“The art of life is not controlling what happens to us but using what happens to us”

– Gloria Steinem

Jobs Update

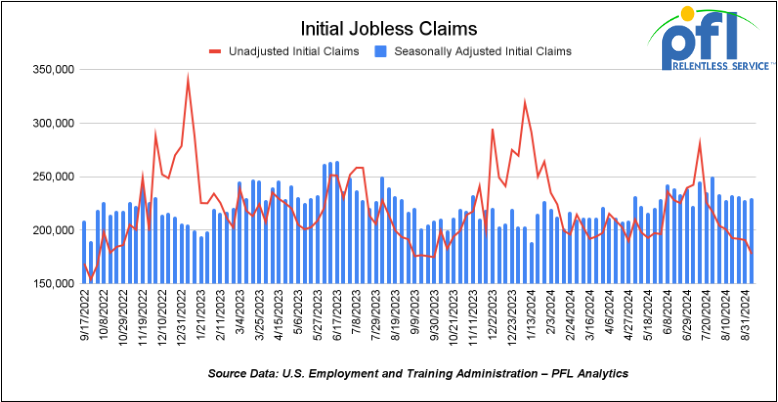

- Initial jobless claims seasonally adjusted for the week ending September 7th came in at 230,000, up 2,000 people week-over-week.

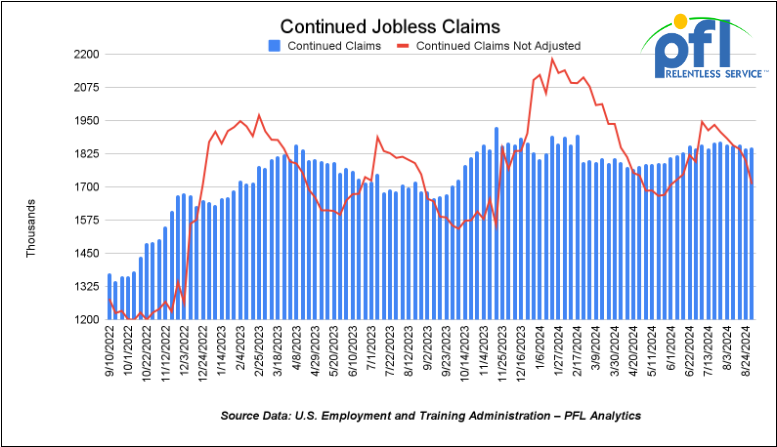

- Continuing jobless claims came in at 1.85 million people, versus the adjusted number of 1.845 million people from the week prior, up 5,000 people week-over-week.

Stocks closed higher on Friday of last week and higher week over week

The DOW closed higher, on Friday of last week up 297.01 points (0.72%) closing out the week at 41,393.78 up 1,048.37 points week-over-week. The S&P 500 closed higher on Friday of last week, up 30.26 points and closed out the week at 5,626.02 up 217.60 points week-over-week. The NASDAQ closed higher on Friday of last week, up 114.3 points (0.68%) and closed out the week at 17,683.98 up 993.15 points week over week.

In overnight trading, DOW futures traded higher and are expected to open at 41,515 this morning up 88 points.

Crude oil closed lower on Friday of last week, but higher week over week.

West Texas Intermediate (WTI) crude closed down -$0.32 per barrel (-0.5%) to close at $68.65 per barrel on Friday of last week, up $0.98 per barrel week over week. Brent traded down -$0.36 USD per barrel (-0.5%) on Friday of last week, to close at $71.61 per barrel up $0.55 per barrel week-over-week.

One Exchange WCS (Western Canadian Select) for October delivery settled Friday on last week at US$13.85 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$ 54.09 per barrel.

