“Yesterday I was clever, so I wanted to change the world. Today I am wise, so I am changing myself.”

– Rumi

Jobs Update

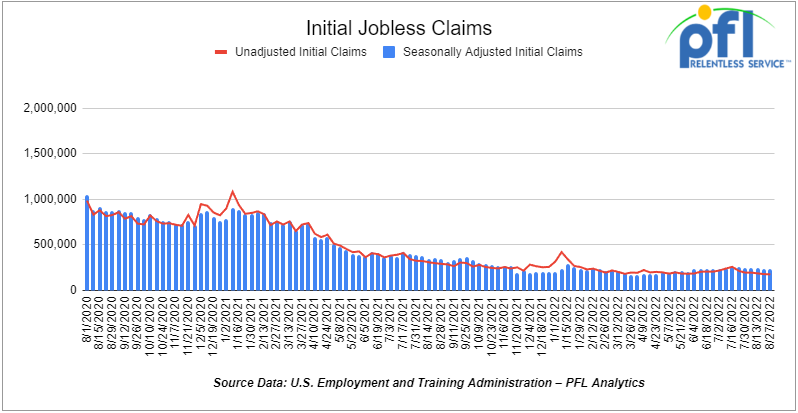

- Initial jobless claims for the week ending August 27th, 2022 came in at 232,000, down 5,000 people week-over-week.

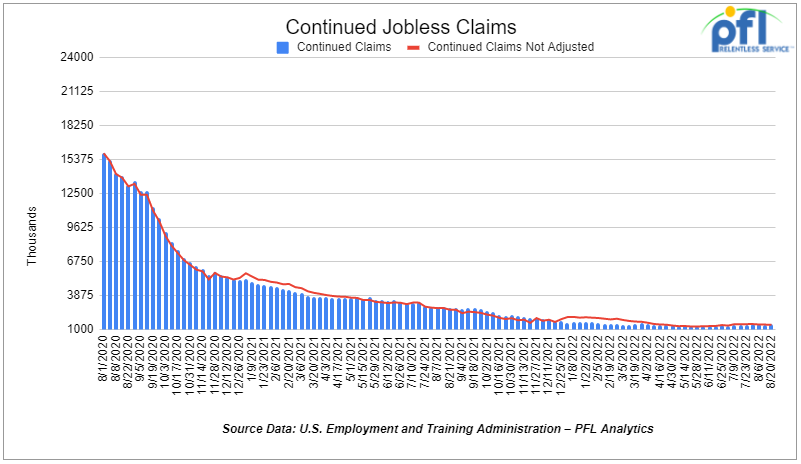

- Continuing claims came in at 1.438 million people, versus the adjusted number of 1.412 million people from the week prior, up 26,000 people week over week.

Stocks closed lower on Friday of last week and down week over week

The DOW closed lower on Friday of last week, down -337.98 points (-1.07%), closing out the week at 31,318.44, down –964.96 points week over week. The S&P 500 closed lower on Friday of last week, down -42.59 (-1.07%) and closed out the week at 3,924.26, down -133.4 points week over week. The NASDAQ closed lower on Friday of last week, down -154.26 points (-1.27%) and closed the week at 11,630.86 points, down -510.85 points week over week.

Oil closed mixed on Friday of last week and lower week over week

West Texas Intermediate futures dropped 6.7% last week on the back of the Fed’s tightening monetary policy and the continued desire to raise interest rates to fight out-of-control inflation caused by Biden’s administration’s continued addiction to printing and spending money that we don’t really have. Renewed antivirus lockdowns in China have not helped the demand side of the equation. The G7 leaders plan to cap the price of Russian crude in retaliation for Vladimir Putin’s aggression in Ukraine, but at what price? Your guess is as good as ours! The move is viewed as largely symbolic and they really can’t control price at the end of the day! In fact, Russia delivered record volumes to the world in August despite sanctions.

WTI traded up 26 cents a barrel to close at $86.87 a barrel on Friday of last week. Brent traded down US$3.28 a barrel to close at $93.02 per barrel U.S.

