“Communication is a skill that you can learn. It’s like riding a bicycle or typing. If you’re willing to work at it, you can rapidly improve the quality of every part of your life.”

Brian Tracy

Jobs Update

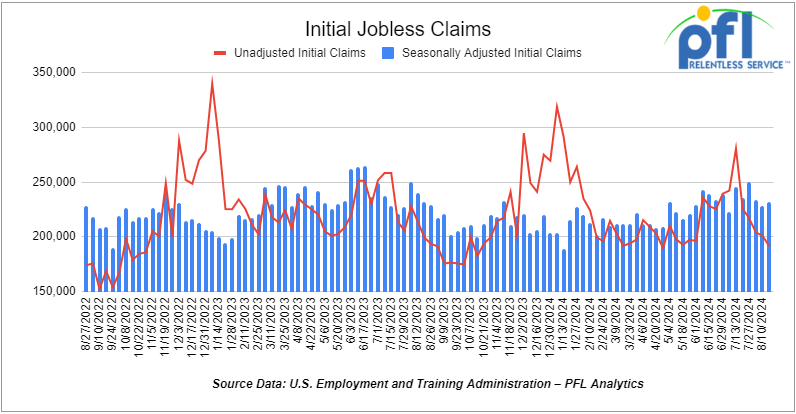

- Initial jobless claims seasonally adjusted for the week ending August 17th came in at 232,000, up 4,000 people week-over-week.

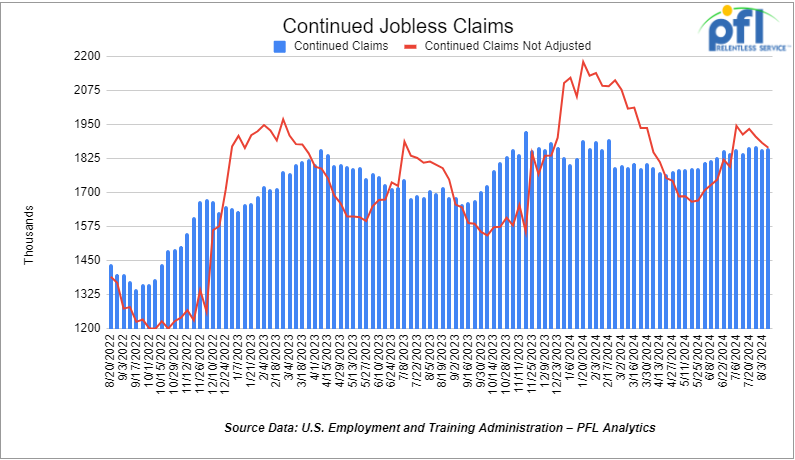

- Continuing jobless claims came in at 1.863 million people, versus the adjusted number of 1.859 million people from the week prior, up 4,000 people week-over-week.

Stocks closed higher on Friday of last week and higher week over week

The DOW closed higher, on Friday of last week up 462.3 points, closing out the week at 41,175.08 up 515.32 points week-over-week. The S&P 500 closed higher on Friday of last week, up 63.97 points and closed out the week at 5634.61 up 80.36 points week-over-week. The NASDAQ closed higher on Friday of last week, up 258.44 points and closed out the week at 17,877.79 up 246.07 points week over week.

In overnight trading, DOW futures traded lower and are expected to open at 19,829.50 this morning up 38.75 points.

Crude oil closed higher on Friday of last week, but lower week over week.

West Texas Intermediate (WTI) crude closed up $1.82 per barrel (+2.49%) to close at $74.83 per barrel on Friday of last week, but down -1.82 per barrel week over week. Brent traded up $1.80 USD per barrel (+2.33%) on Friday of last week, to close at $79.02 per barrel down -0.66 per barrel week-over-week.

One Exchange WCS (Western Canadian Select) for October delivery settled Friday on last week at US$13.65 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$ 61.18 per barrel.

