“For success, attitude is equally as important as ability.” – Walter Scott

Jobs Update

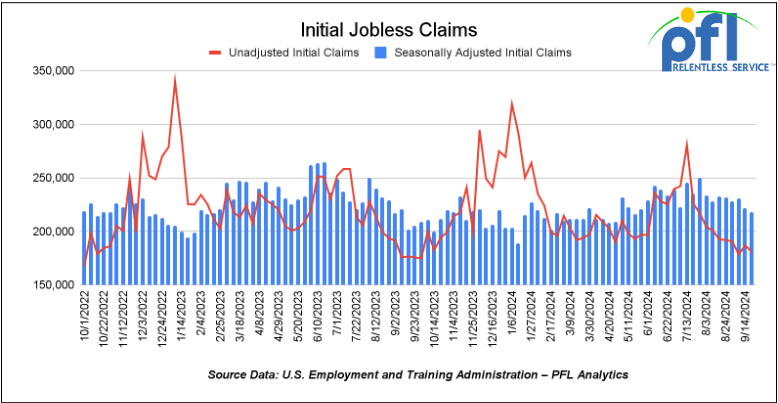

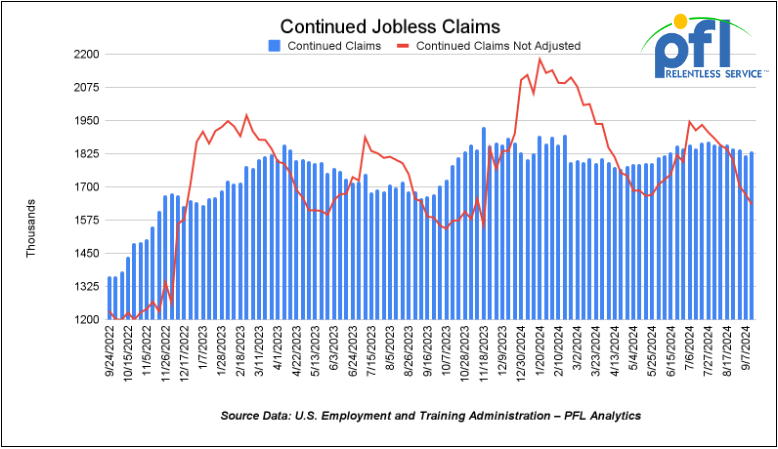

- Initial jobless claims seasonally adjusted for the week ending September 21st came in at 218,000, down -4,000 people week-over-week.

- Continuing jobless claims came in at 1.834 million people, versus the adjusted number of 1.821 million people from the week prior, up 13,000 people week-over-week.

Stocks closed mixed on Friday of last week, but higher week over week

The DOW closed higher, on Friday of last week up 137.89 points (0.33%) , closing out the week at 42,313, up 249.64 points week-over-week. The S&P 500 closed lower on Friday of last week, down -7.2 points and closed out the week at 5,738.17, up 35.62 points week-over-week. The NASDAQ closed lower on Friday of last week, down -70.7 points (-0.39%) and closed out the week at 18,119.59, up 171.27 points week over week.

In overnight trading, DOW futures traded lower and are expected to open at 42,628 this morning down 28 points.

Crude oil closed higher on Friday of last week, but down week over week.

West Texas Intermediate (WTI) crude closed up $0.51 per barrel (0.75%) to close at $68.18 per barrel on Friday of last week, down $3.74 per barrel week over week. Brent traded up $0.38 USD per barrel (0.53%) on Friday of last week, to close at $71.98 per barrel, down $-2.51 per barrel week-over-week.

One Exchange WCS (Western Canadian Select) for November delivery settled Friday on last week at US$13.30 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$ 53.79 per barrel.