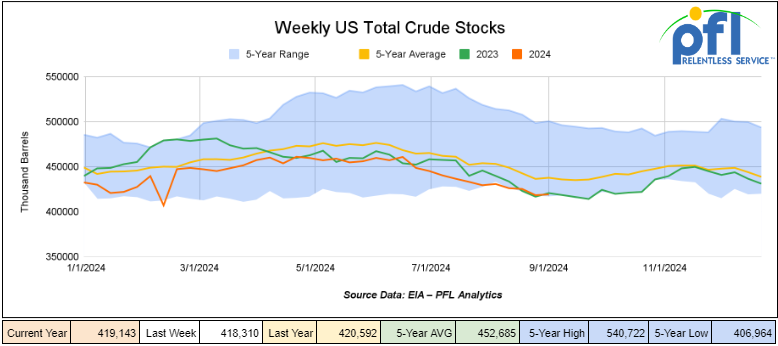

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 800,000 barrels week-over-week. At 419.1 million barrels, U.S. crude oil inventories are 4% below the five-year average for this time of year.

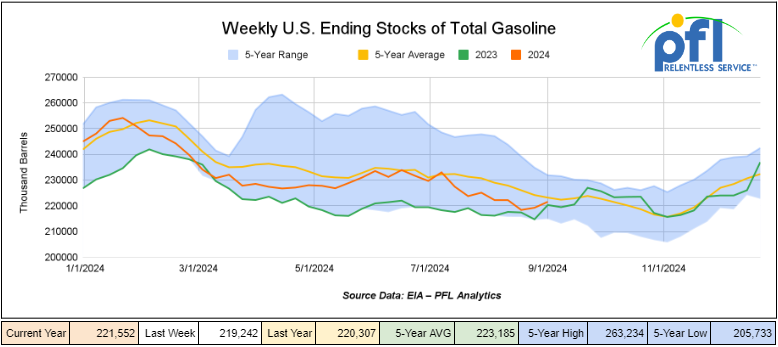

Total motor gasoline inventories increased by 2.3 million barrels week-over-week and are 1% below the five-year average for this time of year.

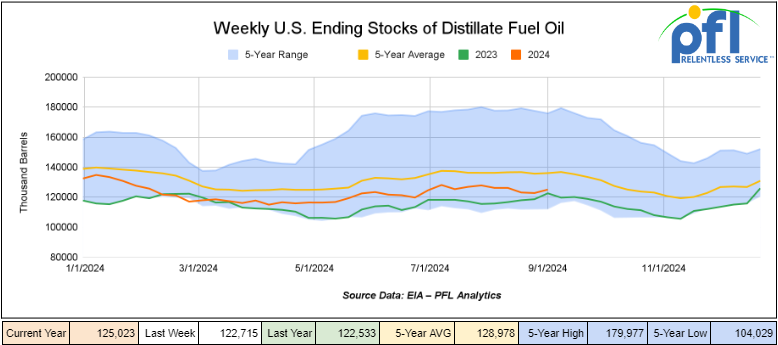

Distillate fuel inventories increased by 2.3 million barrels week-over-week and are about 8% below the five-year average for this time of year.

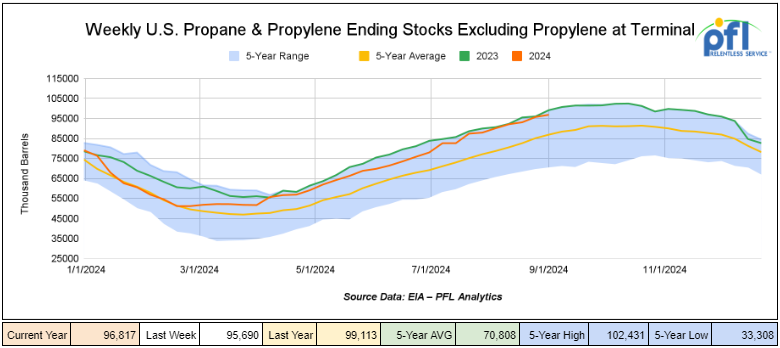

Propane/propylene inventories increased by 1.1 million barrels week-over-week and are 13% above the five-year average for this time of year.