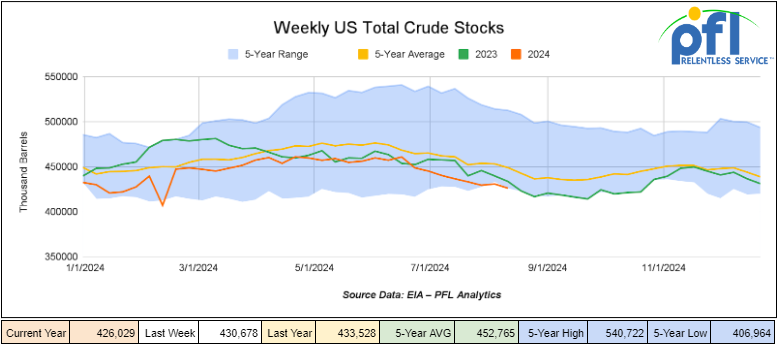

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 4.6 million barrels week-over-week. At 426.0 million barrels, U.S. crude oil inventories are 5% below the five-year average for this time of year.

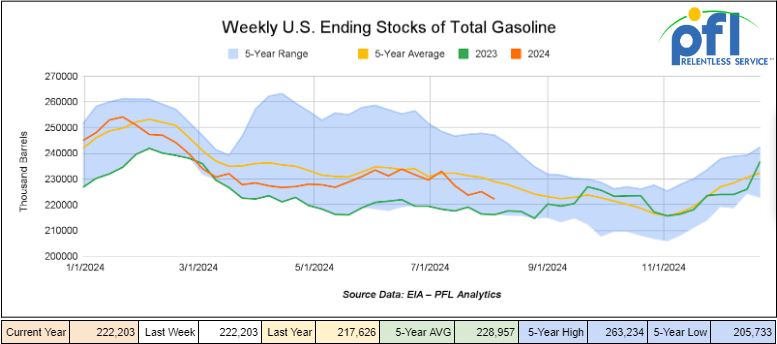

Total motor gasoline inventories decreased by 1.6 million barrels from last week and are 3% below the five-year average for this time of year.

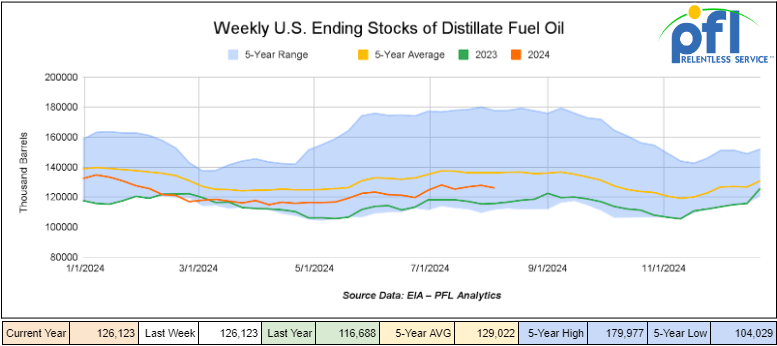

Distillate fuel inventories decreased by 3.3 million barrels week-over-week and are 10% below the five-year average for this time of year.

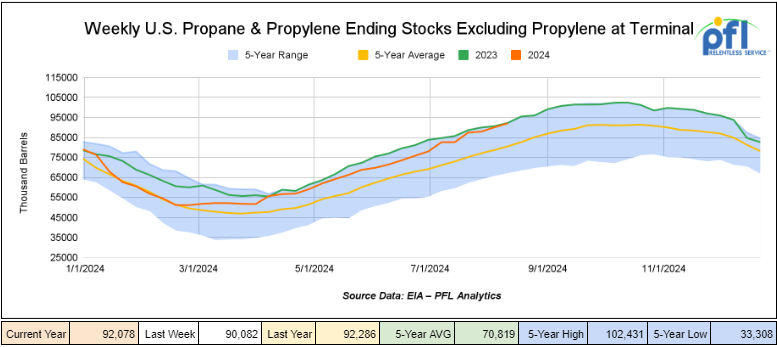

Propane/propylene inventories increased by 2 million barrels week-over-week and are 14% above the five-year average for this time of year.

