“This is the precept by which I have lived: Prepare for the worst; expect the best; and take what comes.”

Hannah Arendt

Jobs Update

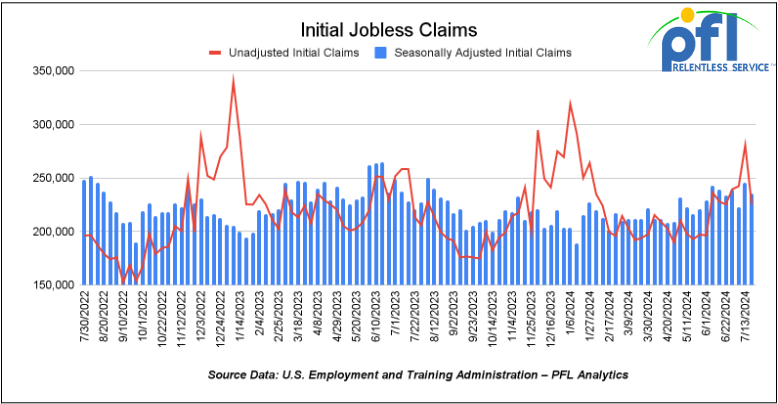

- Initial jobless claims seasonally adjusted for the week ending July 27th came in at 249,000, up 14,000 people week-over-week.

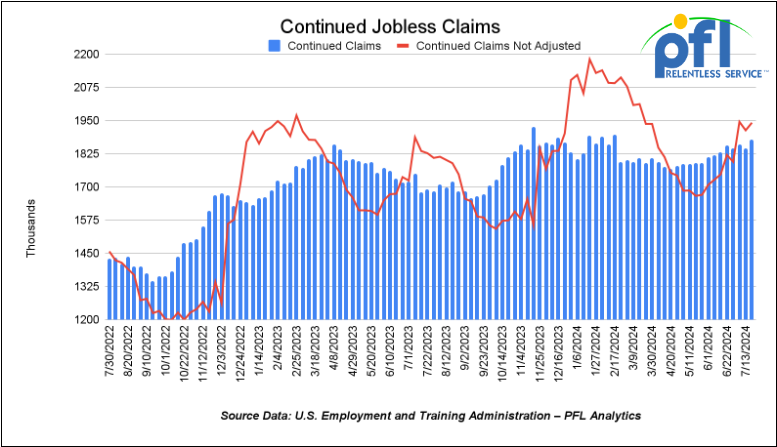

- Continuing jobless claims came in at 1.877 million people, versus the adjusted number of 1.844 million people from the week prior, up 33,001 people week-over-week.

Stocks closed lower on Friday of last week and lower week over week

The DOW closed lower, on Friday of last week down -610.71 (-1.51%) closing out the week at 39737.26 down -852.08 points week-over-week. The S&P 500 closed lower on Friday of last week, down -100.12 and closed out the week at 5346.56 down -112.54 points week-over-week. The NASDAQ closed lower on Friday of last week, down -417.98 and closed out the week at 16776.16 down -581.73 points week over week.

In overnight trading, DOW futures traded lower and are expected to open at 29,261 this morning down -618 points.

Crude oil closed lower on Friday of last week and lower week over week.

West Texas Intermediate (WTI) crude closed lower -$2.79 per barrel (-3.66%) to close at $73.52 per barrel on Friday of last week, down -$3.64 per barrel week over week. Brent traded down -2.71 USD per barrel (-3.41%) on Friday of last week, to close at $76.81 per barrel, down -4.32 per barrel week-over-week.

One Exchange WCS (Western Canadian Select) for September delivery settled on Friday of last week at US$14.45 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$ 59.07 per barrel.

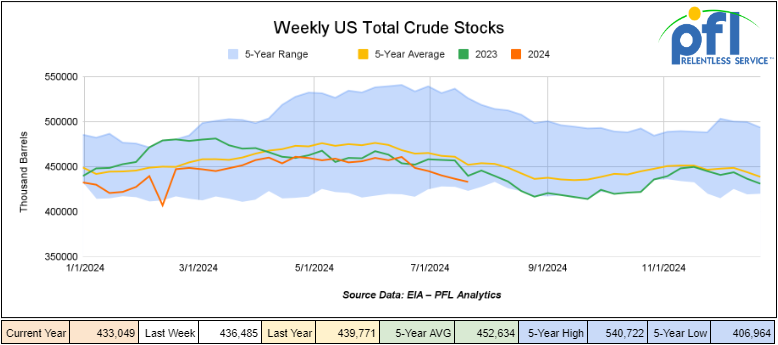

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 3.4 million barrels week-over-week. At 433.0 million barrels, U.S. crude oil inventories are 4% below the five-year average for this time of year.

