“Act as if what you do makes a difference. It does.”

William James

Jobs Update

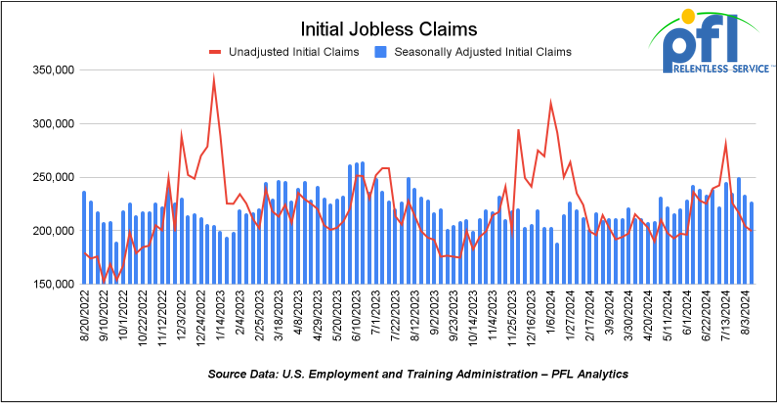

- Initial jobless claims seasonally adjusted for the week ending August 10th came in at 227,000, down -7,000 people week-over-week.

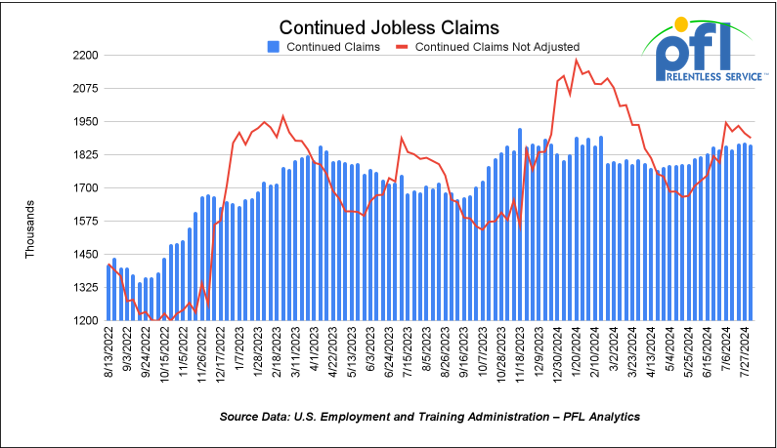

- Continuing jobless claims came in at 1.864 million people, versus the adjusted number of 1.871 million people from the week prior, down -7,001 people week-over-week.

Stocks closed higher on Friday of last week and higher week over week

The DOW closed higher on Friday of last week up 96.7 points (+0.24%), closing out the week at 40,659.76 up 1,162.22 points week-over-week. The S&P 500 closed higher on Friday of last week, up +11.03 points and closed out the week at 5,554.25 up 210.09 points week-over-week. The NASDAQ closed higher on Friday of last week up 37.22 and closed out the week at 17,631.72 up 886.43 points week over week.

In overnight trading, DOW futures traded higher and are expected to open at 40,805 this morning, up +11 points.

Crude oil closed lower on Friday of last week and lower week over week.

West Texas Intermediate (WTI) crude closed down -$1.51 per barrel (-1.9%) to close at $76.65 per barrel on Friday of last week, down -0.19 per barrel week over week. Brent traded down -$1.36 USD per barrel (-1.7%) on Friday of last week, to close at $79.68 per barrel up $0.02 per barrel week-over-week.

One Exchange WCS (Western Canadian Select) for September delivery settled Friday on last week at US$12.35 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$64.34 per barrel.