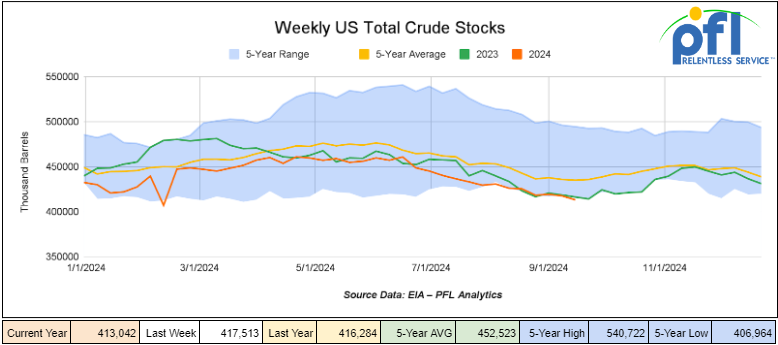

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 4.5 million barrels week-over-week. At 413.0 million barrels, U.S. crude oil inventories are 5% below the five-year average for this time of year.

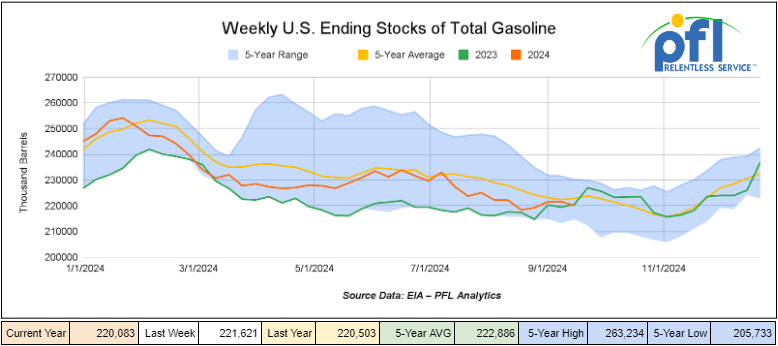

Total motor gasoline inventories decreased by 1.5 million barrels week-over-week and are 1% below the five-year average for this time of year.

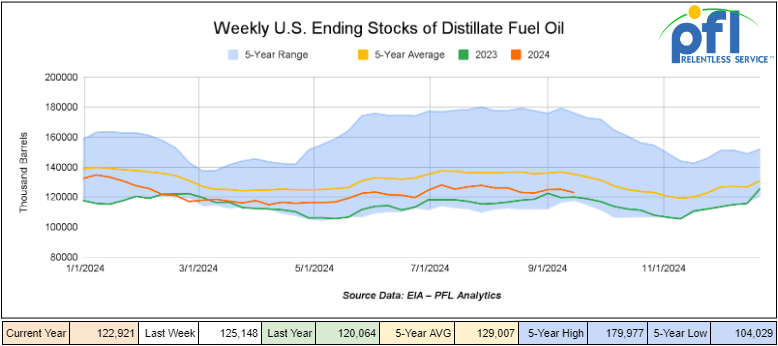

Distillate fuel inventories decreased by 2.2 million barrels week-over-week and are 9% below the five-year average for this time of year.

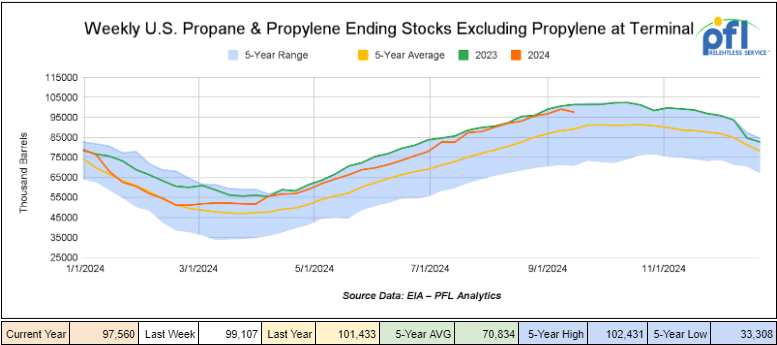

Propane/propylene inventories decreased by 1.5 million barrels week-over-week and are 9% above the five-year average for this time of year.

