“The man who will use his skill and constructive imagination to see how much he can give for a dollar, instead of how little he can give for a dollar, is bound to succeed.”

– Henry Ford

Jobs Update

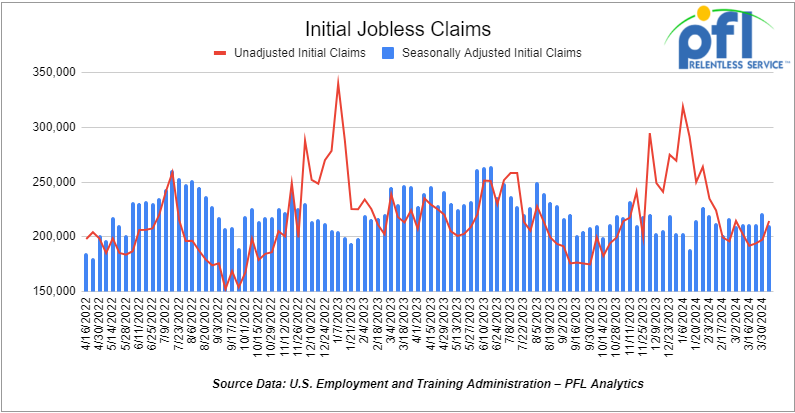

- Initial jobless claims seasonally adjusted for the week ending April 6th, 2023 came in at 211,000, down -11,000 people week-over-week.

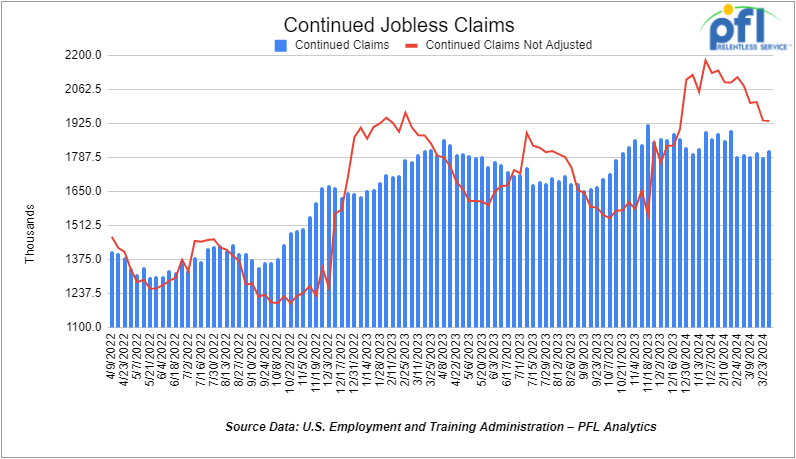

- Continuing jobless claims came in at 1.817 million people, versus the adjusted number of 1.789 million people from the week prior, up 28,000 people week-over-week.

Stocks closed lower on Friday of last week and lower week over week

The DOW closed lower on Friday of last week, down -475.84 points (-1.24%), closing out the week at 37,983.24, down -923.8 points week-over-week. The S&P 500 closed lower on Friday of last week, down -75.65 points (-1.46%), and closed out the week at 5,123.41, down -80.93 points week-over-week. The NASDAQ closed lower on Friday of last week, down -267.1 points (-1.64%), and closed out the week at 16,175.09, down -73.43 points week-over-week.

In overnight trading, DOW futures traded lower and are expected to open at 38,328 this morning up 90 points.

Crude oil closed higher on Friday of last week, but lower week over week.

WTI traded up $0.64 per barrel (0.75%) to close at $85.66 per barrel on Friday of last week, down $1.25 per barrel week-over-week. Brent traded up US$0.71 per barrel (0.79%) on Friday of last week, to close at US$90.45 per barrel, down -US$0.72 per barrel week-over-week.

One Exchange WCS (Western Canadian Select) for May delivery settled Friday at US$13.45 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$71.40 per barrel. On Thursday, it settled at US$13.65 below the WTI-CMA for May delivery. The implied value was US$70.57 per barrel.