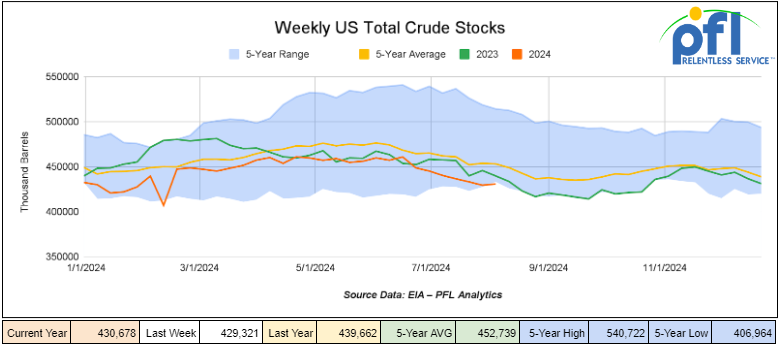

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 1.4 million barrels week-over-week. At 430.7 million barrels, U.S. crude oil inventories are 5% below the five-year average for this time of year.

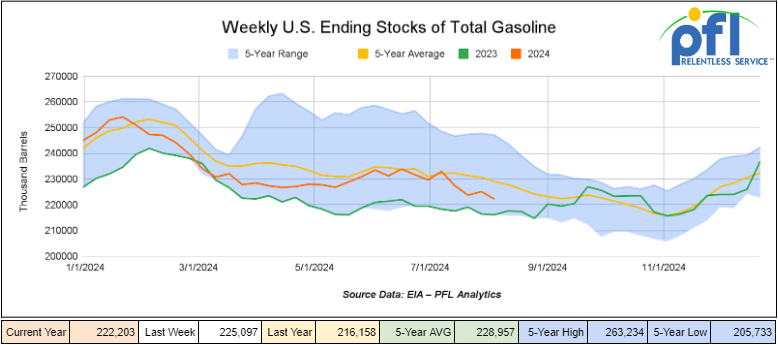

Total motor gasoline inventories decreased by 2.9 million barrels week-over-week and are 3% below the five-year average for this time of year

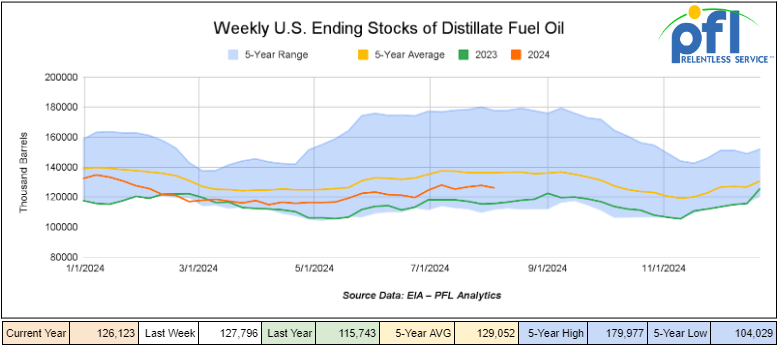

Distillate fuel inventories decreased by 1.7 million barrels week-over-week and are 7% below the five-year average for this time of year.

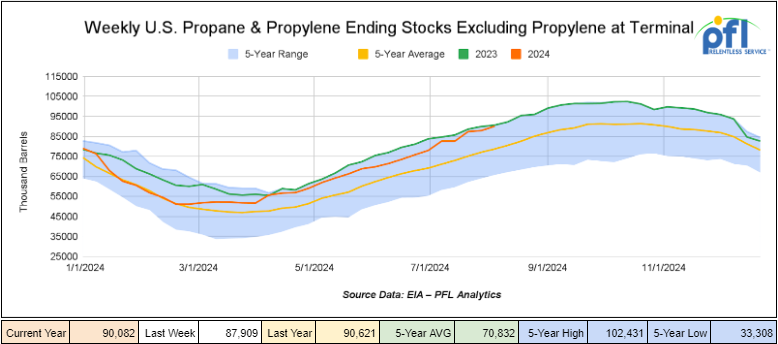

Propane/propylene inventories increased by 2.2 million barrels week-over-week and are 14% above the five-year average for this time of year.

