“Leadership is the art of getting people to do what you want them to do because they want to do it. “

Dwight D. Eisenhower

Weekly jobless claims down slightly week over week but remain elevated

- Initial jobless claims for the week ended July 24, 2021 came in at 385,000 down 15,000 people week over week which was above analysts’ expectations.

- Continuing claims came in at 2.93 Million, down by 366,000 people week over week.

- Altogether, some 13.0 million people are reportedly receiving benefits through eight separate state or federal programs.

- On a good note, payrolls climbed by 943,000 last month after upwardly revised increases the prior two months, a Labor Department report showed Friday of last week. The unemployment rate dropped to a pandemic low of 5.4%, while earnings and hours worked remained elevated.

Stocks closed lower on Friday of last week and down week over week

The Dow closed higher on Friday of last week, up +144.26 (+0.41%) points closing out the week at 35,208.51, up +273.04 points week over week. The S&P 500 closed higher on Friday of last week, up +7.42 points (+0.17%) and closing out the week at 4,436.52, up +41.26 points week over week. The Nasdaq closed lower on Friday of last week, down -59.36 points (-0.40%) and closing out the week at 14,835.76, up 163.08 points week over week.

In overnight trading, DOW futures traded lower and are expected to open down this morning 119 points.

Oil down on Friday and had it biggest weekly decline in months

Oil prices fell about one percent lower on Friday, posting their steepest weekly losses in months, on worries that travel restrictions and new restrictions in other areas to purportedly curb the spread of the “Delta variant” of COVID-19 will derail the global recovery in energy demand. West Texas Intermediate (WTI) for September delivery fell 81 cents to settle at $68.28 a barrel on Friday of last week, down $5.67 a barrel week over week. Brent crude oil settled down 59 cents a barrel on Friday of last week closing at $70.70 a barrel, down $4.71 a barrel week over week.

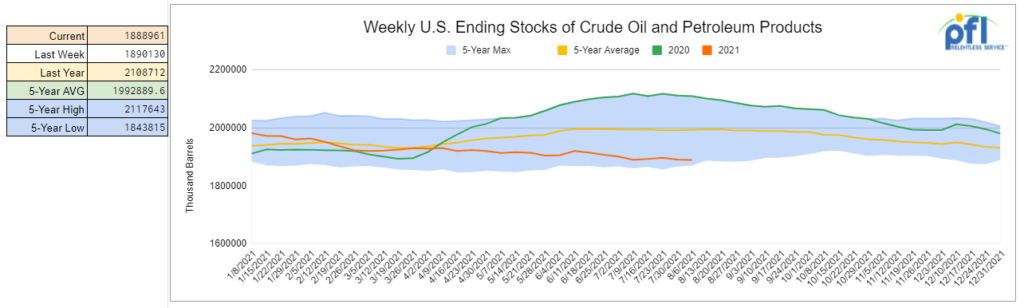

U.S. commercial crude oil inventories increased by 3.6 million barrels week over week. At 439.2 million barrels, U.S. crude oil inventories are 6% below the five-year average for this time of year.

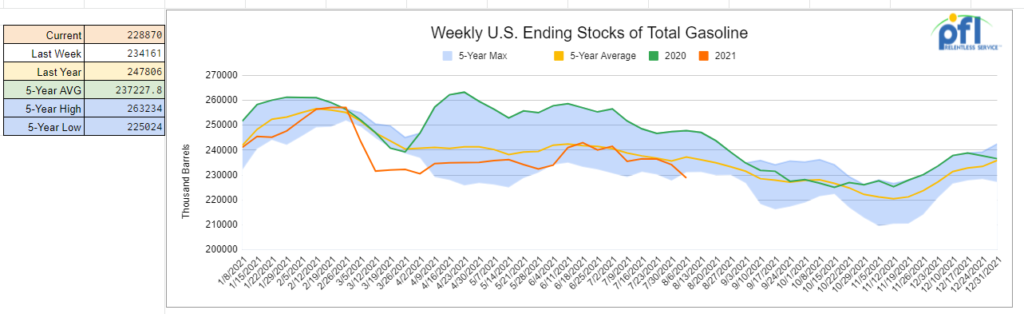

Total motor gasoline inventories decreased by 5.3 million barrels week over week and are 3% below the five year average for this time of year. Finished gasoline and blending components inventories both decreased last week.

