“No man ever steps in the same river twice, for it’s not the same river and he’s not the same man.”

– Heraclitus

Jobs Update

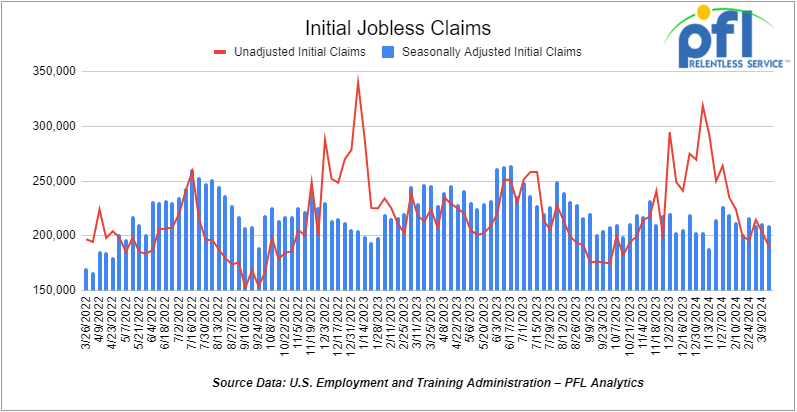

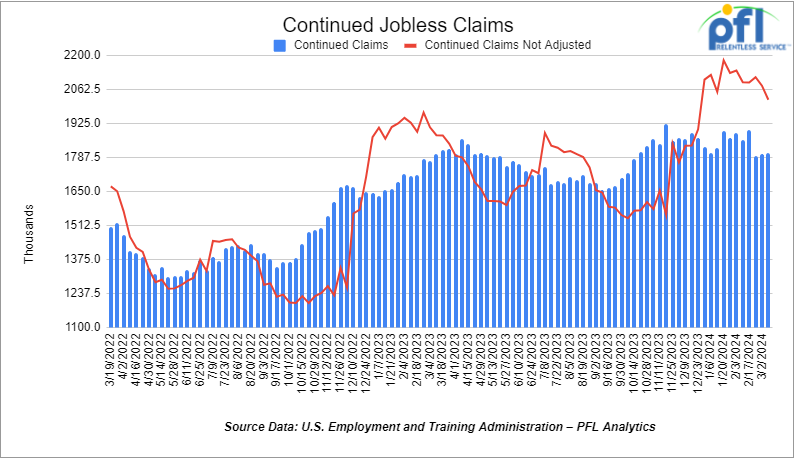

- Initial jobless claims seasonally adjusted for the week ending March 16th, 2023 came in at 210,000, flat week-over-week.

- Continuing jobless claims came in at 1.807 million people, versus the adjusted number of 1.803 million people from the week prior, up 4,000 people week-over-week.

Stocks closed mixed on Friday of last week and mixed week over week

The DOW closed lower on Friday of last week, down -305.47 points (-0.77%), closing out the week at 39,475.9, down -753.21 points week-over-week. The S&P 500 closed lower on Friday of last week, down -7.35 points (-0.14%), and closed out the week at 5,234.18, up 110.49 points week-over-week. The NASDAQ closed higher on Friday of last week, up 26.98 points (0.17%), and closed out the week at 16,428.82, up 343.71 points week-over-week.

In overnight trading, DOW futures traded lower and are expected to open at 39,815 this morning down 53 points.

Crude oil closed lower on Friday of last week and lower week over week.

WTI traded down -$0.44 per barrel (-0.54%) to close at $80.63 per barrel on Friday of last week, down -$0.46 per barrel week-over-week. Brent traded down -US$0.35 per barrel (-0.41%) on Friday of last week, to close at US$85.43 per barrel, up US$0.10 per barrel week-over-week.

One Exchange WCS (Western Canadian Select) for May delivery settled Friday at US$13.00 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$66.99 per barrel. On Thursday, it settled at US$12.60 below the WTI-CMA for May delivery. The implied value was US$67.87 per barrel.

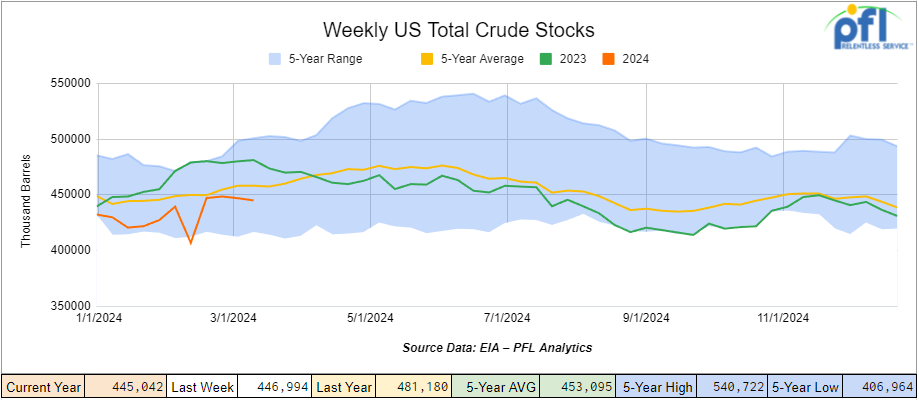

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 2 million barrels week-over-week. At 445.0 million barrels, U.S. crude oil inventories are 3% below the five-year average for this time of year.