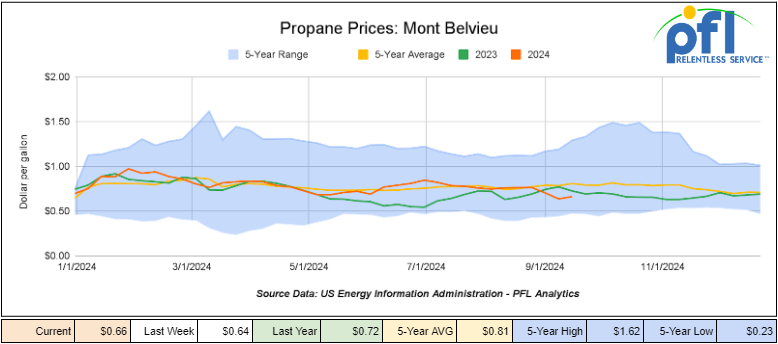

Propane prices closed at 66 cents per gallon on Friday of last week, up 2 cents per gallon week-over-week and down 6 cents per gallon year-over-year.

Overall, total commercial petroleum inventories decreased by 14.6 million barrels during the week ending September 20, 2024.

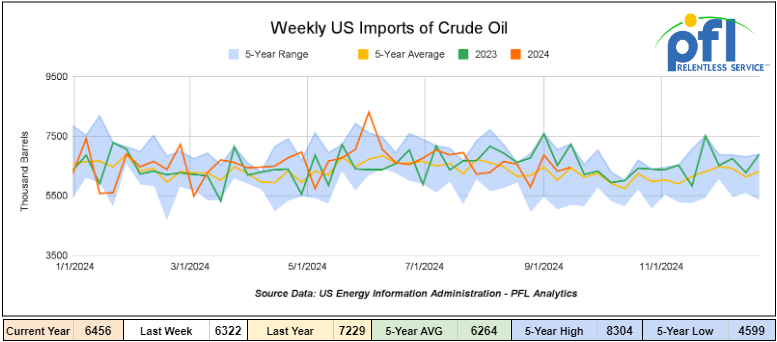

U.S. crude oil imports averaged 6.5 million barrels per day during the week ending September 20, 2024, an increase of 135,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.4 million barrels per day, 9.5% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 746,000 barrels per day, and distillate fuel imports averaged 102,000 barrels per day during the week ending September 13, 2024.

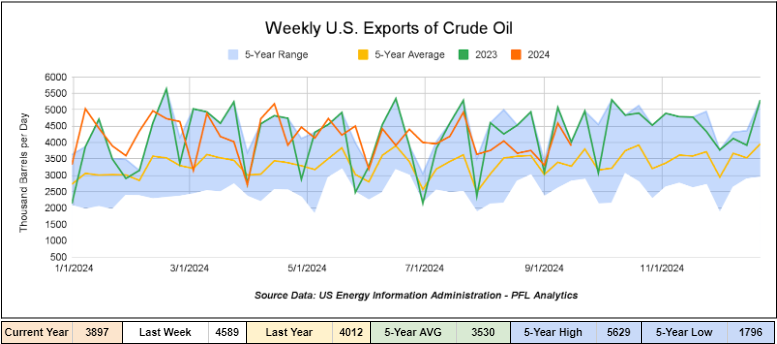

U.S. crude oil exports averaged 3.897 million barrels per day for the week ending September 20th, 2024, a decrease of -692,000 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 3.887 million barrels per day.

