“Selfishness and greed, individual or national, causes most of our troubles.”

President Harry Truman

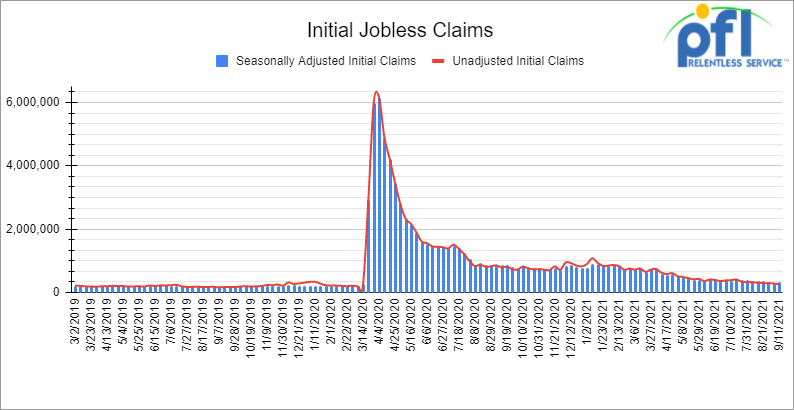

Jobs Update

- Initial jobless claims for the week ending September 10th came in at 332,000, down 20,000 people week over week.

- Continuing claims came in at 2.665 million people versus the adjusted number of 2.852 million people from the week prior, down 187,000 people week over week.

Stocks closed lower on Friday of last week and are down week over week

The DOW closed lower on Friday of last week down -166.44 points (-.48%) closing out the week at 34,584.88 points, down -22.84 points week over week. The S&P 500 closed lower on Friday of last week, down -166.44 points and closed out the week at 4,432.99, down -25.59 points week over week. The Nasdaq closed lower on Friday of last week, down -137.96 points(-.91%) and closed out the week at 15,043.97, down -71.52 points week over week.

In overnight trading, DOW futures traded lower and are expected to open down this morning -498 points.

Oil closed lower on Friday of last week, but higher Week over Week

Oil gained for a fourth week in a row as investors were still focused on shut-in production of which 25% of U.S. offshore crude production remained shut in as of Friday of last week. West Texas Intermediate (WTI) for October delivery declined -64 cents a barrel to settle at $71.97 a barrel on Friday of last week, but up +$2.25 a barrel week over week. Brent crude oil settled down -33 cents a barrel on Friday of last week closing at $75.34 a barrel, but up $2.35 a barrel week over week.

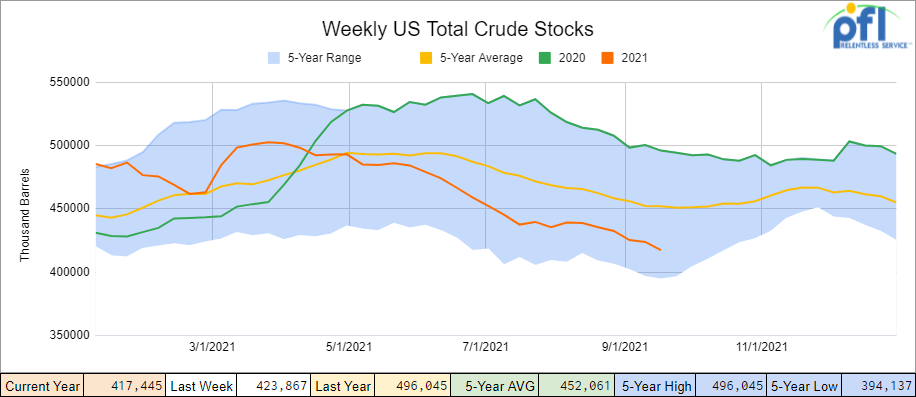

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 6.4 million barrels week over week. At 417.4 million barrels, U.S. crude oil inventories are 7% below the five-year average for this time of year.