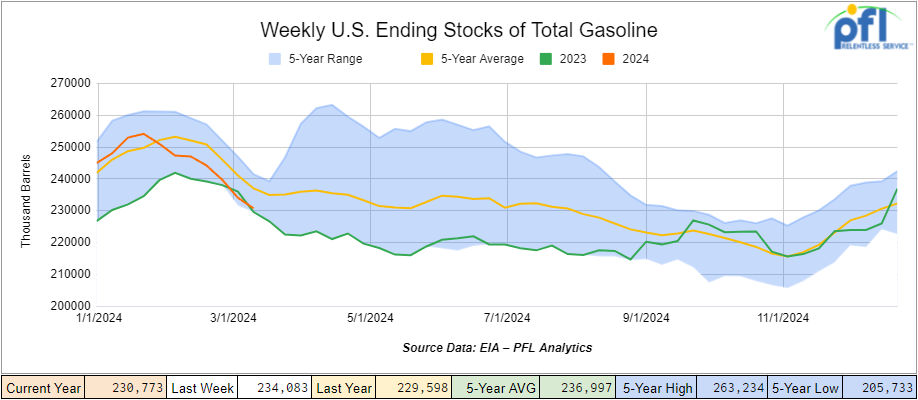

Total motor gasoline inventories decreased by 3.3 million barrels week-over-week and are 2% below the five-year average for this time of year.

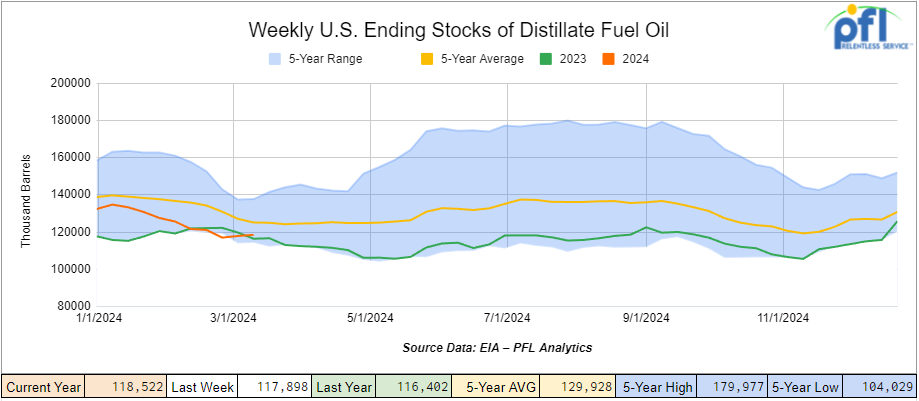

Distillate fuel inventories increased by 600,000 barrels week-over-week and are 5% below the five-year average for this time of year.

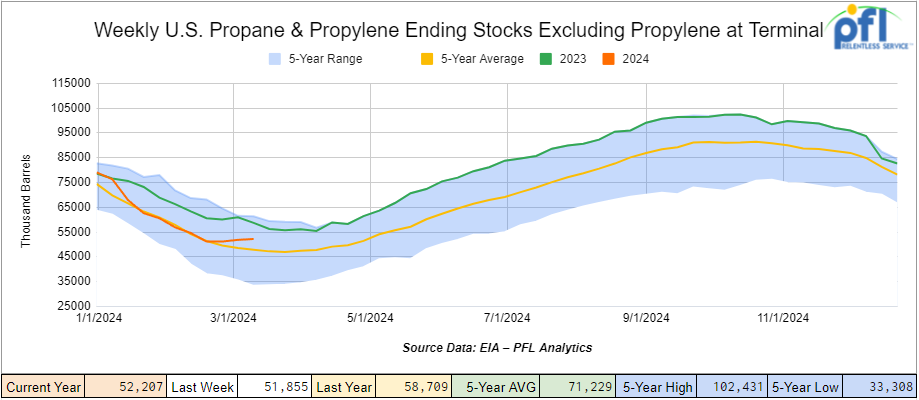

Propane/propylene inventories increased by 400,000 barrels week-over-week and are 9% above the five-year average for this time of year.

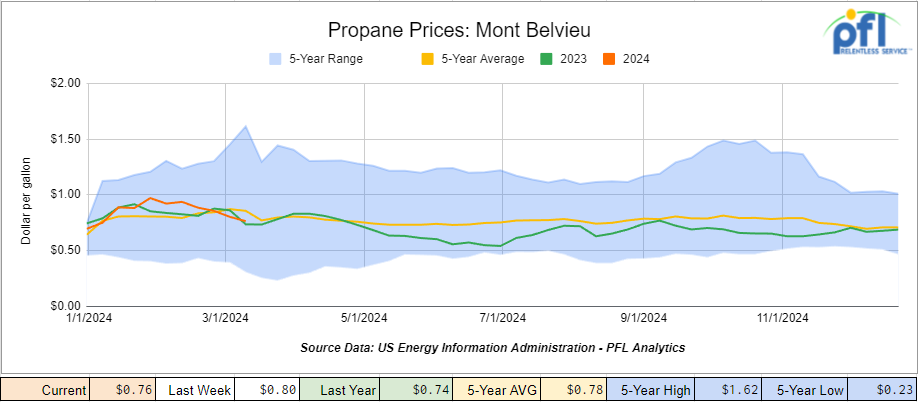

Propane prices closed at 76 cents per gallon, down 4 cents per gallon week-over-week and up 2 cents per gallon year-over-year.