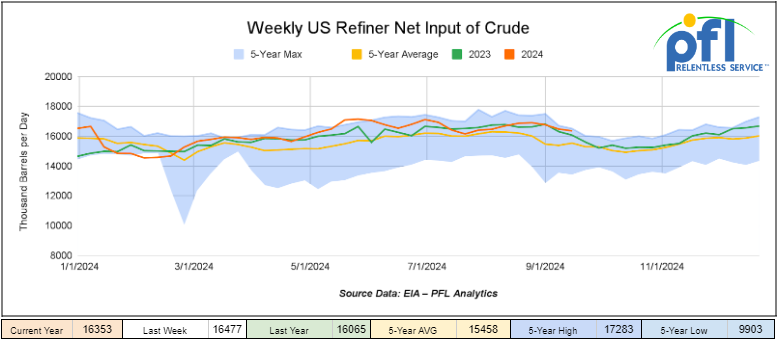

U.S. crude oil refinery inputs averaged 16.4 million barrels per day during the week ending September 20, 2024, which was 124,000 barrels per day less week-over-week.

WTI is poised to open at 68.15, up 3 cents per barrel from Friday’s close.

North American Rail Traffic

Week Ending September 25th, 2024.

Total North American weekly rail volumes were up (+4.87%) in week 39, compared with the same week last year. Total carloads for the week ending on September 25th were 353,603, down (-0.93%) compared with the same week in 2023, while weekly intermodal volume was 359,156, up (+11.29%) compared to the same week in 2023. 7 of the AAR’s 11 major traffic categories posted year-over-year increases. The most significant decrease came from Metallic Ores and Metals, which was down (-13.31%). The most significant increase came from Grain which was up (+11.97%).

In the East, CSX’s total volumes were up (+1.65%), with the largest decrease coming from Metallic ores and Metals (-10.87%) while the largest increase came from Grain (+25.73%). NS’s volumes were up (+11.2%), with the largest increase coming from Other (+25.09%), while the largest decrease came from Farm Products (-0.8%).

In the West, BN’s total volumes were up (+6.95%), with the largest increase coming from Grain (+19.76%) while the largest decrease came from Metallic Ores and Minerals, down (-22.98%). UP’s total rail volumes were up (+6.62%) with the largest decrease coming from Nonmetallic Minerals, down (-19.69%), while the largest increase came from Intermodal, which was up (+19.63%).

In Canada, CN’s total rail volumes were down (-10.81%) with the largest decrease coming from Coal, down (-36.61%) while the largest increase came from Nonmetallic Minerals, up (+14.64%). CP’s total rail volumes were down (-2.85%) with the largest increase coming from Other (+58.33%), while the largest decrease came from Metallic Ores and Metals (-44.33%).

KCS’s total rail volumes were down (-4.24%) with the largest decrease coming from Intermodal (-17.56%) and the largest increase coming from Farm Products (+61.93%).

Source Data: AAR – PFL Analytics

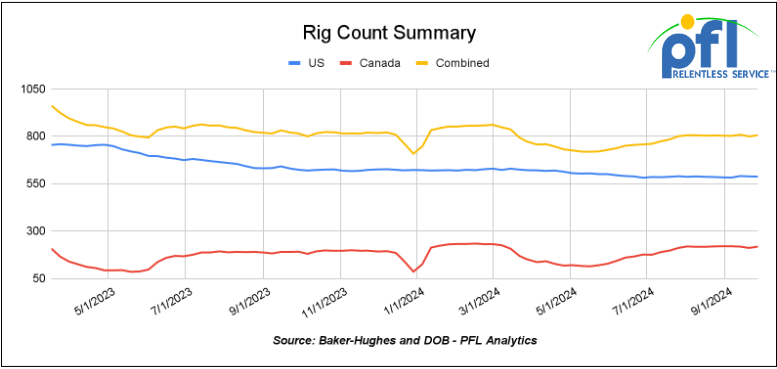

Rig Count

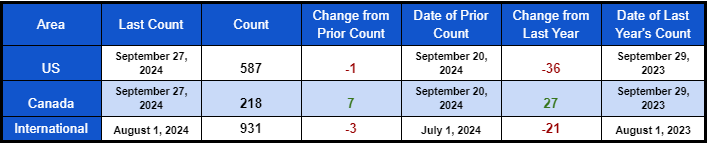

North American rig count was up by 6 rigs week-over-week. The U.S. rig count was down by -1 rigs week-over-week, and down by -36 rigs year-over-year. The U.S. currently has 587 active rigs. Canada’s rig count was up 7 rigs week-over-week and up by 27 rigs year-over-year and Canada’s overall rig count is 218 active rigs. Overall, year over year we are down -9 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are Watching East Coast ports as longshoremen prepare to strike

