“Why do we only rest in peace? Why don’t we live in peace too?”

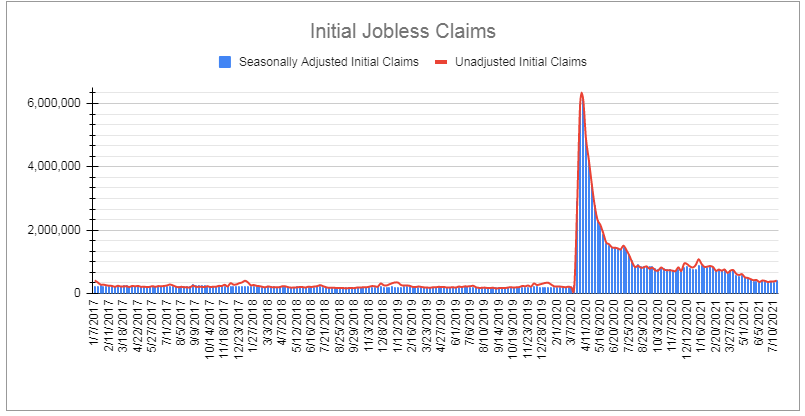

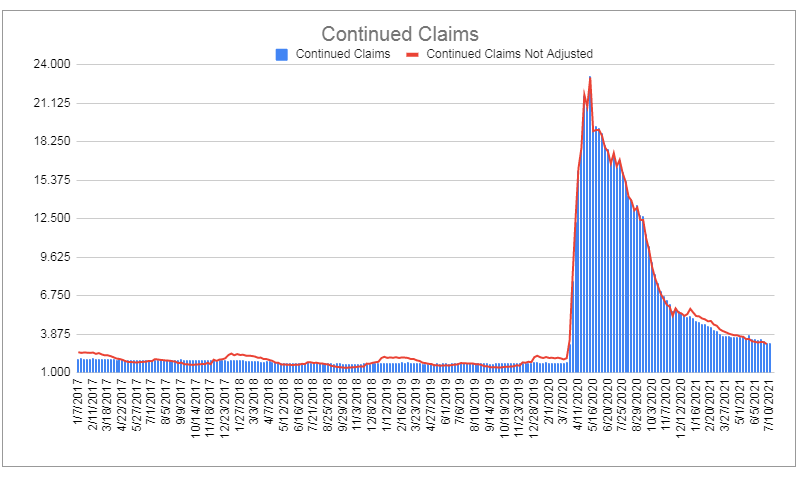

Weekly jobless claims up week over week and well above expectations

- New weekly jobless claims ticked higher last week.

- The Department of Labor released its weekly report on new jobless claims on Thursday morning last week, as it does every week at 8:30 a.m. Eastern Standard Time.

- Initial jobless claims for the week ended July 24, 2021 came in at 400,000 which was above analysts’ expectations of 380,000.

- Continuing claims came in at 3.27 Million, up by 30,000 week over week.

- Altogether, some 13.2 million people are reportedly receiving benefits through eight separate state or federal programs. Total claims averaged less than 2 million a week before the pandemic so we have a ways to go folks.

Stocks closed lower on Friday of last week and down week over week

The Dow closed lower on Friday of last week, down -149.06 (-0.42%) points closing out the week at 34,935.47, down -126.08 points week over week. The S&P 500 closed lower on Friday of last week, down -23.89 points (-0.54%) and closing out the week at 4,395.26 4, down -16.53 points week over week. The Nasdaq closed lower on Friday of last week, down -105.59 points (-0.71%) and closing out the week at 14,672.68, down -164.31 points week over week.

In overnight trading, DOW futures traded higher and are expected to open up this morning 101 points.

Oil up on Friday and up month over month

Oil posted its fourth straight monthly gain as steady demand and tight supplies calmed concerns that a new wave of COVID-19 infections would cripple energy consumption. West Texas Intermediate (WTI) for September delivery rose 33 cents to settle at $73.95 a barrel on Friday of last week. Brent crude oil for September delivery, which expired Friday of last week, added 28 cents to end the session at $76.33 a barrel. Brent crude oil for October rose 31 cents to $75.41 a barrel.