Overall, total commercial petroleum inventories decreased by 6.1 million barrels, during the week ending March 15th, 2024.

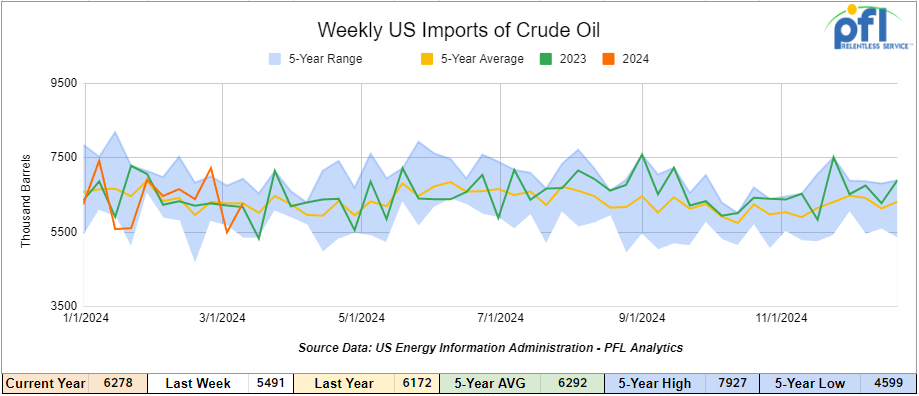

U.S. crude oil imports averaged 6.3 million barrels per day during the week ending March 15th, 2024, an increase of 787,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.3 million barrels per day, 2.0% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 496,000 barrels per day, and distillate fuel imports averaged 170,000 barrels per day during the week ending March 15th, 2024.

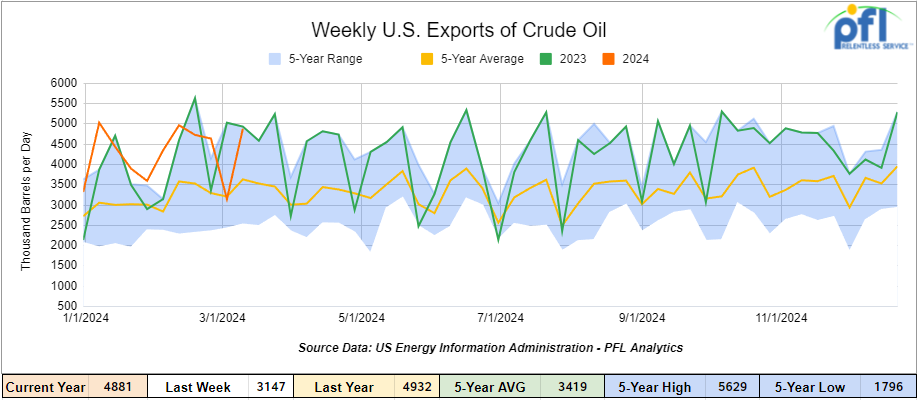

U.S. crude oil exports averaged 4.881 million barrels per day for the week ending March 15th, 2024, an increase of 1.734 million barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 4.348 million barrels per day.

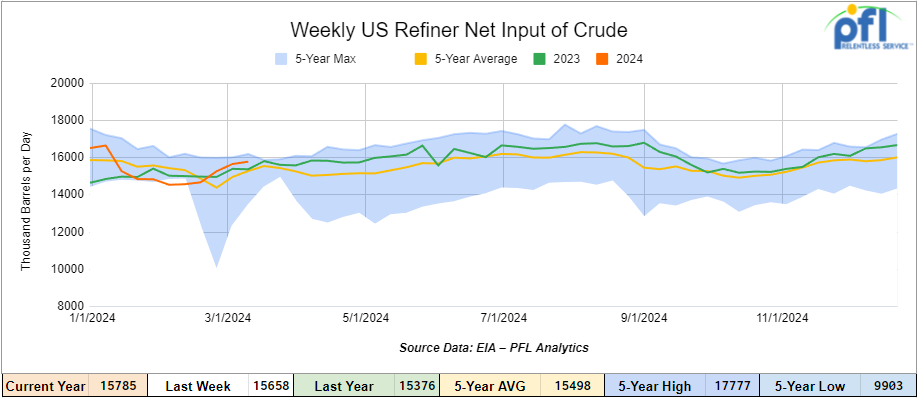

U.S. crude oil refinery inputs averaged 15.8 million barrels per day during the week ending March 15, 2024, which was 127,000 barrels per day more week-over-week.

WTI is poised to open at $81.25, up 82 cents per barrel from Friday’s close.

North American Rail Traffic

Week Ending March 20th, 2024.

