“Nothing so conclusively proves a man’s ability to lead others as what he does from day to day to lead himself.”

-Thomas J. Watson

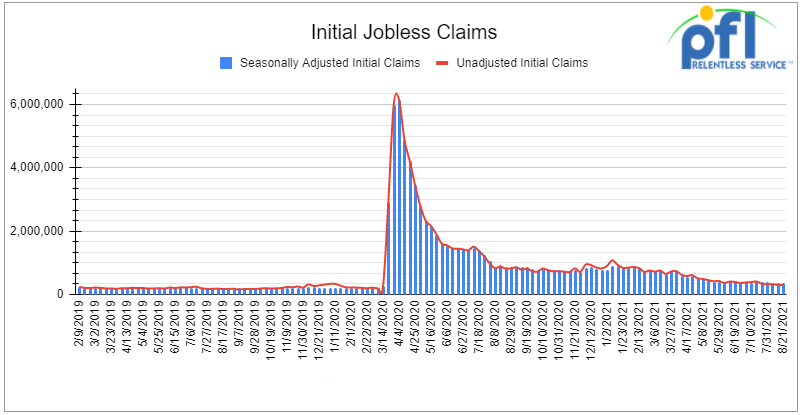

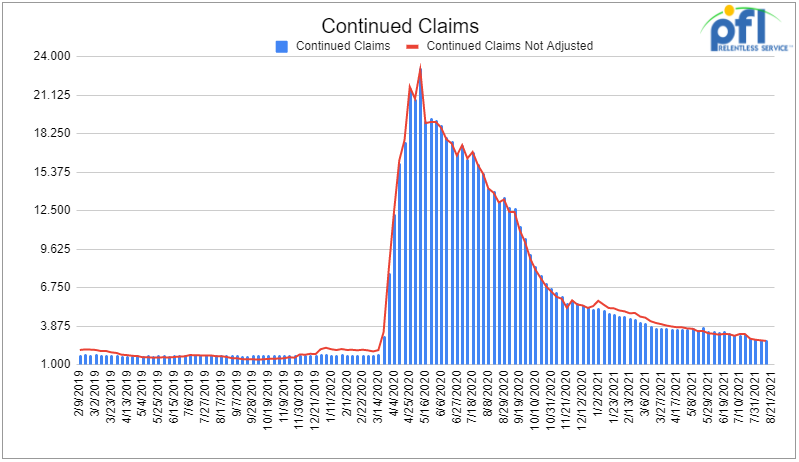

Jobs Update

Weekly jobless claims are down week over week, but remain elevated

- Initial jobless claims for the week ended August 21 came in at 353,000 versus 350,000 people that were expected, up 4,000 people week over week which was slightly above analysts’ expectations. This was the first increase in 5 weeks.

- Continuing claims came in at 2.862 million, versus the 2.772 million people expected

Stocks closed higher on Friday of last week and up week over week

The Dow closed higher on Friday of last week, up +242.68 points (+.69%) closing out the week at 35,455.80, up +335.72 points week over week. The S&P 500 closed higher on Friday of last week, up +39.37 points (+0.88%) and closing out the week at 4,509.37 4, up +67.70 points week over week. The Nasdaq closed higher on Friday of last week, up +183.69 points (+1.23%) and closing out the week at 15,129.50, up +414.84 points week over week.

In overnight trading, DOW futures traded higher and are expected to open up this morning 22 points.

