“Railroads are the great symbols of modernity. They are also, less obviously, the great symbols of democracy.”

– Paul Theroux

Jobs Update

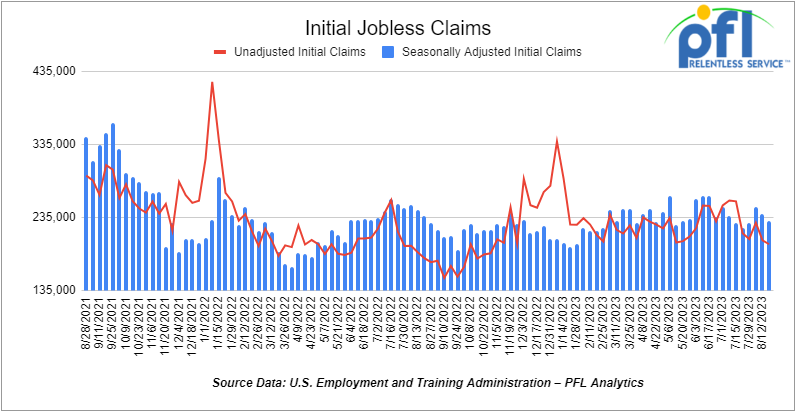

- Initial jobless claims for the week ending August 19th, 2023 came in at 230,000, down -10,000 people week-over-week.

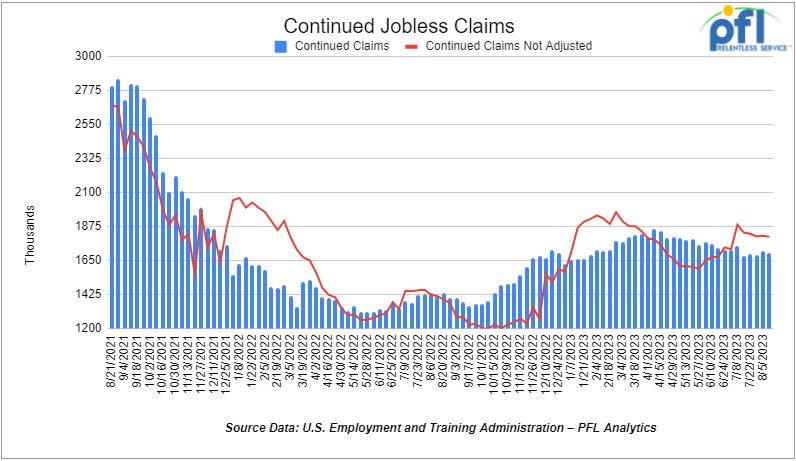

- Continuing jobless claims came in at 1.702 million people, versus the adjusted number of 1.711 million people from the week prior, down -9,000 people week-over-week.

Stocks closed higher on Friday of last week, but mixed week over week

The DOW closed higher on Friday of last week, up 247.48 points (+0.73%), closing out the week at 34,346.9, down -153.76 points week-over-week. The S&P 500 closed higher on Friday of last week, up 29.4 points (+0.67%), and closed out the week at 4,405.71, up +36 points week-over-week. The NASDAQ closed higher on Friday of last week, up 126.67 points (+0.95%), and closed the week at 13,590.65, up 299.87 points week-over-week.

In overnight trading, DOW futures traded higher and are expected to open at 34,457 this morning up 80 points.

Crude oil closed up on Friday of last week, but down week over week

WTI traded up $0.76 per barrel (+1%) to close at $79.83 per barrel on Friday of last week, but down -$1.42 per barrel week-over-week. Brent traded up US$1.12 per barrel (+1.3%) on Friday of last week, to close at US$84.48 per barrel, down -US$0.32 per barrel week-over-week.

