“I never did anything by accident, nor did any of my inventions come by accident. They came by work.”

– Thomas Edison

Jobs Update

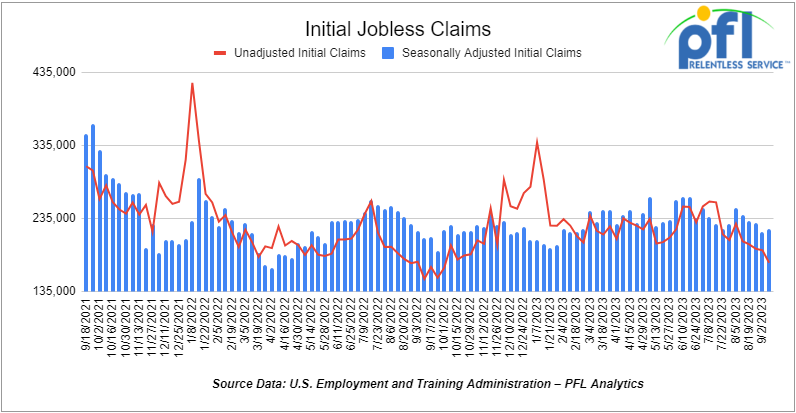

- Initial jobless claims for the week ending September 9th, 2023 came in at 220,000, up 3,000 people week-over-week.

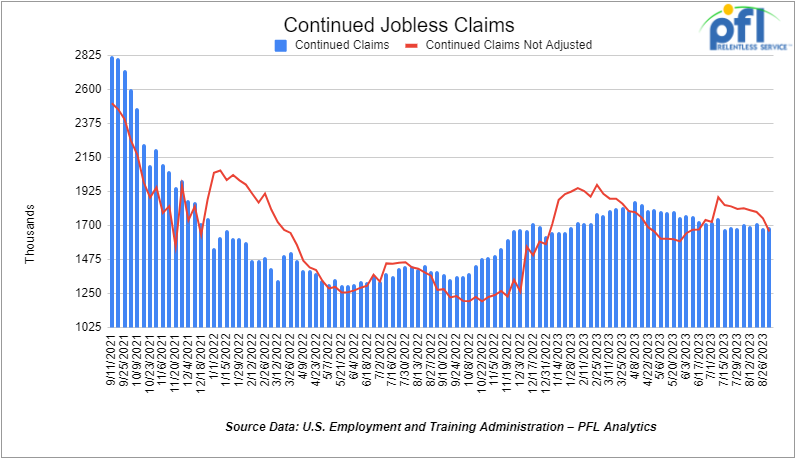

- Continuing jobless claims came in at 1.688 million people, versus the adjusted number of 1.684 million people from the week prior, up 4,000 people week-over-week.

Stocks closed lower on Friday of last week and mixed week over week

The DOW closed lower on Friday of last week, down -288.87 points (-0.83%), closing out the week at 34,618.24, up 41.65 points week-over-week. The S&P 500 closed lower on Friday of last week, down -54.78 points (-1.22%) and closed out the week at 4,450.32, down -7.17 points week-over-week. The NASDAQ closed lower on Friday of last week, down -217.72 points (-1.58%), and closed the week at 13,708.34, down -53.19 points week-over-week.

In overnight trading, DOW futures traded higher and are expected to open at 34,934 this morning up 7 points.

Crude oil closed higher on Friday of last week and up week over week

WTI traded up $0.61 per barrel (+0.68%) to close at $90.77 per barrel on Friday of last week up $3.26 per barrel week-over-week. Brent traded up US$0.23 per barrel (+0.25%) on Friday of last week, to close at US$93.93 per barrel, up US$3.28 per barrel week-over-week.

