“The way to gain a good reputation is to endeavor to be what you desire to appear.”

– Socrates

Jobs Update

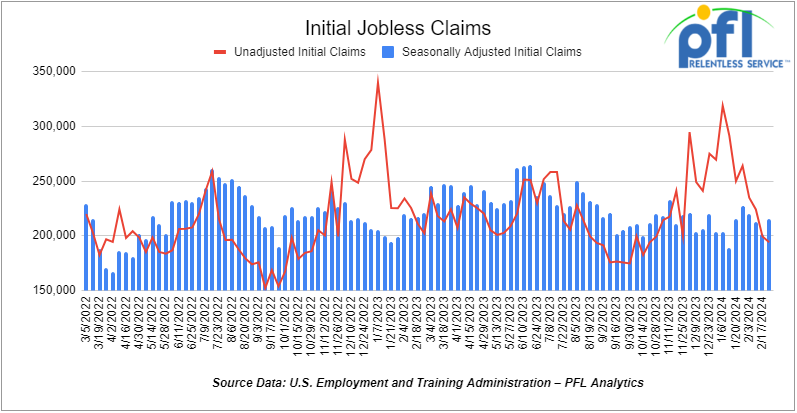

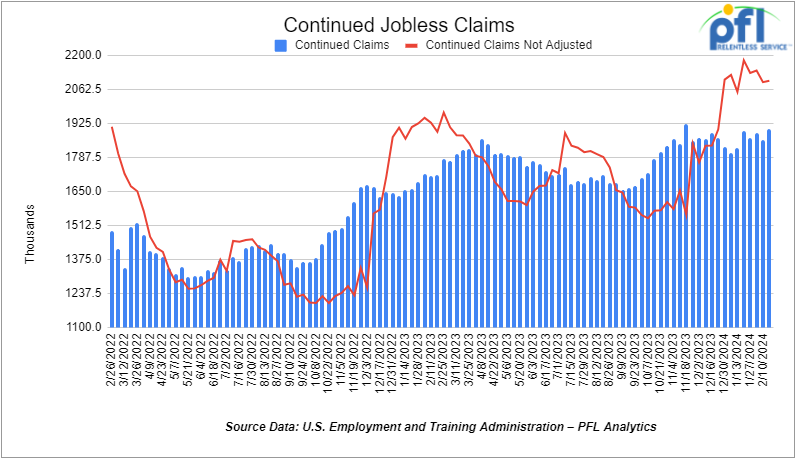

- Initial jobless claims seasonally adjusted for the week ending February 24th, 2023 came in at 215,000, up 13,000 people week-over-week.

- Continuing jobless claims came in at 1.905 million people, versus the adjusted number of 1.86 million people from the week prior, up 45,000 people week-over-week.

Stocks closed higher on Friday of last week, but mixed week over week

The DOW closed higher on Friday of last week, up 90.99 points (0.23%), closing out the week at 39,087.38, down -44.15 points week-over-week. The S&P 500 closed higher on Friday of last week, up 40.81 points (0.8%), and closed out the week at 5,137.08, up 48.28 points week-over-week. The NASDAQ closed higher on Friday of last week, up 183.02 points (1.14%), and closed out the week at 16,274.94, up 278.12 points week-over-week.

In overnight trading, DOW futures traded lower and are expected to open at 39,035 this morning down 107 points.

Crude oil closed higher on Friday of last week and higher week over week.

WTI traded up $1.71 per barrel (2.19%) to close at $79.97 per barrel on Friday of last week, up $3.48 per barrel week-over-week. Brent traded up US$1.64 per barrel (2%) on Friday of last week, to close at US$83.55 per barrel, up US$1.93 per barrel week-over-week.

