“More business is lost every year through neglect than through any other cause”

– Rose Kennedy

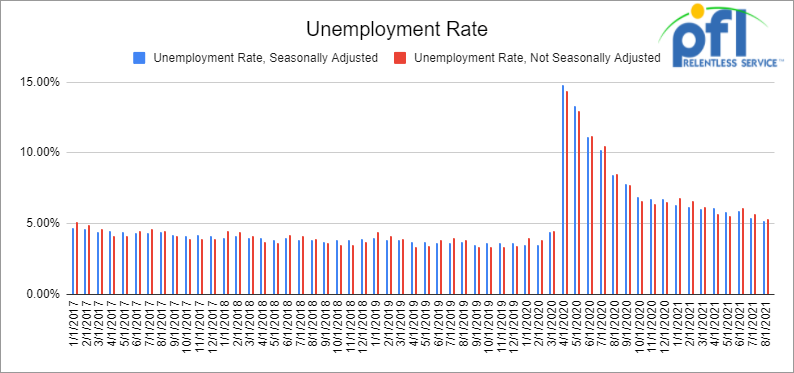

Jobs Update

Weekly jobless claims are down week over week, but remain elevated.

- Initial jobless claims for the week ending September 4th came in at 310,000, down 35,000 people week over week.

- Continuing claims came in at 2.783 million people versus the adjusted number of 2.805 million people from the week prior, down 22,000 people week over week.

Stocks closed lower on Friday of last week and are down week over week

The DOW closed lower on Friday of last week down -271.66 points (-0.78%) closing out the week at 34,607.72 points, down -761.37 points week over week. The S&P 500 closed lower on Friday of last week, down -34.7 points and closing out the week at 4,458.58, down -76.85 points week over week. The Nasdaq closed lower on Friday of last week, down -132.76 points(- 0.87%) and closed out the week at 15,115.49 down -248.03 points week over week.

In overnight trading, DOW futures traded higher and are expected to open up this morning 20.50 points.

Oil closed higher on Friday of last week and are up week over week

Oil gained for a third week in a row as investors focused on shut-in production – more than a million barrels a day of U.S. offshore crude production remained shut in as of Friday of last week after Ida swept through the area nearly two weeks ago. Meanwhile, more Louisiana refineries are resuming operations, raising demand for crude oil. West Texas Intermediate (WTI) for October delivery rose +$1.58 a barrel to settle at $69.72 a barrel on Friday of last week, up +43 cents a barrel week over week. Brent crude oil settled up +$1.54 a barrel on Friday of last week closing at $72.99 a barrel, up +38 cents a barrel week over week.

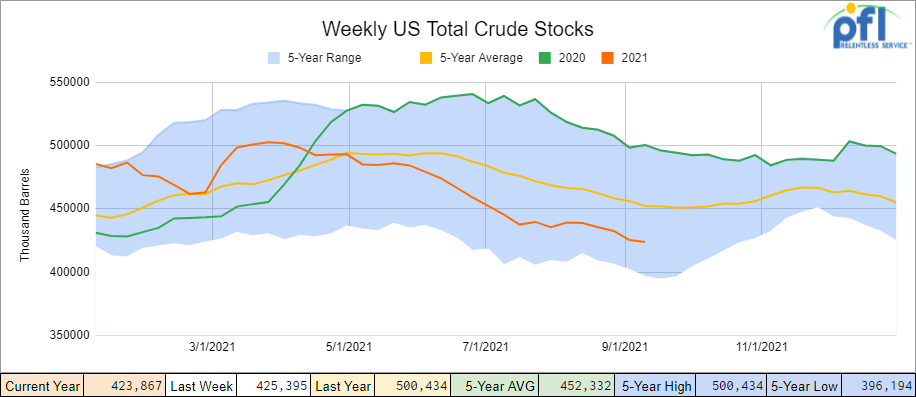

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 1.5 million barrels from the previous week. At 423.9 million barrels, U.S. crude oil inventories are about 6% below the five year average for this time of year.

