Logic will get you from A to Z; imagination will get you everywhere.”

― Albert Einstein

Jobs Update

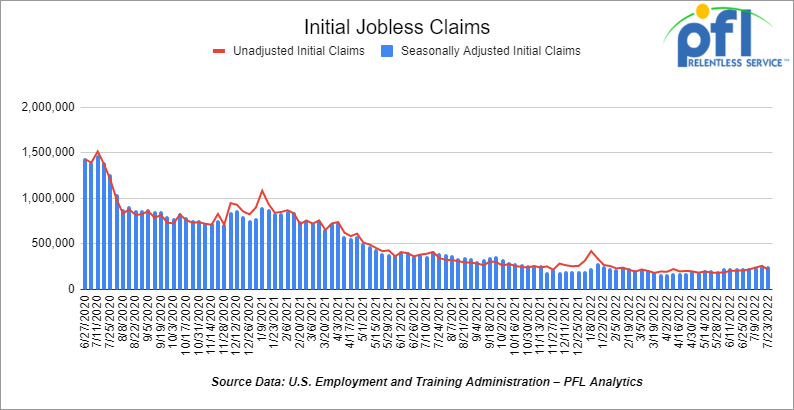

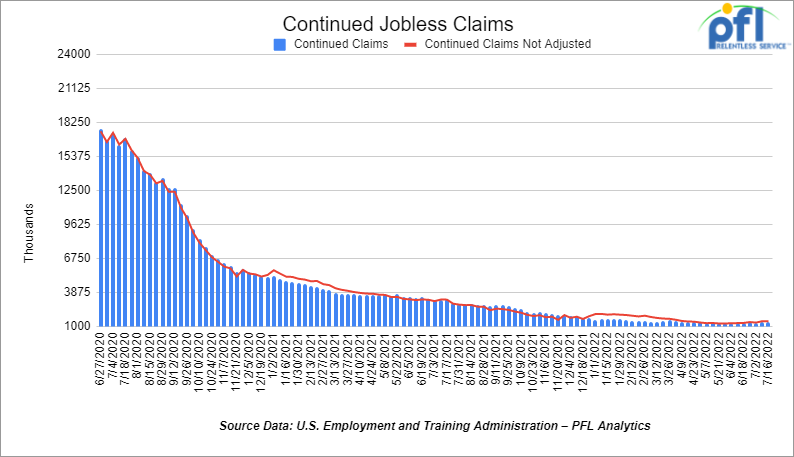

- Initial jobless claims for the week ending July 23rd, 2022 came in at 256,000, down -5,000 people week-over-week.

- Continuing claims came in at 1.359 million people, versus the adjusted number of 1.384 million people from the week prior, down -25,000 people week over week.

Stocks closed higher on Friday of last week and up week over week

The DOW closed higher on Friday of last week, up 315.50 points (0.97%), closing out the week at 32,845.13, up 954.84 points week over week. The S&P 500 closed higher on Friday of last week, up 57.86 (1.88%), and closed out the week at 4,130.29, up 168.66 points week over week. The NASDAQ closed higher on Friday of last week, up 228.09 points (1.93%), and closed the week at 12,390.69 points, up 556.58 points week over week.

In overnight trading, DOW futures traded lower and are expected to open at 32,815 this morning down -10 points.

Oil closed higher on Friday of last week, but down month over month

The underlying fundamentals for oil still remain quite strong. There are serious risks around supply: sanctions on Russia that will kick in more meaningfully later this year, OPEC+ topping out in terms of what it can add to the market, and the supply response in the US not coming on.” In fact, oil production in Texas and New Mexico actually dipped in May, the latest data from the U.S. government showed, in a sign that U.S. oil growth is slowing in the Permian Basin. Growth has largely stalled even as producers increase drilling activity in the basin.

U.S. West Texas Intermediate (WTI) crude futures settled at $98.62 per barrel, rising $2.20, or 2.3 percent, after jumping more than $5 a barrel at one point during the trading session on Friday of last week. Brent for September settlement, which expired Friday of last week, went up 2.7% or $2.87 a barrel to close at $U.S.110.01.