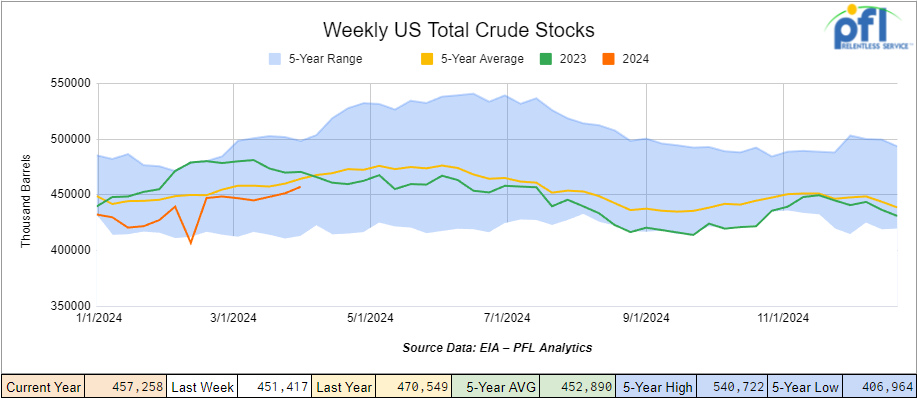

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 5.8 million barrels week-over-week. At 457.3 million barrels, U.S. crude oil inventories are 2% below the five-year average for this time of year.

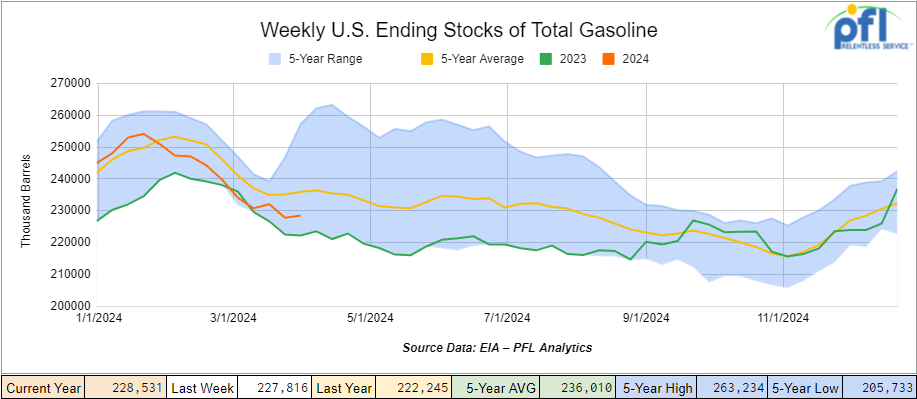

Total motor gasoline inventories increased by 700,000 barrels week-over-week and are 3% below the five-year average for this time of year.

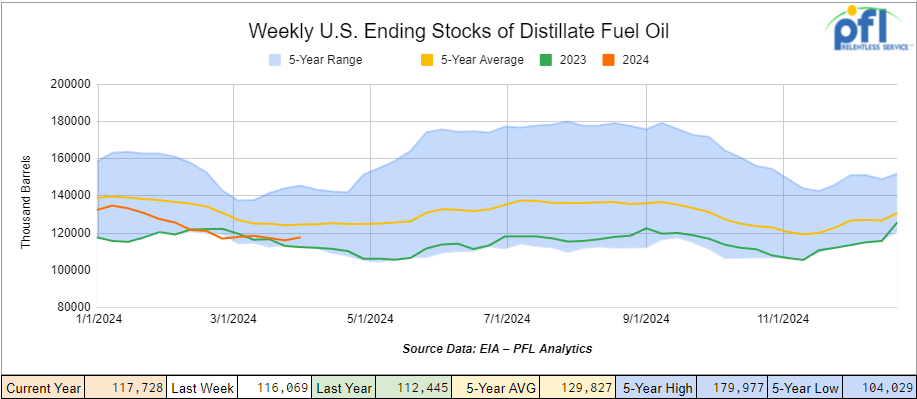

Distillate fuel inventories increased by 1.7 million barrels week-over-week and are 5% below the five-year average for this time of year.