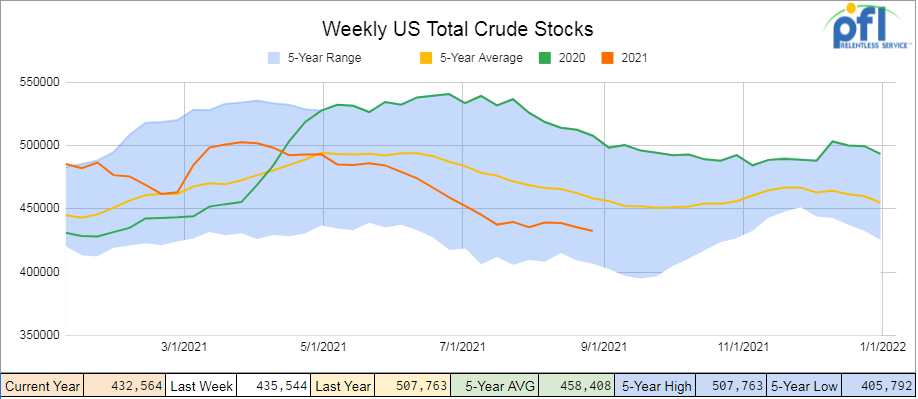

Oil posts biggest weekly gain in One Year on the back of Hurricane Ida

Oil advanced on Friday of last week on the back of Hurricane Ida that caused producers in the gulf to shut in production in advance of the projected Category 4 hurricane. According to the Bureau of Safety and Environment, 59% of oil output in the Gulf of Mexico was shut in on Friday of last week and roughly 49% of natural gas production and a total of 89 platforms were evacuated. West Texas Intermediate (WTI) for October delivery rose $1.32 a barrel to settle at $68.74 a barrel on Friday of last week, up $6.42 a barrel week over week. Brent crude oil settled up $1.63 a barrel on Friday of last week closing at $72.70 a barrel, up $7.52 a barrel week over week.

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 3.0 million barrels week over week. At 432.6 million barrels, U.S. crude oil inventories are 6% below the five-year average for this time of year.

Total motor gasoline inventories decreased by 2.2 million barrels week over week and are 3% below the five year average for this time of year. Finished gasoline and blending component inventories both decreased for the week ending August 20th.

Distillate fuel inventories increased by 600,000 barrels week over week and are 8% below the five-year average for this time of year.

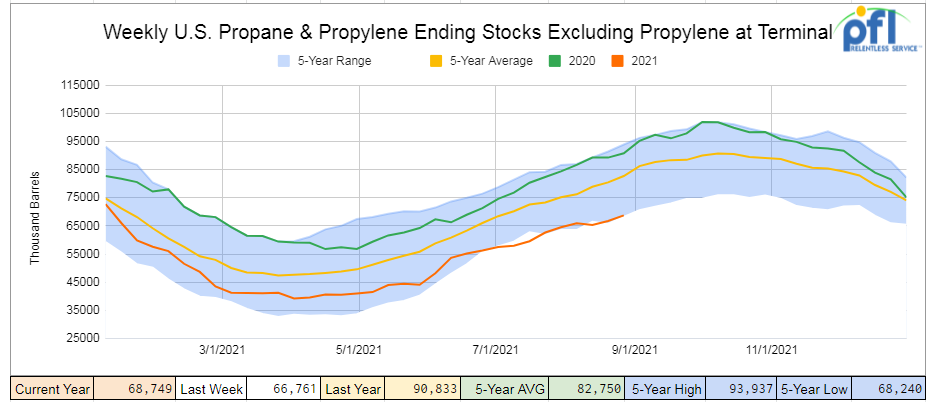

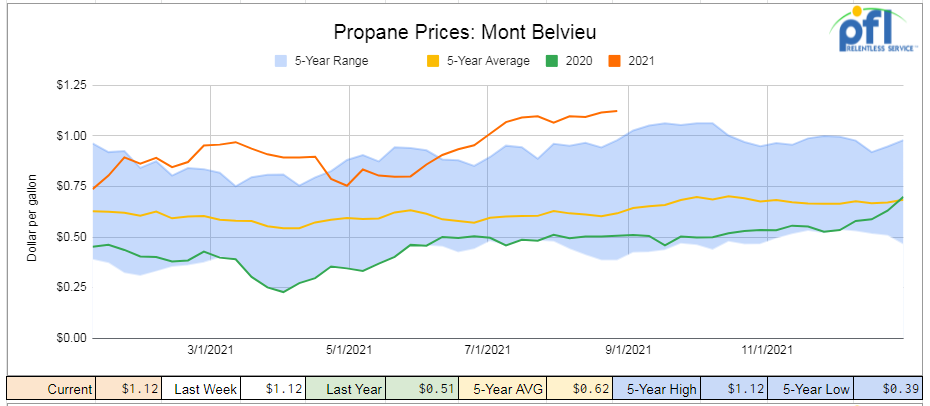

Propane/propylene inventories increased by 2.0 million barrels last week and are 17% below the five-year average for this time of year.

