“Don’t forget to love yourself”

Soren Kierkegaard

Jobs Update

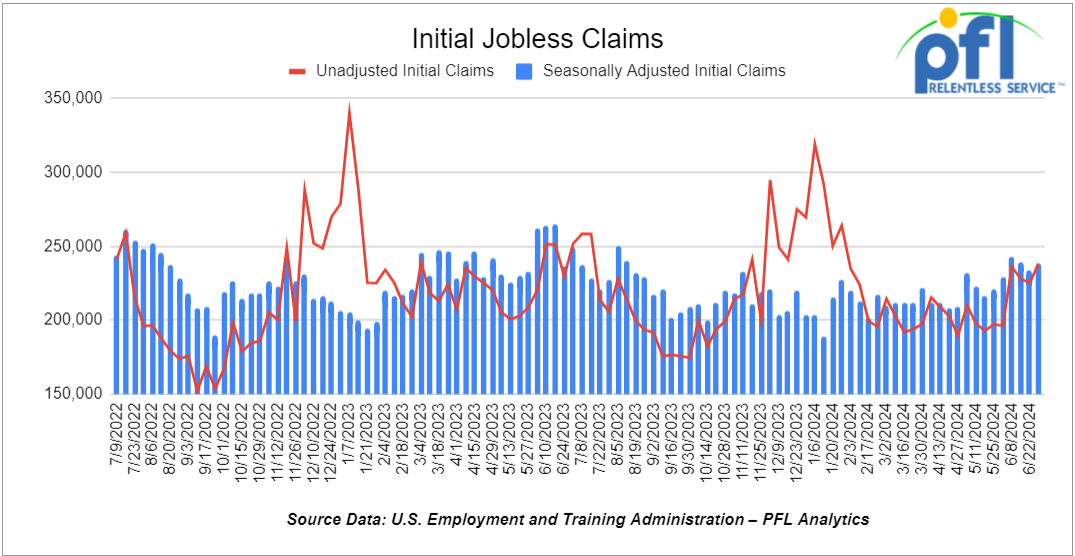

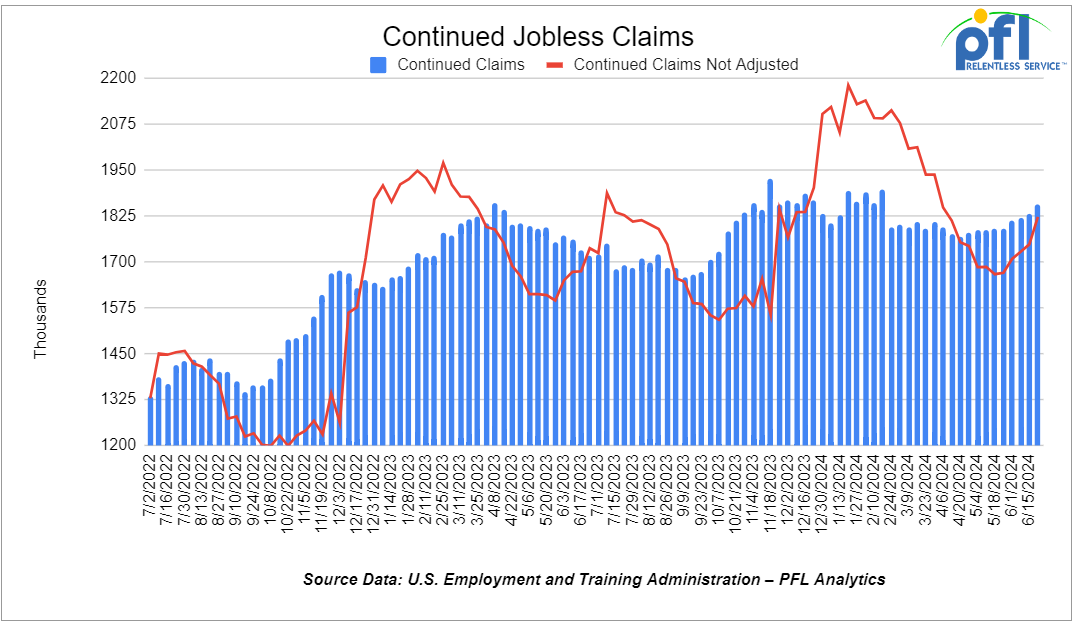

- Initial jobless claims seasonally adjusted for the week ending June 29th, 2024 came in at 238,000, up 4,000 people week-over-week.

- Continuing jobless claims came in at 1.858 million people, versus the adjusted number of 1.832 million people from the week prior, up 26,000 people week-over-week.

Stocks closed higher on Friday of last week and higher week over week

The DOW closed higher on Friday of last week, up 67.87 points (0.17%), closing out the week at 39,375.87, up 257.01 points week-over-week. The S&P 500 closed higher on Friday of last week, up 30.17 points (0.54%), and closed out the week at 5,460.48, up 106.71 points week-over-week. The NASDAQ closed higher on Friday of last week, up 164.46 points (0.93%), and closed out the week at 18,352.76 up 620.16 points week-over-week.