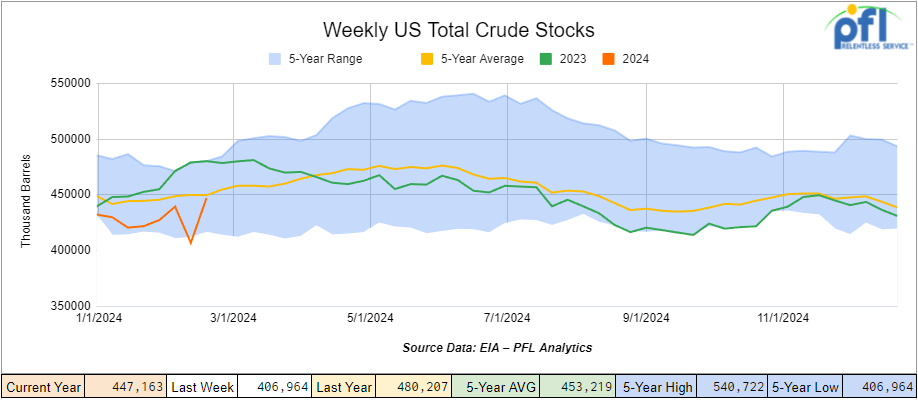

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 4.2 million barrels week-over-week. At 447.2 million barrels, U.S. crude oil inventories are 1% below the five-year average for this time of year.

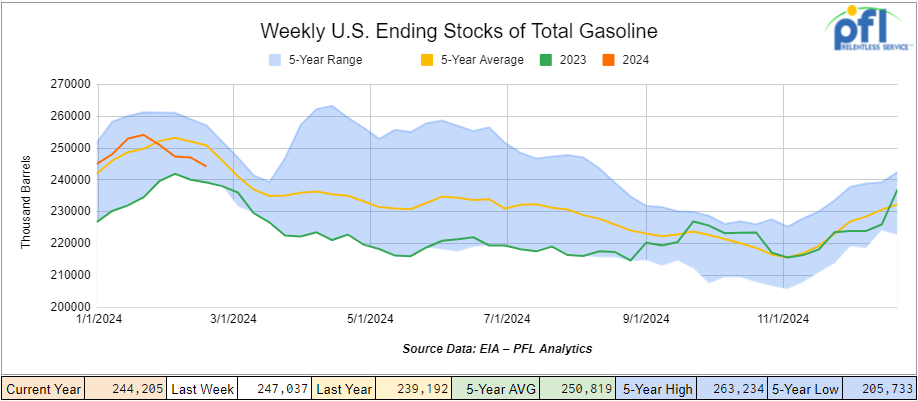

Total motor gasoline inventories decreased by 2.8 million barrels week-over-week and are 2% below the five-year average for this time of year.

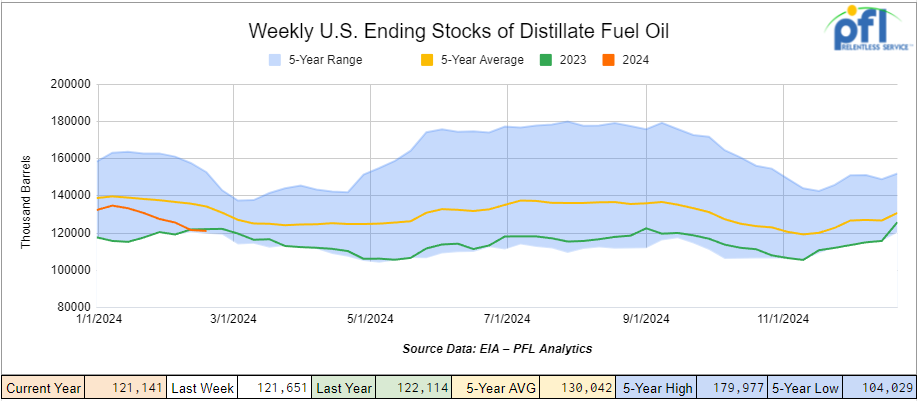

Distillate fuel inventories decreased by 500,000 barrels week-over-week and are 8% below the five-year average for this time of year.