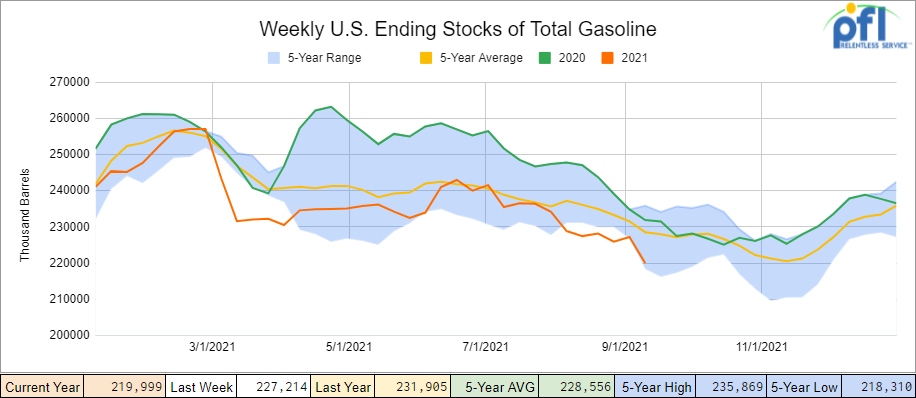

Total motor gasoline inventories decreased by -7.2 million barrels last week and are about -4% below the five year average for this time of year. Finished gasoline and blending components inventories both decreased last week.

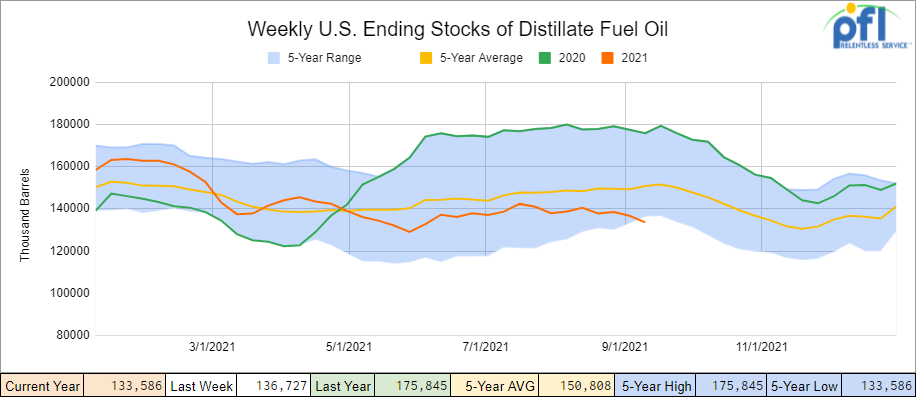

Distillate fuel inventories decreased by 3.1 million barrels last week and are about 12% below the five year average for this time of year.