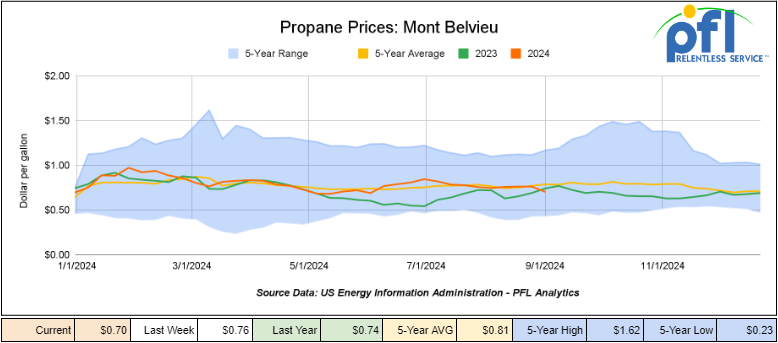

Propane prices closed at 70 cents per gallon on Friday of last week, down 6 cents week-over-week and down 4 cents per gallon year-over-year.

Overall, total commercial petroleum inventories increased by 9 million barrels week-over-week during the week ending September 6, 2024.

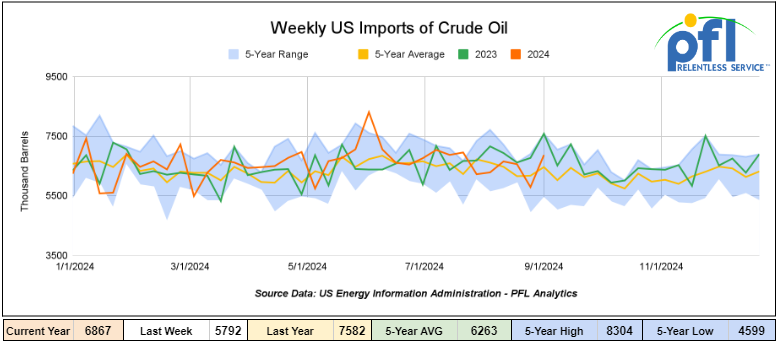

U.S. crude oil imports averaged 6.9 million barrels per day during the week ending September 6, 2024, an increase of 1.1 million barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.5 million barrels per day, 7.3% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 643,000 barrels per day, and distillate fuel imports averaged 201,000 barrels per day during the week ending September 6, 2024.

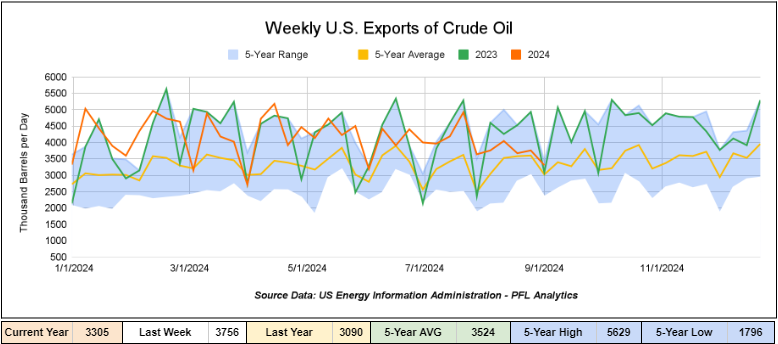

U.S. crude oil exports averaged 3.305 million barrels per day for the week ending September 6th, 2024, a decrease of -451,000 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 3.694 million barrels per day.

U.S. crude oil refinery inputs averaged 16.8 million barrels per day during the week ending September 6, 2024, which was 141,000 barrels per day less week-over-week.

WTI is poised to open at $68.99, up 34 cents per barrel from Friday’s close.

North American Rail Traffic

Week Ending September 11th, 2024.

