“Life is 10% what happens to you and 90% how you react to it” – Charles R. Swindoll

Jobs Update

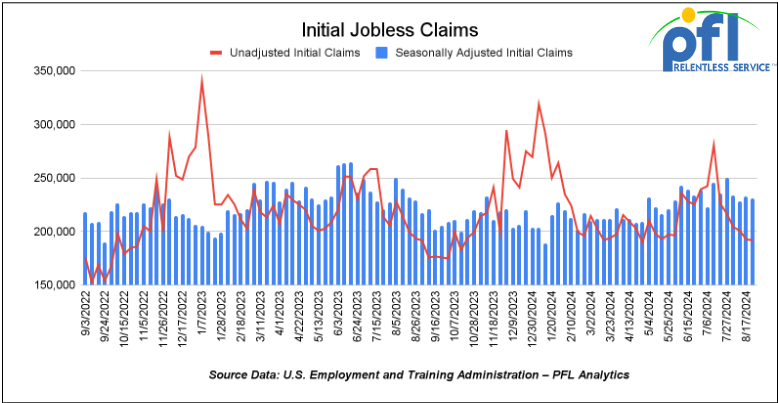

- Initial jobless claims seasonally adjusted for the week ending August 24th came in at 231,000, down -2,000 people week-over-week.

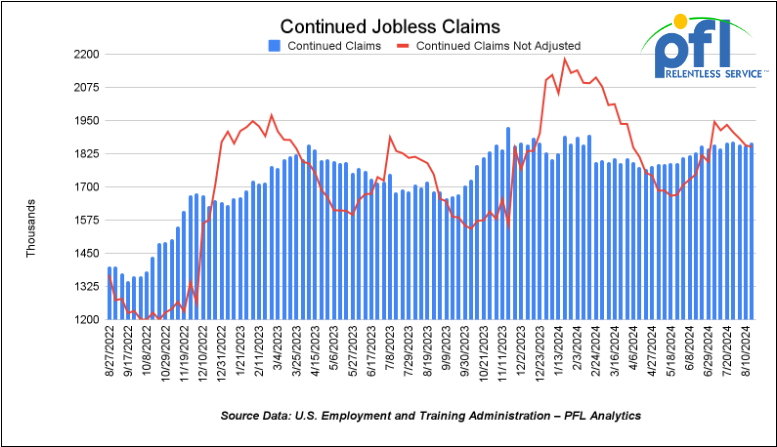

- Continuing jobless claims came in at 1.868 million people, versus the adjusted number of 1.855 million people from the week prior, up 13,000 people week-over-week.

Stocks closed higher on Friday of last week but mixed week over week

The DOW closed higher, on Friday of last week up 228.03 points (0.55%) closing out the week at 41,563.08 up 388 points week-over-week. The S&P 500 closed higher on Friday of last week, up 56.44 points and closed out the week at 5,648.4 up 13.79 points week-over-week. The NASDAQ closed higher on Friday of last week, up 197.2 points and closed out the week at 17,713.63 down -164.16 points week over week.

In overnight trading, DOW futures traded lower and are expected to open at 41,485 this morning down -168 points.

Crude oil closed lower on Friday of last week and lower week over week.

West Texas Intermediate (WTI) crude closed down -$2.36 per barrel (-3.11%) to close at $73.55 per barrel on Friday of last week, down -$1.28 per barrel week over week. Brent traded down -$1.14 USD per barrel (-1.43%) on Friday of last week, to close at $76.93 per barrel down -2.09 per barrel week-over-week.

One Exchange WCS One Exchange WCS (Western Canadian Select) for October delivery settled Friday on last week at US$13.25 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$ 59.90 per barrel.

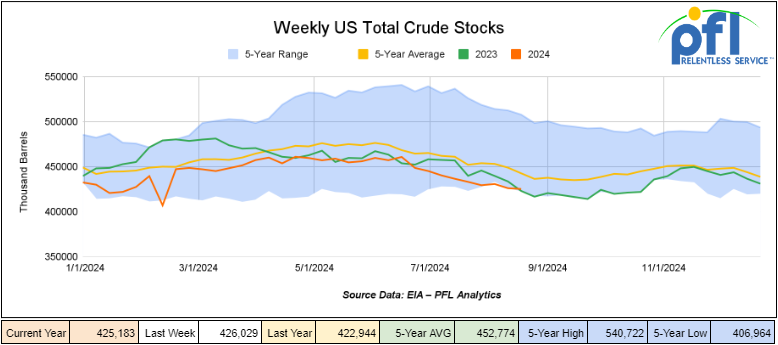

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 800,000 barrels week-over-week. At 425.2 million barrels, U.S. crude oil inventories are 4% below the five-year average for this time of year.

