“The present is the only time any duty can be done or any grace received.”

– C.S. Lewis

Jobs Update

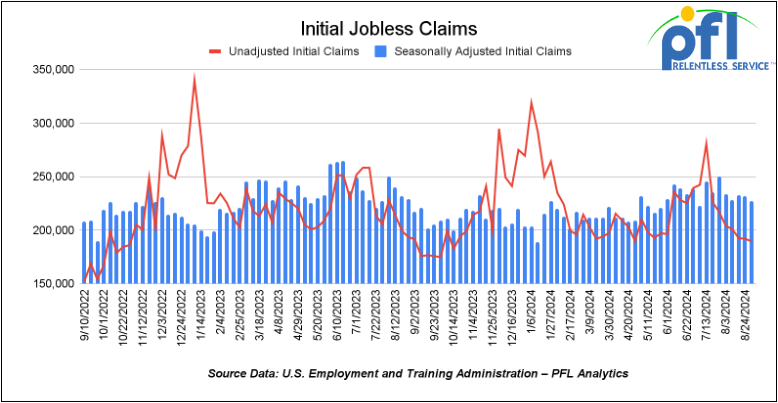

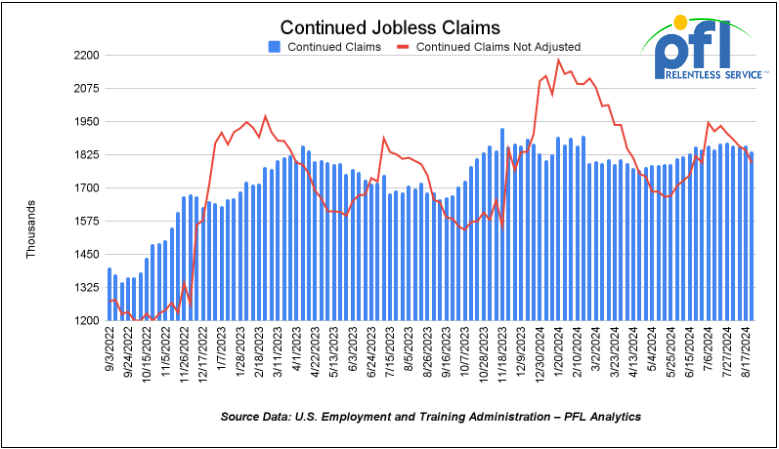

- Initial jobless claims seasonally adjusted for the week ending August 31st came in at 227,000, down -5,000 people week-over-week.

- Continuing jobless claims came in at 1.838 million people, versus the adjusted number of 1.86 million people from the week prior, down -22,000 people week-over-week.

Stocks closed lower on Friday of last week and lower week over week

The DOW closed lower, on Friday of last week down -410.34 points (-1.01%) closing out the week at 40,345.41 down -1,217.67 points week-over-week. The S&P 500 closed lower on Friday of last week, down -94.99 points and closed out the week at 5,408.42 down -239.98 points week-over-week. The NASDAQ closed lower on Friday of last week, down -436.83 points (-2.47%) and closed out the week at 16,690.83 down -1,022.8 points week over week.

In overnight trading, DOW futures traded higher and are expected to open at 40,646 this morning up 239 points.

Crude oil closed lower on Friday of last week and lower week over week.

Oil prices settled 2% lower on Friday, with a big weekly loss after U.S. jobs data was weaker than expected in August, which outweighed price support from a delay to supply increases by OPEC+ producers.

West Texas Intermediate (WTI) crude closed down -$1.48 per barrel (-2.14%) to close at $67.67 per barrel on Friday of last week, down -$5.88 per barrel week over week. Brent traded down -$1.63 USD per barrel (-2.24%) on Friday of last week, to close at $71.06 per barrel down -5.87 per barrel week-over-week.

In other oil related news, U.S. crude production rose roughly 1% in June as record output in Texas and recovery in the Gulf offset falling output in New Mexico and North Dakota. U.S. output averaged 13.12 million barrels per day during the month of June. According to Canada’s new TMX quarterly financials reported last week, the company pumped out 704,000 barrels per day during the month of June, up from 300,000 barrels per day in April.