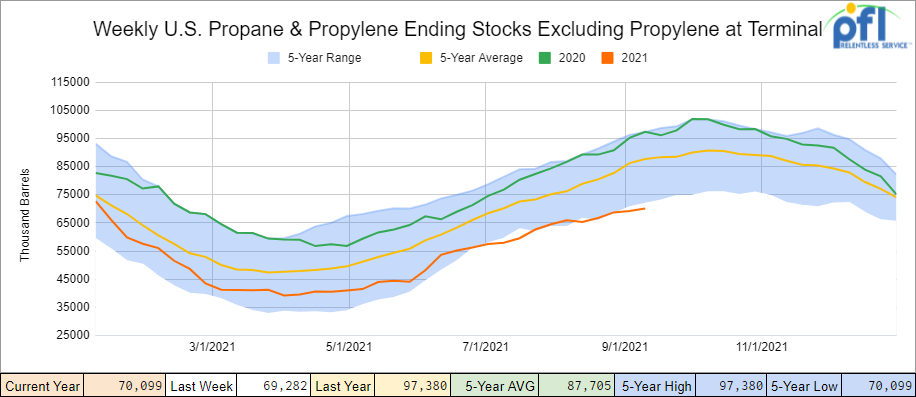

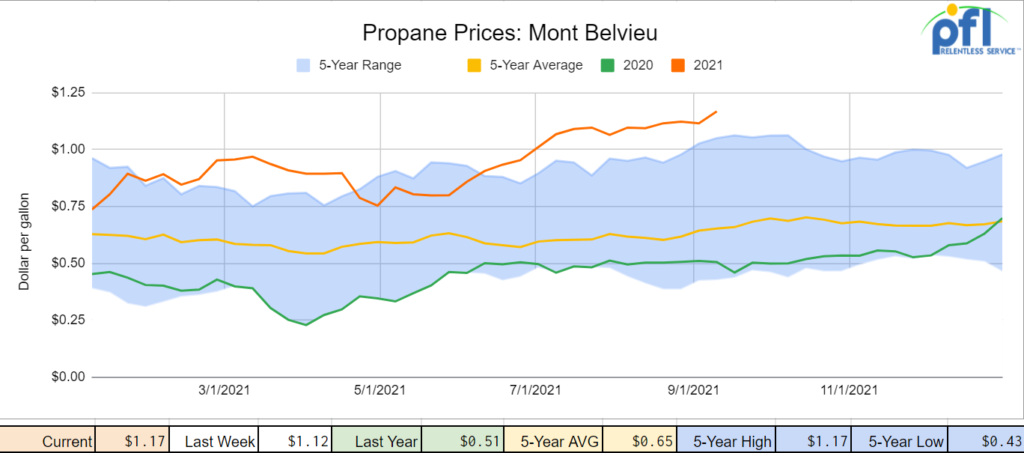

Propane/propylene inventories increased by 0.8 million barrels last week and are about 20% below the five year average for this time of year.

Folks, propane inventories remain very low as Asia continues to suck whatever volume that can out of the U.S. We are now at record low numbers going into the crop drying season and winter is just right around the corner and prices continue to rise to levels not seen in seven years. Storage is down nearly -27 million barrels year over year and prices closed last week at $1.17 per gallon up +5 cents a gallon week over week and up +66 cents a gallon year over year.

Overall total commercial petroleum inventories decreased by 10.4 million barrels last week.

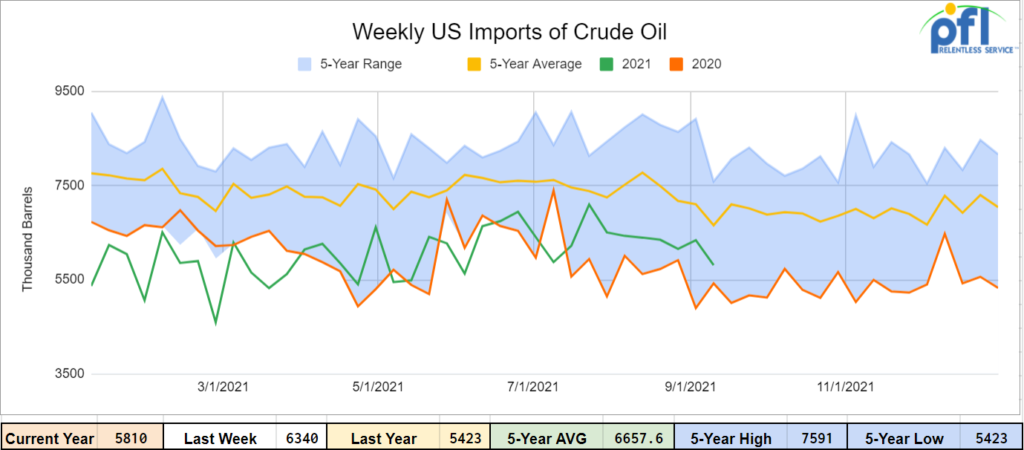

U.S. crude oil imports averaged 5.8 million barrels per day last week, decreased by 0.5 million barrels per day from the previous week. Over the past four weeks, crude oil imports averaged about 6.2 million barrels per day, 12.2% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) last week averaged 899,000 barrels per day, and distillate fuel imports averaged 142,000 barrels per day.

