“It is an immutable law in business that words are words, explanations are explanations, promises are promises-but only performance is reality.”

-Harold S. Geneen

Jobs Update

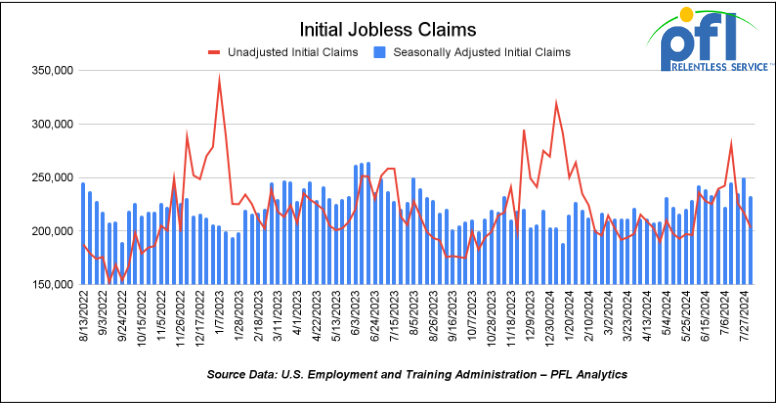

- Initial jobless claims seasonally adjusted for the week ending August 3rd came in at 233,000, down -17000 people week-over-week.

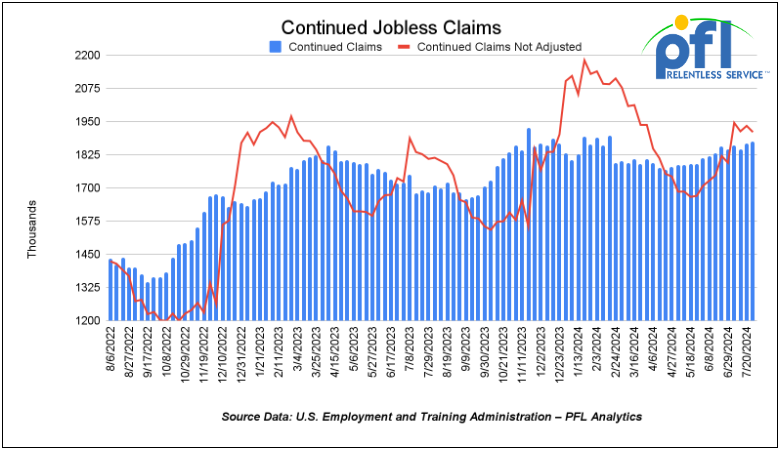

- Continuing jobless claims came in at 1.875 million people, versus the adjusted number of 1.869 million people from the week prior, up 6,000 people week-over-week.

Stocks closed higher on Friday of last week, but lower week over week

The DOW closed higher, on Friday of last week up 51.05 points (+0.13%) closing out the week at 39,497.54 down -239.73 points week-over-week. The S&P 500 closed higher on Friday of last week, up 24.85 points, and closed out the week at 5,344.16, down -2.4 points week-over-week. The NASDAQ closed higher on Friday of last week, up 85.28 points, and closed out the week at 16,745.3, down -30.87 points week over week.

In overnight trading, DOW futures traded higher and are expected to open at 39,643 this morning, up +3 points.

Crude oil closed higher on Friday of last week and higher week over week.

West Texas Intermediate (WTI) crude closed up $0.65 per barrel (+0.9%) to close at $76.84 per barrel on Friday of last week, up $3.32 per barrel week over week. Brent traded up $0.50 USD per barrel (0.6%) on Friday of last week, to close at $79.66 USD per barrel, up $2.85 per barrel week-over-week.

One Exchange WCS (Western Canadian Select) for September delivery settled on Friday of last week at US$13.15 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$61.63 per barrel.

