The History of Ethanol

- Home

- Commodities

- Ethanol History

Grain Ethanol as a Fuel Source for Cars

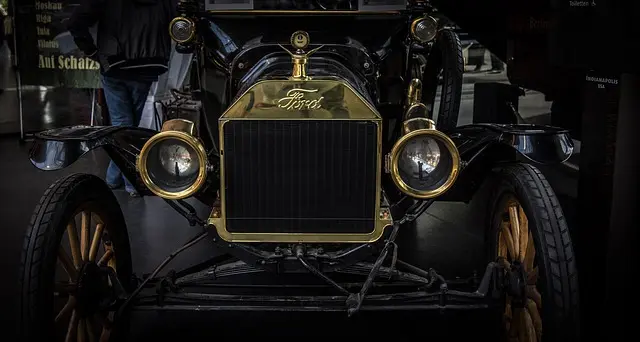

The use of ethanol as an automobile fuel in the United States dates as far back as 1908, to the Ford Model T. Henry Ford was a supporter of home-grown renewable fuels, and his Model T could be modified to run on either gasoline or pure alcohol. Ethanol was used to fuel cars well into the 1920s and 1930s as several efforts were made to sustain a U.S. ethanol program. Standard Oil marketed a 25-percent ethanol by volume gasoline in the 1920s in the Baltimore area.

Ford and others continued to promote the use of ethanol, and by 1938 an alcohol plant in Atchison, Kansas, was producing 18 million gallons of ethanol a year, supplying more than 2,000 service stations in the Midwest. By the 1940s, however, efforts to sustain the U.S. ethanol program had failed. After World War II, there was little interest in the use of agricultural crops to produce liquid fuels. Fuels from petroleum and natural gas became available in large quantities at low cost, eliminating the economic incentives for production of liquid fuels from crops. Federal officials quickly lost interest in alcohol fuel production, and many of the wartime distilleries were dismantled. Others were converted to beverage alcohol plants.

Renewed Interest in Ethanol

Interest in ethanol was renewed in the 1970s, when oil supply disruptions in the Middle East became a national security issue and America began to phase out lead (an octane booster) from gasoline. The American Oil Company and several other major oil companies began to market ethanol as a gasoline volume extender and as an octane booster. Ethanol was blended directly into gasoline in a mix of 10 percent ethanol and 90 percent gasoline, called gasohol. In 1978, Congress approved the National Energy Act, which included a Federal tax exemption for gasoline containing 10 percent alcohol. The Federal subsidy reduced the cost of ethanol to around the wholesale price of gasoline, making it economically viable as a gasoline blending component. The growth of ethanol was enhanced substantially by State tax incentives to ethanol producers. By 1980, 25 States had exempted ethanol from all or part of their gasoline excise taxes in order to promote consumption. Ethanol production jumped from just over 10 million gallons in 1979 to 175 million gallons in 1980. Federal and State tax incentives made ethanol economically attractive in the Midwest, but the difficulty and high cost of transporting ethanol precluded consumption in other markets.

Since 1980, ethanol has enjoyed considerable success. U.S. production has grown by about 12 percent per year, reaching 1.4 billion gallons in 1998. U.S. gasoline consumption in 1998 was approximately 120 billion gallons. The ethanol program received a boost from Congress in 1990 with the passage of the Clean Air Act Amendments (CAAA90). Congress mandated the use of oxygenated fuels (with a minimum of 2.7 percent oxygen by volume) in specific regions of the United States during the winter months to reduce carbon monoxide. The two most common methods to increase the oxygen level of gasoline are blending with MTBE and blending with ethanol. Because ethanol has a higher oxygen content than MTBE, only about half the volume is required to produce the same oxygen level in gasoline. This allows ethanol, typically more expensive than MTBE, to compete favorably with MTBE for the wintertime oxygenate market. Unfortunately, ethanol's high volatility, measured by Reid vapor pressure (Rvp), limits its use in hot weather, where evaporative emissions can contribute to ozone formation. Nevertheless, ethanol's expanded role as a clean-air additive has allowed it to penetrate markets outside the Midwest.

Although most ethanol consumption is in conventional gasoline engines, which are limited to a 10-percent ethanol blend (E10), there is also some demand for ethanol blended in higher concentrations, such as E85 (85 percent ethanol, 15 percent gasoline). E85 vehicles are currently in use as government fleet vehicles, flexible-fuel passenger vehicles, and urban transit buses. Demand for ethanol in E85 has grown from 144,000 gallons in 1992 to 2 million gallons in 1998. Most E85 use falls under government mandates to use alternative fuels. Ethanol does not compete directly with gasoline, even at comparable costs, because its energy (Btu) content is lower than that of gasoline. It takes approximately 1.5 gallons of ethanol do deliver the same mileage as 1 gallon of gasoline.

