“We all have the ability. The difference is how we use it.”

– Stevie Wonder

Jobs Update

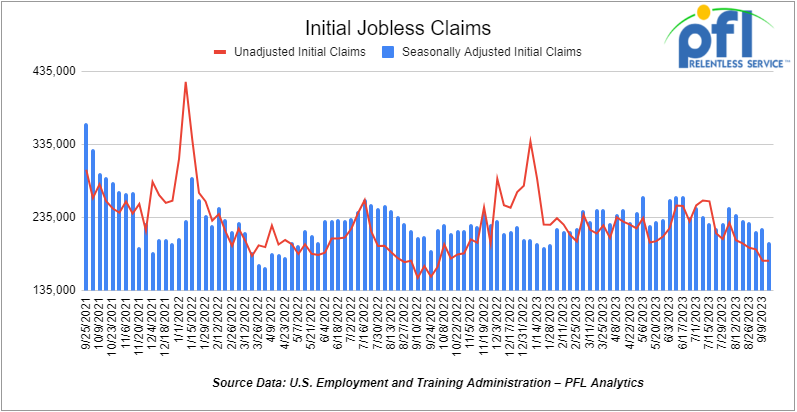

- Initial jobless claims for the week ending September 16th, 2023 came in at 201,000, down -20,000 people week-over-week.

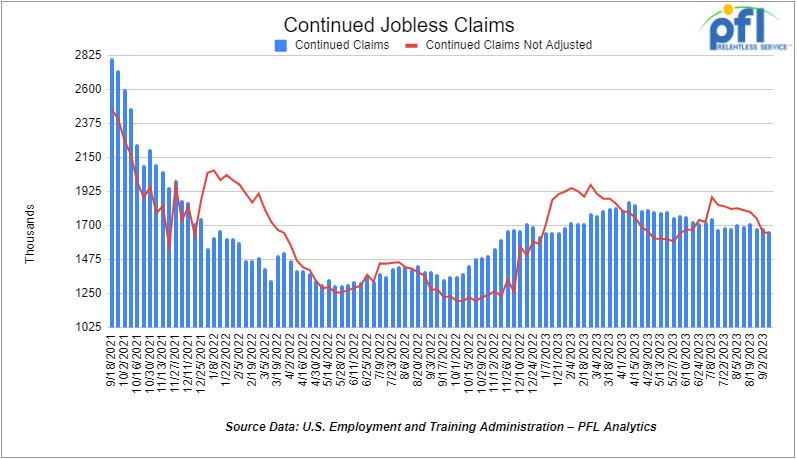

- Continuing jobless claims came in at 1.662 million people, versus the adjusted number of 1.683 million people from the week prior, down -21,000 people week-over-week.

Stocks closed lower on Friday of last week and lower week over week

The DOW closed lower on Friday of last week, down -106.56 points (-0.31%), closing out the week at 33,963.84, down -654.37 points week-over-week. The S&P 500 closed lower on Friday of last week, down -9.94 points (-0.23%) and closed out the week at 4,432.06, down -130.26 points week-over-week. The NASDAQ closed lower on Friday of last week, down -12.18 points (-0.09%), and closed the week at 13,211.81, down -496.53 points week-over-week.

In overnight trading, DOW futures traded lower and are expected to open at 34,198 this morning down -34 points.

Crude oil closed higher on Friday of last week, but lower week over week

WTI traded up $0.40 per barrel (+0.5%) to close at $90.03 per barrel on Friday of last week down -$0.74 per barrel week-over-week. Brent traded down US$0.03 per barrel (-0.25%) on Friday of last week, to close at US$93.27 per barrel, down -US$0.66 per barrel week-over-week.