Thousands of longshoremen at ports from New England to Texas are set to strike early Tuesday in the first walkout of its kind in almost half a century, freezing commercial shipping on a massive scale and disrupting the national economy weeks before the presidential election.

A strike would be the biggest disruption to the flow of goods in and out of the country since the height of the pandemic. Even a short-lived work stoppage would snarl shipping and create havoc in supply chains for weeks. Cargo ranging from cars to electronics, from food to furniture, would be stuck on ships offshore. Each day a strike lasts could cost the U.S. economy up to $1 billion, according to analysts. The current labor contract expires Monday night, freeing the union to strike Tuesday as early as 12:01 a.m. as it presses for substantial raises and stronger guarantees that automated systems will not be used to replace workers.

During the strike, the East Coast union said it would continue to move military cargo and handle cruise ships, to not affect people’s vacations. Ships carrying oil and gas are served by dedicated facilities with crews who would not be on strike; gasoline and fuel oil prices are not expected to be affected. A disruption to rail could be significant. Stay tuned to PFL we are watching this one closely.

We are watching industry conferences

Folks, PFL had a table and attended the NEARS Rail Conference last week in Pittsburgh. It was a great conference but was cut short by some due to travel disruptions due to Hurricane Helene. Jacque Bendon, SVP at the UP, highlighted the war on Coal that we all knew was going on, however, the rail traffic slow down as a result is even deeper than we thought. The UP now ships only 10 unit trains of coal per day from 50 unit trains per day. With coal unit trains averaging 130 rail cars, that is a decrease of 5,200 loaded cars per day. Despite the decrease in coal across the country’s entire network, rail traffic has resiliently been higher with grain shipments and intermodal filling in part of that gap. Other speakers included Jason Trompeter (AVP of Market Research from the NS), Colby Tanner (VP of Industrial Products at the BN), and Michael Miller (President at Genesee & Wyoming).

This week, PFL will be attending SWARS in Houston and is the APP Sponsor of the event – we will also have a table so please stop by and see us. Next, we will be at the well-attended tank car committee meeting in Dallas.

We were watching Hurricane Helene

What a devastating Hurricane Helene turned out to be. The storm made landfall in Florida’s Big Bend region as a Category 4 storm on Thursday of last week at 11:10 p.m. Emergency services were rescuing people trapped by fast-rising waters.

More than 3.8 million customers were without power as of Saturday of last week across Florida, Georgia, South Carolina, North Carolina, Tennessee, Virginia, West Virginia, Kentucky, Ohio, and Illinois and some of those outages could last for weeks.

Current Power Outages Hurricane Helene

Source: Power outages USA – PFL Analytics

As of Sunday evening, at least 95 people have lost their lives to the storm and that number is rising as over 600 people are confirmed missing.

Roughly 24% of crude oil production and 18% of natural gas output in the U.S. Gulf of Mexico was shut in in response to Hurricane Helene, the U.S. Bureau of Safety and Environmental Enforcement said on Friday of last week.

Oil and natural gas production losses fell, peaking at a loss of production at 511,000 barrels on Wednesday of last week. Energy producers had shut in 427,000 barrels per day of oil production and nearly 343 million cubic feet of natural gas from Gulf waters, the bureau said.

Nine oil and gas platforms were evacuated as of Friday of last week, roughly 2.4% of the Gulf of Mexico total, the offshore regulator said, citing reports from producers.

The U.S. Gulf of Mexico accounts for 15% of all domestic oil production and 2% of natural gas output, federal data showed.

Production is expected to be returned soon due to fast moving nature of the storm that limited damage.