Global Propane prices remain elevated – here at home prices are unchanged week over week at $1.12 per gallon a five-year high and are up 61 cents per gallon year over year and up 73 cents per gallon from the five=year low experienced back in April of 2020.

Overall total commercial petroleum inventories decreased by 4.8 million barrels week over week.

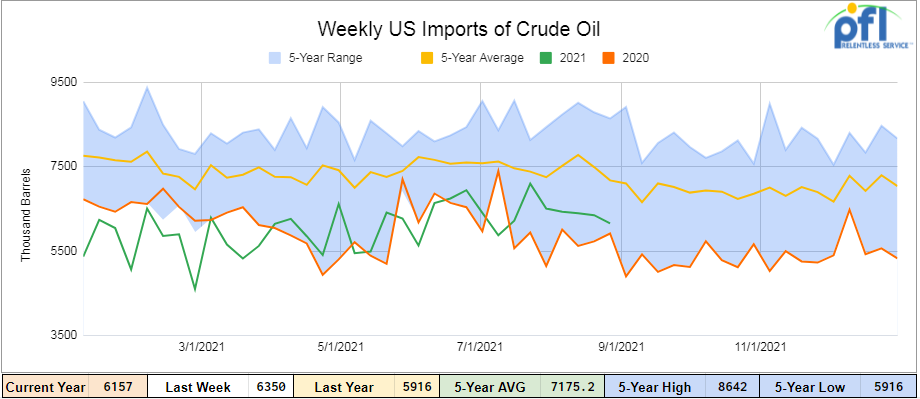

U.S. crude oil imports averaged 6.2 million barrels per day for the week ending August 20th, down by 193,000 barrels per day week over week. Over the past four weeks, crude oil imports averaged 6.3 million barrels per day, 8.8% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) for the week ending August 20th averaged 1.1 million barrels per day, and distillate fuel imports averaged 288,000 barrels per day.

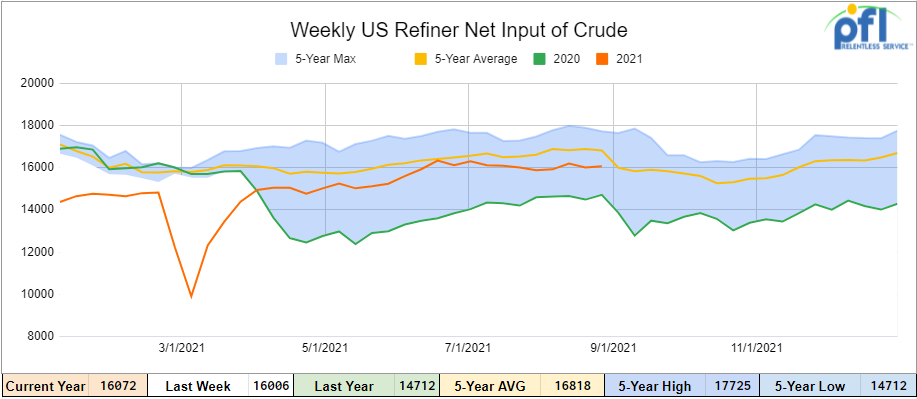

U.S. crude oil refinery inputs averaged 16.1 million barrels per day during the week ending August 20th which was 66,000 barrels per day more than the previous week’s average. Refineries operated at 92.4% of their operable capacity for the week ending August 20th. Gasoline production increased week over week, averaging 10.2 million barrels per day. Distillate fuel production increased week over week, averaging 5.0 million barrels per day.

