“Go as far as you can see; when you get there, you’ll be able to see further.”

—Thomas Carlyle

Jobs Update

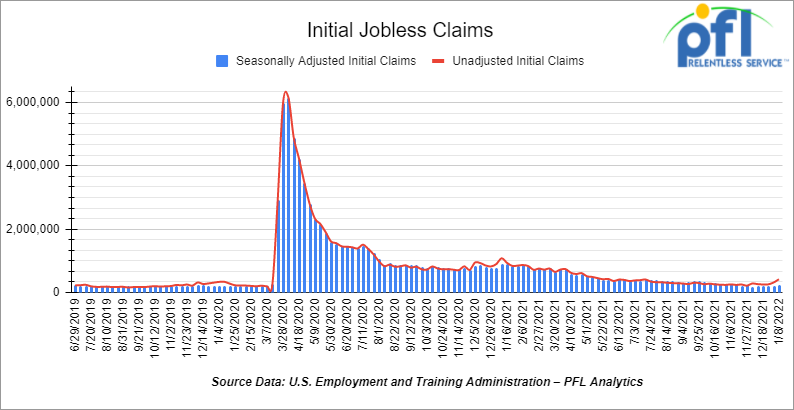

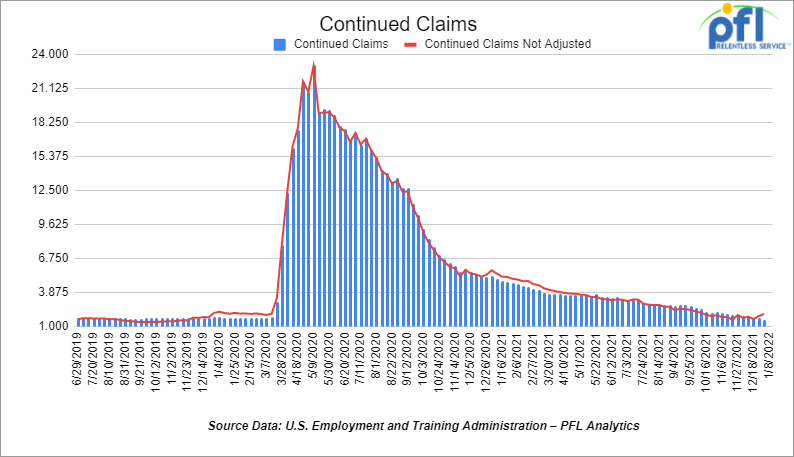

Initial and Continuing Jobless Claims

- Initial jobless claims for the week ending January 8th came in at 230,000, up +23,000 people week over week.

- Continuing claims came in at 1.559 million people versus the adjusted number of 1.753 million people from the week prior, down -194,000 people week over week.

Stocks closed lower on Friday of last week and lower week over week

The DOW closed lower on Friday of last week, down -201.81 points (-0.56%), closing out the week at 35,911.81 points, down –319.85 points week over week. The S&P 500 closed higher on Friday of last week, up 3.82 points (0.08%) and closed out the week at 4,662.85, down -14.18 points week over week. The Nasdaq closed higher on Friday of last week, up 86.94 points (+0.59%) and closed out the week at 14,893.75, down -42.15 points week over week.

In overnight trading, DOW futures traded lower and are expected to open at 35,536 this morning down -260 points.

Oil closed higher on Friday of last week and up week over week on Continued Geopolitical Concerns

Oil futures settled higher on Friday of last week, boosted by supply constraints and worries of a Russian attack on neighboring Ukraine, pushing prices towards their fourth weekly gain. Sources are saying China is set to release crude reserves around the Lunar New Year – we all know how well that works!

West Texas Intermediate (WTI) crude closed up $1.70 a barrel on Friday of last week to settle at $83.82 per barrel up $4.02 per barrel week over week, while Brent futures closed up $1.59 per barrel to settle at $86.06 per barrel, up $4.31 per barrel week over week.