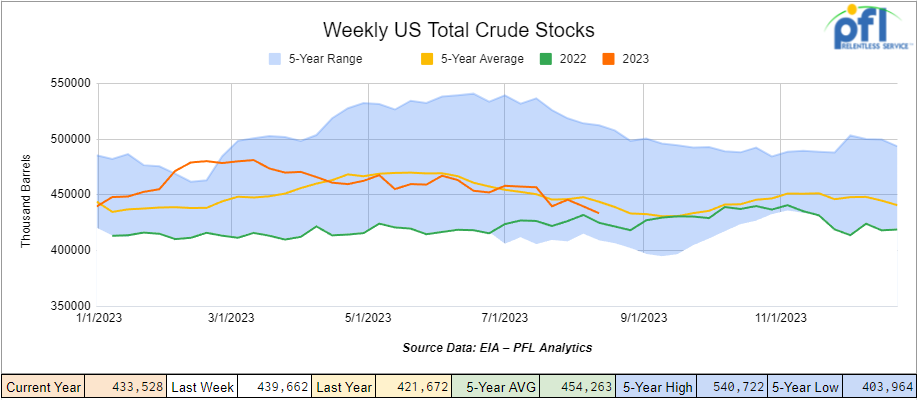

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 6.1 million barrels week-over-week. At 433.5 million barrels, U.S. crude oil inventories are 2% below the five-year average for this time of year.

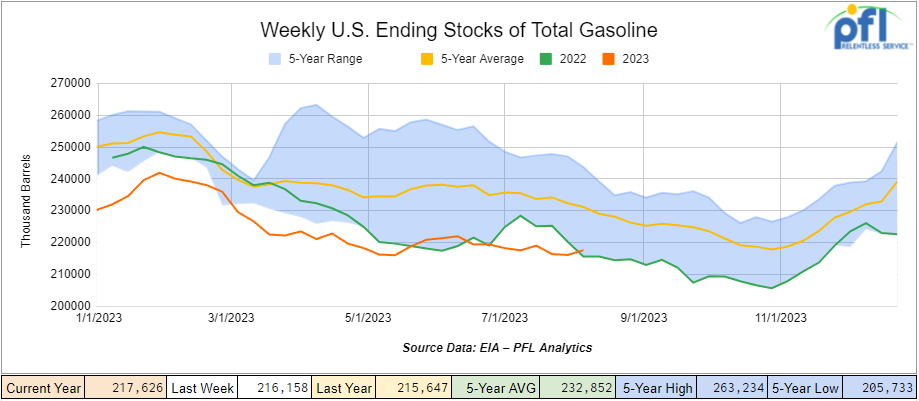

Total motor gasoline inventories increased by 1.5 million barrels week-over-week and are 5% below the five-year average for this time of year.

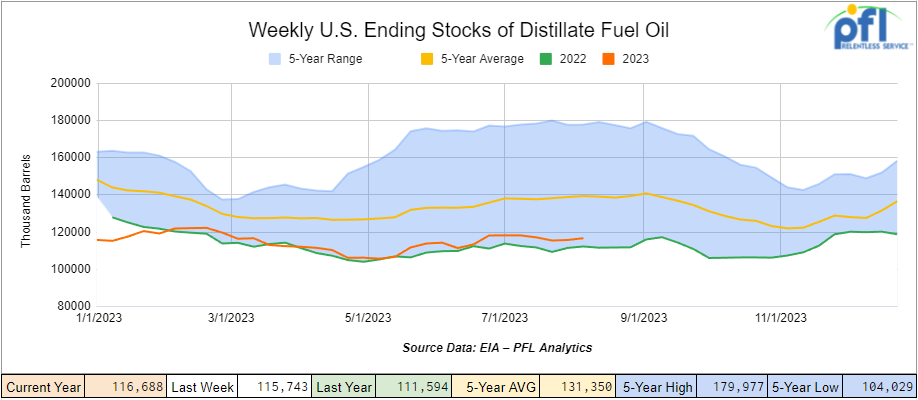

Distillate fuel inventories increased by 900,000 barrels week-over-week and are 16% below the five-year average for this time of year.

