“The results you’re getting are the results you should be getting. If you want different results you must change what you’re doing. There is no prize without the price.”

Dave Anderson

COVID 19 and Markets Update

The United States currently has 5,567,765 confirmed COVID19 cases and 173,139 confirmed deaths.

Canadian and U.S. officials have agreed to keep the border between the two countries closed to non-essential travel for another month. This comes as both countries are still working to stop the spread of COVID-19 and as tensions continue to flare between Canadians and prospective American visitors. The current extension of the cross-border agreement expires on August 21, though as the spread of COVID-19 continues in both countries, the restrictions on recreational travel will remain in place until at least Sept. 21. The ban on discretionary travel was first introduced in March and has been extended each month since.

The U.S. Labor Department stated on Thursday of last week that U.S. workers filed an additional 963K million jobless claims, bringing the total job losses since the coronavirus pandemic to 54.16 million. U.S. oilfield services lost more than 9,000 jobs in July. The U.S. oilfield-services sector cut 9,344 jobs in July, a sharp increase in job losses from a month earlier. In total, nearly 100,000 jobs have been lost since the start of the pandemic in the oil patch.

The DOW did close higher on Friday, up 34.3 points (+ 0.12%) to finish out the week at 27,931.02. The S&P 500 traded lower .58 points (-0.02%) on Friday, closing at 3,372.85 The Nasdaq finished Friday’s session lower, losing 23.20 points (-0.21%) closing out the week at 11,019.30. In overnight trading, DOW futures traded higher and are expected to open up this morning 70 points.

West Texas Intermediate (WTI) traded down 23¢ to close at $42.01 on Friday of last week on the New York Mercantile Exchange, however, the contract was up 79¢ per barrel week over week.

Brent traded down .16¢ cents to close at $44.63 on Friday of last week, a gain of .17¢ per barrel week over week.

U.S. crude inventories fell by 4.5 million barrels last week and now stand at 514.13 MM/bbls.

Gasoline inventories were down by 722,000 bbls while distillate inventories decreased by 2.3 MM/bbls. Diesel demand has picked up significantly in the U.S. and has now reached last year’s levels and is up 4.4% week over week. Exports into Mexico are strong with big increases felt in the gulf coast helping inventory levels shipping 150,000 barrels a day so far this month up 125,000 barrels a day compared to July. Exports for gasoline and Diesel into Mexico are expected to increase in August due to a bunch of problems at Pemex refineries. We are seeing increased interest for railcars in the gulf for exports to Mexico for diesel and gasoline.

Oil is slightly lower in overnight trading and, as of the writing of this report, WTI is poised to open at $41.89 down 12¢/ barrel from Friday’s close.

Things we are keeping an eye on:

- More Power Generation from NatGas. Natural gas-fired generation in the Lower 48 states increased nearly 55,000 gigawatt hours (GWh), up 9%, in the first half of 2020 compared with the first half of 2019. Natural gas is the fastest-growing source of electric power generation, according to data from the U.S. Energy Information Administration’s (EIA) Hourly Electric Grid Monitor. The increase in natural gas-fired generation was the result of recent low prices and natural gas-fired power capacity additions, despite a 5% decline in total electricity generation. The decrease in electricity consumption resulted from reduced business activity as a result of COVID-19 mitigation efforts. Natural gas-fired generation from electric power plants reached record-high levels on July 28 as summertime heat began reaching its seasonal peak. Natural gas futures hit eight-month high and soared on Friday to their highest since December on rising liquefied natural gas exports and forecasts for the weather to remain hot and air conditioning demand high through the end of August. Increased natural gas usage for power generation has led to a decrease in coal shipments this summer with stranded coal cars seemingly everywhere.