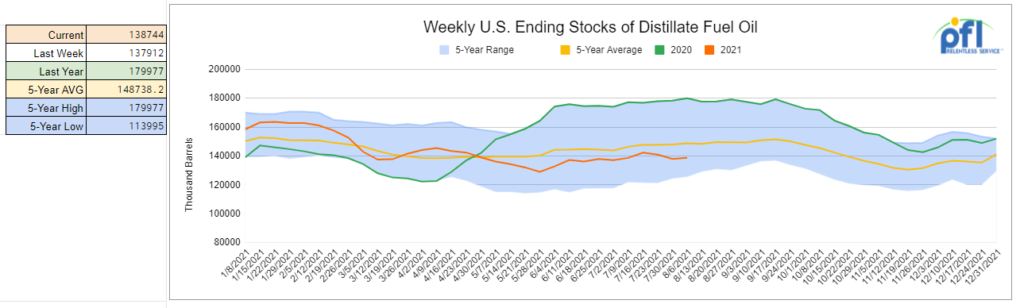

Distillate fuel inventories increased by 800,000 barrels week over week and are 6% below the five-year average for this time of year.

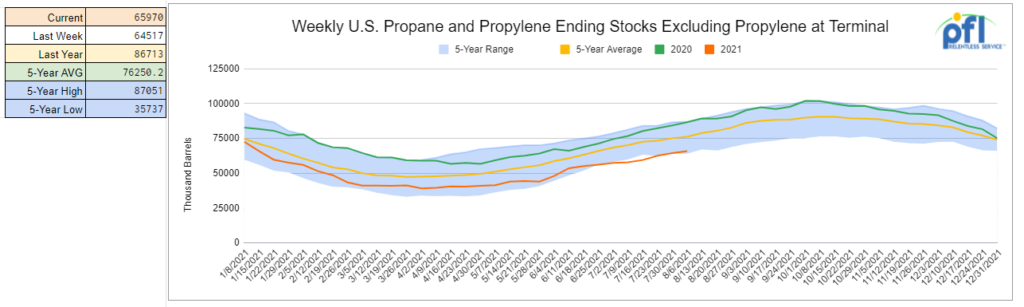

Propane/propylene inventories increased by 1.5 million barrels week over week and are 14% below the five-year average for this time of year.

Total commercial petroleum inventories decreased by 1.2 million barrels last week.

U.S. crude oil imports averaged 6.4 million barrels per day last week, down by 75,000 barrels per day week over week. Over the past four weeks, crude oil imports averaged 6.6 million barrels per day, 15.8% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) last week averaged 845,000 barrels per day, and distillate fuel imports averaged 162,000 barrels per day.

U.S. crude oil refinery inputs averaged 15.9 million barrels per day during the week ending July 30, 2021 which was 46,000 barrels per day more than the previous week’s average. Refineries operated at 91.3% of their operable capacity last week. Gasoline production increased last week, averaging 10.2 million barrels per day. Distillate fuel production increased last week, averaging 4.9 million barrels per day.

Oil is lower in overnight trading and, as of the writing of this report, WTI is poised to open at $65.36, down $2.92 per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were up 3.7% year over year in week 30 (U.S. +3.0%, Canada +3.5%, Mexico +15.5%) resulting in quarter to date volumes that are up 2.8% year over year and year to date volumes that are up 10.9% year over year (U.S. +12.4%, Canada +7.3%, Mexico +6.7%). 7 of the AAR’s 11 major traffic categories posted year over year increases with the largest increases coming from metallic ores & metals (+40.8%) and intermodal (+1.9%). The largest decrease came from motor vehicles & parts (-21.9%).

In the East, CSX’s total volumes were up 6.4%, and the largest increases came from intermodal (+8.2%) and coal (+15.7%). The largest decrease came from motor vehicles & parts (-17.7%). NS’s total volumes were up 1.2%, with the largest increases from metals & products (+27.1%) and petroleum (+70.7%). The largest decrease came from motor vehicles & parts (-22.2%).

In the West, BN’s total volumes were up 8.5%, with the largest increases coming from intermodal (+9.5%) and coal (+13.9%). The largest decrease came from grain (-26.2%). UP’s total volumes were down 2.2%, with the largest decreases coming from intermodal (-5.8%) and motor vehicles & parts (-34.1%). The largest increase came from stone, sand & gravel (+23.4%).

In Canada, CN’s total volumes were up 5.3%, with the largest increases coming from coal (+98.1%) and metallic ores (+27.2%). The largest decreases came from motor vehicles & parts (-27.8%) and farm products (-52.7%). RTMs were up 6.1%. CP’s total volumes were up 6.3%, with the largest increases coming from intermodal (+10.6%), coal (+27.9%) and petroleum (+52.7%). The largest decrease came from farm products (-81.3%). RTMs were down 1.1%.

KCS’s total volumes were up 7.9%, with the largest increase coming from coal (+68.5%).

