“I can’t change the direction of the wind, but I can adjust my sails to always reach my destination”.

– Jimmy Dean

COVID-19

The United States currently has 29,696,250 confirmed COVID 19 cases and 537,838 confirmed deaths.

US Jobless Claims

In the week ending February 27, the advance figure for seasonally adjusted initial claims was 745,000, an increase of 9,000 from the previous week’s revised level. The previous week’s level was revised up by 6,000 from 730,000 to 736,000. The 4-week moving average was 790,750, a decrease of 16,750 from the previous week’s revised average. The previous week’s average was revised down by 250 from 807,750 to 807,500. The advance seasonally adjusted insured unemployment rate was 3.0 percent for the week ending February 20, a decrease of 0.1 percentage point from the previous week’s unrevised rate. The advance number for seasonally adjusted insured unemployment during the week ending on February 20 was 4,295,000, a decrease of 124,000 from the previous week’s unrevised level of 4,419,000. The 4-week moving average was 4,448,000, a decrease of 99,000 from the previous week’s unrevised average of 4,547,000.

Markets Closed Mostly Higher Week Over Week

The Dow closed higher on Friday of last week, up +322 (+1.07%) closing out the week at 31,244.00 points, up +320.63 points week over week. The S&P 500 closed higher on Friday of last week, up +42.50 points (+1.12%) and closing out the week at 3,851.75 points, up +40.60 points week over week. The Nasdaq closed higher on Friday of last week, up +160.25 points (+1.24%) closing out the week at 13,071.25 points, down -12.11 points week over week.

In overnight trading, DOW futures traded lower and are expected to open lower this morning by 43 points.

WTI Higher Week over Week – OPEC+ Shocks Markets

Oil rallied to the highest in nearly two years in New York after OPEC+ shocked markets with a decision to keep supply limited as the global economy starts to recover from a pandemic-driven slump. WTI crude oil for April delivery rose +$2.26 to settle at $66.09 a barrel Friday of last week, up $4.59 a barrel week over week. Brent crude oil for May delivery rose +$2.62 to $69.36 a barrel Friday of last week, up $3.23 per barrel week over week.

U.S. commercial crude oil inventories increased by 21.6 million barrels week over week. At 484.6 million barrels, U.S. crude oil inventories are 3% above the five-year average for this time of year. Total motor gasoline inventories decreased by 13.6 million barrels last week and are 3% below the five-year average for this time of year. Finished gasoline and blending components inventories both decreased last week. Distillate fuel inventories decreased by 9.7 million barrels week over week and are 2% below the five year average for this time of year. Propane/propylene inventories decreased by 2.2 million barrels week over week and are 17% below the five year average for this time of year. Total commercial petroleum inventories decreased by 2.8 million barrels last week.

U.S. crude oil imports averaged 6.3 million barrels per day last week, an increase by 1.7 million barrels per day week over week. Over the past four weeks, crude oil imports averaged about 5.7 million barrels per day, 12.8% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) last week averaged 605,000 barrels per day, and distillate fuel imports averaged 321,000 barrels per day

Oil is lower in overnight trading and, as of the writing of this report, WTI is poised to open at $66.06, down .03 cents per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were up 2.2% year over year in week 8 (U.S. +1.7%, Canada +8.9%, Mexico -14.8%) resulting in year to date volumes that are up 1.1% year over year (U.S. +0.6%, Canada +5.2%, Mexico -7.3%). 3 of the AAR’s 11 major traffic categories posted year over year increases with the largest increase coming from intermodal (+12.4%). The largest decreases came from nonmetallic minerals (-19.2%) and chemicals (-15.3%).

In the East, CSX’s total volumes were up 2.9%, with the largest increase coming from intermodal (+14.4%). The largest decreases came from motor vehicles & parts (-25.7%) and petroleum (-28.5%). NS’s total volumes were down 1.8%, with the largest decreases coming from intermodal (-2.8%) and petroleum (-36.6%). The largest increase came from coal (+7.8%).

In the West, BN’s total volumes were up 3.8%, with the largest increase coming from intermodal (+20.5%). The largest decreases came from petroleum (-39.3%) and coal (-8.2%). UP’s total volumes were down 1.5%, with the largest decreases coming from chemicals (-25.1%), motor vehicles & parts (-30.4%), coal (-12.7%), and stone sand & gravel (-28.3%). The largest increases came from intermodal (+17.7%) and grain (+57.7%).