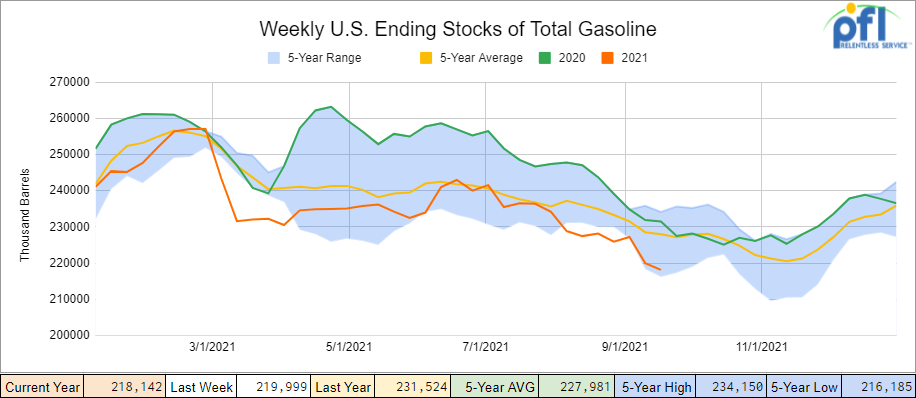

Total motor gasoline inventories decreased by 1.9 million barrels week over week and are 4% below the five-year average for this time of year. Finished gasoline and blending components inventories both decreased for the week ending September 10th 2021.

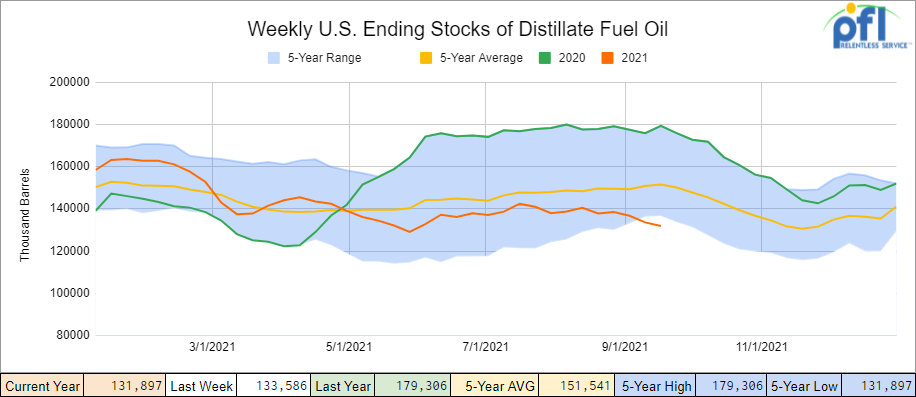

Distillate fuel inventories decreased by 1.7 million barrels week over week and are about 13% below the five-year average for this time of year.

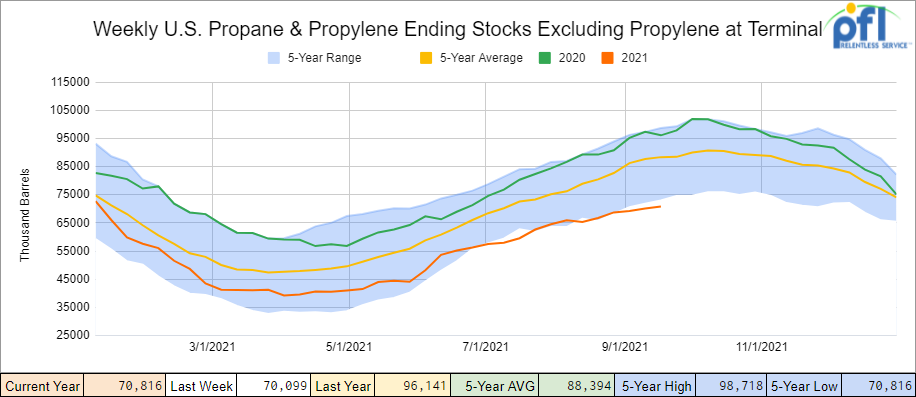

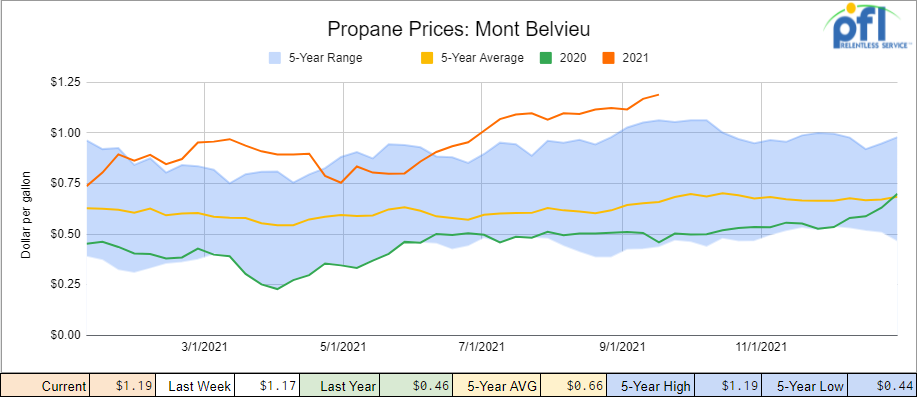

Propane/propylene inventories increased by 0.7 million barrels week over week and are about 20% below the five-year average for this time of year.