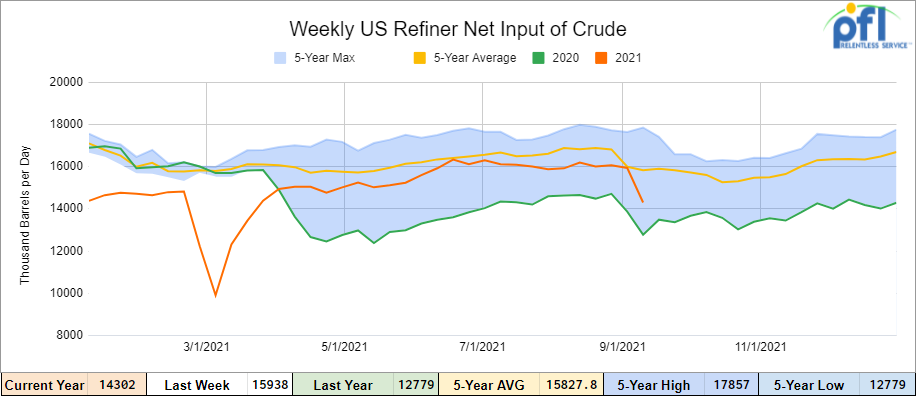

U.S. crude oil refinery inputs averaged 14.3 million barrels per day during the week ending September 3, 2021 which was 1.6 million barrels per day less than the previous week’s average. Refineries operated at 81.9% of their operable capacity last week. Gasoline production increased last week, averaging 10.1 million barrels per day. Distillate fuel production decreased last week, averaging 4.2 million barrels per day

As of the writing of this report, WTI is poised to open higher at $70.40, up 69 cents per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were down 3.5% year over year in week 35 (U.S. -3.0%, Canada -4.8%, Mexico -4.7%) resulting in quarter to date volumes that are up 0.7% year over year and year to date volumes that are up 9.2% year over year (U.S. +10.3%, Canada +6.3%, Mexico +6.1%). 5 of the AAR’s 11 major traffic categories posted year over year decreases with the largest declines coming from intermodal (-6.8%) and grain (-25.8%). The largest increases came from coal (+13.1%) and metallic ores & metals (+15.1%).

In the East, CSX’s total volumes were down 2.6%, with the largest decreases coming from motor vehicles & parts (-35.6%) and chemicals (-20.9%). The largest increase came from coal (+19.2%). NS’s total volumes were down 8.7%, with the largest decrease coming from intermodal (-12.0%). The largest increase came from metals & products (+25.0%).

In the West, BN’s total volumes were up 1.0%, with the largest increases coming from coal (+13.9%) and stone sand & gravel (+64.2%). The largest decrease came from grain (-37.3%). UP’s total volumes were down 3.7%, with the largest decreases coming from intermodal (-7.6%) and motor vehicles & parts (-35.4%). The largest increase came from chemicals (+8.9%).

In Canada, CN’s total volumes were down 7.0%, with the largest decrease coming from intermodal (-10.3%). The largest increase came from coal (+96.7%). RTMs were down 6.7%. CP’s total volumes were up 5.3%, with the largest increase coming from intermodal (+17.7%). The largest decreases came from farm products (-50.8%), motor vehicles & parts (-49.8%) and grain (-22.3%). RTMs were up 0.1%.

KS’s total volumes were down 6.0%, with the largest decrease coming from intermodal (-19.0%).