Total North American weekly rail volumes were up (+5.86%) in week 37, compared with the same week last year. Total carloads for the week ending on September 11th were 344,262, up (1.38%) compared with the same week in 2023, while weekly intermodal volume was 319,427, up (+11.15%) compared to the same week in 2023. 7 of the AAR’s 11 major traffic categories posted year-over-year increases. The most significant decrease came from Motor Vehicles and Parts, which was down (-6.36%). The most significant increase came from Grain which was up (+26.86%).

In the East, CSX’s total volumes were up (+3.65%), with the largest decrease coming from Motor Vehicles and Parts (-10.95%) while the largest increase came from Grain (+22.71%). NS’s volumes were up (+6.56%), with the largest increase coming from Grain (+26.54%), while the largest decrease came from Metallic Ores and Metals (-3.72%).

In the West, BN’s total volumes were up (+11%), with the largest increase coming from Grain (+39.13%) while the largest decrease came from Forest Products down (-20.62%). UP’s total rail volumes were up (+7.26%) with the largest decrease coming from Forest Products, down (-10.92%), while the largest increase came from Grain which was up (+31.67%).

In Canada, CN’s total rail volumes were down (-2.78%) with the largest decrease coming from Metallic Ores and Metals, down (-9.32%) while the largest increase came from Nonmetallic Minerals, up (+25.19%). CP’s total rail volumes were down (-7.01%) with the largest increase coming from Coal (+54.01%), while the largest decrease came from Intermodal, down (-32.16%). KCS’s total rail volumes were down (-9.19%) with the largest decrease coming from Coal (-29.88%) and the largest increase coming from Motor Vehicles and Parts (+34.99%).

Source Data: AAR – PFL Analytics

Rig Count

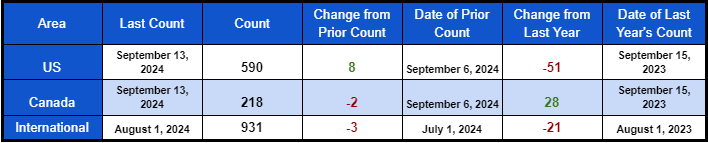

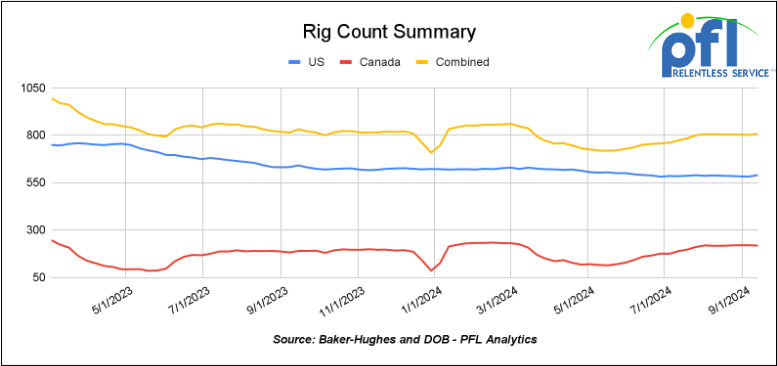

North American rig count was up by 6 rigs week-over-week. The U.S. rig count was up by 8 rigs week-over-week, and down by -51 rigs year-over-year. The U.S. currently has 590 active rigs. Canada’s rig count was down -2 rigs week-over-week, and up by 28 rigs year-over-year and Canada’s overall rig count is 218 active rigs. Overall, year over year we are down -23 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 28,122 from 28,000, which was a gain of 122 rail cars week-over-week. Canadian volumes were higher. CPKC’s shipments fell by -7.1% week over week and CN’s volumes were lower by -7.2% week-over-week. U.S. shipments were mixed The CSX had the largest percentage decrease and was down by -6.2%. The UP had the largest percentage increase and was up by +1.5%

We are watching Hurricane Francine and its impact in the Gulf

According to The Bureau of Safety and Environmental Enforcement (“BSEE”), based on data from offshore operator reports submitted on Wednesday of last week (peak shut-in), personnel were evacuated from a total of 171 production platforms, 46% of the 371 manned platforms in the Gulf of Mexico. Production platforms are the offshore structures from which oil and natural gas are produced and transported to shore. By Saturday, personnel remained evacuated from 52 production platforms, 14% of the 371 manned platforms in the Gulf of Mexico.