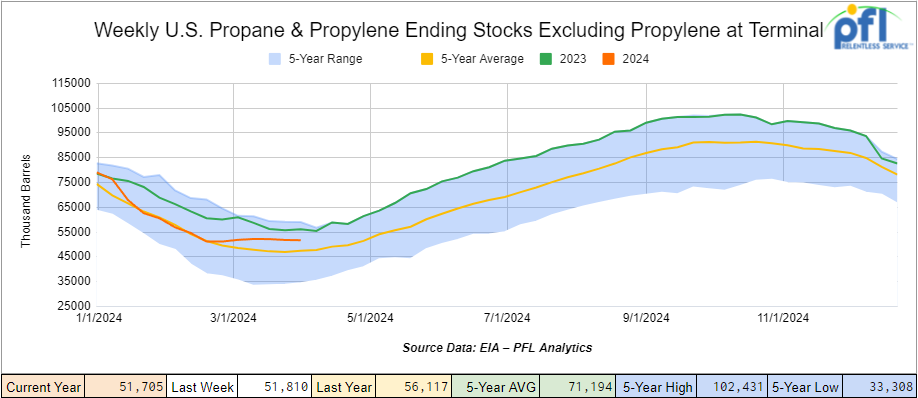

Propane/propylene inventories decreased by 100,000 barrels week-over-week and are 9% above the five-year average for this time of year.

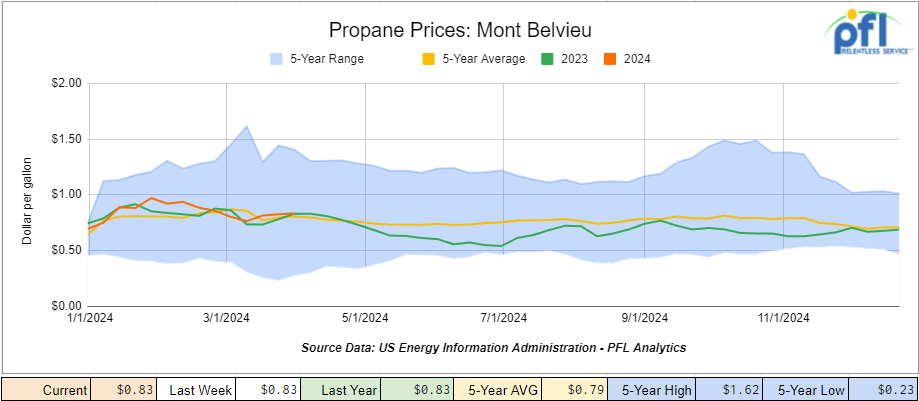

Propane prices closed at 83 cents per gallon, flat week-over-week and flat year-over-year.

Overall, total commercial petroleum inventories increased by 12.4 million barrels during the week ending April 5th, 2024.