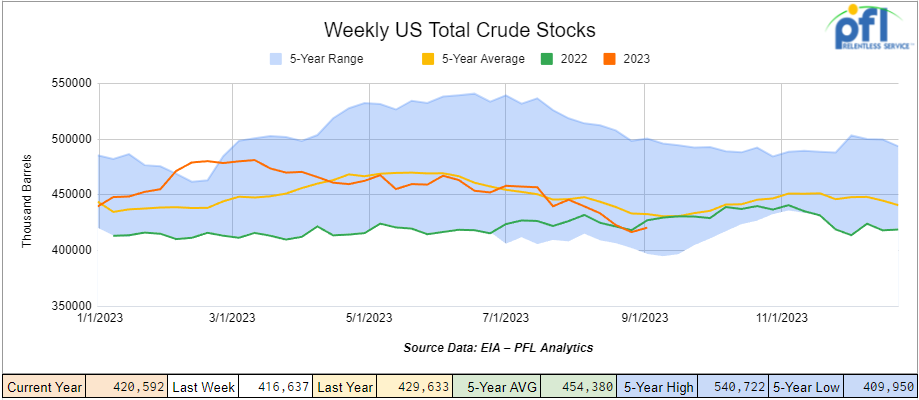

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 4 million barrels week-over-week. At 420.6 million barrels, U.S. crude oil inventories are 2% below the five-year average for this time of year.

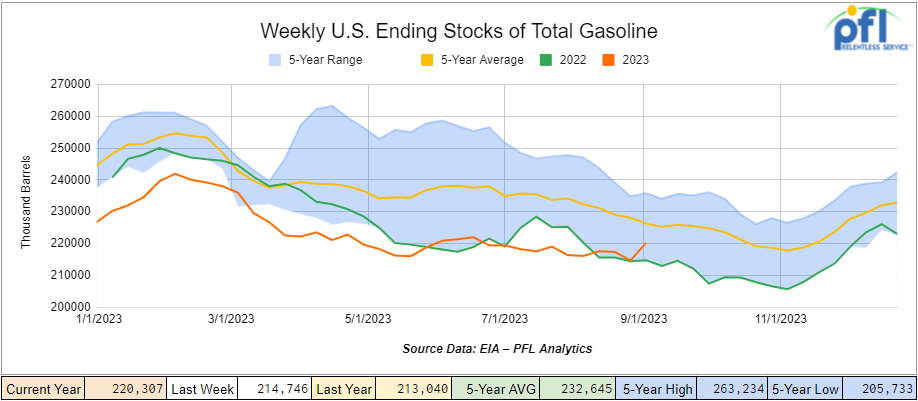

Total motor gasoline inventories increased by 5.6 million barrels week-over-week and are 2% below the five-year average for this time of year.

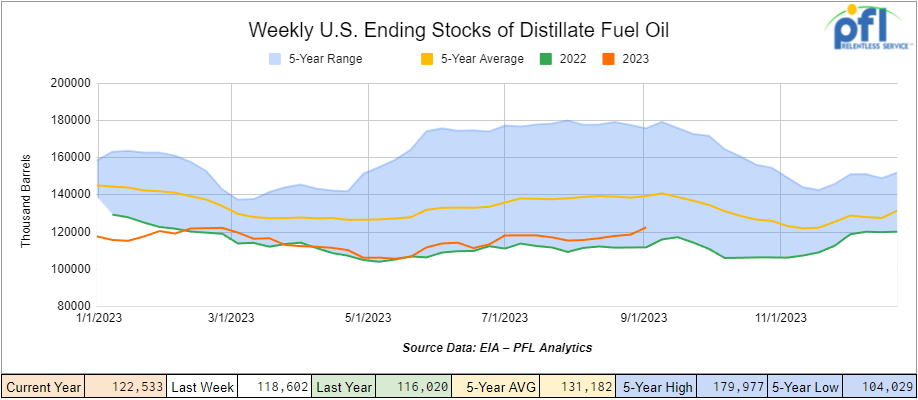

Distillate fuel inventories increased by 3.9 million barrels week-over-week and are 13% below the five-year average for this time of year.

