective agreements covering CN and CPKC engineers and conductors as well as rail traffic controllers at CPCK, expired December 31.

The TCRC electronic strike vote began April 8th and will wrap up May 1st, the earliest a strike or lockout can legally occur is May 22nd.

While there’s still some track ahead of the labor unrest locomotive, the grain sector in Canada is concerned it could be collateral damage in the dispute.

Wade Sobkowich, executive director of the Western Grain Elevator Association, says the risk is “huge” and that the stoppage will be “absolute or near absolute” for bulk grain movements.

He added that even the usual seasonal and cyclical dimension of grain sales and movement aren’t in the sector’s favor this crop year. There’s been more demand for rail cars than have been supplied, leading to what he describes as a “flatlining” effect on sales through the year.

“A larger portion of the crop than normal has been pushed outside the peak period and there is still a lot of grain to move,” he said.

Railways in the grain sector are monopoly service providers in Canada. Customers that originate product out of Canada for export or ship product to other parts of Canada will suffer if the strike moves forward.

The Union’s website notes that the last meetings with CPKC took place March 27 and 28, with the next scheduled date for negotiations set for April 23 and 24 (over this past weekend).

The last negotiations with Canadian National were scheduled to take place April 10, 11, 12, 29 and 30 and then during the week of May 13 and 20.

PFL has been working with a number of shippers to provide backup rail car storage particularly for customers heading back to Canada after exporting product into the United States. Please call PFL for further details.

We have been extremely busy at PFL with return-on-lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs at 239-390-2885

Lease Bids

- 50, 30K 117 Tanks needed off of BNSF or UP in TX for 3-6 Months. Cars are needed for use in Crude service. will look at smaller cars. Prefer short term would look at longer term. Domestic use only

- 20, 25.5k CPC 1232 Tanks needed off of UP or BN in Ok, TX for 3 Year. Cars are needed for use in Asphalt service.

- 30, 29K 117J Tanks needed off of BN or CN in Houston or Edmonton for 1-2 Year. Cars are needed for use in Biodiesel service.

- 200-400, 30K DOT 111 Tanks needed off of UP or BN in Houston for 2 Year. Cars are needed for use in Gas/Diesel service. 1-2 Year

- 10, 25.5K-28.3K DOT 111 Tanks needed off of UP or BN in Houston for 2 Year. Cars are needed for use in Resin service.

- 100-200, 5200 Covered Hoppers needed off of UP, BNSF in Gulf area for 1-2 years. Cars are needed for use in Petcoke service. Open to smaller cube or longer term

- 10, 28.3K 117J Tanks needed off of UP or BN in Texas for 3 Year.

- 25-30, 23.5K or 25.5K Dot 111 or CPC 1232 Tanks needed off of UP or BN in TX, OK, or AR for 3-5 Years. Cars are needed for use in Asphalt service. Needed ASAP., Lined or Unlined. Splash Load

- 100, 30K Dot 111, CPC 1232, DOT 117R, DOT 117J Tanks needed off of CP or CN in Edmonton for 1 Year. Cars are needed for use in Diesel service.

- 250, 4000 Rapid Hoppers needed off of BNSF in TX IL for 5 years. Cars are needed for use in Coal service. in rotary/rapid cars with the electric dumping shoe

- 4, 6260 Covered Hoppers needed off of CSX in Bostick, NC for 2-4 Years. Cars are needed for use in Polypropene Pellets service.

- 80, 30K 117R or 117J Tanks needed off of UP in Nebraska for 12 Months. Cars are needed for use in Ethanol service.

- 100, 30K Dot 111 or CPC 1232 Tanks needed off of UP or BN in New Orleans/Pasadena for 6-12 Months. Cars are needed for use in Gasoline/Diesel service.

- 80, 29k 117R or 117J Tanks needed off of Any Class 1 in Kentucky for 1-5 Years. Cars are needed for use in Crude service.

- 50, 19k DOT111 Tanks needed off of UP or BN in Nevada or CA for 1 year. Cars are needed for use in Sulfuric Acid service. March or April

- 8, 28-30K Any Tanks needed off of UP BN in Texas and Gulf for 5 years. Cars are needed for use in Chlorobenzene service. Need Magrods

- 14, 23.5K DOT111 Tanks needed off of UP in Morrilton, AR for 1 year. Cars are needed for use in Turpentine service.