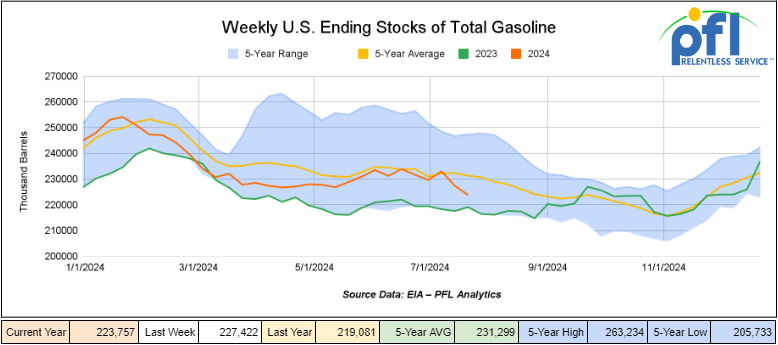

Total motor gasoline inventories decreased by 3.7 million barrels week-over-week and are 3% below the five-year average for this time of year.

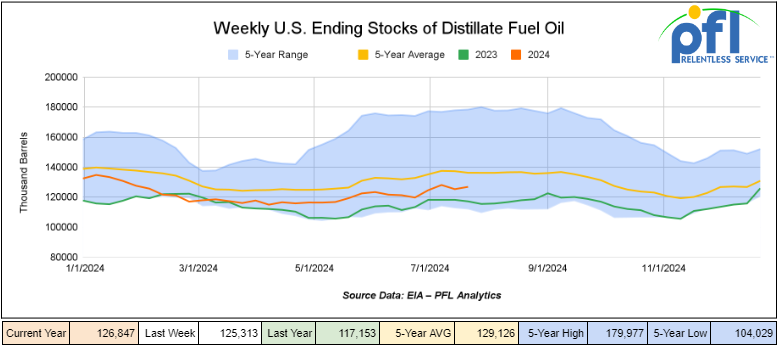

Distillate fuel inventories increased by 1.5 million barrels week-over-week and are 7% below the five-year average for this time of year.

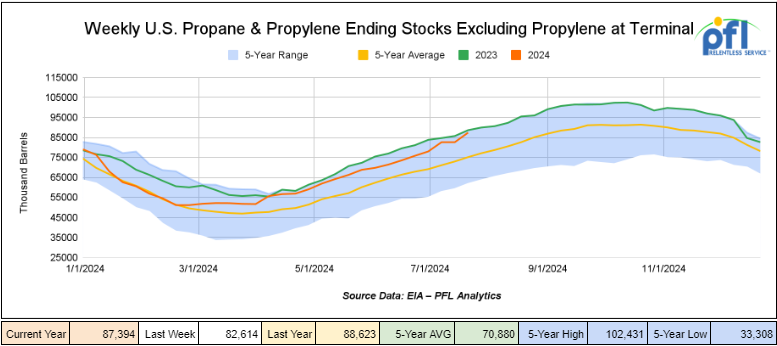

Propane/propylene inventories increased by 2.9 million barrels week-over-week and are 16% above the five-year average for this time of year.

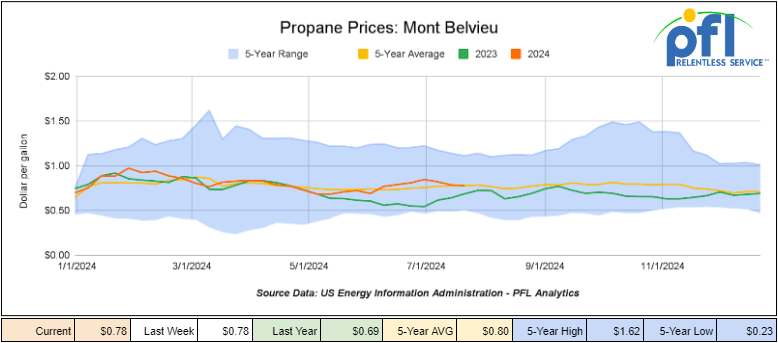

Propane prices closed at 78 cents per gallon which was flat week-over-week but up 9 cents year-over-year

Overall, total commercial petroleum inventories decreased by 2.4 million barrels during the week ending July 26th, 2024.

