“You miss 100% of the shots you don’t take”

– Wayne Gretzky

COVID 19 and Markets Update

The United States currently has 7,321,343 confirmed COVID 19 cases and 209,453 confirmed deaths. Florida Gov. Ron DeSantis signed an executive order last Friday allowing restaurants and bars to immediately begin operating at 100% capacity. “There will not be limitations, from the state of Florida,” he said. DeSantis said he fully expects the state to host a “full Super Bowl” in February. The Super Bowl is scheduled to be held in Tampa Bay on February 7, 2021. DeSantis also suspended “all outstanding fines and penalties that have been applied against individuals” associated with pandemic-related mandates, like mask requirements.

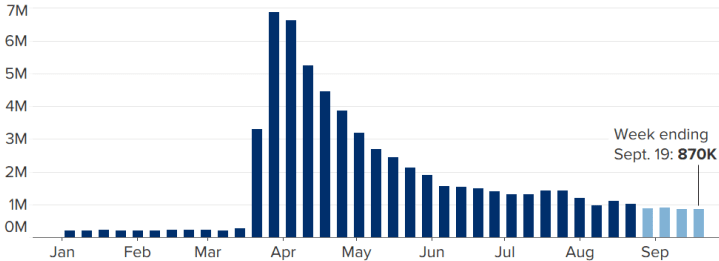

The U.S. Labor Department stated on Thursday of last week that U.S. workers filed an additional 870,000 initial jobless claims, up 10,000 initial jobless claims week over week. Economists polled by Dow Jones expected first-time claims to come in at 850,000, down slightly from the 860,000 claims reported for the previous week. The number of first-time filers for unemployment benefits were higher than expected last week as the labor market continues its sluggish recovery from the coronavirus pandemic.

US Jobless Claims

DOW and NASDAQ

The DOW closed higher on Friday, up 358.56 points (1.34%) to finish out the week at 27,173.96 down 483.46 points week over week. The S&P 500 traded higher 51.87 points (1.60%) on Friday, closing at 3,319.47, down 21.01 points week over week. The Nasdaq finished Friday’s session higher as well, gaining 241.26 points (2.26%) closing out the week at 10,913.56 up 120.28 points week over week. In overnight trading, DOW futures traded higher and are expected to open up this morning 228 points.

Oil Markets

Oil prices declined on Friday of last week, posting their 3rd negative week in four weeks as worries are mounting on rising COVID cases. “There’s a lid on this market to the extent that COVID-19 keeps rearing its ugly head in different spots,” said John Kilduff, Partner at Again Capital. “We just can’t get this demand perked back up,” he stated. At the same time, more crude oil entering the global market threatens to beef up supply and push prices lower. Libya has recently boosted production and Shell has provisionally booked the first crude tanker to load at Libya’s Zueitina terminal since January. A stronger dollar, which tends to move inversely with crude prices, in recent days is also pressuring oil prices. On Friday WTI traded down $.06 or -.15% to close at $40.25. Brent traded down $.02 or -.05% to close at $41.92.

U.S. crude inventories fell by 1.64 MM/bbls last week and now stands at 493.56 MM/bbls according to the EIA. Consensus was for a 2.07 million barrel draw. Crude production was down 200K/bpd to 10.7MM/bpd. Gasoline inventories were down by 4.03Mm/bbls, significantly higher than the forecasted draw of -.660K/bpd. Distillate stocks were drawn down -3.36MM/bbls, versus a forecast of -1.03MM/bbls after weeks straight of builds.

Oil is lower in overnight trading and, as of the writing of this report, WTI is poised to open at $39.89 down 36 cents per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were down 1.4% year over year in week 38 (U.S. -1.3%, Canada +0.4%, Mexico -11.7%), resulting in quarter to date volumes that are down 6.5% and year to date volumes that are down 10.2% (U.S. -10.9%, Canada -7.9%, Mexico -9.7%). 7 of the AAR’s 11 major traffic categories posted year over year decreases with the largest decreases coming from coal (-21.5%), nonmetallic minerals (-11.8%) and petroleum (-22.3%). The largest increase came from intermodal (+3.7%).

