“Sometimes the questions are complicated and the answers are simple”

– Dr. Seuss

PFL Petroleum was live Monday August 31st.

COVID 19 and Markets Update

The United States currently has 6,175,008 confirmed COVID 19 cases and 187,227 confirmed deaths. The number of new cases continues to decline.

Jobless Claims

The U.S. Labor Department stated on Thursday of last week that U.S. workers filed an additional 1.0 million jobless claims, bringing the total job losses since the coronavirus pandemic (COVID-19) to nearly 58 million. Economists polled by Dow Jones expected a total of 1 million and news came in as expected. This was the 22nd time in 23 weeks that initial jobless claims came in above 1 million.

DOW and Nasdaq

The DOW closed higher on Friday, up 161.60 points (+0.57%) to finish out the week at 28,653.87 up 723.54 points week over week. The S&P 500 traded higher 23.46 points (+0.67%) on Friday, closing at 3,508.01 up 110.85 points week over week. The Nasdaq finished Friday’s session higher as well, gaining 70.30 points (+0.60%) closing out the week at 11695.63, up 383.83 points week over week. In overnight trading, DOW futures traded higher and are expected to open up this morning 71 points.

The Oil Markets

West Texas Intermediate (WTI) traded down .07¢ to close at $42.97 on Friday of last week on the New York Mercantile Exchange, up 63¢ per barrel week over week.

Brent traded up .21¢ cents to close at $45.81 on Friday of last week, a gain of $1.46 per barrel week over week.

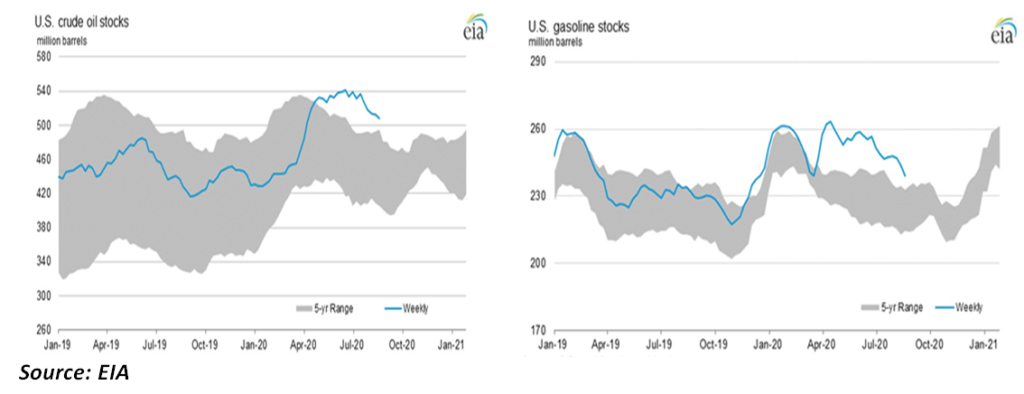

U.S. crude inventories fell by 4.69 million barrels last week and now stand at 507.81 million barrels according to the EIA. Exports were up 1.23MM/bpd to 3.36MM/bpd, while production was mostly flat at 10.8MM/bpd.

Gasoline inventories were down by 4.58 million barrels more than double the forecasted draw as demand increased by 531K/bpd. Distillate stocks had a build of 1.39MM/bbls, vs a forecasted draw of -378K. US gulf coast distillates inventories have stayed above 60 million barrels since mid-July. Their highest level in 30 years according to the EIA.

US Crude and Gasoline Charts (Approaching the Top end of 5 year Averages)

Oil is higher in overnight trading and, as of the writing of this report, WTI is poised to open at 43.49 up 52¢/ barrel from Friday’s close.

Things we are keeping an eye on:

- Alberta Governments Crude by Rail Program – Offloading deals to the private sector has come at a steep price for the Province. The Alberta government is less than halfway through offloading a series of oil-by-rail contracts from its books onto the private sector, a process it was planning to have done by the end of March, the month after Canadian crude exports via rail hit a record high. Since then, those shipments have plummeted. The Province has already paid $866-million to the private sector to offload the contracts, signed as part of a $3.7-billion deal in February, 2019, under the then-NDP government. Alberta’s fiscal update last Thursday earmarked another $1.25-billion to cover the cost of divesting the rest of the contracts. Alberta’s projected deficit for this year rocketed to a record $24.2-billion with royalties stemming from non-renewable resources such as bitumen and natural gas expected to drop to their lowest point in more than four decades. Crude by rail in the Province is still tough with a bunch of cars still parked, however, basis did widen on Friday to -$11.00 which is $3.50 barrel wider month over month and may encourage some cars moving again as production in the Province continues to come online. The four week rolling average of petroleum carried on North American railroads rose to 21,065 from 21,055 up 10 carloads week over week. CP shipments rose by 13.6% while CN’s shipments were down 0.2%.

- IHS Markit reported that world oil demand has grown by 13 million barrels a day in the four months since the bottom of the COVID-induced collapse in April to about 89 per cent of last year’s levels. It says it expects demand growth to plateau at roughly 92 to 95 percent of 2019’s average output of around 100 million barrels per day through the first quarter of 2021 as travel-related fuel demand will remain subdued until virus vaccines are widely available.

- The Federal Railroad Administration’s “passive” acceptance of a railroad company’s plan to use Mexican engineers within the U.S. can be challenged by railroad unions, a U.S. appeals court said in a 2-1 decision.

- National Steel car gets a 1,500 $115 million hopper order from Canadian National Railway Co. who is boosting its grain-hauling capacity.