In overnight trading, DOW futures traded higher and are expected to open at 39,696 this morning up 1 point.

Crude oil closed lower on Friday of last week, but higher week over week.

WTI traded lower -$0.72 per barrel (-0.9%) on Friday of last week, to close at $83.16 per barrel, up $1.62 per barrel week-over-week. Brent traded down -US$0.89 per (-1.02%) barrel to close at US$86.54 per barrel on Friday of last week, up US$0.13 per barrel week-over-week.

One Exchange WCS (Western Canadian Select) for August delivery settled Friday at US$14.65 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$ 68.07 per barrel.

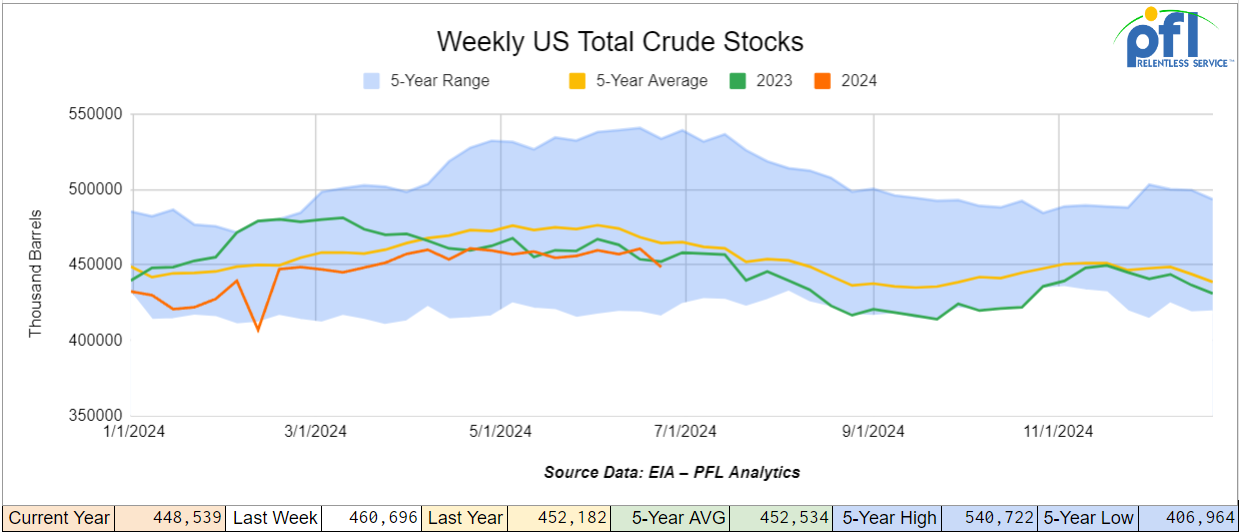

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 12.2 million barrels week-over-week. At 448.5 million barrels, U.S. crude oil inventories are 4% below the five-year average for this time of year.

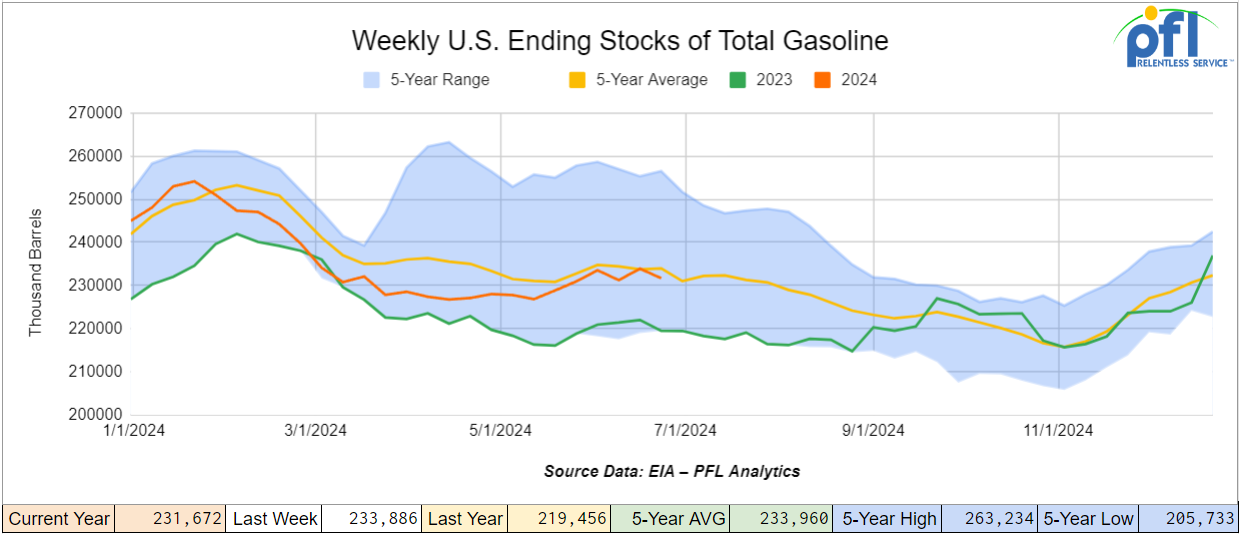

Total motor gasoline inventories decreased by 2.2 million barrels week-over-week and are 1% below the five-year average for this time of year.