U.S. commercial crude oil inventories decreased by 4.1 million barrels week over week. At 435.6 million barrels, U.S. crude oil inventories are -7% below the five-year average for this time of year.

Total motor gasoline inventories decreased by 2.3 million barrels week over week and are at par with the five year average for this time of year. Finished gasoline and blending components inventories both decreased last week.

Distillate fuel inventories decreased by 3.1 million barrels week over week and are -7% below the five-year average for this time of year.

Propane/propylene inventories increased by 1.9 million barrels week over week and are -14% below the five-year average for this time of year. Propane inventories in the U.S. are currently dangerously low. We are projected to go into this year’s winter with just under 80 million barrels of propane in storage – which is well below the 100 million barrels that we went into last year’s heating season with. Expect some price spikes in propane folks, either now or later – otherwise pray for dryer crops coming off the field during harvest or a warmer than normal winter!

Total commercial petroleum inventories decreased by 6.5 million barrels last week.

U.S. crude oil imports averaged 6.5 million barrels per day last week, a decrease of 600,000 barrels per day week over week. Over the past four weeks, crude oil imports averaged 6.4 million barrels per day, 6.9% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) last week averaged 909,000 barrels per day, and distillate fuel imports averaged 188,000 barrels per day.

U.S. crude oil refinery inputs averaged 15.9 million barrels per day during the week ending July 23, 2021 which was 132,000 barrels per day less than the previous week’s average. Refineries operated at 91.1% of their operable capacity last week. Gasoline production increased last week, averaging 9.8 million barrels per day. Distillate fuel production decreased last week, averaging 4.7 million barrels per day.

Oil is lower in overnight trading and, as of the writing of this report, WTI is poised to open at $72.96, down 99 cents per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were up 4.6% year over year in week 29 (U.S. +4.6%, Canada +2.1%, Mexico +15.2%) resulting in quarter to date volumes that are up 2.5% year over year and year to date volumes that are up 11.2% year over year (U.S. +12.7%, Canada +7.4%, Mexico +6.4%). 8 of the AAR’s 11 major traffic categories posted year over year increases with the largest increases coming from metallic ores & metals (+31.6%) and coal (+15.4%). The largest decrease came from motor vehicles & parts (-28.4%).

In the East, CSX’s total volumes were up 8.4%, and the largest increases came from intermodal (+10.4%) and coal (+20.2%). The largest decrease came from motor vehicles & parts (-20.8%). NS’s total volumes were up 2.5%, with the largest increases from coal (+16.0%) and petroleum (+102.9%). The largest decrease came from motor vehicles & parts (-35.8%).

In the West, BN’s total volumes were up 9.1%, with the largest increases coming from intermodal (+10.0%), coal (+12.8%) and metallic ores (+485.7%). UP’s total volumes were up 0.3%, with the largest increases coming from chemicals (+14.7%) and coal (+7.7%). The largest decreases came from intermodal (-5.1%) and motor vehicles & parts (-30.0%).

In Canada, CN’s total volumes were up 0.4%, with the largest increases coming from coal (+51.3%), chemicals (+16.5%) and stone sand & gravel (+53.4%). The largest decreases came from grain (-48.7%) and motor vehicles & parts (-46.3%). RTMs were up 3.4%. CP’s total volumes were up 8.9%, with the largest increases coming from petroleum (+91.9%), stone sand & gravel (+428.8%) and coal (+21.3%). The largest decrease came from farm products (-51.6%). RTMs were up 8.5%.

KCS’s total volumes were up 2.5%, with the largest increase coming from coal (+38.6%).