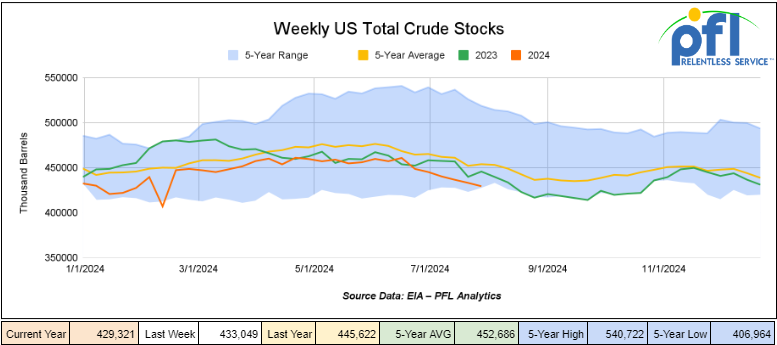

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 3.7 million barrels week-over-week. At 429.3 million barrels, U.S. crude oil inventories are 6% below the five-year average for this time of year.

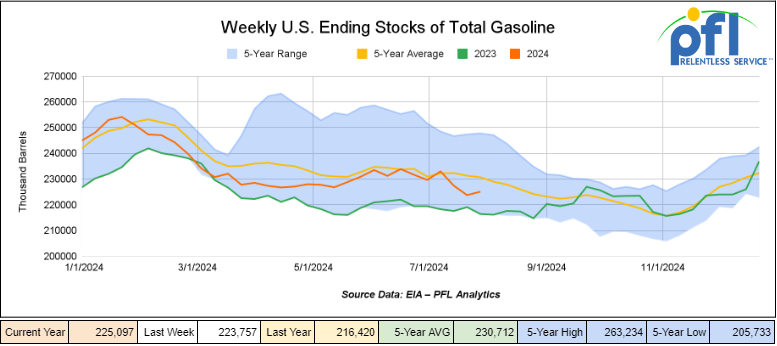

Total motor gasoline inventories increased by 1.3 million barrels week-over-week and are 2% below the five-year average for this time of year

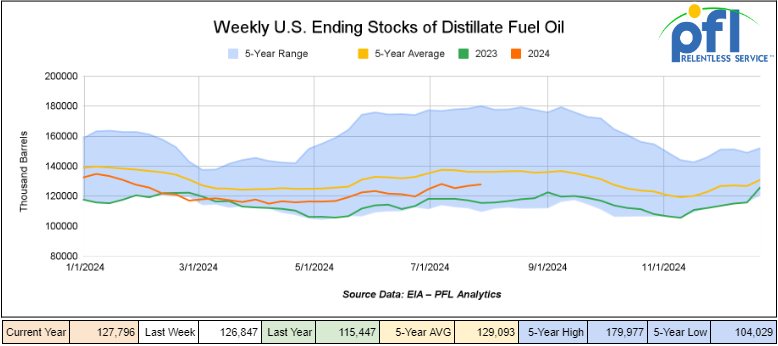

Distillate fuel inventories increased by 900,000 barrels week-over-week and are 6% below the five-year average for this time of year.

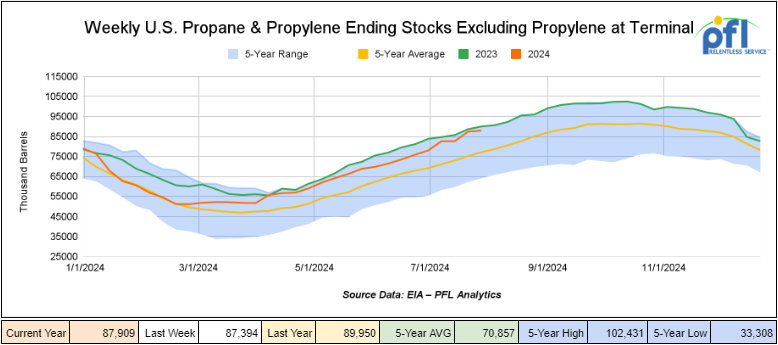

Propane/propylene inventories increased by 500,000 barrels week-over-week and are 13% above the five-year average for this time of year.