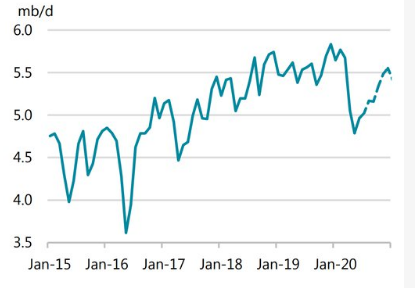

- Canadian Crude – WTI CMA closed at -$9.85 on Friday with an implied value of $32.66 per barrel. As U.S. oil production fell by a record amount in May, Canadian oil producers were able to restore output faster than previously expected, the International Energy Agency (IEA) reported on Thursday last week in its August report on the oil market. Canadian refinery demand still remains depressed but increased demand from the U.S. supported heavy crude grades is gaining steam. Higher oil sands production lifted June supply by 175,000 bbls/d month-on-month, said the IEA. But at just under five million bbls/d output was still some 900,000 bbls/d lower than end-2019 levels. Additional gains in in Canadian production are expected in July and August as companies continue reversing shut-ins and demand from the U.S. has picked up further. According to preliminary data, U.S. crude runs rose by 900,000 barrels per day in June and an additional 600,000 barrels per day in July. By end-July, U.S. imports of Canadian crude had risen from a low of 2.8 million barrels per day to 3.8 million barrels per day according to the EIA. All in all, Canadian oil production is expected to fall by 240,000 barrels per day on average this year before increasing by 220,000 barrels per day in 2021. If all else remains equal based on this schedule without new pipe coming on in the coming days, we should expect crude by rail to kick in Q4 or by the latest Q1 2021.

- Midwest derecho devastated Iowa’s corn crop last week. More than 10 million acres, or 43 percent, of the state’s crops were affected – see picture below:

- On Monday evening last week, a violent, fast-moving thunderstorm complex known as derecho tore a 700-mile path from Nebraska to Indiana. Winds over 70 mph battered Chicago, and as of Thursday afternoon, more than 300,000 people were still without power in northern Illinois as well as Iowa, the state hardest hit. The destructive storms laid siege to more than 10 million acres of Iowa’s corn and soybean crop, devastating farmers and capping off what has already been a difficult few years of farming for many. On the back of the destruction corn and ethanol, markets rallied last week with corn gaining 25.4 cents week over week to close at 324.4 cents on Friday. Meanwhile, Ethanol after a volatile week closed flat on Friday from the previous day’s close ending the week at $1.30 per gallon up 8 and ½ cents per gallon week over week.

- President Trump had a press conference over the weekend on Saturday with some good news on the economy citing that retail spending is at an all-time high, auto production has surged 28%, used car sales are robust, Nasdaq is at an all-time high, so far China is living up to their end to the bargain buying lots of U.S. grown farm products and last, but not least industrial production is increasing at the highest rate ever. When opened up to questioning the media was only focused on getting 25 billion to the post office to do mail in ballots in the upcoming election.

Canadian Crude Supply

The four week rolling average of petroleum carloads on North American railroads rose to 20,994 to 20,594 week over week a gain of 300 cars week over week. CP shipments fell by 14% and CN volumes rose by 6 %

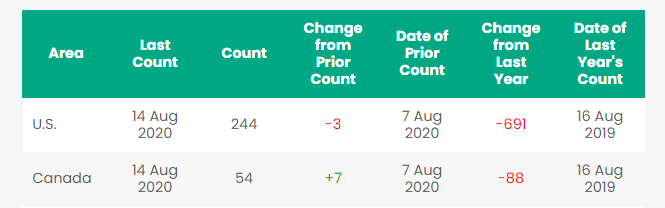

Rig Count

North America rig count moved higher and is up 4 rigs week over week. Canada gaining 7 rigs week over week and Canada’s overall rig count rose this to 54 active rigs. Oil and gas rigs in Canada are now down 88 rigs year on year. The U.S. lost 3 rigs week over week and 691 rigs year over year. Rig count continues to slide in the U.S. even as the oil market has stabilized, the U.S. oil industry has not returned to drilling. Even the Permian basin continues to lose rigs. “North American producers are in a battle for investment allocating growth capital into a global market with artificially constrained supply is a trap our industry has fallen into time and time again,” said Matt Gallagher, CEO of Parsley Energy Inc. last week. Year over year we are down 779 rigs collectively.

