“What you do makes a difference, and you have to decide what kind of difference you want to make.”

~ Jane Goodall

Jobs Update

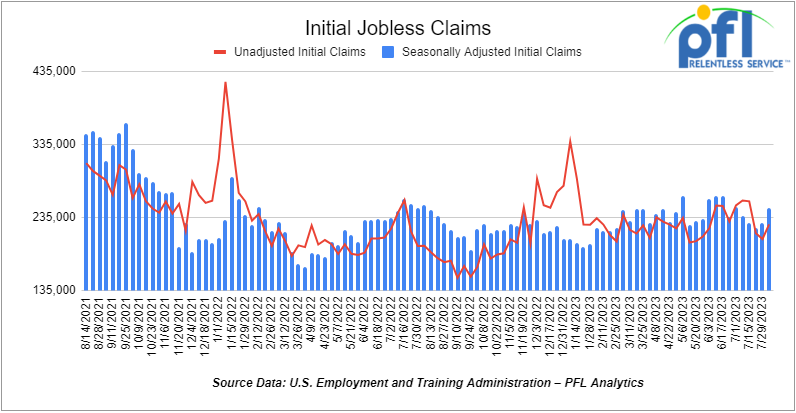

- Initial jobless claims for the week ending August 5th, 2023 came in at 248,000, up 21,000 people week-over-week.

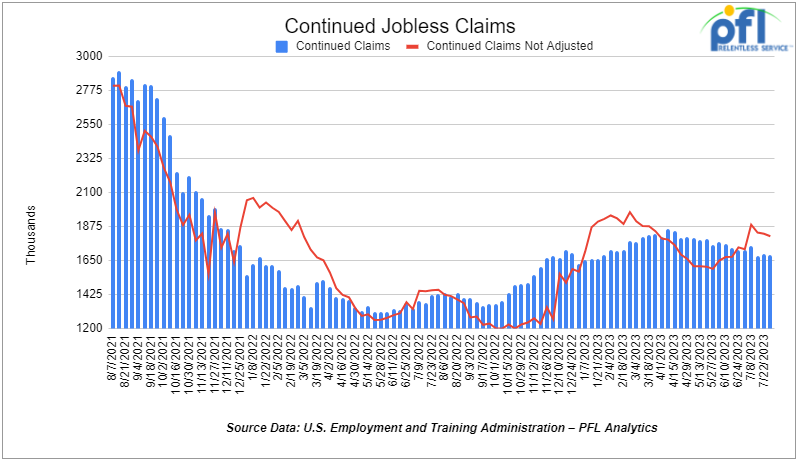

- Continuing jobless claims came in at 1.684 million people, versus the adjusted number of 1.692 million people from the week prior, down -8,000 people week over week.

Stocks closed mixed on Friday of last week and mixed week over week

The DOW closed higher on Friday of last week, up 105.25 points (0.3%), closing out the week at 35,281.4, up 215.78 points week over week. The S&P 500 closed lower on Friday of last week, down -4.78 points (-0.11%) and closed out the week at 4,464.05, down -13.98 points week over week. The NASDAQ closed lower on Friday of last week, down -93.14 points (-0.67%), and closed the week at 13,644.85, down -264.15 points week over week.

In overnight trading, DOW futures traded lower and are expected to open at 35,403 this morning down 52 points.

Crude oil closed up on Friday of last week and higher week over week

WTI traded up $0.37 per barrel (+0.5%) to close at $83.19 per barrel on Friday of last week, up $0.37 per barrel week over week. Brent traded up US$0.41 per barrel (+0.5%) on Friday of last week, to close at US$86.81 per barrel, up US$0.57 per barrel week over week.

