“If I had asked people what they wanted, they would have said faster horses” – Henry Ford

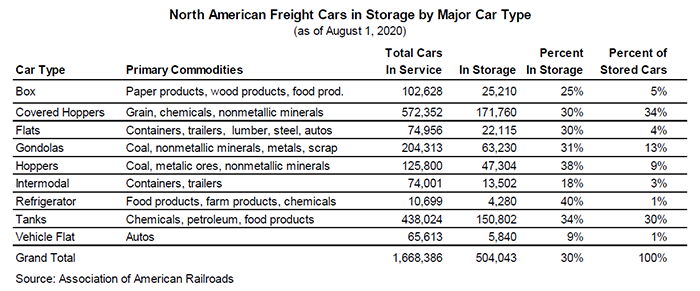

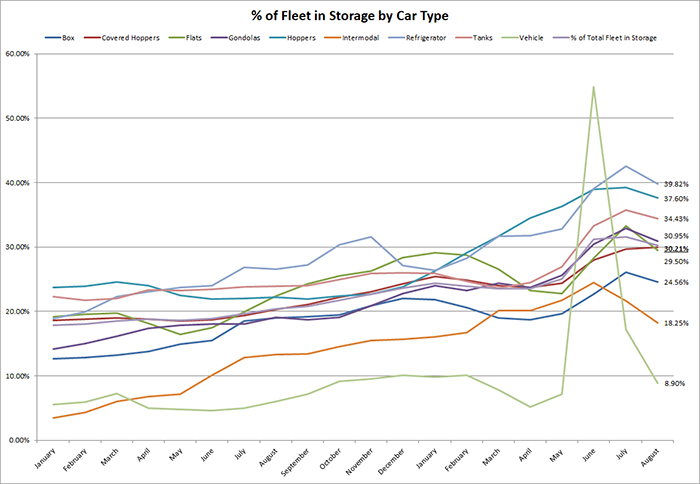

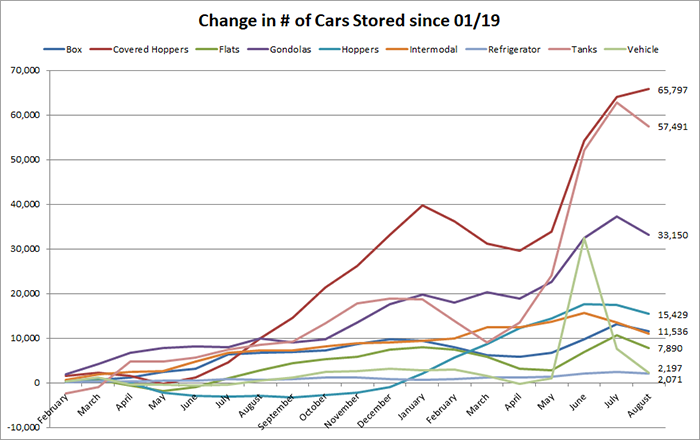

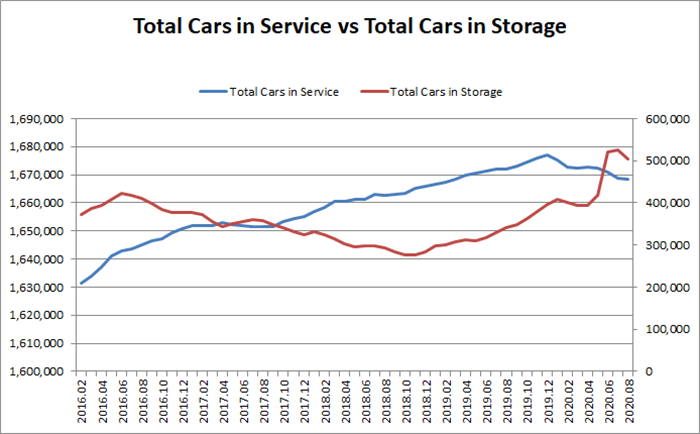

As of August 1st, the total number of cars in storage is 504,043, representing a decline of 22,427 (-4.26%) month over month and an increase of 163,055 (47.8%) from this time last year. This currently represents 30.21% of the total North American fleet in storage, a slight decline from last month’s 31.55% of the total fleet. The total number of stored cars still remains very elevated from pre-pandemic levels, with the total number of cars stored 28% higher than the March 1, 2020 levels.