Futures nevertheless recorded their first back-to-back monthly decline since 2020, as fears of an economic slowdown fuelled bearish sentiment across markets. The U.S. economy shrank for a second quarter as rampant inflation undercut consumer spending. Citigroup Inc. says there are signs the oil market is moderating.

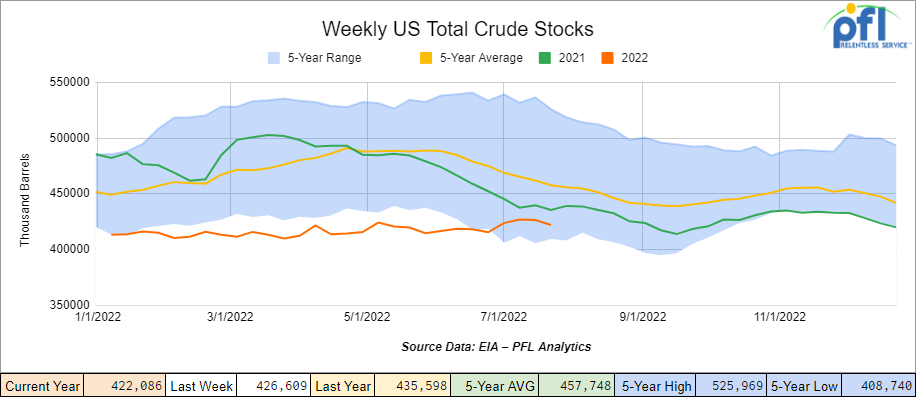

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 4.5 million barrels week over week. At 422.1 million barrels, U.S. crude oil inventories are 6% below the five-year average for this time of year.

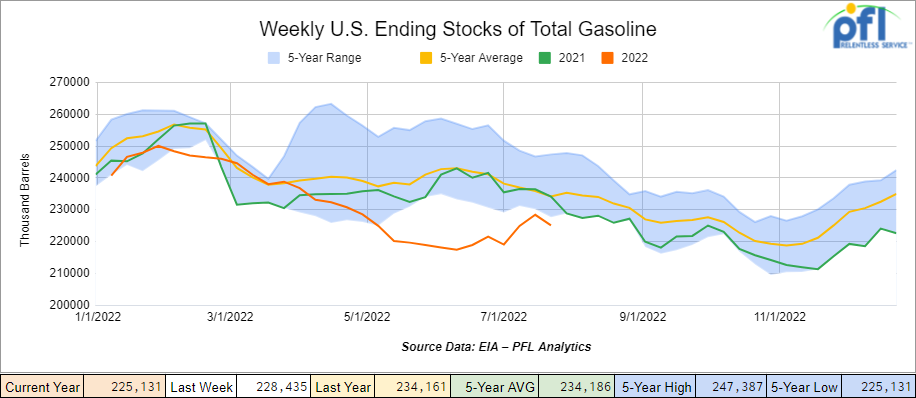

Total motor gasoline inventories decreased by 3.3 million barrels week over week and are 4% below the five-year average for this time of year.

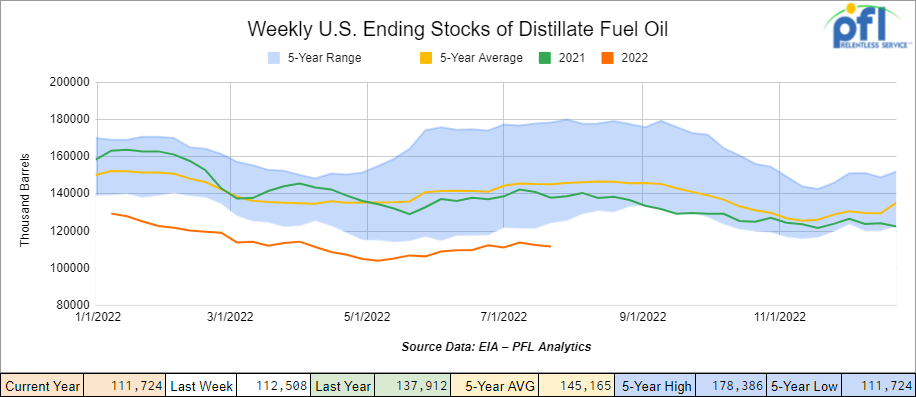

Distillate fuel inventories decreased by 800,000 barrels week over week and are 23% below the five-year average for this time of year.