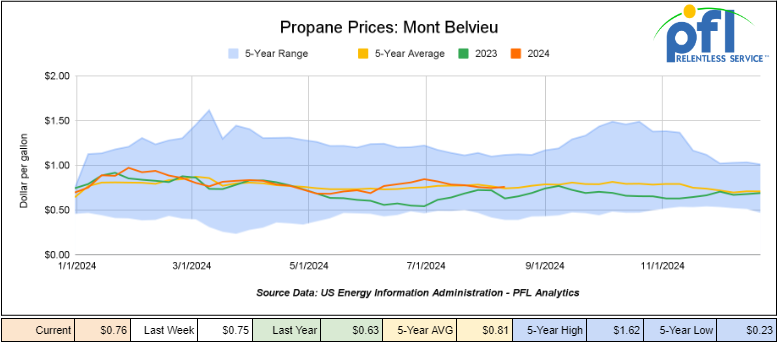

Propane prices closed at 76 cents per gallon on Friday of last week, up 1 cent week-over-week, but down 7 cents year-over-year.

Overall, total commercial petroleum inventories decreased by 5.9 million barrels during the week ending August 16th, 2024.

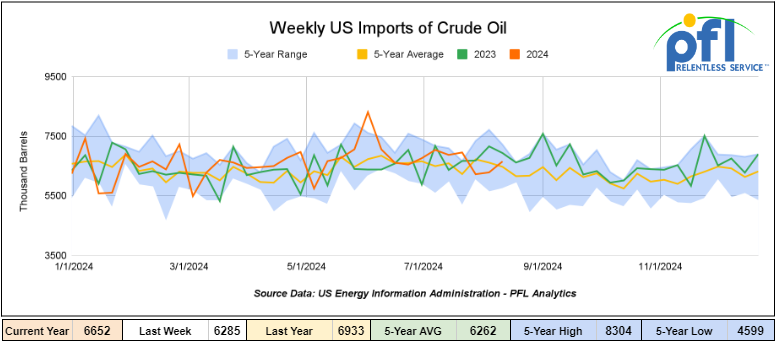

U.S. crude oil imports averaged 6.7 million barrels per day during the week ending August 16th, 2024, an increase of 366,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.5 million barrels per day, 4.8% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) last week averaged 531,000 barrels per day, and distillate fuel imports averaged 63,000 barrels per day, during the week ending August 16th, 2024.

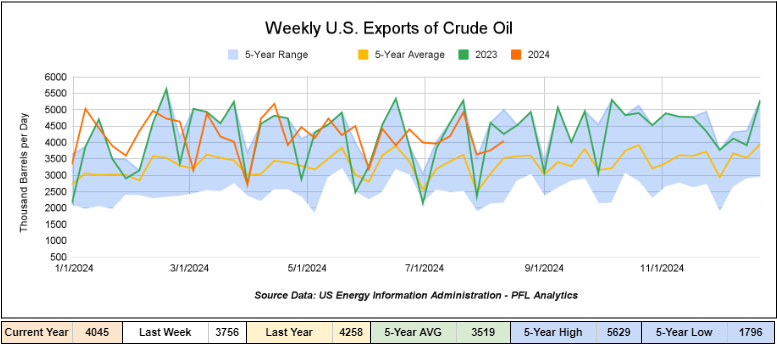

U.S. crude oil exports averaged 4.045 million barrels per day for the week ending August 16th, 2024, an increase of 289,000 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 4.09 million barrels per day.

