“If I had asked people what they wanted, they would have said faster horses.” Henry Ford

COVID 19 and Markets Update

The United States currently has 5,199,444 confirmed COVID 19 cases and 165,617 confirmed deaths.

The U.S. Labor Department stated on Thursday of last week that U.S. workers filed an additional 1.18 million jobless claims, bringing the total job losses since the coronavirus pandemic to 53.2 million. However, total nonfarm payroll employment rose by 1.8 million in July, and the unemployment rate fell to 10.2 percent, the U.S. Bureau of Labor Statistics announced on Friday of last week. These improvements in the labor market reflected the continued resumption of economic activity that had been curtailed due to the Coronavirus (COVID-19) pandemic and efforts to contain it. In July, notable job gains occurred in leisure and hospitality, government, retail trade, professional and business services, other services, and health care.

President Trump signed four Executive Orders Saturday aimed at delivering relief to Americans struggling with the economic fallout of the coronavirus, as Congress failed to do their job yet again.

The President announced a $400-per-week supplemental unemployment payment to out-of-work Americans, unveiled an extension of student loan relief, protections from evictions for renters and homeowners and signed a payroll tax holiday through the end of the year for Americans earning less than $100,000, while promising more relief if he wins a second term.

The DOW did close higher on Friday, up 46.5 points (+ 0.17%) to finish out the week at 27,433.48. The S&P 500 traded up 2.12 points (+0.06%) on Friday, closing at 3,351.28 The Nasdaq finished Friday’s session lower, losing 97.09 points (-0.87%) closing out the week at 11,010.98. In overnight trading, DOW futures traded higher and are expected to open up this morning 91 points.

West Texas Intermediate (WTI) traded down 73¢ to close at $41.22 on Friday of last week on the New York Mercantile Exchange, however, the contract was up 95¢ per barrel week over week.

Brent traded down 46¢ cents to close at $44.63 on Friday of last week, a gain of $1.11 per barrel week over week.

U.S. crude inventories fell by 7.37 million barrels last week and now stand at 518.63 MM/bbls.

Gasoline inventories were up by 400,000 bbls while distillate inventories increased by 1.59 MM/bbls.Oil is higher in overnight trading and, as of the writing of this report, WTI is poised to open at 41.82 up .60 ¢/ barrel from Friday’s close.

Things we are keeping an eye on:

- The U.S. Court of Appeals for the District of Columbia ruled on Wednesday of last week that the Dakota Access Pipeline (DAPL) does not have to be shut and drained, as per a lower court order on July 6. It’s able to keep operating for now. The three-judge panel said they did not have the “findings necessary” to shut it down. However, the panel declined to halt the prior ruling that said the Army Corps of Engineers needs to conduct an environmental impact assessment before ultimately deciding whether the pipeline can keep operating. DAPL is a 1,172-mile-long, 570,000-barrel-per-day oil pipeline that runs from North Dakota to Illinois. On July 9, DAPL’s owner, Energy Transfer LP, a Dallas-based company run by billionaire Kelcy Warren, refused to shut down after the July 6 court order. Energy Transfer continued to accept requests for oil space on the pipeline in August. The Standing Rock Sioux Tribe has been fighting the pipeline since 2016 on the grounds that it damages the environment. Earth justice lawyer Jan Hasselman, who represents the Standing Rock Sioux Tribe against Dakota Access, said: “The bottom line is that the fight continues. We’re right on the law and we’re not giving up until this pipeline is shut down. “

- No news on Marathon’s High Plains Crude Oil Pipeline that was ordered to shut down by the U.S. Interior Department’s Bureau of Indian.

- Canadian Crude – still watching Canadian production rates and crude by rail indicators no real significant shift of rail cars leaving storage yet. Q4 Basis did close at -$14.75 on Friday and indication that shut in production is coming online.