Source: Stephens

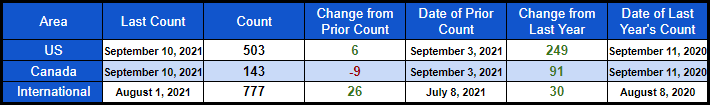

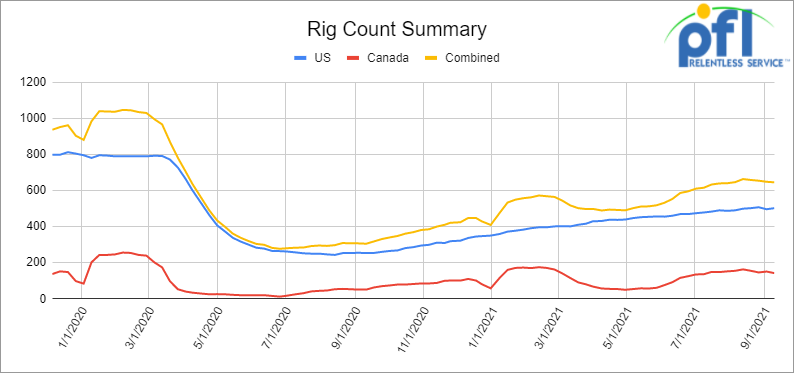

Rig Count

North American rig count is down by 3 rigs week over week. The U.S. rig count was up by 6 rigs week over week and up by 249 rigs year over year. The U.S. currently has 503 active rigs. Canada’s rig count was down by 9 rigs week over week, and up by 91 rigs year over year and Canada’s overall rig count is 143 active rigs. Overall, year over year we are up 340 rigs collectively.

North American Rig Count Summary

A few things we are keeping an eye on:

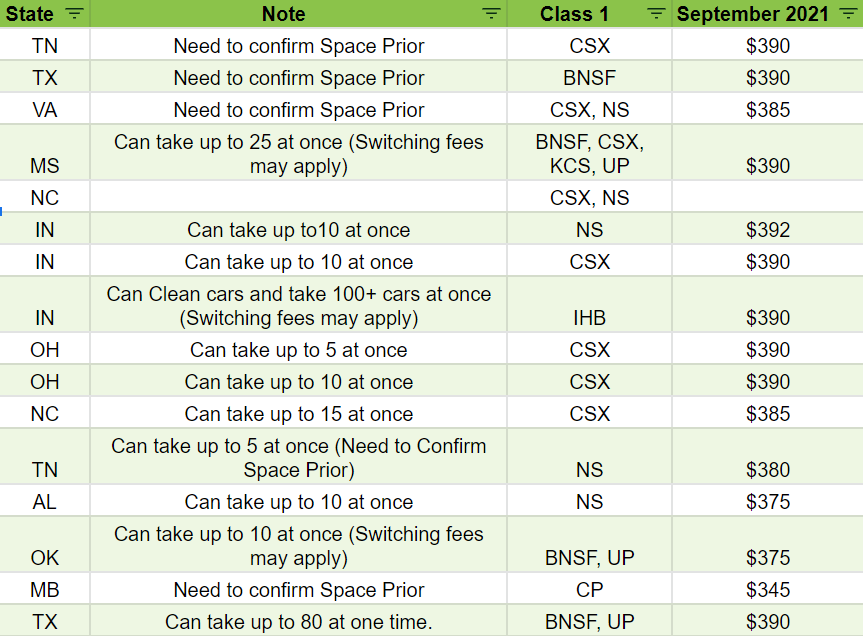

Scrap Pricing

Scrap prices are down again in September falling another 5 percent month over month. There are several reasons for the drop, but one of the biggest reasons is there is just simply too much backlog of scrap. With the high pricing the past several months, there has been a huge rush to scrap distressed or unwanted assets. Mills are not able to process steel as quickly as it is coming in. Analysts are expecting the market to go back up once mills are able to get caught back up on processing in the month of September. This means that this is the best time to start positioning or reserving space for distressed railcars.