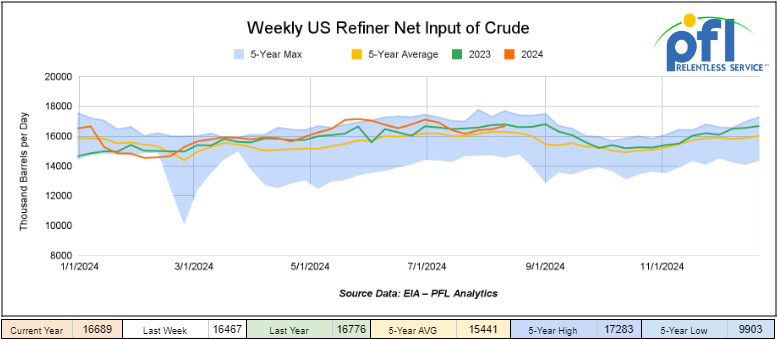

U.S. crude oil refinery inputs averaged 16.7 million barrels per day during the week ending August 16, 2024, which was 222,000 barrels per day week-over-week.

WTI is poised to open at $75.76, up 93 cents per barrel from Friday’s close.

North American Rail Traffic

Week Ending August 21st, 2024.

Total North American weekly rail volumes were up (+5.69%) in week 34, compared with the same week last year. Total carloads for the week ending on August 21st were 349,386, down (-0.79%) compared with the same week in 2023, while weekly intermodal volume was 352,821, up (+13%) compared to the same week in 2023. 7 of the AAR’s 11 major traffic categories posted year-over-year increases. The most significant decrease came from Metallic Ores and Metals, which was down (-16.41%). The most significant increase came from Grain which was up (+24.59%).

In the East, CSX’s total volumes were up (+4.94%), with the largest decrease coming from Nonmetallic Minerals (-10.88%) while the largest increase came from Grain (+62.92%). NS’s volumes were up (+7.8%), with the largest increase coming from Grain (+44.82%) while the largest decrease came from Other (-2.74%).

In the West, BN’s total volumes were up (+11.62%), with the largest increase coming from Petroleum and Petroleum Products (+38.53%) while the largest decrease came from Other down (-16.58%). UP’s total rail volumes were up (+7.78%) with the largest decrease coming from Coal, down (-23.62%) while the largest increase came from Other which was up (+34.99%).

In Canada, CN’s total rail volumes were down (-15.84%) with the largest decrease coming from Metallic Ores and Metals, down (-40.95%) while the largest increase came from Other, up (+47.75%). CP’s total rail volumes were up (+5.04%) with the largest increase coming from Intermodal Units (+20.61%) while the largest decrease came from Metallic Ores and Metals, down (-27.69%).

KCS’s total rail volumes were down (-12.21%) with the largest decrease coming from Coal (-36.54%) and the largest increase coming from Motor Vehicles and Parts (+62.35%).

Source Data: AAR – PFL Analytics

Rig Count

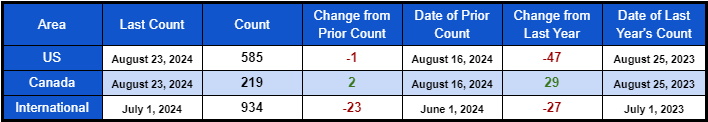

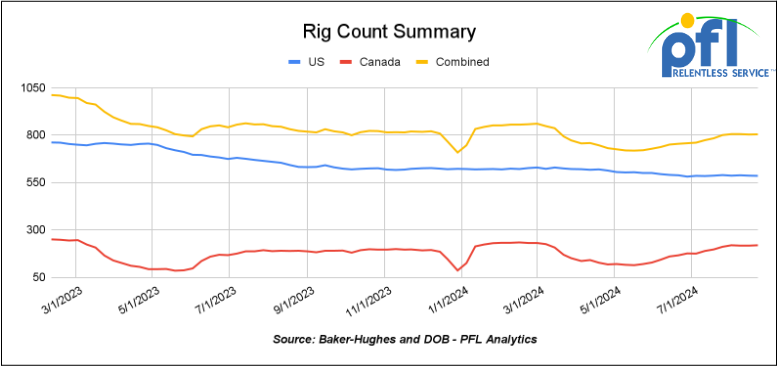

North American rig count was up by 1 rig week-over-week. The US rig count was down by -1 rig week-over-week, and down by -47 rigs year-over-year. The US currently has 585 active rigs. Canada’s rig count was up by 2 rigs week-over-week, and up by 29 rigs year-over-year and Canada’s overall rig count is 219 active rigs. Overall we are down -18 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 28,184 from 27,754, which was a gain of 430 rail cars week-over-week. Canadian volumes were mixed. CPKC’s shipments fell by -2.4% week over week, CN’s volumes were higher by +6.1% week-over-week. U.S. shipments higher across the board. The NS had the largest percentage increase and was up by +19.4%.