As of the writing of this report, WTI is poised to open at $68.09, down 65 cents per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were down 1.5% year over year in week 33 (U.S. -2.6%, Canada +5.2%, Mexico -10.3%) resulting in quarter to date volumes that are up 1.6% year over year and year to date volumes that are up 9.9% year over year (U.S. +11.1%, Canada +6.9%, Mexico +6.0%). 4 of the AAR’s 11 major traffic categories posted year over year decreases with the largest decreases coming from intermodal (-3.3%) and grain (-22.3%). The largest increase came from metallic ores & metals (+20.2%).

In the East, CSX’s total volumes were down 0.4%, with the largest decrease coming from motor vehicles & parts (-20.5%). The largest increase came from coal (+21.6%). NS’s total volumes were down 3.2%, with the largest decrease coming from intermodal (-7.7%). The largest increases came from metals & products (+33.2%) and petroleum (+60.5%).

In the West, BN’s total volumes were up 1.1%, with the largest increases coming from intermodal (+2.5%) and stone sand & gravel (+51.2%). The largest decrease came from grain (-19.0%). UP’s total volumes were down 4.9%, with the largest decrease coming from intermodal (-10.3%). The largest increase came from petroleum (+30.0%).

In Canada, CN’s total volumes were up 5.5%, with the largest increases coming from coal (+103.0%) and metallic ores (+27.7%). The largest decrease came from motor vehicles & parts (-23.2%). RTMs were up 4.8%. CP’s total volumes were up 7.9%, with the largest increase coming from intermodal (+28.5%). The largest decrease came from grain (-46.4%). RTMs were down 2.6%.

KSU’s total volumes were down 5.4%, with the largest decrease coming from intermodal (-15.1%)

Source: Stephens

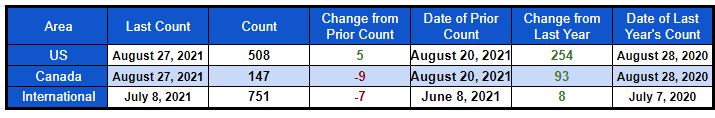

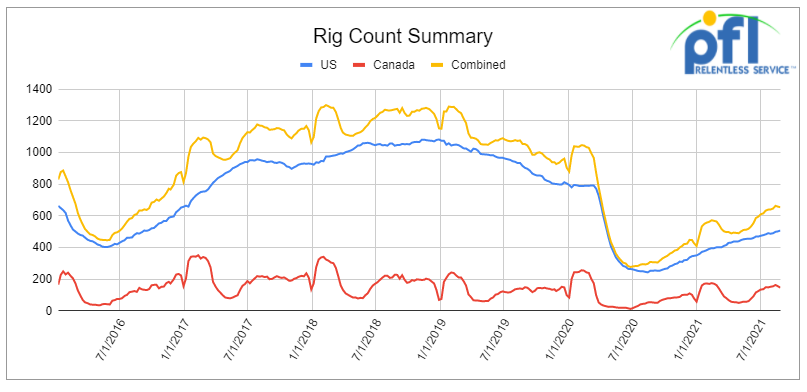

Rig Count

North American rig count is down by 4 rigs week over week. The U.S. rig count was up by 5 rigs week over week and up by 254 rigs year over year. The U.S. currently has 508 active rigs. Canada’s rig count was down by 9 rigs week over week, but up by 93 rigs year over year and Canada’s overall rig count is 147 active rigs. Overall, year over year we are up 347 rigs collectively.