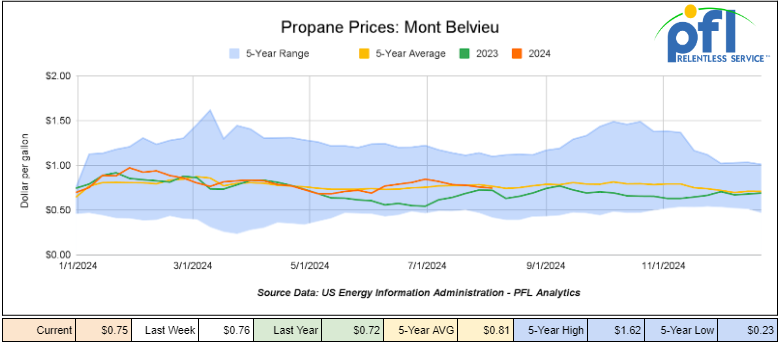

Propane prices closed at 75 cents per gallon on Friday of last week, down 1 cent week-over-week, but up 3 cents year-over-year.

Overall, total commercial petroleum inventories decreased by 3.1 million barrels during the week ending August 9th, 2024.

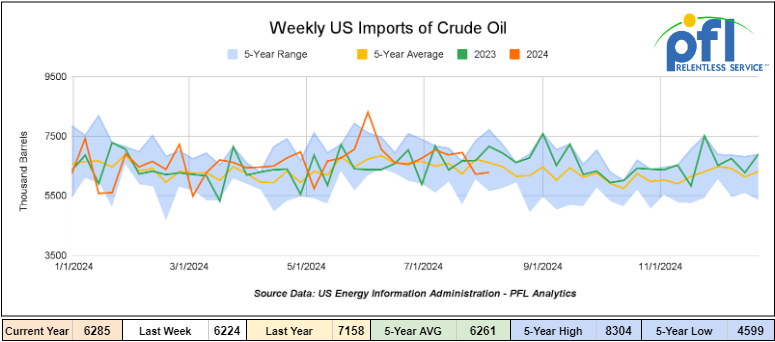

U.S. crude oil imports averaged 6.3 million barrels per day during the week ending August 9th, 2024, an increase of 61,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged about 6.6 million barrels per day, 2.0% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 578,000 barrels per day, and distillate fuel imports averaged 81,000 barrels per day during the week ending August 9th, 2024.

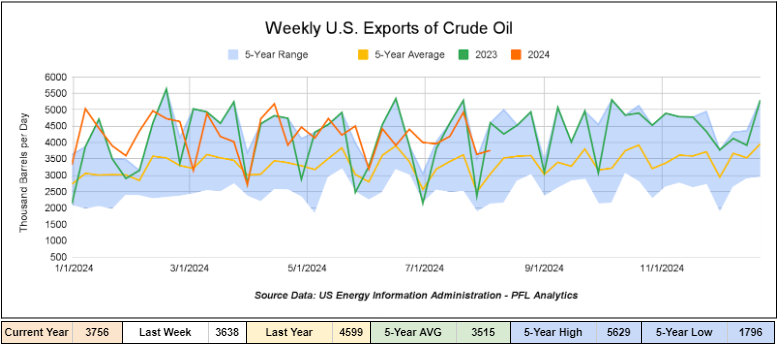

U.S. crude oil exports averaged 3.756 million barrels per day for the week ending August 9th, 2024, an increase of 118,000 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 4.125 million barrels per day.

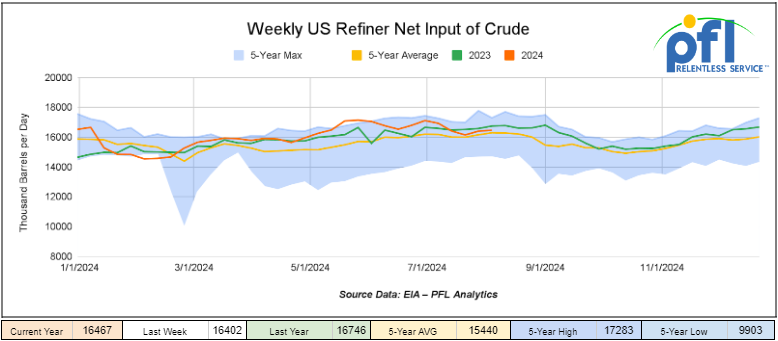

U.S. crude oil refinery inputs averaged 16.5 million barrels per day during the week ending August 9th, 2024, which was 65,000 barrels per day more week-over-week.