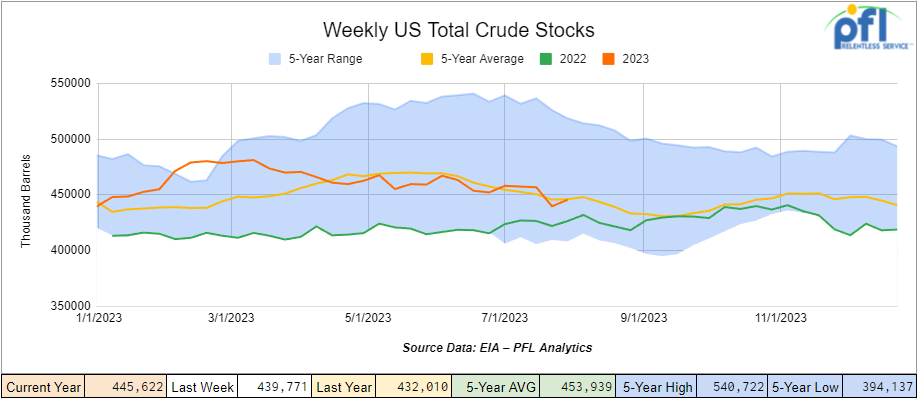

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 5.9 million barrels week over week. At 445.6 million barrels, U.S. crude oil inventories are slightly below the five-year average for this time of year.

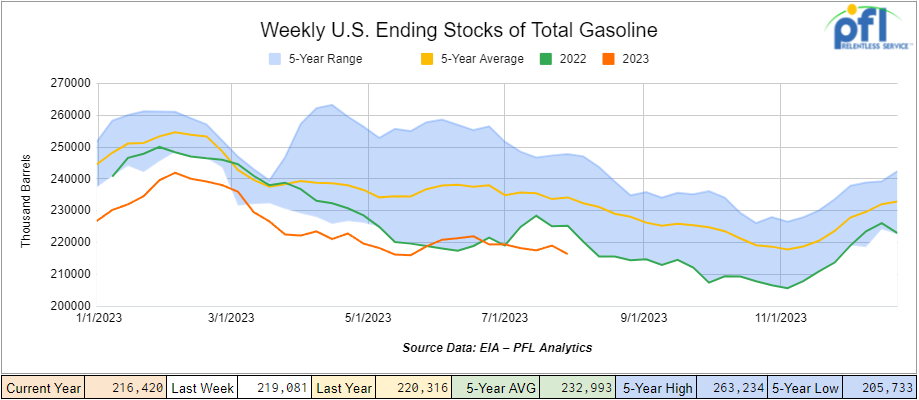

Total motor gasoline inventories decreased by 2.7 million barrels week over week and are 7% below the five-year average for this time of year.

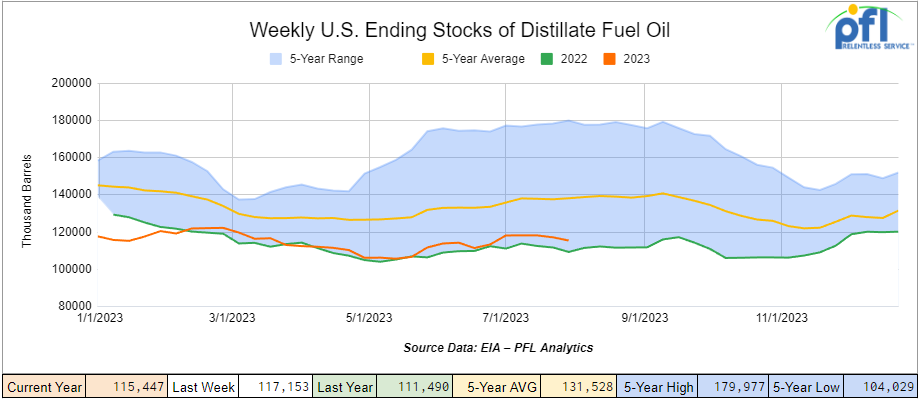

Distillate fuel inventories decreased by 1.7 million barrels week over week and are 17% below the five-year average for this time of year.