In the East

CSX’s total volumes were down 0.5%, with the largest decrease coming from coal (-25.5%). The largest increase came from intermodal (+8.5%). NS’s total volumes were down 6.0%, with the largest decreases coming from coal (-28.1%), petroleum (-50.7%) and stone sand & gravel (-20.1%). The largest increase came from motor vehicles & parts (15.6%).

In the West

BN’s total volumes were down 3.2%, with the largest decreases coming from coal (-20.2%) and stone sand & gravel (-46.7%). The largest increases came from intermodal (+4.5%) and grain (+20.2%). UP’s total volumes were up 2.0%, with the largest increases coming from intermodal (+10.6%) and grain (+36.4%). The largest decreases came from coal (-17.8%), petroleum (-34.7%), chemicals (-7.6%) and stone sand & gravel (-17.1%).

In Canada

CN’s total volumes were down 1.7% with the largest decrease coming from petroleum (-35.3%). The largest increases came from intermodal (+3.3%), metallic ores (+12.2%) and grain (+36.8%). RTMs were down 2.0%. CP’s total volumes were flat, with the largest increases coming from farm products (+86.0%) and chemicals (+22.6%). The largest decreases came from intermodal (-7.2%) and petroleum (-26.6%). RTMs were up 4.4%.

Kansas City Southern

KCS’s total volumes were up 3.7%, with the largest increases coming from grain (+60.6%) and petroleum (+19.6%).

Things we are keeping an eye on:

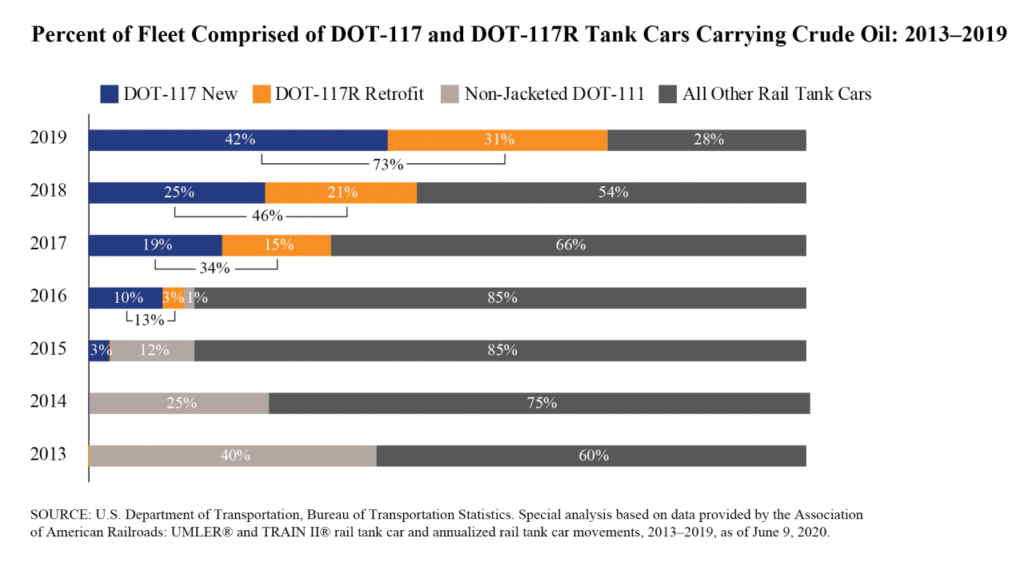

- Tank Cars – A report issued on Thursday of last week by the United States Department of transportation (DOT) said that more rail tank cars meet new safety standards. Nearly half, 48%, of rail tank cars carrying Class 3 flammable liquids in 2019 met the new safety requirements, up from 33% from 2018 reported numbers, according DOT. The report, measuring industry-wide progress in manufacturing and modifying rail tank cars that transport flammable liquids, has been submitted to Congress. This report tracks the transformation of the fleet carrying Class 3 flammable liquids to be a fleet of DOT-117s, which meet new safety requirements. Currently some class 3 flammable liquids are carried in rail tank cars, such as DOT-111s, which have fewer safety features. It is expected that the transformation of the fleet will be complete by year 2029. For crude oil alone, 73% of the tank car fleet in 2019 consisted of DOT-117s, up from 46% from 2018. (see below)

