“Terrorist attacks can shake the foundations of our biggest buildings, but they cannot touch the foundation of America. These acts shatter steel, but they cannot dent the steel of American resolve.”

– George W. Bush

Jobs Update

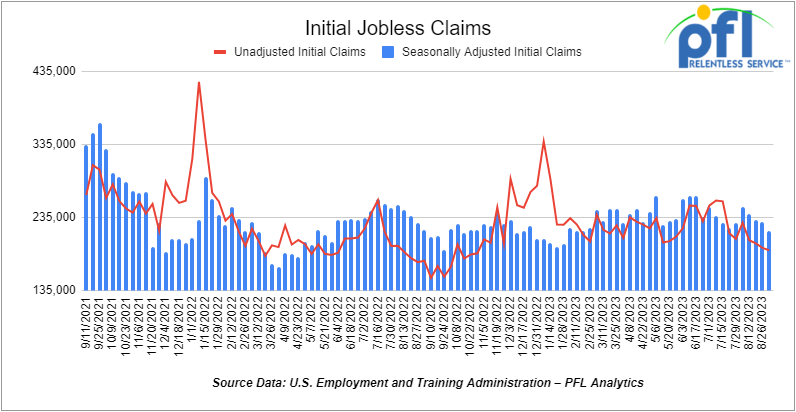

- Initial jobless claims for the week ending September 2nd, 2023 came in at 216,000, down -13,000 people week-over-week.

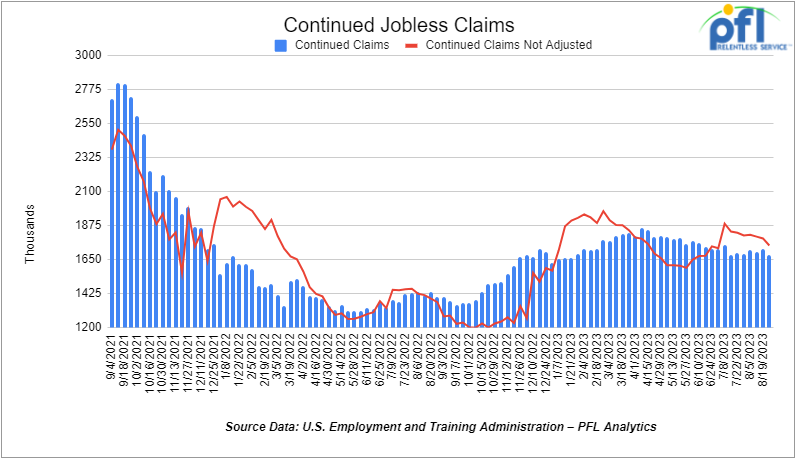

- Continuing jobless claims came in at 1.679 million people, versus the adjusted number of 1.719 million people from the week prior, down -40,000 people week-over-week.

Stocks closed higher on Friday of last week, but lower week over week

The DOW closed higher on Friday of last week, up 75.86 points (+0.22%), closing out the week at 34,576.59, down -261.12 points week-over-week. The S&P 500 closed higher on Friday of last week, up 6.35 points (+0.14%), and closed out the week at 4,457.49, down -58.28 points week-over-week. The NASDAQ closed higher on Friday of last week, up 12.69 points (+0.09%), and closed the week at 13,761.53, down -270.28 points week-over-week.

In overnight trading, DOW futures traded higher and are expected to open at 34,682 this morning up 74 points.

Crude oil closed higher on Friday of last week and up week over week

WTI traded up $0.64 per barrel (+0.7%) to close at $87.51 per barrel on Friday of last week up $2.49 per barrel week-over-week. Brent traded up US$0.73 per barrel (+0.8%) on Friday of last week, to close at US$90.65 per barrel, up US$2.16 per barrel week-over-week.

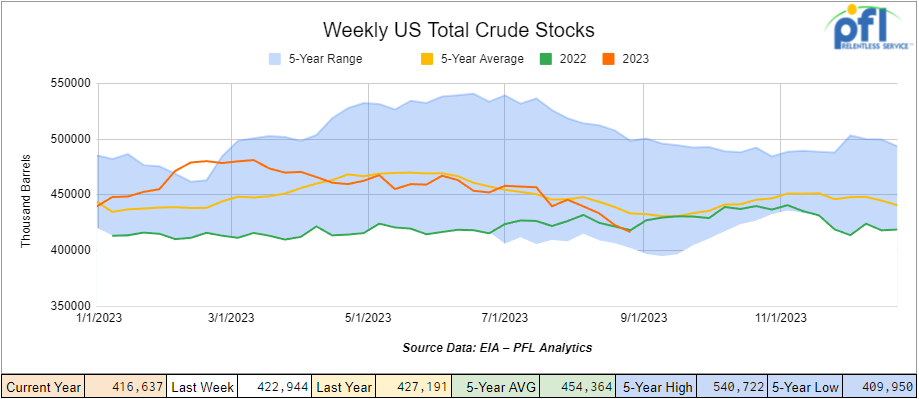

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 6.3 million barrels week-over-week. At 416.6 million barrels, U.S. crude oil inventories are 4% below the five-year average for this time of year.