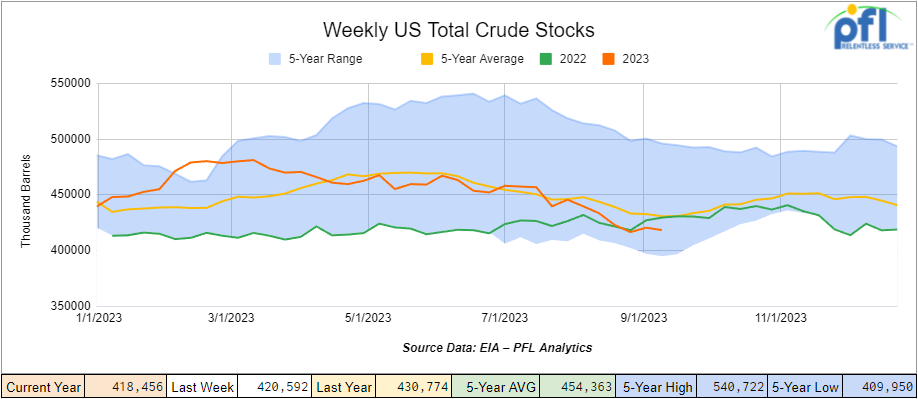

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 2.1 million barrels week-over-week. At 418.5 million barrels, U.S. crude oil inventories are 3% below the five-year average for this time of year.

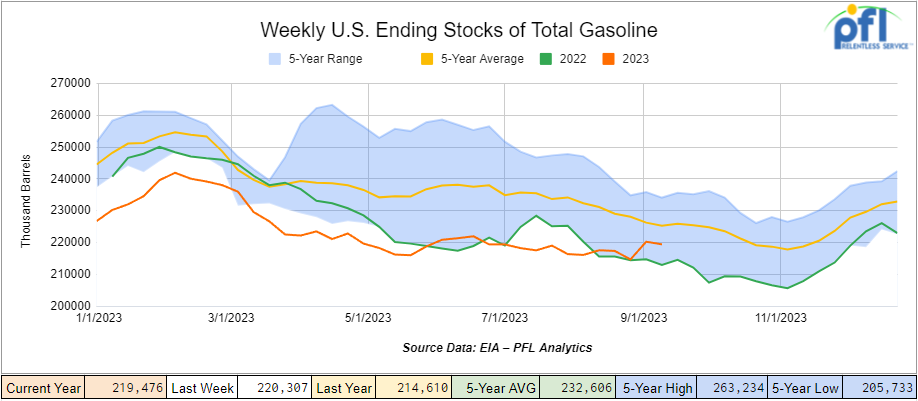

Total motor gasoline inventories decreased by 800,000 barrels week-over-week and are 3% below the five-year average for this time of year.

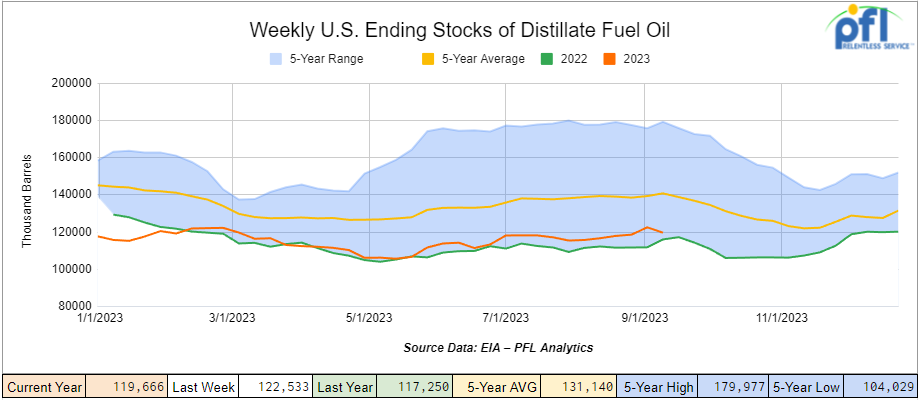

Distillate fuel inventories decreased by 2.9 million barrels week-over-week and are 14% below the five-year average for this time of year.