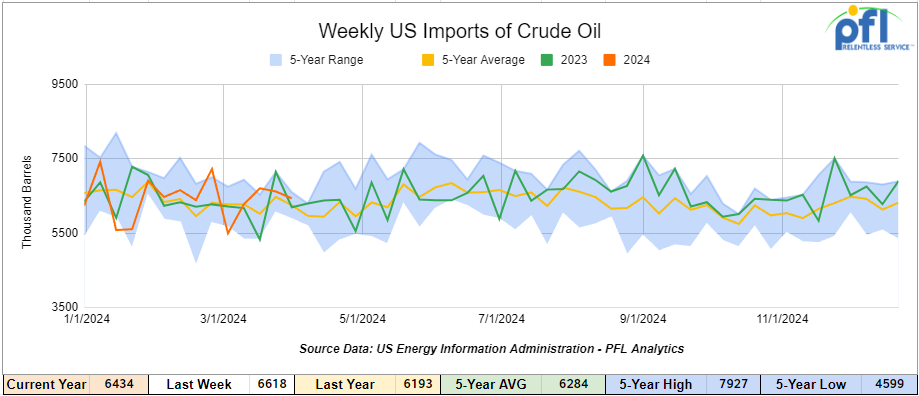

U.S. crude oil imports averaged 6.4 million barrels per day during the week ending April 5th, 2024, a decrease of 183,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.5 million barrels per day, 4.8% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 730,000 barrels per day, and distillate fuel imports averaged 163,000 barrels per day during the week ending April 5th, 2024.

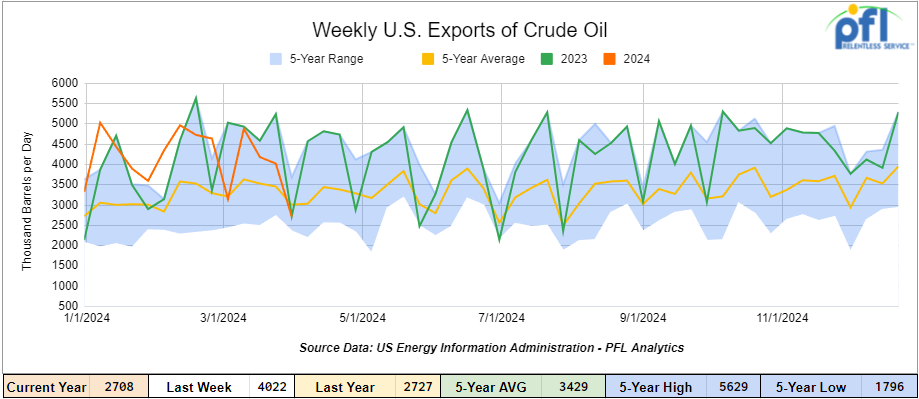

U.S. crude oil exports averaged 2.708 million barrels per day for the week ending April 5th, 2024, a decrease of 1.314 million barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 3.948 million barrels per day.

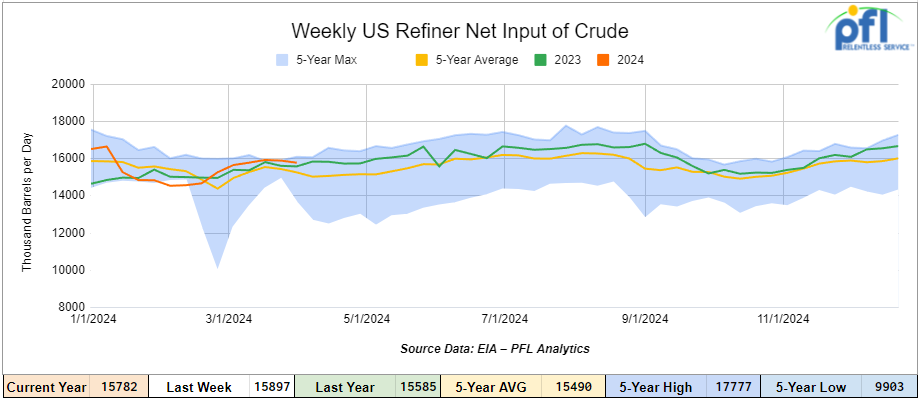

U.S. crude oil refinery inputs averaged 15.8 million barrels per day during the week ending April 5, 2024, which was 115,000 barrels per day less week-over-week.

WTI is poised to open at 84.48, down -$1.17 per barrel from Friday’s close.

North American Rail Traffic

Week Ending April 10th, 2024.

Total North American weekly rail volumes were up (2.21%) in week 15, compared with the same week last year. Total carloads for the week ending on April 10th were 333,225, down (1.71%) compared with the same week in 2023, while weekly intermodal volume was 304,055, up (6.89%) compared to the same week in 2023. 7 of the AAR’s 11 major traffic categories posted year-over-year increases. The most significant decrease came from Coal, which was down (-22.95%). The most significant increase came from Grains which was up (+19.36%).