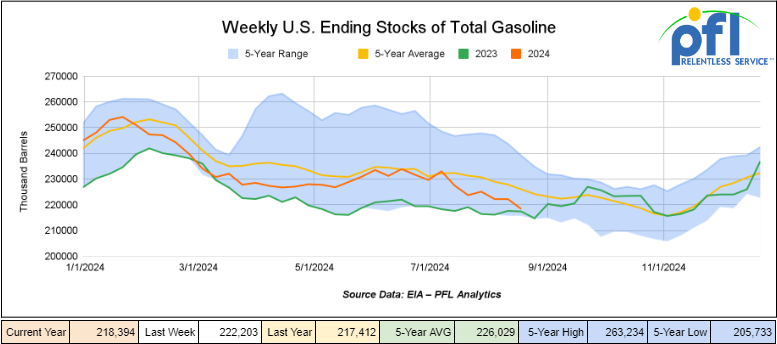

Total motor gasoline inventories decreased by 2.2 million barrels week-over-week and are 3% below the five-year average for this time of year.

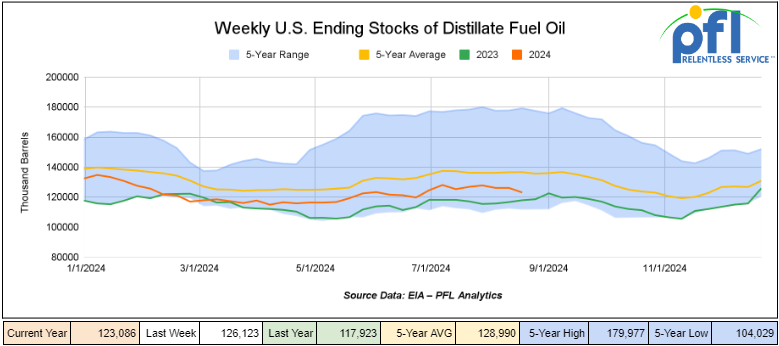

Distillate fuel inventories increased by 300,000 barrels week-over-week and are 10% below the five-year average for this time of year.

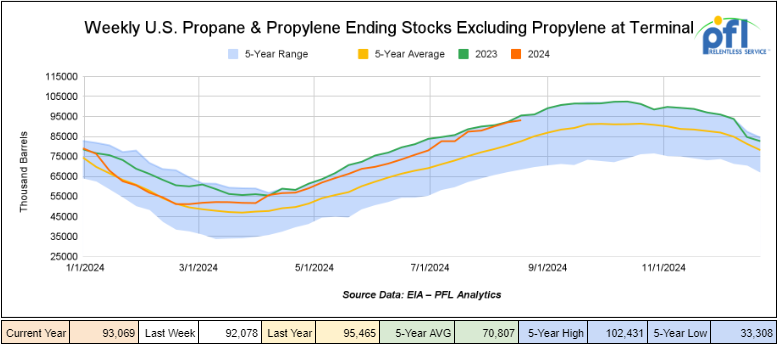

Propane/propylene inventories increased by 1 million barrels week-over-week and are 12% above the five-year average for this time of year.

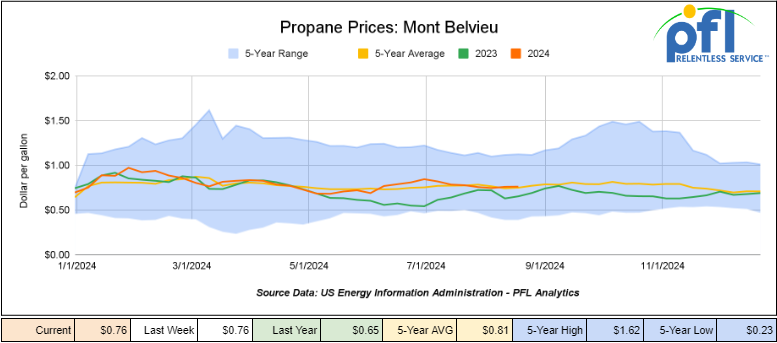

Propane prices closed at 76 cents per gallon on Friday of last week, flat week-over-week, but up 11 cents year-over-year.

Overall, total commercial petroleum inventories decreased by 3.1 million barrels during the week ending August 23rd, 2024.