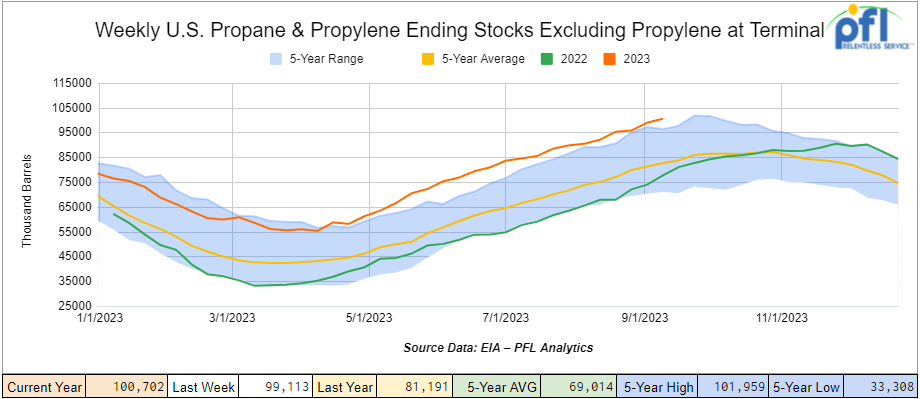

Propane/propylene inventories increased by 1.6 million barrels week-over-week and are 20% above the five-year average for this time of year.

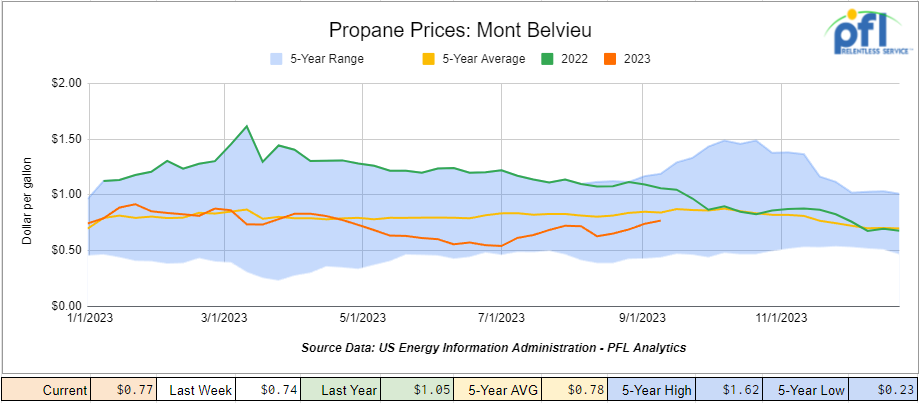

Propane prices closed at 77 cents per gallon, up 3 cents per gallon week-over-week, but down -28 cents per gallon year-over-year.

Overall, total commercial petroleum inventories increased by 3 million barrels during the week ending September 15, 2023.

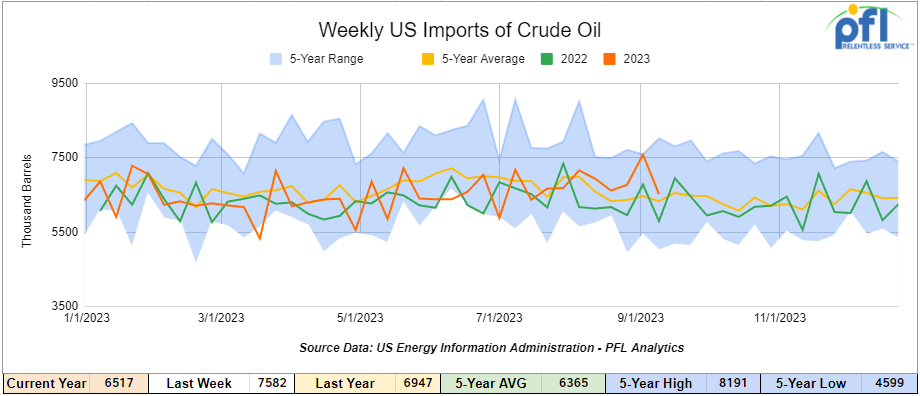

U.S. crude oil imports averaged 6.5 million barrels per day during the week ending September 15, 2023, a decrease of 1.1 million barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.9 million barrels per day, 7.9% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 511,000 barrels per day, and distillate fuel imports averaged 83,000 barrels per day during the week ending September 15, 2023.