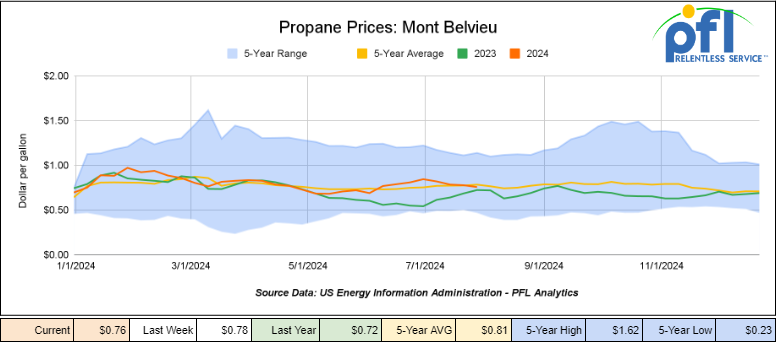

Propane prices closed at 76 cents per gallon on Friday of last week, down 2 cents week-over-week, but up 4 cents year-over-year.

Overall, total commercial petroleum inventories increased by 1.2 million barrels during the week ending August 2nd, 2024.

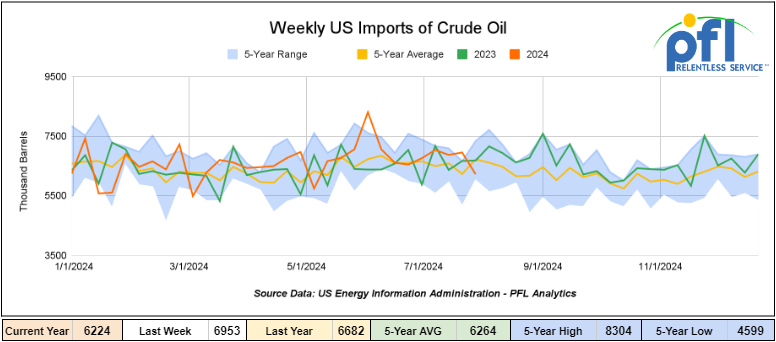

U.S. crude oil imports averaged 6.2 million barrels per day during the week ending August 2nd, 2024, a decrease of 729,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged about 6.8 million barrels per day, 0.7% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 630,000 barrels per day, and distillate fuel imports averaged 115,000 barrels per day during the week ending August 2nd, 2024.

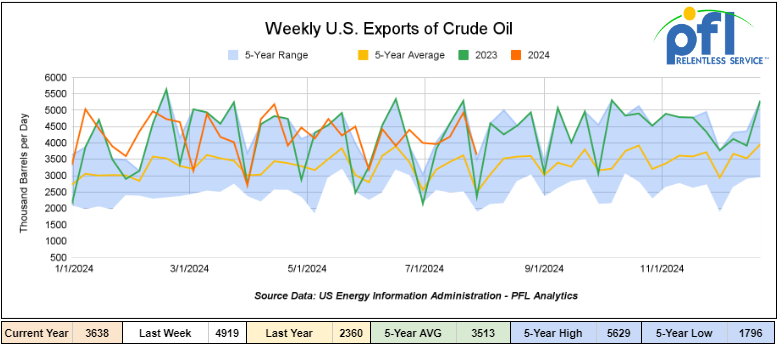

U.S. crude oil exports averaged 3.638 million barrels per day for the week ending August 2nd, 2024, a decrease of -1.281 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 4.177 million barrels per day.