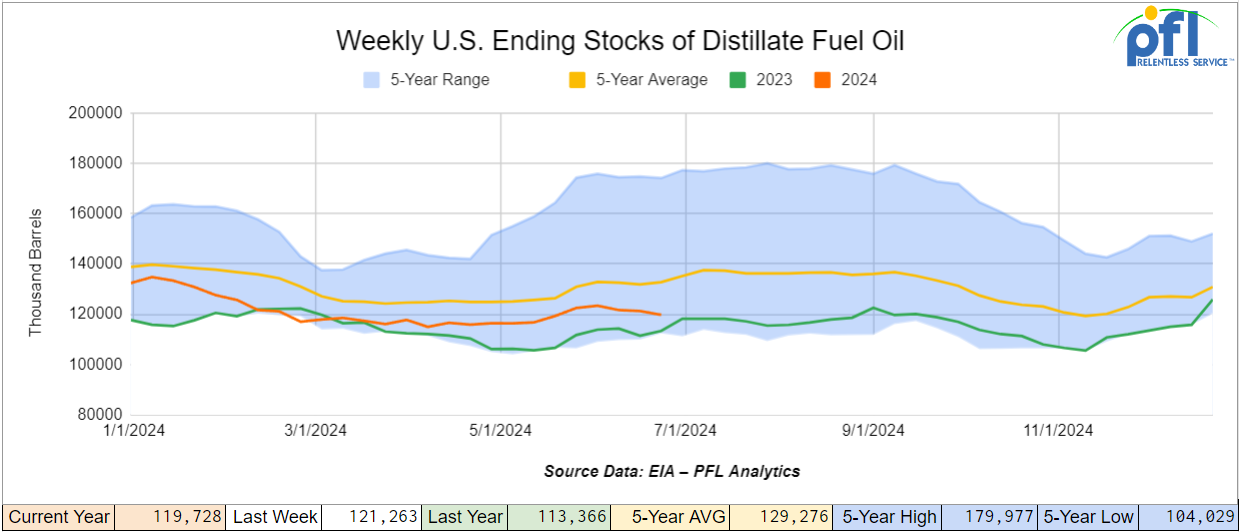

Distillate fuel inventories decreased by 1.5 million barrels week-over-week and are 10% below the five year average for this time of year.

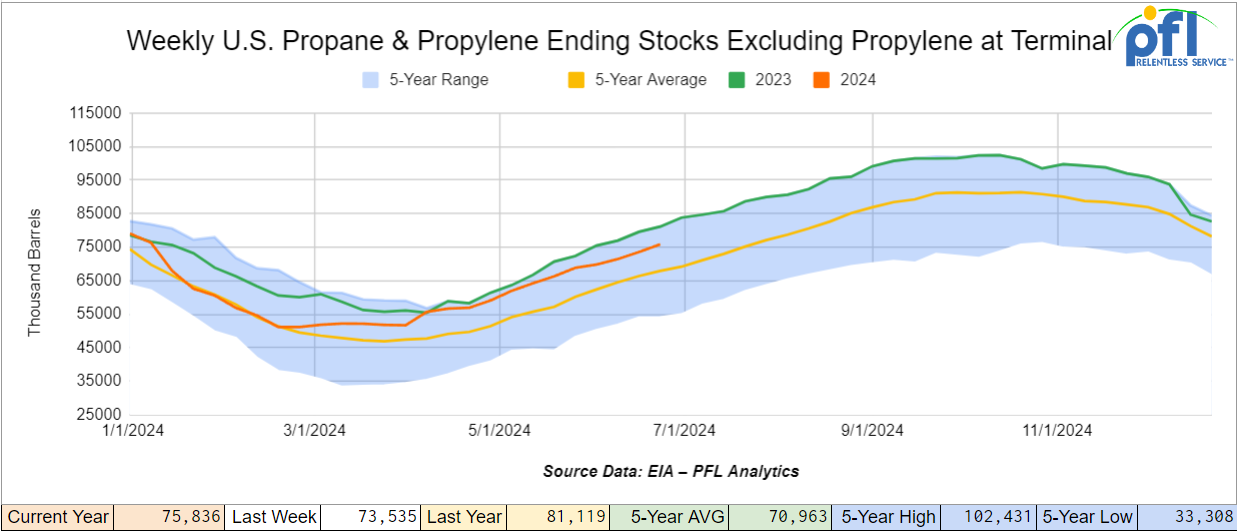

Propane/propylene inventories increased by 2.3 million barrels week-over-week and are 11% above the five year average for this time of year.