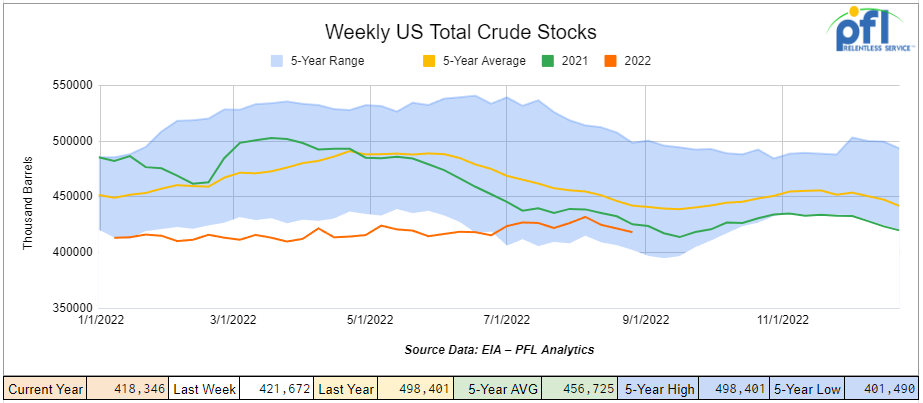

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 3.3 million barrels week over week. At 418.3 million barrels, U.S. crude oil inventories are 6% below the five-year average for this time of year.

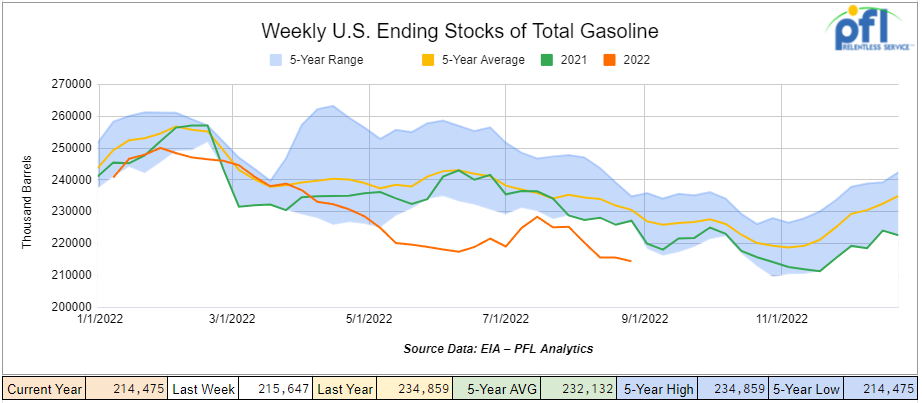

Total motor gasoline inventories decreased by 1.2 million barrels week over week and are 7% below the five-year average for this time of year.

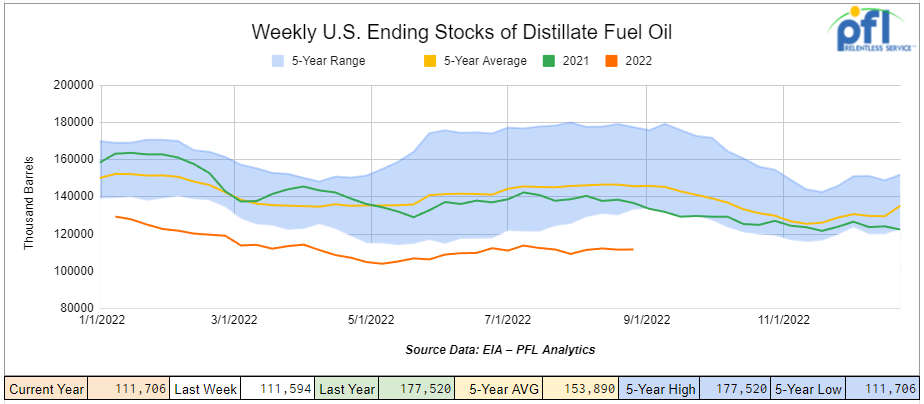

Distillate fuel inventories increased by 100,000 barrels week over week and are 23% below the five-year average for this time of year.