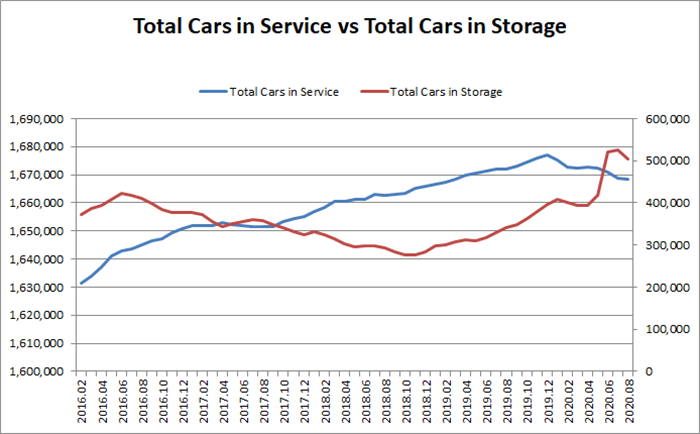

- Railcars in storage – as of August 1st, the total number of cars in storage is 504,043, representing a decline of 22,427 (-4.26%) month over month and an increase of 163,055 (47.8%) from this time last year. This currently represents 30.21% of the total North American fleet in storage, a slight decline from last month’s 31.55% of the total fleet. The total number of stored cars still remains very elevated from pre-pandemic levels, with the total number of cars stored 28% higher than March 1, 2020 levels. The number of cars in service is also declining. (see chart below) Folks there are allot of cars out there that have no use and there is a coalition working with congress to provide tax incentives to the scrapping of cars. PFL provides mobile railcar scrapping services and we are here to help with any scrapping needs and has mobile crews available now. Call PFL today at 239-390-2885 for more details on rail car scrapping. For more detailed information on railcar storage, see PFL’s latest monthly storage report sent out to the industry on Friday.

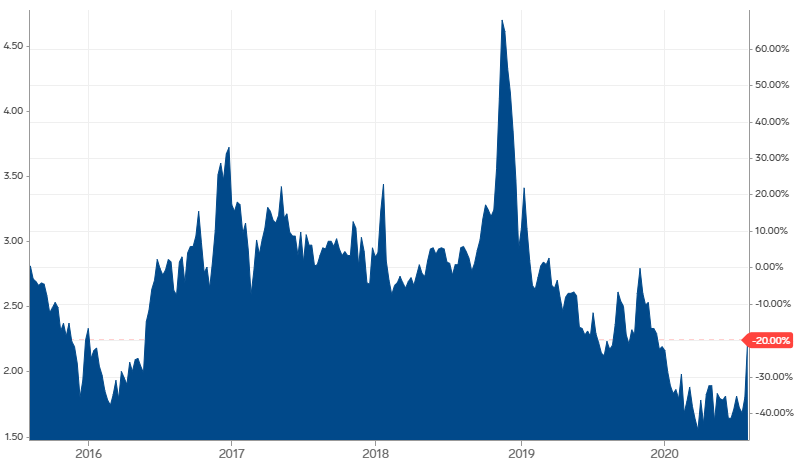

- NatGas Ready for Long-Term Growth. Global natural gas demand set for long-term growth after COVID. The world’s consumption of natural gas is set to decline by 4 percent this year, but global demand will return to growth after the pandemic, thanks to low natural gas prices and stricter environmental policies, a new report showed on Thursday of last week. The Global Gas Report 2020 – published by the International Gas Union (IGU), research company BloombergNEF (BNEF), and Italian gas infrastructure firm Snam – says that the trend of increased natural gas demand due to environmental concerns, which was already underway before the pandemic, will continue after COVID-19 is under control. Natural demand is expected to pick up significantly in September in Asia and estimates are that we will, at this point, not fill storage in the United States this year. We are seeing increased interest in crude by rail LNG into New England from the Marcellus with a number of folks looking for LNG cars. We don’t think LNG cars are going to be a reality. First,of all they are too expensive and secondly, they are too dangerous a train of 110 tank cars filled with liquefied natural gas would have five times the energy of the Hiroshima bomb. In the event of any loss of containment, liquefied natural gas rapidly expands by six hundred times its volume to become a highly flammable gas — and can turn into a “bomb train.” Prices for natural gas rose at Henry Hub on Friday, closing out the trading day up 4.63% at $2.26 per MMBTU (see 5 year natural gas price chart below)

- Trans-Atlantic shipping sinks as trans-Pacific soars – U.S. importers sourcing goods in Asia are opting for faster transits to California as opposed to the long route via the Panama Canal to ports on the Atlantic coast. Simultaneously, lower cargo flows from Europe are further curbing the East Coast share. The East-West split has significant implications for land transport. The more cargo unloaded at the docks in the West, the better for rail and the worse for trucking, and vice versa.

Source: PFL Analytics – raw data AAR

Nat Gas 5 Year Chart (Henry Hub)

Source: NYMEX

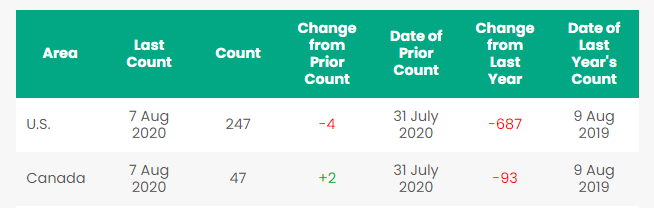

Rig Count

North America rig count moved lower and is down 2 rigs week over week with the U.S. losing 4 rigs week over week and Canada gaining 2 rigs week over week. The number of oil rigs in the U.S. slipped for the week by 4 rigs, according to Baker Hughes data, bringing the total to 176, compared to the 764 active oil rigs this time last year. Two of those four rigs lost this week were in the Permian Basin. The total number of active gas rigs in the United States stayed the same at 69 total rigs. This compares to 169 rigs a year ago. The U.S. Rig count fell to an all-time low last week comparing to data going back to 1940.