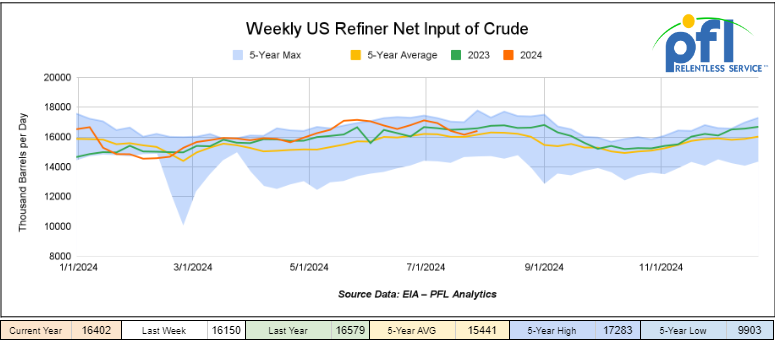

U.S. crude oil refinery inputs averaged 16.4 million barrels per day during the week ending August 2, 2024, which was 252,000 barrels per day more week-over-week.

WTI is poised to open at $77.64, up 80 cents per barrel from Friday’s close.

North American Rail Traffic

Week Ending August 7th, 2024.

Total North American weekly rail volumes were up (4.49%) in week 32, compared with the same week last year. Total carloads for the week ending on August 7th were 243,480, up (0.27%) compared with the same week in 2023, while weekly intermodal volume was 341,147, up (+9.12%) compared to the same week in 2023. 6 of the AAR’s 11 major traffic categories posted year-over-year increases. The most significant decrease came from Coal, which was down (-6%). The most significant increase came from Grain which was up (+13.4%).

In the East, CSX’s total volumes were up (0.9%), with the largest decrease coming from Farm Products (-11.24%) while the largest increase came from Petroleum and Petroleum Products (23.25%). NS’s volumes were up (7.28%), with the largest increase coming from Coal (+28.99%) while the largest decrease came from Motor Vehicles and Parts (-6.13%).

In the West, BN’s total volumes were up (8.77%), with the largest increase coming from Grain (44.21%) while the largest decrease came from Coal down (20.47%). UP’s total rail volumes were up (5.73%) with the largest decrease coming from Coal, down (-14.94%) while the largest increase came from Farm Products which was up (+16.43%).

In Canada, CN’s total rail volumes were down (-9.45%) with the largest decrease coming from Intermodal Units, down (-41.63%) while the largest increase came from Nonmetallic Minerals, up (+12.42%). CP’s total rail volumes were down (7.29%) with the largest increase coming from Other (+100%) while the largest decrease came from Coal, down (-36.94%).

KCS’s total rail volumes were up (4.44%) with the largest decrease coming from Other (-38.48%) and the largest increase coming from Motor Vehicles and Parts (+41.32%).

Source Data: AAR – PFL Analytics

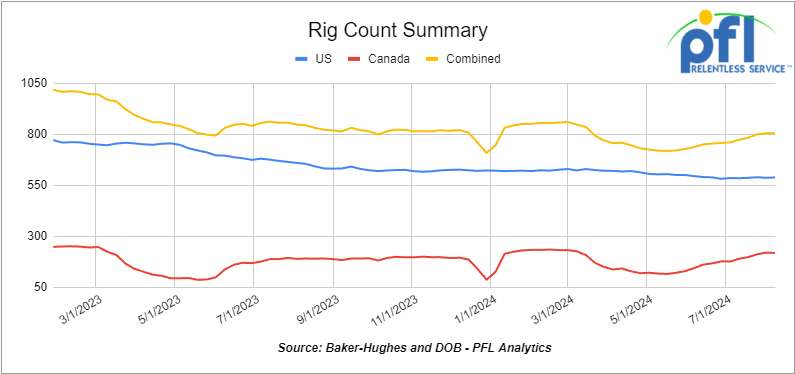

Rig Count

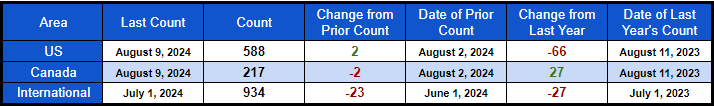

North American rig count was flat week-over-week. The US rig count was up by +2 rigs week-over-week, but down by -66 rigs year-over-year. The US currently has 588 active rigs. Canada’s rig count was down by -2 rigs week-over-week, and up by +27 rigs year-over-year and Canada’s overall rig count is 217 active rigs. Overall we are down -39 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 27,662 from 27,309, which was a gain of 353 rail cars week-over-week – the first gain week over week in five weeks. Canadian volumes were mixed. CN shipments rose by +7.9% week over week, CPKC’s volumes were lower by -8.0% week-over-week. U.S. shipments mostly higher. The UP was the sole decliner and was down by -5.2%. The BN had the largest percentage increase and was up by +24.1%.