WTI is poised to open at $75.87, down -78 cents per barrel from Friday’s close.

North American Rail Traffic

Week Ending August 14th, 2024

Total North American weekly rail volumes were up (+3.46%) in week 33, compared with the same week last year. Total carloads for the week ending on August 14th were 344,045, down (-1.06%) compared with the same week in 2023, while weekly intermodal volume was 339,687, up (+8.48%) compared to the same week in 2023. 6 of the AAR’s 11 major traffic categories posted year-over-year increases. The most significant decrease came from Metallic Ores and Metals, which was down (-13.38%). The most significant increase came from Grain which was up (+29.61%).

In the East, CSX’s total volumes were up (+0.86%), with the largest decrease coming from Metallic Ores and Metals (-5.41%) while the largest increase came from Grain (+54.64%). NS’s volumes were up (+3.88%), with the largest increase coming from Other (+29.4%) while the largest decrease came from Petroleum and Petroleum Products (-14.08%).

In the West, BN’s total volumes were up (+7.13%), with the largest increase coming from Grain (+39.64%) while the largest decrease came from Metallic Ores and Metals down (21.67%). UP’s total rail volumes were up (+7.82%) with the largest decrease coming from Coal, down (-20.41%) while the largest increase came from Grain which was up (+27.72%).

In Canada, CN’s total rail volumes were down (-11.29%) with the largest decrease coming from Intermodal Units, down (-19.69%) while the largest increase came from Other, up (+18.03%). CP’s total rail volumes were up (+14.57%) with the largest increase coming from Grain (+48.71%) while the largest decrease came from Coal, down (-18.66%).

KCS’s total rail volumes were down (-12.17%) with the largest decrease coming from Intermodal (-22.17%) and the largest increase coming from Motor Vehicles and Parts (+15.88%).

Source Data: AAR – PFL Analytics

Rig Count

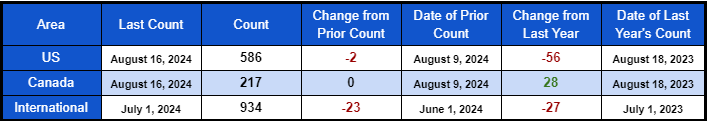

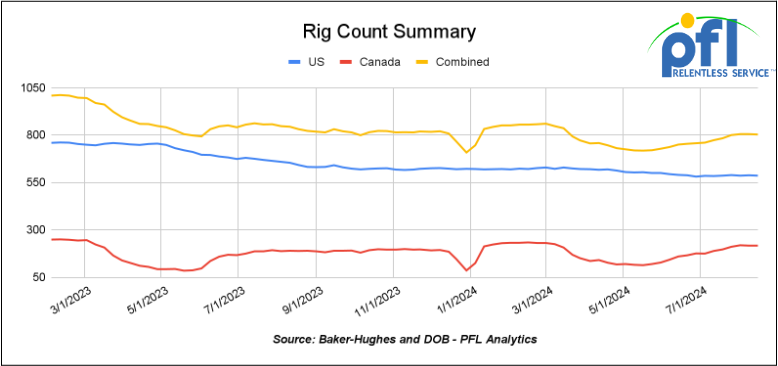

North American rig count was down by -2 rigs week-over-week. The US rig count was down by -2 rigs week-over-week and down by -56 rigs year-over-year. The US currently has 586 active rigs. Canada’s rig count was flat week-over-week, but up by 28 rigs year-over-year. Canada’s overall rig count is 217 active rigs. Overall we are down -28 rigs collectively.