To compare active rigs with supply figures, the EIA’s estimate for oil production in the United States fell for the week ending July 31—the last week for which there is data, at 11 million barrels of oil per day. Oil production in the United States is 2.1 million bpd less than its all-time high reached earlier this year.

Canada’s overall rig count rose this week by 2, reaching 47 active rigs. Oil and gas rigs in Canada are now down 93 year on year. Year over year we are down 780 rigs collectively.

North American Rig Count Summary

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

North American Rail Traffic

Total North American rail volumes were down 10.2% year over year in week 31 (U.S. -9.9%, Canada -10.4%, Mexico -14.3%), resulting in quarter to date volumes that are down 9.4% and year to date volumes that are down 11.6% (U.S. -12.6%, Canada -8.5%, Mexico -10.0%). 10 of the AAR’s 11 major traffic categories posted y/y declines with the largest decreases coming from coal (-29.0%), intermodal (-4.0%), nonmetallic minerals (-23.4%) and metallic ores & metals (-21.8

In the East, CSX’s total volumes were down 7.9%, with the largest decreases coming from coal (-38.9%), stone sand & gravel (-17.6%) and motor vehicles & parts (-12.0%). NCS’s total volumes were down 11.0%, with the largest decreases coming from coal (-36.9%), intermodal (-4.4%) and petroleum (-50.4%).

In the West, BN’s total volumes were down 13.4%, with the largest decreases coming from coal (-25.2%), intermodal (-6.7%) and petroleum (-39.5%). UP’s total volumes were down 6.4%, with the largest decreases coming from coal (-21.4%) and stone sand & gravel (-43.1%). The largest increase came from intermodal (+3.0%).

In Canada, CN’s total volumes were down 10.7% with the largest decreases coming from intermodal (-8.4%), petroleum (-34.9%) and metallic ores (-15.1%). The largest increase came from grain (+41.1%). RTMs were down 5.7%. CP’s total volumes were down 13.2%, with the largest decreases coming from intermodal (-13.9%), petroleum (-48.0%) and coal (-30.7%). RTMs were down 13.0%.

KCS’s total volumes were down 6.1%, with the largest decreases coming from coal (-24.9%) and grain (-24.5%). The largest increase came from intermodal (+6.7%).

Source: Stephens

Railcar Markets

PFL is seeking: 40 cars for LPG service needed in Kansas for Oct-Mar service, dirty preferred, clean considered; 200 25.5 cpc 1232 cars for use in Mexico for 1-3 years for heavy fuel oil; 2 Covered hoppers for purchase, 5500 series, for storage at plant site in the Chicago area, BN or NS connection; 25 22-30K coiled and insulated for biodiesel in the Midwest off the UP, 6-12 months; 5-15 6000+ high sided gons, no interior bracing for purchase off the CN or CP Ontario destination. 5-10 syrup cars are needed in the Midwest. Need 100 steel coal gons for sale. Need ten 20K to 23.5 coiled and insulated for one year in ethylene glycol; 10 CPC 1232 or other for industrial alcohol use in Indiana off the NS for 6 months: lessee would take ethanol cars clean then use for industrial alcohol service and deliver the cars back to you with industrial alcohol heals (cars would be accepted with ethanol heels please call to discuss. Please contact PFL with any of these opportunities, it would be very much appreciated!

PFL is offering: Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil and LPG services. Lease terms negotiable, short and long term opportunities available Leases on 117Js and 117Rs, dirty to dirty for sublease. Clean cars are available 1-5 years scattered across the country. 61 ft. bulkhead flat cars, lease only. Available 200 30K tankers cleaned and ready for service, for sale or lease. 30+ 7600 woodchip gondolas for sale or lease. PFL has a number of steel and aluminum hoppers for various commodities and tank cars, all for sale. Additionally sand cars, box cars, coal cars and hoppers including sugar covered hoppers and plastic pellet cars, are also available for sale and lease in various locations and terms. Call us today!

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. We also assist fleets and lessors with leases and sales and offer Total Fleet Evaluation Services.We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS. WE HAVE JUST COMPLETED A JOB IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|