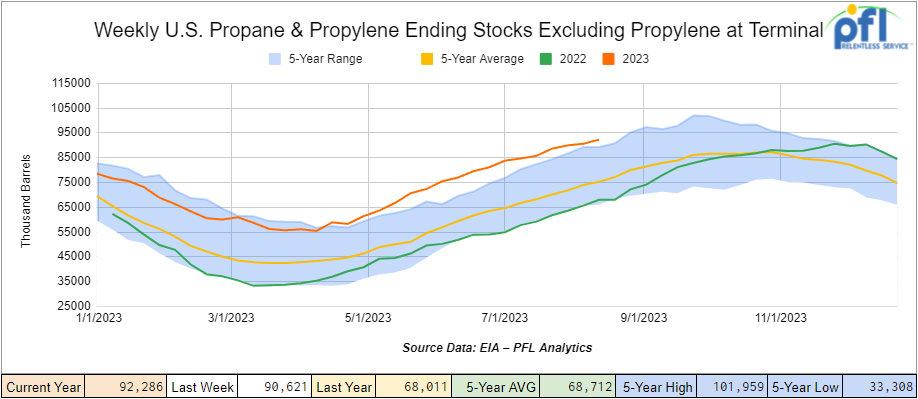

Propane/propylene inventories increased by 1.7 million barrels week-over-week and are 21% above the five-year average for this time of year.

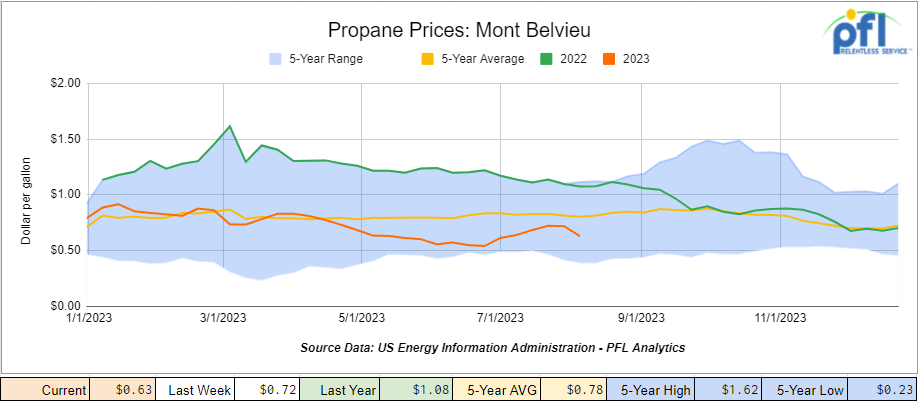

Propane prices closed at 63 cents per gallon, down -9 cents week-over-week and down -45 cents per gallon year over year.

Overall, total commercial petroleum inventories decreased by 3 million barrels during the week ending August 18th, 2023.

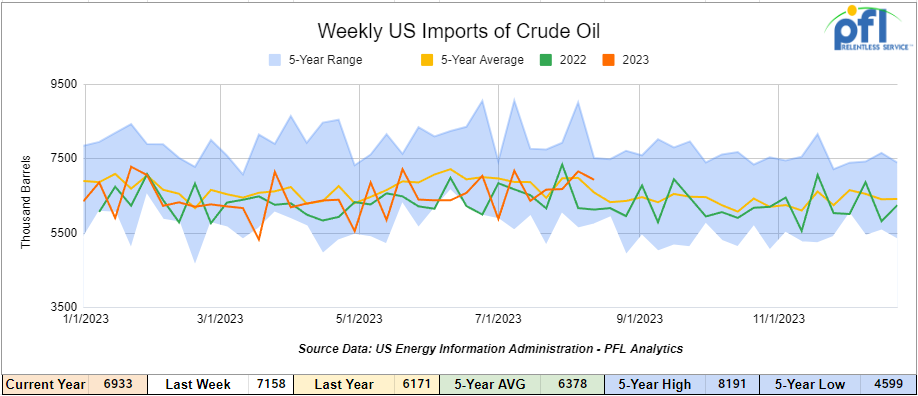

U.S. crude oil imports averaged 6.9 million barrels per day during the week ending August 18th, 2023, a decrease of 225,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.9 million barrels per day, 6.3% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 893,000 barrels per day, and distillate fuel imports averaged 88,000 barrels per day during the week ending August 18th, 2023.

