“Most of the important things in the world have been accomplished by people who have kept on trying when there seemed no help at all.”

– Dale Carnegie

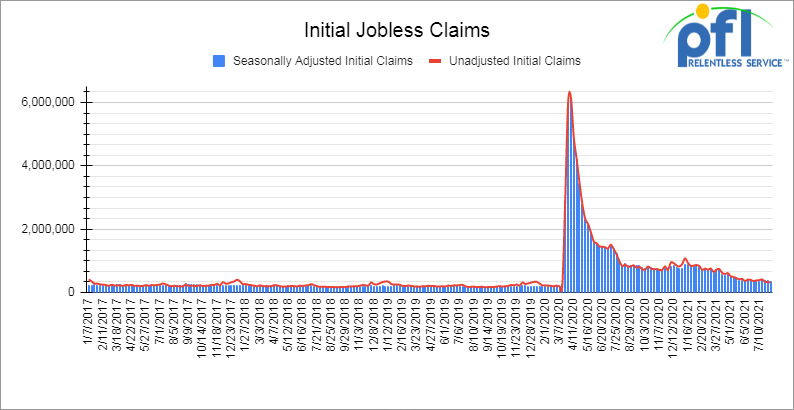

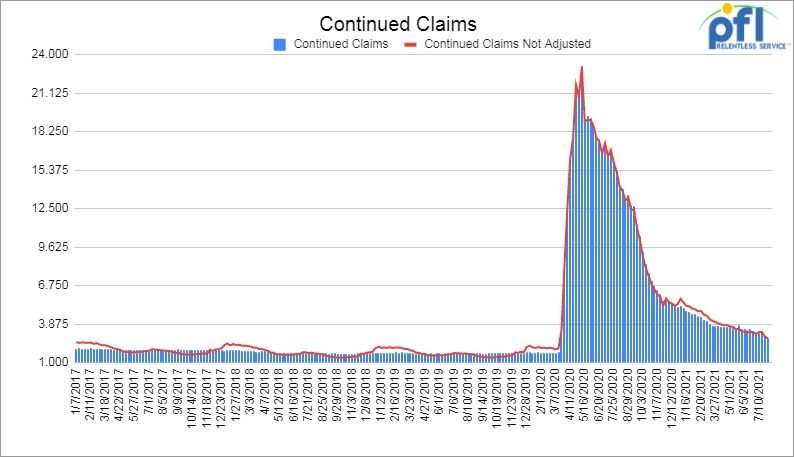

Weekly jobless claims are down slightly week over week, but remain elevated

- Initial jobless claims for the week ended August 7 came in at 375,000, down 10,000 people week over week which was in line with analysts’ expectations.

- Continuing claims came in at 2.866 million, down by 64,000 claims week over week.

- As of July 24, just over 12 million individuals were still claiming unemployment benefits across all programs.

Stocks closed higher on Friday of last week and mixed week over week

The Dow closed higher on Friday of last week, up +15.53 (+0.04%) points closing out the week at 35,515.38, up +309.87 points week over week. The S&P 500 closed higher on Friday of last week, up +7.17 points (+0.16%) and closing out the week at 4,468, up +31.48 points week over week. The Nasdaq closed higher on Friday of last week, up +6.64 points (+0.04%) and closing out the week at 14,822.90, down -12.86 points week over week.

In overnight trading, DOW futures traded lower and are expected to open down this morning 84 points.