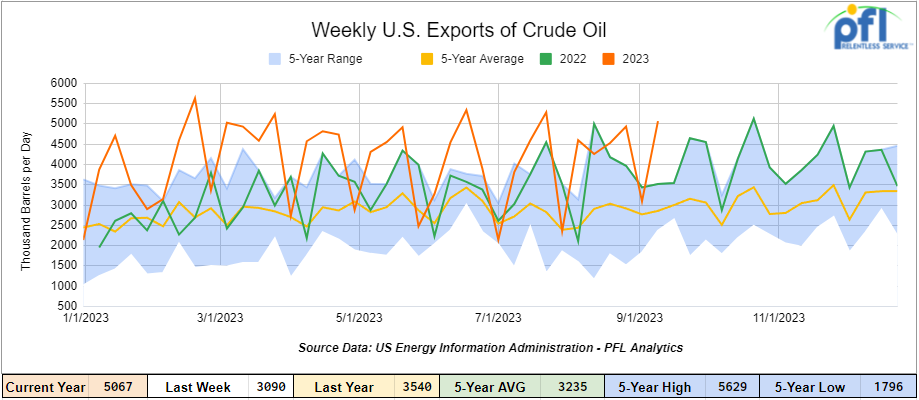

U.S. crude oil exports averaged 5.067 million barrels per day for the week ending September 15th, an increase of 1.977 million barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 4.404 million barrels per day.

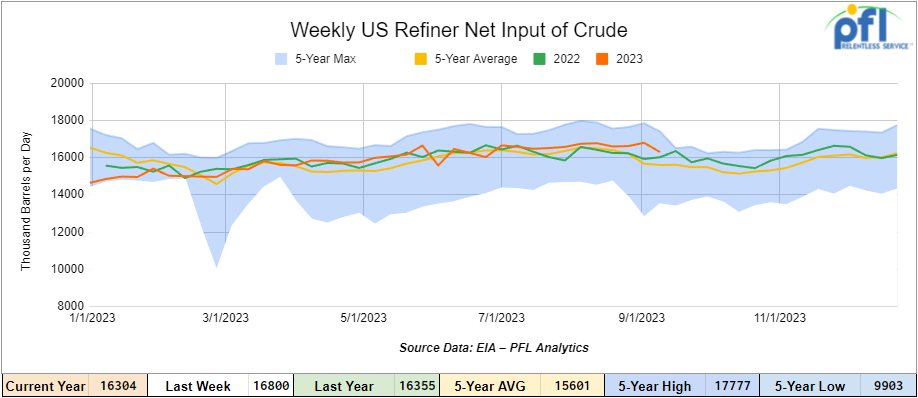

U.S. crude oil refinery inputs averaged 16.3 million barrels per day during the week ending September 15, 2023, which was 496,000 barrels per day less week-over-week.

WTI is poised to open at $90.37, up 32 cents per barrel from Friday’s close.

North American Rail Traffic

Week Ending September 20th, 2023.

Total North American weekly rail volumes were down (-0.18%) in week 37, compared with the same week last year. Total carloads for the week ending on September 20th, 2023 were 354,858, down (-0.78%) compared with the same week in 2022, while weekly intermodal volume was 321,175, up (+0.5%) compared to the same week in 2022. 6 of the AAR’s 11 major traffic categories posted year over year increases with the most significant decrease coming from Grain (-7.92%). The largest increase came from Motor Vehicles and Parts (+16.1%).