Folks, things are not improving for propane, inventory is not improving and the price keeps going up – we hit $1.28 per gallon at one point during the trading session last week.

Overall total commercial petroleum inventories decreased by 8.8 million barrels last week.

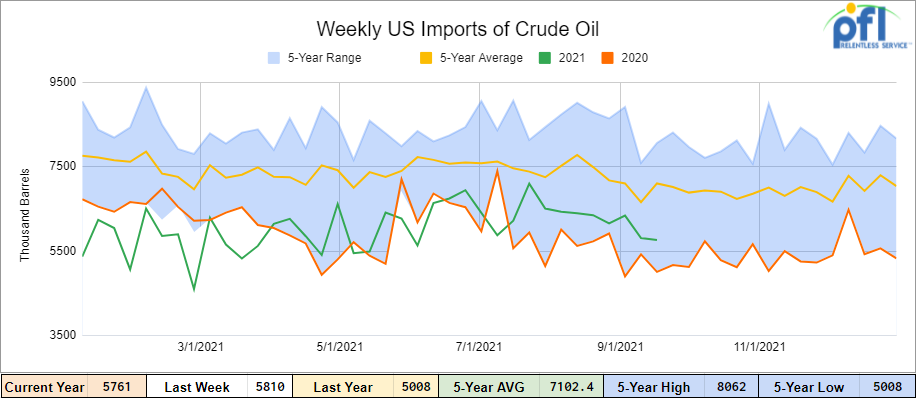

U.S. crude oil imports averaged 5.8 million barrels per day for the week ending September 10th 2021, down by 48,000 barrels per day week over week. Over the past four weeks, crude oil imports averaged 6.0 million barrels per day, this is 13.3% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) for the week ending September 10, 2021 averaged 638,000 barrels per day, and distillate fuel imports averaged 164,000 barrels per day

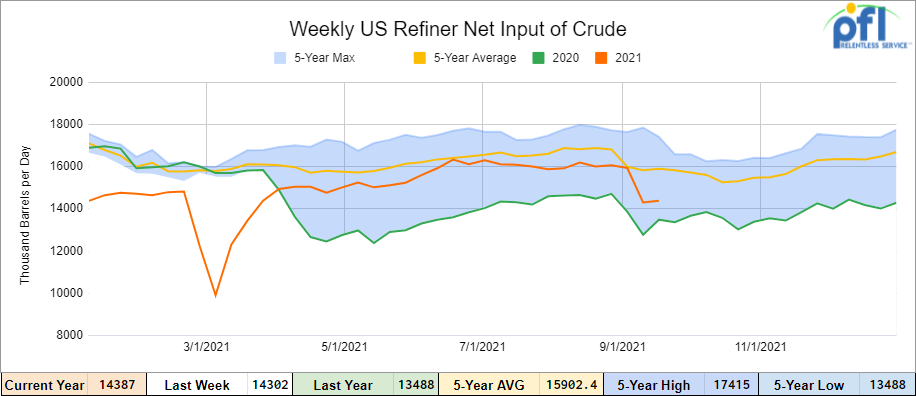

U.S. crude oil refinery inputs averaged 14.4 million barrels per day during the week ending September 10, 2021 which was 85,000 barrels per day more week over week. Refineries operated at 82.1% of their operable capacity last week. Gasoline production decreased last week, averaging 9.3 million barrels per day. Distillate fuel production decreased last week, averaging 4.2 million barrels per day

As of the writing of this report, WTI is poised to open at $70.55 , down -$1.42 per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were down 2.7% year over year in week 36 (U.S. -1.3%, Canada -8.3%, Mexico +1.6%) resulting in quarter to date volumes that are up 0.5% year over year and year to date volumes that are up 8.9% year over year (U.S. +10.0%, Canada +5.9%, Mexico +6.0%). 5 of the AAR’s 11 major traffic categories posted year over year decreases with the largest declines coming from intermodal (-7.3%). The largest increases came from coal (+17.1%) and metallic ores & metals (+18.7%).

In the East, CSX’s total volumes were down 0.6%, with the largest decreases coming from motor vehicles & parts (-43.2%). NS’s total volumes were down 1.8%, with the largest decreases coming from intermodal (-5.4%) and motor vehicles & parts (-29.4%). The largest increase came from metals & products (+29.2%).