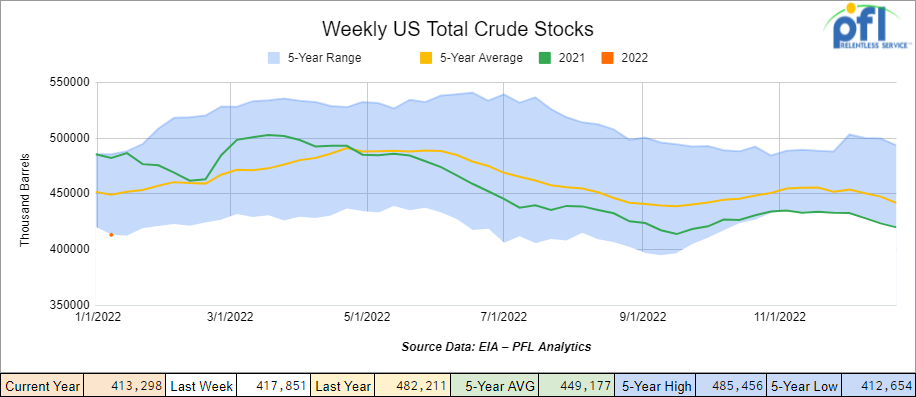

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 4.6 million barrels week over week. At 413.3 million barrels, U.S. crude oil inventories are 8% below the five-year average for this time of year.

Total motor gasoline inventories increased by 8 million barrels week over week and are 3% below the five-year average for this time of year.

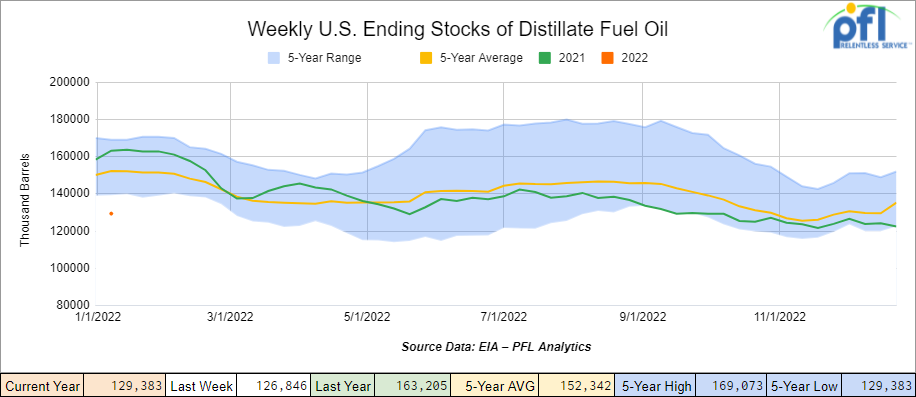

Distillate fuel inventories increased by 2.5 million barrels week over week and are15% below the five-year average for this time of year.

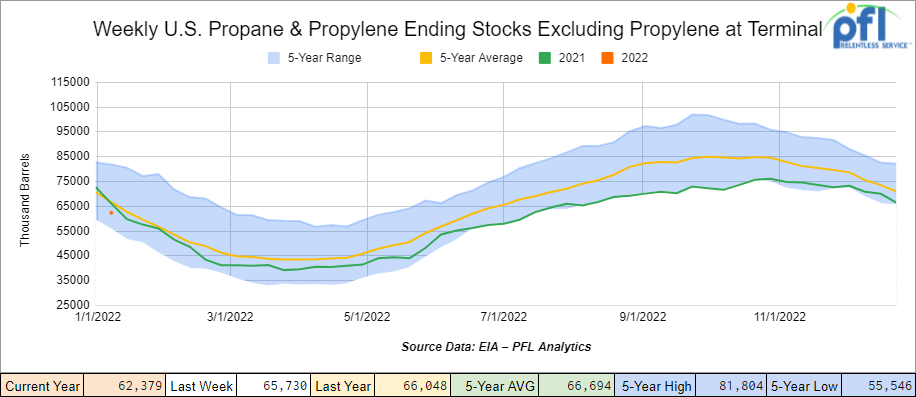

Propane/Propylene inventories decreased by 3.4 million barrels last week and are 6% below the five-year average for this time of year.