Source: Stephens

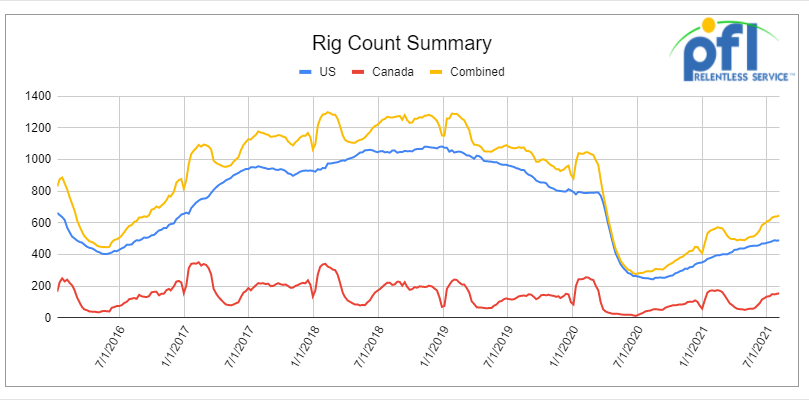

Rig Count

North American rig count is up by 6 rigs week over week. The U.S. rig count was up by 3 rigs week over week and up by 244 rigs year over year. The U.S. currently has 491 active rigs. Canada’s rig count was up by 3 rigs week over week, and up by 109 rigs year over year and Canada’s overall rig count is 156 active rigs. Year over year we are up 343 rigs collectively.

North American Rig Count Summary

Things We are Keeping an Eye on

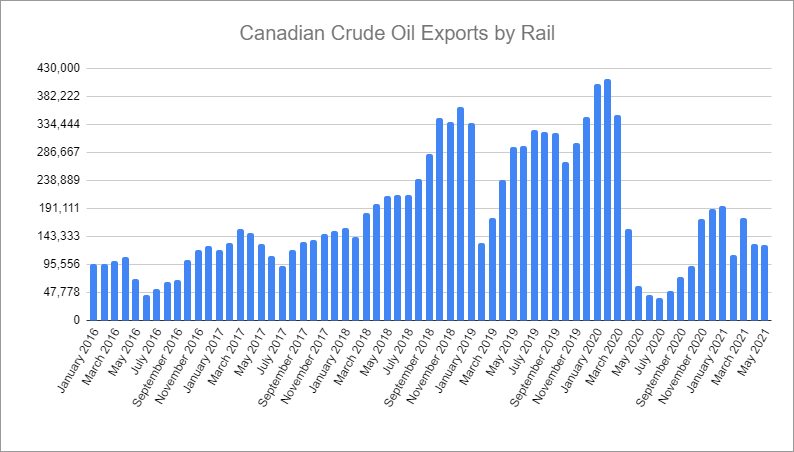

Petroleum by Rail

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 24,008 from 23,818, a gain of 190 rail cars week over week. Canadian volumes were lower – CN shipments were down 2.2% while CP shipments were down by 13.6%.

Railcar Scrapping

The scrap market went down slightly last week, but held close to historic highs with the pricing for August only seeing a 5% drop from July. Economists are forecasting for a relatively flat market until Q4 when prices are expected to drop. This the best time to scrap railcars that may be nearing the end of their lives, distressed cars, or cars phased out by regulations. According to Argus, there were 43,100 railcars scrapped in 2020. As of June 2021, 47,000 railcars have already been scrapped. This blistering pace will only continue through the end of 2021. Space is very limited at facilities, so book your slots now with PFL while you can. If your railcars cannot move – no worries we will come to you for larger orders – call PFL today for mobile scrapping options.

PFL Scrapping Locations

Propane, Natural Gas and Coal

Propane prices in Asia remain on fire and reaching new highs, it is going to be difficult to fill storage here in the U.S. Also, Liquefied Natural gas (‘LNG”) pricing for September delivery into Northeast Asia was estimated at about $16.90 per mmBtu, up $1.30 per mmbtu week over week. Temperatures in Beijing, Tokyo and Shanghai are expected to be higher than average over the next two weeks, increasing short-term demand for cooling. Additionally, buyers are already securing supply ahead of winter. Last winter, spot prices rose to record highs of $33.00 per mmBtu amid production constraints in export countries. Europe has failed to replenish inventories since last winter and are now competing for world spot demand with China. With natural gas so high, coal is following. Folks, here in the U.S. are putting coal cars back to work and are even looking for additional cars in the right place – good news for rail!

Canadian Coal Project Canceled

Ironically, as the demand for coal has skyrocketed, Canada on Friday formally blocked a proposal to build a steelmaking coal mine in the Rocky Mountains of Alberta, citing what it said would be the significant environmental damage. The decision did not come as a surprise since energy regulators last month said the Grassy Mountain Project, proposed by a unit of Australian billionaire Gina Rinehart’s Hancock Prospecting Pty Ltd., would not be in the public interest.