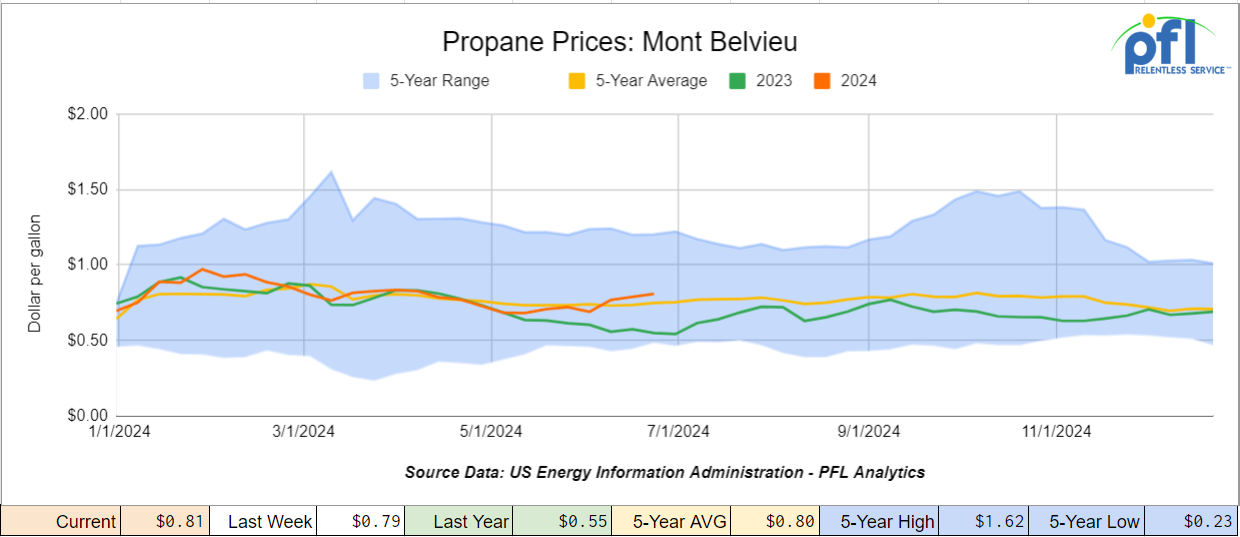

Propane prices closed at 81 cents per gallon, up 2 cents week-over-week, and up 26 cents year-over-year.

Overall, total commercial petroleum inventories decreased by 13 million barrels during the week ending June 28th, 2024.

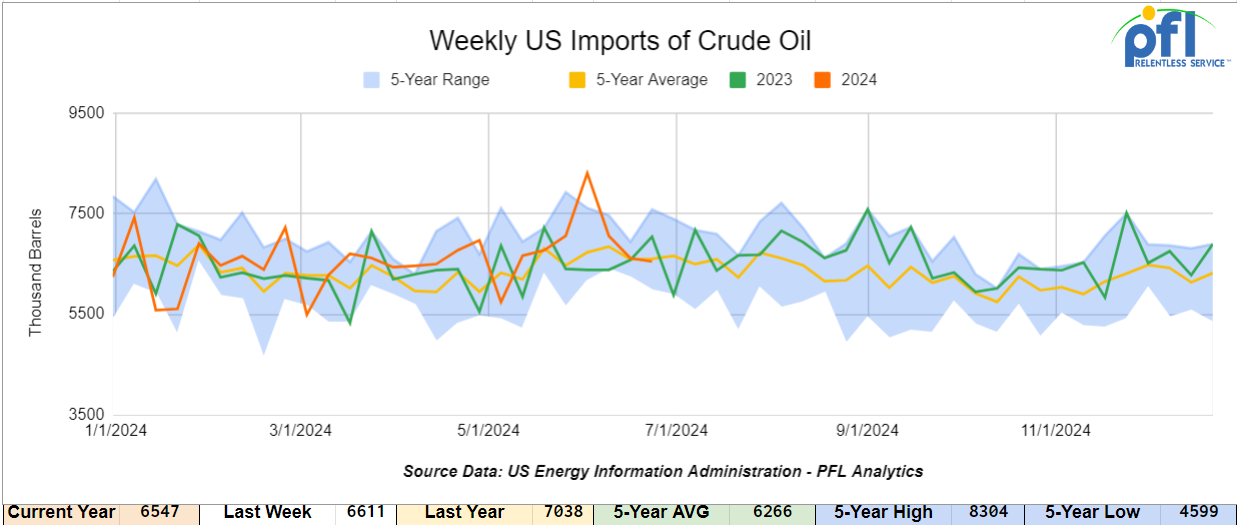

U.S. crude oil imports averaged 6.5 million barrels per day during the week ending June 28th, 2024, a decrease of 65,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 7.1 million barrels per day, 9.0% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 851,000 barrels per day, and distillate fuel imports averaged 94,000 barrels per day during the week ending June 28th, 2024.