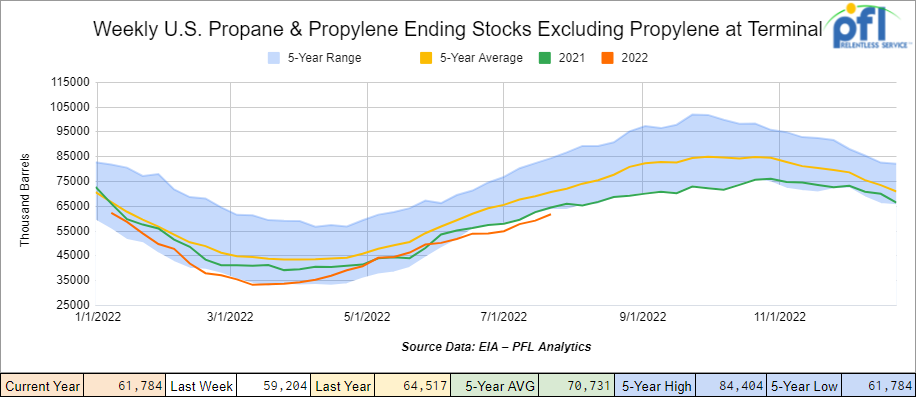

Propane/propylene inventories increased by 2.6 million barrels week over week and are 12% below the five-year average for this time of year.

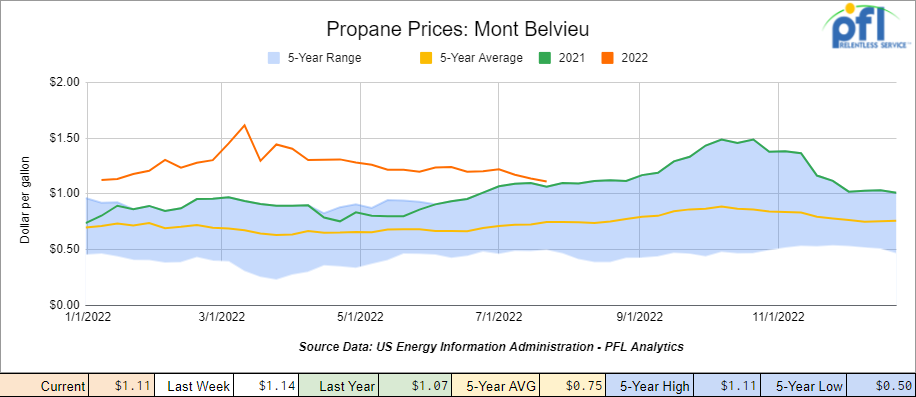

Propane prices closed at $1.11 per gallon on Friday of last week, down 3 cents per gallon week over week, and now only 4 cents higher per gallon than the same time last year.

Overall, total commercial petroleum inventories decreased by 3.3 million barrels last week.

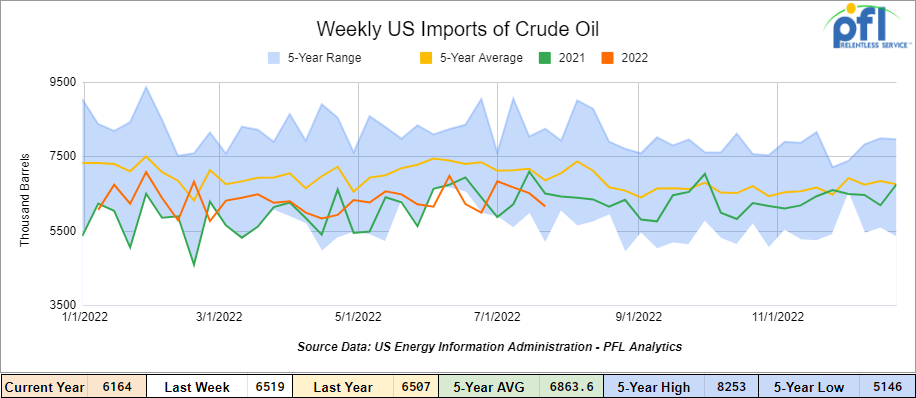

U.S. crude oil imports averaged 6.2 million barrels per day during the week ending July 22nd, 2022, a decrease of 400,000 barrels per day from the previous week. Over the past four weeks, crude oil imports averaged 6.6 million barrels per day, 1.9% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) during the week averaged 599,000 barrels per day, and distillate fuel imports averaged 124,000 barrels per day during the week ending July 22nd, 2022.