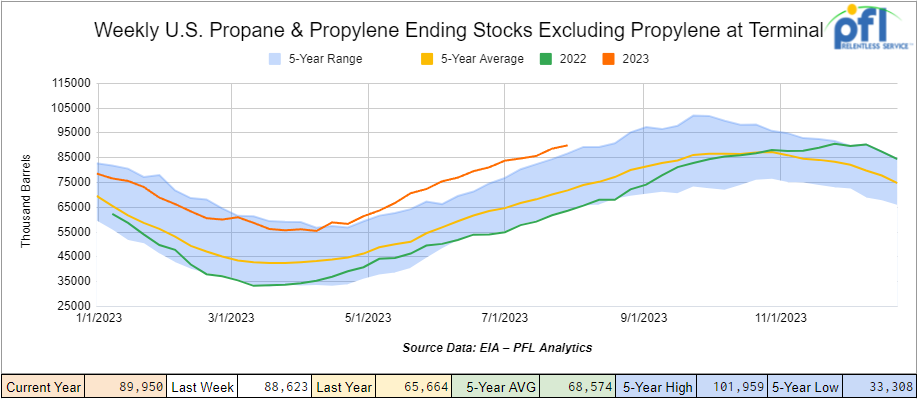

Propane/propylene inventories increased 1.3 million barrels week over week and are 24% above the five-year average for this time of year.

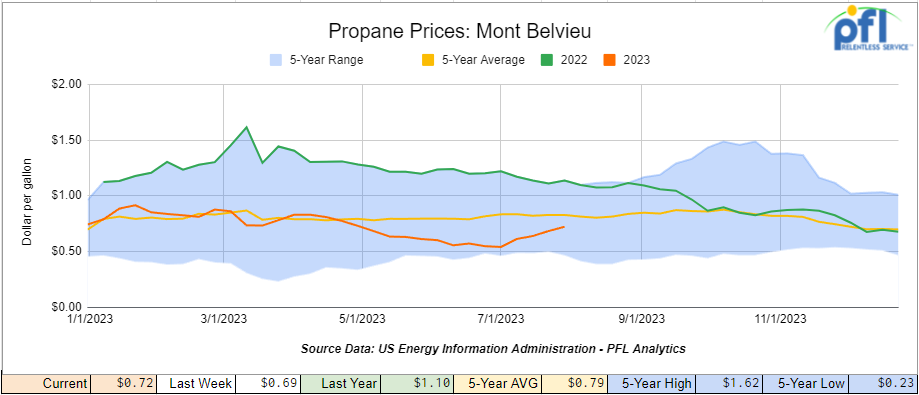

Propane prices closed at 72 cents per gallon, up 3 cents per gallon week over week, but down 38 cents per gallon year over year.

Overall, total commercial petroleum inventories increased by 7.1 million barrels during the week ending August 5th, 2023.

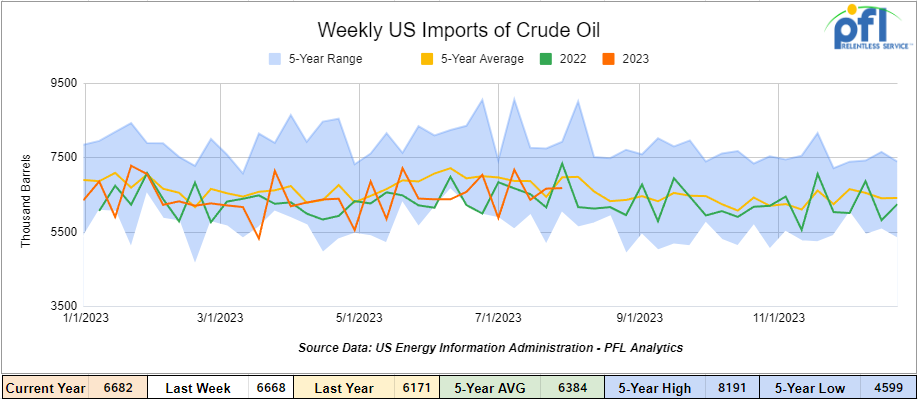

U.S. crude oil imports averaged 6.7 million barrels per day during the week ending August 5th, 2023, an increase of 14,000 barrels per day week over week. Over the past four weeks, crude oil imports averaged 6.7 million barrels per day, 2.7% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) last week averaged 684,000 barrels per day, and distillate fuel imports averaged 65,000 per day during the week ending August 5th, 2023.