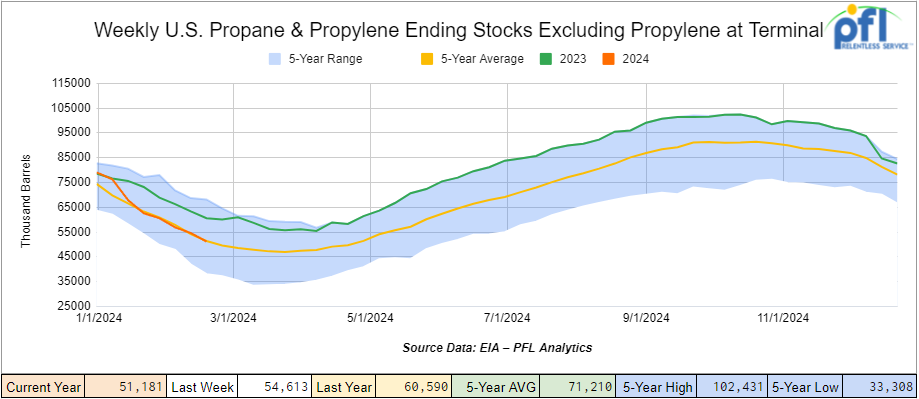

Propane/propylene inventories decreased by 3.4 million barrels week-over-week and are 1% above the five year average for this time of year.

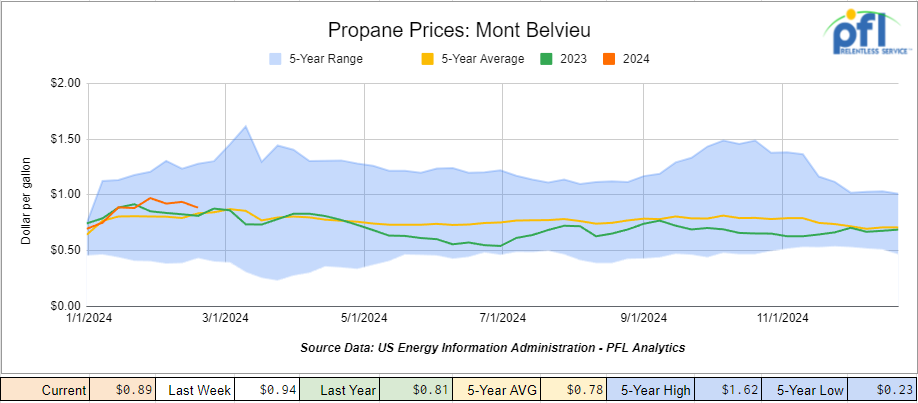

Propane prices closed at 89 cents per gallon, down 5 cents per gallon week-over-week, and up 8 cents per gallon year-over-year.

Overall, total commercial petroleum inventories decreased by 3.2 million barrels. during the week ending February 23, 2024.

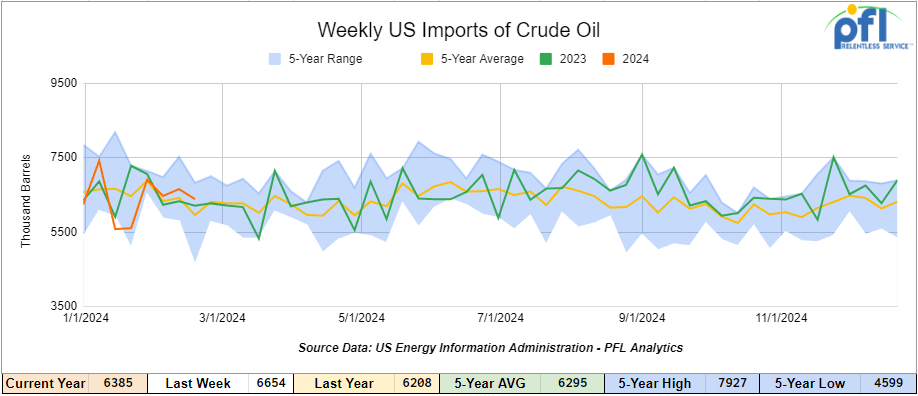

U.S. crude oil imports averaged 6.4 million barrels per day during the week ending February 23, 2024, a decrease of 269,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.6 million barrels per day, 2.3% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 384,000 barrels per day, and distillate fuel imports averaged 112.000 barrels per day during the week ending February 23, 2024.