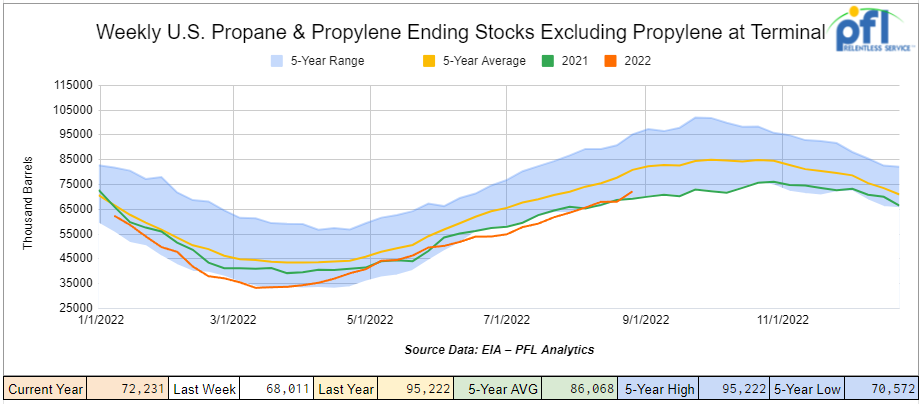

Propane/propylene inventories increased by 4.2 million barrels week over week and are 8% below the five-year average for this time of year.

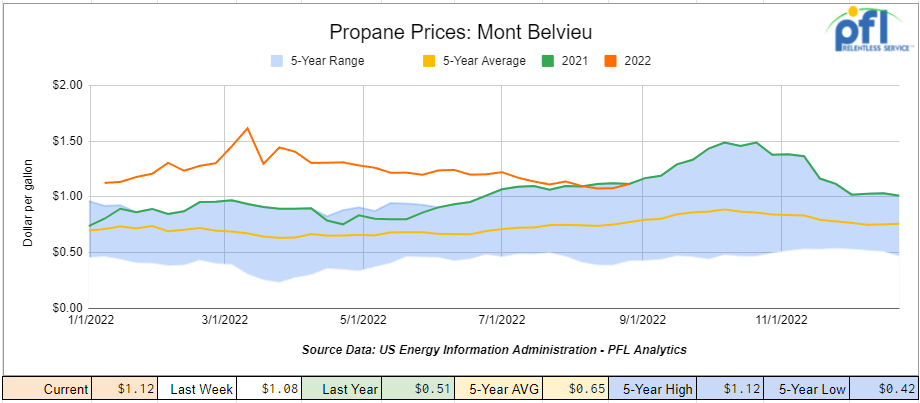

Propane prices were up week over week closing at $1.12 per gallon, up 4 cents per gallon, but flat year over year.

Overall, total commercial petroleum inventories decreased by 200,000 week over week.

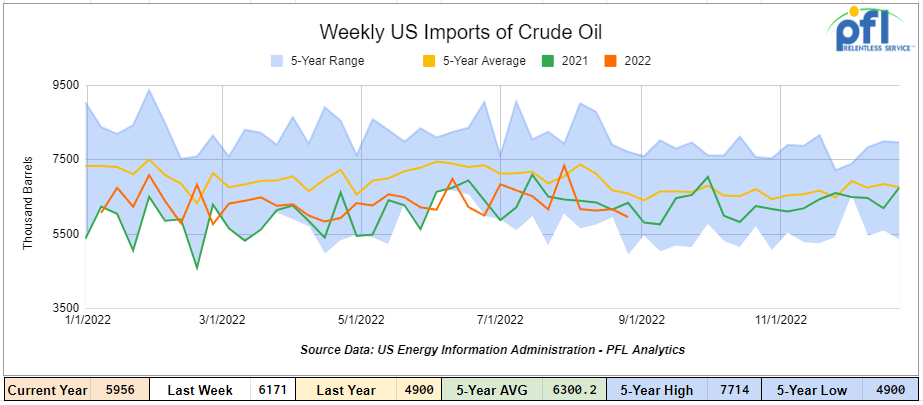

U.S. crude oil imports averaged 6.0 million barrels per day during the week ending August 26th, 2022, a decrease of 216,000 barrels per day week over week. Over the past four weeks, crude oil imports averaged about 6.1 million barrels per day, 3.2% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 584,000 barrels per day, and distillate fuel imports averaged 208,000 barrels per day during the week ending August 26th, 2022.