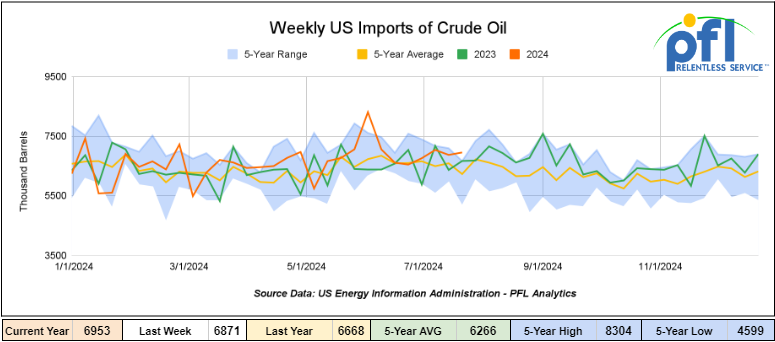

U.S. crude oil imports averaged 7.0 million barrels per day during the week ending July 26th, 2024, an increase of 82,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.9 million barrels per day, 5.9% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 917,000 barrels per day, and distillate fuel imports averaged 140,000 barrels per day during the week ending July 26th, 2024.

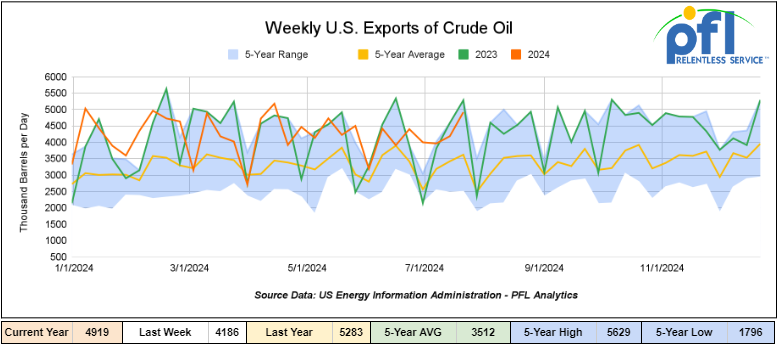

U.S. crude oil exports averaged 4.919 million barrels per day for the week ending July 26th, 2024, an increase of 733,000 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 4.267 million barrels per day.

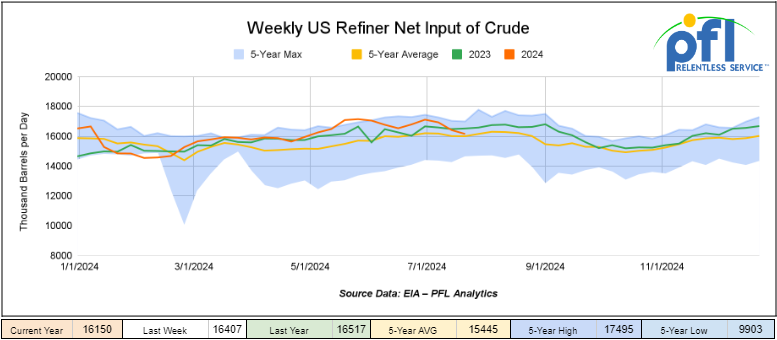

U.S. crude oil refinery inputs averaged 16.2 million barrels per day during the week ending July 26, 2024, which was 258,000 barrels per day less week-over-week.

WTI is poised to open at $71.93, down -$1.59 per barrel from Friday’s close.

North American Rail Traffic

Week Ending July 31st, 2024.

Total North American weekly rail volumes were up (4.59%) in week 31, compared with the same week last year. Total carloads for the week ending on July 31st were 347,168, down (-0.66%) compared with the same week in 2023, while weekly intermodal volume was 3345,244, up (+10.6%) compared to the same week in 2023. 7 of the AAR’s 11 major traffic categories posted year-over-year increases. The most significant decrease came from Motor Vehicles and Parts, which was down (-9.9%). The most significant increase came from Grain which was up (+34.91%).

In the East, CSX’s total volumes were up (6.96%), with the largest decrease coming from Grain (-10.88%) while the largest increase came from Coal (19.26%). NS’s volumes were up (6.99%), with the largest increase coming from Grain (+30.12%) while the largest decrease came from Petroleum and Petroleum Products (-13.47%).

In the West, BN’s total volumes were up (5.19%), with the largest increase coming from Grain (47.34%) while the largest decrease came from Metallic Ores and Metals down (-21%). UP’s total rail volumes were up (5.21%) with the largest decrease coming from Coal, down (-17.85%) while the largest increase came from Grain which was up (+21.01%).

In Canada, CN’s total rail volumes were down (-8.87%) with the largest decrease coming from Intermodal Units, down (-28.64%) while the largest increase came from Nonmetallic Minerals, up (+21.93%). CP’s total rail volumes were up (13.05%) with the largest increase coming from Grain (+187.61%) while the largest decrease came from Coal, down (-29.16%).

KCS’s total rail volumes were down (-5.59%) with the largest decrease coming from Metallic Ores and Metals (-17.58%) and the largest increase coming from Grain (+45.76%).