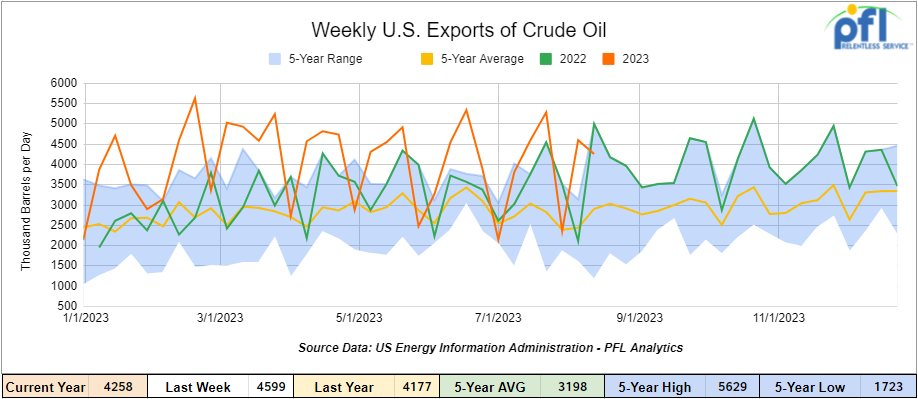

U.S. crude oil exports averaged 4.258 million barrels per day for the week ending August 18th, 2023, a decrease of -341,000 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 4.125 million barrels per day.

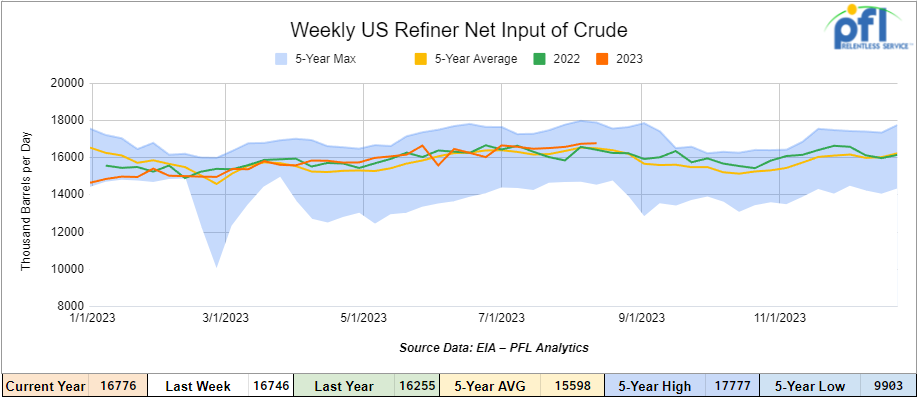

U.S. crude oil refinery inputs averaged 16.8 million barrels per day during the week ending August 18, 2023, which was 30,000 barrels per day more week-over-week.

WTI is poised to open at $80.25, up 42 cents per barrel from Friday’s close.

North American Rail Traffic

Week Ending August 23rd, 2023.

Total North American weekly rail volumes were down (-4.18%) in week 33, compared with the same week last year. Total carloads for the week ending on August 23rd, 2023 were 352,154, down (-0.76%) compared with the same week in 2022, while weekly intermodal volume was 312,244, down (-7.76%) compared to the same week in 2022. 7 of the AAR’s 11 major traffic categories posted year-over-year decreases with the most significant decrease coming from Grain (-16.78%). The largest increase came from Motor Vehicles and Parts (+14.11%).

In the East, CSX’s total volumes were down (-2.16%), with the largest decrease coming from Grain (-29.17%) and the largest increase from Coal (+17.15%). NS’s volumes were down (-2.91%), with the largest decrease coming from Petroleum and Petroleum Products (-21.05%) and the largest increase from Motor Vehicles and Parts (+9.65%).

In the West, BN’s total volumes were down (-5.64%), with the largest decrease coming from Grain (-21.15%), and the largest increase coming from Other (+37.51%). UP’s total rail volumes were down (-3.05%) with the largest decrease coming from Other (-38.80%) and the largest increase coming from Petroleum and Petroleum Products (+16.04%).

In Canada, CN’s total rail volumes were down (-10.18%) with the largest increase coming from Motor Vehicles and Parts (+16.38%) and the largest decrease coming from Grain (-37.34%). CP’s total rail volumes were down (-1.38%) with the largest decrease coming from Nonmetallic Minerals (-18.8%) and the largest increase coming from Motor Vehicles and Parts (+100.35%).