North American Rig Count Summary

A few things we are watching:

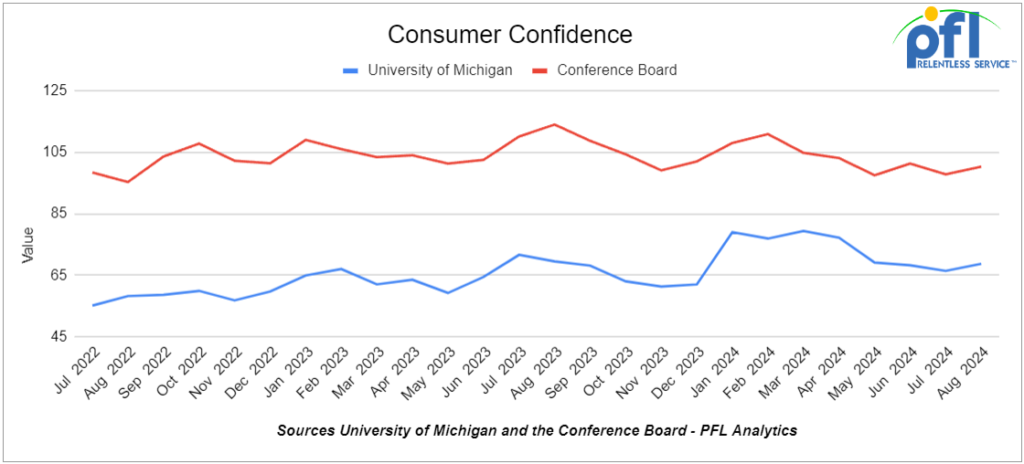

Consumer Confidence

The Index of Consumer Sentiment from the University of Michigan surprisingly increased from 66.4 in July, to 68.7 in August.

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 27,754 from 27,662, which was a gain of 92 rail cars week-over-week, which was the second week in a row of week-over-week gains. Canadian volumes were mixed. CKPC shipments rose by +3.7% week over week, CN’s volumes were lower by -1.7% week-over-week. U.S. shipments are lower across the board. The NS had the largest percentage decrease and was down by -15.9%.

We Continue to Watch Potential Canadian Rail Strikes

The Canadian government has denied an arbitration request by Canadian National Railway Co., increasing the likelihood of a nationwide work stoppage by thousands of its unionized workers.

Labour Minister Steven MacKinnon told the railway and the union, Teamsters Canada Rail Conference, they have a “shared responsibility” to try to negotiate a new contract, according to his letter sent to the company’s representative.

He essentially rejected the rail company’s call to use the ministerial powers to avert a potential job action that may begin as early as this week.

“Teamsters Canada agrees with Minister MacKinnon: agreements are within reach at the bargaining table,” the union said in a statement. “It bears repeating that the main sticking points at the bargaining table are company demands, not union proposals.”

Canadian National has already begun a phased shutdown of its rail networks, beginning with shipments of hazardous materials ahead of the expected work stoppage.

CN said the union “has rejected all offers and has not proposed a single counteroffer.”

CPKC, which has so far failed to reach an agreement with the same union, has also halted shipments of toxic goods and temperature-controlled products such as vegetables, according to a document sent to its customers.

“All stakeholders want an end to this needless uncertainty as rapidly as possible so that we can continue serving the North American economy,” Canadian Pacific said in a statement.

Both companies said their gradual shutdown would ensure hazardous and vulnerable shipments aren’t stranded if a settlement isn’t reached by Aug. 22. They’ve said they will lock the workers out if there’s no agreement by then. PFL has, as a preemptive measure, been storing a large number of rail cars both loaded and empty for its customers ahead of the strike – if you need railcar storage space please call PFL now.

We are watching the supply chain (ports are busy)

Early peak drives record LA port volume as companies are getting nervous for a number of reasons.