One Exchange WCS (Western Canadian Select) for October delivery settled Friday on last week at US$13.70 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$ 54.66 per barrel.

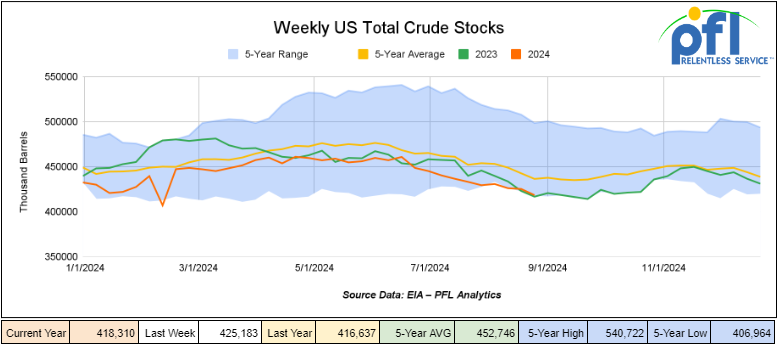

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 6.9 million barrels week-over-week. At 418.3 million barrels, U.S. crude oil inventories are 5% below the five-year average for this time of year.

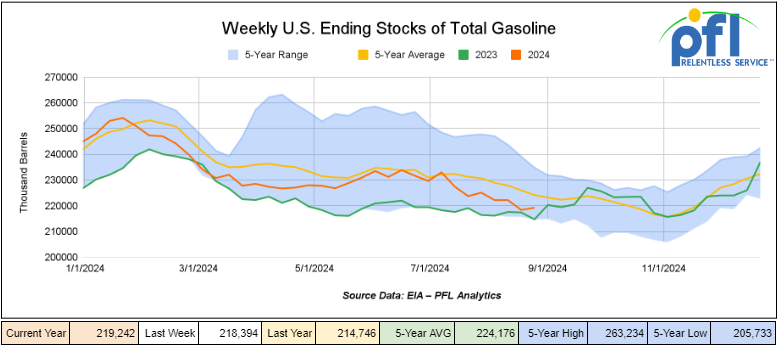

Total motor gasoline inventories increased by 800,000 barrels week-over-week and are 2% below the five-year average for this time of year

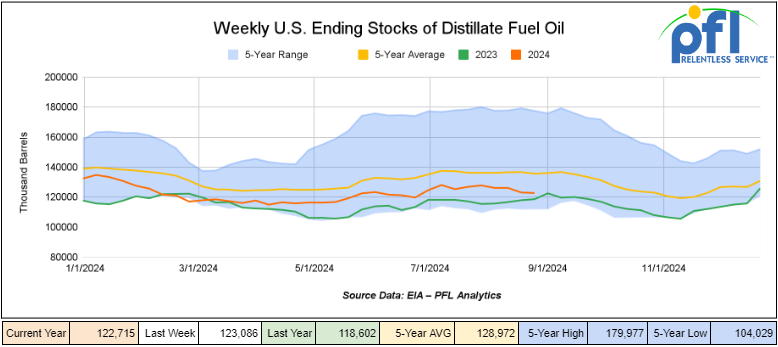

Distillate fuel inventories decreased by 400,000 barrels week-over-week and are 10% below the five-year average for this time of year.

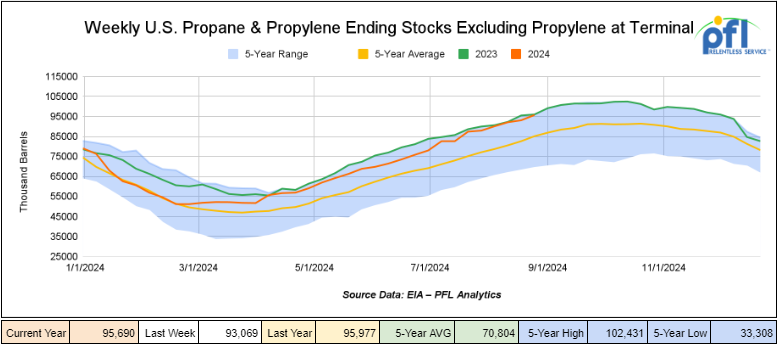

Propane/propylene inventories increased by 2.6 million barrels week-over-week and are 12% above the five-year average for this time of year.