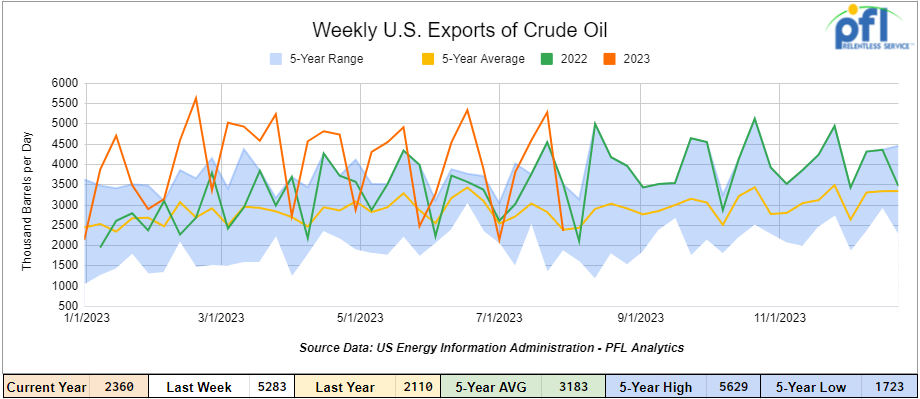

U.S. crude oil exports averaged 2.360 million barrels per day for the week ending August 5th, 2023, a decrease of -2.923 barrels per day week over week. Over the past four weeks, crude oil exports averaged 4.012 million barrels per day.

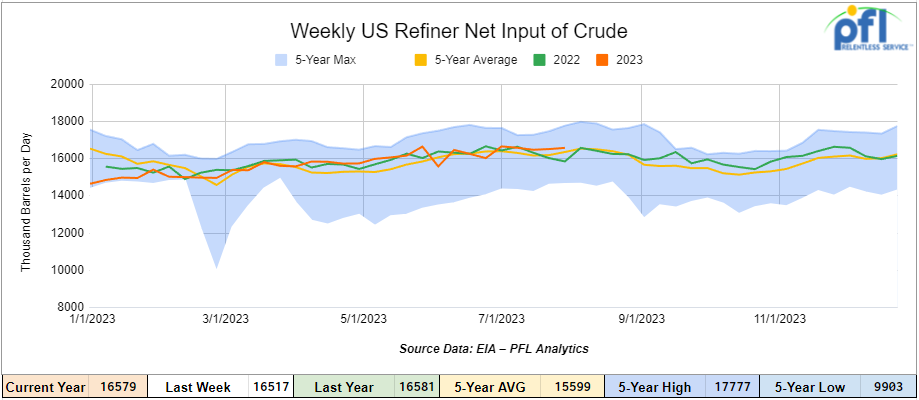

U.S. crude oil refinery inputs averaged 16.6 million barrels per day during the week ending August 4, 2023, which was 62,000 barrels per day more week over week.

WTI is poised to open at 82.92, down -27 cents per barrel from Friday’s close.

North American Rail Traffic

Week Ending August 9th, 2023.

Total North American weekly rail volumes were down (-3.8%) in week 31, compared with the same week last year. Total carloads for the week ending on August 9th, 2023 were 342,552, down (-1.32%) compared with the same week in 2022, while weekly intermodal volume was 312,640, down (-6.37%) compared to the same week in 2022. 7 of the AAR’s 11 major traffic categories posted year over year decreases with the most significant decrease coming from Grain (-17.39%). The largest increase came from Motor Vehicles and Parts (+15.05%).

In the East, CSX’s total volumes were up (0.33%), with the largest decrease coming from Petroleum and Petroleum Products (-8.85%) and the largest increase from Motor Vehicles and Parts (+28.24%). NS’s volumes were down (-2.45%), with the largest decrease coming from Coal (-15.41%) and the largest increase from Motor Vehicles and Parts (+12.72%).

In the West, BN’s total volumes were down (-5.14%), with the largest decrease coming from Grain (-30.73%), and the largest increase coming from Other (+42.74%). UP’s total rail volumes were down (-4.85%) with the largest decrease coming from Grain (-21.27%) and the largest increase coming from Motor Vehicles and Parts (+5.28%).

In Canada, CN’s total rail volumes were down (-4.38%) with the largest increase coming from Coal (+27.03%) and the largest decreases coming from Grain (-43.71%). CP’s total rail volumes were down (-2.16%) with the largest decrease coming from Coal (-32.32%) and the largest increase coming from Motor Vehicles and Parts (+175.61%).