In the East, CSX’s total volumes were up (1.36%), with the largest decrease coming from Other, down (-11.04%) while the largest increase came from Petroleum and Petroleum Products (22.02%). NS’s volumes were up (6.18%), with the largest increase coming from Metallic Ores and Minerals (+18.78%) while the largest decrease came from Chemicals (-4.43%).

In the West, BN’s total volumes were up (+4.94%), with the largest increase coming from Grain (+34.52%) while the largest decrease came from Coal, down (-31.34%). UP’s total rail volumes were down (-4.32%) with the largest decrease coming from Coal, down (-41.75%) while the largest increase came from Other which was up (+7.16%).

In Canada, CN’s total rail volumes were up (+5.08%) with the largest decrease coming from Other, down (-28.18%) while the largest increase came from Chemicals, up (+12.28%). CP’s total rail volumes were up (+8.42%) with the largest increase coming from Grain (+76.82%) while the largest decrease came from Coal, down (-59.15%).KCS’s total rail volumes were up (0.75%) with the largest decrease coming from Coal (-25.73%) and the largest increase coming from Grain (+39.85%).

Source Data: AAR – PFL Analytics

Rig Count

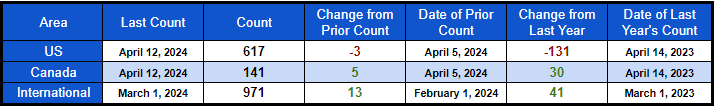

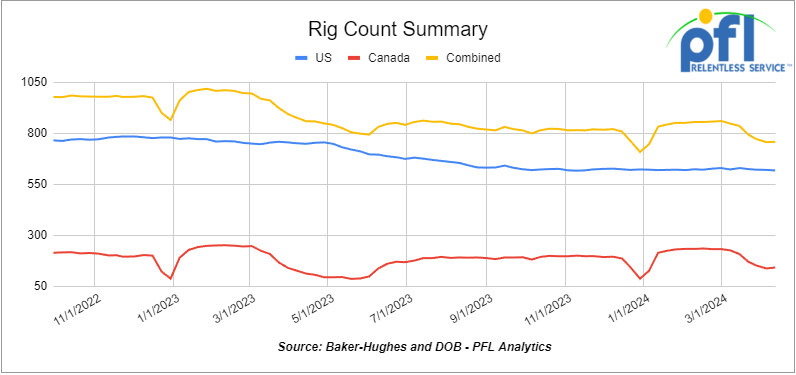

North American rig count was up by 2 rigs week-over-week. U.S. rig count was down by -3 rig week-over-week, and down by -131 rigs year-over-year. The U.S. currently has 617 active rigs. Canada’s rig count was up by 5 rigs week-over-week, and up by 30 rigs year-over-year. Canada’s overall rig count is 141 active rigs. Overall, year-over-year, we are down -101 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 28,199 from 28,299 which was a loss of 100 rail cars week-over-week. Canadian volumes were little changed. CPKC’s shipments were higher by +1.4% week over week. CN’s volumes were lower by -1.0% week-over-week. U.S. shipments were mostly lower. The NS had the largest percentage decrease and was down by -12.3%.

Biden Administration Urges Court Not to Shut Down Enbridge Line 5

The Biden administration has weighed in for the first time on a major cross-border legal dispute that could shut down portions of Enbridge’s Line 5 Canada-U.S. oil pipeline.

The more than 1,000-kilometer-long Line 5 carries 540,000 barrels of oil and natural gas liquids daily across Wisconsin and Michigan to refineries in Sarnia, Ontario, Canada. The legal dispute in question is one to which the U.S. government is not actually a party. It involves Calgary-based Enbridge Inc. and the Wisconsin-based Bad River Band of Lake Superior Chippewa, through whose territory the pipeline runs.