In Canada, CN’s total volumes were up 17.4%, with the largest increase coming from intermodal (+46.0%). The largest decreases came from metallic ores (-8.3%) and stone sand & gravel (-33.0%). RTMs were up 15.7%. CP’s total volumes were down 7.6%, with the largest decreases coming from intermodal (-11.9%), petroleum (-27.7%) and chemicals (-17.4%). RTMs were down 7.5%.

KCS’s total volumes were down 5.0%, with the largest decrease coming from motor vehicles & parts (-39.4%). The largest increase came from coal (+59.3%).

Source: Stephens

Rig Count

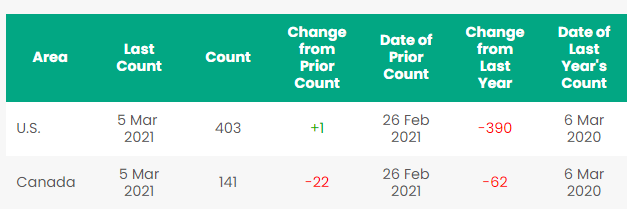

North America rig count is down by 21 rigs week over week. The U.S. was up by 1 rig week over week (oil rigs were up 1 to 310, gas rigs were unchanged at 92, and miscellaneous rigs unchanged at one rig, according to Baker Hughes). The U.S. currently has 403 active rigs. Canada’s rig count was down by 22 rigs week over week and Canada’s overall rig count is 141 active rigs. Year over year we are down 452 rigs collectively.

North American Rig Count Summary

Things we are keeping an eye on

- Railcars in storage – The AAR just released monthly data on railcars in storage via its Rail Time Indicators Report. As of March 1, 2021 there were 392,500 empty railcars in storage representing 23.7% of North America’s railcar fleet. The latest numbers were 4,400 cars lower month over month as the down trend in railcars in storage continues. The largest declines were in tank cars and gondolas. We expect to see this trend to continue as the economy improves, blue states open up for business and unwanted cars are scrapped. Please see PFL’s newly released monthly railcar storage report for a detailed analysis. (Click Here)

- USD Development Group (‘USD”) announced in a recent earnings call that it’s Diluent Recovery Unit (‘DRU”) is on schedule and on budget and will be commissioned in the 3rd quarter. The DRU project is a joint venture between Gibson and USD. ConocoPhillips has contracted for 50,000 barrels per day of space and USD is looking to sign up others under long term take or pay contracts. Crude by rail out of Canada will significantly pick up once the project comes on line and is competitive with pipelines since the final product that we like to call raw bitumen is classified as non-haz and class ones charge lower rates to move the product in addition a cheaper railcar can be used if one wants to. In other Alberta news, keep an eye on basis – if all remains equal we think it could widen paving the way for more conventional crude by rail. Alberta inventories are increasing as take away capacity cannot keep up with growing crude production and is expected to worsen. Crude stockpiles in Alberta ended November at 72 million barrels up by 2 million barrels month over month according to the Alberta Energy Regulator. Typically the higher the inventories, the wider the basis!

- Petroleum by Rail – The four-week rolling average of petroleum carloads carried on the sixth largest North American railroads fell to 24,021 from 24,415 week over week on the back of continued weather delays. Canadian volumes were up on better basis numbers, CP shipments rose by 25% and CN volumes were up by 12%. U.S. rail road operators were mostly down although UP had the largest percentage increase, up by 34.5%

- We are watching the latest and greatest economic indicators:

- Gross Domestic Product (“GDP”) – According to the Bureau of Economic Analysis’s second estimate released February 25, U.S. GDP grew an annualized 4.1% in Q4 2020. That’s a slight upward revision from the BEA’s first estimate of 4.0% from a month earlier. It’s also much less than what’s needed to recover economic ground lost over the past year. The hope is the economy will roar back to life in 2021 — hopefully sooner rather than later. Recently, many economists have concluded that recovery will be sooner and stronger than they used to think, thanks to vaccinations and more and more areas opening up.

- Purchasing Managers Index (“PMI”) – The PMI rose to 60.8% in February 2021, up from 58.7% in January and matching the highest it’s been in more than 16 years (it was also 60.8% in February 2018). The index has been above 50% for nine straight months. The new orders component of the PMI was 64.8% in February, up from 61.1% in January and an indication that manufacturing could see continued growth in the months ahead.