KCS’s total rail volumes were down (-13.64%) with the largest decrease coming from Intermodal (-29.87%) and the largest increase coming from Chemicals (+10.40%).

Source Data: AAR – PFL Analytics

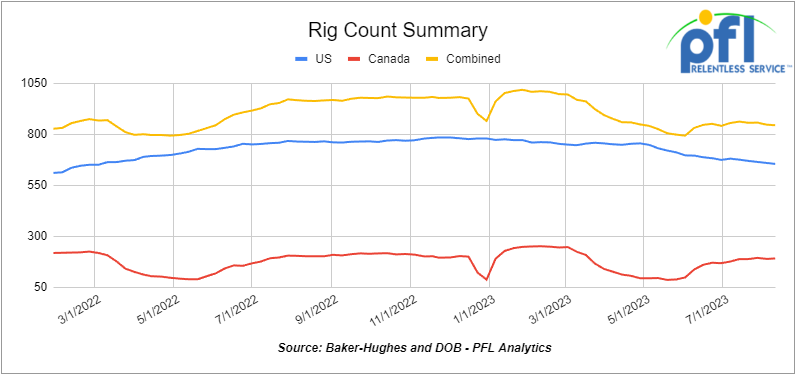

Rig Count

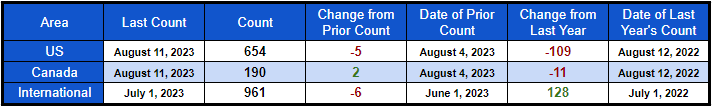

North American rig count was down by -3 rigs week over week. U.S. rig count was down by -5 rigs week over week and down by -109 rigs year-over-year. The U.S. currently has 654 active rigs. Canada’s rig count was up by 2 rigs week-over-week, and down by -11 rigs year over year. Canada’s overall rig count is 190 active rigs. Overall, year-over-year, we are down -120 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are watching Oil Demand and Distillate(s)

Global oil demand has surged to a record level and may continue to rise in August, potentially extending the recent increase in crude prices, according to the International Energy Agency (IEA). The demand spike, hitting an all-time high of 103 million barrels per day (bpd) in June, is attributed to robust summer air travel, strong economic growth in countries participating in the Organization for Economic Co-operation and Development, and increased energy consumption in China, especially for petrochemical production. The IEA projects a possible further demand peak, with an estimated average of 102.2 million bpd for 2023, a historic high. The year is expected to witness a rise of 2.2 million bpd in demand, with China contributing 70% of this growth, according to the IEA. In July, production from OPEC+ nations fell to its lowest point since October 2021, following Saudi Arabia’s reduction of its own output by 1 million barrels per day, which could extend into September. This action was taken to support and stabilize prices. Oil prices have been bolstered by Saudi Arabia and Russia’s supply cuts, with Brent crude trading at $87 per barrel, prompting speculation of a potential return to $100 per barrel oil this year. The IEA warns that while demand is anticipated to increase in 2024, the pace will slow, with China continuing to drive most of the growth.

Meanwhile, the country’s refining capabilities are maxed out – Refiners are unable to increase production even with this summer’s soaring crack spreads according to the IEA in a statement released on Friday of last week. With functioning refineries at record utilization rates (some have shuttered and switched to renewable diesel via the Green new deal) we are in trouble with distillates (heating oil and diesel) heading into this winter. The bottom line is,the current situation has created many strains on the system. As it relates to rail, we do not have enough of the so-called proper rail cars on the system to meet demand – hoping for some changes real soon. We need Europe to step it up, build another massive refinery here in the U.S. and finish off Keystone – PFL Opinion.

The Green New Deal, is it really “Green?” We report You Decide

Four years ago, socialist Congresswoman Alexandria Ocasio-Cortez, along with Senator Ed Markey, introduced the far-reaching Green New Deal proposal. This notably socialist initiative aimed to enact massive spending programs, eliminate “pollution and greenhouse gas emissions as much as technologically feasible,” revolutionize U.S. manufacturing and transportation, and upgrade “all existing buildings in the United States.” The Green New Deal also involves significant alterations to the agricultural industry, a jobs guarantee, and government-managed healthcare, economic security, healthy food, and access to natural spaces for all citizens with a mind-melting final price tag that could be as high as $94.4 trillion.