Ethanol use is also being expanded to multi-component fuel systems. P-series fuels, created by Pure Energy Corp., are blends of ethanol, methyltetrahydrofuran (MTHF), natural gas liquids, and in some cases butane to meet cold-start requirements.10 Pure Energy is also developing a new fuel called OxyDiesel, composed of 80 percent diesel fuel, 15 percent ethanol, and 5 percent blending agent to raise cetane levels.11 The company has developed an additive system to prevent water absorption for a stable ethanol-diesel mixture that can be shipped through a pipeline.12 Currently, fuels blended with ethanol cannot be shipped in multifuel pipelines, because the moisture in pipelines and storage tanks is absorbed by the ethanol, causing it to separate from gasoline. Rather, the petroleum-based gasoline components have to be shipped separately and then blended with ethanol at a terminal as the product is loaded into trucks.

The demand for ethanol could increase if MTBE were eliminated from gasoline. MTBE (in addition to its use in high oxygen fuels) is widely used as a year-round gasoline additive for RFG to meet the legislated requirement for 2.0 percent oxygen by weight. The use of MTBE has recently been questioned, however, because traces of the additive have been found in 5 to 10 percent of the drinking water supplies in areas using RFG. In 1999, concerns about water quality resulted in the announcement of a State-wide phaseout of MTBE by the Governor of California, as well as numerous legislative proposals at both the State and Federal levels aimed at reducing or eliminating the use of MTBE in gasoline. Ethanol would be the leading candidate to replace MTBE, although it is not without its drawbacks. Compared with MTBE, ethanol use results in higher evaporative emissions of smog-forming volatile organic compounds (VOCs), requiring refiners to remove other gasoline components such as pentanes or butanes to meet the Rvp limits set by the U.S. Environmental Protection Agency (EPA).

Ethanol Logistics

Logistics is also an issue for ethanol use. At present, ethanol supplies come primarily from the Midwest, where the majority of ethanol is produced from corn feedstocks. Downstream Alternatives, Inc., has analyzed the logistics of supplying ethanol to California, in a study for the Renewable Fuels Association. The analysis found that, because of the distances involved, the only viable alternatives for transporting ethanol to California would be rail shipments or marine cargoes. Rail shipment would be required for ethanol plants that are landlocked. In addition, small plants (less than 80 millions gallons production capacity) would not be likely to ship by marine cargo, which requires large shipment volumes. Rail transit times from Midwest ethanol plants to California can range from 2 to 3 weeks, with typical costs of 14 to 17 cents per gallon, depending on the plant of origin and the market destination.

Larger ethanol plants located on the water would have the option to ship waterborne cargoes. Product would be shipped down the Mississippi via barge and then staged at a terminal in New Orleans until sufficient quantities of ethanol were accumulated for shipment. The ethanol would then be shipped south through the Panama Canal and north to California ports. The entire process would take a minimum of 34 days, and the costs would be nearly the same as the costs for rail shipments. In both cases, the ethanol would then have to be transported from a rail or marine terminal by truck to a final destination terminal before blending into gasoline. In addition, some terminals would need to make modifications to offer ethanol even if tankage were adequate to accommodate ethanol blending.

The cost of producing and transporting ethanol will continue to limit its use as a renewable fuel. Ethanol relies heavily on Federal and State subsidies to remain economically viable as a gasoline blending component. The current Federal subsidy, at 54 cents per gallon, makes it possible for ethanol to compete as a gasoline additive. Corn prices are the dominant cost factor in ethanol production, and ethanol supply is extremely sensitive to corn prices, as was seen in 1996. Ethanol production dropped sharply in mid-1996, when late planting due to wet conditions resulted in short corn supplies and higher prices.

Substantial reductions in ethanol production costs may be made possible by replacing corn with less expensive cellulose-based feedstocks. Cellulosic feedstocks include agricultural wastes, grasses and woods, and other low-value biomass such as municipal waste. Although cellulosic materials are less expensive than corn, they are more costly to convert to ethanol because of the extensive processing required. Cellulase enzymes (used to convert cellulose to sugar) at $0.45 per gallon of ethanol are currently too expensive for commercial use. Current technology, however, could reduce the cost of enzymes to less than $0.10 per gallon of ethanol if a sufficient market develops. Advances in biotechnology could lower costs further by allowing fermentation of the nonglucose sugars produced in the hydrolysis of cellulose using genetically engineered bacteria. If Department of Energy goals are met, the cost of producing ethanol could be reduced by as much as 60 cents per gallon by 2018. Currently, the cost of producing ethanol from cellulose is estimated to be between $1.15 and $1.43 per gallon in 1998 dollars.

Source: EIA