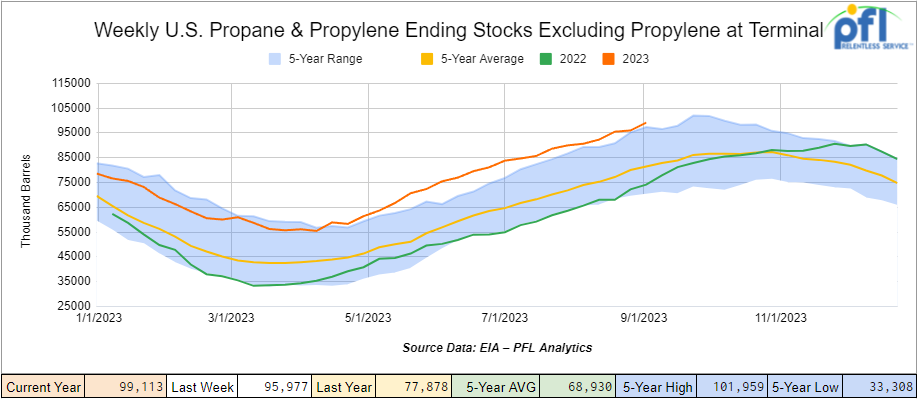

Propane/propylene inventories increased 3.1 million barrels week-over-week and are 21% above the five-year average for this time of year.

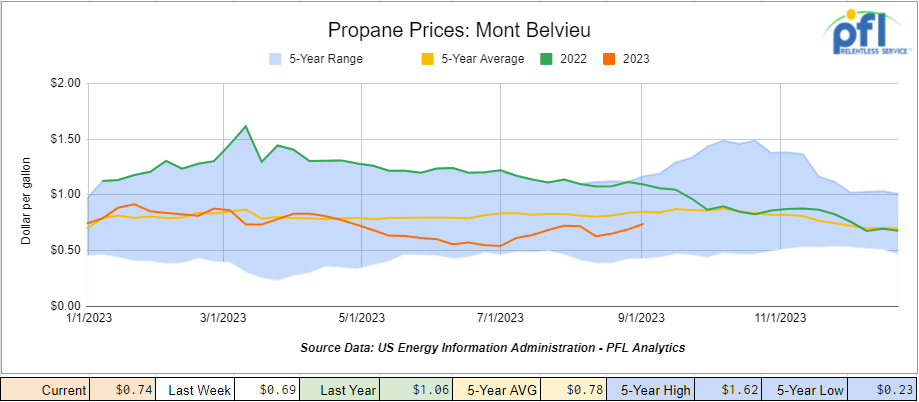

Propane prices closed at 74 cents per gallon, up 5 cents week-over-week, but down -32 cents per gallon year-over-year.

Overall, total commercial petroleum inventories increased by 10.4 million barrels last week during the week ending September 8, 2023.

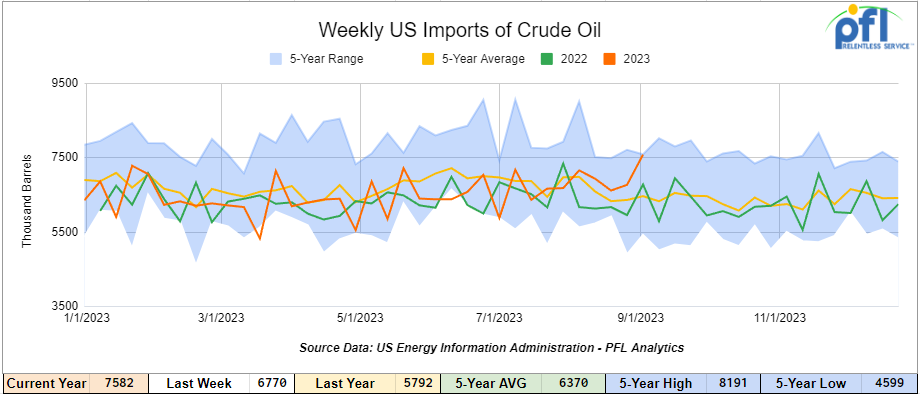

U.S. crude oil imports averaged 7.6 million barrels per day during the week ending September 8, 2023, an increase of 812,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 7 million barrels per day, 13.0% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 899,000 barrels per day, and distillate fuel imports averaged 185,000 barrels per day during the week ending September 8, 2023.