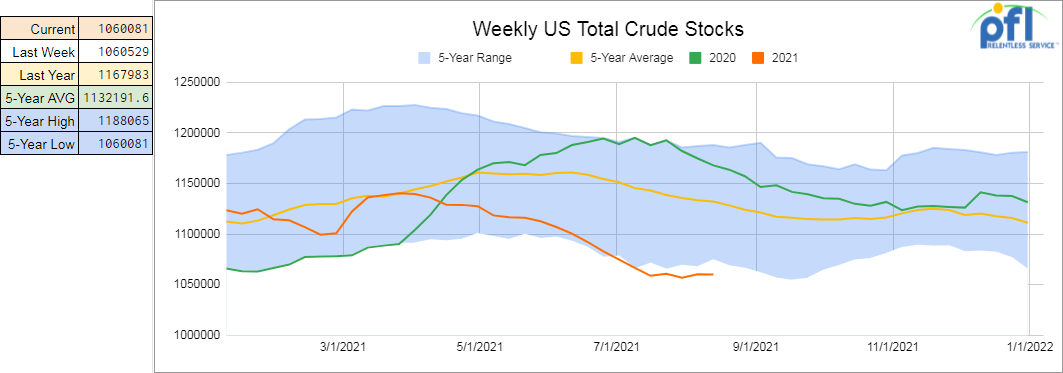

Oil down on Friday and had it biggest weekly decline in months

Oil prices fell about one percent lower on Friday, on continued COVID worries. West Texas Intermediate (WTI) for September delivery fell 65 cents to settle at $68.44 a barrel on Friday of last week, up $0.16 a barrel week over week. Brent crude oil settled down 72 cents a barrel on Friday of last week closing at $70.59 a barrel, down $0.11 a barrel week over week.

U.S. commercial crude oil inventories decreased by 400,000 barrels week over week. At 438.8 million barrels (commercial inventories), U.S. crude oil inventories are 6% below the five-year average for this time of year.

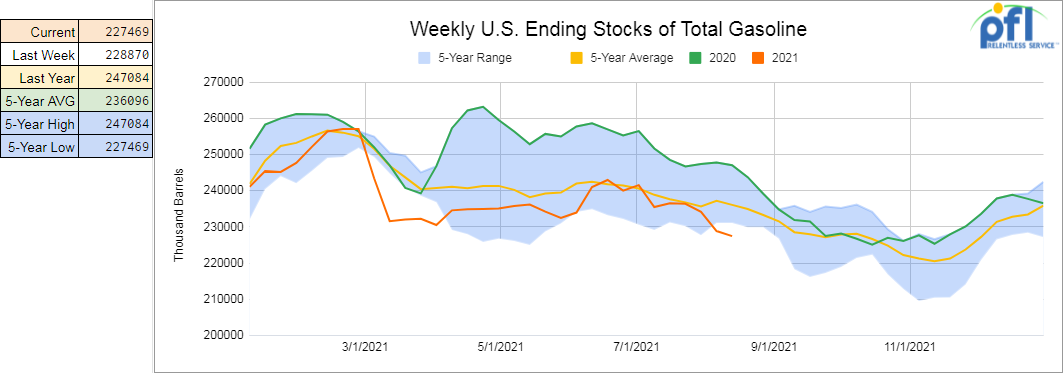

Total motor gasoline inventories decreased by 1.4 million barrels week over week and are 3% below the five year average for this time of year. Finished gasoline inventories increased while blending components inventories decreased last week.

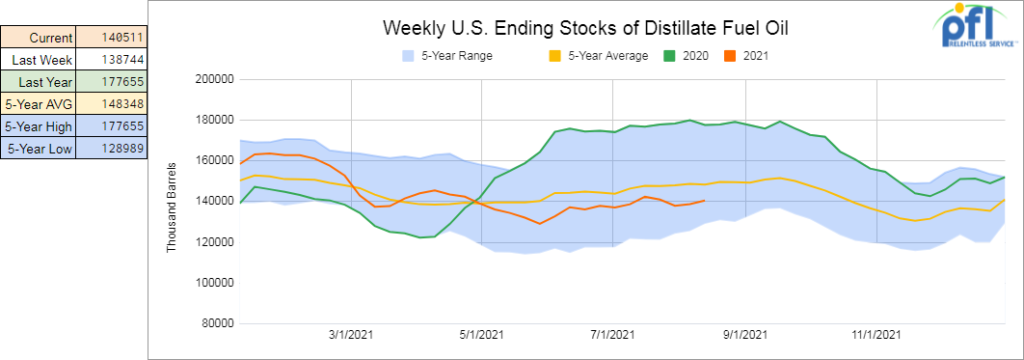

Distillate fuel inventories increased by 1.8 million barrels week over week and are 6% below the five-year average for this time of year.