The Port of Los Angeles handled a record-breaking 939,600 twenty-foot equivalent units in July, up 37% year over year. It was the busiest month in more than two years and the best July in the port’s 116-year history. July was the 14th consecutive month of year-over-year export gains in Los Angeles

The growing volume comes as shippers confront a variety of supply chain issues, from East Coast dockworker contract negotiations to Red Sea cargo vessel diversions and the possibility of additional tariffs.

The port processed 323,431 empty containers, up 54% compared to 2023.

Total volume was 5,671,091 TEUs through the first seven months of 2024, an 18% increase over the previous year.

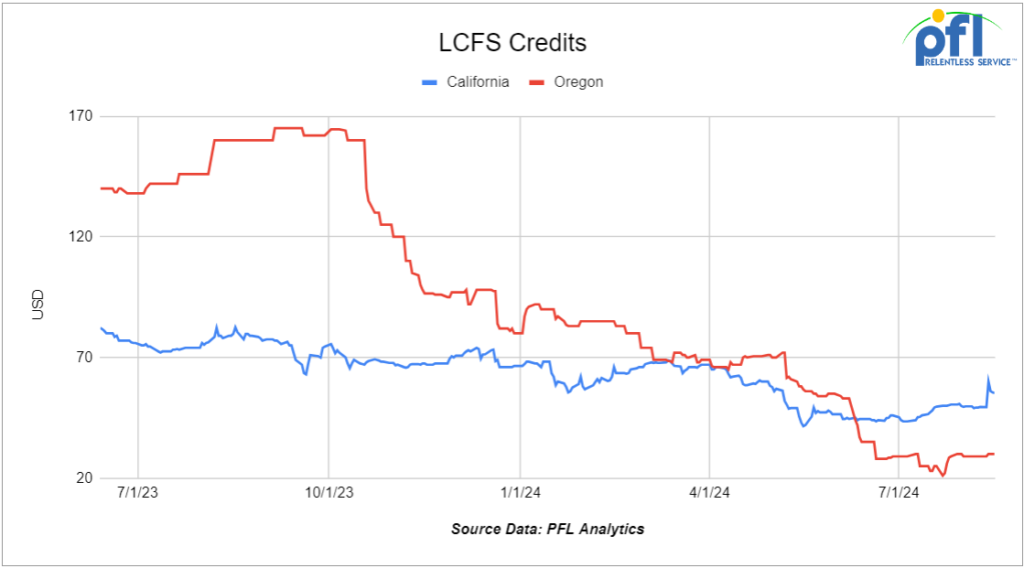

We Continue to watch Renewables

Folks, for better or worse, the government continues throwing money at renewables (or making you pay for the implementation) – it seems California is never satisfied with its carbon intensity and wants to keep the party going! California Low Carbon Fuel Standard credit prices jumped $10 on Tuesday of last week in response to an announcement from the state’s Air Resources Board, which set a 22.75% carbon emissions reduction target for 2025, up sharply from the LCFS program’s previous 2025 target of 13.75%. LCFS credits traded to their highest level since April peaking at $65 per MT on the back of the announcement. Closing out the week at $55.50 per MT up $5.50 per MT week over week.