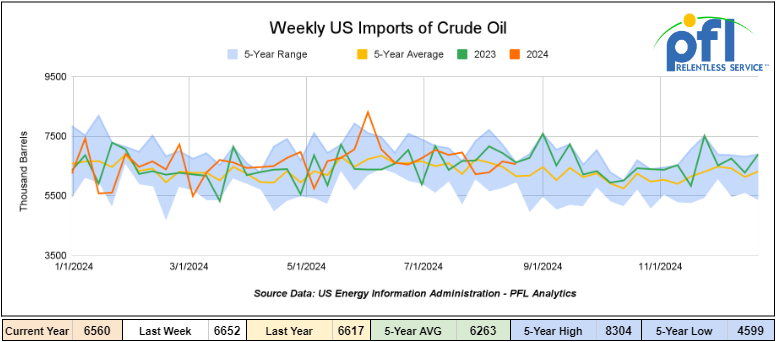

U.S. crude oil imports averaged 6.6 million barrels per day during the week ending August 23rd, 2024, a decrease of 92,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.4 million barrels per day, 6.1% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 867,000 barrels per day, and distillate fuel imports averaged 220,000 barrels per day during the week ending August 23rd, 2024.

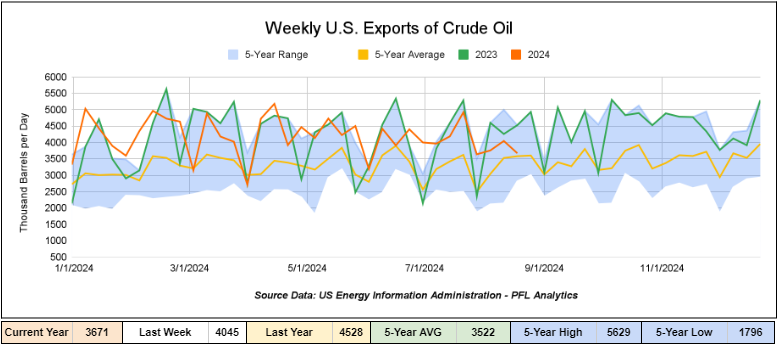

U.S. crude oil exports averaged 3.671 million barrels per day for the week ending August 23rd, 2024, a decrease of 374,000 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 3.778 million barrels per day.

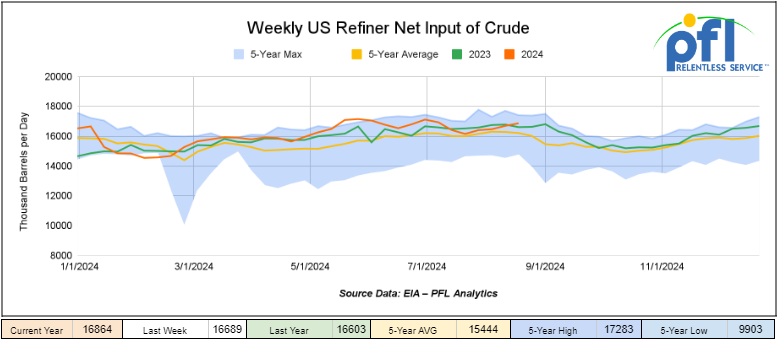

U.S. crude oil refinery inputs averaged 16.9 million barrels per day during the week ending August 23, 2024, which was 175,000 barrels per day more week-over-week.

WTI is poised to open at $73.03, down -52 cents per barrel from Friday’s close.

North American Rail Traffic

Week Ending August 28th, 2024.

Total North American weekly rail volumes were up (+7.51%) in week 35, compared with the same week last year. Total carloads for the week ending on August 28th were 351,444, up (14.33%) compared with the same week in 2023, while weekly intermodal volume was 346,418, up (+14.33%) compared to the same week in 2023. 7 of the AAR’s 11 major traffic categories posted year-over-year increases. The most significant decrease came from Coal, which was down (-6.43%). The most significant increase came from Grain which was up (+26.66%).

In the East, CSX’s total volumes were up (+4.31%), with the largest decrease coming from Coal (-8.7%) while the largest increase came from Grain (+45.13%). NS’s volumes were up (+9.91%), with the largest increase coming from Grain (+29.96%) while the largest decrease came from Metallic Ores and Metals (-5.34%).

In the West, BN’s total volumes were up (+10.94%), with the largest increase coming from Grain (+35.72%) while the largest decrease came from Coal down (-13.54%). UP’s total rail volumes were up (+13.5%) with the largest decrease coming from Coal, down (-11.65%), while the largest increase came from Intermodal Units which was up (+29.35%).