Personnel were evacuated from 3 non-dynamically positioned (DP) rig(s), equivalent to 60% of the 5 rigs of this type currently operating in the Gulf. Rigs can include several types of offshore drilling facilities including jackup rigs, platform rigs, all submersibles, and moored semisubmersibles. By Saturday all personnel were restored back to the rigs.

As part of the evacuation process, personnel activate the applicable shut-in procedure, which can frequently be accomplished from a remote location. This involves closing safety valves located below the surface of the ocean floor to prevent the release of oil or gas, effectively shutting in production from wells in the Gulf, and protecting the marine and coastal environments. Shutting in oil and gas production is a standard procedure conducted by industry for safety and environmental reasons.

From operator reports, BSEE estimated that approximately 38.56% (roughly 760,00 barrels of oil per day) of the current oil production and 48.77% of the current natural gas production in the Gulf of Mexico was shut-in (roughly 1 bcf per day). The production percentages are calculated using information submitted by offshore operators in daily reports. Shut-in production information included in these reports is based on the amount of oil and gas the operator expected to produce that day. The shut-in production figures therefore are estimates, which BSEE compares to historical production reports to ensure the estimates follow a logical pattern. See below, the interesting overlay where Hurricane Francine’s hurricane-force winds were plotted by BSEE over the gulf production platforms – the hurricane-force wind data was provided to BSEE by the National Hurricane Center.

Production Platforms in the Gulf and Hurricane Francine Hurricane Force Winds

Source Data: BSEE – PFL Analytics

We are the U.S. Department of Energy

Another week goes by and more government spending on the Green New Deal – it almost seems unstoppable at this point as we continue to spend money that we don’t have. The U.S. Department of Energy’s (DOE) Office of Fossil Energy and Carbon Management (FECM) announced on Friday of last week that up to $15 million in federal funding to support research and development (R&D) projects that help reduce methane emissions and “other and harmful environmental impacts from undocumented orphaned oil and natural gas wells” the DOE said in a press release. “The focus is on projects that advance cost-effective technologies toward commercialization that address characterization, advanced remediation techniques, and long-term monitoring of undocumented orphaned wells.” The DOE claims that “These technology innovations will help to further the Biden-Harris Administration’s goal to cut methane emissions by 30% compared with 2020 levels by 2030.”

North America’s Continued Labor Disputes Supply Chains and Rail Could be Disrupted Yet Again

In Canada, weeks after the Canadian Government ordered the CN and CPKC back to work, legal battles are still looming. The Teamsters filed four separate challenges on Thursday August 29th in the Canadian Federal Court of Appeal challenging the labor minister’s order for binding arbitration and the Canada Industrial Relations Board (“CIRB”) decision to stop the lockout and work stoppage for CN and CPKC. There are two challenges for each railroad. Now, workers at the port of Vancouver are threatening to strike. The Port of Vancouver is Canada’s largest port for exporting commodities. If a strike does occur rail traffic could be diverted to other Ports in Canada and the U.S, but rest assured rail traffic would be significantly impacted.

Also, Air Canada’s pilots almost went on strike before cutting a last-minute deal yesterday that would have halted all air cargo shipments on Thursday of this week. The airline was finalizing contingency plans for a phased shutdown of most operations, including passenger traffic.

Here in the U.S., firefighters are leaving their positions. Federal firefighters say their employer is exacerbating exhaustion by misclassifying their jobs. In an extremely critical letter sent to top officials at the U.S. Forest Service and the United States Department of Agriculture, the National Federation of Federal Employees, the union that represents federal wildland firefighters, accused the agency of decades of wage theft and job misclassification.