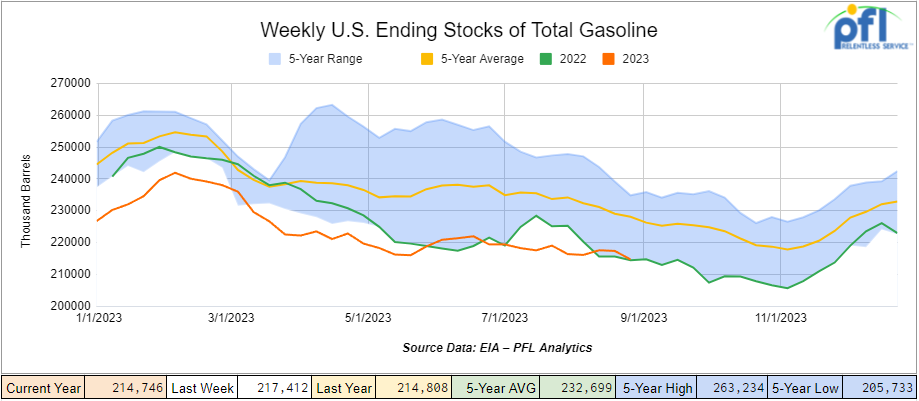

Total motor gasoline inventories decreased by 2.7 million barrels week-over-week and are 5% below the five-year average for this time of year.

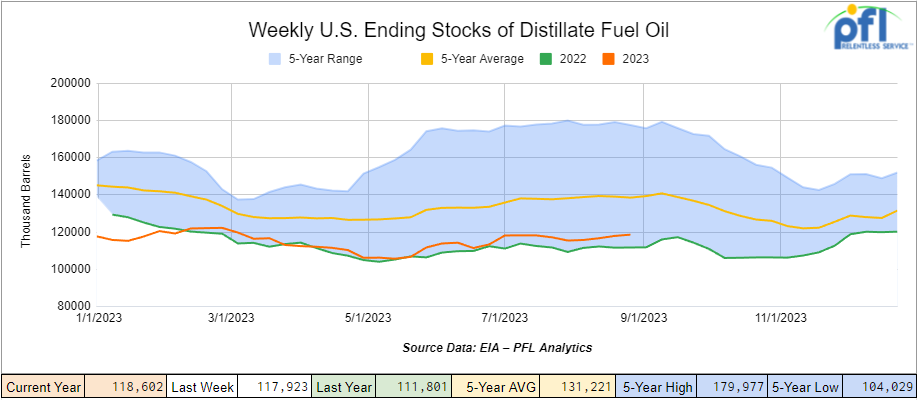

Distillate fuel inventories increased by 700,000 barrels week-over-week and are 14% below the five-year average for this time of year.

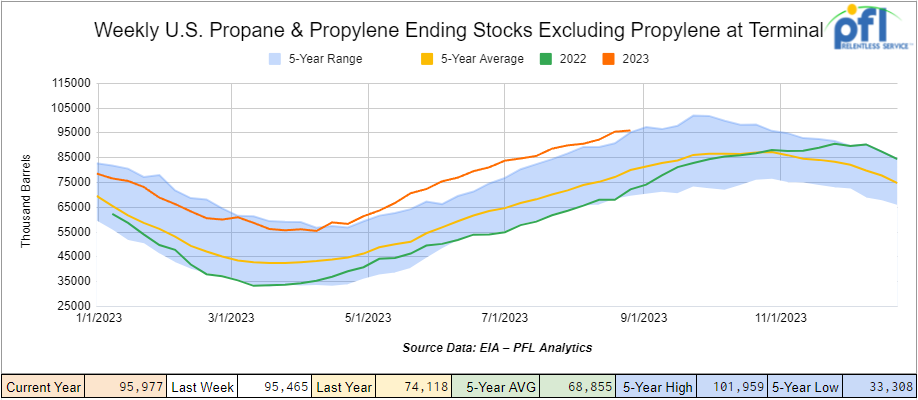

Propane/propylene inventories increased 500,000 barrels week-over-week and are 18% above the five-year average for this time of year.

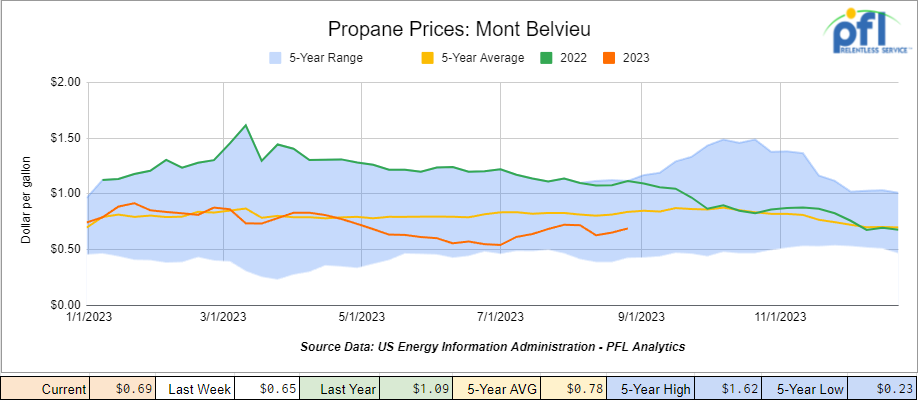

Propane prices closed at 69 cents per gallon, up 4 cents week-over-week, but down -40 cents per gallon year over year.

Overall, total commercial petroleum inventories increased by 400,000 barrels during the week ending September 1st, 2023.