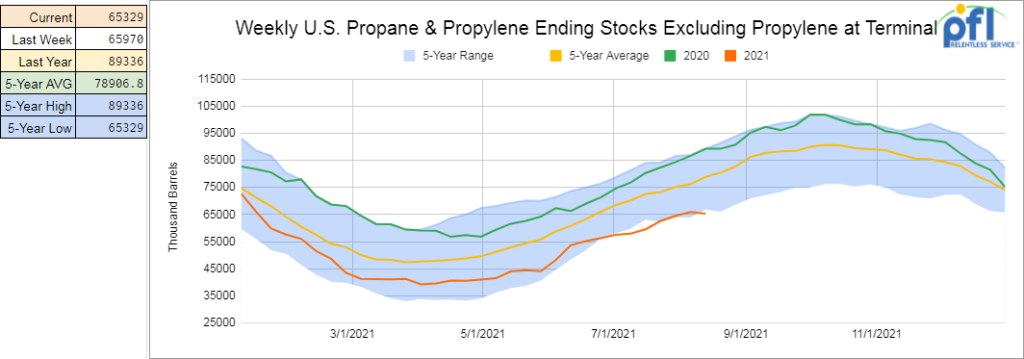

Propane/propylene inventories decreased by 600,000 barrels week over week and are 18% below the five-year average for this time of year.

Total commercial petroleum inventories decreased by 0.1 million barrels last week

U.S. crude oil imports averaged 6.4 million barrels per day last week, down by 36,000 barrels per day from the previous week. Over the past four weeks, crude oil imports averaged about 6.6 million barrels per day, 16.3% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) last week averaged 925,000 barrels per day, and distillate fuel imports averaged 185,000 barrels per day.

U.S. crude oil refinery inputs averaged 16.2 million barrels per day during the week ending August 6, 2021 which was 277,000 barrels per day more than the previous week’s average. Refineries operated at 91.8% of their operable capacity last week. Gasoline production decreased last week, averaging 10.0 million barrels per day. Distillate fuel production increased last week, averaging 4.9 million barrels per day

Oil is lower in overnight trading and, as of the writing of this report, WTI is poised to open at $67.46, down 98 cents per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were up 1.1% year over year in week 31 (U.S. +2.4%, Canada +0.6%, Mexico -13.8%) resulting in quarter to date volumes that are up 2.4% year over year and year to date volumes that are up 10.6% year over year (U.S. +12.0%, Canada +7.1%, Mexico +7.2%). 7 of the AAR’s 11 major traffic categories posted year over year increases with the largest increases coming from coal (+15.3%) and metallic ores & metals (+27.8%). The largest decrease came from grain (-24.7%).

In the East, CSX’s total volumes were up 7.9%, and the largest increases came from intermodal (+7.3%) and coal (+26.4%). The largest decrease came from motor vehicles & parts (-17.1%). NS’s total volumes were up 3.4%, with the largest increases from metals & products (+36.9%) and coal (+11.2%). The largest decrease came from motor vehicles & parts (-18.8%).

In the West, BN’s total volumes were up 3.6%, with the largest increases coming from intermodal (+2.4%), stone sand & gravel (+51.8%) and coal (+6.0%). The largest decrease came from grain (-26.2%). UP’s total volumes were down 0.2%, with the largest decreases coming from intermodal (-5.1%) and motor vehicles & parts (-25.9%). The largest increases came from chemicals (+12.1%) and coal (+9.3%).