Total North American weekly rail volumes were up (7.53%) in week 12, compared with the same week last year. Total carloads for the week ending on March 20th were 350,208, up (2.97%) compared with the same week in 2023, while weekly intermodal volume was 320,274, up (13%) compared to the same week in 2023. 9 of the AAR’s 11 major traffic categories posted year-over-year increases. The most significant decrease came from Coal, which was down (-16.21%). The most significant increase came from Petroleum and Petroleum Products which was up (+19.62%).

In the East, CSX’s total volumes were up (11.16%), with the largest decrease coming from Grain, down (-14.54%) while the largest increase came from Petroleum and Petroleum Products (30.67%). NS’s volumes were up (10.53%), with the largest increase coming from Coal (+18.20%) while the largest decrease came from Grain (-12.76%).

In the West, BN’s total volumes were up (8.41%), with the largest increase coming from Grain (+37.20%) while the largest decrease came from Coal, down (-32.43%). UP’s total rail volumes were up (2.66%) with the largest decrease coming from Coal, down (-29.72%) while the largest increase came from Grain which was up (26.46%).

In Canada, CN’s total rail volumes were up (7.32%) with the largest decrease coming from Grain, down (-39.56%) while the largest increase came from Nonmetallic Minerals, up (+23.06%). CP’s total rail volumes were up (+27.07%) with the largest increase coming from Grain (+117.74%) while the largest decrease came from Coal, down (-67.36%).

KCS’s total rail volumes were down (-8.3%) with the largest decrease coming from Coal (-35.9%) and the largest increase coming from Motor Vehicles and Parts (+32.11%).

Source Data: AAR – PFL Analytics

Rig Count

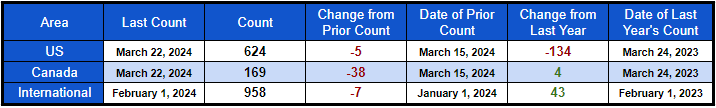

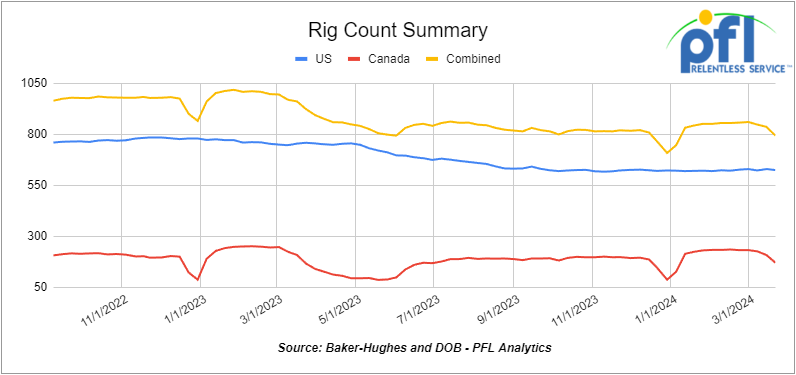

North American rig count was down by -43 rigs week-over-week. U.S. rig count was down by -5 rigs week-over-week but down by -134 rigs year-over-year. The U.S. currently has 624 active rigs. Canada’s rig count was down by -38 rigs week-over-week, but up by 4 rigs year-over-year. Canada’s overall rig count is 169 active rigs. Overall, year-over-year, we are down -130 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 28,987 from 29,408 which was a loss of 421 rail cars week-over-week. Canadian volumes were higher. CPKC’s shipments were higher by +12.9% week over week. CN’s volumes were higher by +2.9% week-over-week. U.S. shipments were mostly higher. The BN had the largest percentage increase and was up by +14.5%. The UP was the sole decliner and was down by -12%.

We are Watching Trans Mountain (TMX) in a Confusing Week for the Pipeline

In the continuation of Government fighting Government up in Canada, the Canada Energy Regulator (CER) ordered on Tuesday of last week a halt to all reclamation and clean-up activities on Spread 6 of the Government owned Trans Mountain Expansion Pipeline near Lightning Rock, Abbotsford, BC.

This decision came after Inspection Officers, alongside TMX-IAMC Indigenous Monitors, conducted an unannounced inspection on March 12 and discovered company contractors working without the necessary authorizations near a known and active nesting site of a Red-tailed Hawk.

The Inspection Officers have issued an Inspection Officer Order mandating the cessation of all activities until the company rectifies the situation to their satisfaction.

Additionally, the company is required to correct and provide documented evidence of all non-compliances for this section of the pipeline right-of-way before resuming work.

An internal investigation into the incident’s root cause is also mandated, with findings to be reviewed by the CER. Furthermore, TMX must outline how it will supervise the scheduling and coordination of its contractor work crews in the future.

The CER is demanding a commitment from TMXs Accountable Officer to ensure the implementation of all corrective actions as described. The regulator vows to monitor the company’s compliance closely and will lift the order once all requirements have been sufficiently addressed.

At the same time, TMX has begun filling its pipeline expansion with oil in a staged process, according to officials last week, as construction of the long-delayed project nears an end.

The pipeline expansion faces technical challenges in the next two weeks as it finishes the last segment in British Columbia, chief financial officer Mark Maki told Reuters.