Source Data: AAR – PFL Analytics

Rig Count

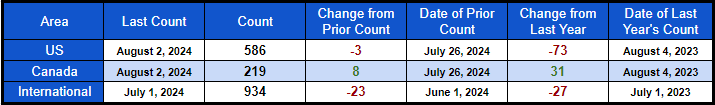

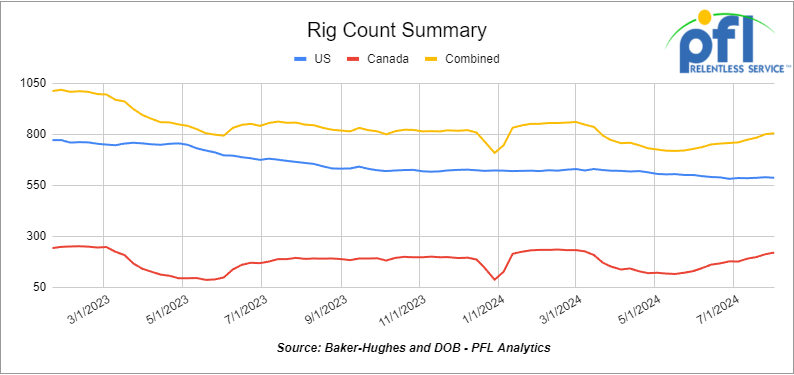

North American rig count was up by 5 rigs week-over-week. The US rig count was down by -3 rigs week-over-week, and down by -73 rigs year-over-year. The US currently has 586 active rigs. Canada’s rig count was up by 8 rigs week-over-week, and up by 31 rigs year-over-year and Canada’s overall rig count is 219 active rigs. Overall we are down -42 rigs collectively.

International rig count was down by -23 rigs month-over-month and down -27 rigs year-over-year. Internationally there are 934 active rigs.

North American Rig Count Summary

A few things we are watching:

We are watching Tropical Storm Debbie

Well folks as of 5:00 am this morning Hurricane Debby looked like it was headed straight for Steinhatchee, Florida, according to the latest information provided by the National Hurricane Center. The next update will be provided by 9:00 AM EST. The storm has already created quite a bit of flooding in the state of Florida from Naples to Tampa and is not done with its path of destruction as insurance companies shudder. See current path:

The problem with this storm is it is going to be with us for a long time dumping a bunch of rain in Florida, Georgia and South Carolina and significant flooding is expected in Savana and Charleston. See key messages below from the National Hurricane Center and be safe out there

Key Messages From National Hurricane Center Advisory 12 5:00 AM EST

- Potentially historic heavy rainfall across southeast Georgia and the coastal plain of South Carolina through Saturday morning will likely result in areas of catastrophic flooding. Heavy rainfall will likely in considerable flooding impacts from portions of central and northern Florida and across portions of central and northeast North Carolina through Saturday morning.

- There is danger of life-threatening storm surge along portions of the Gulf Coast of Florida, with 6-10 feet of inundation above ground level expected somewhere between Ochlockonee River to Yankeetown through the morning. Residents in the Storm Surge Warning area should follow any advice given by local officials.

- Hurricane conditions are expected this morning along portions of the Florida Big Bend region where a Hurricane Warning is in effect. Tropical storm conditions are expected to continue for several more hours farther south within the Tropical Storm Warning area along Florida’s west coast, including the Tampa Bay area.

- Dangerous storm surge and wind impacts are expected along portions of the southeast U.S. coast from northeastern Florida to North Carolina through the middle of the week, and storm surge warnings and tropical storm watches and warnings are in effect for portions of these areas

Be safe out there folks our prayers are with you!

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 27,309 from 27,813, which was a loss of 504 rail cars week-over-week. Canadian volumes were mixed. CPKC’s shipments rose by +7.3% week over week, CN’s volumes were lower by -5.5% week-over-week. U.S. shipments mostly higher. The BN was the sole decliner and was down by -16.5%. The CSX had the largest percentage increase and was up by +4.9%.

We are watching Natural Gas and Liquified Natural Gas (LNG)

Folks, last week we talked about LNG developments in Canada. The reason why we continue to touch on this subject (Natural Gas and Liquified Natural Gas (LNG)) is because natural gas is incredibly cheap and, on this continent, we have so much of it. The more clean burning natural gas and LNG that is produced, the better it is for rail, as associated liquids must be stripped to dry gas specifications to move on pipelines. Not only do we need to burn more clean burning natural gas here at home for electricity generation, fuel for powering trucks and cars (Waste management has 1/3 of their fleet running on natural gas or renewable natural gas), but we need to export more of it. Burning clean burning natural gas is also incredibly important for the U.S. economy and individual families who are subsidizing the green new deal which is far from green, as we all know.