Environment Minister Jonathan Wilkinson, responsible for making the final decision, said the project would harm surface water quality and threaten endangered animal and tree species. Hancock’s Riversdale Resources Ltd. unit said that at its peak, the proposed CAD$800 million ($638 million USD) project would produce 4.5 million tons of steelmaking coal a year, generate CAD$1.7 billion in taxes as well as royalties over the 23-year mine life, and employ 400 people. They plan to appeal the decision.

Dakota Access Pipeline

Energy Transfer said it has completed a phased expansion of Dakota Access Pipeline that boosted capacity to 750,000 bpd from 570,000 bpd, even as it wages a legal battle for DAPL’s survival. “We recently placed the next phase of incremental capacity for the Bakken Pipeline Optimization project into service, which is supported by minimum volume commitments from long-term customers,” co-CEO Tom Long said during a conference call with investors. “With completion of this phase of the optimization, Dakota Access now has the ability to flow approximately 750,000 barrels per day.” This is great news for Energy Transfer and its partners but not good news for crude by rail out of the region.

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

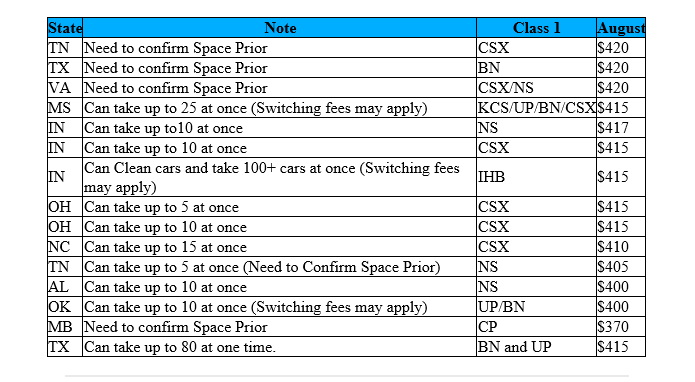

Railcar Markets

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 100 coal cars rotary hoppers for service on the BNSF 1-2 years Negotiable

- 25 bulkhead flats 286 any class one for up to 5 years Negotiable

- 100 fuel oil cars in Texas dirty to dirty service

- 100 non coiled R’s or J’s clean or last in Jet Fuel needed in Houston

- 10 open top hoppers 2400 C FT in Texas needed for stone on the UP 3-5 years

- 20 19,000 Gal Stainless cars in Louisiana UP for nitric acid 1-3 years negotiable

- 8 Hoppers for plastic pellets wanted to purchase

- 15-25 5,200CF or greater covered hoppers needed in Illinois off the CN or NS.

- 10 6,300CF or greater covered hoppers needed in the Midwest.

- 20 17K tank cars for purchase. Must be food grade.

- 20 117s 29K for use in Wash and LA on the UP for VGO and UMO

- 15-25 20K 23.5K cars for Oct Slurry needed in the South for 1 Year

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js – Selection is Dwindling. Call Today!

- 100 117Rs dirty last in Gasoline in Texas for lease Negotiable

- 20 117R 30K plus tanks for ethanol in Wisconsin off the CN Negotiable

- 80 6350 Grain Hoppers in Nebraska on the BN Clean Negotiable

- 90 117Rs 30K located in Alberta CN or CP Refined Products Dirty – negotiable

- 37 BRAND NEW 5161 Sugar Hoppers in Arkansas UP – negotiable

- 99 340W Pressure Cars various locations Butane and Propane dirty negotiable

- 100 73 ft 286 GRL riser less deck, center part for sale,

- 19 auto-max II automobile carrier racks – tri-49 for sale – negotiable

- 10 food grade stainless steel cars

- 30 CPC 1232 25.5K Pennsylvania NS clean negotiable

- 100-150 29K C/I 117J cars for lease. Dirty in Bakken crude and can be returned dirty.

- 100 29K C/I 1232 cars for lease. Dirty in Heavy Crude and can be returned dirty.

- 100 117Rs 29K clean last used in crude Washington State – price negotiable sale or lease

- 21 111s 29K tanks last in alcohol dirty on the CN in Wisconsin for lease price negotiable

- 100 111s of various volumes and locations last in fuel oil dirty price negotiable

- Various Hoppers for sale and lease 3000-5800 CF 263 and 286 multiple locations negotiable

- 45 Boxcars 60ft Plate F’s Located in Tenn CSX – Lease Negotiable

- 28 20K Veg oil cars for lease in Arkansas – Negotiable

- 100 3200 Covered Hoppers for sale price negotiable

- 100 Center beam Flats with risers 73ft in SD and Iowa for sale negotiable

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|