- Industrial Output and Capacity Utilization – According to the Federal Reserve, “Total industrial production has not returned to its pre-pandemic levels of early last year. In January, the indexes for about half of the market groups were still below their year-earlier readings; notably, weakness in the oil patch during most of last year has left the production of energy materials 6.2 percent below its level of 12 months earlier.”

- Employment – On March 5, the Bureau of Labor Statistics (BLS) announced that net job gains in February 2021 were a preliminary 379,000, much more than the 210,000 or so most economists expected. Moreover, job gains for January were revised up from 49,000 to 166,000. The official unemployment rate fell to 6.2% in February 2021 from 6.3% in January 2021.

- Consumer Confidence – Not much change here folks, the index of consumer confidence from the Conference Board edged higher in February to 91.3 from 88.9 in January. It’s trended within a narrow band for four straight months.

- Consumer Spending – U.S. consumer spending rose a preliminary 2.4% from December 2020 to January 2021. If it holds after revisions, it will be the biggest month over month gain in seven months, reversing declines in November and December. Spending on goods in January surged 5.8%; spending on services grew 0.7%. Expect spending to increase as people get their checks! Since consumer spending represents 2/3 of the U.S. economy, this is good news.

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Railcar Markets

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 35 3000-3400 CF Aluminum Hoppers with Manual Knocker Gates for the use in Sulfur in Alberta for 3-5 Years.

- 30 28.3K Tank Cars for the use in Biodiesel service in Chicago for 1 Year.

- 50 25.5K CPC 1232’s for the use in Asphalt service in Chicago for 1 Year.

- 150 2400 CF Steel Gondolas needed for Iron Pyrite Service in Montana for 1-3 Years. Needed end of Q4 2021

- 50 25.5K-29K CPC 1232’s for the use in Bitumen Service in Saskatchewan for 1 Year.

- 100 30K 117J’s for the use in Bakken Service in North Dakota for 1 Year.

- 100 31.8K CPC 1232’s for the use in Condensate in the Northeast for 1 Year. Must have Mag Rods.

- 10 30K Tank Cars for the Use in Veg Oil in the Midwest for 1-3 Years.

- 50 340W Pressure Cars needed for Butane in the Northeast for 1 Year.

- 10 31.8K CPC 1232’s or 30K 117Rs for the use in Liquor service for 5 Years. Must have specific lining.

- 100 31.8k CPC 1232’s for the Use in Gas or Diesel service in Texas for 1 Year.

- 100 23.5K CPC 1232’s for the use in Asphalt service in the Midwest or Canada.

- 30-50 Stainless Steel Tank Cars needed for the use in Liquor in the Southeast for 3-5 Years.

- 150 steel gondolas 2400 in Montana for 3 years BNSF Negotiable

- 50 cars for the use of Asphalt in Chicago for 1 Year. Cars can be 23.5K or 25.5K.

- 30 28.3K Tank Cars for the use of Biodiesel in Chicago for 1 Year.

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations

- Covered PD Hoppers clean various sizes and locations 263 and 286’s negotiable

- 70 117Js in Texas dirty to dirty price negotiable

- 100 117Js 28.3 C/I for sale or lease in Texas

- 50 CPC 1232 28.3 tanks clean last veg oil various locations negotiable

- 200 30K tankers cleaned and ready for service, for sale or lease,

- 218 73 ft 286 GRL riser less deck, center part for sale,

- 19 auto-max II automobile carrier racks – tri-level for sale or lease in Arkansas

- 49 60’ Box cars 286 EOL refurbished in Tenn.,

- 20 low sided gondolas for lease in NJ 2743 cu ft,

- 100 34.2 Gallon Dot 111 for lease great for Ethanol or Alcohol

- 10 food grade stainless steel cars

- 30 CPC 1232 25.5K Pennsylvania NS clean negotiable

- 9 31.8 crude tanks in Detroit clean NS CSX CN Negotiable

- Covered PD Hoppers clean various sizes and locations 263 and 286’s negotiable

- 70 117Js in Texas dirty to dirty price negotiable

- 100 117Js 28.3 C/I for sale or lease in Texas

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|