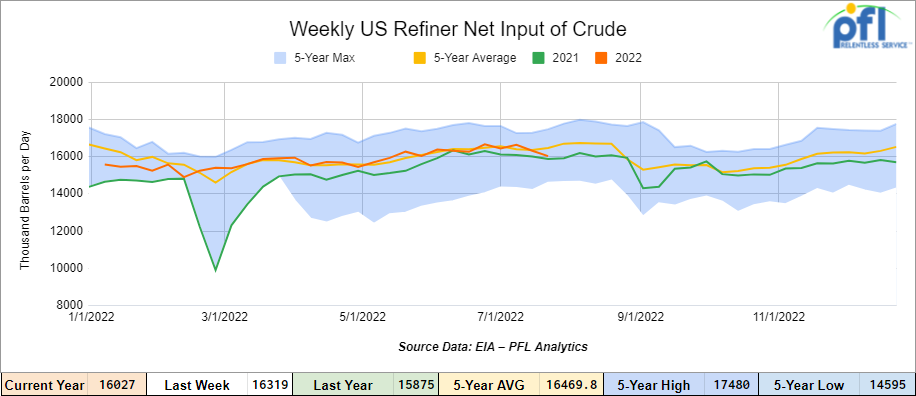

U.S. crude oil refinery inputs averaged 16.0 million barrels per day during the week ending July 22, 2022, which was 292,000 barrels per day less than the previous week’s average.

As of the writing of this report, WTI is poised to open at $96.95, down $1.67 per barrel from Friday’s close.

North American Rail Traffic

Week Ending July 23rd, 2022.

Total North American weekly rail volumes were down -3.3% in week 30 compared with the same week last year. Total carloads for the week ending July 23rd were 325,611, down -0.9% compared with the same week in 2021, while Weekly intermodal volume was 347,952, down -5.4% compared to 2021. 6 of the AAR’s 11 major traffic categories posted year-over-year declines with the most significant decrease coming from Grain (-13.3%). The largest increase was from Coal (4.6%) and Nonmetallic Minerals (4.3%).

In the east, CSX’s total volumes were up 2.29%, with the largest decrease coming from Chemicals (-14.15%) and the largest increases from Intermodal (+9.29%), Forest Products (+8.58%), and Nonmetallic Minerals and Products (+8.05%). Norfolk Southern’s total volumes were down -1.52%, with the largest decrease stemming from Petroleum and Petroleum Products (-19.36%) and the largest increase from Grain (+13.76%).

In the west, BN’s total volumes were down -4.36%, with the largest decrease stemming from Metallic Ores and Minerals (-14.63%), and the largest increase from Other (+20.41%) UP’s total rail volumes were up 3.9% with the largest decrease stemming from Nonmetallic Minerals and Products (-11.42%) and the largest increase from Coal (+46.86%) and Chemicals (41.45%).

In Canada CN’s total rail volumes were up down -0.95% with the largest decrease stemming from Coal (-41.61%) and the largest increase from Grain (+101.5%). CP’s total rail volumes were down 2.65% with the largest decrease stemming from Coal (-41.61%) and the largest increase from Motor Vehicles and Parts (+35.47%).

KCS’s total rail volumes were up 9.57% with the largest decrease from Chemicals (-33.33%) and the largest increase from Metallic Ores and Minerals (29.72%).