KCS’s total rail volumes were down (-5.18%) with the largest decrease coming from Intermodal (-20.65%) and the largest increase coming from Motor Vehicles and Parts (+51.85%).

Source Data: AAR – PFL Analytics

Rig Count

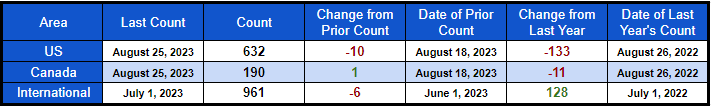

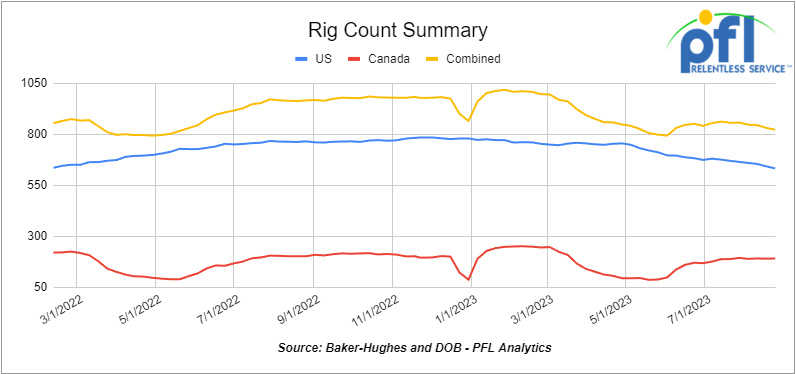

North American rig count was down by -9 rigs week-over-week. U.S. rig count was down by -10 rigs week-over-week and down by -133 rigs year-over-year. The U.S. currently has 632 active rigs. Canada’s rig count was up by 1 rig week-over-week, and down by -11 rigs year over year. Canada’s overall rig count is 190 active rigs. Overall, year-over-year, we are down -144 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 25,940 from 25,768, which was a gain of +172 rail cars week-over-week. Canadian volumes were mixed. CPKC’s shipments increased by +5.0% week over week, and CN’s volumes were lower by -1.9% week-over-week. U.S. shipments were also mixed. The BN had the largest percentage decrease and was down by -11.1% week-over-week. The CSX had the largest percentage increase and was up by +11.8% week-over-week.

We are Watching TMX – At Risk of More Delays with Potential Route Change

Folks, just when you didn’t think it was possible, the impossible happens. How difficult is it to build a pipeline these days? Well, if you are building one in Canada or certain States in the United States it can be challenging to say the least. TMX a pipeline expansion that’s set to boost Canada’s oil shipments to the Pacific Coast is facing the prospect of a costly delay just months before its scheduled startup.

Trans Mountain Corporation is seeking a route change for the expansion project after running into engineering challenges while drilling a tunnel in British Columbia, according to an August 10th letter filed with the Canada Energy Regulator.

The change faces opposition from an indigenous group, and if it isn’t approved, the pipeline’s start date will be pushed back and its cost will “significantly increase” beyond initial estimates, government-owned Trans Mountain said in the filing.

The new challenges add to repeated delays and cost overruns that have dogged the project since it began more than a decade ago. The project’s cost has more than quadrupled to C$30.9 billion ($22.8 billion).

The expansion will boost the pipeline’s capacity to 890,000 bbls/d from 300,000 bbls/d currently.

The latest complication involves a route change of roughly 1.3 kilometers of pipeline that lies in the traditional territory of the local Stk’emlúpsemc te Secwépemc Nation, or SSN. The tunneling was a modification made to accommodate SSN’s concerns, and the local community wants to stick with it, according to an Aug. 4th SSN letter to Trans Mountain.

The route change is also happening as Trans Mountain negotiates shipping tolls.

Canadian Natural Resources Limited, along with several other companies that have signed contracts to use the line, requested a two-week extension on the deadline to provide comments on tolls.

The altered route may have “implications” on the timing of the commencement date for the line, Canadian Natural said.