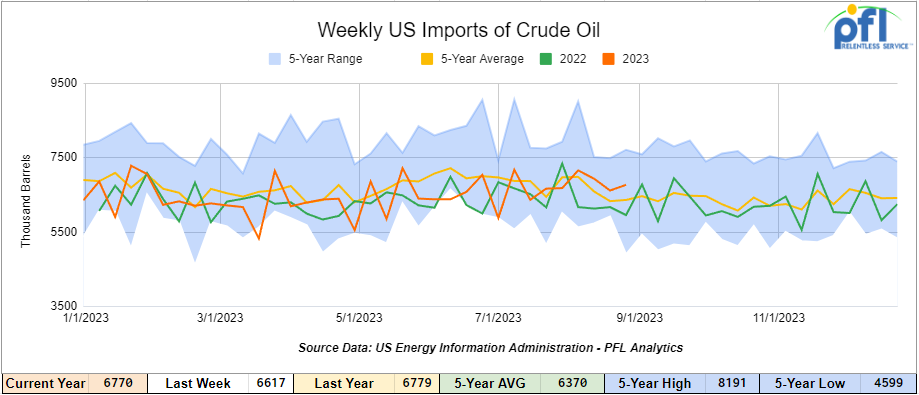

U.S. crude oil imports averaged 6.8 million barrels per day last week during the week ending September 1st, 2023, an increase of 154,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.9 million barrels per day, 9.7% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 982,000 barrels per day, and distillate fuel imports averaged 130,000 barrels per day during the week ending September 1st, 2023.

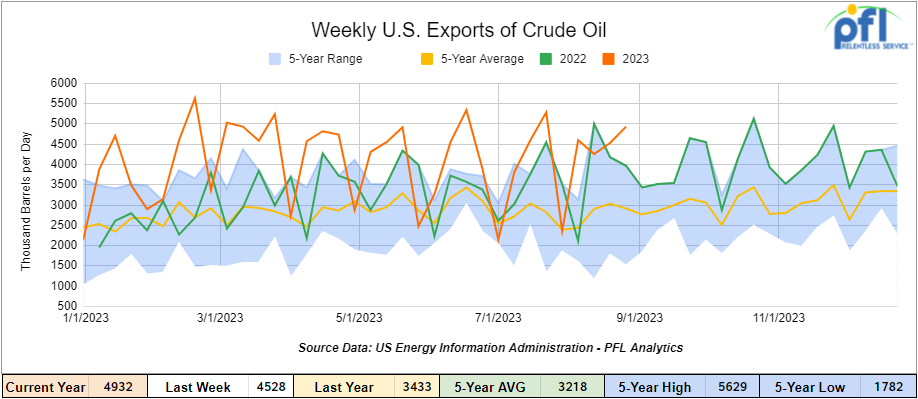

U.S. crude oil exports averaged 4.932 million barrels per day for the week ending September 1st, an increase of 404,000 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 4.579 million barrels per day.

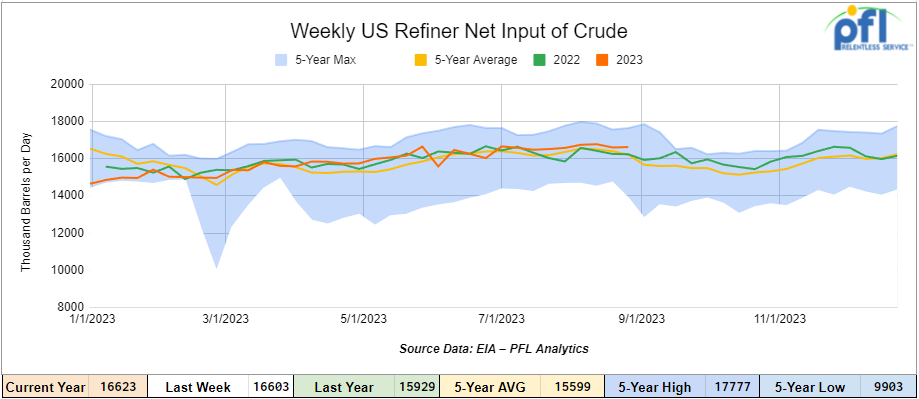

U.S. crude oil refinery inputs averaged 16.6 million barrels per day during the week ending September 1, 2023, which was 20,000 barrels per day more week-over-week.

WTI is poised to open at $87, down 0.51 per barrel from Friday’s close.

North American Rail Traffic

Week Ending September 6th, 2023.

Total North American weekly rail volumes were down (-6.28%) in week 35, compared with the same week last year. Total carloads for the week ending on September 6th, 2023 were 351,923, down (-1.43%) compared with the same week in 2022, while weekly intermodal volume was 306,512, down (-11.3%) compared to the same week in 2022. 6 of the AAR’s 11 major traffic categories posted year over year increases with the most significant decrease coming from Grain (-19.14%). The largest increase came from Motor Vehicles and Parts (+14.47%). Agriculture products have been having a rough time in 2023 which is surprising considering what is happening with Ukraine flows. According to the USDA Farm Income Forecast, net farm income (adjusted for inflation), a broad measure of farm profitability, is expected to decrease $48 billion (25.4%) in 2023 compared with 2022.The forecast from USDA cites two factors contributing to the year over year decline: Lower government payments and higher production expenses.

The Ag Economy Barometer dipped 8 points to a reading of 115 in July. July’s decline was fueled by producers’ weaker perception of current conditions both on their farms and in U.S. agriculture as the Current Conditions Index fell 13 points to a reading of 108. The Future Expectations Index also declined in August to a reading of 119, 5 points below a month earlier.

In the East, CSX’s total volumes were down (-4.82%), with the largest decrease coming from Grain (-16.4%) and the largest increase from Petroleum and Petroleum Products (+30.45%). NS’s volumes were down (-8.17%), with the largest decrease coming from Coal (-21.56%) and the largest increase from Metallic Ores and Metals (+7.06%).

In the West, BN’s total volumes were down (-5.17%), with the largest decrease coming from Grain (-19.94%), and the largest increase coming from Other (+40.7%). UP’s total rail volumes were down (-3.72%) with the largest decrease coming from Grain (-27.84%) and the largest increase coming from Petroleum and Petroleum Products (+14.73%).