- Hurricane Laura aftermath – Gulf of Mexico energy industry dodges Hurricane Laura. The concentration of energy assets along the Texas and Louisiana coast more or less avoided the worst-case scenario from Hurricane Laura. “The damage is not as bad as anticipated, which is creating more sell pressure along the energy complex,” said Phil Flynn, senior market analyst at Price Futures Group. More than 80 percent of oil output in the Gulf of Mexico and almost 3 million barrels a day of refining capacity had been shut ahead of the storm, most of which should come back online fairly quickly.

- Dakota Access – It’s fate is up to the election. The U.S. Army Corps of Engineers has asked an appeals court to reverse a lower court’s ruling vacating the permit of the Dakota Access oil pipeline to operate, arguing that such ruling creates “impossible” standards that could scupper future major infrastructure projects. The pipeline’s fate largely depends on the outcome of the presidential election.

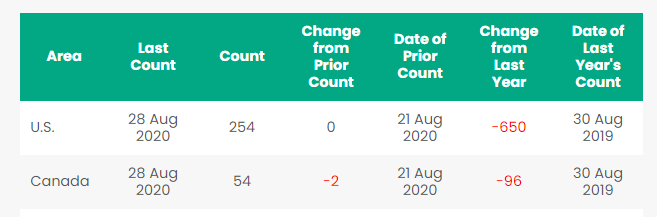

Rig Count

North America rig count moved lower week over losing 2 Rigs week over week. The U.S. was flat week over week with 254 active rigs. Canada lost 2 rigs week over week and Canada’s overall rig count declined to 54 active rigs Year over year we are down 746 rigs collectively.

North American Rig Count Summary

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

North American Rail Traffic

Total North American rail volumes were down 5.1% year over year in week 34 (U.S. -3.3%, Canada -10.3%, Mexico -8.0%), resulting in quarter to date volumes that are down 8.4% and year to date volumes that are down 11.2% (U.S. -11.9%, Canada -8.6%, Mexico -10.7%). 8 of the AAR’s 11 major traffic categories posted year over year declines with the largest decreases coming from coal (-21.0%), nonmetallic minerals (-21.9%) and petroleum (-28.0%). The largest increase came from intermodal (+2.4%).

In the East

CSX’s total volumes were down 2.1%, with the largest decrease coming from coal (-36.8%). The largest increases came from intermodal (+8.0%) and chemicals (+10.9%). NS’s total volumes were down 4.7%, with the largest decreases coming from coal (-23.7%), petroleum (-47.4%) and stone sand & gravel (-27.8%). The largest increase came from intermodal (+3.4%).

In the West

BN’s total volumes were down 5.6%, with the largest decreases coming from coal (-14.3%), stone sand & gravel (-55.6%) and petroleum (-34.6%). The largest increases came from intermodal (+1.5%) and motor vehicles & parts (+24.3%). UP’s total volumes were down 2.0%, with the largest decreases coming from stone sand & gravel (-35.1%), coal (-14.8%), motor vehicles & parts (-18.7%) and petroleum (-29.5%). The largest increases came from intermodal (+8.1%) and grain (+36.7%).

In Canada

CN’s total volumes were down 10.9% with the largest decreases coming from petroleum (-37.3%), metallic ores (-18.4%) and coal (-35.8%). RTMs were down 12.9%. CP’s total volumes were down 11.4%, with the largest decreases coming from intermodal (-15.1%), petroleum (-52.5%) and stone sand & gravel (-65.5%). RTMs were down 7.8%.

Kansas City Southern

KCS’s total volumes were down 3.6%, with the largest decrease coming from motor vehicles & parts (-18.6%).

Source: Stephens

Railcar Markets

PFL is seeking:

- 200 25.5 cpc 1232 cars for use in Mexico for 1-3 years for heavy fuel oil;

- 2 Covered hoppers for purchase 5500 series, for storage at plant site in the Chicago area, BN or NS connection;

- 40 LPG pressure cars for various locations and lease terms up to one year. 25 22-30K coiled and insulated for biodiesel in the Midwest off the UP, 6-12 months;

- 5-15 6000+ high sided gondolas, no interior bracing for purchase off the CN or CP Ontario destination.

- 5-10 31.8s food grade needed in the Midwest for service in Mexico, 5 year lease.

- 5-10 syrup cars are needed in the Midwest.

- 200 steel coal gondolas for purchase.

- 100 4750’s for grain service in the Midwest, one year lease.

- Need 50-90 263 or 268 needed for corn syrup 12 month lease.

- Need ten 20K to 23.5 coiled and insulated for one year in ethylene glycol;

- 10 CPC 1232 or other for industrial alcohol use in Indiana off the NS for 6 months: lessee would take ethanol cars clean then use for industrial alcohol service and deliver the cars back to you with industrial alcohol heals (cars would be accepted with ethanol heels) please call to discuss.

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil. Lease terms negotiable, short and long term opportunities available Clean cars are available 1-5 years scattered across the country.

- Leases on 117Js and 117Rs, dirty to dirty for sublease.

- 455 117Js cleaned and relined for sale or lease in Texas. 207 CPC -1232’s for sale or lease in Texas.

- 61 ft. bulkhead flat cars, lease only.

- 200 30K tankers cleaned and ready for service, for sale or lease.

- 100 5650 PD hoppers brand new 65 ft, lease only, available in 60 days.

- 218 73 ft 286 GRL riserless deck, center part for sale.

- 28 auto-max II automobile carrier racks – tri-level for sale.

- 100 65’ 100 ton log cars for sale, various locations. 49 60’ Box cars 286 EOL refurbed in Tenn.

- PFL has a number of steel and aluminum hoppers for various commodities and tank cars, all for sale.

- Additionally sand cars, box cars, coal cars and hoppers including sugar covered hoppers and plastic pellet cars, are also available for sale and lease in various locations and terms.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offer Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS. WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|