Source Data : AAR – PFL Analytics

Rig Count

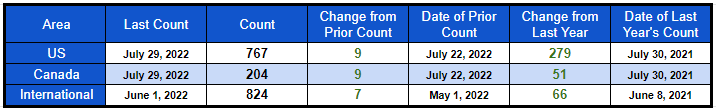

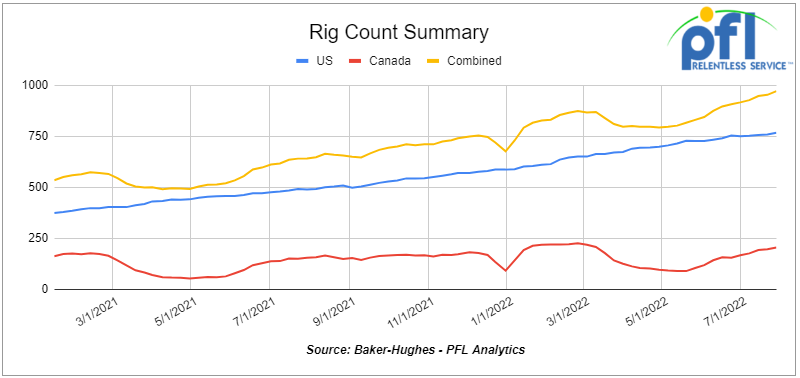

North American rig count was up 18 rigs week over week. U.S. rig count was up 9 rigs week-over-week and up by 279 rigs year over year. The U.S. currently has 767 active rigs. Canada’s rig count was up by 9 rigs week-over-week, and up by 51 rigs year-over-year. Canada’s overall rig count is 204 active rigs. Overall, year over year, we are up 330 rigs collectively.

North American Rig Count Summary

A few things we are keeping an eye on:

We are eying Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 24,722 from 24,567, which was a gain of 155 railcars week-over-week. This was the fifth week of consecutive gains. Canadian volumes were mixed. CP’s shipments were up by 1.1% and CN’s volumes were down by 6.9%. U.S. shipments were higher across the board. The CSX had the largest percentage increase, up by 15.6%.