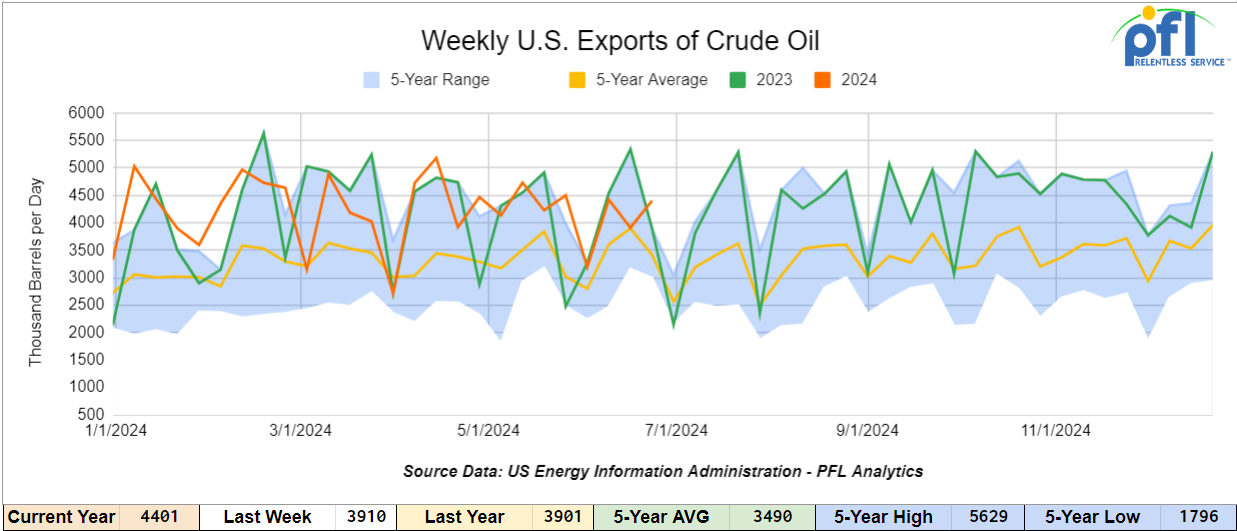

U.S. crude oil exports averaged 4,401 million barrels per day for the week ending June 28th, 2024, an increase of 491,000 per day week-over-week. Over the past four weeks, crude oil exports averaged 3.979 million barrels per day.

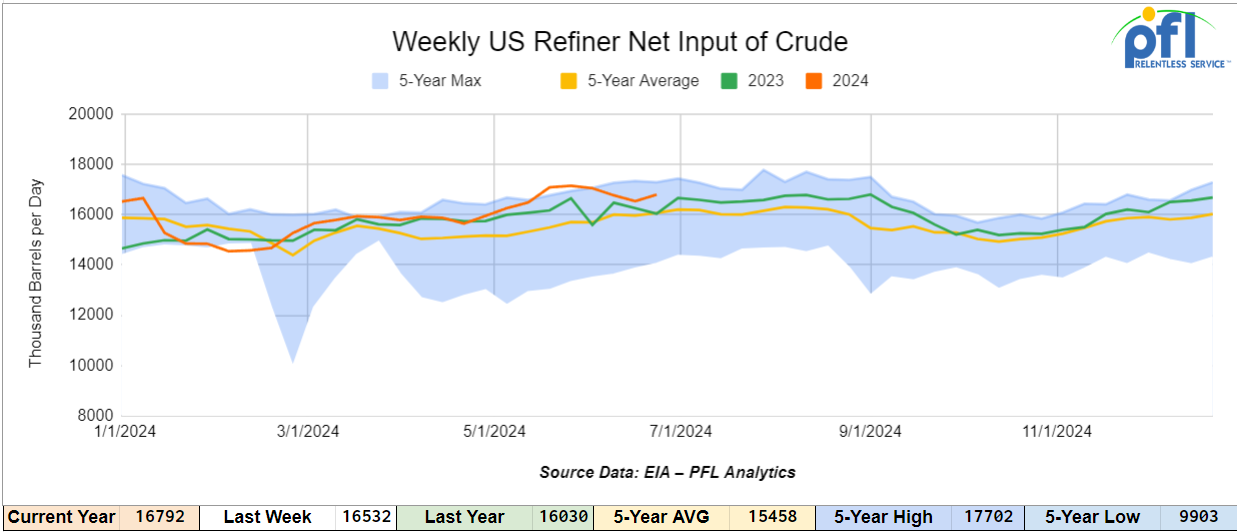

U.S. crude oil refinery inputs averaged 16.8 million barrels per day during the week ending June 28, 2024, which was 260,000 barrels per day more week-over-week.

WTI is poised to open at $82.22, down 94 cents per barrel from Friday’s close.

North American Rail Traffic

Week Ending July 3rd, 2024.

Total North American weekly rail volumes were up (5.25%) in week 27, compared with the same week last year. Total carloads for the week ending on July 3rd were 3349,268, up (3.77%) compared with the same week in 2023, while weekly intermodal volume was 333,411, up (+6.85%) compared to the same week in 2023. 9 of the AAR’s 11 major traffic categories posted year-over-year increases. The most significant decrease came from Nonmetallic Minerals, which was down (-4.21%). The most significant increase came from Petroleum and Petroleum Products which was up (+21.27%).