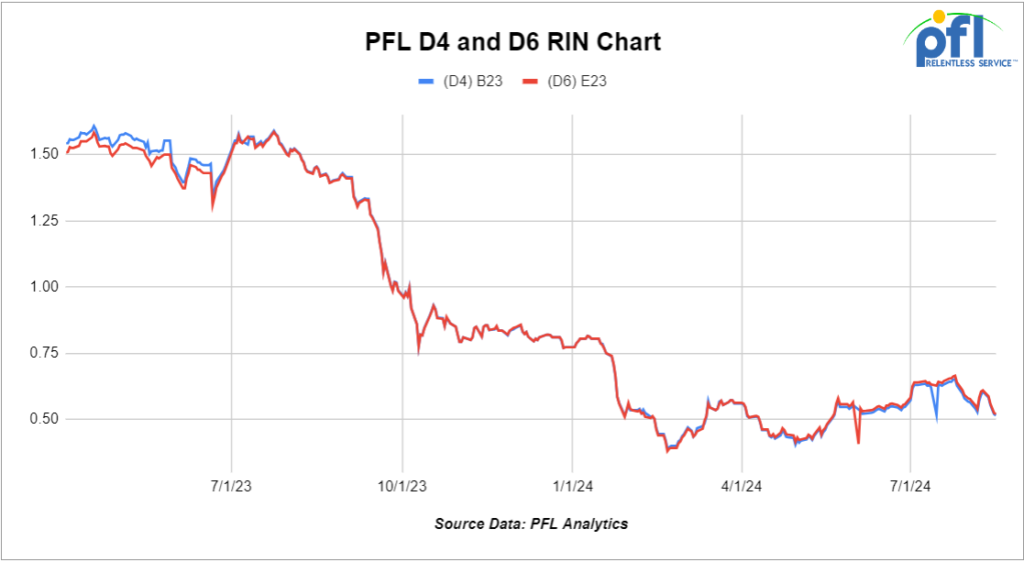

RINs fell to a 12-week low on RFS developments and weak feedstock pricing last week. Ethanol-related D6 and biomass-based diesel D4 Renewable Identification Number credit values on Thursday dropped to their lowest levels since late May, pressured by weak biofuels feedstock prices and other worries concerning the RFS. There was a D.C. Circuit Court of Appeals ruling that said the EPA “unlawfully” denied petitions from small refiners seeking RFS compliance exemption. It is a never-ending battle, folks, making it hard for businesses to make educated decisions – renewables in the fuel mix are not a bad thing but no one needs constantly moving targets and constant government interference. Stay tuned to PFL. We are watching this one.

Lease Bids

- 10, 5250 Covered Hoppers needed off of UP or BN in Midwest for up to 5 years. Cars are needed for use in Dry Edible Beans service.

- 10, 3250 thru hatch Hoppers needed off of BNSF in TX IL for 5 years. Cars are needed for use in Agg service.

- 10, 25.5 117J Tanks needed off of All class ones in Chicago for Epoxy Resin. Cars are clean 5 years

- 30, 33K Pressure Tanks needed off of Any Class 1 in Any Location for 6 Months. Cars are needed for use in Propane service. Needed for Winter

- 100, 5200 Covered Hoppers needed off of UP or BN in Northwest for 6 month. Cars are needed for use in Pet Coke service. Roud Hatch, Bottom Outlet Doors

- 25, 25.5K DOT 111 Tanks needed off of UP in LA for 1-5 Years. Cars are needed for use in Lubricant service.

- 15-20, 29K 117R Tanks needed off of NS or CSX in Ohio for 6-12 Months. Cars are needed for use in Ply Oil service.

- 200, 30K any type Tanks needed off of UP or BN in Texas for RD. Cars are needed for use in Dirty service.

- 20, 4750’s Through Hatch Covered Hoppers needed off of UP BN in USA West for 3 years. Cars are needed for use in Fertilizer service.

- 80, 25.5K-29K any type Tanks needed off of NS or CSX in Northeast for 1-5 Years. Cars are needed for use in Crude service.

- 100, 15.5K DOT 111 Tanks needed off of Any Class 1 in USA for 1-3 Years. Cars are needed for use in Molten Sulfur service.

- 50, 30K 117 Tanks needed off of BNSF or UP in TX for 3-6 Months. Cars are needed for use in Crude service. will look at smaller cars. Prefer short term would look at longer term. Domestic use only

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

- 20, 25.5k CPC 1232 Tanks needed off of UP or BN in OK, TX for 3 Year. Cars are needed for use in Asphalt service.

- 100, 25.5K DOT 111 Tanks needed off of Any Class 1 in Texas for 3 Years +. Cars are needed for use in Asphalt service.

- 30, 29K 117J Tanks needed off of BN or CN in Houston or Edmonton for 1-2 Year. Cars are needed for use in Biodiesel service.