Meanwhile, electricity prices are soaring take a look at PJM (PJM is a regional transmission organization (RTO) that coordinates the movement of wholesale electricity in all or parts of 13 states and the District of Columbia). Prices in the PJM Interconnection’s latest capacity auction hit record highs recently, which should provide incentives for power plant companies to build new generating resources (clean burning natural gas seems to make sense) and keep existing ones operating, according to the grid operator. For most of the PJM region, capacity prices for the 2025/26 delivery year soared to $269.92/MW-day, up from $28.92/MW-day in the last auction, the grid operator said in an auction report. Prices hit zonal caps of $466.35/MW-day for the Baltimore Gas and Electric zone in Maryland, and $444.26/MW-day for the Dominion zone in Virginia and North Carolina. The auction’s total cost to consumers jumped to $14.7 billion from $2.2 billion in the last auction.

The spike in capacity prices was driven by power plant retirements, increased load, and new market rules – coupled with new resource accreditation metrics that are designed to reflect how much capacity a resource delivers during system stresses, Stu Bresler, PJM executive vice president for market services and strategy, said during a media briefing last week. In other words, the government continues to drive power prices higher and wants us to rely on the grid to get around in the future in electric cars. Instead of burning more clean-burning natural gas, we are shutting it in at alarming numbers, while the green new deal marches forward. Natural gas prices in Canada hit 30-year lows on Friday of last week trading at $0.73 CAD per MMBTU or roughly 53 USD cents per MMBTU (in 1996 dollars that would = $0.265 USD per MMBTU). In Canada, natural gas producers are shutting in production. ARC Resources Ltd. is curtailing 250 mmcf/d of natural gas production at its dry gas Sunrise asset in B.C. due to low natural gas prices, the company president and chief executive officer Terry Anderson said on the company’s second quarter 2024 conference call last week.

“We’re operating at the cycle bottom for natural gas while condensate is over $100 per barrel,” said Anderson. “We want to be disciplined and focus on profitability and not boes.”

The 250 mmcf/d cut in production equals around 19% of ARC’s second-quarter total gas production of 1.29 bcf/d. Arc is not the only one shutting clean burning natural gas in up in Canada.

The U.S. has had its fair share of shut-ins as well. In the U.S. prices are not as bad as they are up in Canada but very cheap compared to any energy source out there. NYMEX Henry Hub Natgas settled at $1.96 US per MMBTU on Friday of last week for September delivery.

There was some good news coming out of Freeport last week. Freeport LNG expects to increase production beyond its 15.3 million metric ton per annum (MTPA) capacity as it wraps up an expansion project.

Freeport LNG operates the second-largest U.S. processing plant and its ups and downs have led to gas-price swings in the U.S. and Europe.

Feedgas flows to Freeport on Friday were on track to reach a record 2.3 bcfd, up from 2.1 bcfd on Thursday and an average of 1.9 bcfd over the prior seven days.

On July 7, Freeport shut its plant in anticipation of the passage of Hurricane Beryl, the plant remained down for eight days and then resumed operations on a phased basis, having suffered damage to its fin fan air coolers due to the storm.

The company said that all three of its LNG liquefaction trains have now been safely restarted and it is in the process of returning to normal production rates.

Last month, the U.S. exported 6.69 million metric tons (MT) of LNG (10.6 bcf per day), compared to 7.11 million MT in June and 7.60 MT in May.

July’s 6.69 MT marked the second lowest monthly volume for the year, above only April’s 6.19 million MT, which reflected mechanical problems at Freeport LNG.

Freeport’s reign, as the U.S. second largest LNG facility, could end later this year as Venture Global’s 20 MTPA (2.6 bcf per day) Plaquemines export facility in Louisiana is expected to begin operations.

We are watching CN Rail and their New Fire Fighting Rail Cars

As forest fires have devastated parts of Western Canada, there’s a new tool to help keep them under control. CN Rail now has three railcars designed to fight fires along its more than 40,000 kilometers (roughly 25,000 miles) of tracks across Canada and the United States.

About CN’s firefighting railcars

The company’s first firefighting railcar, Poseidon, served as a proof of concept, and this year it added two more to its fleet: Neptune and Trident. CN’s firefighting railcars is a 66-foot bulkhead flat railcar equipped with two 3,500-gallon tanks, three water pumps, fire hoses, and a diesel-electric generator. Two tank railcars, each with a capacity of nearly 21,000 gallons, are attached to either side of the flat railcar. The railcar can safely emit various forms of fire prevention and suppression substances, including water, foam, and fire retardant. See below:

CN’s firefighting railcars

Source: CN – PFL Analytics

“Our priority is to maintain the integrity of the supply chain so that we can continue to serve our customers and power the economy. By deploying these new firefighting railcars, we’re not only reinforcing our commitment to securing the supply chain, but also helping to support the safety and security of our neighbors in communities along our network.” Said – Matthew McClaren, Assistant Vice-President, Safety, at CN in a press release.