In 2023, the U.S. District Court for the Western District of Wisconsin ruled in favor of the Bad River Band and ordered Enbridge to shut down parts of the pipeline within three years and pay the band $5.2 million for trespassing on its land after easement rights expired.

Undo cross-border pipeline shutdown order, federal government’s filing urges U.S. appeals court.

Both Enbridge and the band, which had wanted an immediate shutdown, appealed the ruling.

The Canadian government, in its own brief last fall, argued that a shutdown of the line would violate a 1977 Canada-U.S. pipeline agreement in which the countries agreed not to block the flow of each other’s hydrocarbons.

On Wednesday of last week, a submission from the U.S. Department of Justice cited Ottawa’s argument and urged the U.S. Court of Appeals for the 7th Circuit to send the ruling back to the lower court.

Wednesday’s brief supported the financial penalty the lower court issued against Enbridge; in fact, it said the payment to the community should be increased. However, it urged the appeals court to reverse the part of the ruling that would require a shutdown of several kilometers of the pipeline.

The U.S. federal government cited Canada’s claim that a shutdown of the pipeline would have devastating economic consequences, particularly in parts of Central Canada. Supporters of Line 5 say it’s a vital supply line for refineries in Ontario and Quebec and essential to the production of jet fuel for major airports on both sides of the Canada-U.S. border.

Enbridge Line 5 Pipeline Route

Source Enbridge: PFL Analytics

We are watching the Trans Mountain Pipeline in Canada

No change from last week folks Trans Mountain expects to begin commercial operation of the 590,000-b/d crude oil pipeline expansion on May 1, 2024, and anticipates providing service for all contracted volumes in May.

After it begins transporting crude oil on the system, Trans Mountain will continue cleanup, reclamation, road, and civil work, it said.

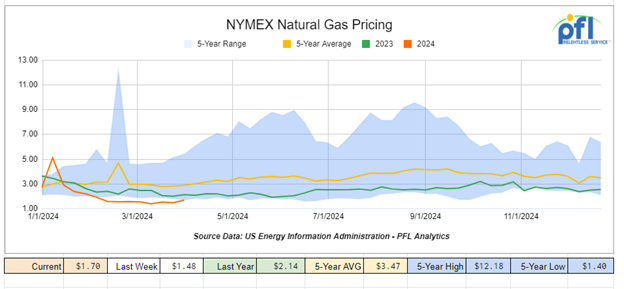

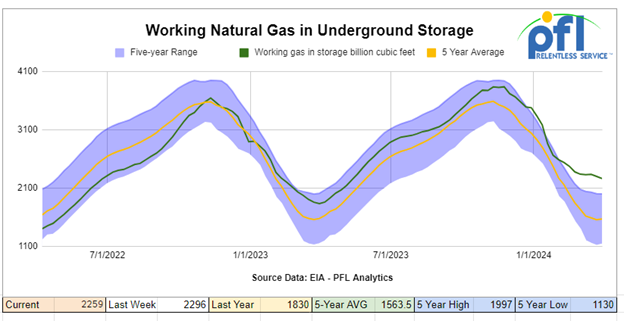

We are watching Natural Gas

It seems that natural gas now is just a byproduct of Oil and the increased production of LPGs. Unfortunately, natural gas is trapped all over the U.S. because we are not allowed to build pipelines to burn the cleanest burning fuel out there. It is a shame to sit back and watch this happen. Producers are not producing more natural gas because they want to it is because they must. Most wells drilled particularly in the Permian are associated wells which means they produce both Oil and liquid-rich natural gas. The liquid-rich natural gas is then separated from the oil – then the liquid-rich natural gas is further processed to strip it of propane, natural gasoline, etc… then you get dry pipeline spec natural gas that we burn at our homes for home heating, chilled and exported, or burned in cogeneration facilities to produce electricity. Increased natural gas production is great for rail in so many ways!