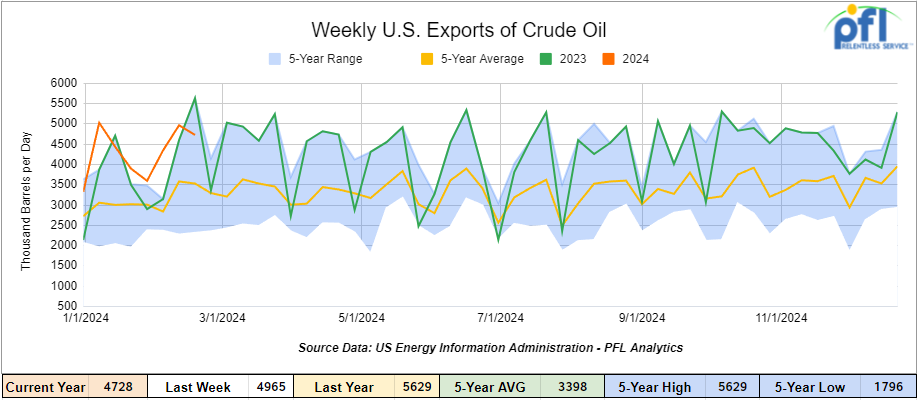

U.S. crude oil exports averaged 4.728 million barrels per day for the week ending February 23rd, 2024, a decrease of 237,000 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 4.409 million barrels per day.

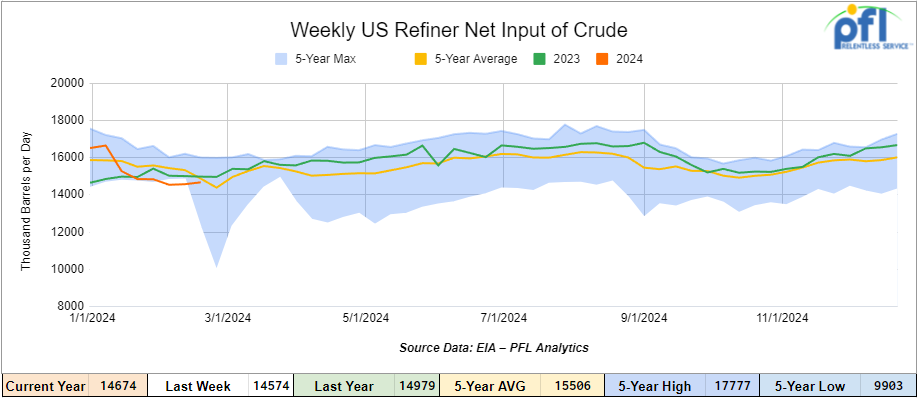

U.S. crude oil refinery inputs averaged 14.7 million barrels per day during the week ending February 23, 2024, which was 100,000 barrels per day more week-over-week.

WTI is poised to open at 79.71 , down 26 cents per barrel from Friday’s close.

North American Rail Traffic

Week Ending February 28th, 2024.

Total North American weekly rail volumes were up (5.82%) in week 9, compared with the same week last year. Total carloads for the week ending on February 28th were 355,065, up (2.16%) compared with the same week in 2023, while weekly intermodal volume was 326,272, up (10.12%) compared to the same week in 2023. 8 of the AAR’s 11 major traffic categories posted year-over-year increases with the largest decrease coming from Coal, down (-4.45%) while the largest increase came from Grain up (+13.42%).

In the East, CSX’s total volumes were up (3.82%), with the largest decrease coming from Grain, down (-12.39%) while the largest increase came from Motor Vehicles and Parts up (19.22%). NS’s volumes were up 2.09%), with the largest increase coming from Other (+18.97%) while the largest decrease came from Grain (-24.98%).

In the West, BN’s total volumes were up (15.91%), with the largest increase coming from Grain (+39.86%) while the largest decrease came from Coal, down (-4.96%). UP’s total rail volumes were up (3.59%) with the largest decrease coming from Other, down (-18.12%) while the largest increase came from Petroleum and Petroleum Products which was up (23.08%).