In Canada, CN’s total rail volumes were down (-13.18%) with the largest increase coming from Chemicals (+20.26%) and the largest decrease coming from Intermodal (-42.88%). CP’s total rail volumes were down (-1.43%) with the largest decrease coming from Other (-46.96%) and the largest increase coming from Motor Vehicles and Parts (+108.03%).

KCS’s total rail volumes were down (-14.28%) with the largest decrease coming from Intermodal (-26.28%) and the largest increase coming from Coal (+13.66%).

Source Data: AAR – PFL Analytics

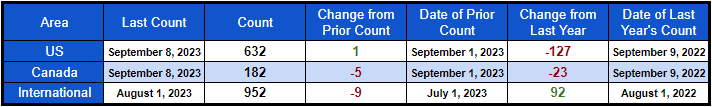

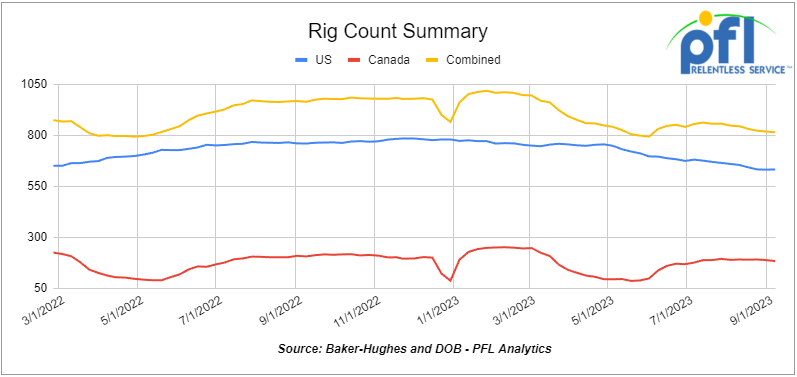

Rig Count

North American rig count was down by -4 rigs week-over-week. U.S. rig count was up by 1 rig week-over-week and down by -127 rigs year-over-year. The U.S. currently has 632 active rigs. Canada’s rig count was down by -5 rigs week-over-week, and down by -23 rigs year over year. Canada’s overall rig count is 182 active rigs. Overall, year-over-year, we are down -150 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 26,087 from 25,859, which was a gain of +228 rail cars week-over-week. Canadian volumes were mixed. CPKC’s shipments increased by +13.6% week over week, and CN’s volumes were lower by -1.3% week-over-week. U.S. shipments were also mixed. The CSX had the largest percentage increase and was up by +14.7% week-over-week. The BN had the largest percentage decrease and was down by -7.1% week-over-week.

DAPL Continues to Fight for Survival

PFL received a call from a consultant this week asking us if the Dakota Access Pipeline (“DAPL”) was shut down, could enough rail cars be brought on to fill the void? This was not the first time we received this inquiry. We have received similar calls and emails as it relates to the shutting down of Enbridge Line 5. The answer is no way – it is suicide. Consumers are already being pinched, rail cars are tight and construction costs for new cars are on the high side – inventory levels are low on pretty much every commodity and in case you haven’t noticed there is a war going on for conventional fuels and refiners, producers and rail shippers are getting relentlessly squeezed and other countries are laughing at us. Why Federal authorities would even consider shutting any pipeline down is troubling, let alone not letting new ones get approved. $4.00 gas at the pump is going to look cheap unless we get our act together quickly.

On Friday of last week, Federal officials released a draft environmental review of DAPL but said they’re waiting for more input before deciding the future of the line’s controversial river crossing in North Dakota.

The draft was released over three years after a federal judge ordered the environmental review and revoked the permit for the Missouri River crossing, upstream of the Standing Rock Sioux Tribe’s reservation. The tribe is concerned a pipeline oil spill could contaminate its water supply.

The environmental review is key for whether the federal government reissues the permit. The pipeline has been operating since 2017, including during the environmental review.

The draft environmental impact statement, which is dated in June, but was made public Friday of last week, noted that the Corps “has not selected a preferred alternative,” but will make a decision in its final review, after considering input from the public and other agencies.

The draft details five options for the pipeline, including denying the easement for the crossing and removing or abandoning a 7,500-foot segment. Officials could also approve the easement with measures for “increased operational safety,” or grant the same easement with no changes. A fifth option is a 111-mile reroute of the pipeline to north of Bismarck, over 38 miles upstream from the current crossing. The reroute would require new permits from federal, state, and local authorities and regulators, which could take at least two years. The exact path of such a reroute is unknown, according to the draft.

“We are seeking public input on the environmental analysis of each alternative, and that input combined with the environmental analysis will help us to make an informed decision among the alternatives,” Corps Omaha District spokesman Steve Wolf told The Associated Press.

A comment period will end Nov. 13. Public meetings are scheduled Nov. 1-2 in Bismarck.

A final environmental impact statement will follow the public input and environmental analysis, and a formal decision will be made, Wolf said.

North Dakota’s governor-led, three-member Industrial Commission on Thursday of last week heard of the draft’s pending release. Republican Gov. Doug Burgum on Thursday of last week called the selection of no preferred alternative “unusual if not unprecedented.”

The pipeline, which officials say is safe, moves oil from western North Dakota to Illinois. Leaders in North Dakota’s oil industry and state government consider the pipeline to be crucial infrastructure, with far less oil now transported by rail.

The pipeline is moving about 600,000 to 650,000 barrels of oil per day. Its capacity is 750,000 barrels per day. North Dakota produces about 1.1 million barrels of oil per day.