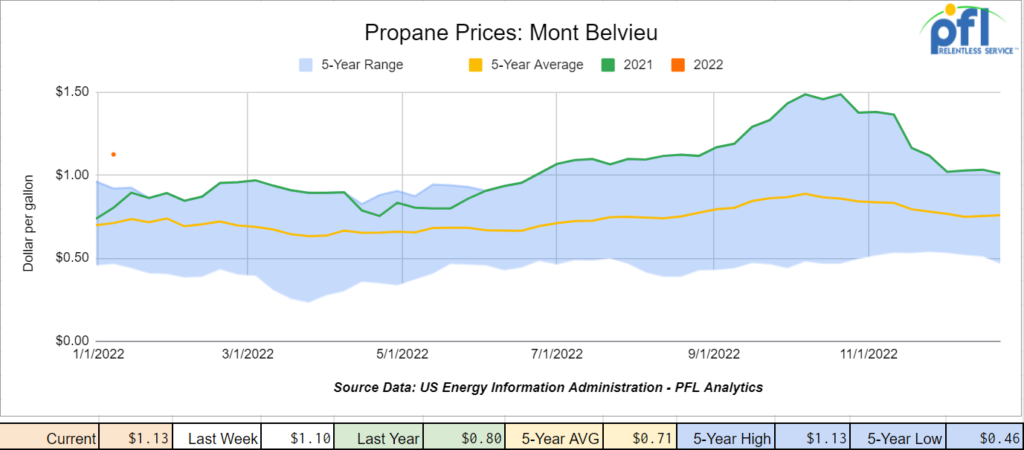

Propane continued to move higher week over week closing up 3 cents per gallon at $1.13 per gallon

Overall, total commercial petroleum inventories decreased by 4.5 million barrels week over week.

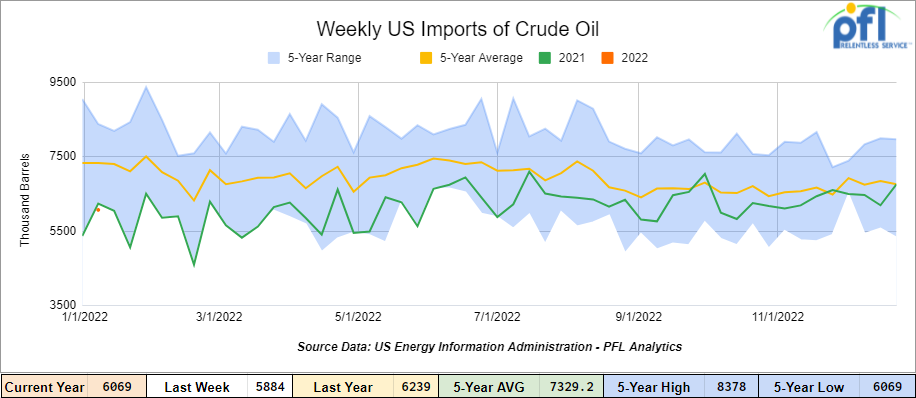

U.S. crude oil imports averaged 6.1 million barrels per day for the week ending January 7th, up by 185,000 barrels per day from the previous week. Over the past four weeks, crude oil imports averaged 6.2 million barrels per day, 10.7% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 589,000 barrels per day, and distillate fuel imports averaged 216,000 barrels per day.

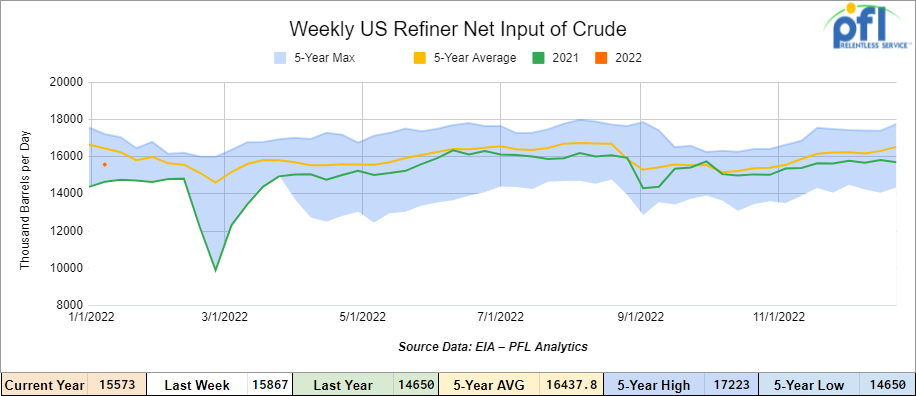

U.S. crude oil refinery inputs averaged 15.6 million barrels per day during the week ending January 7, 2022 which was 293,000 barrels per day less than the previous week’s average. Refineries operated at 88.4% of their operable capacity.

As of the writing of this report, WTI is poised to open at $85.22 , up $1.40 per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were down 17.4% year over year in week 1 (U.S. -16.0%, Canada -22.8%, Mexico -13.7%). All of the AAR’s 11 major traffic categories posted year over year declines with the largest decreases coming from intermodal (-21.2%), grain (-24.6%) and coal (-13.6%).