In Canada, CN’s total rail volumes were up (2.74%) with the largest decrease coming from Other, down (-28.37%) while the largest increase came from Nonmetallic Minerals, up (+36.53%). CP’s total rail volumes were up (+39.01%) with the largest increase coming from Grain (+167.67%) while the largest decrease came from Farm Products, down (-21.46%).

KCS’s total rail volumes were down (-18.53%) with the largest decrease coming from Intermodal Units (-33.07%) and the largest increase coming from Coal (+14.12%).

Source Data: AAR – PFL Analytics

Rig Count

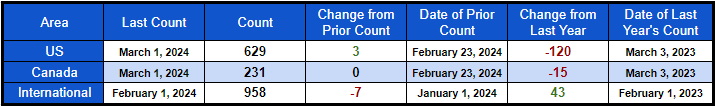

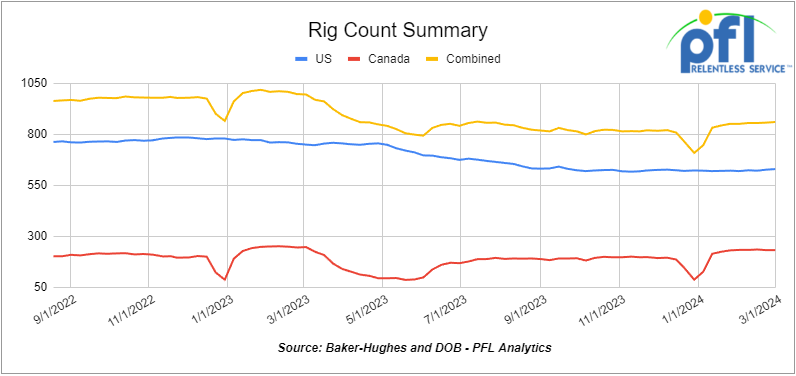

North American rig count was up by 2 rigs week-over-week. U.S. rig count was up by 5 rigs week-over-week and down by -127 rigs year-over-year. The U.S. currently has 626 active rigs. Canada’s rig count was down by -3 rigs week-over-week, and down by -13 rigs year-over-year. Canada’s overall rig count is 231 active rigs. Overall, year-over-year, we are down -140 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 30,125 from 30,067, which was a gain of +58 rail cars week-over-week. Canadian volumes were lower. CPKC’s shipments fell by -1.9% week over week. CN’s volumes were also lower by -1.9% week-over-week. U.S. shipments were mostly higher. The CSX was the sole decliner week over week and was down by -15.8%. The BN had the largest percentage increase and was up by +14.4% week over week.

We were at SEARS last week.

There was a record turnout of 333 people that gathered in Atlanta. There was quite a bit of talk about taking trucks off the road, saving the environment, and going to intermodal. This seemed to be the theme of the conference as we took it. CSX, the NS said that is their goal.

Johnathan Starks CEO of FTR was interesting. While the goal of course is to take trucks off the road in a lot of cases it is not competitive or the service is just not there to make it happen. Rodger Tutterrow gave us an economic update – was not bullish on carloads for 2024. While Chemicals are doing well other segments of the Market are not. He figures interest rates have room to go higher!

Chairman of the STB Martin Oberman is not happy with the investor takeover of the NS (Ancora Holdings) and made it perfectly clear on his personal opinion and touts the NS as the leader in safety and investment in infrastructure. For more information on SEARS contact PFL today.