In Canada, CN’s total rail volumes were down (-11.84%) with the largest decrease coming from Intermodal, down (-33.07%) while the largest increase came from Coal, up (+18.7%). CP’s total rail volumes were down (-12.19%) with the largest increase coming from Coal (+20.33%), while the largest decrease came from Intermodal, down (-47.06%).

KCS’s total rail volumes were down (-5.57%) with the largest decrease coming from Coal (-23.58%) and the largest increase coming from Motor Vehicles and Parts (+89.54%).

Source Data: AAR – PFL Analytics

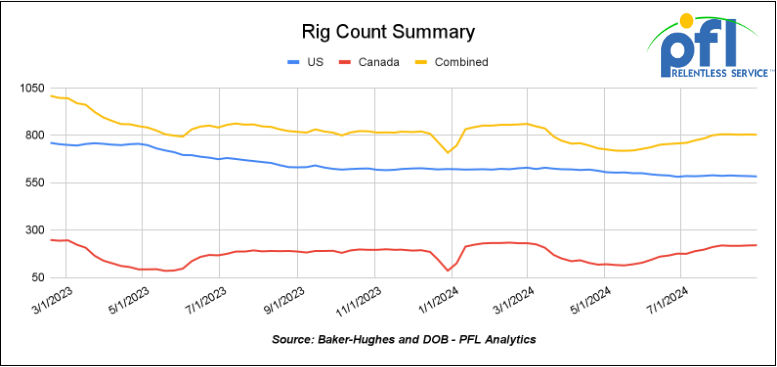

Rig Count

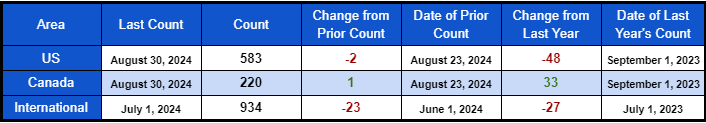

North American rig count was down by -1 rig week-over-week. The US rig count was down by -2 rigs week-over-week, and down by -48 rigs year-over-year. The U.S. currently has 583 active rigs. Canada’s rig count was up by 1 rig week-over-week, and up by 33 rigs year-over-year and Canada’s overall rig count is 220 active rigs. Overall, we are down -158 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 27,783 from 28,184, which was a loss of 401 rail cars week-over-week. Canadian volumes were down ahead of the rail strikes. CPKC’s shipments fell by -24.2% week over week, CN’s volumes were lower by -25.2% week-over-week. U.S. shipments lower across the board. The BN had the largest percentage decrease and was down by -8.5%.

Insurance rates for transporting product through the Red Sea are more than Double

Oil transportation is getting more expensive with all the geopolitical uncertainty that is out there. Red Sea shipping insurance is surging with reports of the latest sinking tanker. After Houthis attacked the Greek-flagged Sounion tanker in the Red Sea last week, which is still leaking into the sea, the cost of additional war risk insurance for ships sailing through the Red Sea more than doubled to 1% of the vessel’s value from 0.4% before the attack.

Sounion Tanker

Source: Reuters: PFL Analytics

We Continue to Watch Canadian Rail Strikes – here is the latest!

The union representing thousands of railroaders has appealed to the federal government’s move that ended Monday August 22nd rail shutdown – a work stoppage that halted freight and commuter traffic across the country.

In filings to the Federal Court of Appeal, the Teamsters union challenged directives for binding arbitration issued to a labor board by Labor Minister Steven MacKinnon on Aug. 22, less than a day after the lockout of 9,300 workers by Canadian National Railway Co. and Canadian Pacific Kansas City Ltd. In response to Mr. MacKinnon’s instructions, the Canada Industrial Relations Board ordered the country’s two major railways to resume operations and employees to return to their posts until binding arbitration could produce new contracts. In addition to the government directives, the union is also contesting the tribunal’s decisions. Paul Boucher, president of the Teamsters Canada Rail Conference, said the actions set a “dangerous precedent” that threatens workers’ constitutional right to collective bargaining. “Without it, unions lose leverage to negotiate better wages and safer working conditions for all Canadians,” Mr. Boucher said in a news release. The railway companies, along with some industry groups, have said the minister’s move ended months of needless uncertainty and subdued supply chain turmoil after the Teamsters rejected requests for arbitration. “CN would have preferred a negotiated settlement,” said spokeswoman Ashley Michnowski in an email. I guess more to come on this, just when you thought it was over – stay tuned to PFL we are watching this one.