In the East, CSX’s total volumes were up (1.89%), with the largest decrease coming from Grain (-16.26%) and the largest increase from Motor Vehicles and Parts (+15.73%). NS’s volumes were up (3.45%), with the largest decrease coming from Grain (-20.46) and the largest increase from Chemicals (+11.22%).

In the West, BN’s total volumes were down (-1.07%), with the largest decrease coming from Coal (-12.1%), and the largest increase coming from Motor Vehicles and Parts (+34.24%). UP’s total rail volumes were up (+1.07%) with the largest decrease coming from Grain (-25.17%) and the largest increase coming from Petroleum and Petroleum Products (+17.13%).

In Canada, CN’s total rail volumes were down (-12.99%) with the largest increase coming from Motor Vehicles and Parts (+20.72%) and the largest decrease coming from Other (-53.98%). CP’s total rail volumes were down (-0.06%) with the largest decrease coming from Coal (-36.01%) and the largest increase coming from Motor Vehicles and Parts (+79.1%). KCS’s total rail volumes were down (-2.46%) with the largest decrease coming from Nonmetallic Minerals (-20.15%) and the largest increase coming from Forest Products (+10.33%).

Source Data: AAR – PFL Analytics

Rig Count

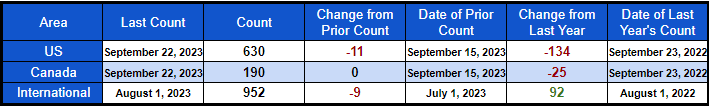

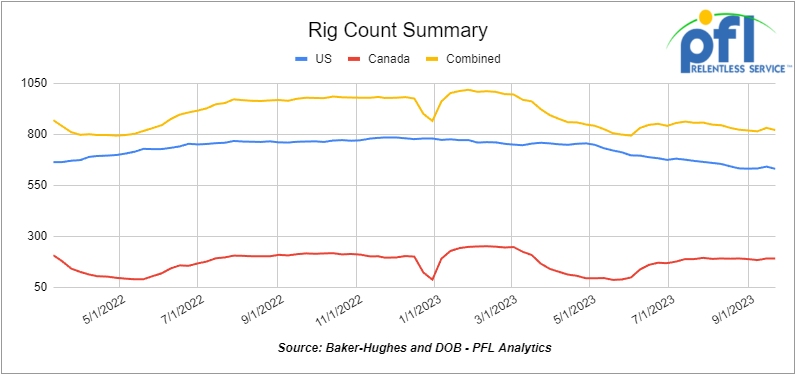

North American rig count was down by -11 rigs week-over-week. U.S. rig count was down by -11 rigs week-over-week and down by -134 rigs year-over-year. The U.S. currently has 630 active rigs. Canada’s rig count was flat week-over-week, but down by -25 rigs year over year. Canada’s overall rig count is 190 active rigs. Overall, year-over-year, we are down -159 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 26,788 from 26,171, which was a gain of +617 rail cars week-over-week. Canadian volumes were higher and people are looking for rail cars again for that market as spreads widen and demand picks up in the gulf and Asia for Canadian grades. One Exchange Western Canadian Select (“WCS”) for November delivery settled on Thursday of last week at US$18.10 [per barrel below WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$69.80 per barrel. On Wednesday, the index also settled at US$18.10 per barrel below the WTI-CMA for November delivery. The implied value was US$69.81 per barrel.

CPKC’s shipments rose by +21.2% week over week, and CN’s volumes were higher by +5.1% week-over-week. U.S. shipments were mixed. The NS had the largest percentage increase and was up by +33.3% week-over-week. The BN had the largest percentage decrease and was down by -1.3% week-over-week.