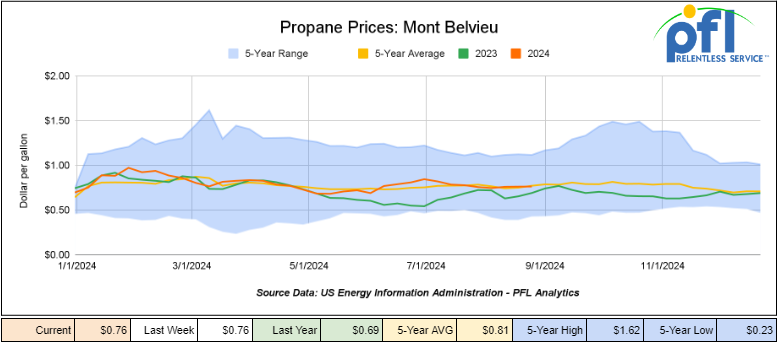

Propane prices closed at 76 cents per gallon on Friday of last week, flat week-over-week for the second week in a row, but up 7 cents per gallon year-over-year.

Overall, total commercial petroleum inventories decreased by 8 million barrels during the week ending August 30th, 2024.

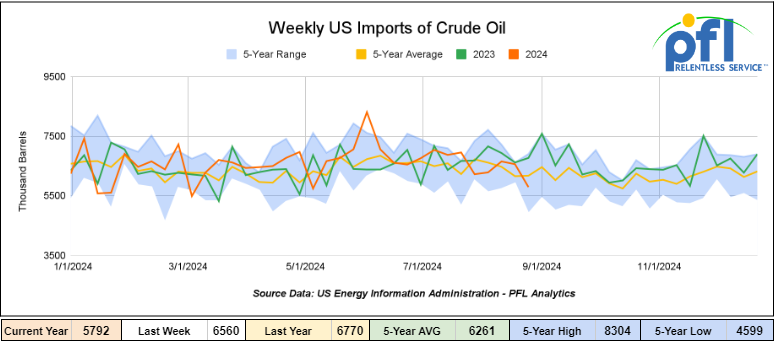

U.S. crude oil imports averaged 5.8 million barrels per day during the week ending August 30th, 2024, a decrease of 768,000 barrels per day, week-over-week. Over the past four weeks, crude oil imports averaged 6.3 million barrels per day, 8.0% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 655,000 barrels per day, and distillate fuel imports averaged 182,000 barrels per day during the week ending August 30th, 2024.

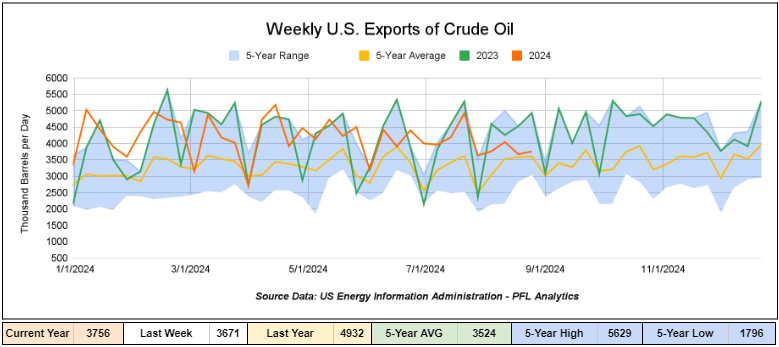

U.S. crude oil exports averaged 3.756 million barrels per day for the week ending August 30th, 2024, an increase of 85,000 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 3.807 million barrels per day.