We Continue to watch Renewables

Folks, renewables continue to crumble in pretty much every area, yet the federal government and many states continue to throw more taxpayer dollars at it. Here is the latest and greatest:

- It seems the Department of Energy (DOE) is giving millions of dollars every day to companies for research and funding the Green New Deal – on Friday of last week they announced $52.5 Million to catalyze commercial carbon dioxide removal technology. They cited funding will come from President Biden’s investing in America agenda and drive technology innovation and commercialization to reach net-zero greenhouse gas emissions.

- Surprise, surprise – another solar company filed for bankruptcy. SunPower filed for bankruptcy and plans to sell or wind down its remaining operations. Facing a “severe liquidity crisis,” the residential solar installer must sell its assets to pay down more than $2 billion in debts, officials said. According to the company’s bankruptcy filings, SunPower encountered an acute liquidity crisis following a steep drop in demand for residential solar and a series of erroneous financial reports that rendered the company unable to secure new financing.

- U.S. refiner Delek announced on Tuesday of last week that it was temporarily idling three biodiesel plants in Texas, Arkansas, and Mississippi, as it explores other uses for the sites. Chevron earlier this year closed two biodiesel plants in Wisconsin and Iowa due to market conditions.

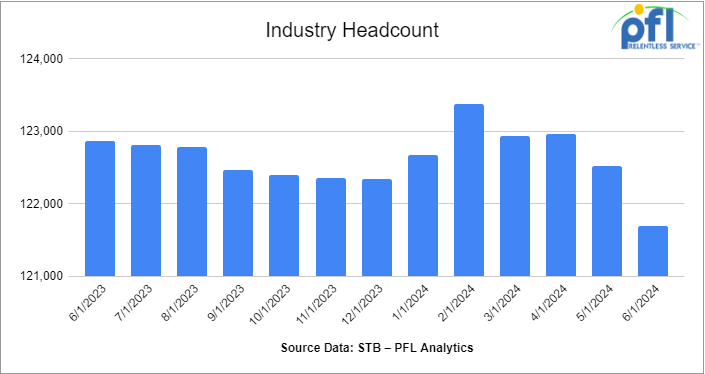

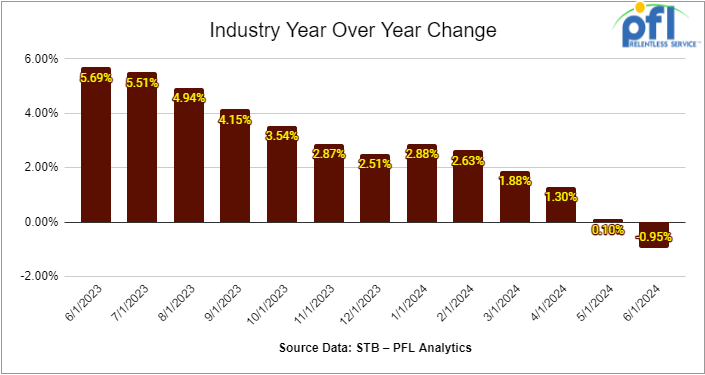

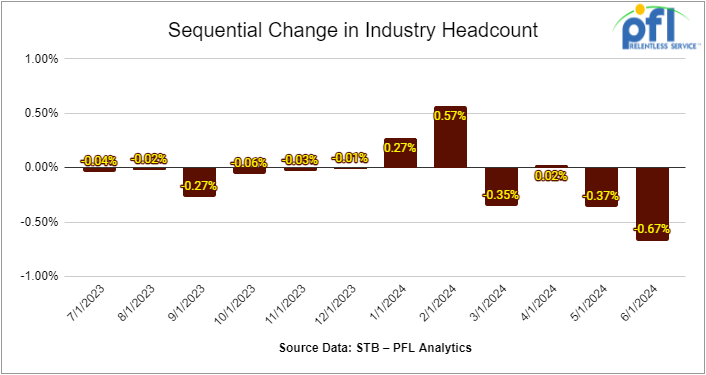

We are watching Class 1 Industry Headcount

Class I railroads employed 121,697 workers in the United States in June, a -0.7% decrease from May 2024’s count and a -0.9% year-over-year decrease, according to Surface Transportation Board data.

Three of the six employment categories posted month-over-month increases between May and June. They were – maintenance of way and structures, up +0.5% to 29,035 workers; transportation (other than train and engine), up + 0.1% to 4,938; and executives, officials, and staff assistants, up 0.8% to 8,065.

Categories that posted month-over-month decreases were transportation (train and engine), -0.9% to 52,430 employees; maintenance of equipment and stores, -1.5% to 17,625; and professional and administrative, -1.4% to 10,103.

Year over year, two categories posted employment gains including transportation (other than train and engine) at 1.2% and maintenance of way and structures at 0.9%.

Categories that registered year-over-year decreases in June were transportation (train and engine), -1.8%; professional and administrative, -1.1%; executives, officials, and staff assistants, -1.5%; and maintenance of equipment and stores, -1.2%

We Continue to Watch Potential Canadian Rail Strikes