We Continue to Watch Potential Strikes

There was good news last week as UPS struck a deal with workers that will avoid a strike. In the five-year deal, the shipping giant has agreed to increase and standardize pay, end forced overtime on drivers’ days off, and add air conditioning to more trucks. The same cannot be said for the United Auto Workers union at the moment. Last week autoworkers overwhelmingly voted to allow union leaders to call a strike if negotiations with General Motors, Ford, and Stellantis don’t start making some serious headway before the current contract expires on September 14. This could be bad news for rail. Auto traffic has been the bright spot in rail.

We continue to watch LNG and LPG’s

According to the EIA, the United States exported more liquefied natural gas than any other country in the first six months of 2023. U.S. LNG exports averaged 11.6 billion cubic feet per day (Bcf/d) during this period, 4% (0.5 Bcf/d) higher than the first half of last year and 9.5% (1.0 Bcf/d) higher than the 2022 annual average, according to data from the U.S. Department of Energy’s LNG Reports. Australia was the world’s second-largest LNG exporter in the first half of 2023, with LNG exports averaging 10.6 Bcf/d during this period, followed by Qatar at 10.4 Bcf/d. The increase in LNG exports from the United States was mainly the result of Freeport LNG’s return to service and continued growth in global LNG demand, particularly in Europe. The more LNG produced the more LPG’s – good for rail and the pressure car.

We have been extremely busy at PFL with return-on-lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs at 239-390-2885

Lease Bids

- 30-100, 31.8K CPC 1232 Tanks needed off of UP or BN in Texas for Purchase or Lease.

- 100, 6300 Covered Hoppers needed off of BN in South Dakota for 3-6 Months. Cars are needed for use in DDG service.

- 15, 30K 117 Tanks needed off of NS in SouthEast for 1 Year. Cars are needed for use in Diesel service.

- 25, 33K 340W Pressure Tanks needed off of UP or BN in Midwest for Oct-March. Cars are needed for use in Propane service.

- 20-25, 30K 117 Tanks needed off of UP or BN in Illinois for 5 Years. Cars are needed for use in Ethanol service.

- 10, 30K 117 Tanks needed off of NS or CSX in Marcellus for Trip Lease. Cars are needed for use in C5 service.

- 100, 28.3K DOT 111/117 Tanks needed off of UP or BN in Midwest/Texas for 5 Years. Cars are needed for use in Veg Oils / Biodiesel service. Need to be Unlined

- 25-50, 33K 400W Pressure Tanks needed off of CN or CP in Canada for Short Term. Cars are needed for use in Propylene service.

- 50-100, 4550 Covered Hoppers needed off of UP or BN in Texas for 5 Years. Cars are needed for use in Grain service.

- 10, 33K 340W Pressure Tanks needed off of CN in LA for 1 Year. Cars are needed for use in Butane service.

- 25, 20.5K CPC1232 or 117J Tanks needed off of BNSF or UP in the west for 3-5 Years. Cars are needed for use in Magnesium chloride service. SDS onhand

- 25-50, 25.5K 117J Tanks needed off of NS CSX in Northeast for 5 Years. Cars are needed for use in Asphalt / Heavy Fuel Oil service.

- 30-50, 33K 340W Pressure Tanks needed off of any class 1 in any location for 6-12 Months. Cars are needed for use in Propane service.

- 60-150, 30K 117J Tanks needed off of TYR, UP in Corpus Christi, TX for 1 year. Cars are needed for use in Diesel service.

- 15, 28.3K 117J Tanks needed off of any class 1 in any location for 3 years. Cars are needed for use in Glycerin & Palm Oil service.

- up to 50, 31.8K 117J, 117R, CPC 1232 Tanks needed off of any class 1 in Texas or Ohio for 1-3 years. Cars are needed for use in Diesel / Gasoline service.

- 45, 3000 cf PDs Hoppers needed off of any class 1 in Texas for 3 years. Cars are needed for use in Any service.

- 30, 17K-20K 117J Tanks needed off of UP or BN in the Midwest/West Coast for 3-5 Years. Cars are needed for use in Caustic service.