The bottom line there’s so much natural gas flowing from Texas wells that producers are paying customers to take it off their hands. With crude hovering near a six-month high, companies extracting it are tapping wells previously drilled but not completed. More oil at current prices means more cash. They are not giving away natural gas because of the lack of pipelines to take it off their hands. Right now, the US gas market is glutted with natural gas. Inventory levels are nearly 40% above the five-year average for this time of year. We can blame the weather and climate change – but the bottom line – it is really bad energy policies are to blame. See the charts below:

We have been extremely busy at PFL with return-on-lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs at 239-390-2885

Lease Bids

- 50, 30K 117 Tanks needed off of BNSF or UP in TX for 3-6 Months. Cars are needed for use in Crude service. will look at smaller cars. Prefer short term would look at longer term. Domestic use only

- 20, 25.5k CPC 1232 Tanks needed off of UP or BN in Ok, TX for 3 Year. Cars are needed for use in Asphalt service.

- 30, 29K 117J Tanks needed off of BN or CN in Houston or Edmonton for 1-2 Year. Cars are needed for use in Biodiesel service.

- 200-400, 30K DOT 111 Tanks needed off of UP or BN in Houston for 2 Year. Cars are needed for use in Gas/Diesel service. 1-2 Year

- 10, 25.5K-28.3K DOT 111 Tanks needed off of UP or BN in Houston for 2 Year. Cars are needed for use in Resin service.

- 100-200, 5200 Covered Hoppers needed off of UP, BNSF in Gulf area for 1-2 years. Cars are needed for use in Petcoke service. Open to smaller cube or longer-term

- 10, 28.3K 117J Tanks needed off of UP or BN in Texas for 3 Year.

- 25-30, 23.5K or 25.5K Dot 111 or CPC 1232 Tanks needed off of UP or BN in TX, OK, or AR for 3-5 Years. Cars are needed for use in Asphalt service. Needed ASAP., Lined or Unlined. Splash Load

- 100, 30K Dot 111, CPC 1232, DOT 117R, DOT 117J Tanks needed off of CP or CN in Edmonton for 1 Year. Cars are needed for use in Diesel service.

- 250, 4000 Rapid Hoppers needed off of BNSF in TX IL for 5 years. Cars are needed for use in Coal service. in rotary/rapid cars with the electric dumping shoe

- 4, 6260 Covered Hoppers needed off of CSX in Bostick, NC for 2-4 Years. Cars are needed for use in Polypropene Pellets service.

- 80, 30K 117R or 117J Tanks needed off of UP in Nebraska for 12 Months. Cars are needed for use in Ethanol service.

- 100, 30K Dot 111 or CPC 1232 Tanks needed off of UP or BN in New Orleans/Pasadena for 6-12 Months. Cars are needed for use in Gasoline/Diesel service.

- 80, 29k 117R or 117J Tanks needed off of Any Class 1 in Kentucky for 1-5 Years. Cars are needed for use in Crude service.

- 50, 19k DOT111 Tanks needed off of UP or BN in Nevada or CA for 1 year. Cars are needed for use in Sulfuric Acid service. March or April

- 8, 28-30K Any Tanks needed off of UP BN in Texas and Gulf for 5 years. Cars are needed for use in Chlorobenzene service. Need Magrods

- 14, 23.5K DOT111 Tanks needed off of UP in Morrilton, AR for 1 year. Cars are needed for use in Turpentine service.

- 10, 30k any Tanks needed off of UP BN in Texas for 1 year plus. Cars are needed for use in Fuel Oil service.

- 25-50, 5000CF-5100CF Covered Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in Dry sugar service. 3 bay gravity dump, Hempel 37700

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 50, 23.5-25.5 DOT111 Tank s needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 20-25, 30K DOT117 Tanks needed off of UP or BN in Illinois for 5 years. Cars are needed for use in Ethanol service.

- 50-100, 4550 Covered Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in Grain service.

- 10, 33K 340W Pressure Tanks needed off of CN in LA for 1 year. Cars are needed for use in Butane service.

