“Keep your face always toward the sunshine – and shadows will fall behind you.” – Walt Whitman

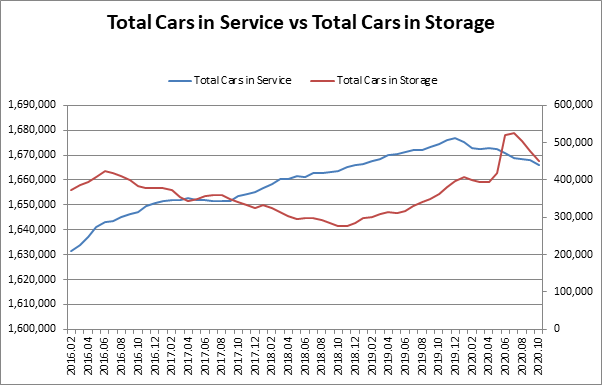

Railcars in Storage Decreased

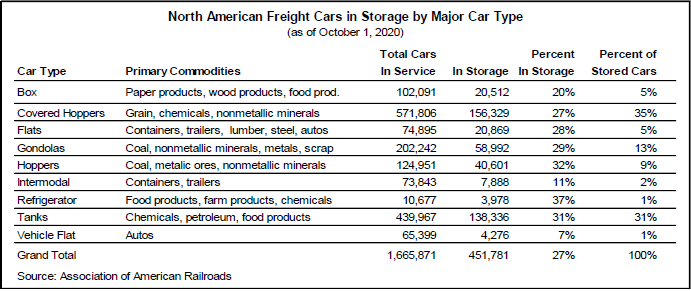

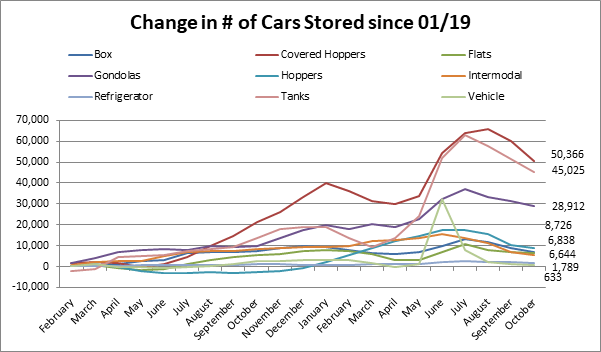

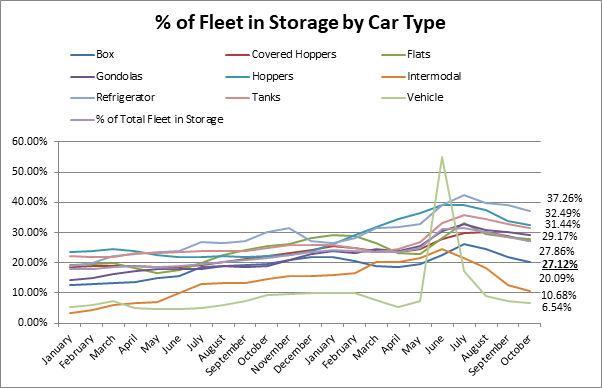

As of October 1st, the total number of cars in storage continued the downtrend to 451,781 cars, representing a month-over-month decline of 24,791 cars or -5.2%. The number of cars in storage remains 88,141 cars (24.24%) higher than this time last year. Despite total cars in service decreasing slightly, the percentage of the total fleet in storage declined to 27.12% from 28.57% last month; this is well below the July high of 31.55% of the total fleet in storage, but still higher than 21.71% of the total fleet in storage this time last year. Lastly, looking at pre-pandemic levels, we are still 57,931 cars (14.71%) higher than where we were on March 1st. The chart of total cars in storage seems to be forming an upside-down “V” since the pandemic, please see below.

For the second consecutive month, every category we track saw a month-over-month decline in the number of cars in storage. This furthers our thesis that things may be starting to normalize and, absent further disruptions, we should be on our way to better times for the rail industry. We do expect the downward trend will likely continue in the long run, but the pace could decelerate and may even stall in the short term.