Source: Stephens

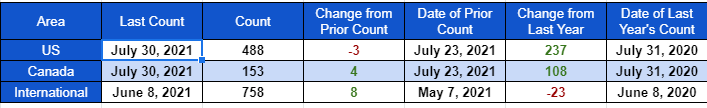

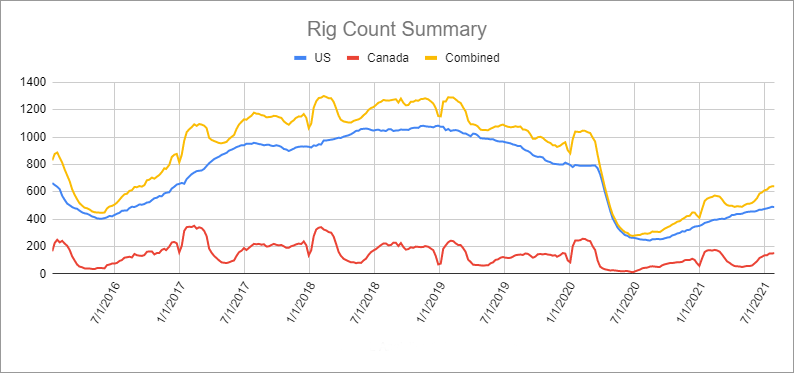

Rig Count

North American rig count is up by 1 rig week over week. The U.S. rig count was down 3 rigs week over week, but up by 237 rigs year over year. The U.S. currently has 488 active rigs. Canada’s rig count was up by 4 rigs week over week, and up by 108 rigs year over year and Canada’s overall rig count is 153 active rigs. Year over year we are up 345 rigs collectively.

North American Rig Count Summary

Things We are Keeping an Eye on

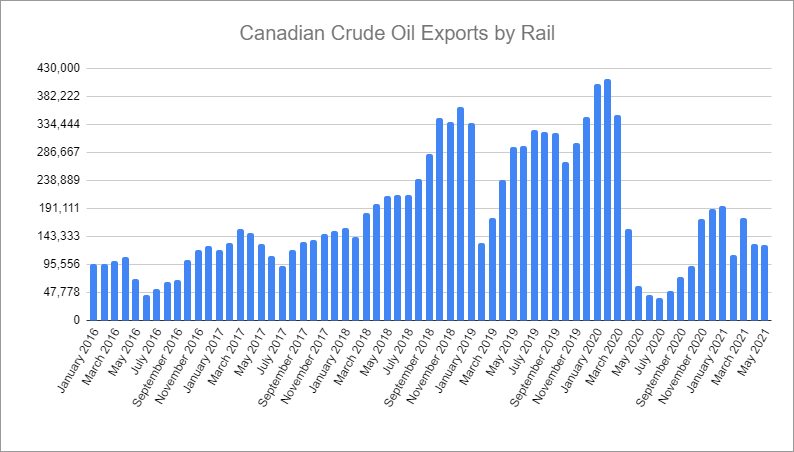

Petroleum by Rail

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 23,818, from 23,527 a gain of 291 rail cars week over week. U.S. volumes were up across the board. The NS had the largest percentage increase up by 20.6%. Canadian volumes were higher – CN shipments were up by 7.6% while CP shipments were up by 21.47%.

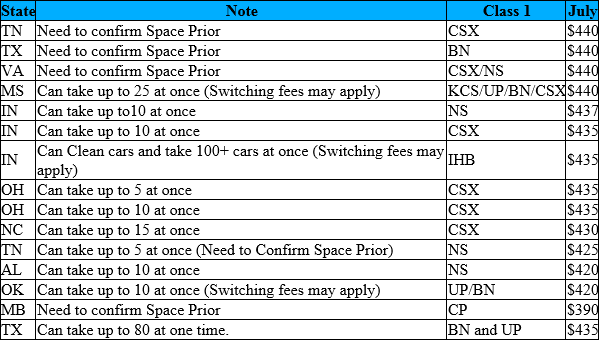

Folks, we are keeping an eye on Alberta – Canadian heavy fell hard on Friday of last week with WCS closing at -14.45 per barrel against WTI. Today represents the first day of the trade cycle so we will be keeping any eye on basis numbers. The reason for the drop was Enbridge rejected some 54% of its August nominations leaving more supply stranded. The wider the basis the better the economics for crude by rail. Stay tuned to PFL for further details.