The issue is among many – from a stalled pay raise to short staffing and escalating job hazards – that have contributed to severe burnout and struggles with recruitment and retention, just as fires become more difficult and dangerous to fight.

We have problems with our east coast ports here in the U.S. The International Longshoremen’s Association (ILA) is prepared to initiate an East Coast work stoppage at the ports that would essentially range from the Canadian border down to and including the Gulf Coast. After two days of meetings, the largest longshoremen’s union on the continent ended up with a unanimous vote to approve a strike beginning October 1 if their demands for a new contract aren’t met.

If a strike were to happen, it would have a catastrophic effect on the overall U.S. economy, experts say. If the affected ports were to close, it would impact 43% of U.S. imports. The ports account for $3.7 billion per day.

As things stand now, the two sides don’t appear close to bridging the gap in negotiations, as the port owners, represented by the United States Maritime Alliance, suggest that the ILA is operating as though a strike is forthcoming. An obvious significant impact to rail – let’s hope this one is averted.

Labor unrest seems to be everywhere folks, inflation has hit the middle class hard. The problem is that as wages go up businesses will shutter in some instances, and the price of everyday goods and services will continue to rise. It is not a good situation we seem to be in.

We continue to watch Key Economic Indicators

The Producer Price Index

The Producer Price Index (PPI) for final demand rose by 0.2% in August. Prices for final demand services saw a 0.4% increase, while the index for final demand goods remained unchanged. Over the 12 months ending in August, final demand prices increased by 1.7%.

Lease Bids

- 10, 3250 thru hatch Hoppers needed off of BNSF in TX IL for 5 years. Cars are needed for use in Agg service.

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 20, 25.5k CPC 1232 Tanks needed off of UP or BN in OK, TX for 3 Year. Cars are needed for use in Asphalt service.

- 100, 25.5K DOT 111 Tanks needed off of Any Class 1 in Texas for 3 Years +. Cars are needed for use in Asphalt service.

- 25-30, 23.5K or 25.5K Dot 111 or CPC 1232 Tanks needed off of UP or BN in TX, OK, or AR for 3-5 Years. Cars are needed for use in Asphalt service. Needed ASAP., Lined or Unlined. Splash Load

- 50, 23.5-25.5 DOT111 Tank s needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

- 30, 17K-20K DOT117J Tanks needed off of UP or BN in Midwest/West Coast for 3-5 years. Cars are needed for use in Caustic service.

- 8, 28-30K any type Tanks needed off of UP BN in Texas and Gulf for 5 years. Cars are needed for use in Chlorobenzene service. must be lined with plasite 3070

- 250, 4000 Rapid Hoppers needed off of BNSF in TX IL for 5 years. Cars are needed for use in Coal service. in rotary/rapid cars with the electric dumping shoe

- 50, 30K 117 Tanks needed off of BNSF or UP in TX for 3-6 Months. Cars are needed for use in Crude service. will look at smaller cars. Prefer short term would look at longer term. Domestic use only

- 200, 30K any type Tanks needed off of UP or BN in Texas for RD. Cars are needed for use in Dirty service.

- 10, 5250 Covered Hoppers needed off of UP or BN in Midwest for up to 5 years. Cars are needed for use in Dry Edible Beans service.

- 25-50, 5000CF-5100CF Covered Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in Dry sugar service. 3 bay gravity dump, Hempel 37700

- 10, 25.5 117J Tanks needed off of All class ones in Chicago for 1 Year. Cars are needed for use in Epoxy Resin service. 5 years

- 20, 4750’s Through Hatch Covered Hoppers needed off of UP BN in USA West for 3 years. Cars are needed for use in Fertilizer service.