The U.S. Supreme Court last year refused to take up an appeal of the tribe’s lawsuit over the pipeline. The tribe first filed the lawsuit in 2016. Thousands of people gathered and camped near the pipeline’s river crossing for protests that lasted months and sparked hundreds of arrests in 2016 and 2017. More than 830 criminal cases resulted from the protests.

Standing Rock last year withdrew as a cooperating agency in the environmental review.

The pipeline “is an ongoing trespass against the Standing Rock Sioux Tribe,” Tribal Chair Janet Alkire previously said. “Every day that the pipeline operates and transfers oil, trespass damages continually accrue.” Stay tuned to PFL, we are watching this one.

STB addresses ‘revenue adequate’ Class I’s, reciprocal switching access

The Surface Transportation Board (STB) recently determined that five Class I’s were “revenue adequate” in 2022.

The STB also has issued a notice of proposed rulemaking that focuses on providing shippers access to reciprocal switching as a remedy for poor rail service.

The proposed regulations would provide a streamlined path for the prescription of a reciprocal switching agreement when service to a terminal-area shipper fails to meet any of three performance standards: service reliability, service consistency, and inadequate local service.

The proposed standards are intended to reflect a minimal level of rail service below which a shipper would be entitled to relief, and each standard would provide an independent path for a petitioner to obtain a prescription of a reciprocal switching agreement.

To enable shippers to monitor and measure their rail service, the proposed rule would require all Class Is to provide their customers with the historical data for the three service metrics within seven days of a customer’s request.

“The board is proposing that one approach to improving rail service is to afford affected shippers the opportunity to obtain a reciprocal switch to a competing Class I when service falls below a standard set in the proposed rule.”

“While the STB did not perform a cost-benefit analysis, any new regulation must be backed by data, narrowly tailored to address a specific and well-defined problem, and ensure benefits exceed costs,” said Jefferies. “Any switching regulation must avoid upending the fundamental economics and operations of an industry critical to the national economy — that Congress saved once by partially deregulating — and be subject to the highest level of scrutiny.”

We are Watching Some Key Economic Indicators

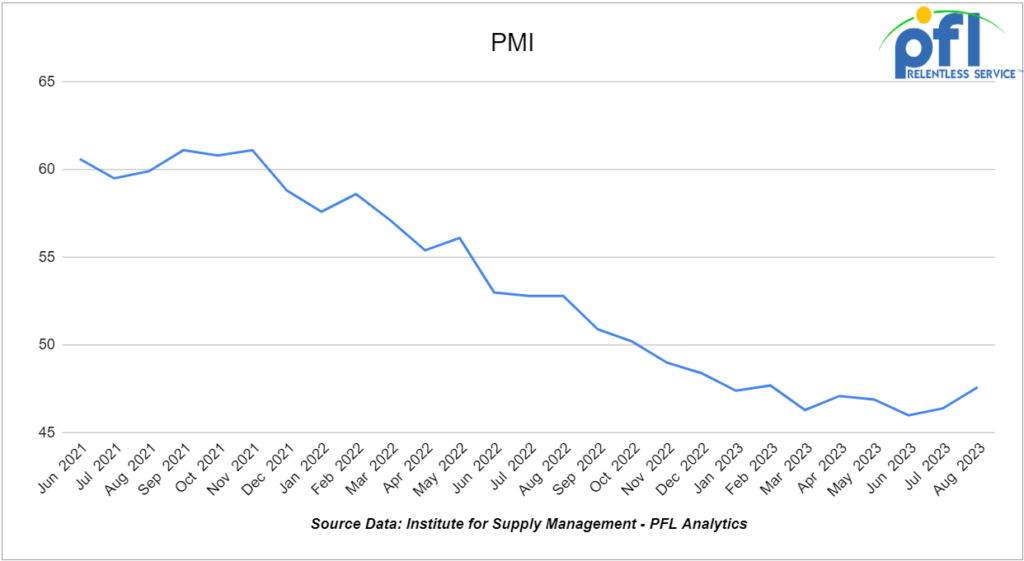

Purchasing Managers Index (PMI)

The Institute for Supply Management releases two PMI reports – one covering manufacturing and the other covering services. These reports are based on surveys of supply managers across the country and track changes in business activity. A reading above 50% on the index indicates expansion, while a reading below 50% signifies contraction, with a faster pace of change the farther the reading is from 50. In August, the PMI slightly increased to 47.6% from June’s 46.4%, marking the tenth consecutive month of readings below 50% and a 1.2% increase month over month from July. Meanwhile, the new orders component decreased to 46.8% from 47.4% down 0.6% month over month.