Permits for horizontal drilling hit a 10-year low. Not only is the rig count at historic lows, but so are new drilling permits. “Drilling permits, which are increasingly reliable indicators of future activity levels, dipped to a 10-year monthly low this July, with only 454 awards it is unlikely that the rig count will increase significantly before 2021.”

North American Rig Count Summary

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

North American Rail Traffic

Total North American rail volumes were down 7.2% year over year in week 32 (U.S. -6.7%, Canada -8.2%, Mexico -10.5%), resulting in quarter to date volumes that are down 9.1% and year to date volumes that are down 11.5% (U.S. -12.4%, Canada -8.5%, Mexico -10.8%). 10 of the AAR’s 11 major traffic categories posted year over year declines with the largest decreases coming from coal (-23.2%), nonmetallic minerals (-25.6%), metallic ores & metals (-17.4%) and petroleum (-28.3%). The largest increase came from grain (+10.9%).

In the East, CSX’s total volumes were down 5.8%, with the largest decreases coming from coal (-22.8%) and motor vehicles & parts (-15.4%). The largest increase came from intermodal (+2.8%). NCS’s total volumes were down 11.0%, with the largest decreases coming from coal (-36.6%), intermodal (-2.7%) and stone sand & gravel (-32.9%).

In the West, BN’s total volumes were down 8.4%, with the largest decreases coming from coal (-18.2%), stone sand & gravel (-51.3%) and petroleum (-34.4%). UP’s total volumes were down 3.7%, with the largest decreases coming from coal (-21.8%), stone clay & glass (-46.5%), stone sand & gravel (-25.0%) and petroleum (-37.8%). The largest increase came from intermodal (+9.7%).

In Canada, CN’s total volumes were down 5.8% with the largest decreases coming from petroleum (-35.0%) and chemicals (-15.5%). The largest increase came from grain (+48.2%). RTMs were down 7.7%. CP’s total volumes were down 13.3%, with the largest decreases coming from intermodal (-13.8%), petroleum (-53.7%), coal (-21.6%) and stone sand & gravel (-65.8%). RTMs were down 14.9%.

KCS’s total volumes were down 2.5%, with the largest decrease coming from coal (-31.2%). The largest increase came from petroleum (+23.4%).

Source: Stephens

Railcar Markets

PFL is seeking: 200 25.5 cpc 1232 cars for use in Mexico for 1-3 years for heavy fuel oil; 2 Covered hoppers for purchase, 5500 series, for storage at plant site in the Chicago area, BN or NS connection; 25 22-30K coiled and insulated for biodiesel in the Midwest off the UP, 6-12 months; 5-15 6000+ high sided gons, no interior bracing for purchase off the CN or CP Ontario destination. 5-10 syrup cars are needed in the Midwest. Need 100 steel coal gons for sale. Need ten 20K to 23.5 coiled and insulated for one year in ethylene glycol. Please contact PFL with any of these opportunities, it would be very much appreciated!

PFL is offering: Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel and crude oil. Lease terms negotiable, short and long term opportunities available clean cars are available 1-5 years scattered across the country. Leases and subleases are available on 117Js and 117Rs. We have 455 117Js cleaned and recently lined for sale or lease in Texas. We have 207 CPC -1232’s for sale or lease also located in Texas. We have 61 ft. bulkhead flat cars, for lease. We have available 200 30K tankers cleaned and ready for service, for sale or lease. 100 5650 PD hoppers brand new 65 ft available for lease. We have 218 73 ft 286 GRL riser less deck, center part for sale, 28 auto-max II automobile carrier racks – tri-level for sale. PFL has a number of steel and aluminum hoppers for various commodities and tank cars, all for sale. Sand cars, box cars, coal cars and hoppers including sugar covered hoppers and plastic pellet cars are also available for sale and lease in various locations and terms. Call us today for further details!

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. We also assist fleets and lessors with leases and sales and offer Total Fleet Evaluation Services.We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS. WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|