- Petroleum by Rail –The four-week rolling average of petroleum carried on the largest North American railroads rose to 21,560 compared with 21,172 the prior week. Canadian and U.S. volumes rose. CP shipments rose by 21.6% and CN volumes rose by 14%. U.S. railroads were up across the board with CSX posting the largest gain at 10.7%

- California Wants to ban ICE vehicles by 2035. Still reeling from historic wildfires, California Governor Gavin Newsom is seeking to end the internal-combustion engine. Governor Newsom ordered state regulators to come up with rules to phase out the sale of new gasoline or diesel vehicles by year 2035. The move will have a dramatic impact on in-state refiners and oil producers as California consumes nearly 1 million barrels of oil per day and the impact will likely be felt globally. However, successful implementation is uncertain as it relates to ongoing legal battles, the makeup of the Supreme Court and the outcome of the presidential election. At the same time the UK is aiming to bring forward its ban on gasoline and diesel vehicles from 2040 to 2030. Prime Minister Boris Johnson is expected to roll out the announcement this fall in an effort to accelerate the transition to electric vehicles.

- U.S. Transportation Secretary Elaine L. Chao announced a $320.6 Million for Rail Infrastructure and Safety Improvements on Wednesday of last week. The Federal Railroad Administration (FRA) has selected 50 projects in 29 states to receive competitive grant funding for 2020. The projects selected include a wide variety of railroad investments that improve the safety, efficiency, and reliability of freight and intercity passenger service. “This $320.6 million federal investment will upgrade U.S. rail infrastructure and enhance rail safety in communities across America,” said U.S. Transportation Secretary Elaine L. Chao. Nine of the projects were selected to specifically address safety at highway-rail grade crossings, and deter illegal trespassing, which is the leading cause of rail-related deaths in America. Other projects expand, upgrade, or rehabilitate railroad track, switches, yard, and station facilities to increase performance and service delivery. For specific details on each project awarded please visit railroads.gov

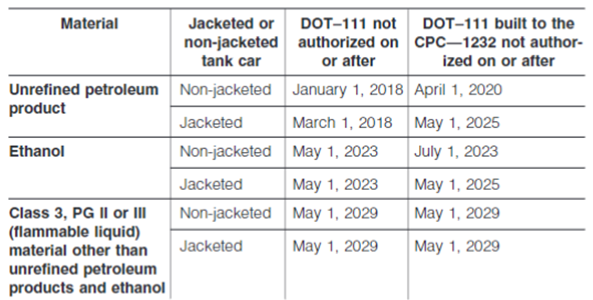

Non-jacketed DOT-111s, which do not meet the new safety standards, have not carried crude oil since 2016 and the percentage of all other tank car types carrying crude oil dropped from 66% in 2017 to 28% in 2019. DOT-111s were required to stop carrying crude oil in 2018. Non-jacketed tank cars lack a layer of insulation and/or thermal protection between the tank shell and jacket that stabilizes the temperature of the liquid contained in the tank car and reduces the conductivity of heat from outside sources to the contents of the tank car. Non-jacketed DOT-111s are in the process of being phased out of the fleet of tank cars carrying Class 3 flammable liquids and will be completely phased out by May of 2029. (See below)

Phasing out DOT 111’s*

*DOT Specification 111 tank cars and DOT Specification 111 tank cars built to CPC1232 industry standard are no longer authorized for transport of Class 3 flammable liquids, unless retrofitted prior to the dates corresponding to the specific material in the above table.

Source: United States Department of transportation (DOT)

Class 3 flammable liquids most commonly include crude oil, ethanol, and refined petroleum products. In 2019, 112,685 rail tank cars were used to carry Class 3 flammable liquids, which is nearly as many as the 2015 fleet of 113,045 rail tank cars. In 2015, only 3% of the fleet carrying crude oil and other Class 3 flammable liquids consisted of the DOT-117s which meet the new safety standards, compared to 48% in 2019. A survey conducted by the DOT indicated that 7,938 DOT-117 and DOT-117R tank cars are projected to be built or retrofitted in 2020. It is expected that by the end of the transition period in 2029, all Class 3 flammable liquids will be carried in rail tank cars that meet or exceed the DOT-117 or DOT-117R specifications.