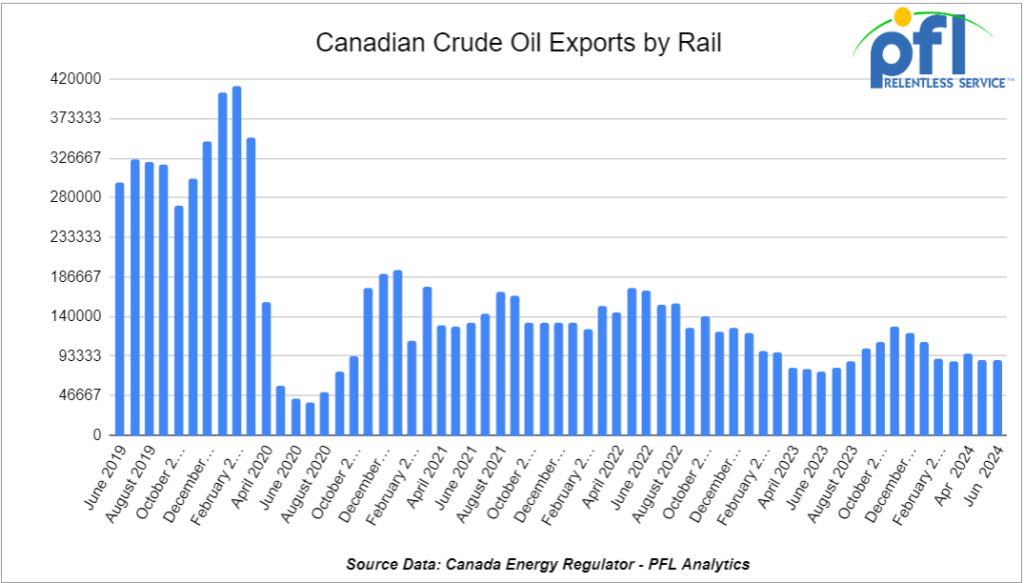

We are Watching Crude by Rail out of Canada

Crude by rail out of Canada increased slightly month over month. The Canadian Energy regulator reported on August 20, 2024, that 89,204 barrels were exported during the month of June 2024 from 89,141 barrels in May of 2024 an increase of 63 barrels per day month over month.

Crude by rail will always be necessary out of Canada for stranded oil not connected by pipelines and raw bitumen shipped as a non-haz product which is not able to flow in pipelines and is competitive with pipeline tolls is a growing market to keep an eye on. Other factors would be existing long-term contractual commitments and basis -we really need to see the basis of the WTI-CMA (West Texas Intermediate – Calendar Month Average) blow out to at least -$17 per barrel for sustained periods of time for Crude by Rail to make economic sense. That may come sooner than we think, as Canadian producers are resilient and we are seeing more production than anticipated. In the short term, with the rail strike-dependent situation in Canada, we could see a short-term decline in raw bitumen deliveries that are 100% rail-dependent. Stay tuned to PFL for further details.

We Continue to Watch Canadian Rail Strikes – here is the latest!

Strikes are over, folks. CKPC was ordered back to work on Friday of last week and on Saturday CN received an order from the Canada Industrial Relations Board (CIRB) imposing binding arbitration between the Company and the Teamsters Canada Rail Conference.

The CIRB has also ordered that no further labor stoppage, including a lockout or strike, can occur during the arbitration process. This means that the strike notice issued to CN by the Teamsters on Friday of last week has been voided.