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 28,487 from 27,768, which was a gain of 719 rail cars week-over-week. Canadian volumes were mixed. CPKC’s shipments fell by 1.0% week over week, CN’s volumes were higher by 5.8% week-over-week. U.S. shipments were mostly higher. The CSX was the sole decliner and was down 7.8%. The NS had the largest percentage increase and was up by +5%.

We are Watching Crude by Rail out of Canada

Crude by rail out of Canada decreased month over month. The Canadian Energy regulator reported on September 24th, 2024, that 83,201 barrels were exported during the month of July 2024 from 89,204 barrels in June of 2024 a decrease of 6,003 barrels per day month over month.

We continue to watch Key economic indicators

Consumer Confidence

Not surprisingly, the Conference Board’s Index of Consumer Confidence decreased to 98.7 in September from an upwardly revised 105.6 in August.

Consumer Spending

In August 2024, inflation-adjusted consumer spending increased by 0.1% over July, with a 0.2% rise in spending on services. Goods spending saw only a slight uptick of less than 0.1%. This marked a slowdown from the stronger 0.5% growth in July. The primary drivers of service spending increases were housing and financial services, while new motor vehicle purchases contributed to a decrease in goods spending. Year-over-year, consumer spending was up 2.2%, with services prices increasing 3.7%

Lease Bids

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 50, 23.5-25.5 DOT111 Tank s needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 50, 28.3K DOT 111 Tanks needed off of Any Class 1 in any location for 3-7 Years. Cars are needed for use in Base Oils service.

- 20, 25.5k CPC 1232 Tanks needed off of UP or BN in OK, TX for 3 Year. Cars are needed for use in Asphalt service.

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

- 15-20, 29K 117R Tanks needed off of NS or CSX in Ohio for 6-12 Months. Cars are needed for use in Ply Oil service.

- 100, 5200 Covered Hoppers needed off of UP or BN in Northwest for 6 month. Cars are needed for use in Pet Coke service. Roud Hatch, Bottom Outlet Doors

- 10, 5250 Covered Hoppers needed off of UP or BN in Midwest for up to 5 years. Cars are needed for use in Dry Edible Beans service.

- 30-50, 23.5K Any Type Tanks needed off of any class 1 in any location for 1-5Years. Cars are needed for use in Glycols service.

- 30, 4750-5200 Covered Hoppers needed off of BN or UP in Lake Charles, LA for 5 Years. Cars are needed for use in Pet Coke service.

Sales Bids

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Cement service. Cement Gates needed.

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 4, 25.5K DOT 111 Tanks needed off of any class 1 in Texas.

- 10, 30K DOT 111 Tanks needed off of any class 1 in Texas. Cars are needed for use in UCO service.

- 10, 5600CF PD Hoppers needed off of any class 1 in Texas.

- 50, 4750CF Covered Hoppers needed off of any class 1 in Texas. Cars are needed for use in Grain service.

Lease Offers

- 50, 5400, Covered Hoppers located off of NS, IORY in MI. Cars were last used in bean meal. 1 year+

- 90, 25.5K, DOT 111 Tanks located off of UP in Texas. Cars were last used in Fuel OIl. 2-3 Year Term

- 50, 28.3K, 117R Tanks located off of All Class 1s in St. Louis. Cars are clean 1 Year Term

Sales Offers

- 100-300, 3400, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 150, 28.3K, DOT117J Tanks located off of various class 1s in multiple locations. Will take 90K

- 300, 31.8K, CPC 1232 Tanks located off of BN in Texas.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|

PFL will be at the Following Conferences

- Where: La Quinta, CA

- Attending: David Cohen (954-729-4774)

- Conference Website

- Where: Hyatt Regency Dallas in Dallas, TX

- Attending:Curtis Chandler (239.405.3365), David Cohen (954-729-4774), Brian Baker (239.297.4519), Cyndi Popov(403) 402-5043

- Conference Website