In Canada, CN’s total volumes were down 0.1%, with the largest decreases coming from intermodal (-5.3%) and grain (-48.3%). The largest increases came from coal (+101.6%) and metallic ores (+18.4%). RTMs were down 0.4%. CP’s total volumes were up 4.9%, with the largest increases coming from petroleum (+100.2%), intermodal (+10.9%) and coal (+27.7%). The largest decrease came from grain (-34.3%). RTMs were down 5.2%.

KCS’s total volumes were down 7.0%, with the largest decrease coming from intermodal (-13.6%)

Source: Stephens

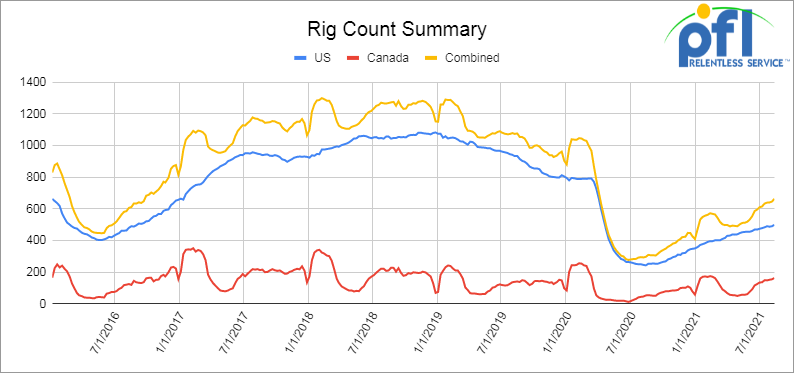

Rig Count

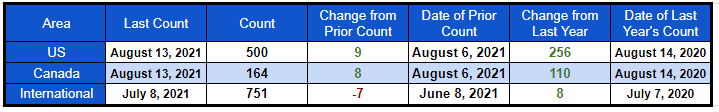

North American rig count is up by 17 rigs week over week. The U.S. rig count was up by 9 rigs week over week and up by 256 rigs year over year. The U.S. currently has 500 active rigs. Canada’s rig count was up by 8 rigs week over week, and up by 110 rigs year over year and Canada’s overall rig count is 164 active rigs. Overall, year over year we are up 366 rigs collectively.