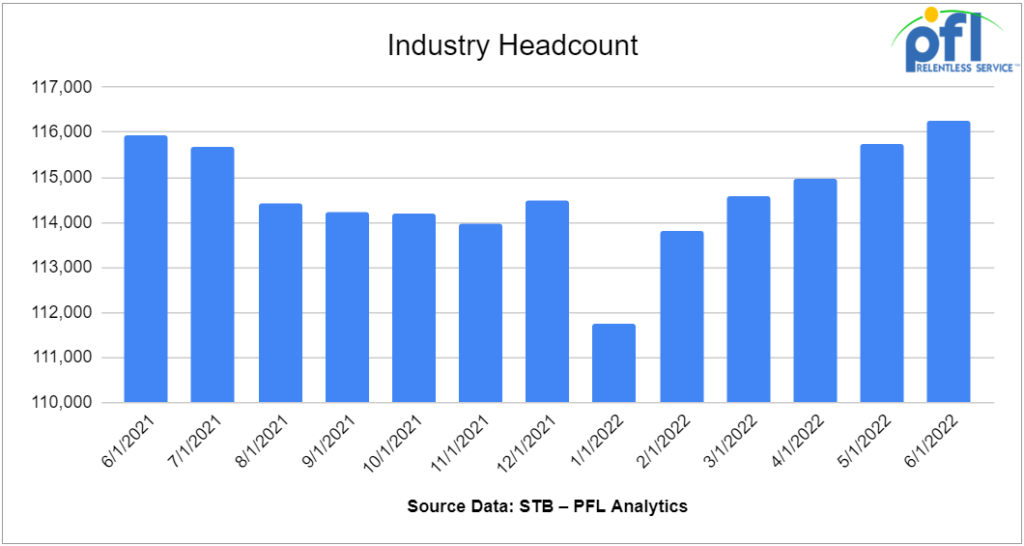

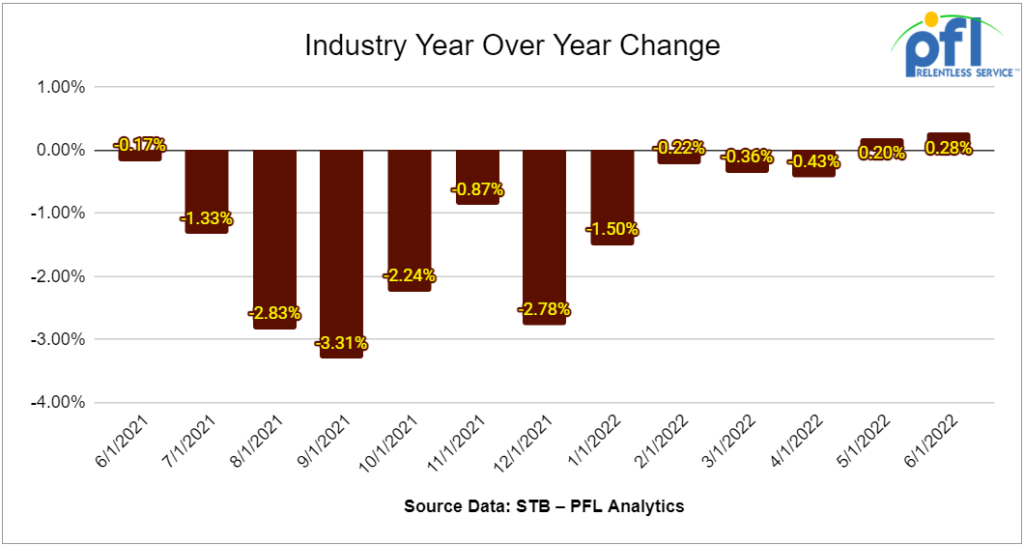

U.S. Class I workforce grew in June

As of mid-June, U.S. Class I’s employed 116,251 people, a 0.41% increase compared with employment levels in mid-May and a 0.28% increase from June 2021’s level, according to Surface Transportation Board data.

Four out of six employment categories logged increases last month. They were professional and administrative, up 3.31% to 9,859 employees; executives, officials, and staff assistants, up 0.99% to 7,763; maintenance of way and structures, up 0.45% to 28,492; and transportation (train and engine), up 0.01% to 48,080.

The two categories that logged month-to-month decreases were transportation (other than train and engine), which fell 0.38% to 4,675 workers; and maintenance of equipment and stores, which dropped 0.14% to 17,382.

Enbridge back to apportionment in August

After 5 months of acceptance of all nominations on its 3 million barrel per day mainline system, Enbridge is back to apportionment in August. Producers have been able to ship crude oil about of Alberta for 5 consecutive months without constraints. Most producer-planned plant turnarounds have been completed. It is too early to tell how much volume got will get rejected and the impacts this will have if any on CBR and associated basis markets – but it looks as though we hit the wall and inventory in Alberta will build once again. Stay tuned to PFL as we are watching this one closely

Manchin Caves

On Wednesday of last week, Senators Joe Manchin and Majority Leader Chuck Schumer announced that they had reached an agreement on a bill imposing a 15% minimum tax on certain large corporations, providing clean energy tax subsidies, incentives for consumers to conserve energy and appropriating significant sums for enhancement of the Internal Revenue Service enforcement efforts. The Inflation Reduction Act of 2022 would raise an estimated $739 billion and provides for $433 billion in estimated spending, resulting in a projected decrease in the federal deficit of approximately $300 billion. The bill, while much smaller than the $3 trillion initially sought by the Biden administration, would bring significant change to large sectors of the economy while impacting millions of Americans.

While the Inflation Reduction Act of 2022 leaves the majority of the Trump-era corporate and individual income tax cuts intact, it would also be the largest increase on corporate taxes in decades.

Under the proposal, corporations having “Book Income” in excess of $1 billion would be subject to a 15% alternative minimum tax (AMT). “Book Income” is defined generally as the net income reported on such companies’ financial statements. Many large corporations often report significantly higher income on their financial statements than they report on their federal income tax returns as a result of tax deductions and exclusions that are not taken into account for financial statement purposes. As a minimum tax, it would be due only if it exceeds the corporation’s regular tax. This provision is expected to raise $313 billion.

Another large revenue raiser is a projected $124 billion from a major enforcement investment at the Internal Revenue Service. The bill provides the largest increase in the budget of the IRS in history. This amount is more than paid for, according to Democrats, by closing the “tax gap” – the difference between what people and businesses owe in taxes and what they actually pay. The “tax gap” is estimated to be in the range of almost $400 billion.