- 25, 20.5K CPC1232 or DOT117J Tanks needed off of BNSF or UP in the west for 3-5 years. Cars are needed for use in Magnesium chloride service. SDS onhand

- 25-50, 25.5K DOT117J Tanks needed off of NS CSX in Northeast for 5 years. Cars are needed for use in Asphalt / Heavy Fuel Oil service.

- 15, 28.3K DOT117J Tanks needed off of any class 1 in any location for 3 years. Cars are needed for use in Glycerin & Palm Oil service.

- 30, 17K-20K DOT117J Tanks needed off of UP or BN in Midwest/West Coast for 3-5 years. Cars are needed for use in Caustic service.

- 150, 23.5K DOT111 Tanks needed off of any class 1 in LA for 2-3 years. Cars are needed for use in Fluid service. Needed July

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

Sales Bids

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 20, 2770-3400 Mill Gondolas needed off of any class 1 in South Texas. Cars are needed for use in scrap metal service.

- 20, 2770 Mill Gondolas needed off of CSX in the northeast. Cars are needed for use in non-haz soil service. 52-60 ft

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Sand service.

- 8, 5200 Covered Hoppers needed off of various class 1s in various locations. Cars are needed for use in Plastic Pellet service.

- 20-30, 3000 – 3300 PD Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 10, 4000 Open Top Hoppers needed off of CSX in the northeast. Cars are needed for use in scrap metal service. Open top hopper

- 10, 6400 Open Top Hoppers needed off of CSX in the northeast. Cars are needed for use in wood chip service. Open top hopper, flat bottom

- 200+, 5000cf Covered Hoppers needed off of any class 1 in various locations.

- 5, 3400CF Covered Hoppers needed off of any class 1 in Ohio. Cars are needed for use in Sand service.

- 20-30, Open Top Hoppers needed off of NS or CSX in Northeast. Cars are needed for use in aggregate service. Gravity dump

- 5, 23,5K DOT 111 Tanks needed off of any class 1 in Texas. Negotiable

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 100, 15.7K DOT111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

- 2-4, 28K DOT111 Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

- 5, 30K DOT 111 Tanks needed off of in US. Cars are needed for use in Fuels service.

Lease Offers

- 200-500, 5200, Covered Hoppers located off of CN and NS in Moving on CN and NS. Cars were last used in Grain. Lease available until Fall.

- 100, 33K, 340W Pressures located off of CN or CP in Canada. Cars are clean

- 10, 21.9K, Tanks located off of UP in Longview, TX. Cars are clean CO2 Cars. Brand New. 2-5 Year Lease

- 125, 28.3K, 117J Tanks located off of Various Class 1s in Multiple locations. Cars are clean Long Term Lease, 5 Years +

- 50, 28.3K, AAR 211 Tanks located off of BN in Moving. Cars were last used in Biodiesel. 1 Year Lease; Free Move on BN

- 15, 29.2, DOT 111 Tanks located off of UP or BN in Houston. Cars were last used in Sunflower Oil. 1 Year

- 15, 25.5, DOT 111 Tanks located off of UP or BN in Houston. Cars were last used in Sunflower Oil. 1 Year

- 100+, 29K, 117R Tanks located off of All Class Ones in St Louis. Cars were last used in Veg Oils. Up to 4 Years

- 15, 33K, 340W Tanks located off of All Class Ones in North America. Cars were last used in Propane/Butane. Up to 1 year.

Sales Offers

- 20, Refer, Box Boxcars located off of UP in ID.

- 100-300, 3400, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 100, 28.3K, DOT117J Tanks located off of various class 1s in multiple locations.

- 100, 17K, DOT111 Tanks located off of various class 1s in multiple locations.

- 100, 19K, DOT111 Tanks located off of various class 1s in multiple locations.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|

PFL will be at the Following Conferences

- Where: Sheraton Grand Chicago Riverwalk, 301 E. North Water St., Chicago, IL 60611

- Attending: Curtis Chandler (239.405.3365)

- Conference Website