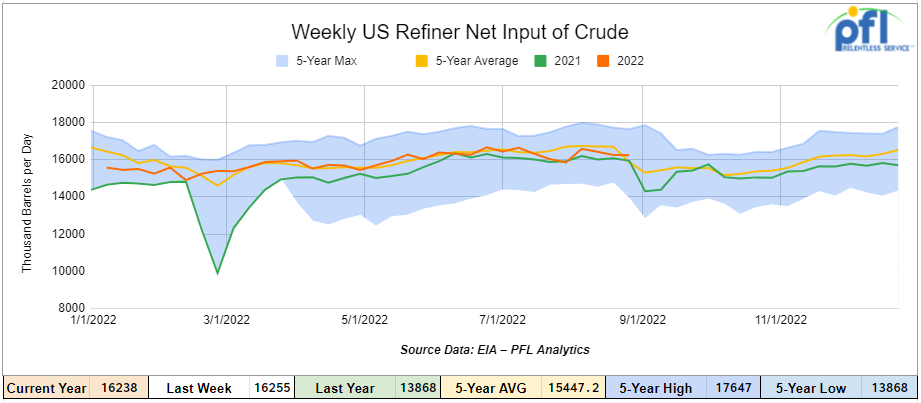

U.S. crude oil refinery inputs averaged 16.2 million barrels per day during the week ending August 26, 2022, which was 17,000 barrels per day less than the previous week’s average.

As of the writing of this report, WTI is poised to open at $86.61, down $0.28 per barrel from Friday’s close.

North American Rail Traffic

Week Ending August 27th, 2022.

Total North American weekly rail volumes were up 1.5% in week 34 compared with the same week last year. Total carloads for the week ending August 27th were 340,747, up 2.4% compared with the same week in 2021, while Weekly intermodal volume was 359,832, up 0.7% compared to 2021. 7 of the AAR’s 11 major traffic categories posted year-over-year increases with the most significant decrease coming from Petroleum and Petroleum Products (-7.4%). The largest increase was from Motor Vehicles and Parts (+12.7%) and Coal (+7%).

In the east, CSX’s total volumes were up 0.24%, with the largest decrease coming from Petroleum and Petroleum Products (-15.01%) and the largest increase from Grain (+63.57%). Norfolk Southern’s total volumes were up +5.07%, with the largest decrease coming from Petroleum and Petroleum Products (-19.16%) and the largest increases from Grain (+29.60%).

In the west, BN’s total volumes were up 1.46%, with the largest decrease coming from Petroleum and Petroleum Products (-17.16%), the largest increase coming from Grain (+24.63%) UP’s total rail volumes were up +7.03% with the largest decrease coming from Forest Products (-4.05%) and the largest increase coming from Motor Vehicles and Parts (+41.17%).

In Canada CN’s total rail volumes were up 3.86% with the largest decrease coming from Other (-8.31%) and the largest increases coming from Grain (+62.04%). CP’s total rail volumes were up 6.69% with the largest decrease coming from Petroleum and Petroleum Products (-27.18%) and the largest increase coming from Intermodal (+42.96%).

KCS’s total rail volumes were down -3.18% with the largest increase coming from Motor Vehicles and Parts (+63.27%) and the largest decrease coming from Chemicals (-17.59%).

Source Data: AAR – PFL Analytics

Rig Count

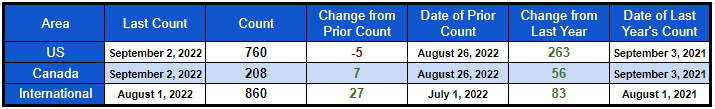

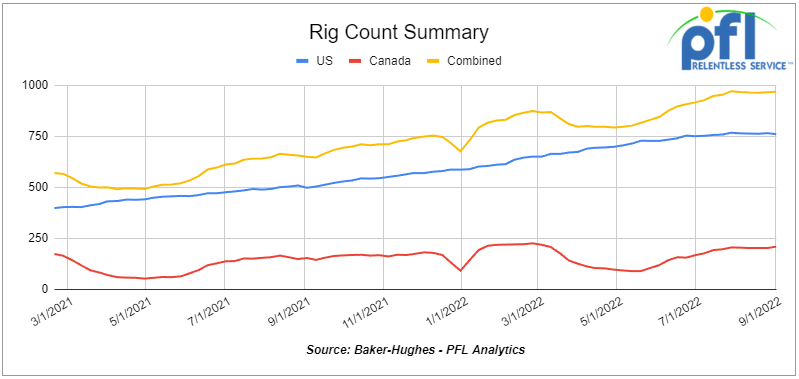

North American rig count was up 2 rigs week over week. U.S. rig count was down 5 rigs week-over-week and up by 263 rigs year over year. The U.S. currently has 760 active rigs. Canada’s rig count was up 7 rigs week-over-week, and up by 56 rigs year-over-year. Canada’s overall rig count is 208 active rigs. Overall, year over year, we are up 319 rigs collectively.