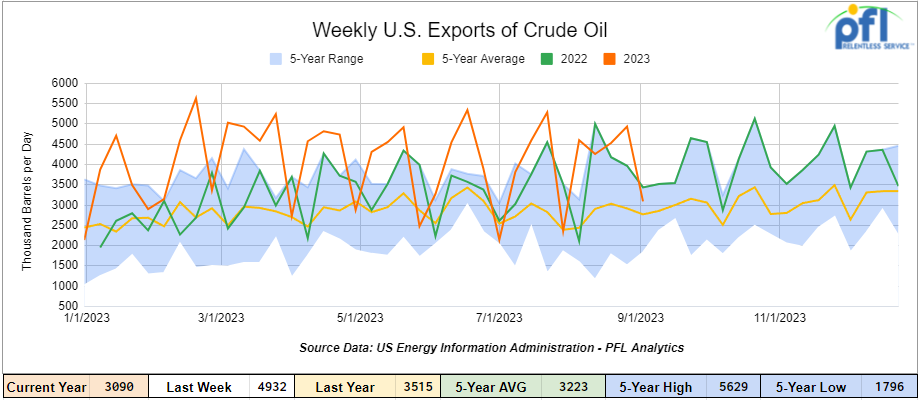

U.S. crude oil exports averaged 3.09 million barrels per day for the week ending September 8th, a decrease of -1.842 million barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 4.202 million barrels per day.

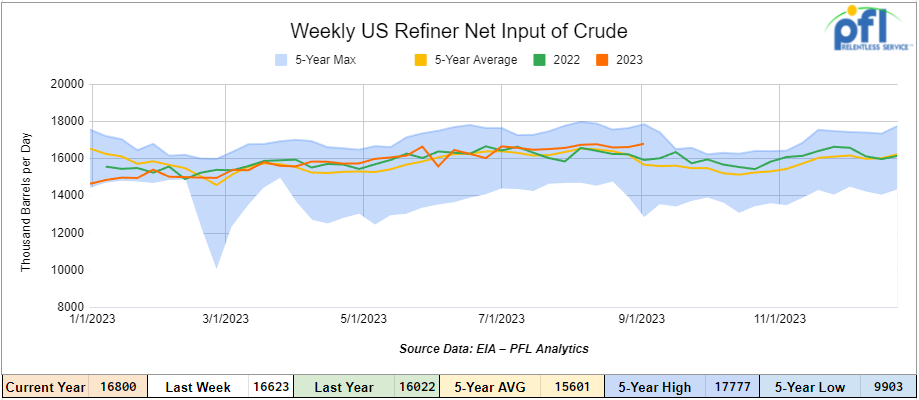

U.S. crude oil refinery inputs averaged 16.8 million barrels per day during the week ending September 8, 2023, which was 177,000 barrels per day more week-over-week.

WTI is poised to open at $91.29, up 52 cents per barrel from Friday’s close.

North American Rail Traffic

Week Ending September 13th, 2023.

Total North American weekly rail volumes were down (-3.43%) in week 36, compared with the same week last year. Total carloads for the week ending on September 13th, 2023 were 339,563, up (+0.49%) compared with the same week in 2022, while weekly intermodal volume was 287,396, down (-7.67%) compared to the same week in 2022. 7 of the AAR’s 11 major traffic categories posted year-over-year decreases with the most significant decrease coming from Grain (-8.71%). The largest increase came from Motor Vehicles and Parts (+10.93%).