Both of Canada’s national railways are now threatening to lock out employees if their separate labor negotiations with Teamsters Canada aren’t resolved by 12:01 a.m. on Aug. 22.

CN Rail is formally calling on the federal government to deploy binding arbitration in the company’s dispute with Teamsters Canada. In a media release, CN Rail said it is making the request to “protect Canada’s economy.”

CN said that if the dispute isn’t resolved soon, it will have “no choice” but to begin a phased network shutdown, concluding with a lockout.

Canadian Pacific Kansas City (CPKC) said in a media release it is issuing its lockout notice publicly to give customers and supply chains time to plan for a work stoppage. The rail company adds that it has offered to enter binding arbitration with the Teamsters.

Teamsters Canada public affairs director Christopher Monette called the threat of a lockout “unexpected and needlessly antagonizing.”

“With at least thirteen days of negotiations still ahead, this move represents an unnecessary escalation that goes against the principles of good faith bargaining that CN and CPKC claims to uphold,’ Monette said.

The news follows a decision by the Canada Industrial Relations Board (CIRB) that CN Rail and CPKC will not be expected to maintain service in the event of a strike or lockout because rail service is not considered “essential” under the Canada Labor Code.

The roughly 9,300 employees represented by Teamsters Canada at the two railways now have a strike mandate. The CIRB has ordered a 13-day cooling-off period for both sides and a strike can’t take place now before Aug. 22.

In its ruling, released Friday of last week, the CIRB said that while what constitutes an “essential service” might seem self-evident, the Canada Labor Code’s definition is specific.

The CIRB said it had to decide whether an interruption of rail service would result in an immediate, serious threat to public health and safety under the law.

The board concluded that a work stoppage would not present an immediate threat to public safety because previous work stoppages involving the parties presented no such threat, and no party brought forward convincing evidence to the contrary.

“There is no doubt that a work stoppage at CPKC/CN would result in inconvenience, economic hardship and, possibly, as some groups and organizations have suggested, harm to Canada’s global reputation as a reliable trading partner,” the CIRB decision says.

“While such possible harm is by no means insignificant, these are not factors that are to be considered by the Board when addressing a referral under section 87.4 of the Canadian Labor Code.”

Posting on the social media platform X (Twitter), Labor Minister Steven MacKinnon said the parties involved have a responsibility to Canadians.