The international rig count is up by 27 rigs week-over-week and up by 83 rigs year-over-year. Internationally there are 860 active rigs.

North American Rig Count Summary

A few things we are keeping an eye on:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 23,557 from 23,662 which was a loss of -105 railcars week-over-week. This was the fifth week-over-week decline after a five-week run of increases. Canadian volumes were mixed CP’s shipments rose by +5.9% and CN’s volumes were down by -6.6% U.S. shipments were also mixed. The UP had the largest percentage increase, up by +6.4%, and CSX the largest percentage decrease down by -8.4%.

We are eyeing Crude and Crude by Rail Out of Canada

It is getting a little complicated to predict what is going to happen up in Alberta as it relates to crude and crude by rail, but there is an obvious tightness in pipeline capacity and the new supply and demand dynamics at play. Here is what we know:

- On August 28th BP’s Whiting refinery caught fire, the 6th largest in the country at 465,000 barrels per day. Thank goodness no one was hurt and the fire was put out quickly and BP announced that a restart date was undetermined. This weighed heavily on basis numbers – WTI vs. WCS which blew out day 1 of September’s trade cycle as BP is a large user of Canadian heavier grades at this facility. BP did announce that it was restarting the refinery a week later and that the refinery would return to partial levels this past Sunday – nevertheless, basis is lower week over week even though NYMEX suffered a 6% loss week over week. On August 26th WCS versus WTI closed at –US$19.75 per barrel, with an implied value of $72.17 per barrel in Edmonton. On Friday of last week (September 2nd) WCS for October delivery settled at -US$20.50 below the WTI-CMA. The implied value was US$65.79 per barrel, which was down in real dollars in Edmonton $6.38 cents U.S. per barrel week over week. We expect, although not released by the Canadian Energy Regulator, that inventories are building, a recipe for perhaps more short-term crude by rail arbitrage opportunities, that is if there are dirty cars in a position to take advantage at loading.

- Competition from the U.S. government – well here we go again, government meddling. It appears that the SPR releases have been the biggest source of competition for Canadian heavy barrels and the major driver for the widening of the WCS-WTI price spread, but there have also been other international factors with which Canadian barrels have had to compete. For instance, international sanctions on Russian crude oil sales by numerous countries have forced Russia to offer steep discounts for its flagship Urals crude, another medium sour barrel. These heavily discounted barrels have created additional pricing pressure on WCS as buyers of Canadian heavy crude in Europe and Asia have often had cheaper Russian Urals available (for those countries that are not participating in the sanctions, such as China and India). Throw in additional barrels coming out of countries such as Saudi Arabia, which are typically heavier and sour, as the country pushes toward the limits of its productive capacity, and Canadian heavy barrels have been under additional pressure from many areas of the world.

The bottom line is that government interference and price control measures have weighed heavily on Canadian production planning and a stable crude by rail approach, having most take the sidelines waiting for the madness to subside and getting back to a more predictable environment.

On a side note, President Biden wants to spend 500 billion dollars to upgrade our Strategic Petroleum Reserves infrastructure – why? Well, it turns out the facility’s pumps and infrastructure was designed to only operate so many times and for an emergency use and not used as a typical storage facility where volumes come in and out on a regular basis. Therefore, these barrels that the government is releasing into the market costs you more than you might think in hidden infrastructure spending (tax bill) – go figure.

We are watching Another Pipeline in Limbo

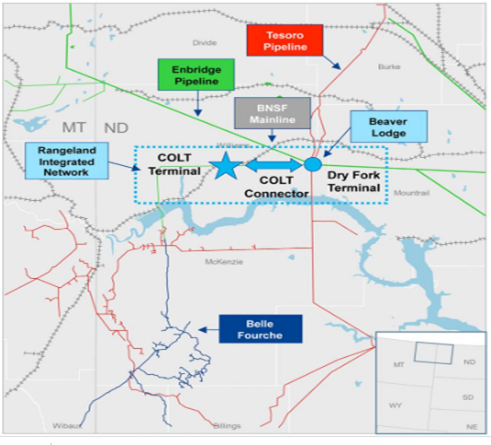

Marathon failed to make a deal with the U.S. Bureau of Indian Affairs that ordered the High Plains Pipeline shuddered as a result of a battle over a 15-mile portion of the pipeline that crosses the Fort Berthold Indian Reservation that expired in 2013. The reservations want the pipeline shut down. The High plains pipeline owned by Marathon has been shut down since late 2020. Litigation will now move forward after a 90-day window ordered by a federal district judge in North Dakota to allow settlement talks to continue failed.