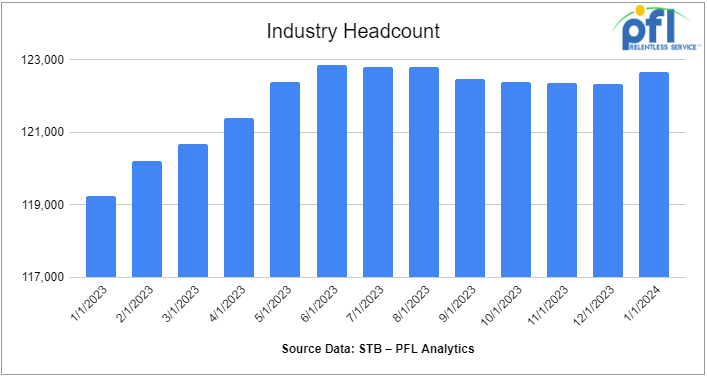

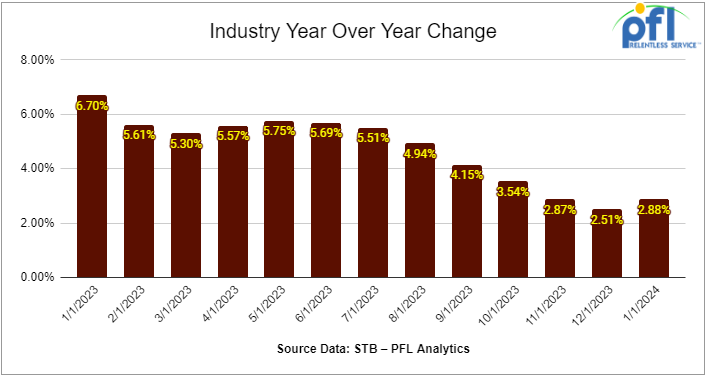

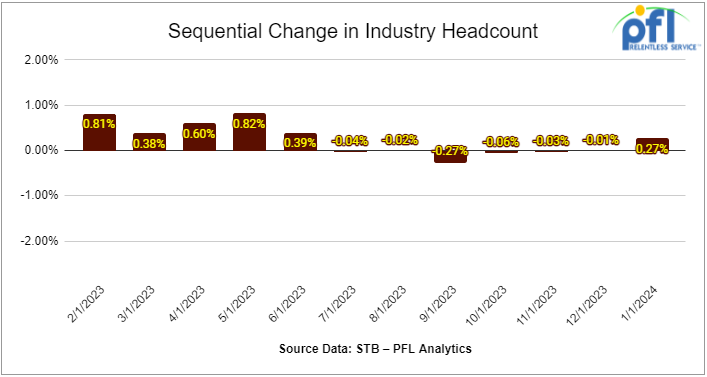

We are watching Class 1 Industry Headcount

Class 1s employed 122,677 workers in the United States last month, up 0.27% from December 2023’s count and a 2.88% year-over-year increase, according to Surface Transportation Board data.

Four of six employment categories registered increases between December and January. They were: executives, officials and staff assistants, up 0.88% to 8,222 employees; maintenance of equipment and stores, up 0.79% to 18,208; professional and administrative, up 0.68% to 10,380; and transportation (train and engine), up 0.44% to 52,650.

The two categories that logged month-to-month decreases were transportation (other than T&E), down 0.6% to 4,955 employees; and maintenance of way and structures, down 0.53% to 28,262.

Year over year, all categories posted increases: transportation (T&E), at 4.64%; professional and administrative, 2.97%; executives, officials and staff assistants, 2.8%; maintenance of equipment and stores, 2.33%; transportation (other than T&E), 2.08%; and maintenance of way and structures, 0.2%.

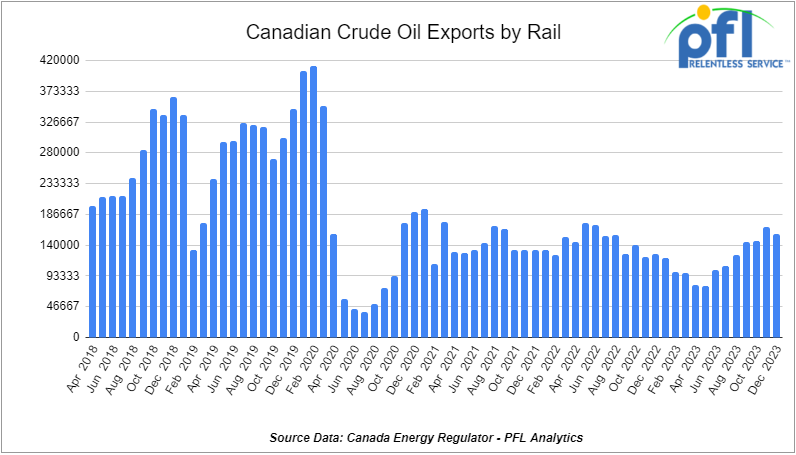

We are watching Crude by Rail out of Canada

The Canadian Energy Regulator (“CER”) updated its monthly crude by rail numbers on February 23, 2024. For December 2023, Canada exported 157,142 barrels per day by rail (down by -9,864 barrels per day month over month). This is the first month-over-month decline after the seventh consecutive month-over-month increases but still the second-highest reading since June of 2022.