North American Rig Count Summary

Things We are Keeping an Eye on

Hurricanes

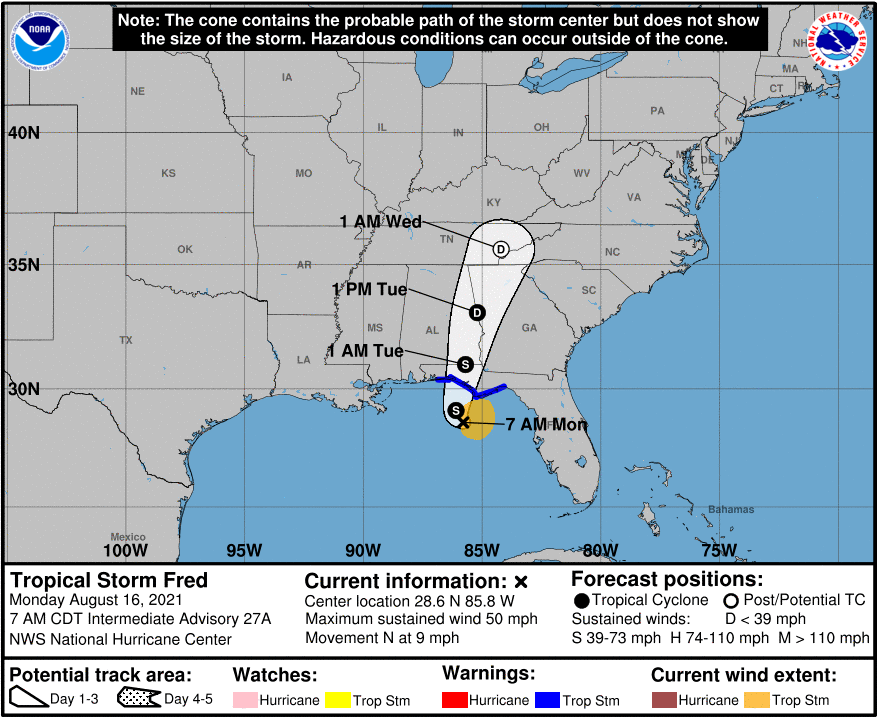

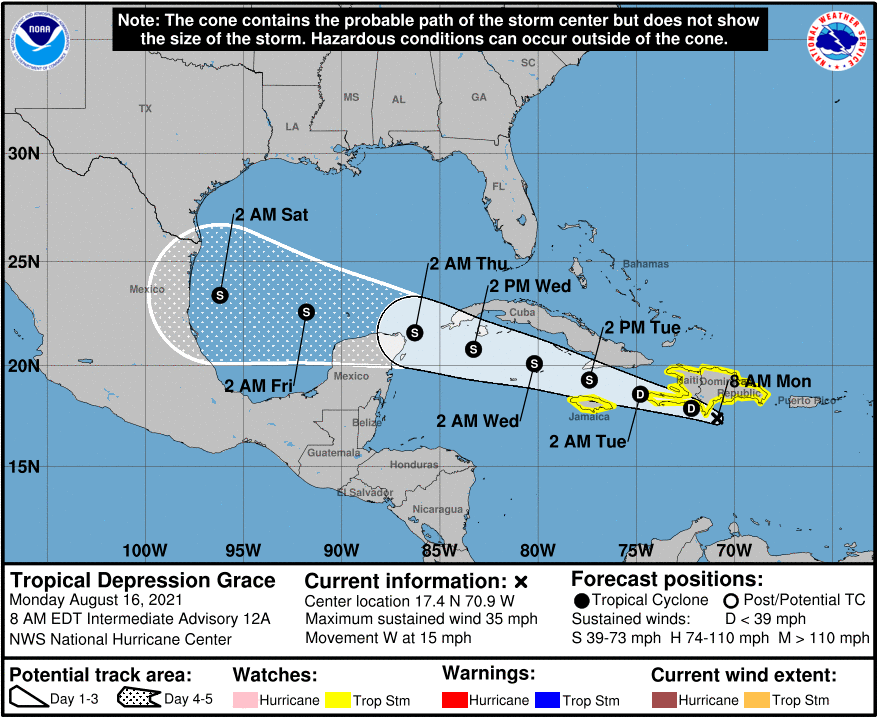

Hurricane season officially ends at the end of November, but we are just entering into what will be the peak season for such events. The National Operatic and Atmospheric Administration (NOAA) updated its outlook for storms from 13-20 to 15-21 and indicated that 7-10 of the storms are expected to become hurricanes and 3-5 storms to become major hurricanes right now we have Fred and Grace that we are keeping an eye on.

Fred is expected to make U.S. land fall in the Florida Panhandle later this evening according the National Hurricane Center latest update that came out at 8:00 am EDT.

Grace has her eyes on Haiti and is currently a tropical storm and heading ultimately to Mexico according the National Hurricane Center latest update that came out at 8:00 am EDT.