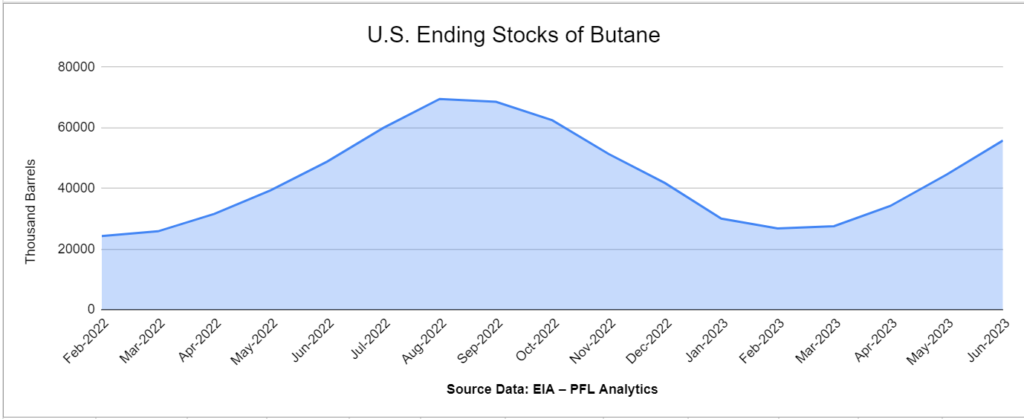

We are watching Butane Blending

Looks like it is game on, folks. Crude oil and gasoline is high, but butane remains seasonably weak and butane inventories are robust up 14% year over year. The EIA estimates that butane stocks will be over 53.1 mm bbls by the end of the first quarter of 2024 – 33% higher year over year.

Normally, winter blending season starts on September 15th and ends on March 15th. Summer grade gasoline contains 2% butane while winter grade butane can contain over 8%. PFL has already seen some of its loaded butane cars put in rotation.

We are Watching U.S. Crude Production Continue to Decline

Folks, get ready for a short squeeze – while Washington and the EPA continues to wage war on our oil and natural gas companies U.S. oil production is falling – go figure. U.S. oil output from top shale areas fell for 3rd straight month in October, according to the U.S. Energy Information Administration (“EIA”). It’s Output from top shale-producing regions is on track to fall for a third month in a row in October to the lowest level since May 2023, said the EIA in its monthly drilling productivity report released on Monday of last week. U.S. oil output is expected to fall to 9.393 million barrels per day in October from 9.433 million barrels per day in September, according to the EIA. A record 9.476 million barrels per day was produced in July of 2023.

We were watching the 24th World Petroleum Congress in Calgary Last Week

Held in Calgary from September 17th – 21st it was dubbed as “The Path to Net Zero”. Some interesting clips – Cenovus executive chair Alex Pourbaix jumped into the Alberta clean power debate at the World Petroleum Congress, saying he’s concerned about the reliability of an Alberta power grid that would be totally dependent on renewable energy.

“Renewables on their own, they are unreliable,” he told a session on energy security, while acknowledging that some would consider that unfair to say. “But what is more of a challenge with them is [that] they’re unreliable; we don’t know when they’re not going to work.” We at PFL agree with this statement – we have built solar farms – when the sun’s not shining, you don’t get power and the inverters are always breaking down!

Other top executives noted that balancing the ‘energy trilemma’ of sustainability, affordability and security is a top consideration in the energy transition discussion.

Meanwhile, forecasts of a steep reduction in oil and gas demand by 2050 do not add up because a viable replacement does not exist, according to Shaikh Nawaf Saud Al Sabah, the deputy chair and CEO of Kuwait Petroleum Corporation.

“The way we look at it in Kuwait is this is an energy transition and not an energy switch,” said Al Sabah. “It requires quite a bit of time to move through the energy position we are in right now. If you care to read more about what happened at the World Petroleum Congress here is the link.