In the East, CSX’s total volumes were down (-2.22%), with the largest decrease coming from Intermodal (-9.81%) and the largest increase from Motor Vehicles and Parts (+22.63%). NS’s volumes were down (-3.43%), with the largest decrease coming from Petroleum and Petroleum Products (-28.35%) and the largest increase from Motor Vehicles and Parts (+13.95%).

In the West, BN’s total volumes were down (-4.99%), with the largest decrease coming from Grain (-19.82%), and the largest increase coming from Other (+31.73%). UP’s total rail volumes were down (-0.67%) with the largest decrease coming from Other (-14.30%) and the largest increase coming from Petroleum and Petroleum Products (+23.75%).

In Canada, CN’s total rail volumes were down (-7.65%) with the largest increase coming from Grain (+48.45%) and the largest decrease coming from Intermodal (-38.04%). CP’s total rail volumes were up (-6.86%) with the largest decrease coming from Other (-11.70%) and the largest increase coming from Motor Vehicles and Parts (+100.34%).

KCS’s total rail volumes were down (-9.88%) with the largest decrease coming from Other (-31.25%) and the largest increase coming from Grain (+27.57%).

Source Data: AAR – PFL Analytics

Rig Count

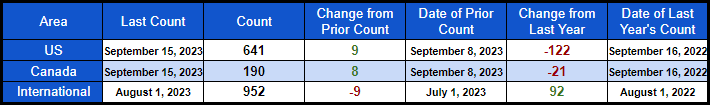

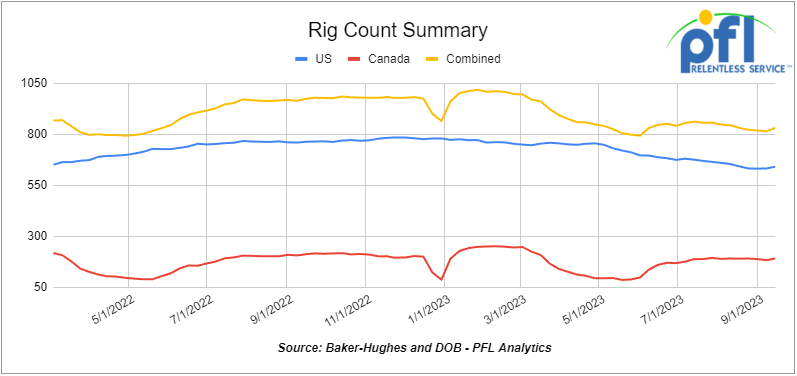

North American rig count was up by 17 rigs week-over-week. U.S. rig count was up by 9 rig week-over-week, but down by -122 rigs year-over-year. The U.S. currently has 641 active rigs. Canada’s rig count was up by 8 rigs week-over-week, but down by -21 rigs year over year. Canada’s overall rig count is 190 active rigs. Overall, year-over-year, we are down -143 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 26,171 from 26,087, which was a gain of +84 rail cars week-over-week. Canadian volumes were lower. CPKC’s shipments decreased by -7.9% week over week, and CN’s volumes were lower by -2.2% week-over-week. U.S. shipments were mixed. The BN had the largest percentage increase and was up by +7.3% week-over-week. The NS had the largest percentage decrease and was down by -14.7% week-over-week.