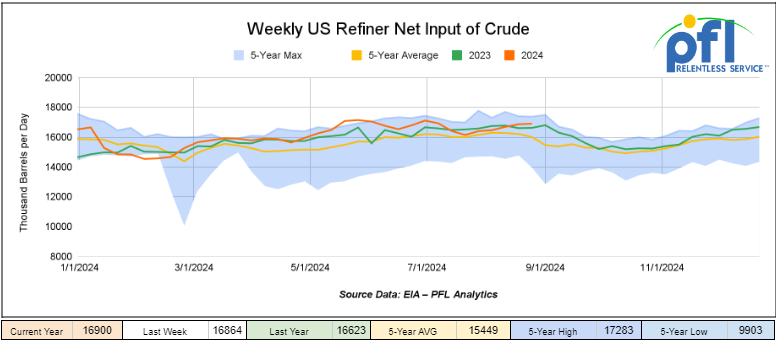

U.S. crude oil refinery inputs averaged 16.9 million barrels per day during the week ending August 30, 2024, which was 36,000 barrels per day more week-over-week.

WTI is poised to open at $68.40, up 73 cents per barrel from Friday’s close.

North American Rail Traffic

Week Ending September 4th, 2024.

Total North American weekly rail volumes were up (+6.89%) in week 36, compared with the same week last year. Total carloads for the week ending on September 4th were 354,853, up (0.83%) compared with the same week in 2023, while weekly intermodal volume was 348,924, up (+13.84%) compared to the same week in 2023. 7 of the AAR’s 11 major traffic categories posted year-over-year increases. The most significant decrease came from Coal, which was down (-6.95%). The most significant increase came from Grain which was up (+35.62%).

In the East, CSX’s total volumes were up (+6.68%), with the largest decrease coming from Metallic Ores and Metals (-11.35%) while the largest increase came from Grain (+31.1%). NS’s volumes were up (+14.8%), with the largest increase coming from Grain (+62.82%) while the largest decrease came from Petroleum and Petroleum Products (-10.76%).

In the West, BN’s total volumes were up (+9.27%), with the largest increase coming from Grain (+37.48%) while the largest decrease came from Chemicals down (-13.87%). UP’s total rail volumes were up (+4.79%) with the largest decrease coming from Coal, down (-25.85%), while the largest increase came from Grain which was up (+22.79%).

In Canada, CN’s total rail volumes were down (-5.84%) with the largest decrease coming from Coal, down (-26.09%) while the largest increase came from Grain, up (+37.38%). CP’s total rail volumes were down (-6.43%) with the largest increase coming from Other (+101.64%), while the largest decrease came from Intermodal, down (-33.43%). KCS’s total rail volumes were down (-5.76%) with the largest decrease coming from Other (-25.81%) and the largest increase coming from Motor Vehicles and Parts (+69.53%).