PFL is proud to offer the below options for delivered scrap across North America. Our goal is to maximize your return and minimize your costs. If your railcar is unable to move, we do also offer mobile scrapping across the country. Call PFL today with any of your scrapping needs.

Petroleum by Rail

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 25,162 from 25,248 a loss of 86 rail cars week over week. Canadian volumes were mixed – CP shipments were up by 5.0% and CN shipments were down by 4.3%. U.S. volumes were lower across the board due to operational issues from Hurricane Ida with the NS had the largest percentage decrease down by 15.7%.

The Aftermath of Hurricane Ida

The good news is that infrastructure at the nation’s refineries for the most part seem to be intact and some are now operating at normal levels and others expected to come online this week, however, according to media reports Phillips 66 may idle its New Orleans-based Alliance refinery as the damage sustained by Hurricane Ida might be too costly to repair. The 250,000 barrel per day refinery was shut down on August 28 ahead of the arrival of Ida, Phillips will complete a damage assessment this week, according to sources. This incident may complicate the potential sale of the site previously announced by Phillips. The main problem at this point seems to be crude availability to refineries. Hurricane Ida knocked out many smaller shallower platforms and it may drag on for a while. Exxon has had to borrow over 3.3 million barrels of oil from the SPR , Shell has declared force majeure on numerous crude delivery contracts and said that 80% of its gulf coast production remains offline. The DOE continues to coordinate with industry, interagency, and state partners to support the response to Ida. A similar situation occurred in 2017 when Hurricane Harvey made landfall on the night of August 25, which was a Category 4 storm—the strongest hurricane to impact Texas in more than 50 years. The impacts of Hurricane Harvey were widespread. And at one point, much of the Gulf region’s oil refining capability was shut down, resulting in fuel shortages. Following the hurricane, Secretary of Energy Rick Perry authorized the Strategic Petroleum Reserve (SPR) to establish exchange agreements with affected refiners who requested emergency crude from the Reserve. Though Hurricane Harvey prompted the evacuation of some SPR personnel, the Reserve continued to operate under emergency conditions and supplied much-needed oil to refiners. By September 28, a total of 5.2 million barrels of oil from the SPR had been delivered to Gulf Coast refineries, helping to continue their processing operations and prevent further supply disruptions.

Enbridge Line 3

Well folks, we could see this pipeline come on line in just 2 days. Line 3 replacement will add 390,000 barrels per day of crude oil takeaway capacity from Alberta to the United States. An obvious headwind for crude by rail out of Canada. Stay tuned to PFL for further information.

Trans Mountain Pipeline

Trans Mountain pipeline in their quarterly earnings gave construction guidance on its expansion. The expansion project construction reached approximately 30% completion as of the end of the second quarter ending June 30th and inclusive of pre-construction activities we exceeded 50% overall project progress. Significant progress has been reached at our facilities and terminal locations, which are between 35% and 45% complete. Many key activities, including the Burnaby Mountain Tunnel boring, are underway and progressing,” said Ian Anderson President and CEO. “The progress on the pipeline work faced some challenges with environmental conditions including extreme heat and wildfire hazards, however we were pleased to hit a key milestone of 200 kilometres of new pipe in the ground in July. We look forward to a busy summer and fall of pipelining along the entire route.” As of June 30, 2021, a total of 13,640 people have been hired for the Expansion Project, of which 1,470 (or more than 10%) were Indigenous, with approximately 9,400 people actively working on the Project in hundreds of communities across B.C and Alberta. Since the Project’s inception, $8.4 billion in capital spending has been incurred to the end of the second quarter in 2021, including a total of $1.3 billion and $2.3 billion for the three and six months ended June 30, 2021, respectively. Spending to-date on the Expansion Project also includes pre-construction costs of permitting, regulatory processes, legal matters, materials such as pipe, valves, buildings, and motors, and financing costs. Trans Mountain anticipates mechanical completion of the Project by the end of 2022, with commercial operations commencing soon thereafter.