In the West, BNSF’s total volumes were down 0.6%, with the largest decreases coming from grain (-23.4%) and intermodal (-2.3%). The largest increase came from coal (+10.1%). UP’s total volumes were down 0.5%, with the largest decreases coming from intermodal (-10.8%) and motor vehicles & parts (-36.2%). The largest increase came from coal (+33.0%).

In Canada, CN’s total volumes were down 9.6%, with the largest decrease coming from intermodal (-20.8%). The largest increase came from coal (+99.8%). Revenue per ton miles was down 9.2%. CP’s total volumes were down 0.1%, with the largest decrease coming from motor vehicles & parts (-54.7%) and grain (-23.3%). The largest increase came from intermodal (16.6%). Revenue per ton miles was down 4.5%.

KS’s total volumes were down 7.8%, with the largest decrease coming from intermodal (-19.3%) and the largest increase coming from coal (+56.5%).

Source: Stephens

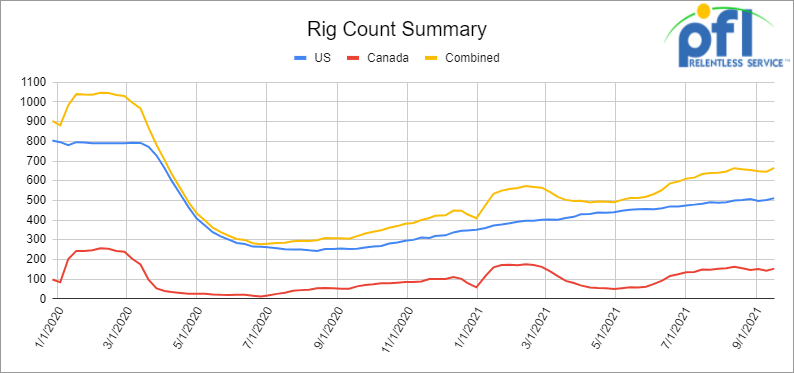

Rig Count

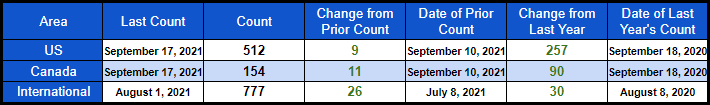

North American rig count is up by 20 rigs week over week. The U.S. rig count was up by 9 rigs week over week and up by 257 rigs year over year. The U.S. currently has 512 active rigs. Canada’s rig count was up by 11 rigs week over week, but up by 30 rigs year over year and Canada’s overall rig count is 154 active rigs. Overall, year over year we are up 347 rigs collectively.

North American Rig Count Summary

A few things we are keeping an eye on:

Railcar Markets

Enbridge Line 3 replacement

We called Enbridge on Friday of last week to see if Line 3 was up and running, as rumor was it could start up as early as September 15. As of Friday of last week, we can confirm the pipeline was not up and running and we could not get a clear answer as to the exact date it would be running, except that it would be up and running sometime in the fourth quarter. Earlier this month, Enbridge sent a notice to shippers saying it expects to offer 620,000 barrels per day of capacity on the pipeline in October, and it is expected to reach full capacity of 760,000 barrels per day by the end of this year. In other line 3 news The Minnesota Department of Natural Resources (DNR) said on Thursday of last week that it fined Enbridge $3.32 million, citing the company’s failure to follow environmental laws during the construction of its Line 3 oil pipeline replacement. “Enbridge breached the confining layer of an artesian aquifer, resulting in an unauthorized groundwater appropriation during the construction of the Line 3 replacement project near Enbridge’s Clearbrook Terminal,” DNR said in a statement. DNR’s order also requires Enbridge to implement a restoration plan to stop the unauthorized groundwater flow within 30 days and conduct additional groundwater and site monitoring. The regulator ordered Enbridge to place $2.75 million in escrow for restoration and mitigation of any damage to the calcareous fen wetlands. DNR referred the matter to the Clearwater County attorney for criminal prosecution. If the company violates the restoration order, it would be subject to additional misdemeanor charges under state law, DNR added. In response, Enbridge said in a statement it would continue to work closely with the agency on the resolution of the matter. “Enbridge has been working with the DNR since June to provide the required site information and approval of a corrective action plan, which is currently being implemented.”