After a spectacular failure in 2019, the Biden Administration has brought the deal back with a vengeance and will introduce it to the House and Senate. Remarkably, the proposed deal is being expanded to include the “Green New Deal for Health.” The proposal encompasses various socialist and progressive measures, such as allocating $100 billion in government grants to enhance medical facilities’ climate resilience and disaster preparedness, introducing extensive climate change regulations to establish a “green medical supply chain,” and would establish a new office within the Department of Health and Human Services called the Office of Climate Change and Health Equity. The proposed Climate Change and Health Equity Office would be responsible for overseeing “a robust, Federal response to the impact of climate change on the health of the American people and the health care system.” The Climate Change and Health Equity Office would also be tasked with creating government reports showing the “physical, mental, and behavioral health consequences of climate change,” developing tools to track carbon-dioxide emissions, and leading “efforts to reduce the carbon footprint” of the healthcare industry. To put it differently, this could lead to a further escalation of already surging healthcare expenses, jeopardize numerous jobs, and result in heightened taxes, creating additional financial challenges for working-class Americans seeking essential medical care.

Fortunately, both the Green New Deal and the Green New Deal for Health face insurmountable odds of gaining approval within the Republican-controlled House of Representatives in the upcoming year or the next. However, the unyielding determination of the far-left to promote these extreme proposals should act as a crucial alert to the potential trajectory if Americans fail to consistently resist the ascent of socialism in the United States, particularly within the chambers of Congress. Other countries and jurisdictions are losing their appeal for going so called “green”.

Look at Alberta – the province of Alberta, a significant fossil fuel producer in Canada, has temporarily halted the approval of new renewable electricity generation projects exceeding one megawatt, leading to objections from environmental groups. The pause, lasting until February 29, 2024, aims to address concerns about the pace of development and will involve a review of policies for renewable electricity generation. This move has strained relations with the federal government’s climate goals, as Ottawa seeks substantial emissions reductions from Alberta to achieve its targets.

The province’s decision cites worries from municipalities and landowners regarding responsible land use, along with reliability concerns tied to the rapid transition away from coal and the rise of renewables. Nearly 100 projects, with a potential investment of at least $25 billion ($18.7 billion USD) and the capacity to power over 3 million homes, are jeopardized by the freeze, according to the Pembina Institute. The move has drawn criticism for its potential impact on energy affordability and aligning with fossil fuels rather than renewable energy, further exacerbating the ongoing debate surrounding Alberta’s energy policies. There are other jurisdictions reevaluating initiatives – sounds like COVID all over again. PFL believes that a first step should be carbon capture, efficiency and more natural gas production should be the way to go – baby but meaningful steps. Stay tuned to PFL we are watching this one.

We are watching Canadian Lithium Mining

Part of the green new deal involves the production of not-so-friendly batteries – that don’t last as long as one might think and the mining of rare earth resources that disrupt the environment and consume significant financial and conventional resources. One company in Canada is positioning itself to do just that- Allkem (ASX, TSX: AKE) has strengthened the significance of its James Bay lithium project in northern Québec to a tier-1 lithium pegmatite asset. The revised resource estimate totals 110.2 million tonnes with an average of 1.30% Li2O (lithium oxide). Marking a substantial 173% increase over the prior estimate.

The updated resource incorporates findings from two drilling campaigns conducted since early 2022, contributing about 37,500 meters of delineation drilling. Notably, the NW Sector, now part of the James Bay resource, is higher grade than the rest of the deposit, offering potential to enhance future operational grade profiles. The entire deposit retains further exploration potential both along-strike and at depth, prompting Allkem to implement a resource growth strategy through continued drilling. We have yet to access the rail impact of such ventures but stay tuned to PFL we are watching this one for you!