China is releasing crude oil

China is releasing Crude oil from its strategic petroleum reserves – In a statement on Thursday of last week, the National Food and Strategic Reserves Administration said the country had tapped its giant oil reserves to “to ease the pressure of rising raw material prices.” It didn’t offer further details, but people familiar with the matter said the statement referred to millions of barrels the government offered in mid-July. The announcement comes amid surging energy costs in China, not just for oil but also for coal, LPG and natural gas. Electricity shortages are occurring in some provinces and have forced some factories to cut production. Inflation is rapidly rising as it is here in the U.S., apparently a political headache for Beijing.

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Railcar Markets

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 70, 5150 Covered Hoppers needed in the Midwest for 3 Month starting October. Any class one

- 100, 5800 Covered Hoppers 286 can be West or East for Plastic 3-5 years

- 50-100, 4750 Covered Hoppers needed for Pet-coke. Can take in the South.

- 70, 117R or J needed for Ethanol for 3 years. Can take in the South.

- 30, 25.5’s or greater food grade Kosher veg oil cars for 6-12 months

- 90-100, 28.3K C/I Tank Cars needed for Biodiesel in the Midwest for 1 Year.

- 50, 6500+ cu-ft Mill Gon or Open Top Hopper for wood chips in the Southeast for 5 Years.

- 25 bulkhead flats 286 any class one for up to 5 years Negotiable

- 10 open top hoppers 2400 C FT in Texas needed for stone on the UP 3-5 years

- 20, 19,000 Gal Stainless cars in Louisiana UP for nitric acid 1-3 years – Oct negotiable

- 10, 6,300CF or greater covered hoppers needed in the Midwest.

- 15-25, 20K 23.5K cars for Oct Slurry needed in the South for 1 Year

- 2, 89’ Flat cars for purchase or lease – needed in TX off the BNSF

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js – Selection is Dwindling. Call Today!

- 200 Clean C/I 25.5K 117J in Texas. Brand New Cars!

- 34 Clean C/I 25.5K CPC 1232’s located in PA.

- 200 117Js 29K OK and TX Clean and brand new – Lined- lease negotiable

- 100 117Rs dirty last in Gasoline in Texas for lease Negotiable

- 20 117R 30K plus tanks for ethanol in Wisconsin off the CN Negotiable

- 90 117Rs 30K located in Alberta CN or CP Refined Products Dirty – negotiable

- 37 BRAND NEW 5161 Sugar Hoppers in Arkansas UP – negotiable

- 99 340W Pressure Cars various locations Butane and Propane dirty negotiable

- 100 73 ft 286 GRL riser less deck, center part for sale,

- 19 auto-max II automobile carrier racks – tri-49 for sale – negotiable

- 10 food grade stainless steel cars

- 20 20K Stainless cars in 3 locations in the south – negotiable

- 30 CPC 1232 25.5K C/I Pennsylvania NS clean negotiable

- 100-150 29K C/I 117J cars for lease. Dirty in Bakken crude and can be returned dirty.

- 100 29K C/I 1232 cars for lease. Dirty in Heavy Crude and can be returned dirty.

- 100 117Rs 29K clean last used in crude Washington State – price negotiable sale or lease

- 21 111s 29K tanks last in alcohol dirty on the CN in Wisconsin for lease price negotiable

- 100 111s of various volumes and locations last in fuel oil dirty price negotiable

- Various Hoppers for sale and lease 3000-5800 CF 263 and 286 multiple locations negotiable

- 45 Boxcars 60ft Plate F’s Located in Tenn CSX – Lease Negotiable

- 28 20K Veg oil cars for lease in Arkansas – Negotiable

- 100 3200 Covered Hoppers for sale price negotiable

- 100 Center beam Flats with risers 73ft in SD and Iowa for sale negotiable

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|