Alberta Premier Smith Leads Opposition to Contentious Federal Bill C-59 That Threatens Free Speech in Canada

At a recent energy conference, Alberta Premier Danielle Smith was forthright in her determination to oppose Canada’s Federal government legislation.

She said she would gladly go to jail for talking about the true record of Alberta’s Oil and Gas Industry.

Smith was a featured panelist at the Canadian Energy Executive Association’s CEEA73 Conference, held recently in the Banff Springs Hotel in Alberta Canada. See below:

Banff Springs Hotel

Source: Fairmont Hotels: PFL Analytics

The legislation she was alluding to is commonly known as Bill C-59, approved by the federal government in June 2024.

Fellow panelists were alarmed about the legislation.

Buried in the bill were paragraphs that had been inserted with limited broad public knowledge or business input. They amended the Competition Act, the law that oversees anti-competitive practices like price-fixing, or false or misleading advertising.

The amendments targeted advertising rules aimed at ‘greenwashing,’ the practice of making deceptive claims regarding benefits to the environment. Anyone caught making false claims by the Competition Tribunal could be subject to multimillion-dollar fines. Their purpose is to destroy the oil and gas sector.

The Alberta government has stated its vehement opposition to the legislation.

To protect oil and gas businesses in Alberta, the government plans to develop a website under the province’s Canadian Energy Centre as a protective umbrella to list statistics on CO2 and methane reduction. Smith said “If companies are quoting us, then I should think that gives you an indemnity.

A change of leadership in Ottawa was generally seen as the most viable solution. While some panelists urged continued negotiations with Ottawa, others scoffed at the notion. “Trying to get anywhere with the current government is hopeless,” said Jock Finlayson, from the Fraser Institute. “It’s like trying to feed a sandwich to a corpse.” There is more to come on this one and we are watching it closely.

Consumer Confidence

The Conference Board’s Index of Consumer Confidence surprisingly increased to 103.3 in August from an upwardly revised 101.9 in July.

Consumer Spending

In July 2024, total consumer spending adjusted for inflation rose a preliminary 0.4% over June 2024. This follows a revised increase of 0.3% in June and a drop of 0.1% in May. Year-over-year inflation-adjusted total spending in July 2024 was up 2.6%.

Inflation-adjusted spending on goods rose a preliminary 0.7% in July, continuing from the 0.6% increase in June 2024. Inflation-adjusted spending on services rose 0.2% in July, marking the eleventh consecutive month-to-month increase.

Lease Bids

- 30, 4750-5200 Covered Hoppers needed off of BN or UP in Lake Charles, LA for 5 Years. Cars are needed for use in Pet Coke service.

- 30-50, 23.5K Any Type Tanks needed off of any class 1 in any location for 1-5Years. Cars are needed for use in Glycols service.

- 10, 5250 Covered Hoppers needed off of UP or BN in Midwest for up to 5 years. Cars are needed for use in Dry Edible Beans service.

- 10, 3250 thru hatch Hoppers needed off of BNSF in TX IL for 5 years. Cars are needed for use in Agg service.

- 10, 25.5 117J Tanks needed off of All class ones in Chicago for Epoxy Resin. Cars are clean 5 years

- 30, 33K Pressure Tanks needed off of Any Class 1 in Any Location for 6 Months. Cars are needed for use in Propane service. Needed for Winter

- 100, 5200 Covered Hoppers needed off of UP or BN in Northwest for 6 month. Cars are needed for use in Pet Coke service. Roud Hatch, Bottom Outlet Doors

- 25, 25.5K DOT 111 Tanks needed off of UP in LA for 1-5 Years. Cars are needed for use in Lubricant service.

- 15-20, 29K 117R Tanks needed off of NS or CSX in Ohio for 6-12 Months. Cars are needed for use in Ply Oil service.

- 200, 30K any type Tanks needed off of UP or BN in Texas for RD. Cars are needed for use in Dirty service.

- 20, 4750’s Through Hatch Covered Hoppers needed off of UP BN in USA West for 3 years. Cars are needed for use in Fertilizer service.

- 80, 25.5K-29K any type Tanks needed off of NS or CSX in Northeast for 1-5 Years. Cars are needed for use in Crude service.

- 100, 15.5K DOT 111 Tanks needed off of Any Class 1 in USA for 1-3 Years. Cars are needed for use in Molten Sulfur service.