We are expecting to see volumes continue to increase as producers continue to build inventory and are in need of a crude-by-rail outlet. Despite a lower spread out of Edmonton as of late, a weak Canadian Dollar and a relatively high crude number from a Canadian dollar perspective will not deter the Canadian producer. One Exchange WCS (Western Canadian Select) for April delivery settled Friday at US$16.40 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$62.48 per barrel or roughly $85.59 Canadian per barrel. On Thursday, it settled at US$16.80 below the WTI-CMA for March delivery. The implied value was US$60.48 per barrel.

All are waiting for Trans Mountain to start up and see how all this shakes out. We are now looking at a line pack to begin towards the end of March (doubtful) and be completed within three weeks. Deliveries should begin in April or sometime in Q22024l with an increased capacity of 600,000 barrels per day but don’t expect to see the line full immediately as there is still quite a bit of logistics to be worked out on the receiving end.

We have been extremely busy at PFL with return-on-lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs at 239-390-2885

Lease Bids

- 250, 4000 Rapid Hoppers needed off of BNSF in TX IL for 5 years. Cars are needed for use in Coal service. in rotary/rapid cars with the electric dumping shoe

- 4, 6260 Covered Hoppers needed off of CSX in Bostick, NC for 2-4 Years. Cars are needed for use in Polypropene Pellets service.

- 50-100, 4750CF Open/Covered Hoppers needed off of BN in Washington for Feb-Jun. Cars are needed for use in Petcoke service.

- 80, 30K 117R or 117J Tanks needed off of UP in Nebraska for 12 Months. Cars are needed for use in Ethanol service.

- 100, 30K Dot 111 or CPC 1232 Tanks needed off of UP or BN in New Orleans/Pasadena for 6-12 Months. Cars are needed for use in Gasoline/Diesel service.

- 80, 29k 117R or 117J Tanks needed off of Any Class 1 in Kentucky for 1-5 Years. Cars are needed for use in Crude service.

- 50, 19k DOT111 Tanks needed off of UP or BN in Nevada or CA for 1 year. Cars are needed for use in Sulfuric Acid service. March or April

- 8, 28-30K Any Tanks needed off of UP BN in Texas and Gulf for 5 years. Cars are needed for use in Chlorobenzene service. Need Magrods

- 14, 23.5K DOT111 Tanks needed off of UP in Morrilton, AR for 1 year. Cars are needed for use in Turpentine service.

- 10, 30k any Tanks needed off of UP BN in Texas for 1 year plus. Cars are needed for use in Fuel Oil service.

- 25-50, 5000CF-5100CF Covered Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in Dry sugar service. 3 bay gravity dump, Hempel 37700

- 30-40, 28.3K DOT117R, DOT117J, DOT111 Tanks needed off of UP in Iowa for 2-3 years. Cars are needed for use in Feedstocks service.

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 50, 23.5-25.5 DOT111 Tanks needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

- 25, 30K Any Tanks needed off of in Houston for December -June. Cars are needed for use in Diesel service.

- 75, 30K Any Tanks needed off of Any Class 1 in Chicago for December 23-May 24. Cars are needed for use in Gasoline service.

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 108, 28.3K Any Tanks needed off of CN in Canada for 1-3 years. Cars are needed for use in Crude service.

- 20-25, 30K DOT117 Tanks needed off of UP or BN in Illinois for 5 years. Cars are needed for use in Ethanol service.

- 100, 28.3K Any Tanks needed off of UP or BN in Midwest/Texas for 5 years. Cars are needed for use in Veg Oils / Biodiesel service. Need to be Unlined

- 50-100, 4550 Covered Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in Grain service.