In the East, CSX’s total volumes were down 14.4%, with the largest decreases coming from intermodal (-10.2%), coal (-32.0%) and grain (-50.0%). NS’s total volumes were down 16.9%, with the largest decreases coming from intermodal (-22.1%) and coal (-10.5%).

In the West, BN’s total volumes were down 18.3%, with the largest decreases coming from intermodal (-23.5%), coal (-11.1%), grain (-20.7%) and petroleum (-30.6%). UP’s total volumes were down 7.6%, with the largest decreases coming from intermodal (-16.1%) and petroleum (-24.2%). The largest increase came from coal (+13.3%).

In Canada, CN’s total volumes were down 19.6%, with the largest decreases coming from intermodal (-28.0%), grain (-27.3%) and farm products (-49.6%). The largest increase came from metallic ores (+13.1%). Revenue per ton miles were down 24.4%. CP’s total volumes were down 22.7%, with the largest decreases coming from coal (-58.0%), petroleum (-39.2%), intermodal (-8.9%) and motor vehicles & parts (-44.8%). Revenue per ton miles was down 27.5%.

KCS’s total volumes were down 1.8%, with the largest decrease coming from petroleum (-32.2%). The largest increase came from intermodal (+10.3%).

Source Data: Stephens

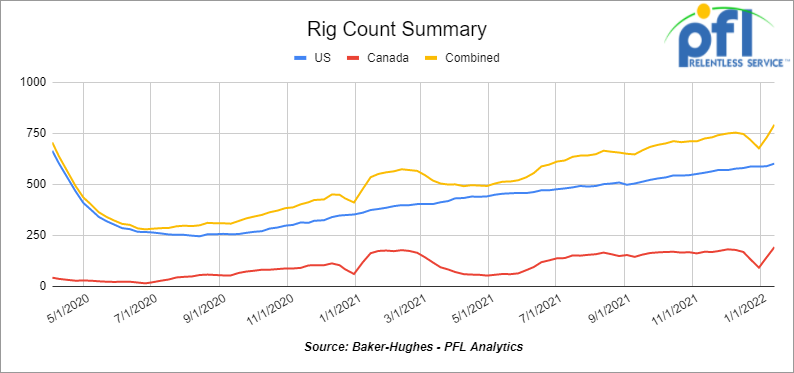

Rig Count

North American rig count is up by 63 rigs week over week. The U.S. rig count was up by 13 rigs week over week and up by 228 rigs year over year. The U.S. currently has 601 active rigs. Canada’s rig count was up by 50 rigs week over week and up by 30 rigs year over year and Canada’s overall rig count is 191 active rigs. Overall, year over year, we are up 258 rigs collectively.

North American Rig Count Summary

A few things we are keeping an eye on:

Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads declined to 22,782 from 24,139, a loss of 1,357 rail-cars week over week. Canadian volumes were up: CP volumes were up by 3.9% and CN volumes were up by 5.5% week over week. U.S. volumes were mixed with the NS having the largest percentage increase (up by 4.9%) and the BN having the largest percentage decrease (down by 9.2%).

U.S. Trucking Trends

Average truckload rates ex-fuel (weighted average of contract and spot) were 8% higher year over year in December according to Cass Information Systems. 2022 pricing outlooks are mixed, with contacts indicating dry-van contract rates likely lower 0-5% versus 4Q21 (2021 rates were +10-15%). Asset-based carriers likely see prices outperform broader market trends due to capacity constraints.

- Dry-van TL spot rates jumped up around the holidays and are now 18% above year-ago levels. Strong demand trends (including above average use of spot market capacity) will likely continue into the next 6+ months. Rising fuel prices will also likely add to spot market prices, as prices remain elevated. As a result, any significant moderation in rates vs current levels appears to be likely pushed into the second half of 2022.

- During December, total freight shipments were +8% year over year and flat month over month, according to Cass Information Systems. While underlying demand commentary remains positive (continued consumer strength, inventory replenishment, and increased industrial activity), shortages of raw materials, equipment and drivers appear to constrain shipments.

Global Airfreight, Containerized Ocean Traffic

- Total U.S. and Canadian container imports in December hit a new record high as year over year growth accelerated in the month despite capacity likely being fully utilized. December imports were up +9% year over year and up +3% percent month over month according to PIERS. We expect full year 2021 volumes to be up +20% year over year as shippers restock below target inventory levels. Forward-looking demand commentary remains bullish given inventory restocking and existing shipment backlogs.