McClaren says one of their railcars proved effective when it was deployed to Jasper, Alberta, Canada to fight wildfires near their tracks.

“We used the Trident fire suppression asset to assist the community,” he said.

Despite best efforts to fight that wildfire, at least one-third of buildings in the town of Jasper were destroyed by fire. CN’s firefighting railcars can be deployed anywhere along the company’s lines. They can be propelled by locomotives, or even trucks designed to drive along the tracks. McClaren says the company now has an extreme weather plan and uses satellite imagery to track hotspots along its network so they can deploy the railcars in time.

We Are Watching Some Key Economic Indicators

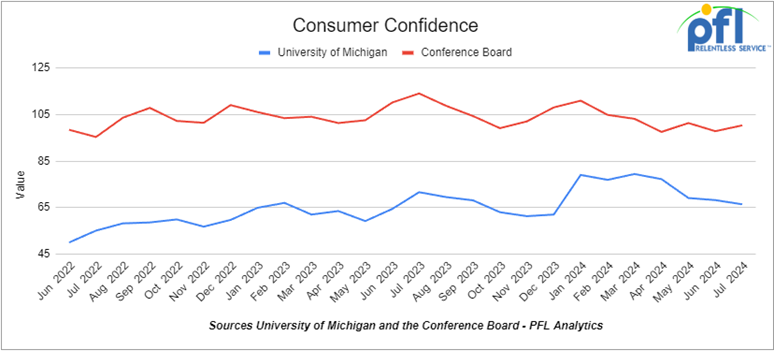

Consumer Confidence

The Conference Board’s Index of Consumer Confidence increased to 100.3 in July from a revised 97.8 in June.

The Index of Consumer Sentiment from the University of Michigan decreased from 68.2 in June to a revised 66.4 in July.

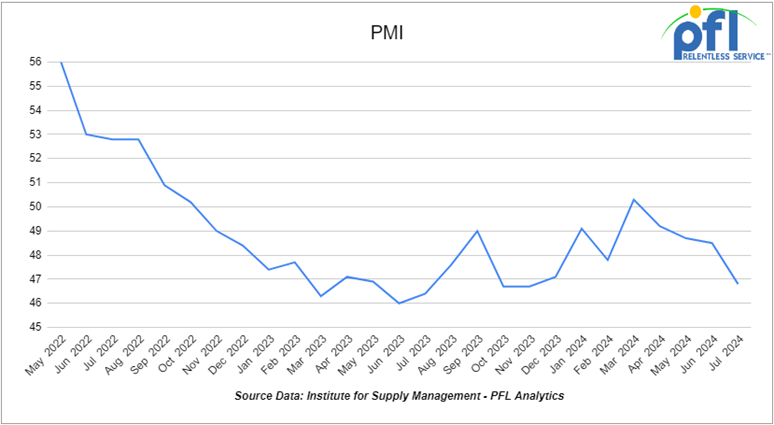

Purchasing Managers Index (PMI)

The Institute for Supply Management releases two PMI reports – one covering manufacturing and the other covering services. These reports are based on surveys of supply managers across the country and track changes in business activity. A reading above 50% on the index indicates expansion, while a reading below 50% signifies contraction, with a faster pace of change the farther the reading is from 50.

The Manufacturing PMI in July was 46.8%, down from 48.5% in June and 48.7% in May. This is the fourth straight monthly contraction in PMI. The new orders subindex fell to 47.4% in July from 49.3% in June. The Services PMI in July was 52.7%, a slight increase from 52.5% in June, indicating continued expansion in the service sector.

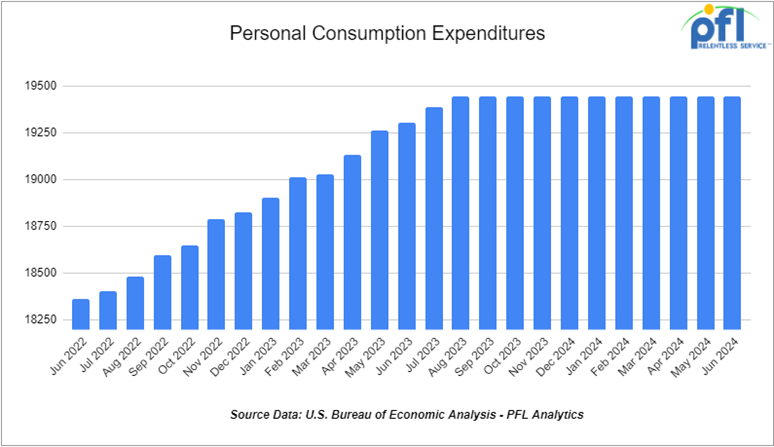

Consumer Spending

In June 2024, total consumer spending adjusted for inflation rose a preliminary 0.3% over May 2024. This follows a revised increase of 0.4% in May and a drop of 0.1% in April. Year-over-year inflation-adjusted total spending in June 2024 was up 2.5%.