“We feel good about progress,” Maki said on the sidelines of the CERAWeek energy conference in Houston. “We’ve got some key technical things that are coming up here in the coming week or two. And once those are done, I think it should be relatively smooth sailing.”

The Canadian government-owned C$34-billion (US$25 billion) pipeline expansion will nearly triple the flow of crude from Alberta to Canada’s Pacific Coast to 890,000 bbls/d, but has been plagued by years of delays, construction problems and cost overruns.

The pipeline, scheduled to be in service in the second quarter, is expected to raise Canadian crude prices just as producers boost production. We have already seen basis tighten.

Bloomberg reported Suncor Energy Inc. has sold one of the first cargoes to be shipped through the expansion to China’s Sinochem Group.

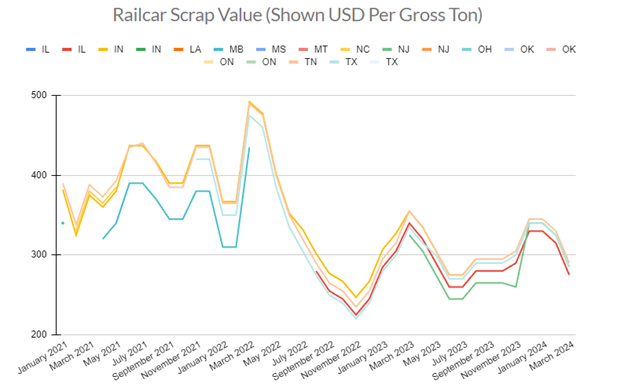

We are watching Scrap Prices – they are down sharply this month

The decline in scrap prices for March by 10% reflects a complex interplay of global economic factors and industry-specific challenges. The suspension of scrap purchases by Turkish importers since early February created an imbalance in the supply-demand dynamics, leading to an oversupply of scrap in key markets. This oversupply, compounded by declining steel prices, especially in Turkey, forced suppliers worldwide to adjust prices downwards in order to manage the excess inventory. Consequently, the market saw a sharp drop in scrap prices across regions, including the East Coast of the United States. While hopes for a seasonal upturn in steel demand persist, market participants anticipate continued pressure on scrap prices in the short term due to sluggish steel demand globally and weak consumption in sectors such as construction, particularly in the European Union. Despite these challenges, expectations for medium-term recovery in scrap prices may emerge as reconstruction efforts in Turkey post-earthquake could potentially stimulate demand for steel, subsequently boosting the requirements for scrap stocks. PFL pays cash for scrap – see pricing below:

Source: PFL

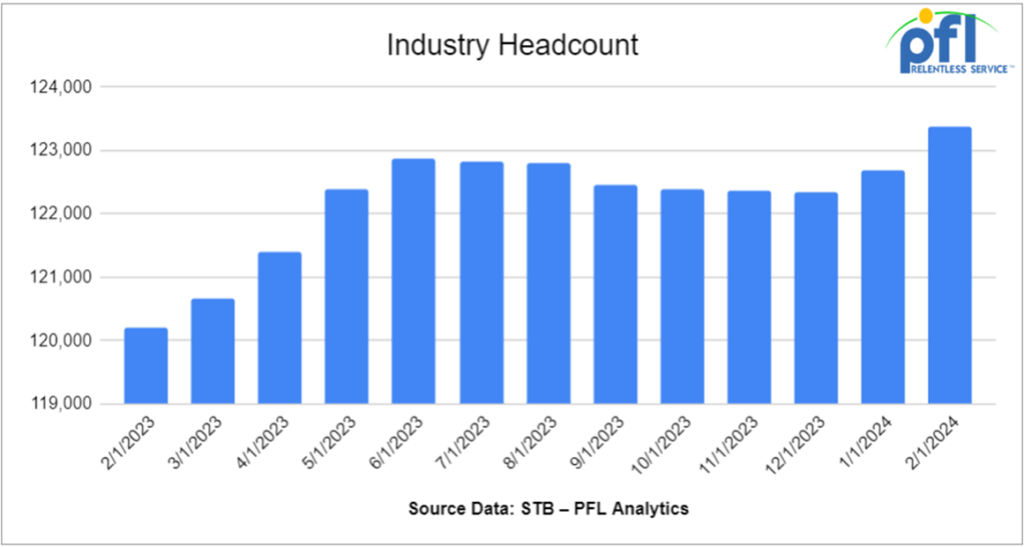

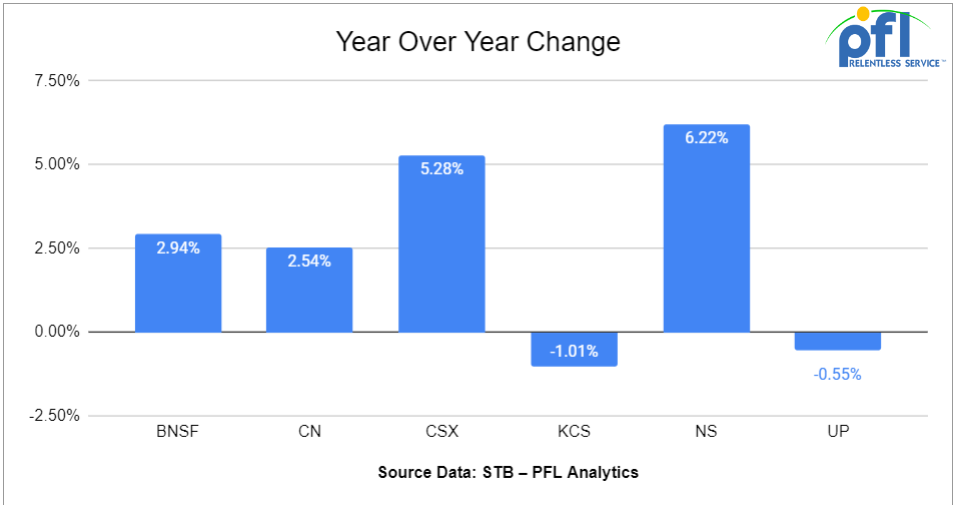

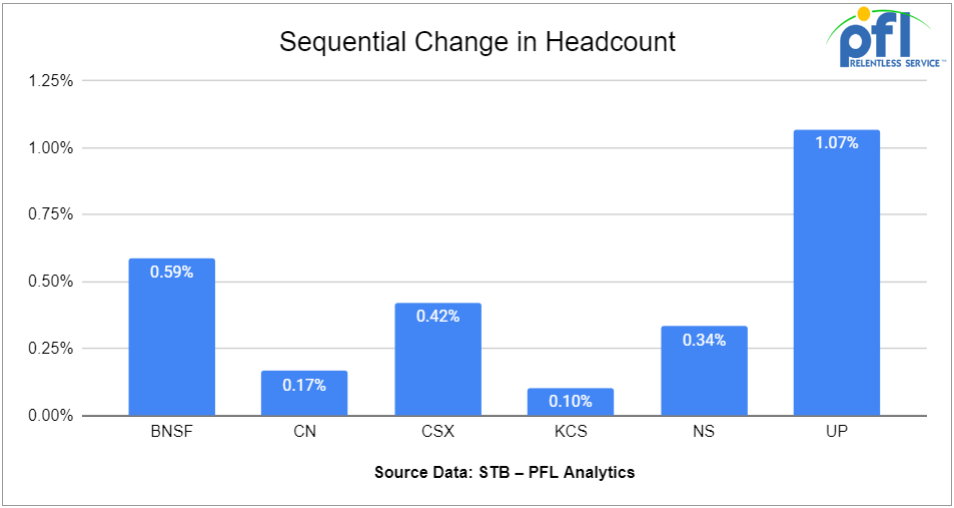

We are watching Class 1 Industry Headcount

The U.S. Class I workforce grew month over month. As of mid-February, the large railroads employed 123,377 people in the United States, up 0.6% from January’s level and 2.6% from February 2023’s count, according to Surface Transportation Board employment data.

Month-over-month, four out of six employment categories posted gains, led by maintenance of way and structures, which rose 1.8% to 28,775. Professional and administrative staff moved up 0.6% to 10,445, the transportation (train and engine) workforce rose 0.4% to 52,867, and maintenance of equipment and stores ranks inched up 0.1% to 18,231.

The number of executives, officials and staff assistants fell 1.1% to 8,131 and the number of transportation (other than train and engine) workers dipped by 0.5% to 4,928.

Year over year, all six categories reached higher figures as of mid-February, led by the transportation (train and engine) sector which registered a nearly 4% gain. The other categories and their respective percentage increases were: professional and administrative, 3.6%; maintenance of equipment and stores, 2.1%; transportation (other than train and engine), 1.7%; maintenance of way and structures, 1.1%; and executives, officials and staff assistants, 0.2%.

We are watching the EPA and the Biden Administration

The EPA and Biden are hopeful that Electric vehicle sales are set to rise under the new EPA tailpipe pollution rule. Electric vehicle (EV) sales are set to rise in the 2030s under a far-reaching climate regulation issued by the Biden administration on Mar 20, 2024

Under the final rule, the Environmental Protection Agency (EPA) set national pollution standards for passenger cars, light-duty trucks, and medium-duty vehicles for model years 2027 through 2032 and beyond. While the new rules do not mandate that automakers transform fleets to sell more EVs by a certain date, those automakers could build more EVs to comply with stricter emissions standards.

According to the EPA, the new standards would prevent more than 7 billion tons of carbon emissions by 2055, provide nearly $100 billion of annual net benefits to society, and avert 2,500 premature deaths from auto pollution by reducing emissions of fine particulate matter from gasoline-powered vehicles by more than 95%.

The EPA added that the transportation sector represents nearly 40% of US climate emissions. The proposed rule moves the Biden administration a step closer toward its goal to reduce emissions by 50-52% of 2005 levels by 2030.

Unlike 2023’s stricter proposed rule, automakers are not required to dramatically boost EV sales until after 2030 and they can use plug-in hybrid gasoline-electric vehicles as well as all-electric vehicles to meet new standards. Automakers may choose to produce 30-56% of new light-duty vehicle sales as battery-electric vehicles, with the rest consisting of a mix of other clean vehicle technology, according to an EPA fact sheet. The rule would continue to allow for gasoline-fueled vehicle sales.