The Crude Oil Gathering segment of Marathon consists of a 700-mile common carrier pipeline, the High Plains Pipeline, which operates out of the Williston and Bakken areas in North Dakota and Montana. The pipeline transports almost all the crude oil processed at its North Dakota refinery via the High Plains Pipeline.

The pipeline was expanded in 2015 to 90,000 bpd capacity.

Tesoro – Now Marathon Pipeline Detailed Below

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 5, 20K unlined tanks needed in Texas for 2 years BNSF – more needed by year end

- 100, 340W Pressure cars for a 6 month term for propane. Can take in various locations, needed ASAP

- 30-50, Asphalt cars needed in Wisconsin on the CN for 6 months. Dirty to Dirty.

- 20-25, CPC 1232 28.3K C/I Tank Cars for Feedstock in the Midwest off the CN for 6 months. Dirty to Dirty. Needed September/October.

- 50, 340W Pressure cars needed for Winter lease starting in October for Propane. Can take in Texas.

- 50, 30K 117J needed in Texas or Louisiana for condensate. 6 month term, Dirty to Dirty. Can take last in Crude.

- 100 Coiled and insulated cars for Crude. Needed in Canada for 6 months. Dirty to Dirty

- 50 117Js with magrods in the east – 10 for immediate trip lease – 40 for longer term

- 50 6350 covered hoppers in the midwest with most class ones for up to 5 years for DDG

- Up to 40 5500 Covered Gons 286 unlined CSX/NS preferred but will consider other

- 4 Lined tanks for glycerin to run from Arkansas to Georgia 1-3 years

- 30 boxcars on UP or CP for 3 years to run from TX to Edmonton – negotiable

- 6-10 Open top 4200 gons for hauling scrap NS in Ohio for 1-3 years

- 100, 2480 CU-FT Ag Gons needed in Texas off of the UP for 1-3 Years.

- 50, 117J 30K+ Tank cars are needed in several locations. Can take in various locations off various Class 1’s. Can have prior Ethanol heel or Gasoline heel

- Various Hoppers 286 GRL 4200-7000 CU FT in several locations negotiable

- 300 5800 Covered hoppers needed for plastic – 5-year lease – negotiable

- 50, 5800cuft or larger Covered Hopper for use in DDG needed in the Midwest for 3-4 years. Immediate need.

- 10-20 Covered hopper grain cars in the midwest 5200-5500 2-3 years

- 100 Moulton Sulfur cars for purchase – any location – negotiable

- 50 Ag Gons 2500-2800cuft 286k GRL in the east for 5 years negotiable

- 100 15K Tanks 286 for Molten Sulfur in the Northeast CSX/NS for 6 months negotiable

- 100, 5800 Covered Hoppers 286 can be West or East for Plastic 3-5 years

- 70, 117R or J needed for Ethanol for 3 years. Can take in the South.

- 50, 6500+ cu-ft Mill Gon or Open Top Hopper for wood chips in the Southeast for 5 Years.

- 20, 19,000 Gal Stainless cars in Louisiana UP for nitric acid 1-3 years – Oct negotiable

- 10, 6,300CF or greater covered hoppers are needed in the Midwest.

PFL is offering:

- 25 117Rs for sublease dirty to dirty service BN/UP – negotiable

- 25, 31.8K CPC 1232 last in Crude in New Mexico. Dirty to Dirty.

- 200 Clean C/I 25.5K 117J in Texas. Brand New Cars!

- 150 DOT 111s last in ethanol in the Midwest with free move. Available in September.

- Up to 500 sand cars for sale or lease at various locations and class ones – Great Price!

- 150 117R’s 31.8 clean for lease in Texas KCS – for sale or lease – negotiable

- 31.8K Tank Cars last in Diesel. Dirty to dirty in Texas

- 200 117Js 29K in the Midwest. Lined and brand new- lease negotiable

- 100 117Rs dirty last in Gasoline in Texas for lease Negotiable

- Various Hoppers for lease 263 and 268 multiple locations negotiable

- 61, 117Js in the Midwest. Last in Bakken. Dirty to Dirty service.

- 340W pressure cars located in various locations.

- 200 117Js 29K OK and TX Clean and brand new – Lined- lease negotiable

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|