Industrial Output & Capacity Utilization

As of July 2024, industrial production in the U.S. fell by 0.6%, following a 0.3% increase in June. This decline was influenced by shutdowns in the petrochemical industry due to Hurricane Beryl, which had a notable impact, reducing growth by approximately 0.3%. Manufacturing output also decreased by 0.3% in July, driven mainly by a significant 7% drop in automotive production.

Capacity utilization, which measures how fully firms are using their machinery and equipment, decreased to 77.8% in July, down from previous levels and below the long-term average. This drop was largely attributed to reduced production in several sectors, including utilities and automotive

We are watching Class 1 Industry Headcount

Class I railroads employed 121,142 workers in the United States in July 2024, a -0.5% decrease from June 2024’s count and a -1.1% year-over-year decrease, according to Surface Transportation Board data.

Three of the six employment categories posted month-over-month increases between June and July. They were: maintenance of way and structures, up +0.3% to 28,946 workers; transportation (other than train and engine), up +0.2% to 4,949; and executives, officials, and staff assistants, up +0.7% to 8,073.

Categories that posted month-over-month decreases were transportation (train and engine), down -0.7% to 52,061 employees; maintenance of equipment and stores, down -1.2% to 17,425; and professional and administrative, down -1.0% to 10,061. Year over year, only the transportation (other than train and engine) category posted an employment gain at 1.1%. Categories that registered year-over-year decreases in July were transportation (train and engine), down -2.0%; professional and administrative, down -1.3%; executives, officials, and staff assistants, down -1.7%; and maintenance of equipment and stores, down -1.4%

Lease Bids

- 30, 4750-5200 Covered Hoppers needed off of BN or UP in Lake Charles, LA for 5 Years. Cars are needed for use in Pet Coke service.

- 30-50, 23.5K Any Type Tanks needed off of any class 1 in any location for 1-5Years. Cars are needed for use in Glycols service.

- 10, 5250 Covered Hoppers needed off of UP or BN in Midwest for up to 5 years. Cars are needed for use in Dry Edible Beans service.

- 10, 3250 thru hatch Hoppers needed off of BNSF in TX IL for 5 years. Cars are needed for use in Agg service.

- 10, 25.5 117J Tanks needed off of All class ones in Chicago for Epoxy Resin. Cars are clean 5 years

- 30, 33K Pressure Tanks needed off of Any Class 1 in Any Location for 6 Months. Cars are needed for use in Propane service. Needed for Winter

- 100, 5200 Covered Hoppers needed off of UP or BN in Northwest for 6 month. Cars are needed for use in Pet Coke service. Roud Hatch, Bottom Outlet Doors

- 25, 25.5K DOT 111 Tanks needed off of UP in LA for 1-5 Years. Cars are needed for use in Lubricant service.

- 15-20, 29K 117R Tanks needed off of NS or CSX in Ohio for 6-12 Months. Cars are needed for use in Ply Oil service.

- 200, 30K any type Tanks needed off of UP or BN in Texas for RD. Cars are needed for use in Dirty service.

- 20, 4750’s Through Hatch Covered Hoppers needed off of UP BN in USA West for 3 years. Cars are needed for use in Fertilizer service.

- 80, 25.5K-29K any type Tanks needed off of NS or CSX in Northeast for 1-5 Years. Cars are needed for use in Crude service.

- 100, 15.5K DOT 111 Tanks needed off of Any Class 1 in USA for 1-3 Years. Cars are needed for use in Molten Sulfur service.

- 50, 30K 117 Tanks needed off of BNSF or UP in TX for 3-6 Months. Cars are needed for use in Crude service. will look at smaller cars. Prefer short term would look at longer term. Domestic use only

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

- 20, 25.5k CPC 1232 Tanks needed off of UP or BN in OK, TX for 3 Year. Cars are needed for use in Asphalt service.

- 100, 25.5K DOT 111 Tanks needed off of Any Class 1 in Texas for 3 Years +. Cars are needed for use in Asphalt service.

- 30, 29K 117J Tanks needed off of BN or CN in Houston or Edmonton for 1-2 Year. Cars are needed for use in Biodiesel service.