The Biden administration said it eased the final standards after fierce opposition from the automotive unions, a key election-year constituency, and concerns about fueling infrastructure not keeping pace with EV growth. EPA projects US auto manufacturing employment to grow because of the new standards. Our guess is that there is not a chance.

We don’t know where the EPA is getting their numbers from and we all know that EVs are not green. Several Republican-led states and oil and gas industry representatives have indicated they will challenge the rule.

“At a time when millions of Americans are struggling with high costs and inflation, the Biden administration has finalized a regulation that will unequivocally eliminate most new gas cars and traditional hybrids from the US market in less than a decade, the American Fuel & Petrochemical Manufacturers and the American Petroleum Institute said in a joint statement. “This regulation will make new gas-powered vehicles unavailable or prohibitively expensive for most Americans…Our organizations are certainly prepared to challenge it in court.”

Republicans in Congress are searching for ways to block the new regulations.

The rule comes as sales of EVs are slowing as consumers opt for cheaper hybrids and plug-in hybrids. Fourth-quarter 2023 EV sales increased 40%, down from a 49% jump in third-quarter 2023 and a 52% spike in the second quarter, according to Kelley’s Blue Book.

Despite pretty much the entire country making it clear that EV mandates are hurting the industry (with major automakers like Ford and GM slashing investment), President Biden is forging forward with his “green agenda.”

The report says that the Environmental Protection Agency is poised to implement emissions limits that (Biden thinks) could significantly boost electric vehicle sales, requiring EVs to constitute about two-thirds of new car and light truck sales by 2032, a sharp increase from less than 10% last year.

Unless, of course, people stop buying new cars.

The average price of a new EV is roughly $50,000, and only two cost less than $40,000 as of December: the Chevy Bolt and Nissan Leaf. Some makers have slashed EV prices to boost sales, but they are also losing money. Ford ran an operating loss of $4.7 billion on its EV business in 2023, equivalent to $64,731 per EV sold.

The companies are heavily subsidizing EVs with profits from gas-powered cars. This means middle-class Americans in Fargo are paying more for gas-powered cars so the affluent in Napa Valley can buy cheaper EVs. This cost-shift won’t be financially sustainable as the Biden mandate ramps up, and it may not be politically sustainable either.

Most popular gas-powered pickups emit about 430 grams of CO2 per mile. Under EPA’s final rule, trucks will have to average 184 g/mile in 2027, 128 g/mile in 2030 and 90 g/mile by 2032. Companies will effectively have to produce one to two electric trucks for every gas-powered one in 2027. The ratio will be closer to four to one by 2032.

EPA claims the rule preserves “consumer choice” because hybrids and plug-in hybrids can help meet the standards in the early years. But automakers will have no choice but to limit gas-powered, and increase EV production to meet the mandates. The only “choice” Americans will have in the future is electric. Complete madness would be an understatement.

We have been extremely busy at PFL with return-on-lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs at 239-390-2885

Lease Bids

- 100-200, 5200 Covered Hoppers needed off of UP, BNSF in Gulf area for 1-2 years. Cars are needed for use in Petcoke service. Open to smaller cube or longer-term

- 10, 28.3K 117J Tanks needed off of UP or BN in Texas for 3 Year.

- 250, 4000 Rapid Hoppers needed off of BNSF in TX IL for 5 years. Cars are needed for use in Coal service. in rotary/rapid cars with the electric dumping shoe

- 4, 6260 Covered Hoppers needed off of CSX in Bostick, NC for 2-4 Years. Cars are needed for use in Polypropene Pellets service.

- 50-100, 4750CF Open/Covered Hoppers needed off of BN in Washington for Feb-Jun. Cars are needed for use in Petcoke service.

- 80, 30K 117R or 117J Tanks needed off of UP in Nebraska for 12 Months. Cars are needed for use in Ethanol service.

- 100, 30K Dot 111 or CPC 1232 Tanks needed off of UP or BN in New Orleans/Pasadena for 6-12 Months. Cars are needed for use in Gasoline/Diesel service.

- 80, 29k 117R or 117J Tanks needed off of Any Class 1 in Kentucky for 1-5 Years. Cars are needed for use in Crude service.

- 50, 19k DOT111 Tanks needed off of UP or BN in Nevada or CA for 1 year. Cars are needed for use in Sulfuric Acid service. March or April

- 8, 28-30K Any Tanks needed off of UP BN in Texas and Gulf for 5 years. Cars are needed for use in Chlorobenzene service. Need Magrods

- 14, 23.5K DOT111 Tanks needed off of UP in Morrilton, AR for 1 year. Cars are needed for use in Turpentine service.

- 10, 30k any Tanks needed off of UP BN in Texas for 1 year plus. Cars are needed for use in Fuel Oil service.

- 25-50, 5000CF-5100CF Covered Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in Dry sugar service. 3 bay gravity dump, Hempel 37700

- 30-40, 28.3K DOT117R, DOT117J, DOT111 Tanks needed off of UP in Iowa for 2-3 years. Cars are needed for use in Feedstocks service.

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 50, 23.5-25.5 DOT111 Tanks needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

- 25, 30K Any Tanks needed off of in Houston for December -June. Cars are needed for use in Diesel service.