We are watching Energy

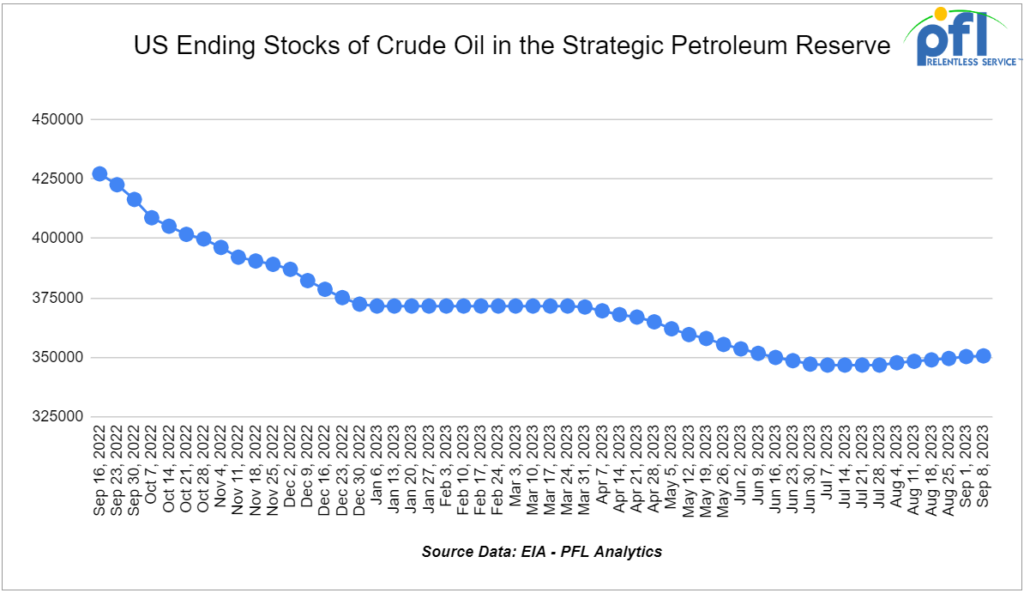

Global oil daily demand is projected to see a shortfall as OPEC+ continues its cuts. Demand will eclipse supply by 1.2 million barrels a day on average during the second half of 2023, the IEA said on Wednesday of last week. That projection comes on the back of a forecast from the Organization of Petroleum Exporting Countries that the fourth quarter may see the biggest deficit in over a decade. The U.S. Energy Information Administration predicts a more modest gap. We will wait and see. With the U.S. as a net importer of crude already, we are really price takers at this point and are getting squeezed. Hopefully, the White House does not get any bright ideas about selling off our crude reserves again – it did not work the first time as crude oil is now above the level in which the administration originally sold the crude for in an attempt to control prices. Despite announcing on several occasions that the crude sold off was going to be repurchased, that has not happened. As a refresh below is where we are sitting as it relates to the SPR (needle hasn’t moved):

On the flip side LPG’s and Natural gas production seems to be somewhat robust.

U.S. ethane production reached a new monthly record of 2.7 million barrels per day in April 2023, continuing the upward trend that started in 2013, according to data from the EIA. Increased natural gas and ethane production in the Permian Basin, which spans Texas and New Mexico, drove the increase.

Ethane, which serves mainly as a petrochemical feedstock, is recovered along with other natural gas plant liquids (NGPLs) at natural gas processing plants. As raw natural gas from wells is processed to meet natural gas pipeline specifications. Marketed natural gas production, which includes both dry natural gas and NGPLs before they are separated out, also set records this year. For the first half of the year, U.S. marketed natural gas production averaged 111 billion cubic feet per day, a record high. Increased natural gas production is important for rail as it increases to need for pressure cars to move around liquids such as propane, butane and ethane since all natural gas processing facilities lack pipeline capacity to move LPG’s to market rail is relied upon in a big way

LNG feedgas flows rebounded Friday as Freeport LNG ramped up flows following several days of reduced intake volumes at the Texas facility last week. Feedgas deliveries to the plant fell to less than 0.3 Bcf/d for September 10-13, implying that at least two, if not all three of its liquefaction trains, were offline for several days. The outage led to pipeline alerts on the Gulf South Pipeline, a feeder pipe to the facility, as well as canceled cargoes, according to news reports. As of Friday, the facility is back up and running to full rates.

We Are Watching the UAW Strike

Folks this is a strike where unfortunately no one wins and it should have not come to this point to begin with. Why did the strike happen? Well, it’s been brewing ever since the current administration entered the white house and implemented the Green New Deal.