Embridge Line 5

Well folks, the battle over shutting down Line 5 seems like it will never be over. Michigan Attorney General, Dana Nessel, wrote in a Sept. 15 court filing that the state “unambiguously communicated to the mediator that any further continuation of the mediation process would be unproductive for them, and they have no ‘desire to continue with the mediation process,’” as she requested an end to mediation with Calgary-based Enbridge, North America’s largest pipeline company. Enbridge and Michigan have been locked in legal battles over Line 5, and a potential replacement project, since Democratic Governor Gretchen Whitmer took office in 2019. Line 5 moves oil and propane from Western Canada to the U.S. Midwest and Ontario but crosses a critical Great Lakes waterway, the Straits of Mackinac. See below:

Enbridge Line 5 Still Under Fire

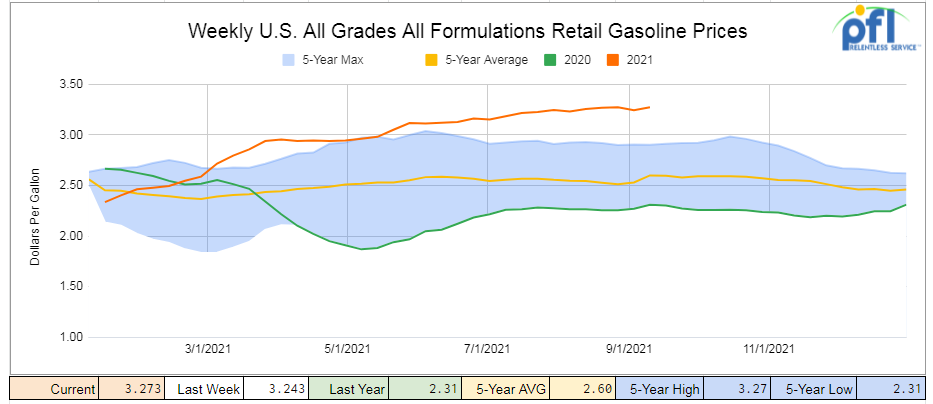

Does the state of Michigan not realize that we are already short propane? We are heading into winter and President Biden is asking for OPEC to increase oil production because prices are out of control and the American Consumer is getting hit in the pocket book everywhere. In fact last week President Biden ordered an investigation on why retail gasoline prices are so high. We don’t understand this one. It is pretty obvious why they are – rising oil prices and renewable obligations on U.S. refiners. (see chart below). We are disappointed that a resolution could not be reached during the mediation process. The shutting of line 5 would result in so many unintended consequences – cost thousands of jobs and people may even freeze as a worst case scenario. A definite tailwind for rail and truck if this were to happen. Problem is there are most likely not enough rail cars built to handle the incremental pressure car demand if Line 5 was shut down.

U.S. Retail Gasoline Prices

Petroleum by Rail

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 24,967 from 25,162 a loss of 195 rail cars week over week. Canadian volumes were mixed – CP shipments fell by 24% and CN shipments were up by 4.9%. U.S. volumes were also mixed; the UP had the largest percentage increase up by 9.4% and the BN had the largest percentage decrease down by 8.8%.

Carbon Recapture in Houston

In our minds, it was a great concept floated by Exxon earlier this year and is getting some legs. The project is aimed at capturing millions of tons of carbon emissions along the U.S. Gulf Coast in Texas now has the support of some of the world’s biggest refiners and chemical manufacturers. On Thursday of last week Dow, Chevron, Phillips 66 and Calpine Corp. were among 11 companies who agreed to “begin discussing plans” on a proposed hub that could store 50 million tons of carbon dioxide a year by 2030 and double that amount by 2040. “If appropriate policies and regulations are put in place, the project could generate tens of thousands of new jobs, protect current jobs and reduce emissions at a lower cost to society than many other widely available technologies,” the companies said in the statement. Folks, we love this one – this is how we go green. Electric cars are not going to do any good for anyone in the state of Florida, Texas or anyone in the gulf coast that needs to evacuate for a Hurricane – think about it after two hours of driving everyone needs to recharge their batteries – what are they thinking! PFL has always been supporters of renewable energy and a balanced approach to reducing our CO2 footprint – but let’s not get carried away. We should also be using Carbon recapture for enhanced oil recovery wherever possible that would be killing two birds with one stone. Carbon recapture should be #1 on the green agenda, but no one is talking about it – hats off to companies like Exxon and Suncor in Canada who are advocates of carbon recapture!