- 75, 30K Any Tanks needed off of Any Class 1 in Chicago for December 23-May 24. Cars are needed for use in Gasoline service.

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 108, 28.3K Any Tanks needed off of CN in Canada for 1-3 years. Cars are needed for use in Crude service.

- 20-25, 30K DOT117 Tanks needed off of UP or BN in Illinois for 5 years. Cars are needed for use in Ethanol service.

- 100, 28.3K Any Tanks needed off of UP or BN in Midwest/Texas for 5 years. Cars are needed for use in Veg Oils / Biodiesel service. Need to be Unlined

- 50-100, 4550 Covered Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in Grain service.

- 10, 33K 340W Pressure Tanks needed off of CN in LA for 1 year. Cars are needed for use in Butane service.

- 25, 20.5K CPC1232 or DOT117J Tanks needed off of BNSF or UP in the west for 3-5 years. Cars are needed for use in Magnesium chloride service. SDS onhand

- 25-50, 25.5K DOT117J Tanks needed off of NS CSX in Northeast for 5 years. Cars are needed for use in Asphalt / Heavy Fuel Oil service.

- 15, 28.3K DOT117J Tanks needed off of any class 1 in any location for 3 years. Cars are needed for use in Glycerin & Palm Oil service.

- 30, 17K-20K DOT117J Tanks needed off of UP or BN in Midwest/West Coast for 3-5 years. Cars are needed for use in Caustic service.

- 150, 23.5K DOT111 Tanks needed off of any class 1 in LA for 2-3 years. Cars are needed for use in Fluid service. Needed July

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

- 25-30, 23.5K or 25.5K Dot 111 or CPC 1232 Tanks needed off of UP or BN in TX, OK, or AR for 3-5 Years. Cars are needed for use in Asphalt service. Needed ASAP., Lined or Unlined. Splash Load

Sales Bids

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 20, 2770-3400 Mill Gondolas needed off of any class 1 in South Texas. Cars are needed for use in scrap metal service.

- 20, 2770 Mill Gondolas needed off of CSX in the northeast. Cars are needed for use in non-haz soil service. 52-60 ft

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Sand service.

- 8, 5200 Covered Hoppers needed off of various class 1s in various locations. Cars are needed for use in Plastic Pellet service.

- 20-30, 3000 – 3300 PD Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 10, 4000 Open Top Hoppers needed off of CSX in the northeast. Cars are needed for use in scrap metal service. Open top hopper

- 10, 6400 Open Top Hoppers needed off of CSX in the northeast. Cars are needed for use in wood chip service. Open top hopper, flat bottom

- 5, 23,5K DOT 111 Tanks needed off of any class 1 in Texas. Negotiable

- 200+, 5000cf Covered Hoppers needed off of any class 1 in various locations.

- 5, 3400CF Covered Hoppers needed off of any class 1 in Ohio. Cars are needed for use in Sand service.

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 100, 15.7K DOT111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

- 2-4, 28K DOT111 Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

- 20-30, Open Top Hoppers needed off of NS or CSX in Northeast. Cars are needed for use in Aggregate service. Gravity dump

- 5, 30K DOT 111 Tanks needed off of in US. Cars are needed for use in fuel service.

Lease Offers

- 15, Plate E and F Boxs located off of NS in New Orleans. Cars are clean Double Sliding Doors

- 38, 4750 plus, 3-4 Hatch Gravity Covered Hopperss located off of CSX CN CP in Florida. Sub-lease 12-18 months

- 50, 33K, 340W Pressures located off of in Moving. Cars were last used in Propane. 1 year lease

- 10, 28.3K, DOT117R Tanks located off of All Class Ones in St Louis. Cars are clean Call 239-390-2885 for more information

- 10, 21.9K, Tanks located off of UP in Longview, TX. Cars are clean CO2 Cars. Brand New. 2-5 Year Lease

- 125, 28.3K, 117J Tanks located off of Various Class 1s in Multiple locations. Cars are clean Long Term Lease, 5 Years +

- 50, 28.3K, AAR 211 Tanks located off of BN in Moving. Cars were last used in Biodiesel. 1 Year Lease; Free Move on BN

- 200-500, 5200, Covered Hoppers located off of CN and NS in Moving on CN and NS. Cars were last used in Grain. Lease is available until Fall.

- 100, 33K, 340W Pressure Tanks located off of CN or CP in Canada. Cars are clean

Sales Offers

- 20, Refer, Box Boxcars located off of UP in ID.

- 100-300, 3400, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 100, 28.3K, DOT117J Tanks located off of various class 1s in multiple locations.

- 100, 17K, DOT111 Tanks located off of various class 1s in multiple locations.

- 100, 19K, DOT111 Tanks located off of various class 1s in multiple locations.

- 40, 29K, DOT111 Tanks located off of CN in Canada. C/I; Free Move CN

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|

PFL will be at the Following Conferences

- Attending: Curtis Chandler (239.405.3365) David Cohen (954-729-4774)

- Conference Website

- Where: Moody Gardens Hotel and Convention Center

- Attending: Curtis Chandler (239.405.3365) David Cohen (954-729-4774)

- Conference Website