- Spot ocean rates from Asia to the U.S. West Coast are up +216% year over year, according to the FBX. Spot rates likely remain significantly above pre-COVID into 2022 as demand continues to outstrip capacity and network velocities remain below average. 2022 ocean contract rates will likely rise as strong demand will most likely continue, network velocity remains challenged, and labor challenges persist.

- Airfreight markets continue to see demand increase faster than capacity with additional demand from last chance holiday push, resulting in rates on the Asia-U.S. route at new all-time highs. Rates from Asia to North America are up 70% year over year (up 10% month over month). Rates to Europe are up 43% year over year as demand remains strong and passenger capacity (40%+ of industry capacity) remains somewhat muted. Air rates are expected to moderate in the first half of 2022, but remain significantly elevated vs pre-COVID levels.

MARS Conference in Chicago

Despite most participants thinking the conference would be cancelled the show went on folks and was surprisingly well attended and ended up being a mask free event with everyone in good spirits and eager to kick off the new year with new business. Speakers from the class ones cited the same concerns – labor constraints are affecting their service ability – the same theme we have been hearing for well over a year. All said they were on the right track, but there were no promises as to when service will improve. The secondary rail market for cars of all sizes has been robust with people still reluctant to enter into long term pricey contracts for new builds but this reality is right around the corner as workable supply is drying up.

Continued Regulatory Woes for DAPL

An Illinois appellate court on Wednesday of last week vacated approval given by the Illinois Commerce Commission (ICC) to allow the expansion of the Dakota Access oil pipeline capacity up to 1.1 million barrels per day.

The Dakota Access Pipeline (DAPL) can transport about 570,000 barrels per day (bpd) of crude oil from North Dakota to the Midwest, though the company said in August it had completed a capacity expansion to 750,000 barrels per day.

Last year the pipeline withstood a legal challenge by Standing Rock Sioux and other adversaries to shut the pipeline.

In 2020, the commission approved the addition of pumping stations that would boost the pipeline’s capacity over the objections of environmental groups such as the Sierra Club and the National Resources Defense Council. The commission needed to consider the public need for the proposed improvement, but the court said the commission erroneously interpreted the public to mean the world, not the United States.

The court also found that the commission abused its discretion in finding irrelevant the objectors’ evidence that the pipeline’s operator, Sunoco, had been fined for safety and environmental violations in the past. The saga continues for DAPL.

Alberta Government hot on Carbon Capture and Storage

The Alberta government is currently accepting requests for proposals to operate an underground carbon storage hub serving the Alberta Industrial Heartland (AIH) zone near Edmonton. The process to select an operator for another hub near Cold Lake will come “on the heels” of that, Savage said in an interview late on Thursday of last week.

“We are going to need to move on Cold Lake very, very quickly after Heartland,” Savage said. “It’s a hub that will give certainty to oilsands and heavy oil production.”

The government is keen to move forward this year on several carbon storage hubs, where an operator will sequester both their own and third-party emissions, so industries in different areas of the provinces are not at a competitive disadvantage.

Carbon capture, utilization and storage (CCUS) is expected to be a key part of global efforts to contain emissions from fossil fuel production.

“CCUS is probably my number one priority file at the moment,” Savage said.

Fatih Birol, the head of the International Energy Agency, said on Thursday his organization considered CCUS to be one of the three most critical decarbonization technologies.

Alberta is aiming to aggressively expand its CCUS industry to help cut emissions and safeguard the future of its energy industry as the world aims for net-zero emissions by 2050. Savage’s comments show how that plan is taking shape.

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 50 25.5 Tanks C&I for heavy fuel oil in Texas dirty to dirty 1-2 years negotiable

- 50 29K C&I Tanks for veg oil to purchase – Immediate need

- 20 pressure cars 340’s in SE clean or last in butane or propane 1-2 years Immediate Need

- 15 5200-5500 PD hoppers in the west UP for 5 years for soda ash negotiable

- 30 5800 and 6250 covered gons for sale

- 100 117Js Coiled and Insulated dirty to dirty service BNSF CN or CP

- 50, 5800cuft or larger Covered Hopper for the use in DDG needed in the Midwest for 3-4 years. Immediate need.

- 10 25-28K C&I tanks for veg oil needed in the south for 2 years negotiable

- 10-20 Covered hopper grain cars in the midwest 5200-5500 2-3 years

- 20-30, 19K Tank Cars for Caustic Soda needed in Texas off the UP or BN.

- Unit Train of 28.3K 117Js for use in Crude service off the CN or BN in MT, ND, or Alberta.