In the East, CSX’s total volumes were up (6.35%), with the largest decrease coming from Metallic Ores and Metals (-12.18%) while the largest increase came from Petroleum and Petroleum Products (25.99%). NS’s volumes were up (7.67%), with the largest increase coming from Other (+17.41%) while the largest decrease came from Grain (-15.25%).

In the West, BN’s total volumes were up (5.25%), with the largest increase coming from Petroleum and Petroleum Products (40.52%) while the largest decrease came from Coal down (-14.87%). UP’s total rail volumes were up (4.94%) with the largest decrease coming from Nonmetallic Minerals, down (-15.22%) while the largest increase came from Grain which was up (+15.68%).

In Canada, CN’s total rail volumes were up (3.6%) with the largest decrease coming from Other, down (-13.03%) while the largest increase came from Grain, up (+37.54%). CP’s total rail volumes were down (-0.41%) with the largest increase coming from Grain (+37.54%) while the largest decrease came from Farm Products, down (-19.13%).

KCS’s total rail volumes were down (-1.17%) with the largest decrease coming from Other (-23.97%) and the largest increase coming from Grain (+56.05%).

Source Data: AAR – PFL Analytics

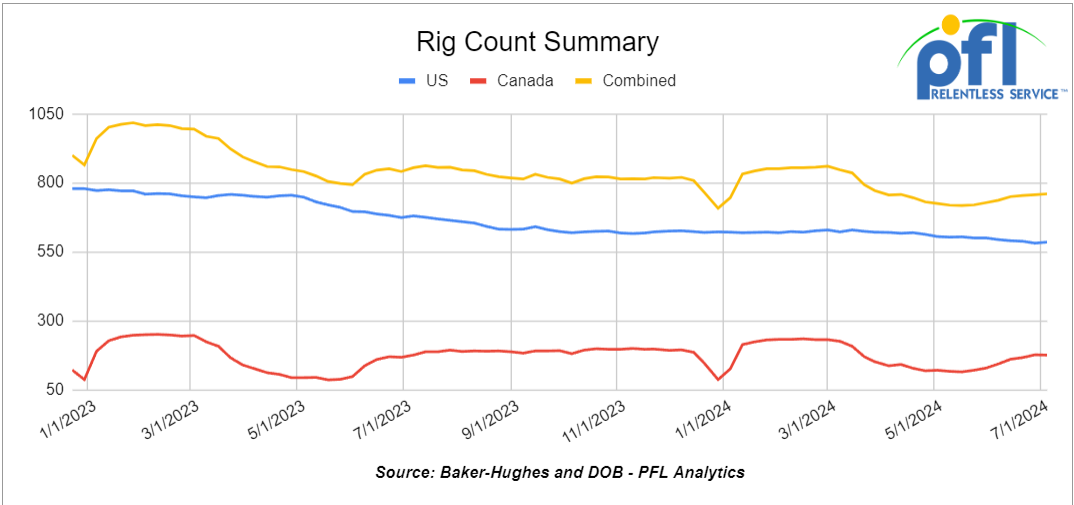

Rig Count

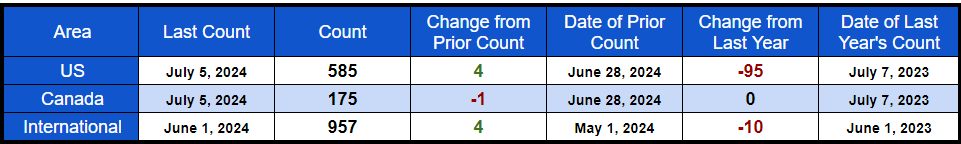

North American rig count was up by 3 rigs week-over-week. U.S. rig count was up by 4 rigs week-over-week, and down by -95 rigs year-over-year. The U.S. currently has 581 active rigs. Canada’s rig count was down by -1 rigs week-over-week, but flat year-over-year. Canada’s overall rig count is 175 active rigs. Overall, year-over-year, we are down -95 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 28,579 from 27,774, which was a gain of 805 rail cars week-over-week. Canadian volumes were mixed. CPKC’s shipments fell by – 6.9% week over week, and CN’s volumes were higher by +6.6% week-over-week. U.S. shipments were up across the board. The CSX had the largest percentage increase and was up by 13.6%.