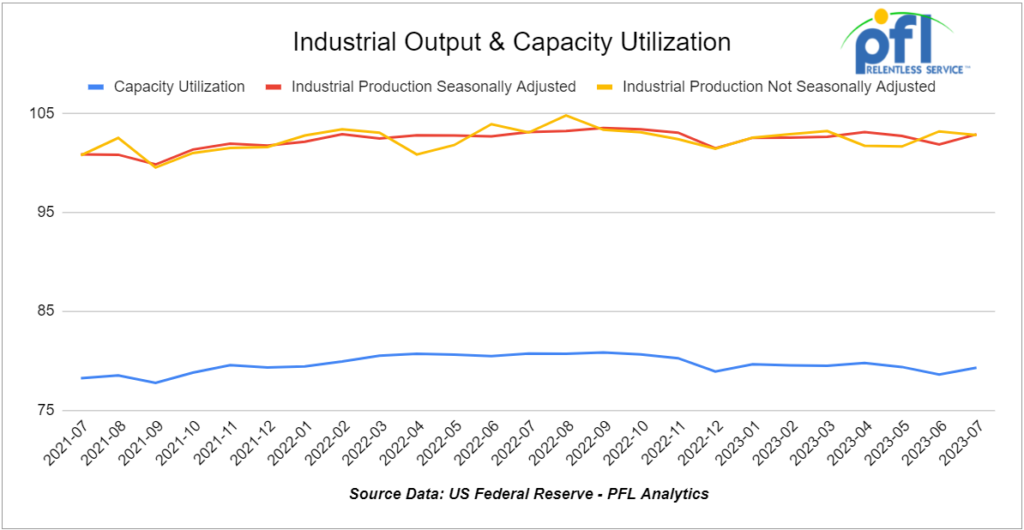

Industrial Output & Capacity Utilization

The Federal Reserve reported that total U.S. industrial output rose a preliminary 1.0% in July 2023 over June 2023, marking its largest gain month over month in six months. For manufacturing (which is around 75% of total output), output in July rose a preliminary 0.5% from June, but was flat on a 3-month rolling average basis. Over the past year, manufacturing output has trended slowly down. In July, it was paced by a surge in auto industry output.

The overall industrial capacity utilization rate in July was a preliminary 79.3%, up from 78.6% in June but lower than every other month this year. Capacity utilization for manufacturing was a preliminary 77.8% in July, up from 77.5% in June, but below most other months in 2023.

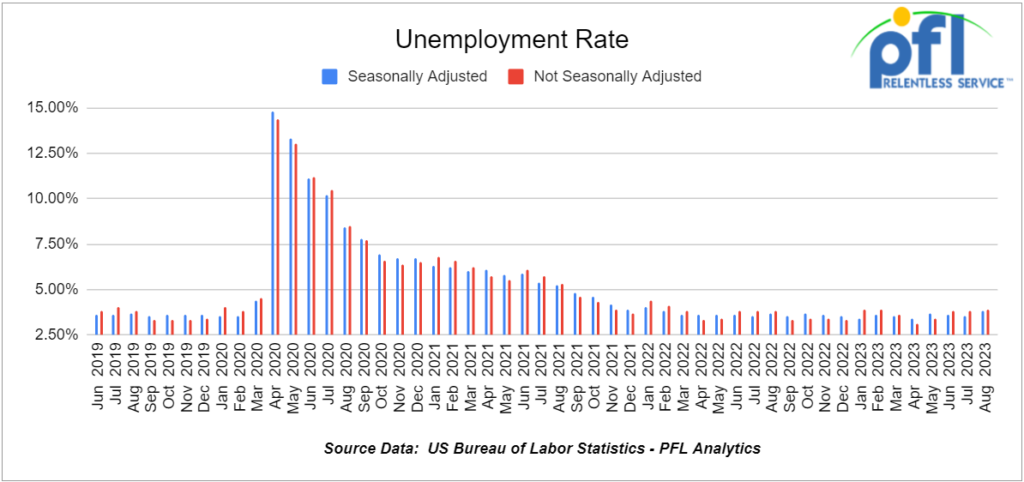

U.S. Unemployment Rate

The Bureau of Labor Statistics (BLS) reported that a preliminary 187,000 net new jobs were created in August 2023, up from 157,000 in July (revised down from 187,000) and 105,000 in June (revised down from 185,000). The June-August average was 150,000. That’s the smallest 3-month average since December 2019. (The monthly average for all of 2019 was 165,000.)

The overall unemployment rate was 3.8% in August, up from 3.5% from July.

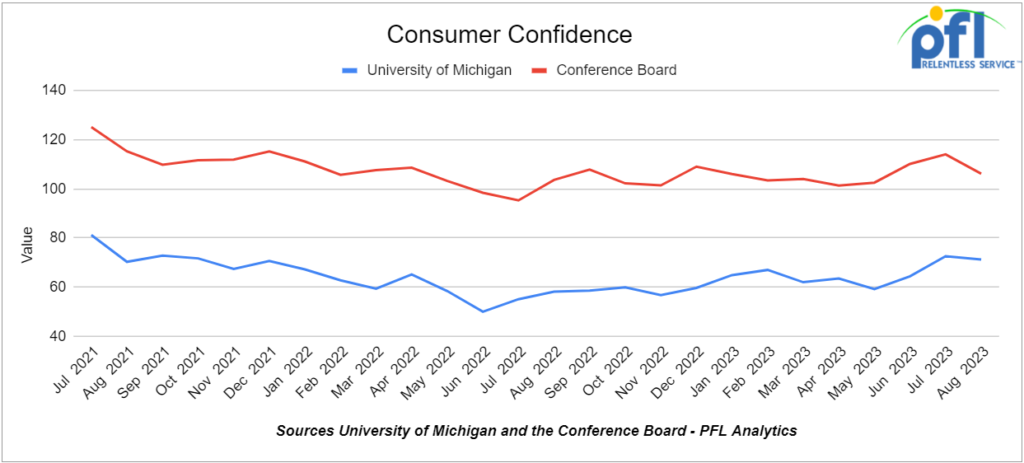

The Conference Board’s Index of Consumer Confidence decreased in August to 106.1 erasing all gains in June and July. The University of Michigan’s index of consumer sentiment fell from 71.6 in July to 69.5 in August.