North American Rig Count Summary

A few things we are keeping an eye on:

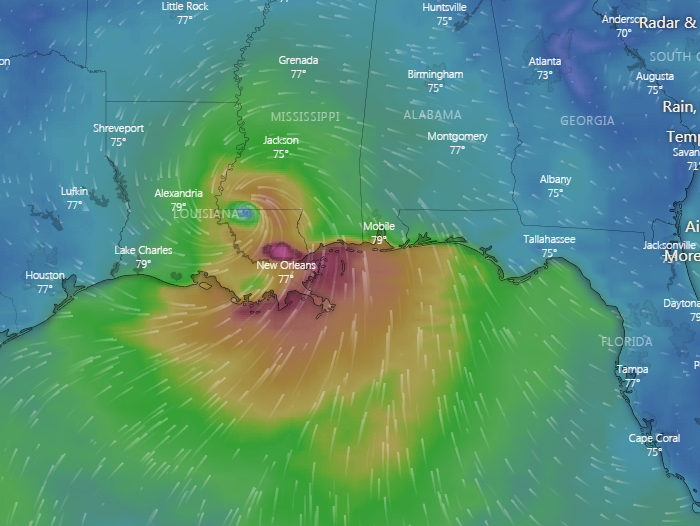

- We are watching Hurricane Ida – As anticipated Hurricane Ida hit the gulf coast with a vengeance over the weekend as a category 4 hurricane. As of 5:00 am 1,015,208 people in Louisiana were without Power and 91,064 people in Mississippi without power. Ida as of 6:00 am was still a cat 1 and slamming Baton Rouge. Flash flooding and down trees are everywhere. First responders have not responded as of yet because of the still dangerous situation on the ground.

Hurricane Ida Position as of 5:00 am Eastern It is unclear as to the effects of rail, refinery and Petrochemical plant damage. PFL will be watching the fallout closely and is here to help if any repositioning of cars is needed. At the moment folks are continuing to bunker down and some will be assessing damage later this morning. For the moment the worst conditions are on the east side of the storm into Mississippi and Alabama. The threat for the Gulf Coast States will continue well into tomorrow afternoon with rain and flash flooding being the real threats. Stay tuned to PFL for an to the minute updates.

Source: Windy.com - We are watching the Enbridge Line Three Expansion – The Minnesota Supreme Court denied hearing an appeal from Native American tribes and environmental groups that want the pipeline shut down – Another victory for Enbridge as the pipeline nears completion and could start flowing incremental Oil from Canada to the U.S. as early as September 15th. The pipeline has been flowing 390,000 barrels per day and expected to begin pumping 760,000 barrels per day once construction is complete in just 16 days.

- DOE Selling 20 Million Barrels of Crude from the Strategic Petroleum Reserves (SPR) – This was announced on Monday of last week. Bids are due tomorrow and deliveries will take place between October 2021 and December 15, 2021. The sale will be conducted with crude oil from the following four SPR sites (maximum amount from each site listed):

- Up to 8 million barrels from Bryan Mound

- Up to 8 million barrels from Big Hill

- Up to 8 million barrels from West Hackberry

- Up to 1 million barrels from Bayou Choctaw

Rumor is, we are selling the crude to stabilize gasoline prices yet at the same time trying to shut down pipelines – at a little bit at a loss here, folks.

- Petroleum by Rail – The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 24,902 from 24,980, a loss of 78 rail cars week over week. Canadian volumes were mixed – CN shipments were up by 11.1% and CP shipments were down by 5.1%. U.S. volumes were mostly higher with the CSX having the largest percentage increase up 9.2% while NS’s shipments fell by 1.9%.

- The Rail Car Industry real busy – A few items noteworthy:

- Folks, right now there is a significant amount of railcar scrapping going on – make sure to call PFL for your scrapping needs we have facilities on virtually every class one where we can accept cars in addition we can come to you and offer mobile rail car scrapping for stranded cars.

- Greenbrier announced on Monday of last week new orders totaling 5,500 units valued at more than $530 million received thus far during its fourth fiscal quarter that began on June 1, 2021. This increases Greenbrier’s backlog and the orders announced are from a diverse mix of customers and comprise a broad range of railcar types, including intermodal, boxcars, tanks, covered hoppers and gondolas.