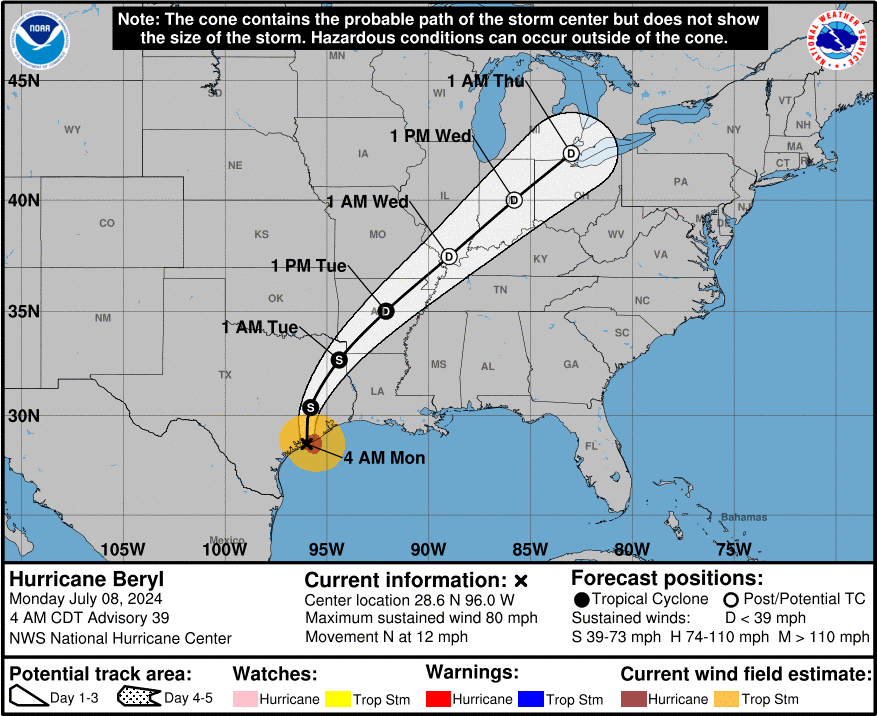

We are watching Hurricane Beryl as it barrels towards Texas

After it devastated Jamaica and passed through Mexico’s Yucatan Peninsula, Beryl now has its eyes on Texas and will be the first U.S. landfall in 2024. As of 6 AM EST, Beryl has made landfall in Matagorda, TX which is just southwest of Houston as a Category 1 hurricane

The Bureau of Safety and Environmental Enforcement (BSEE) has activated its Hurricane Response Team and is monitoring offshore oil and gas operators in the Gulf as they evacuate platforms and rigs in response to the storm. The team works with offshore operators and other state and federal agencies until operations return to normal and the storm is no longer a threat to Gulf of Mexico oil and gas activities.

Based on data from offshore operator reports submitted as of 11:30 CDT on Friday of last week, personnel have been evacuated from a total of 279 production platforms, 49.82% of the 560 manned platforms in the Gulf of Mexico. Production platforms are the structures located offshore from which oil and gas are produced. Unlike drilling rigs, which typically move from location to location, production facilities remain in the same location throughout a project’s duration. Personnel have been evacuated from 11 rigs (non-dynamically positioned), equivalent to 100 percent of the 11 rigs of this type currently operating in the Gulf. Rigs can include several types of offshore drilling facilities including jackup rigs, platform rigs, all submersibles, and moored semisubmersibles.

A total of 11 dynamically positioned rigs have moved off location out of the storm’s projected path as a precaution. This number represents 73.3 percent of the 15 DP rigs currently operating in the Gulf. Dynamically positioned rigs maintain their location while conducting well operations by using thrusters and propellers. These rigs are not moored to the seafloor; therefore, they can move off location in a relatively short time frame. Personnel remain on board and return to the location once the storm has passed.

As part of the evacuation process, personnel activate the applicable shut-in procedure, which can frequently be accomplished from a remote location. This involves closing the sub-surface safety valves located below the surface of the ocean floor to prevent the release of oil or gas, effectively shutting in production from wells in the Gulf, and protecting the marine and coastal environments. Shutting in oil and gas production is a standard procedure conducted by industry for safety and environmental reasons.

From the operator reports, it is estimated that approximately 90.84 percent of the current oil production in the Gulf of Mexico has been shut in. BSEE estimates that approximately 84.87 percent of the gas production in the Gulf of Mexico has been shut in. The production percentages are calculated using information submitted by offshore operators in daily reports. Shut-in production information included in these reports is based on the amount of oil and gas the operator expected to produce that day. The shut-in production figures therefore are estimates, which BSEE compares to historical production reports to ensure the estimates follow a logical pattern.

After the storm has passed, facilities will be inspected. Once all standard checks have been completed, production from undamaged facilities will be brought back online immediately. Facilities sustaining damage may take longer to bring back online. It is not just the production of oil and natural gas facilities that are at risk here, but onshore chemical and plastic facilities that rely on natural gas and crude production. This could impact rail significantly in the short term. If you need emergency rail car storage, please call PFL today, below is the current position of Hurricane Beryl:

Source: National Hurricane Center – PFL Analytics

We are Watching More Wildfires up in Canada

A wildfire in northern Alberta forced Suncor Energy to shut in some oil sands production. Despite it not moving closer to any infrastructure Alberta’s Wildfire Agency expects another challenging weekend for their crews.

Suncor, Canada’s second-largest oil company, temporarily curtailed some production and evacuated non-essential workers from its 215,000 barrel-per-day (bpd) Firebag site on Wednesday of last week because of a fire roughly eight kilometers (5 miles) away from the facility.

The Calgary-based company did not specify how much production was shut in but said Firebag would be kept ready to resume full output as soon as conditions were safe.