- 50, 30K 117 Tanks needed off of BNSF or UP in TX for 3-6 Months. Cars are needed for use in Crude service. will look at smaller cars. Prefer short term would look at longer term. Domestic use only

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

- 20, 25.5k CPC 1232 Tanks needed off of UP or BN in OK, TX for 3 Year. Cars are needed for use in Asphalt service.

- 100, 25.5K DOT 111 Tanks needed off of Any Class 1 in Texas for 3 Years +. Cars are needed for use in Asphalt service.

- 30, 29K 117J Tanks needed off of BN or CN in Houston or Edmonton for 1-2 Year. Cars are needed for use in Biodiesel service.

- 10, 25.5K-28.3K DOT 111 Tanks needed off of UP or BN in Houston for 2 Year. Cars are needed for use in Resin service.

- 10, 28.3K 117J Tanks needed off of UP or BN in Texas for 3 Year.

- 25-30, 23.5K or 25.5K Dot 111 or CPC 1232 Tanks needed off of UP or BN in TX, OK, or AR for 3-5 Years. Cars are needed for use in Asphalt service. Needed ASAP., Lined or Unlined. Splash Load

- 250, 4000 Rapid Hoppers needed off of BNSF in TX IL for 5 years. Cars are needed for use in Coal service. in rotary/rapid cars with the electric dumping shoe

- 4, 6260 Covered Hoppers needed off of CSX in Bostick, NC for 2-4 Years. Cars are needed for use in Polypropene Pellets service.

- 8, 28-30K any type Tanks needed off of UP BN in Texas and Gulf for 5 years. Cars are needed for use in Chlorobenzene service. must be lined with plasite 3070

- 14, 23.5K DOT111 Tanks needed off of UP in Morrilton, AR for 1 year. Cars are needed for use in Turpentine service.

- 10, 30k any type Tanks needed off of UP BN in Texas for 1 year plus. Cars are needed for use in Fuel Oil service.

- 25-50, 5000CF-5100CF Covered Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in Dry sugar service. 3 bay gravity dump, Hempel 37700

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 50, 23.5-25.5 DOT111 Tank s needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 25, 20.5K CPC1232 or DOT117J Tanks needed off of BNSF or UP in the west for 3-5 years. Cars are needed for use in Magnesium chloride service. SDS onhand

- 15, 28.3K DOT117J Tanks needed off of any class 1 in any location for 3 years. Cars are needed for use in Glycerin & Palm Oil service.

- 30, 17K-20K DOT117J Tanks needed off of UP or BN in Midwest/West Coast for 3-5 years. Cars are needed for use in Caustic service.

- 150, 23.5K DOT111 Tanks needed off of any class 1 in LA for 2-3 years. Cars are needed for use in Fluid service. Needed July

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

Sales Bids

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Cement service. Cement Gates needed.

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 20-30, 3000 – 3300 PD Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 2-4, 28K DOT111 Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

- 100, 15.7K DOT111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

- 5, 30K DOT 111 Tanks needed off of in US. Cars are needed for use in Fuels service.

- 5, 23,5K DOT 111 Tanks needed off of any class 1 in Texas. Negotiable

Lease Offers

- 50, 5400, Covered Hoppers located off of NS, IORY in MI. Cars were last used in bean meal. 1 year+

- 2, Flat Double-stack rail transports located off of KCS in Texas. Cars are clean Lease or sell. (Intermodal Container)

- 60, 33K, 340W Pressure Tanks located off of All Class Ones in North America. Cars were last used in Propane/Butane. Up to 1 year.

- 50, 30K, DOT 117J Tanks located off of All Class Ones in North America. Cars were last used in Ethanol. 1-2 Year Term.

Sales Offers

- 24, 5300CF, Plate C Boxcars located off of NS or CSX in Southeast.

- 100-300, 3400, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 19, 4400, Rotary Gondolas located off of UP and BN in California and Wyoming.

- 100, 28.3K, DOT117J Tanks located off of various class 1s in multiple locations.

- 7, 30K, DOT 111 Tanks located off of UP in TX, CA, NM.

- 300, 31.8K, CPC 1232 Tanks located off of BN in Texas.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|

PFL will be at the Following Conferences

- Where: La Quinta, CA

- Attending: David Cohen (954-729-4774)

- Conference Website

- Where: Hyatt Regency Dallas in Dallas, TX

- Attending:Curtis Chandler (239.405.3365), David Cohen (954-729-4774), Brian Baker (239.297.4519), Cyndi Popov(403) 402-5043

- Conference Website