- 10, 30k any Tanks needed off of UP BN in Texas for 1 year plus. Cars are needed for use in Fuel Oil service.

- 25-50, 5000CF-5100CF Covered Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in Dry sugar service. 3 bay gravity dump, Hempel 37700

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 50, 23.5-25.5 DOT111 Tanks needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 20-25, 30K DOT117 Tanks needed off of UP or BN in Illinois for 5 years. Cars are needed for use in Ethanol service.

- 50-100, 4550 Covered Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in Grain service.

- 10, 33K 340W Pressure Tanks needed off of CN in LA for 1 year. Cars are needed for use in Butane service.

- 25, 20.5K CPC1232 or DOT117J Tanks needed off of BNSF or UP in the west for 3-5 years. Cars are needed for use in Magnesium chloride service. SDS onhand

- 25-50, 25.5K DOT117J Tanks needed off of NS CSX in Northeast for 5 years. Cars are needed for use in Asphalt / Heavy Fuel Oil service.

- 15, 28.3K DOT117J Tanks needed off of any class 1 in any location for 3 years. Cars are needed for use in Glycerin & Palm Oil service.

- 30, 17K-20K DOT117J Tanks needed off of UP or BN in Midwest/West Coast for 3-5 years. Cars are needed for use in Caustic service.

- 150, 23.5K DOT111 Tanks needed off of any class 1 in LA for 2-3 years. Cars are needed for use in Fluid service. Needed July

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

Sales Bids

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 20, 2770-3400 Mill Gondolas needed off of any class 1 in South Texas. Cars are needed for use in scrap metal service.

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Sand service.

- 20-30, 3000 – 3300 PD Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 5, 3400CF Covered Hoppers needed off of any class 1 in Ohio. Cars are needed for use in Sand service.

- 20-30, Open Top Hoppers needed off of NS or CSX in Northeast. Cars are needed for use in aggregate service. Gravity dump

- 5, 23,5K DOT 111 Tanks needed off of any class 1 in Texas. Negotiable

- 20, 17K DOT111 Tanks are needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 100, 15.7K DOT111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

- 2-4, 28K DOT111 Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

- 5, 30K DOT 111 Tanks needed off of in US. Cars are needed for use in fuel service.

Lease Offers

- 200-500, 5200, Covered Hoppers located off of CN and NS in Moving on CN and NS. Cars were last used in Grain. The lease is available until Fall.

- 100, 33K, 340W Pressures located off of CN or CP in Canada. Cars are clean

- 10, 21.9K, Tanks located off of UP in Longview, TX. Cars are clean CO2 Cars. Brand New. 2-5 Year Lease

- 125, 28.3K, 117J Tanks located off of Various Class 1s in Multiple locations. Cars are clean Long Term Lease, 5 Years +

- 50, 28.3K, AAR 211 Tanks located off of BN in Moving. Cars were last used in Biodiesel. 1 year Lease; Free Move on BN

- 15, 29.2, DOT 111 Tanks located off of UP or BN in Houston. Cars were last used in Sunflower Oil. 1 Year

- 15, 25.5, DOT 111 Tanks located off of UP or BN in Houston. Cars were last used in Sunflower Oil. 1 Year

- 100+, 29K, 117R Tanks located off of All Class Ones in St Louis. Cars were last used in Veg Oils. Up to 4 Years

- 15, 33K, 340W Tanks located off of All Class Ones in North America. Cars were last used in Propane/Butane. Up to 1 year.

Sales Offers

- 20, Refer, Box Boxcars located off of UP in ID.

- 100-300, 3400, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 100, 28.3K, DOT117J Tanks located off of various class 1s in multiple locations.

- 100, 17K, DOT111 Tanks located off of various class 1s in multiple locations.

- 100, 19K, DOT111 Tanks located off of various class 1s in multiple locations.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|

PFL will be at the Following Conferences

- Attending: Curtis Chandler (239.405.3365) David Cohen (954-729-4774)

- Conference Website

- Where: Moody Gardens Hotel and Convention Center

- Attending: Curtis Chandler (239.405.3365) David Cohen (954-729-4774)

- Conference Website