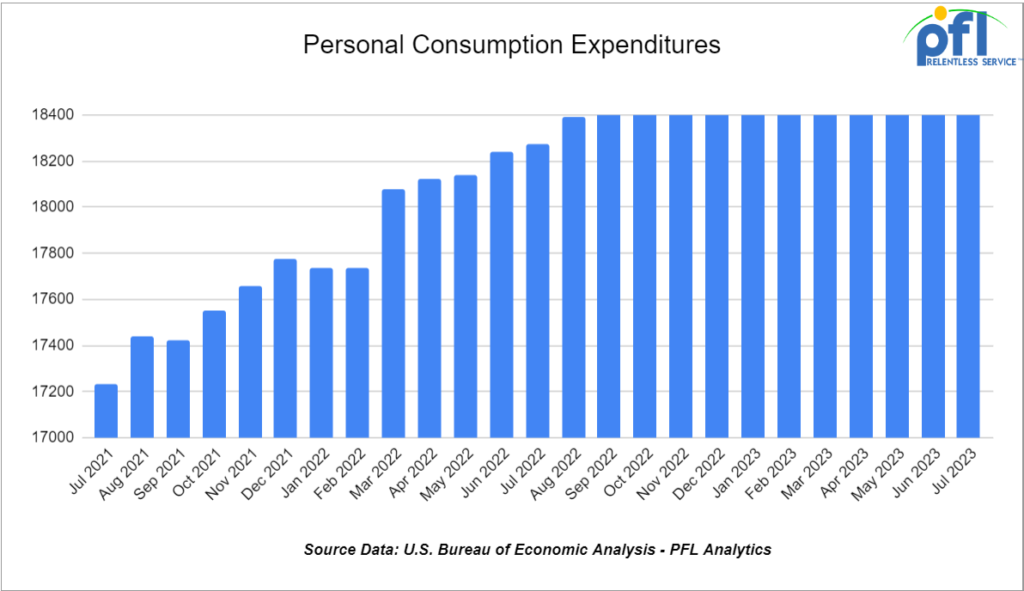

Consumer Spending

Not adjusted for inflation, total U.S. consumer spending rose a preliminary 0.8% in July over June — the largest month-over-month gain in six months. Spending on goods rose a preliminary 0.7% in July, up from 0.6% in June from May. Spending on services was up 0.8% in July.

Adjusted for inflation, the gain for total spending was 0.6% in July. Consumers, however, are going into debt trying to maintain their existing lifestyle in this inflationary environment. This train has to end at some point.

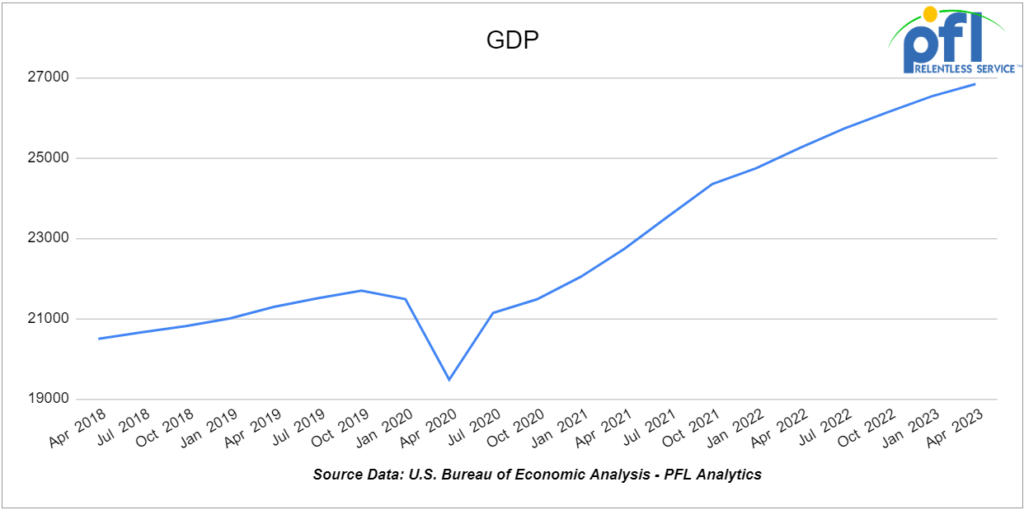

GDP

On August 30, the Bureau of Economic Analysis said its second preliminary estimate was that U.S. GDP grew 2.1% in Q2 2023. The first estimate was 2.4%.

Inflation continues to dominate talk about the U.S. economy. The price index for personal consumption expenditures (PCE — the inflation gauge preferred by the Federal Reserve) was 3.3% higher in July 2023 than in July 2022. That’s up from 3.0% in June 2023. More rate hikes? We think so.

We have been extremely busy at PFL with return-on-lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs at 239-390-2885

Lease Bids

- 20-25, 30 or 31.8K Tanks needed off of in Texas for 1-5 Years. Cars are needed for use in VGO service. NC/NI

- 3, 30 or 31.8K Tanks needed off of in Texas for 1-5 Years. Cars are needed for use in Naphtha service. NC/NI

- 10-20, 30 or 31.8K Tanks needed off of in Texas for 1-2 Years. Cars are needed for use in Diesel service. NC/NI

- 1, 30 or 31.8K Tanks needed off of in Texas for 6-12 Months. Cars are needed for use in Mono-Propylene Glycol service. NC/NI

- 30-100, 31.8K CPC 1232 Tanks needed off of UP or BN in Texas for Purchase or Lease. Cars are needed for use in refined prodcuts service.

- 100, 6300 Covered Hoppers needed off of BN in South Dakota for 3-6 Months. Cars are needed for use in DDG service.

- 15, 30K 117 Tanks needed off of NS in SouthEast for 1 Year. Cars are needed for use in Diesel service.

- 25, 33K 340W Pressure Tanks needed off of UP or BN in Midwest for Oct-March. Cars are needed for use in Propane service.

- 20-25, 30K 117 Tanks needed off of UP or BN in Illinois for 5 Years. Cars are needed for use in Ethanol service.