UAW Strike is Having a Huge Impact on more than just Auto Workers

Folks, let’s hope this strike is over real soon it is not good for anyone including the workers striking, but so many other workers and companies across America are about to suffer. United States Steel Corp. and Fort Wayne and Indiana-based Steel Dynamics Inc. (SDI) have joined other steelmaking and scrap recycling companies warning of difficult conditions in the second half of this year.

They join earlier announcements from steel producer Nucor Corp. which operates a network of scrap yards, and global scrap recycling firm Sims Ltd. in issuing cautionary guidance to investors.

U.S. Steel, provided third-quarter 2023 adjusted net earnings per diluted share guidance of $1.10 to $1.15 per share, down 40% quarter over quarter. U.S. Steel President and CEO David B. Burritt also announced the firm intends to idle a blast furnace in Illinois.

“Today’s guidance also reflects the expected impact on third quarter financial results from the United Auto Workers union strike announced earlier this month,” Burritt says. “Consistent with actions taken in 2022 to balance our melt capacity with our order book, we will temporarily idle blast furnace ‘B’ at Granite City Works and are reallocating volumes to other domestic facilities to efficiently meet customer demand.” This move has affected all PFL clean and scrap facilities across our network – please call PFL before directing traffic to any PFL clean and scrap location.

U.S. Steel also says earnings in its Mini Mill segment, which consists predominantly of the Big River Steel business unit in Arkansas, are expected to be lower than in the second quarter.

U.S. Steel says selling prices in the segment moderated during the quarter and recent results are “expected to reflect better customer volume performance than previously anticipated and benefit from lower raw material costs.”

SDI, meanwhile, provided third-quarter 2023 earnings guidance in the range of $3.46 to $3.50 per diluted share. Down 27% quarter over quarter. Stay tuned to PFL we are watching this one very closely.

We have been extremely busy at PFL with return-on-lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs at 239-390-2885

Lease Bids

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 Years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 108, 28.3K Any Tanks needed off of CN in Canada for 1-3 Years. Cars are needed for use in Crude service.

- 20-25, 30 or 31.8K Tanks needed off of in Texas for 1-5 Years. Cars are needed for use in VGO service. NC/NI

- 3, 30 or 31.8K Tanks needed off of in Texas for 1-5 Years. Cars are needed for use in Naphtha service. NC/NI

- 10-20, 30 or 31.8K Tanks needed off of in Texas for 1-2 Years. Cars are needed for use in Diesel service. NC/NI

- 1, 30 or 31.8K Tanks needed off of in Texas for 6-12 Months. Cars are needed for use in Mono-Propylene Glycol service. NC/NI

- 30-100, 31.8K CPC 1232 Tanks needed off of UP or BN in Texas for Purchase or Lease. Cars are needed for use in refined prodcuts service.

- 15, 30K 117 Tanks needed off of NS in SouthEast for 1 Year. Cars are needed for use in Diesel service.

- 25, 33K 340W Pressure Tanks needed off of UP or BN in Midwest for Oct-March. Cars are needed for use in Propane service.

- 20-25, 30K 117 Tanks needed off of UP or BN in Illinois for 5 Years. Cars are needed for use in Ethanol service.

- 100, 28.3K DOT 111/117 Tanks needed off of UP or BN in Midwest/Texas for 5 Years. Cars are needed for use in Veg Oils / Biodiesel service. Need to be Unlined

- 25-50, 33K 400W Pressure Tanks needed off of CN or CP in Canada for Short Term. Cars are needed for use in Propylene service.

- 50-100, 4550 Covered Hoppers needed off of UP or BN in Texas for 5 Years. Cars are needed for use in Grain service.

- 10, 33K 340W Pressure Tanks needed off of CN in LA for 1 Year. Cars are needed for use in Butane service.

- 25, 20.5K CPC1232 or 117J Tanks needed off of BNSF or UP in the west for 3-5 Year. Cars are needed for use in Magnesium chloride service. SDS onhand

- 25-50, 25.5K 117J Tanks needed off of NS CSX in NorthEast for 5 Years. Cars are needed for use in Asphalt / Heavy Fuel Oil service.