The Business Council of Canada released a letter calling for immediate federal intervention to stop a labor disruption on the railways. The letter was co-signed by nearly 100 business groups and industry associations and is addressed to Prime Minister Justin Trudeau, MacKinnon, and Transport Minister Pablo Rodriguez.

“Rail is the backbone of the Canadian economy. Businesses of all sizes and in all sectors rely on rail to deliver goods that are essential for their operations and the employment of millions of Canadians,” Business Council of Canada president and CEO Goldy Hyder said in an emailed statement.

In their letter, the Business Council says goods worth $380 billion are shipped on Canada’s railways every year.

We Continue to watch Debby and the Tropics

Debbie was a massive rain and flooding event for Florida and the U.S. Southeast. The Governors of four States waived hours of service restrictions for fuel deliveries. Florida’s Governor Ron DeSantis declared a state of emergency and lifted restrictions for trucked deliveries of essential goods including petroleum products that will last until the end of September. North Carolina issued a similar waiver that will stretch into the first week of September. Meanwhile, South Carolina and Georgia ordered waivers from August 4th to August 19th and August 4th to August 8th respectively.

Seven days after Debby’s first landfall as a hurricane in Florida, then a second landfall as a tropical storm in South Carolina, we have one seemingly right behind it. Debby brought historic rainfall from Florida to the Carolinas. Elsewhere in the tropics, a tropical wave in the Atlantic is likely to become a Hurricane later this week as it approaches the Lesser Antilles and Caribbean Sea. When it does become a named storm, it will be Ernesto. Right now the soon-to-be Ernesto is a depression and will be a named tropical storm tomorrow and poses no threat to the United States according to the National Hurricane Center’s 5:00 am update.

Lease Bids

- 10, 5250 Covered Hoppers needed off of UP or BN in Midwest for up to 5 years. Cars are needed for use in Dry Edible Beans service.

- 10, 3250 thru hatch Hoppers needed off of BNSF in TX IL for 5 years. Cars are needed for use in Agg service.

- 10, 25.5 117J Tanks needed off of All class ones in Chicago for Epoxy Resin. Cars are clean 5 years

- 30, 33K Pressure Tanks needed off of Any Class 1 in Any Location for 6 Months. Cars are needed for use in Propane service. Needed for Winter

- 100, 5200 Covered Hoppers needed off of UP or BN in Northwest for 6 month. Cars are needed for use in Pet Coke service. Roud Hatch, Bottom Outlet Doors

- 25, 25.5K DOT 111 Tanks needed off of UP in LA for 1-5 Years. Cars are needed for use in Lubricant service.

- 15-20, 29K 117R Tanks needed off of NS or CSX in Ohio for 6-12 Months. Cars are needed for use in Ply Oil service.

- 200, 30K any type Tanks needed off of UP or BN in Texas for RD. Cars are needed for use in Dirty service.

- 20, 4750’s Through Hatch Covered Hoppers needed off of UP BN in USA West for 3 years. Cars are needed for use in Fertilizer service.

- 80, 25.5K-29K any type Tanks needed off of NS or CSX in Northeast for 1-5 Years. Cars are needed for use in Crude service.

- 100, 15.5K DOT 111 Tanks needed off of Any Class 1 in USA for 1-3 Years. Cars are needed for use in Molten Sulfur service.

- 50, 30K 117 Tanks needed off of BNSF or UP in TX for 3-6 Months. Cars are needed for use in Crude service. will look at smaller cars. Prefer short term would look at longer term. Domestic use only

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

- 20, 25.5k CPC 1232 Tanks needed off of UP or BN in OK, TX for 3 Year. Cars are needed for use in Asphalt service.

- 100, 25.5K DOT 111 Tanks needed off of Any Class 1 in Texas for 3 Years +. Cars are needed for use in Asphalt service.

- 30, 29K 117J Tanks needed off of BN or CN in Houston or Edmonton for 1-2 Year. Cars are needed for use in Biodiesel service.