Inflation-adjusted spending on goods rose a preliminary 0.6% in June, continuing from the 0.7% decline in April 2024. Inflation-adjusted spending on services rose 0.1% in June, marking the tenth consecutive month-to-month increase

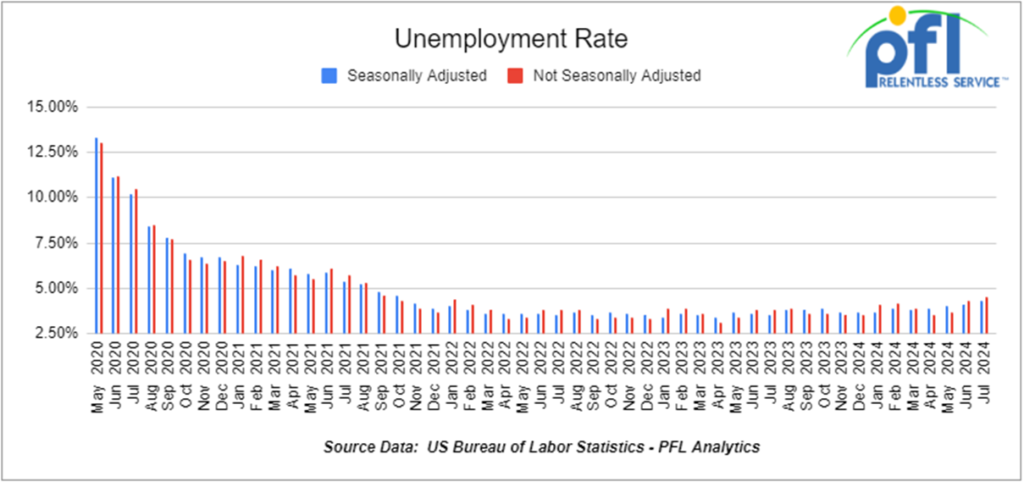

US Unemployment

On August 2, the BLS reported that a preliminary 114,000 net new jobs were created in July 2024, and figures for May and June 2024 were revised substantially downward. May was revised down to 218,000 new jobs, and June was revised down to 106,000. According to the BLS, so far this year, net new job gains have totaled approximately 1.33 million. The official unemployment rate was 4.3% in July, up 0.2% month over month

Industrial Output & Capacity Utilization

Manufacturing accounts for approximately 75% of total output. manufacturing output in June was up a preliminary 0.6% from May 2024.

Capacity utilization is a measure of how fully firms are using the machinery and equipment — increased to 77.9%

Lease Bids

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

- 150, 23.5K DOT111 Tanks needed off of any class 1 in LA for 2-3 years. Cars are needed for use in Fluid service. Needed July

- 30, 17K-20K DOT117J Tanks needed off of UP or BN in Midwest/West Coast for 3-5 years. Cars are needed for use in Caustic service.

- 15, 28.3K DOT117J Tanks needed off of any class 1 in any location for 3 years. Cars are needed for use in Glycerin & Palm Oil service.

- 25, 20.5K CPC1232 or DOT117J Tanks needed off of BNSF or UP in the west for 3-5 years. Cars are needed for use in Magnesium chloride service. SDS onhand

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 50, 23.5-25.5 DOT111 Tank s needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 25-50, 5000CF-5100CF Covered Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in Dry sugar service. 3 bay gravity dump, Hempel 37700

- 10, 30k any type Tanks needed off of UP BN in Texas for 1 year plus. Cars are needed for use in Fuel Oil service.

- 14, 23.5K DOT111 Tanks needed off of UP in Morrilton, AR for 1 year. Cars are needed for use in Turpentine service.

- 8, 28-30K any type Tanks needed off of UP BN in Texas and Gulf for 5 years. Cars are needed for use in Chlorobenzene service. Need Magrods

- 4, 6260 Covered Hoppers needed off of CSX in Bostick, NC for 2-4 Years. Cars are needed for use in Polypropene Pellets service.