- 30-50, 33K 340W Pressure Tanks needed off of any class 1 in any location for 6-12 Months. Cars are needed for use in Propane service.

- 15, 28.3K 117J Tanks needed off of any class 1 in any location for 3 year. Cars are needed for use in Glycerin & Palm Oil service.

- 30, 17K-20K 117J Tanks needed off of UP or BN in Midwest/West Coast for 3-5 Years. Cars are needed for use in Caustic service.

- 10, 286K 15.7K Tanks needed off of KCS in Texas for 1 Year. Cars are needed for use in Sulfuric Acid service. Needed Next few months

- 150, 23.5K DOT 111 Tanks needed off of any class 1 in LA for 2-3 Year. Cars are needed for use in Fluid service. Needed July

- 25-50, 32K 340W Pressure Tanks needed off of NS or CSX in Marcellus for 1-2 Years. Cars are needed for use in Propane service.

- 25-50, 30K DOT 111, 117, CPC 1232 Tanks needed off of CN or CP in WI, Sarnia for 1-2 Years. Cars are needed for use in Diesel service.

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

- 30-40, 286K DOT 113 Tanks needed off of CN or CP/ UP in Canada/MM for 5 Years. Cars are needed for use in CO2 service. Q1

- 30, 30K DOT 111 Tanks needed off of UP in Texas for 1-3 Years. Cars are needed for use in Diesel service.

- 25-50, 5000CF-5100CF Lined Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in Dry sugar service. 3 bay gravity dump

- 10, any capacity Stainless Steel Tanks needed off of any class 1 in Canada for 5-10 years. Cars are needed for use in Alcohol service.

- Up to 60, 5150cf Covered Hoppers needed off of CN, CSX, NS in the east or midwest for 3 years. Cars are needed for use in Fertilizer service. 3-4 hatch gravity dumps

- 20-30, 14k Any Tanks needed off of BNSF, UP in Texas for 1-3 Years. Cars are needed for use in HCl service. Call for more details

Sales Bids

- 100, Plate F Boxcars needed off of BN or UP in Texas.

- 20, 2770 Mill Gondolas needed off of CSX in the northeast. Cars are needed for use in non-haz soil service. 52-60 ft

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 20, 2770-3400 Mill Gondolas needed off of any class 1 in South Texas. Cars are needed for use in scrap metal service.

- 8, 5200 Covered Hoppers needed off of various class 1s in various locations. Cars are needed for use in Plastic Pellet service.

- 10, 4000 Open Hoppers needed off of CSX in the northeast. Cars are needed for use in scrap metal service. Open top hopper

- 20-30, 3000 – 3300 PDs Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Sand service.

- 45, 3000 cf PD Hoppers needed off of any class 1 in Texas. Negotiable

- 200+, 5000cf Covered Hoppers needed off of any class 1 in various locations.

- 10, 6400 Open Hoppers needed off of CSX in the northeast. Cars are needed for use in wood chip service. Open top hopper, flat bottom

- 20, 17K DOT 111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 100, 15.7K DOT 111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT 111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

Lease Offers

- 70, 25.5K, 117J Tanks located off of UP in Texas. Cars are clean Call for more information

- 25, 25.5K, DOT111 Tanks located off of UP/KCS in Brownsville, TX. Cars were last used in Asphalt.

- 127, 28.3K, DOT111 Tanks located off of All Class 1s in St. Louis. Cars are clean

- 10, 28.3K, 117R Tanks located off of All Class 1s in St. Louis. Cars are clean

Sales Offers

- 100-200, 31.8K, CPC 1232 Tanks located off of BN in Chicago. Dirty/Clean

- 100, 28.3K, 117J Tanks located off of various class 1s in multiple locations.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|