- 100-150 340 pressure cars for LPG service in Texas

- 70-90 Biodiesel cars C&I any type car in the midwest or TX 1-2 years

- 15-25, 23.5K cars for chem needed in the South for 1 Year.

- 50 117R 30K+ for gasoline in the midwest CSX or NS for 6 months negotiable

- 100 Moulton Sulfur cars for purchase – any location – negotiable

- 10 DOT111 or 1232 25.5K 286 GRL for Crude Glycerin anywhere in US 1 year lease

- 12 Plate F 286 GRL Boxcars 12’ plug doors midwest preferred for 1 year lease

- 30-50 Log Flats with stanchions 286K GRL in the midwest/east CSX NS 1-3 years negotiable

- 50 Ag Gons 2500-2800cuft 286k GRL in the east CSX for 5 years negotiable

- 25 Covered wood chip Gons 6000CF 286 GRL any location for 1-3 years negotiable

- 25 Boxcars for paper 6000CF 286 GRL 1-3 years anywhere

- 10-20 propane cars needed for a short term lease in ND off the CP.

- 100 15K Tanks 286 for Molten Sulfur in the Northeast CSX/NS for 6 months negotiable

- 200 117Js 28.3 C&I 286 in the North on the CN for 1 year Crude dirty to dirty Negotiable

- 20 5650 PD Hoppers 286s needed in Montana for talc BNSF for 3-5 years

- 100 Open Top Hoppers needed in the Midwest for coal BNSF 1 year

- 100, 5800 Covered Hoppers 286 can be West or East for Plastic 3-5 years

- 50-100, 4750 Covered Hoppers needed for Pet-coke. Can take in the South.

- 70, 117R or J needed for Ethanol for 3 years. Can take in the South.

- 30, 25.5’s or greater food grade Kosher veg oil cars for 6-12 months

- 50, 6500+ cu-ft Mill Gon or Open Top Hopper for wood chips in the Southeast for 5 Years.

- 25 bulkhead flats 286 any class one for up to 5 years Negotiable

- 20, 19,000 Gal Stainless cars in Louisiana UP for nitric acid 1-3 years – Oct negotiable

- 10, 6,300CF or greater covered hoppers are needed in the Midwest.

- 2, 89’ Flat cars for purchase or lease – needed in TX off the BNSF

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js – Selection is Dwindling. Call Today!

- 200 Clean C/I 25.5K 117J in Texas. Brand New Cars!

- 150 25.5 111’s in the midwest for sale – Negotiable

- 150 117R’s 31.8 clean for lease in Texas – negotiable

- 31.8K Tank Cars last in Diesel. Dirty to dirty in Texas

- 200 117Js 29K OK and TX Clean and brand new – Lined- lease negotiable

- 100 117Rs dirty last in Gasoline in Texas for lease Negotiable

- 90 117Rs 30K located in Alberta CN or CP Refined Products Dirty – negotiable

- 25 BRAND NEW 5161 Sugar Hoppers in Arkansas UP – negotiable

- 99 340W Pressure Cars various locations Butane and Propane dirty negotiable

- 100 73 ft 286 GRL riser less deck, center part for sale,

- 19 auto-max II automobile carrier racks – tri-49 for sale – negotiable

- 10 food grade stainless steel cars sale or lease

- 20 20K Stainless cars in 3 locations in the south – sale or lease – negotiable

- 30 CPC 1232 25.5K C/I Pennsylvania NS clean negotiable

- 100-150 29K C/I 117J cars for lease. Dirty in Bakken crude and can be returned dirty.

- 100 29K C/I 1232 cars for lease. Dirty in Heavy Crude and can be returned dirty.

- 50 29K 117Js in Nebraska for sale or lease clean last in crude – available Feb 2022

- 100 117Rs 29K clean last used in crude Washington State – price negotiable sale or lease

- 21 111s 29K tanks last in alcohol dirty on the CN in Wisconsin for lease price negotiable

- 100 111s of various volumes and locations last in fuel oil dirty price negotiable

- Various Hoppers for sale and lease 3000-5800 CF 263 and 286 multiple locations negotiable

- 45 Boxcars 60ft Plate F’s Located in Tenn CSX – Lease Negotiable

- 28 20K Veg oil cars for lease in Arkansas – Negotiable

- 100 3200 Covered Hoppers for sale price negotiable

- 100 Center beam Flats with risers 73ft in SD and Iowa for sale negotiable

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offer Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|