You can’t blame the people who work for the Auto manufacturers who want a 37% pay increase over 4 years – why do they want this much of a pay increase? Because in the current environment, they cannot pay their bills – why can’t they? Because of inflation and rising energy prices. Energy prices lead to a rise in the price of everything that we touch because it takes energy to make everything we consume. Why are energy prices rising – because of the current administration’s war on big oil – canceling permits, canceling pipelines such as Keystone XL that would have provided America with 1 million barrels per day of cheap Canadian Crude Oil. They have even canceled or significantly delayed clean-burning natural gas pipelines.

Additionally, to pay for the Green New Deal we have to print more money that we don’t have – give companies and countries subsidies for technology that really isn’t even green! Do you think the mining of rare earth minerals with conventional energy to build solar panels is green? The troubling situation here is we don’t even mine the rare earth minerals here but China does! We are currently held hostage for oil now we are going to be held hostage for minerals. Wind farms as a whole are over-discussed. It’s a huge domino effect and here we are in.

From the car manufacturers standpoint, they have offered 20% pay increases over 4 years and Ford has claimed that transitioning from gasoline to electric cars that no one really wants to buy is costing them billions of dollars to do so and that wage increases of this magnitude will bankrupt them.

At the end of the day, hopefully, there will be a quick resolution as rail traffic is set to suffer. What we really need at the end of the day is a reversal on the Green New Deal now – don’t get us wrong we are all about the environment – recycling, carbon capture, and fuel efficiency are the low-hanging fruit. Heck, we would even support tree planting but let’s not bankrupt ourselves. One final thought – let’s say the Autoworkers get what they want. Get ready to pay more for a car – more inflation is coming. Failed government policies have caused this mess and that is all there is to it.

We have been extremely busy at PFL with return-on-lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs at 239-390-2885

Lease Bids

- 20-25, 30 or 31.8K Tanks needed off of in Texas for 1-5 Years. Cars are needed for use in VGO service. NC/NI

- 3, 30 or 31.8K Tanks needed off of in Texas for 1-5 Years. Cars are needed for use in Naphtha service. NC/NI

- 10-20, 30 or 31.8K Tanks needed off of in Texas for 1-2 Years. Cars are needed for use in Diesel service. NC/NI

- 1, 30 or 31.8K Tanks needed off of in Texas for 6-12 Months. Cars are needed for use in Mono-Propylene Glycol service. NC/NI

- 30-100, 31.8K CPC 1232 Tanks needed off of UP or BN in Texas for Purchase or Lease. Cars are needed for use in refined prodcuts service.

- 15, 30K 117 Tanks needed off of NS in SouthEast for 1 Year. Cars are needed for use in Diesel service.

- 25, 33K 340W Pressure Tanks needed off of UP or BN in Midwest for Oct-March. Cars are needed for use in Propane service.

- 20-25, 30K 117 Tanks needed off of UP or BN in Illinois for 5 Years. Cars are needed for use in Ethanol service.

- 100, 28.3K DOT 111/117 Tanks needed off of UP or BN in Midwest/Texas for 5 Years. Cars are needed for use in Veg Oils / Biodiesel service. Need to be Unlined

- 25-50, 33K 400W Pressure Tanks needed off of CN or CP in Canada for Short Term. Cars are needed for use in Propylene service.

- 50-100, 4550 Covered Hoppers needed off of UP or BN in Texas for 5 Years. Cars are needed for use in Grain service.

- 10, 33K 340W Pressure Tanks needed off of CN in LA for 1 Year. Cars are needed for use in Butane service.

- 25, 20.5K CPC1232 or 117J Tanks needed off of BNSF or UP in the west for 3-5 Year. Cars are needed for use in Magnesium chloride service. SDS onhand

- 25-50, 25.5K 117J Tanks needed off of NS CSX in NorthEast for 5 Years. Cars are needed for use in Asphalt / Heavy Fuel Oil service.

- 30-50, 33K 340W Pressure Tanks needed off of any class 1 in any location for 6-12 Months. Cars are needed for use in Propane service.