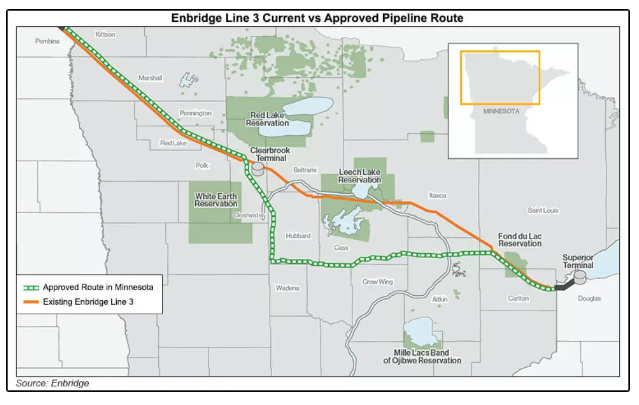

Enbridge Line 3

Oil is set to begin flowing as soon as September through Enbridge Inc.’s disputed Line 3 replacement pipe, moving more Canadian supply to the Lower 48, according to a filing with the Canada Energy Regulator (CER). Enbridge disclosed the target in a request for CER approval to collect a shipping toll surcharge that would cover costs of the $9 billion project when completion of its hotly contested Minnesota leg enables deliveries. “Construction of the Line 3 replacement program…could be completed within the next 30 to 60 days, which will allow the Line 3 replacement pipeline to commence service as early as Sept. 15,” according to the filing.

The new Line 3 is forecasted to give Canadian Crude Oil exporters an added 370,000 b/d of capacity. The project replaces 53-year-old pipe and enables an operating pressure gain.

Enbridge is asking CER to allow it to raise its tolls because of cost overruns. Enbridge is not out of the woods yet as ongoing disputes continue. Even though Line 3 opponents have lost all their lawsuits to date in state and federal courts, formal resistance in legal arenas is also still underway.

On the back of the news, WCS versus WTI strengthened on Friday of last week closing out the day and the week at -$12.75 per barrel – with WCS in the gulf at -$6.20 per barrel there is no room for the commercial trader to ship via rail.

Petroleum by Rail

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 24,684 from 24,008, a gain of 676 rail cars week over week. Canadian volumes were higher- CN shipments were up 4.5% while CP shipments were up by 12.2%. U.S. volumes were mixed with CSX having the largest percentage increase up 10.2% and the BN having the largest percentage decrease down by 7.3%.

Mexican Government Creating Havoc on Energy markets in the gulf

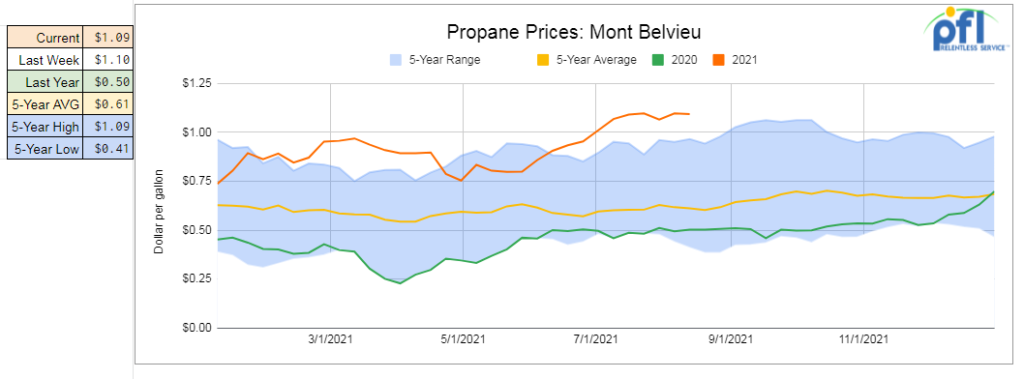

Gasoline and Diesel railcars are getting backed up in the U.S. after unloading and some cars are having to be diverted to storage as a result of the Mexican government suspending or canceling permits for importation. In a new twist, the government of Mexico instituted price caps on LPG prices in the country which kicked-in in August while LPG prices continue to rise due to high demand worldwide. Last week last mile distributors marched in Mexico in protest saying they are being put out or business due to the price caps. Talks are supposed to continue this week. Mexico uses a significant amount of propane for cooking and heating. Prices continue to rise for propane and we are short everywhere. See chart:

KCS’S Board Rejects CP’s latest bid from CP as the battle for KCS between CP and CN continue

Kansas City Southern said on Thursday of last week that its board determined that the unsolicited proposal received from Canadian Pacific Railway does not constitute a “superior proposal” to its agreement with Canadian National Railway Co.