- 10, 286K 15.7K Tanks needed off of KCS in Texas for 1 Year. Cars are needed for use in Sulfuric Acid service. Needed Next few months

- 150, 23.5K DOT 111 Tanks needed off of any class 1 in LA for 2-3 Years. Cars are needed for use in Fluid service. Needed July

- 25-50, 32K 340W Pressure Tanks needed off of NS or CSX in Marcellus for 1-2 Years. Cars are needed for use in Propane service.

- 25-50, 30K DOT 111, 117, CPC 1232 Tanks needed off of CN or CP in WI, Sarnia for 1-2 Years. Cars are needed for use in Diesel service.

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

- 30-40, 286K DOT 113 Tanks needed off of CN or CP/ UP in Canada/MM for 5 Years. Cars are needed for use in CO2 service. Q1

- 70, 32K 340W Pressure Tanks needed off of CP or CN in Edmonton for 3 Years. Cars are needed for use in Propane service.

- 30, 30K DOT 111 Tanks needed off of UP in Texas for 1-3 Years. Cars are needed for use in Diesel service.

- 5-7, 28.3K 117R Tanks needed off of NS or CSX in NC for 1 Year. Cars are needed for use in UCO service.

- 25-50, 5000CF-5100CF Lined Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in Dry sugar service. 3-bay gravity dump

- 10, any capacity Stainless Steel Tanks needed off of any class 1 in Canada for 5-10 years. Cars are needed for use in Alcohol service.

- 30-50, 30K 117 Tanks needed off of any class 1 in Northeast or Midwest for 1 Year. Cars are needed for use in C5 service. Must have Magrods

- 100, 33K 340W Pressure Tanks needed off of CN in Canada for 3-5 Years. Cars are needed for use in Propane service.

- Up to 60, 5150cf Covered Hoppers needed off of CN, CSX, and NS in the east or midwest for 3 years. Cars are needed for use in Fertilizer service. 3-4 hatch gravity dumps

- 20-30, 14k Any tanks needed off of BNSF, UP in Texas for 1-3 Years. Cars are needed for use in HCl service. Call for more details

Sales Bids

- 1-2, Any DOT 111, 117, CPC 1232 Tanks needed off of any class 1 in Texas. Coiled and Insulated

- 45, 3000 cf PD Hoppers needed off of any class 1 in Texas. Negotiable

- 20-25, 25.5K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Texas. Cars are needed for use in Veg Oil service. Coiled and insulated

- 15, 30K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Texas. Cars are needed for use in Veg Oil service.

- 2-4, 28K DOT 111 Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

- 100, Plate F Boxcars needed off of BN or UP in Texas.

- 200+, 5000cf Covered Hoppers needed off of any class 1 in various locations.

- 20-30, 3000 – 3300 PDs Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 100, 15.7K DOT 111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT 111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

- 20, 2770 Mill Gondolas needed off of CSX in the northeast. Cars are needed for use in non-haz soil service. 52-60 ft

- 10, 4000 Open Hoppers needed off of CSX in the northeast. Cars are needed for use in scrap metal service. Open top hopper

- 10, 6400 Open Hoppers needed off of CSX in the northeast. Cars are needed for use in wood chip service. Open top hopper, flat bottom

Lease Offers

- 70, 25.5K, 117J Tanks located off of UP in Texas. Cars are clean Call for more information

- 30, 23.5K, DOT111 Tanks located off of UP or BN in Texas. Cars were last used in Clean / UAN.

- 25-100, 17.6K, DOT111 Tanks located off of UP or BN in the Midwest. Cars were last used in Fertilizer / Corn syrup. Free move available

- 20, 20k, DOT111 Tanks located off of CSX in GA. Cars are clean

- 2, 20K, DOT111 Tanks located off of UP in TX. Cars are clean

- 5, 20K, DOT111 Tanks located off of UP in TX. Cars were last used in sulfuric acid. Free move available

- 10, 6500, Covered Hoppers located off of UP and BN in Iowa. Cars are clean

Sales Offers

- 100-200, 31.8K, CPC 1232 Tanks located off of BN in Chicago. Dirty/Clean

- 100, 28.3K, 117J Tanks located off of various class 1s in multiple locations.

- 110, 25.5K, DOT 111 Tanks located off of UP and BN in multiple locations. Dirty, Food Grade. Cars are currently moving

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|