- 15, 28.3K 117J Tanks needed off of any class 1 in any location for 3 year. Cars are needed for use in Glycerin & Palm Oil service.

- 30, 17K-20K 117J Tanks needed off of UP or BN in Midwest/West Coast for 3-5 Years. Cars are needed for use in Caustic service.

- 10, 286K 15.7K Tanks needed off of KCS in Texas for 1 Year. Cars are needed for use in Sulfuric Acid service. Needed Next few months

- 150, 23.5K DOT 111 Tanks needed off of any class 1 in LA for 2-3 Year. Cars are needed for use in Fluid service. Needed July

- 25-50, 32K 340W Pressure Tanks needed off of NS or CSX in Marcellus for 1-2 Years. Cars are needed for use in Propane service.

- 25-50, 30K DOT 111, 117, CPC 1232 Tanks needed off of CN or CP in WI, Sarnia for 1-2 Years. Cars are needed for use in Diesel service.

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

- 70, 32K 340W Pressure Tanks needed off of CP or CN in Edmonton for 3 Years. Cars are needed for use in Propane service.

- 30-40, 286K DOT 113 Tanks needed off of CN or CP/ UP in Canada/MM for 5 Years. Cars are needed for use in CO2 service. Q1

- 30, 30K DOT 111 Tanks needed off of UP in Texas for 1-3 Years. Cars are needed for use in Diesel service.

- 5-7, 28.3K 117R Tanks needed off of NS or CSX in NC for 1 Year. Cars are needed for use in UCO service.

- 25-50, 5000CF-5100CF Lined Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in Dry sugar service. 3 bay gravity dump

- 10, any capacity Stainless Steel Tanks needed off of any class 1 in Canada for 5-10 years. Cars are needed for use in Alcohol service.

- 100, 33K 340W Pressure Tanks needed off of CN in Canada for 3-5 Years. Cars are needed for use in Propane service.

- Up to 60, 5150cf Covered Hoppers needed off of CN, CSX, NS in the east or midwest for 3 years. Cars are needed for use in Fertilizer service. 3-4 hatch gravity dumps

- 20-30, 14k Any Tanks needed off of BNSF, UP in Texas for 1-3 Years. Cars are needed for use in HCl service. Call for more details

Sales Bids

- 100, Plate F Boxcars needed off of BN or UP in Texas.

- 20, 2770 Mill Gondolas needed off of CSX in the northeast. Cars are needed for use in non-haz soil service. 52-60 ft

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 20, 2770-3400 Mill Gondolas needed off of any class 1 in South Texas. Cars are needed for use in scrap metal service.

- 8, 5200 Covered Hoppers needed off of various class 1s in various locations. Cars are needed for use in Plastic Pellet service.

- 10, 4000 Open Hoppers needed off of CSX in the northeast. Cars are needed for use in scrap metal service. Open top hopper

- 20-30, 3000 – 3300 PDs Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Sand service.

- 45, 3000 cf PD Hoppers needed off of any class 1 in Texas. Negotiable

- 200+, 5000cf Covered Hoppers needed off of any class 1 in various locations.

- 10, 6400 Open Hoppers needed off of CSX in the northeast. Cars are needed for use in wood chip service. Open top hopper, flat bottom

- 20, 17K DOT 111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 100, 15.7K DOT 111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT 111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

Lease Offers

- 70, 25.5K, 117J Tanks located off of UP in Texas. Cars are clean Call for more information

- 25, 25.5K, DOT111 Tanks located off of UP/KCS in Brownsville, TX. Cars were last used in Asphalt.

- 127, 28.3K, DOT111 Tanks located off of All Class 1s in St. Louis. Cars are clean

- 10, 28.3K, 117R Tanks located off of All Class 1s in St. Louis. Cars are clean

Sales Offers

- 100-200, 31.8K, CPC 1232 Tanks located off of BN in Chicago. Dirty/Clean

- 100, 28.3K, 117J Tanks located off of various class 1s in multiple locations.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|