- 10, 25.5K-28.3K DOT 111 Tanks needed off of UP or BN in Houston for 2 Year. Cars are needed for use in Resin service.

- 10, 28.3K 117J Tanks needed off of UP or BN in Texas for 3 Year.

- 25-30, 23.5K or 25.5K Dot 111 or CPC 1232 Tanks needed off of UP or BN in TX, OK, or AR for 3-5 Years. Cars are needed for use in Asphalt service. Needed ASAP., Lined or Unlined. Splash Load

- 250, 4000 Rapid Hoppers needed off of BNSF in TX IL for 5 years. Cars are needed for use in Coal service. in rotary/rapid cars with the electric dumping shoe

- 4, 6260 Covered Hoppers needed off of CSX in Bostick, NC for 2-4 Years. Cars are needed for use in Polypropene Pellets service.

- 8, 28-30K any type Tanks needed off of UP BN in Texas and Gulf for 5 years. Cars are needed for use in Chlorobenzene service. Need Magrods

- 14, 23.5K DOT111 Tanks needed off of UP in Morrilton, AR for 1 year. Cars are needed for use in Turpentine service.

- 10, 30k any type Tanks needed off of UP BN in Texas for 1 year plus. Cars are needed for use in Fuel Oil service.

- 25-50, 5000CF-5100CF Covered Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in Dry sugar service. 3 bay gravity dump, Hempel 37700

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 50, 23.5-25.5 DOT111 Tank s needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 25, 20.5K CPC1232 or DOT117J Tanks needed off of BNSF or UP in the west for 3-5 years. Cars are needed for use in Magnesium chloride service. SDS onhand

- 15, 28.3K DOT117J Tanks needed off of any class 1 in any location for 3 years. Cars are needed for use in Glycerin & Palm Oil service.

- 30, 17K-20K DOT117J Tanks needed off of UP or BN in Midwest/West Coast for 3-5 years. Cars are needed for use in Caustic service.

- 150, 23.5K DOT111 Tanks needed off of any class 1 in LA for 2-3 years. Cars are needed for use in Fluid service. Needed July

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

Sales Bids

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Cement service. Cement Gates needed.

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 20-30, 3000 – 3300 PD Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 2-4, 28K DOT111 Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

- 100, 15.7K DOT111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

- 5, 30K DOT 111 Tanks needed off of in US. Cars are needed for use in Fuels service.

- 5, 23,5K DOT 111 Tanks needed off of any class 1 in Texas. Negotiable

Lease Offers

- 50, 5400, Covered Hoppers located off of NS, IORY in MI. Cars were last used in bean meal. 1 year+

- 2, Flat Double-stack rail transports located off of KCS in Texas. Cars are clean Lease or sell. (Intermodal Container)

- 60, 33K, 340W Pressure Tanks located off of All Class Ones in North America. Cars were last used in Propane/Butane. Up to 1 year.

- 5, 25.5K, DOT 111 Tanks located off of UP in Kansas. Cars were last used in Veg Oils. 2 Year Term

- 50, 30K, DOT 117J Tanks located off of All Class Ones in North America. Cars were last used in Ethanol. 1-2 Year Term.

Sales Offers

- 24, 5300CF, Plate C Boxcars located off of NS or CSX in Southeast.

- 100-300, 3400, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 19, 4400, Rotary Gondolas located off of UP and BN in California and Wyoming.

- 100, 28.3K, DOT117J Tanks located off of various class 1s in multiple locations.

- 7, 30K, DOT 111 Tanks located off of UP in TX, CA, NM.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|

PFL will be at the Following Conferences

- Where: La Quinta, CA

- Attending: David Cohen (954-729-4774)

- Conference Website

- Where: Hyatt Regency Dallas in Dallas, TX

- Attending:Curtis Chandler (239.405.3365), David Cohen (954-729-4774), Brian Baker (239.297.4519), Cyndi Popov(403) 402-5043

- Conference Website