We are watching Deepwater Drilling

The deepwater and ultra-deepwater drilling market is projected to experience a Compound Annual Growth Rate (CAGR) of 5% from 2022 to 2027, with an anticipated market size expansion of $3.5 billion according to PFL analytics. The driving force behind this market growth is the rising demand for oil and gas, propelled by global population growth, economic advancement, and heightened energy consumption in developing nations like China (arguably China is no longer a developing nation, but like to be referred to as such so they don’t have to play by the rules or the Green new Deal) and India. The application of oil and gas in sectors like manufacturing, power generation, and transportation further contributes to the escalating demand.

Deepwater and ultra-deepwater drilling sector is gaining prominence in meeting the mounting oil and gas requisites. These untapped reserves offer strategic solutions, with key regions such as the Gulf of Mexico, but more so in other nations as those other nations don’t fall under United States punitive environmental guidelines are playing a crucial role in global energy production. The integration of digital technologies, exemplified by partnerships like ExxonMobil and Microsoft’s collaboration employing AI and machine learning, is a significant market trend that enhances operational efficiency. Substantial challenges do hinder market growth, primarily the high initial investment and operational costs associated with this specialized form of drilling. The intricate infrastructure demands, such as offshore platforms and subsea pipelines, pose financial hurdles, restricting market entry for smaller enterprises.

We have been extremely busy at PFL with return-on-lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

Lease Bids

- 30-100, 31.8K CPC 1232 Tanks needed off of UP or BN in Texas for Purchase or Lease.

- 100, 6300 Covered Hoppers needed off of BN in South Dakota for 3-6 Months. Cars are needed for use in DDG service.

- 15, 30K 117 Tanks needed off of NS in SouthEast for 1 Year. Cars are needed for use in Diesel service.

- 25, 33K 340W Pressure Tanks needed off of UP or BN in Midwest for Oct-March. Cars are needed for use in Propane service.

- 20-25, 30K 117 Tanks needed off of UP or BN in Illinois for 5 Years. Cars are needed for use in Ethanol service.

- 10, 30K 117 Tanks needed off of NS or CSX in Marcellus for Trip Lease. Cars are needed for use in C5 service.

- 100, 28.3K DOT 111/117 Tanks needed off of UP or BN in Midwest/Texas for 5 Years. Cars are needed for use in Veg Oils / Biodiesel service. Need to be Unlined

- 25-50, 33K 400W Pressure Tanks needed off of CN or CP in Canada for Short Term. Cars are needed for use in Propylene service.

- 50-100, 4550 Covered Hoppers needed off of UP or BN in Texas for 5 Years. Cars are needed for use in Grain service.

- 10, 33K 340W Pressure Tanks needed off of CN in LA for 1 Year. Cars are needed for use in Butane service.

- 25, 20.5K CPC1232 or 117J Tanks needed off of BNSF or UP in the west for 3-5 Year. Cars are needed for use in Magnesium chloride service. SDS onhand

- 25-50, 25.5K 117J Tanks needed off of NS CSX in NorthEast for 5 Years. Cars are needed for use in Asphalt / Heavy Fuel Oil service.

- 30-50, 33K 340W Pressure Tanks needed off of any class 1 in any location for 6-12 Months. Cars are needed for use in Propane service.

- 60-150, 30K 117J Tanks needed off of TYR, UP in Corpus Christi, TX for 1 year. Cars are needed for use in Diesel service.

- 15, 28.3K 117J Tanks needed off of any class 1 in any location for 3 year. Cars are needed for use in Glycerin & Palm Oil service.

- up to 50, 31.8K 117J, 117R, CPC 1232 Tanks needed off of any class 1 in Texas or Ohio for 1-3 years. Cars are needed for use in Diesel / Gasoline service.

- 45, 3000 cf PDs Hoppers needed off of any class 1 in Texas for 3 years. Cars are needed for use in Any service.

- 30, 17K-20K 117J Tanks needed off of UP or BN in Midwest/West Coast for 3-5 Years. Cars are needed for use in Caustic service.

- 10, 286K 15.7K Tanks needed off of KCS in Texas for 1 Year. Cars are needed for use in Sulfuric Acid service. Needed Next few months

- 150, 23.5K DOT 111 Tanks needed off of any class 1 in LA for 2-3 Year. Cars are needed for use in Fluid service. Needed July

- 25-50, 32K 340W Pressure Tanks needed off of NS or CSX in Marcellus for 1-2 Years. Cars are needed for use in Propane service.