- 100, 28.3K DOT 111/117 Tanks needed off of UP or BN in Midwest/Texas for 5 Years. Cars are needed for use in Veg Oils / Biodiesel service. Need to be Unlined

- 25-50, 33K 400W Pressure Tanks needed off of CN or CP in Canada for Short Term. Cars are needed for use in Propylene service.

- 50-100, 4550 Covered Hoppers needed off of UP or BN in Texas for 5 Years. Cars are needed for use in Grain service.

- 10, 33K 340W Pressure Tanks needed off of CN in LA for 1 Year. Cars are needed for use in Butane service.

- 25, 20.5K CPC1232 or 117J Tanks needed off of BNSF or UP in the west for 3-5 Year. Cars are needed for use in Magnesium chloride service. SDS onhand

- 25-50, 25.5K 117J Tanks needed off of NS CSX in NorthEast for 5 Years. Cars are needed for use in Asphalt / Heavy Fuel Oil service.

- 30-50, 33K 340W Pressure Tanks needed off of any class 1 in any location for 6-12 Months. Cars are needed for use in Propane service.

- 60-150, 30K 117J Tanks needed off of TYR, UP in Corpus Christi, TX for 1 year. Cars are needed for use in Diesel service.

- 15, 28.3K 117J Tanks needed off of any class 1 in any location for 3 year. Cars are needed for use in Glycerin & Palm Oil service.

- up to 50, 31.8K 117J, 117R, CPC 1232 Tanks needed off of any class 1 in Texas or Ohio for 1-3 years. Cars are needed for use in Diesel / Gasoline service.

- 45, 3000 cf PDs Hoppers needed off of any class 1 in Texas for 3 years. Cars are needed for use in Any service.

- 30, 17K-20K 117J Tanks needed off of UP or BN in Midwest/West Coast for 3-5 Years. Cars are needed for use in Caustic service.

- 10, 286K 15.7K Tanks needed off of KCS in Texas for 1 Year. Cars are needed for use in Sulfuric Acid service. Needed Next few months

- 150, 23.5K DOT 111 Tanks needed off of any class 1 in LA for 2-3 Year. Cars are needed for use in Fluid service. Needed July

- 25-50, 32K 340W Pressure Tanks needed off of NS or CSX in Marcellus for 1-2 Years. Cars are needed for use in Propane service.

- 25-50, 30K DOT 111, 117, CPC 1232 Tanks needed off of CN or CP in WI, Sarnia for 1-2 Years. Cars are needed for use in Diesel service.

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

- 70, 32K 340W Pressure Tanks needed off of CP or CN in Edmonton for 3 Years. Cars are needed for use in Propane service.

- 30-40, 286K DOT 113 Tanks needed off of CN or CP/ UP in Canada/MM for 5 Years. Cars are needed for use in CO2 service. Q1

- 30, 30K DOT 111 Tanks needed off of UP in Texas for 1-3 Years. Cars are needed for use in Diesel service.

- 5-7, 28.3K 117R Tanks needed off of NS or CSX in NC for 1 Year. Cars are needed for use in UCO service.

- 25-50, 5000CF-5100CF Lined Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in Dry sugar service. 3 bay gravity dump

- 10, any capacity Stainless Steel Tanks needed off of any class 1 in Canada for 5-10 years. Cars are needed for use in Alcohol service.

- 100, 33K 340W Pressure Tanks needed off of CN in Canada for 3-5 Years. Cars are needed for use in Propane service.

- Up to 60, 5150cf Covered Hoppers needed off of CN, CSX, NS in the east or midwest for 3 years. Cars are needed for use in Fertilizer service. 3-4 hatch gravity dumps

- 20-30, 14k Any Tanks needed off of BNSF, UP in Texas for 1-3 Years. Cars are needed for use in HCl service. Call for more details

Sales Bids

- 100, Plate F Boxcars needed off of BN or UP in Texas.

- 20, 2770 Mill Gondolas needed off of CSX in the northeast. Cars are needed for use in non-haz soil service. 52-60 ft

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 20, 2770-3400 Mill Gondolas needed off of any class 1 in South Texas. Cars are needed for use in scrap metal service.

- 8, 5200 Covered Hoppers needed off of various class 1s in various locations. Cars are needed for use in Plastic Pellet service.

- 10, 4000 Open Hoppers needed off of CSX in the northeast. Cars are needed for use in scrap metal service. Open top hopper

- 20-30, 3000 – 3300 PDs Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Sand service.

- 45, 3000 cf PD Hoppers needed off of any class 1 in Texas. Negotiable

- 200+, 5000cf Covered Hoppers needed off of any class 1 in various locations.

- 10, 6400 Open Hoppers needed off of CSX in the northeast. Cars are needed for use in wood chip service. Open top hopper, flat bottom

- 20, 17K DOT 111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 100, 15.7K DOT 111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT 111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

Lease Offers

- 70, 25.5K, 117J Tanks located off of UP in Texas. Cars are clean Call for more information

- 25-100, 17.6K, DOT111 Tanks located off of UP or BN in Midwest. Cars were last used in Fertilizer / Corn Syurp. Free move available

- 20, 20k, DOT111 Tanks located off of CSX in GA. Cars are clean

- 2, 20K, DOT111 Tanks located off of UP in TX. Cars are clean

- 5, 20K, DOT111 Tanks located off of UP in TX. Cars were last used in Sulfuirc Acid. Free move available

Sales Offers

- 100-200, 31.8K, CPC 1232 Tanks located off of BN in Chicago. Dirty/Clean

- 100, 28.3K, 117J Tanks located off of various class 1s in multiple locations.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|