- 10, 25.5K-28.3K DOT 111 Tanks needed off of UP or BN in Houston for 2 Year. Cars are needed for use in Resin service.

- 10, 28.3K 117J Tanks needed off of UP or BN in Texas for 3 Year.

- 25-30, 23.5K or 25.5K Dot 111 or CPC 1232 Tanks needed off of UP or BN in TX, OK, or AR for 3-5 Years. Cars are needed for use in Asphalt service. Needed ASAP., Lined or Unlined. Splash Load

- 250, 4000 Rapid Hoppers needed off of BNSF in TX IL for 5 years. Cars are needed for use in Coal service. in rotary/rapid cars with the electric dumping shoe

- 4, 6260 Covered Hoppers needed off of CSX in Bostick, NC for 2-4 Years. Cars are needed for use in Polypropene Pellets service.

- 8, 28-30K any type Tanks needed off of UP BN in Texas and Gulf for 5 years. Cars are needed for use in Chlorobenzene service. must be lined with plasite 3070

- 14, 23.5K DOT111 Tanks needed off of UP in Morrilton, AR for 1 year. Cars are needed for use in Turpentine service.

- 10, 30k any type Tanks needed off of UP BN in Texas for 1 year plus. Cars are needed for use in Fuel Oil service.

- 25-50, 5000CF-5100CF Covered Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in Dry sugar service. 3 bay gravity dump, Hempel 37700

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 50, 23.5-25.5 DOT111 Tank s needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 25, 20.5K CPC1232 or DOT117J Tanks needed off of BNSF or UP in the west for 3-5 years. Cars are needed for use in Magnesium chloride service. SDS onhand

- 15, 28.3K DOT117J Tanks needed off of any class 1 in any location for 3 years. Cars are needed for use in Glycerin & Palm Oil service.

- 30, 17K-20K DOT117J Tanks needed off of UP or BN in Midwest/West Coast for 3-5 years. Cars are needed for use in Caustic service.

- 150, 23.5K DOT111 Tanks needed off of any class 1 in LA for 2-3 years. Cars are needed for use in Fluid service. Needed July

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

Sales Bids

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Cement service. Cement Gates needed.

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 20-30, 3000 – 3300 PD Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 2-4, 28K DOT111 Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

- 100, 15.7K DOT111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

- 5, 30K DOT 111 Tanks needed off of in US. Cars are needed for use in Fuels service.

- 5, 23,5K DOT 111 Tanks needed off of any class 1 in Texas. Negotiable

Lease Offers

- 50, 5400, Covered Hoppers located off of NS, IORY in MI. Cars were last used in bean meal. 1 year+

- 2, Flat Double-stack rail transports located off of KCS in Texas. Cars are clean Lease or sell. (Intermodal Container)

- 60, 33K, 340W Pressure Tanks located off of All Class Ones in North America. Cars were last used in Propane/Butane. Up to 1 year.

- 5, 25.5K, DOT 111 Tanks located off of UP in Kansas. Cars were last used in Veg Oils. 2 Year Term

- 50, 30K, DOT 117J Tanks located off of All Class Ones in North America. Cars were last used in Ethanol. 1-2 Year Term.

Sales Offers

- 24, 5300CF, Plate C Boxcars located off of NS or CSX in Southeast.

- 100-300, 3400, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 19, 4400, Rotary Gondolas located off of UP and BN in California and Wyoming.

- 100, 28.3K, DOT117J Tanks located off of various class 1s in multiple locations.

- 7, 30K, DOT 111 Tanks located off of UP in TX, CA, NM.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|

PFL will be at the Following Conferences

- Where: La Quinta, CA

- Attending: David Cohen (954-729-4774)

- Conference Website

- Where: Hyatt Regency Dallas in Dallas, TX

- Attending:Curtis Chandler (239.405.3365), David Cohen (954-729-4774), Brian Baker (239.297.4519), Cyndi Popov(403) 402-5043

- Conference Website