Source Data: AAR – PFL Analytics

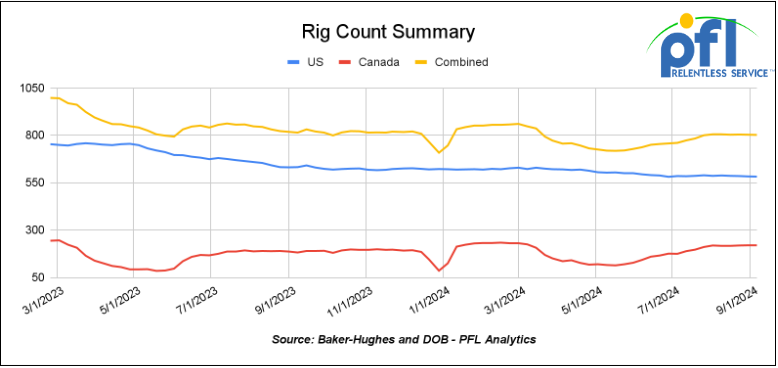

Rig Count

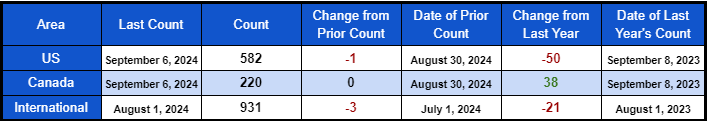

North American rig count was down by -1 rig week-over-week. The US rig count was down by -1 rigs week-over-week, and down by -50 rigs year-over-year. The U.S. currently has 582 active rigs. Canada’s rig count was flat week-over-week, and up by 38 rigs year-over-year and Canada’s overall rig count is 220 active rigs. Overall, we are down -12 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 28,000 from 27,783, which was a gain of 217 rail cars week-over-week. Canadian volumes were higher. CPKC’s shipments rose by +41% week over week, CN’s volumes were higher by +27.3% week-over-week. U.S. shipments were mostly higher The CSX had the largest percentage increase and was up by +11.2%. The NS was the sole decliner and was down by -6.5%.

We are Watching Argus and TMX

Oil pricing agency, Argus, launched on Wednesday of last week three daily price quotes for crude exported from Western Canada’s newly expanded Trans Mountain pipeline, amid rising demand for the oil from Asia.

The agency will assess prices of crude loaded from the TMX pipeline onto Aframax-sized tankers capable of carrying 80,000 metric tons (584,000 bbls) of oil at the Westridge docks, Argus said in a statement.

The new prices will cover three types of heavy crude grades, it added.

The first two groups – crude of similar quality to Cold Lake with lower acidity and crude that resembles Access Western Blend (AWB) with high acidity — are priced on free-on-board Vancouver basis. The third group consists of crude with high acidity priced on a delivered to Zhejiang, China, basis.

Between May 20 and Aug. 20, about half of the more than 300,000 bbls/d crude exported from Vancouver went to Asia with the balance going to the U.S. West Coast, mostly to California, according to Argus.

“Asian demand for heavy crude oil is strong, Chinese buyers have emerged as main lifters of TMX crude over the first few months of operation. A large percentage of the high TAN crude grades from the TMX being shipped to the Pacific Area Lightering zone (PAL), off the coast of southern California, and transferred onto Very Large Crude Carriers which then move to Asia”, it added.

We are watching Canada’s Rail Dilemma and Now the Politics

Canadian Teamsters filed four separate challenges on Thursday August 29th in the Canadian Federal Court of Appeal challenging the labor minister’s order for binding arbitration and the Canada Industrial Relations Board (“CIRB”) decision to stop the lockout and work stoppage for CN and CPKC. There are two challenges for each railroad.

This latest legal maneuver comes after the labor union vowed to challenge the ruling.

The CIRB originally ordered the railroads and labor to appear Thursday of last week for a scheduled meeting on the arbitration process, but due to a scheduling issue with one of the attorneys, the CIRB agreed to reschedule the first meeting.

CIRB says, “No date has been determined yet. We are awaiting confirmation of the parties’ availability.”

Union officials say that they are confident the law is on their side and the appellate court will allow the unions to bargain with the railroads in a traditional manner versus arbitration.

The union is arguing its constitutional charter rights were violated and is asking for a ruling to be made in an expedited manner.

“The government’s interference has prolonged the negotiation process,” said Christopher Monette, director of public affairs for Teamsters Canada. “This only adds more uncertainty to the supply chain.”

On the back of the dispute, good old Justin Trudeau lost some power. The Canadian Prime Minister suffered an unexpected blow on Wednesday of last week when the small party helping keep his minority Liberal government in power withdrew its automatic support, forcing him to attempt new alliances to govern.

Promising to continue governing and pushing through social programs, Trudeau dismissed talk of early elections after the left-leaning New Democratic Party’s leader Jagmeet Singh said he was “ripping up” a deal struck between the two men in 2022.

But the move leaves Trudeau reliant on support from other opposition lawmakers to survive confidence votes in the lower chamber of parliament at a time when polls show that he will lose badly if an election were held now. An election must be held by the end of October 2025 under Canadian law.

“An election will come in the coming year, hopefully not until next fall, because in the meantime, we’re going to deliver for Canadians,” Trudeau told reporters at a school where he had arrived to talk about expanding lunch programs.

“I really hope the NDP stays focused on how we can deliver for Canadians, as we have over the past years, rather than focusing on politics.”