Global Airfreight, Containerized Ocean Traffic

Things are not getting any better out there. Total US and Canadian container imports were near record highs yet again in August, with incremental month over month growth capped by capacity constraints. It is expected that full-year 2021 volumes will be up between 20-25% year over year as shippers restock inventory.

Spot ocean rates from Asia to the U.S. West Coast are up +454% year over year, according to the FBX. In the last 60 days alone prices for a container are up from $10,000 to $15,000..

Airfreight markets continue to see demand recover faster than capacity, resulting in rates on the Asia-US route near all-time highs. Rates from Asia to North America are up 57% year over year. Rates to Europe are up 44% year over year.

August Headcount for U.S. Rails

The Surface Transportation Board (STB) recently released August headcount data for the U.S. rails. For the industry as a whole, August headcount was down 2.8% year over year versus July headcount that was down 1.3% year over year. Industry headcount decreased 1.1% versus the 5-year August average which was flat. KSU was the only rail to see headcount increase year over year! We would expect to see hiring accelerate. PFL recently attended the NARS conference in Chicago and every class one is looking to add bodies. At the same time most admit that the labor market is challenging and finding qualified individuals to fill positions is proving to be problematic.

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 70, 5150 Covered Hoppers needed in the Midwest for 3 Month starting October. Any class one

- 20 5650 PD Hoppers 286s needed in Montana for talc BNSF for 3-5 years

- 100 Open Top Hoppers needed in the Midwest for coal BNSF 1 year

- 100, 5800 Covered Hoppers 286 can be West or East for Plastic 3-5 years

- 50-100, 4750 Covered Hoppers needed for Pet-coke. Can take in the South.

- 70, 117R or J needed for Ethanol for 3 years. Can take in the South.

- 30, 25.5’s or greater food grade Kosher veg oil cars for 6-12 months

- 50, 6500+ cu-ft Mill Gon or Open Top Hopper for wood chips in the Southeast for 5 Years.

- 25 bulkhead flats 286 any class one for up to 5 years Negotiable

- 10 open top hoppers 2400 C FT in Texas needed for stone on the UP 3-5 years

- 20, 19,000 Gal Stainless cars in Louisiana UP for nitric acid 1-3 years – Oct negotiable

- 10, 6,300CF or greater covered hoppers needed in the Midwest.

- 15-25, 20K 23.5K cars for chem needed in the South for 1 Year

- 2, 89’ Flat cars for purchase or lease – needed in TX off the BNSF

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js – Selection is Dwindling. Call Today!

- 200 Clean C/I 25.5K 117J in Texas. Brand New Cars!

- 34 Clean C/I 25.5K CPC 1232’s located in PA.

- 200 117Js 29K OK and TX Clean and brand new – Lined- lease negotiable

- 142 111’s Clean last in gasoline in Texas for lease off the UP – negotiable

- 200 plus 4750 Covered Hoppers 263s off the CN For Sale

- 100 117Rs dirty last in Gasoline in Texas for lease Negotiable

- 20 117R 30K plus tanks for ethanol in Wisconsin off the CN Negotiable

- 90 117Rs 30K located in Alberta CN or CP Refined Products Dirty – negotiable

- 37 BRAND NEW 5161 Sugar Hoppers in Arkansas UP – negotiable

- 99 340W Pressure Cars various locations Butane and Propane dirty negotiable

- 100 73 ft 286 GRL riser less deck, center part for sale,

- 19 auto-max II automobile carrier racks – tri-49 for sale – negotiable

- 10 food grade stainless steel cars

- 20 20K Stainless cars in 3 locations in the south – negotiable

- 30 CPC 1232 25.5K C/I Pennsylvania NS clean negotiable

- 100-150 29K C/I 117J cars for lease. Dirty in Bakken crude and can be returned dirty.

- 100 29K C/I 1232 cars for lease. Dirty in Heavy Crude and can be returned dirty.

- 100 117Rs 29K clean last used in crude Washington State – price negotiable sale or lease

- 21 111s 29K tanks last in alcohol dirty on the CN in Wisconsin for lease price negotiable

- 100 111s of various volumes and locations last in fuel oil dirty price negotiable

- Various Hoppers for sale and lease 3000-5800 CF 263 and 286 multiple locations negotiable

- 45 Boxcars 60ft Plate F’s Located in Tenn CSX – Lease Negotiable

- 28 20K Veg oil cars for lease in Arkansas – Negotiable

- 100 3200 Covered Hoppers for sale price negotiable

- 100 Center beam Flats with risers 73ft in SD and Iowa for sale negotiable

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|