CP Rail presented a new US$27-billion offer for U.S. peer Kansas City Southern on Tuesday, lower than a US$29-billion rival bid from CN Rail, hoping antitrust concerns over the latter will give it an edge.

Kansas City Southern said it continues to recommend shareholders vote for its proposed deal with CN Rail.

CP Rail chief executive Keith Creel had refused to raise his previous US$25-billion bid for Kansas City after losing to CN Rail in May, arguing that the deal that Kansas City had chosen to pursue was “not a real deal” because the Surface Transportation Board, the American rail regulator, would shoot it down.

The STB has yet to rule on the proposed “voting trust” structure of that transaction. KSU has scheduled a special meeting of its stockholders on Aug. 19 to vote on the merger agreement with CN and other proposals.

KSU added if the STB does not release a public decision by Aug. 17, the special meeting will be adjourned to give all shareholders and the board time to receive and consider the STB decision.

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Railcar Markets

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 100 coal cars rotary hoppers for service on the BNSF 1-2 years Negotiable

- 90-100 28.3K C/I Tank Cars needed for Biodiesel in the Midwest for 1 Year.

- 50 6500+ cuft Mill Gon or Open Top Hopper for wood chips in the Southeast for 5 Years.

- 15 28.3K Tank Cars needed for Used Motor Oil in the North for 1-3Years.

- 25 bulkhead flats 286 any class one for up to 5 years Negotiable

- 100 non coiled R’s or J’s clean or last in Jet Fuel needed in Houston

- 10 open top hoppers 2400 C FT in Texas needed for stone on the UP 3-5 years

- 20 19,000 Gal Stainless cars in Louisiana UP for nitric acid 1-3 years negotiable

- 15-25 5,200CF or greater covered hoppers needed in Illinois off the CN or NS.

- 10 6,300CF or greater covered hoppers needed in the Midwest.

- 20 117s 29K for use in Wash and LA on the UP for VGO and UMO

- 15-25 20K 23.5K cars for Oct Slurry needed in the South for 1 Year

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js – Selection is Dwindling. Call Today!

- 200 Clean C/I 25.5K 117J in Texas. Brand New Cars!

- 34 Clean C/I 25.5K CPC 1232’s located in PA.

- 100 117Rs dirty last in Gasoline in Texas for lease Negotiable

- 20 117R 30K plus tanks for ethanol in Wisconsin off the CN Negotiable

- 80 6350 Grain Hoppers in Nebraska on the BN Clean Negotiable

- 90 117Rs 30K located in Alberta CN or CP Refined Products Dirty – negotiable

- 37 BRAND NEW 5161 Sugar Hoppers in Arkansas UP – negotiable

- 99 340W Pressure Cars various locations Butane and Propane dirty negotiable

- 100 73 ft 286 GRL riser less deck, center part for sale,

- 19 auto-max II automobile carrier racks – tri-49 for sale – negotiable

- 10 food grade stainless steel cars

- 30 CPC 1232 25.5K Pennsylvania NS clean negotiable

- 100-150 29K C/I 117J cars for lease. Dirty in Bakken crude and can be returned dirty.

- 100 29K C/I 1232 cars for lease. Dirty in Heavy Crude and can be returned dirty.

- 100 117Rs 29K clean last used in crude Washington State – price negotiable sale or lease

- 21 111s 29K tanks last in alcohol dirty on the CN in Wisconsin for lease price negotiable

- 100 111s of various volumes and locations last in fuel oil dirty price negotiable

- Various Hoppers for sale and lease 3000-5800 CF 263 and 286 multiple locations negotiable

- 45 Boxcars 60ft Plate F’s Located in Tenn CSX – Lease Negotiable

- 28 20K Veg oil cars for lease in Arkansas – Negotiable

- 100 3200 Covered Hoppers for sale price negotiable

- 100 Center beam Flats with risers 73ft in SD and Iowa for sale negotiable

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|