- 150, 23.5K DOT111 Tanks needed off of any class 1 in LA for 2-3 years. Cars are needed for use in Fluid service. Needed July

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 10, 30k any type Tanks needed off of UP BN in Texas for 1 year plus. Cars are needed for use in Fuel Oil service.

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

- 15, 28.3K DOT117J Tanks needed off of any class 1 in any location for 3 years. Cars are needed for use in Glycerin & Palm Oil service.

- 30-50, 23.5K Any Type Tanks needed off of any class 1 in any location for 1-5Years. Cars are needed for use in Glycols service.

- 25, 25.5K DOT 111 Tanks needed off of UP in LA for 1-5 Years. Cars are needed for use in Lubricant service.

- 25, 20.5K CPC1232 or DOT117J Tanks needed off of BNSF or UP in the west for 3-5 years. Cars are needed for use in Magnesium chloride service. SDS onhand

- 100, 15.5K DOT 111 Tanks needed off of Any Class 1 in USA for 1-3 Years. Cars are needed for use in Molten Sulfur service.

- 30, 4750-5200 Covered Hoppers needed off of BN or UP in Lake Charles, LA for 5 Years. Cars are needed for use in Pet Coke service.

- 100, 5200 Covered Hoppers needed off of UP or BN in Northwest for 6 month. Cars are needed for use in Pet Coke service. Roud Hatch, Bottom Outlet Doors

- 15-20, 29K 117R Tanks needed off of NS or CSX in Ohio for 6-12 Months. Cars are needed for use in Ply Oil service.

- 4, 6260 Covered Hoppers needed off of CSX in Bostick, NC for 2-4 Years. Cars are needed for use in Polypropene Pellets service.

- 10, 25.5K-28.3K DOT 111 Tanks needed off of UP or BN in Houston for 2 Year. Cars are needed for use in Resin service.

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

- 14, 23.5K DOT111 Tanks needed off of UP in Morrilton, AR for 1 year. Cars are needed for use in Turpentine service.

Sales Bids

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Cement service. Cement Gates needed.

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 20-30, 3000 – 3300 PD Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 2-4, 28K DOT111 Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

- 100, 15.7K DOT111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

- 5, 30K DOT 111 Tanks needed off of in US. Cars are needed for use in Fuels service.

- 4, 25.5K DOT 111 Tanks needed off of any class 1 in Texas. Negotiable

- 10, 30K DOT 111 Tanks needed off of any class 1 in Texas. Cars are needed for use in UCO service. Negotiable

- 10, 5600CF PD Hoppers needed off of any class 1 in Texas.

- 50, 4750CF Covered Hoppers needed off of any class 1 in Texas. Cars are needed for use in Grain service.

Lease Offers

- 50, 5400, Covered Hoppers located off of NS, IORY in MI. Cars were last used in bean meal. 1 year+

- 45, 33K, 340W Pressure Tanks located off of All Class Ones in North America. Cars were last used in Propane/Butane. Free move on CN or CP

- 50, 30K, DOT 117J Tanks located off of BN in Texas. Cars were last used in Ethanol. 1-2 Year Term.

Sales Offers

- 24, 5300CF, Plate C Boxcars located off of NS or CSX in Southeast.

- 100-300, 3400, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 19, 4400, Rotary Gondolas located off of UP and BN in California and Wyoming.

- 150, 28.3K, DOT117J Tanks located off of various class 1s in multiple locations. Will take 90K

- 300, 31.8K, CPC 1232 Tanks located off of BN in Texas.

- 7, 30K, DOT-111 Tanks located off of UP in CA and TX.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|

PFL will be at the Following Conferences

- Where: La Quinta, CA

- Attending: David Cohen (954-729-4774)

- Conference Website

- Where: Hyatt Regency Dallas in Dallas, TX

- Attending:Curtis Chandler (239.405.3365), David Cohen (954-729-4774), Brian Baker (239.297.4519), Cyndi Popov(403) 402-5043

- Conference Website