- 10, 25.5K-28.3K DOT 111 Tanks needed off of UP or BN in Houston for 2 Year. Cars are needed for use in Resin service.

- 10, 28.3K 117J Tanks needed off of UP or BN in Texas for 3 Year.

- 25-30, 23.5K or 25.5K Dot 111 or CPC 1232 Tanks needed off of UP or BN in TX, OK, or AR for 3-5 Years. Cars are needed for use in Asphalt service. Needed ASAP., Lined or Unlined. Splash Load

- 250, 4000 Rapid Hoppers needed off of BNSF in TX IL for 5 years. Cars are needed for use in Coal service. in rotary/rapid cars with the electric dumping shoe

- 4, 6260 Covered Hoppers needed off of CSX in Bostick, NC for 2-4 Years. Cars are needed for use in Polypropene Pellets service.

- 8, 28-30K any type Tanks needed off of UP BN in Texas and Gulf for 5 years. Cars are needed for use in Chlorobenzene service. Need Magrods

- 14, 23.5K DOT111 Tanks needed off of UP in Morrilton, AR for 1 year. Cars are needed for use in Turpentine service.

- 10, 30k any type Tanks needed off of UP BN in Texas for 1 year plus. Cars are needed for use in Fuel Oil service.

- 25-50, 5000CF-5100CF Covered Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in Dry sugar service. 3 bay gravity dump, Hempel 37700

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 50, 23.5-25.5 DOT111 Tanks needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 25, 20.5K CPC1232 or DOT117J Tanks needed off of BNSF or UP in the west for 3-5 years. Cars are needed for use in Magnesium chloride service. SDS onhand

- 15, 28.3K DOT117J Tanks needed off of any class 1 in any location for 3 years. Cars are needed for use in Glycerin & Palm Oil service.

- 30, 17K-20K DOT117J Tanks needed off of UP or BN in Midwest/West Coast for 3-5 years. Cars are needed for use in Caustic service.

- 150, 23.5K DOT111 Tanks needed off of any class 1 in LA for 2-3 years. Cars are needed for use in Fluid service. Needed July

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

Sales Bids

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Cement service. Cement Gates needed.

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 20-30, 3000 – 3300 PD Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 2-4, 28K DOT111 Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

- 100, 15.7K DOT111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

- 5, 30K DOT 111 Tanks needed off of in US. Cars are needed for use in fuel service.

- 5, 23,5K DOT 111 Tanks needed off of any class 1 in Texas. Negotiable

Lease Offers

- 50, 5400, Covered Hoppers located off of NS, IORY in MI. Cars were last used in bean meal. 1 year+

- 2, Flat Double-stack rail transports located off of KCS in Texas. Cars are clean Lease or sell. (Intermodal Container)

- 60, 33K, 340W Pressure Tanks located off of All Class Ones in North America. Cars were last used in Propane/Butane. Up to 1 year.

- 5, 25.5K, DOT 111 Tanks located off of UP in Kansas. Cars were last used in Veg Oils. 2-Year Term

- 50, 30K, DOT 117J Tanks located off of All Class Ones in North America. Cars were last used in Ethanol. 1-2 Year Term.

Sales Offers

- 24, 5300CF, Plate C Boxcars located off of NS or CSX in Southeast.

- 100-300, 3400, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 19, 4400, Rotary Gondolas located off of UP and BN in California and Wyoming.

- 100, 28.3K, DOT117J Tanks located off of various class 1s in multiple locations.

- 7, 30K, DOT 111 Tanks located off of UP in TX, CA, NM.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|

PFL will be at the Following Conferences

- Where: La Quinta, CA

- Attending: David Cohen (954-729-4774)

- Conference Website

- Where: Hyatt Regency Dallas in Dallas, TX

- Attending:Curtis Chandler (239.405.3365), David Cohen (954-729-4774), Brian Baker (239.297.4519), Cyndi Popov(403) 402-5043

- Conference Website