Trudeau, 52, first took office in November 2015, but has, over the last two years, struggled to fend off attacks from the opposition center-right Conservatives, who blame him for high inflation and a housing crisis. See makeup of Canada’s Parliament (like our congress except for a few more parties) below:

Canada’s Parliament

Source: Parliament of Canada – PFL Analytics

Lib. = Liberal Justin’s Party CPC (Left-Leaning, Trudeau’s Party). CPC = Conservatives – equal to Republicans, center right-leaning. BQ = Bloc Quebecois – only in Quebec, it looks after the Quebec separatist party. NDP = New Democratic Party – Union Party, claims to look after the worker – left-leaning – formed a coalition government with the Liberals that is now over. GP = Green Party – loves the Green New Deal here in the U.S. IND = Independents. Vacant = means vacant.

We are watching a couple of Key Economic Indicators

U.S Unemployment

On September 6th, the BLS reported that a preliminary 142,000 net new jobs were created in August 2024, reflecting a slowdown in job growth. Figures for June and July 2024 were revised slightly.

According to the BLS, so far this year, net new job gains have totaled 1.47 million. The official unemployment rate was 4.2% in August, up 0.1% month over month.

Purchasing Managers Index (PMI)

The Institute for Supply Management releases two PMI reports – one covering manufacturing and the other covering services. These reports are based on surveys of supply managers across the country and track changes in business activity. A reading above 50% on the index indicates expansion, while a reading below 50% signifies contraction, with a faster pace of change the farther the reading is from 50.

In August 2024, the Manufacturing PMI was reported at 47.2%, up slightly from 46.8% in July, but still reflecting the fifth consecutive month of contraction. The new orders subindex also improved slightly, continuing its upward trend.

Lease Bids

- 30, 4750-5200 Covered Hoppers needed off of BN or UP in Lake Charles, LA for 5 Years. Cars are needed for use in Pet Coke service.

- 30-50, 23.5K Any Type Tanks needed off of any class 1 in any location for 1-5Years. Cars are needed for use in Glycols service.

- 10, 5250 Covered Hoppers needed off of UP or BN in Midwest for up to 5 years. Cars are needed for use in Dry Edible Beans service.

- 10, 3250 thru hatch Hoppers needed off of BNSF in TX IL for 5 years. Cars are needed for use in Agg service.

- 10, 25.5 117J Tanks needed off of All class ones in Chicago for Epoxy Resin. Cars are clean 5 years

- 100, 5200 Covered Hoppers needed off of UP or BN in Northwest for 6 month. Cars are needed for use in Pet Coke service. Roud Hatch, Bottom Outlet Doors

- 25, 25.5K DOT 111 Tanks needed off of UP in LA for 1-5 Years. Cars are needed for use in Lubricant service.

- 15-20, 29K 117R Tanks needed off of NS or CSX in Ohio for 6-12 Months. Cars are needed for use in Ply Oil service.

- 200, 30K any type Tanks needed off of UP or BN in Texas for RD. Cars are needed for use in Dirty service.

- 20, 4750’s Through Hatch Covered Hoppers needed off of UP BN in USA West for 3 years. Cars are needed for use in Fertilizer service.

- 100, 15.5K DOT 111 Tanks needed off of Any Class 1 in USA for 1-3 Years. Cars are needed for use in Molten Sulfur service.

- 50, 30K 117 Tanks needed off of BNSF or UP in TX for 3-6 Months. Cars are needed for use in Crude service. will look at smaller cars. Prefer short term would look at longer term. Domestic use only

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

- 20, 25.5k CPC 1232 Tanks needed off of UP or BN in OK, TX for 3 Year. Cars are needed for use in Asphalt service.

- 100, 25.5K DOT 111 Tanks needed off of Any Class 1 in Texas for 3 Years +. Cars are needed for use in Asphalt service.

- 10, 25.5K-28.3K DOT 111 Tanks needed off of UP or BN in Houston for 2 Year. Cars are needed for use in Resin service.