- Trinity and Wafra Inc. announced a new railcar investment vehicle program (RIV) between Trinity and certain funds managed by Wafra. The RIV program will invest in diversified portfolios of leased railcars originated by Trinity Industries Leasing Company targeting up to $1 billion in total acquisitions over an expected three-year investment period.

- We are watching Natural Gas and global LNG – The average LNG price for October delivery into Northeast Asia is estimated at $17.20 per mmBtu, up $1.70 per mmbtu week over week. Natgas has been strong here in the U.S. with a build in storage last week less than analyst expectations and below the 5 year average on the back of increased power generation and using the commodity for electricity generation due to a lack of wind to power those windmills. That and the fact that production was shut in on Friday of last week in the gulf due to an impending hurricane caused Natural gas to close at $4.371 up 18.7 cents day over day. The good news for rail is that elevated Natgas prices has caused electricity generators to use more coal where they can increasing rail traffic for the good. As far as outlook goes we are anticipating $5.00 Natgas + at some point during this heating season due to decline rates of associated gas production particularly in the Permian and other factors. Call PFL to trouble shoot your coal car needs if you have any 239-390-2885!

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Railcar Markets

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 70 5150 Covered Hoppers needed in Midwest for 3 Month starting October.

- 20-50 4750 Covered Hoppers needed for Petcoke. Can take in South.

- 70 117R or J needed for Ethanol for 3 years. Can take in the South.

- 30 25.5’s or greater food grade veg oil cars for 6-12 months

- 90-100 28.3K C/I Tank Cars needed for Biodiesel in the Midwest for 1 Year.

- 50 6500+ cuft Mill Gon or Open Top Hopper for wood chips in the Southeast for 5 Years.

- 25 bulkhead flats 286 any class one for up to 5 years Negotiable

- 10 open top hoppers 2400 C FT in Texas needed for stone on the UP 3-5 years

- 20 19,000 Gal Stainless cars in Louisiana UP for nitric acid 1-3 years – Oct negotiable

- 10 6,300CF or greater covered hoppers needed in the Midwest.

- 15-25 20K 23.5K cars for Oct Slurry needed in the South for 1 Year

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js – Selection is Dwindling. Call Today!

- 200 Clean C/I 25.5K 117J in Texas. Brand New Cars!

- 34 Clean C/I 25.5K CPC 1232’s located in PA.

- 100 117Rs dirty last in Gasoline in Texas for lease Negotiable

- 20 117R 30K plus tanks for ethanol in Wisconsin off the CN Negotiable

- 90 117Rs 30K located in Alberta CN or CP Refined Products Dirty – negotiable

- 37 BRAND NEW 5161 Sugar Hoppers in Arkansas UP – negotiable

- 99 340W Pressure Cars various locations Butane and Propane dirty negotiable

- 100 73 ft 286 GRL riser less deck, center part for sale,

- 19 auto-max II automobile carrier racks – tri-49 for sale – negotiable

- 10 food grade stainless steel cars

- 20 20K Stainless cars in 3 locations in the south – negotiable

- 30 CPC 1232 25.5K C/I Pennsylvania NS clean negotiable

- 100-150 29K C/I 117J cars for lease. Dirty in Bakken crude and can be returned dirty.

- 100 29K C/I 1232 cars for lease. Dirty in Heavy Crude and can be returned dirty.

- 100 117Rs 29K clean last used in crude Washington State – price negotiable sale or lease

- 21 111s 29K tanks last in alcohol dirty on the CN in Wisconsin for lease price negotiable

- 100 111s of various volumes and locations last in fuel oil dirty price negotiable

- Various Hoppers for sale and lease 3000-5800 CF 263 and 286 multiple locations negotiable

- 45 Boxcars 60ft Plate F’s Located in Tenn CSX – Lease Negotiable

- 28 20K Veg oil cars for lease in Arkansas – Negotiable

- 100 3200 Covered Hoppers for sale price negotiable

- 100 Center beam Flats with risers 73ft in SD and Iowa for sale negotiable

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|