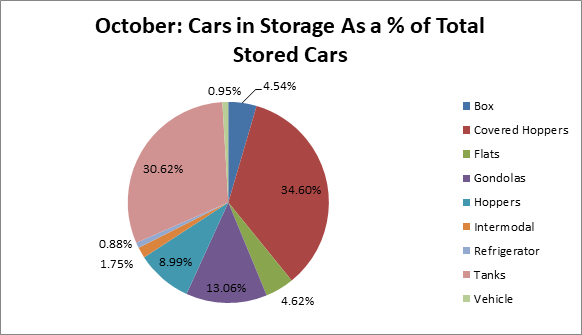

Tanks, Covered Hoppers, and Gondolas in storage still remain the most elevated from pre-pandemic levels, with most other categories back around normal levels or below. These three categories represent the biggest portion of the total North American fleet, so we would also expect these categories to have the most cars stored as a percentage of total stored cars. However, while a majority of the declines in storage numbers over the last few months can be attributed to tanks and covered hoppers, the levels remain elevated because some of the products shipped in these cars have been the hardest hit by the pandemic.

Cars are Moving Back Into Service

PFL has started to see cars moving from storage back into service. The majority have been for industrial products in more cyclical industries or consumer products. This is another good sign that hopefully the broader economy should follow. Food and grain cars have also been hot, especially now that we are in the harvest season. Grain traffic has been relatively unaffected by the pandemic, with carloads actually increasing year over year each month. Grain alone accounted 21% of all US railcar traffic last month.

Demand Remains Depressed

With all that said, demand for railcars still remains depressed. We have seen some action picking back up in the leasing market which is encouraging, but we are still well below prepandemic activity. Lease prices remain below historical averages and a lot of larger companies we encounter are hesitant to make any longer-term commitments. Katie Farmer, BNSF’s incoming CEO has this to say about rail traffic last week, “We basically say that if we’re handling 200,000 units a week, that indicates we’re a busy railroad.” “In 2018, we handled over 200,000 units a week, 41 times that year. Fast forward to 2020 and with the impact of the pandemic, we haven’t hit 200,000 units on our railroads yet.” She continued, “In the depth of the pandemic, our rail loadings were actually down to about 150,000 units a week. Now, we have seen that continue to come back. And we anticipate this week we’ll handle somewhere in the neighborhood of mid 195,000-196,000 range,” she added.

DOT-111 Tank Cars and Small Cube Covered Hoppers

The most challenging areas of the rail fleet when it comes to storage will be the older DOT-111 tank cars, and smaller cube-covered hoppers. Full utilization of these fleets may never happen again as there is a significant glut of these cars in the market and a limited number of commodities that can be shipped in them. The industry is looking at retrofitting 111s when it makes sense, and is currently looking into repurposing or re-bodying the small cube-covered hoppers. While a lot still remains to be seen on the fate of these cars, we have talked in depth in previous reports about different legislative proposals to incentivize scrapping cars and achieve an equilibrium fleet utilization number.

If you are in need of railcars or have storage available or if you need maintenance, the cleaning of cars or are looking to reposition cars in a cost-effective manner, call PFL today! We can troubleshoot your situation and work diligently to find a solution for you!

If you are a leasing company and have cars being returned on lease call PFL today to secure a return on lease location.

| State | Class | Spaces | Description |

|---|

As a storage operator or a user of storage, PFL can help maximize your profitability. PFL offers turn-key solutions to operators and users alike. PFL Field Services LLC is preforming work inside many storage operations and short lines. PFL Field Services will clean railcars, service railcars cars and scrap cars on a mobile basis with a PFL Guarantee and has crews available ready to serve you today no matter where you are at in the country. We have acquired top rated, brand new equipment to service you the customers. PFL Field Services also offers inspection services from top rated qualified inspectors now full time at PFL. Call us today to book a time! Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs onsite at a storage facility. Saving a user empty moves to a shop. Not only is it more efficient saving time and money for the car owner or lessee and lessor but retains the short lines storage customer at the facility over the long term. PFL handles loaded storage, empty storage mobile railcar cleaning, blasting, mobile railcar repair and scrapping of all railcars at storage facilities across the country. If you are an operator and have cars onsite that your customers need to have work done let them know you can do it via PFL Field Services. We can assist on return on lease scenarios saving Lessor and Lessee thousands of dollars. Call the desk today 239-390-2885.