- 25-50, 30K DOT 111, 117, CPC 1232 Tanks needed off of CN or CP in WI, Sarnia for 1-2 Years. Cars are needed for use in Diesel service.

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

- 30-40, 286K DOT 113 Tanks needed off of CN or CP/ UP in Canada/MM for 5 Years. Cars are needed for use in CO2 service. Q1

- 70, 32K 340W Pressure Tanks needed off of CP or CN in Edmonton for 3 Years. Cars are needed for use in Propane service.

- 30, 30K DOT 111 Tanks needed off of UP in Texas for 1-3 Years. Cars are needed for use in Diesel service.

- 5-7, 28.3K 117R Tanks needed off of NS or CSX in NC for 1 Year. Cars are needed for use in UCO service.

- 25-50, 5000CF-5100CF Lined Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in Dry sugar service. 3 bay gravity dump

- 10, any capacity Stainless Steel Tanks needed off of any class 1 in Canada for 5-10 years. Cars are needed for use in Alcohol service.

- 30-50, 30K 117 Tanks needed off of any class 1 in Northeast or Midwest for 1 Year. Cars are needed for use in C5 service. Must have Magrods

- 100, 33K 340W Pressure Tanks needed off of CN in Canada for 3-5 Years. Cars are needed for use in Propane service.

- Up to 60, 5150cf Covered Hoppers needed off of CN, CSX, NS in the east or midwest for 3 years. Cars are needed for use in Fertilizer service. 3-4 hatch gravity dumps

- 20-30, 14k Any Tanks needed off of BNSF, UP in Texas for 1-3 Years. Cars are needed for use in HCl service. Call for more details

Sales Bids

- 1-2, Any DOT 111, 117, CPC 1232 Tanks needed off of any class 1 in Texas. Coiled and Insulated

- 45, 3000 cf PD Hoppers needed off of any class 1 in Texas. Negotiable

- 20-25, 25.5K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Texas. Cars are needed for use in Veg Oil service. Coiled and insulated

- 15, 30K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Texas. Cars are needed for use in Veg Oil service.

- 2-4, 28K DOT 111 Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

- 100, Plate F Boxcars needed off of BN or UP in Texas.

- 200+, 5000cf Covered Hoppers needed off of any class 1 in various locations.

- 20-30, 3000 – 3300 PDs Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 100, 15.7K DOT 111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT 111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

- 20, 2770 Mill Gondolas needed off of CSX in the northeast. Cars are needed for use in non-haz soil service. 52-60 ft

- 10, 4000 Open Hoppers needed off of CSX in the northeast. Cars are needed for use in scrap metal service. Open top hopper

- 10, 6400 Open Hoppers needed off of CSX in the northeast. Cars are needed for use in wood chip service. Open top hopper, flat bottom

Lease Offers

- 70, 25.5K, 117J Tanks located off of UP in Texas. Cars are clean Call for more information

- 30, 23.5K, DOT111 Tanks located off of UP or BN in Texas. Cars were last used in Clean / UAN.

- 25-100, 17.6K, DOT111 Tanks located off of UP or BN in Midwest. Cars were last used in Fertilizer / Corn Syurp. Free move available

- 20, 20k, DOT111 Tanks located off of CSX in GA. Cars are clean

- 2, 20K, DOT111 Tanks located off of UP in TX. Cars are clean

- 5, 20K, DOT111 Tanks located off of UP in TX. Cars were last used in Sulfuirc Acid. Free move available

- 100, 28.3K, 117R Tanks located off of All Class 1’s in St. Louis. Cars are clean

- 10, 6500, Covered Hoppers located off of UP and BN in Iowa. Cars are clean

Sales Offers

- 100-200, 31.8K, CPC 1232 Tanks located off of BN in Chicago. Dirty/Clean

- 100, 28.3K, 117J Tanks located off of various class 1s in multiple locations.

- 110, 25.5K, DOT 111 Tanks located off of UP and BN in multiple locations. Dirty, Food Grade. Cars are currently moving

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|