Cars are starting to move again as every category we track, except covered hoppers, saw month-over-month storage declines. Covered hoppers now represent 34.1% of all of the cars in storage as sand cars continue to be a challenge for our industry. Vehicle cars, gondolas, and intermodal cars had the biggest percentage declines in the number of cars stored with Vehicle cars in storage now pretty much back in line with historical levels. Intermodal cars in storage broke their pre-pandemic uptrend with the number of intermodal cars in storage now at 13,502 (18.25% of the total fleet), a decline of 2,500 cars m/m that puts this category back to levels not seen since Feb 2020. Big increases in m/m intermodal traffic is also giving the total rail traffic numbers a boost. With the total North American volumes up 538,788 (29.95%) in July, intermodal traffic alone accounted for an increase of 291,027(54%). While U.S. weekly carload volumes continue to be significantly lower than a year ago, intermodal volume was only slightly lower in contrast.

As oil prices continue their move higher, all eyes will be on Canada and whether energy companies from the country reactivate some more of their idled crude fleet. The basis traded today around -$11.90, close to the levels needed for barrels to start moving by rail again. Q4 basis is trading around -$14.90. This may result in tank cars coming out of storage, with the consensus in the industry thinking this will happen in Q4 or early Q12021. Most energy companies are actually very risk averse, so we do not expect the ramp up to be swift or dramatic until we see some stability in prices and basis. It is more likely that this will ramp up slowly as we approach year end and head into the next year. Companies will want to be sure these prices levels are here to stay before they spend millions to ramp their programs back up. On this subject, we received news out of Bakken with the court’s ruling ETP will not have to immediately shut and drain the DAPL. We touched on this issue last month and indicated this could lead to more tank cars coming out of storage, but it seems as though the can has been kicked down the road once again. PFL did see some cars coming out as a contingency in case the pipeline was forced to shut down, but they may move back to storage as the ongoing legal battle continues.

In last month’s storage report we indicated we thought storage was peaking and it turns out that would appear to be the case. However, we do expect that storage levels will continue to remain elevated as the economic recovery continues. As weekly rail volumes start to improve, the industry overall is looking for solutions to relieve the burden of its railcar supply glut. One significant solution would be a tax incentive for scrapping excess capacity. “We have an industry coalition that is promoting and working with Congress on a railcar act. It would be an incentive and future stimulus to scrap and take out the inefficient cars in the storage. That would be a very attractive program. We’ve got wide parties of support for that,” said Greenbrier President and CEO, Bill Furman during his company’s FYQ3 earnings call on July 10. Where the industry is really oversupplied is on the coal car and sand car side. These are two markets that historically accounted for huge rail volumes and large quantities of cars that are now dwindling down. We believe car owners and the overall industry could really benefit from a program like this and PFL is here to help with any scrapping needs and has mobile crews available now. Call PFL today at 239-390-2885 for more details on rail car scrapping.

If you are need of or have storage available or if you need maintenance, the cleaning of cars or are looking to reposition cars in a cost effective manner, call PFL today! We can trouble shoot your situation and work diligently to find a solution for you!

If you are a leasing company and having cars being returned on lease call PFL today to secure a return on lease location.

Loaded hazmat storage in key market areas is still available, so please give PFL a call today.

| State | Class | Spaces | Description |

|---|

As a storage operator or a user of storage, PFL can help maximize you profitability. PFL offers turn-key solutions to operators and users alike. PFL Field Services LLC is preforming work inside many storage operations and short lines. PFL Field Services will clean railcars, service railcars cars and scrap cars on a mobile basis with a PFL Guarantee and has crews available ready to serve you today no matter where you are at in the country. We have acquired top rated, brand new equipment to service you the customers. PFL Field Services also offers inspection services from top rated qualified inspectors now full time at PFL. Call us today to book a time! Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs onsite at a storage facility. Saving a user empty moves to a shop. Not only is it more efficient saving time and money for the car owner or lessee and lessor but retains the short lines storage customer at the facility over the long term. PFL handles loaded storage, empty storage mobile railcar cleaning, blasting, mobile railcar repair and scrapping of all railcars at storage facilities across the country. If you are an operator and have cars onsite that your customers need to have work done let them know you can do it via PFL Field Services. We can assist on return on lease scenarios saving Lessor and Lessee thousands of dollars. Call the desk today 239-390-2885.