- 25-30, 23.5K or 25.5K Dot 111 or CPC 1232 Tanks needed off of UP or BN in TX, OK, or AR for 3-5 Years. Cars are needed for use in Asphalt service. Needed ASAP., Lined or Unlined. Splash Load

- 10, 28.3K 117J Tanks needed off of UP or BN in Texas for 3 Year.

- 250, 4000 Rapid Hoppers needed off of BNSF in TX IL for 5 years. Cars are needed for use in Coal service. in rotary/rapid cars with the electric dumping shoe

- 4, 6260 Covered Hoppers needed off of CSX in Bostick, NC for 2-4 Years. Cars are needed for use in Polypropene Pellets service.

- 8, 28-30K any type Tanks needed off of UP BN in Texas and Gulf for 5 years. Cars are needed for use in Chlorobenzene service. must be lined with plasite 3070

- 14, 23.5K DOT111 Tanks needed off of UP in Morrilton, AR for 1 year. Cars are needed for use in Turpentine service.

- 10, 30k any type Tanks needed off of UP BN in Texas for 1 year plus. Cars are needed for use in Fuel Oil service.

- 25-50, 5000CF-5100CF Covered Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in Dry sugar service. 3 bay gravity dump, Hempel 37700

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 50, 23.5-25.5 DOT111 Tank s needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 25, 20.5K CPC1232 or DOT117J Tanks needed off of BNSF or UP in the west for 3-5 years. Cars are needed for use in Magnesium chloride service. SDS onhand

- 15, 28.3K DOT117J Tanks needed off of any class 1 in any location for 3 years. Cars are needed for use in Glycerin & Palm Oil service.

- 30, 17K-20K DOT117J Tanks needed off of UP or BN in Midwest/West Coast for 3-5 years. Cars are needed for use in Caustic service.

- 150, 23.5K DOT111 Tanks needed off of any class 1 in LA for 2-3 years. Cars are needed for use in Fluid service. Needed July

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

Sales Bids

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Cement service. Cement Gates needed.

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 20-30, 3000 – 3300 PD Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 2-4, 28K DOT111 Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

- 100, 15.7K DOT111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

- 5, 30K DOT 111 Tanks needed off of in US. Cars are needed for use in Fuels service.

- 4, 25.5K DOT 111 Tanks needed off of any class 1 in Texas. Negotiable

- 10, 30K DOT 111 Tanks needed off of any class 1 in Texas. Cars are needed for use in UCO service. Negotiable

- 10, 5600CF PD Hoppers needed off of any class 1 in Texas.

- 50, 4750CF Covered Hoppers needed off of any class 1 in Texas. Cars are needed for use in Grain service.

Lease Offers

- 50, 5400, Covered Hoppers located off of NS, IORY in MI. Cars were last used in bean meal. 1 year+

- 2, Flat Double-stack rail transports located off of KCS in Texas. Cars are clean Lease or sell. (Intermodal Container)

- 45, 33K, 340W Pressure Tanks located off of All Class Ones in North America. Cars were last used in Propane/Butane. Free move on CN or CP

- 50, 30K, DOT 117J Tanks located off of BN in Texas. Cars were last used in Ethanol. 1-2 Year Term.

Sales Offers

- 24, 5300CF, Plate C Boxcars located off of NS or CSX in Southeast.

- 100-300, 3400, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 19, 4400, Rotary Gondolas located off of UP and BN in California and Wyoming.

- 100, 28.3K, DOT117J Tanks located off of various class 1s in multiple locations.

- 7, 30K, DOT 111 Tanks located off of UP in TX, CA, NM.

- 300, 31.8K, CPC 1232 Tanks located off of BN in Texas.

- 7, 30K, DOT-111 Tanks located off of UP in CA and TX.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|

PFL will be at the Following Conferences

- Where: La Quinta, CA

- Attending: David Cohen (954-729-4774)

- Conference Website

- Where: Hyatt Regency Dallas in Dallas, TX

- Attending:Curtis Chandler (239.405.3365), David Cohen (954-729-4774), Brian Baker (239.297.4519), Cyndi Popov(403) 402-5043

- Conference Website