Railcar Scrapping

PFL was quoted in Argus Petroleum Transportation North America’s newsletter on Friday of last week in regards to its participation of the tremendous amount of rail car scrapping going on in the country right now as record steel prices, government incentives have urged some to get rid of unwanted cars and reload with newer ones. Prices for August are expected to be posted on Wednesday of this week and PFL will advise everyone of new pricing as it becomes available – hopefully we get lucky and we move even higher! In the meantime, please see PFL’s July pricing that just rolled off the board. We pay cash for rail cars at the locations below otherwise for mobile scrapping call us to trouble shoot! Never has there been a better time to scrap a rail car!

PFL Scrapping Locations

Coal

Coal is on fire and there is no letup to be seen anytime soon – The price of high-grade Australian thermal coal (used for power generation) rose to $151 per ton Friday of last week, more than triple its price last September. The price of semi-soft Australian coking coal (or metallurgical coal, used for steel production) was $127 per ton, up almost 80% year to date. Asian demand is on fire. Ironically, some of the extreme weather events being attributed to global warming are now increasing demand for seaborne shipments of high-carbon-emitting coal.

Hot weather here in the U.S. is simultaneously boosting prices and lowering reserves of natural gas, which competes with thermal coal for power generation. “Even in Europe, which is the epicenter for decarburization, low natural gas inventories are driving a sharp increase in thermal coal imports from virtually every nation.”

Shipping coal around has not been cheap either – spot rates are over $30,000 a day with Capesizes (ships that can carry 180,000 Dead Weight Ton (DWT) hitting $32,500 a day). Inventories are low (we expect huge restocking September through November to get ready for winter) and with Natural Gas prices over $4.00 per MMBTU here in the U.S. and over $12 per MMBTU in Asia coal is not going away anytime soon!

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Railcar Markets

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 100 fuel oil cars in Texas dirty to dirty service

- 100 non coiled R’s or J’s clean or last in Jet Fuel needed in Houston

- 100 117Rs or Js needed for gas and diesel in Texas dirty preferred BNSF service

- 10 open top hoppers 2400 C FT in Texas needed for stone on the UP 3-5 years

- 20 19,000 Gal Stainless cars in Louisiana UP for nitric acid 1-3 years negotiable

- 5 Gondolas for Sale for aggregate in Texas any line

- 8 Hoppers for plastic pellets wanted to purchase

- 15-25 3915 CF PD Hoppers in Chicago any class one 3 year lease – negotiable

- 18-25 5,200CF or greater covered hoppers needed in Illinois off the CN or NS.

- 20-25 30K 117Rs for the use in ethanol in the Midwest. Dirty to dirty service/

- 10 6,300CF or greater covered hoppers needed in the Midwest.

- 10 PD cars for cement service for purchase.

- 20 17K tank cars for purchase. Must be food grade.

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js – Selection is Dwindling. Call Today!

- 20 117R 30K plus tanks for ethanol in Wisconsin off the CN Negotiable

- 80 6350 Grain Hoppers in Nebraska on the BN Clean Negotiable

- 90 117Rs 30K located in Alberta CN or CP Refined Products Dirty – negotiable

- 37 BRAND NEW 5161 Sugar Hoppers in Arkansas UP – negotiable

- 205 117Js 29K BRAND NEW in Colo and Iowa off the UP, BNSF – price negotiable

- 99 340W Pressure Cars various locations Butane and Propane dirty negotiable

- 100 73 ft 286 GRL riser less deck, center part for sale,

- 19 auto-max II automobile carrier racks – tri-49 for sale – negotiable

- 10 food grade stainless steel cars

- 30 CPC 1232 25.5K Pennsylvania NS clean negotiable

- 100-150 29K C/I 117J cars for lease. Dirty in Bakken crude and can be returned dirty.

- 100 29K C/I 1232 cars for lease. Dirty in Heavy Crude and can be returned dirty.

- 100 117Rs 29K clean last used in crude Washington State – price negotiable sale or lease

- 21 111s 29K tanks last in alcohol dirty on the CN in Wisconsin for lease price negotiable

- 100 111s of various volumes and locations last in fuel oil dirty price negotiable

- Various Hoppers for sale and lease 3000-5800 CF 263 and 286 multiple locations negotiable

- 45 Boxcars 60ft Plate F’s Located in Tenn CSX – Lease Negotiable

- 28 20K Veg oil cars for lease in Arkansas – Negotiable

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|