In addition, the Inflation Reduction Act attempts to close the “carried interest” tax loophole. Under current law, private equity managers are compensated in two ways: a straight percentage management fee and a share of any gain realized on exit from the investment. This second element is what is known as the “carried interest” and is currently taxed at the very favorable, long term capital gains rate. This provision would tax these amounts as short-term capital gains, taxed as ordinary income. This change is estimated to generate $14 billion.

Further, according to the Congressional Budget Office, the bill would raise an estimated $288 billion through reform of prescription drug pricing. This provision allows Medicare to negotiate drug prices with pharmaceutical companies and caps out-of-pocket costs for those on Medicare at $2,000 per year.

On the expenditure side, the Inflation Reduction Act provides “over $60 billion for clean energy manufacturing and incentives for wind, solar and battery production.” It also includes another $60 billion to invest in low-income communities to reduce pollution from factories and ports as well as $30 billion in grants and loans to states and utility companies to transition to cleaner forms of electricity. There is also more than $420 billion to support carbon-reducing agricultural practices.

For the consumer, the bill provides a $7,500 tax credit on the purchase of new electronic vehicles and a $4,000 credit for used EV’s by low- or moderate-income taxpayers. In addition, homeowners could receive up to $10 billion in grants and rebates in return for home improvements that increase energy efficiency. There would also be 10 years of tax credits to offset the cost of installing rooftop solar panels.

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 50 117Js with magrods in the east – 10 for immediate trip lease – 40 for longer term

- 50 6350 covered hoppers in the midwest with most class ones for up to 5 years for DDG

- Up to 40 5500 Covered Gons 286 unlined CSX/NS preferred but will consider other

- 4 Lined tanks for glycerin to run from Arkansas to Georgia 1-3 years

- 30 boxcars on UP or CP for 3 years to run from TX to Edmonton – negotiable

- 6-10 Open top 4200 gons for hauling scrap NS in Ohio for 1-3 years

- 100, 2480 CU-FT Ag Gons needed in Texas off of the UP for 1-3 Years.

- 50, 30K+ Tank cars are needed in several locations. Can take in various locations off various Class 1’s. Can have prior Ethanol heel or Gasoline heel

- .Various Hoppers 286 GRL 4200-7000 CU FT in several locations negotiable

- 300 5800 Covered hoppers needed for plastic – 5-year lease – negotiable

- 50, 5800cuft or larger Covered Hopper for use in DDG needed in the Midwest for 3-4 years. Immediate need.

- 10-20 Covered hopper grain cars in the midwest 5200-5500 2-3 years

- 100 Moulton Sulfur cars for purchase – any location – negotiable

- 50 Ag Gons 2500-2800cuft 286k GRL in the east for 5 years negotiable

- 100 15K Tanks 286 for Molten Sulfur in the Northeast CSX/NS for 6 months negotiable

- 100, 5800 Covered Hoppers 286 can be West or East for Plastic 3-5 years

- 70, 117R or J needed for Ethanol for 3 years. Can take in the South.

- 50, 6500+ cu-ft Mill Gon or Open Top Hopper for wood chips in the Southeast for 5 Years.

- 20, 19,000 Gal Stainless cars in Louisiana UP for nitric acid 1-3 years – Oct negotiable

- 10, 6,300CF or greater covered hoppers are needed in the Midwest.

PFL is offering:

- 200 Clean C/I 25.5K 117J in Texas. Brand New Cars!

- 150 DOT 111s last in ethanol in the Midwest with free move. Available in September.

- Up to 500 sand cars for sale or lease at various locations and class ones – Great Price!

- 150 117R’s 31.8 clean for lease in Texas KCS – negotiable

- 31.8K Tank Cars last in Diesel. Dirty to dirty in Texas

- 200 117Js 29K in the Midwest. Lined and brand new- lease negotiable

- 100 117Rs dirty last in Gasoline in Texas for lease Negotiable

- 100 117Rs 29K clean last used in crude Washington State – price negotiable sale or lease.

- Various Hoppers for lease 3000-6250 CF 263 and 268 multiple locations negotiable

- 61, 117Js in the Midwest. Last in Bakken. Dirty to Dirty service.

- 340W pressure cars located in various locations.

- 200 117Js 29K OK and TX Clean and brand new – Lined- lease negotiable

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|