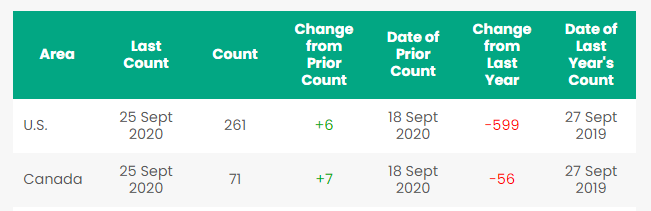

Rig Count

North America rig count is up 13 Rigs week over week. The U.S. gained 6 rigs week over week with 261 active rigs- oil rigs were up 4 rigs week over week at 183, gas rigs were up 2 to 75, and miscellaneous rigs were unchanged at 3. Canada gained 7 rigs week over week and Canada’s overall rig count is now at 71 active rigs. Year over year we are down 655 rigs collectively.

North American Rig Count Summary

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Railcar Markets

PFL is seeking:

- 2 Covered hoppers for purchase 5500 series, for storage at plant site in the Chicago area, BN or NS connection,

- 20 117R’s 30,000 gallon cars needed for alcohol service cars have to be non -lined

- 340W’s LPG pressure cars for various locations and lease terms,

- 5-15 6000+ high sided gons, no interior bracing for purchase off the CN or CP Ontario destination,

- 100 CPC 1232 31.8 prior gasoline service for 3-6 month lease (extendable with mutual agreement) in Texas.

- 17 30.3 gal for lease in New Mexico 1 year for crude

- 100 4750’s for grain service in the Midwest, one year lease,

- 50-90 263 or 286 GRL needed for corn syrup for purchase,

- 50-60 Sulfuric acid cars 13.6 for purchase,

- 40-50 molten Sulfur Cars 13.8 for purchase,

- 100 coal gons for lease

- 15 500W tanks for CO2 use for lease 6-12 months

- 17 30.3 pressure cars for lease in Midwest or west preferred

- 10 20K to 23.5 coiled and insulated for lease one year for ethylene glycol,

- 100 1232 tanks for crude 8 month lease in Edmonton CA

- 10 23-25.5 for glycerin 6-12 months UP or CN MO to WY

- 25-50 340W Pressure cars for LPG 6-12 months Edmonton Canada

- 15 500W tanks for CO2 6-12 months multiple locations

- 20 117R 30.3K Gal BN Crude Gallup NM 1 year

- 100 1232 Tanks for BN Edmonton Canada 8 months Crude

- 200 1232 25.5K Gal Texas UP BN 2 years fuel oil

- 25 117R 28.3 Gal Texas Class One Open 2-5 years Diesel

- 6 31.8 Gal tanks Ohio 3-5 years Nonene

- 50-90 263 or 268 for Corn Syrup for sale location negotiable

- 50-60 13.6K tanks for sulfuric acid for sale location negotiable

- 40-50 13.8K tanks for Molten Sulfer for sale location negotiable

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable,

- Short and long term opportunities available clean cars are available 1-5 years scattered across the country. Various last commodities. Leases on 117Js and 117Rs, dirty to dirty for sublease,

- 450 117Js 28.3 C/I for sale or lease in Texas

- 200 CPC 1232 Compliant 25.5’s C/I for sale or lease

- 100 65 ft. bulkhead flat cars, for sale or lease

- 200 30K tankers cleaned and ready for service, for sale or lease,

- 100 5650 PD hoppers brand new 65 ft, lease only, available in 30 days,

- 218 73 ft 286 GRL riserless deck, center part for sale,

- 28 auto-max II automobile carrier racks – tri-level for sale,

- 100 65’ 100 ton log cars for lease, various locations,

- 10 food grade 14.3 tanks lined for phosphoric acid for sale in Louisiana,

- 49 60’ Box cars 286 EOL refurbished in Tenn.,

- 132 286 GRL DOT111s coiled and insulated 29K Gal for sale

- 20 low sided gondolas for lease in NJ 2743 cu ft,

- 100 34.2 Gallon Dot 111 for lease great for Ethanol or Alcohol

- 20 food grade stainless steel cars

- 50 300 series Pressure cars

- PFL has a number of steel and aluminum hoppers for various commodities for sale,

- Sand cars, box cars, coal cars and hoppers including sugar covered hoppers and plastic pellet cars, are also available for sale or lease in various locations.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS. WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|