- 250, 4000 Rapid Hoppers needed off of BNSF in TX IL for 5 years. Cars are needed for use in Coal service. in rotary/rapid cars with the electric dumping shoe

- 10, 28.3K 117J Tanks needed off of UP or BN in Texas for 3 Year.

- 25-30, 23.5K or 25.5K Dot 111 or CPC 1232 Tanks needed off of UP or BN in TX, OK, or AR for 3-5 Years. Cars are needed for use in Asphalt service. Needed ASAP., Lined or Unlined. Splash Load

- 10, 25.5K-28.3K DOT 111 Tanks needed off of UP or BN in Houston for 2 Year. Cars are needed for use in Resin service.

- 30, 29K 117J Tanks needed off of BN or CN in Houston or Edmonton for 1-2 Year. Cars are needed for use in Biodiesel service.

- 100, 25.5K DOT 111 Tanks needed off of Any Class 1 in Texas for 3 Years +. Cars are needed for use in Asphalt service.

- 20, 25.5k CPC 1232 Tanks needed off of UP or BN in OK, TX for 3 Year. Cars are needed for use in Asphalt service.

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

- 50, 30K 117 Tanks needed off of BNSF or UP in TX for 3-6 Months. Cars are needed for use in Crude service. will look at smaller cars. Prefer short term would look at longer term. Domestic use only

- 100, 15.5K DOT 111 Tanks needed off of Any Class 1 in USA for 1-3 Years. Cars are needed for use in Molten Sulfur service.

- 20, 4750’s Through Hatch Covered Hoppers needed off of UP BN in USA West for 3 years. Cars are needed for use in Fertilizer service.

- 80, 25.5K-29K any type Tanks needed off of NS or CSX in Northeast for 1-5 Years. Cars are needed for use in Crude service.

- 200, 30K any type Tanks needed off of UP or BN in Texas for RD. Cars are needed for use in Dirty service.

- 15-20, 29K 117R Tanks needed off of NS or CSX in Ohio for 6-12 Months. Cars are needed for use in Ply Oil service.

- 100, 5200 Covered Hoppers needed off of UP or BN in Northwest for 6 month. Cars are needed for use in Pet Coke service. Roud Hatch, Bottom Outlet Doors

- 25, 25.5K DOT 111 Tanks needed off of UP in LA for 1-5 Years. Cars are needed for use in Lubricant service.

- 30, 33K Pressure Tanks needed off of Any Class 1 in Any Location for 6 Months. Cars are needed for use in Propane service. Needed for Winter

- 10, 25.5 117J Tanks needed off of All class ones in Chicago for Epoxy Resin. Cars are clean 5 years

- 10, 5250 Covered Hoppers needed off of UP or BN in Midwest for up to 5 years. Cars are needed for use in Dry Edible Beans service.

- 10, 3250 thru hatch Hoppers needed off of BNSF in TX IL for 5 years. Cars are needed for use in Agg service.

Sales Bids

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Cement service. Cement Gates needed.

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 20-30, 3000 – 3300 PD Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 2-4, 28K DOT111 Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

- 100, 15.7K DOT111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

- 5, 30K DOT 111 Tanks needed off of in US. Cars are needed for use in Fuels service.

- 5, 23,5K DOT 111 Tanks needed off of any class 1 in Texas. Negotiable

Lease Offers

- 50, 5400, Covered Hoppers located off of NS, IORY in MI. Cars were last used in bean meal. 1 year+

- 2, Flat Double-stack rail transports located off of KCS in Texas. Cars are clean Lease or sell. (Intermodal Container)

- 60, 33K, 340W Pressure Tanks located off of All Class Ones in North America. Cars were last used in Propane/Butane. Up to 1 year.

- 5, 25.5K, DOT 111 Tanks located off of UP in Kansas. Cars were last used in Veg Oils. 2 Year Term

- 50, 30K, DOT 117J Tanks located off of All Class Ones in North America. Cars were last used in Ethanol. 1-2 Year Term.

Sales Offers

- 24, 5300CF, Plate C Boxcars located off of NS or CSX in Southeast.

- 100-300, 3400, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 19, 4400, Rotary Gondolas located off of UP and BN in California and Wyoming.

- 100, 28.3K, DOT117J Tanks located off of various class 1s in multiple locations.

- 7, 30K, DOT 111 Tanks located off of UP in TX, CA, NM.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|

PFL will be at the Following Conferences

- Where: La Quinta, CA

- Attending: David Cohen (954-729-4774)

- Conference Website

- Where: Hyatt Regency Dallas in Dallas, TX

- Attending:Curtis Chandler (239.405.3365), David Cohen (954-729-4774), Brian Baker (239.297.4519), Cyndi Popov(403) 402-5043

- Conference Website