- 10, 33K 340W Pressure Tanks needed off of CN in LA for 1 year. Cars are needed for use in Butane service.

- 25, 20.5K CPC1232 or DOT117J Tanks needed off of BNSF or UP in the west for 3-5 years. Cars are needed for use in Magnesium chloride service. SDS onhand

- 25-50, 25.5K DOT117J Tanks needed off of NS CSX in Northeast for 5 years. Cars are needed for use in Asphalt / Heavy Fuel Oil service.

- 15, 28.3K DOT117J Tanks needed off of any class 1 in any location for 3 years. Cars are needed for use in Glycerin & Palm Oil service.

- 30, 17K-20K DOT117J Tanks needed off of UP or BN in Midwest/West Coast for 3-5 years. Cars are needed for use in Caustic service.

- 150, 23.5K DOT111 Tanks needed off of any class 1 in LA for 2-3 years. Cars are needed for use in Fluid service. Needed July

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

Sales Bids

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 20, 2770-3400 Mill Gondolas needed off of any class 1 in South Texas. Cars are needed for use in scrap metal service.

- 20, 2770 Mill Gondolas needed off of CSX in the northeast. Cars are needed for use in non-haz soil service. 52-60 ft

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Sand service.

- 8, 5200 Covered Hoppers needed off of various class 1s in various locations. Cars are needed for use in Plastic Pellet service.

- 20-30, 3000 – 3300 PD Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 10, 4000 Open Top Hoppers needed off of CSX in the northeast. Cars are needed for use in scrap metal service. Open top hopper

- 10, 6400 Open Top Hoppers needed off of CSX in the northeast. Cars are needed for use in wood chip service. Open top hopper, flat bottom

- 45, 3000 cf PD Hoppers needed off of any class 1 in Texas. Negotiable

- 200+, 5000cf Covered Hoppers needed off of any class 1 in various locations.

- 5, 3400CF Covered Hoppers needed off of any class 1 in Ohio. Cars are needed for use in Sand service.

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 100, 15.7K DOT111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

- 2-4, 28K DOT111 Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

- 20-30, Open Top Hoppers needed off of NS or CSX in Northeast. Cars are needed for use in Aggregate service. Gravity dump

- 5, 30K DOT 111 Tanks needed off of in US. Cars are needed for use in Fuels service.

Lease Offers

- 15, Plate E and F Boxs located off of NS in New Orleans. Cars are clean Double Sliding Doors

- 38, 4750 plus, 3-4 Hatch Gravity Covered Hopperss located off of CSX CN CP in Florida. Sub-lease 12-18 months

- 50, 33K, 340W Pressures located off of in Moving. Cars were last used in Propane. 1 year lease

- 10, 28.3K, DOT117R Tanks located off of All Class Ones in St Louis. Cars are clean Call 239-390-2885 for more information

- 10, 21.9K, Tanks located off of UP in Longview, TX. Cars are clean CO2 Cars. Brand New. 2-5 Year Lease

- 125, 28.3K, 117J Tanks located off of Various Class 1s in Multiple locations. Cars are clean Long Term Lease, 5 Years +

- 80, 25.5K, 117J Tanks located off of UP in Texas. Cars are clean Long term Lease.

- 50, 28.3K, AAR 211 Tanks located off of BN in Moving. Cars were last used in Biodiesel. 1 Year Lease; Free Move on BN

Sales Offers

- 20, Refer, Boxcars located off of UP in ID.

- 100-300, 3400, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 100, 28.3K, DOT117J Tanks located off of various class 1s in multiple locations.

- 100, 17K, DOT111 Tanks located off of various class 1s in multiple locations.

- 100, 19K, DOT111 Tanks located off of various class 1s in multiple locations.

- 40, 29K, DOT111 Tanks located off of CN in Canada. C/I; Free Move CN

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|

PFL will be at the Following Conferences

- Attending: Curtis Chandler (239.405.3365) David Cohen (954-729-4774)

- Conference Website

- Where: Moody Gardens Hotel and Convention Center

- Attending: Curtis Chandler (239.405.3365) David Cohen (954-729-4774)

- Conference Website