Alberta Wildfire said the out-of-control blaze about 70 kilometers (43 miles) northeast of the oil sands hub of Fort McMurray, is around 12,000 hectares (29,700 acres) in size.

“Yesterday, there was no significant growth towards any infrastructure,” the agency said in a statement on Friday of last week. However, the eastern flank of the fire, furthest from Firebag, grew significantly, Alberta Wildfire added.

There are 142 firefighters and 14 helicopters tackling the blaze, including two that can fly at night. Presently in Alberta, there are approximately 69 active wildfires, with 14 considered out of control.

Suncor Oil Sands Mining Operation

Source: Suncor – PFL Analytics

We are Watching the Biden Administration and the SPR

Surprise, surprise – everyone saw this one coming. In the latest and greatest, the Biden administration has not awarded contracts in recent solicitation to purchase an additional 6 million barrels of sour crude for delivery to the country’s Strategic Petroleum Reserves. The crude was supposed to be delivered between September and January. At the time of the solution, crude was trading around $75 per barrel but has recently blown through the self-imposed price cap set by the Biden Administration of $79.00 per barrel. It is unclear why they held off on awarding the contracts.

Lease Bids

- 20, 4750’s Through Hatch Covered Hoppers needed off of UP BN in USA West for 3 years. Cars are needed for use in Fertilizer service.

- 25-50, 5000CF-5100CF Covered Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in Dry sugar service. 3 bay gravity dump, Hempel 37700

- 4, 6260 Covered Hoppers needed off of CSX in Bostick, NC for 2-4 Years. Cars are needed for use in Polypropene Pellets service.

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 250, 4000 Rapid Hoppers needed off of BNSF in TX IL for 5 years. Cars are needed for use in Coal service. in rotary/rapid cars with the electric dumping shoe

- 150, 23.5K DOT111 Tanks needed off of any class 1 in LA for 2-3 years. Cars are needed for use in Fluid service. Needed July

- 30, 17K-20K DOT117J Tanks needed off of UP or BN in Midwest/West Coast for 3-5 years. Cars are needed for use in Caustic service.

- 15, 28.3K DOT117J Tanks needed off of any class 1 in any location for 3 years. Cars are needed for use in Glycerin & Palm Oil service.

- 25, 20.5K CPC1232 or DOT117J Tanks needed off of BNSF or UP in the west for 3-5 years. Cars are needed for use in Magnesium chloride service. SDS onhand

- 10, 30k any Tanks needed off of UP BN in Texas for 1 year plus. Cars are needed for use in Fuel Oil service.

- 14, 23.5K DOT111 Tanks needed off of UP in Morrilton, AR for 1 year. Cars are needed for use in Turpentine service.

- 8, 28-30K Any Tanks needed off of UP BN in Texas and Gulf for 5 years. Cars are needed for use in Chlorobenzene service. Need Magrods

- 10, 28.3K 117J Tanks needed off of UP or BN in Texas for 3 Year.

- 25-30, 23.5K or 25.5K Dot 111 or CPC 1232 Tanks needed off of UP or BN in TX, OK, or AR for 3-5 Years. Cars are needed for use in Asphalt service. Needed ASAP., Lined or Unlined. Splash Load

- 10, 25.5K-28.3K DOT 111 Tanks needed off of UP or BN in Houston for 2 Year. Cars are needed for use in Resin service.

- 30, 29K 117J Tanks needed off of BN or CN in Houston or Edmonton for 1-2 Year. Cars are needed for use in Biodiesel service.

- 100, 25.5K DOT 111 Tanks needed off of Any Class 1 in Texas for 3 Years +. Cars are needed for use in Asphalt service.

- 20, 25.5k CPC 1232 Tanks needed off of UP or BN in OK, TX for 3 Year. Cars are needed for use in Asphalt service.

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

- 50, 30K 117 Tanks needed off of BNSF or UP in TX for 3-6 Months. Cars are needed for use in Crude service. will look at smaller cars. Prefer short term would look at longer term. Domestic use only

- 100, 15.5K DOT 111 Tanks needed off of Any Class 1 in USA for 1-3 Years. Cars are needed for use in Molten Sulfur service.

- 200, 30K Any Tanks needed off of UP or BN in Texas for RD. Cars are needed for use in Dirty service.

- 50, 23.5-25.5 DOT111 Tank s needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

- 15-20, 29K 117R Tanks needed off of NS or CSX in Ohio for 6-12 Months. Cars are needed for use in Ply Oil service.

- 80, 25.5K-29K Any Tanks needed off of NS or CSX in Northeast for 1-5 Years. Cars are needed for use in Crude service.

Sales Bids

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Sand service.

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 20, 2770-3400 Mill Gondolas needed off of any class 1 in South Texas. Cars are needed for use in scrap metal service.

- 20-30, 3000 – 3300 PD Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 20-30, Open Top Hoppers needed off of NS or CSX in Northeast. Cars are needed for use in aggregate service. Gravity dump

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 2-4, 28K DOT111 Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

- 100, 15.7K DOT111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

- 5, 30K DOT 111 Tanks needed off of in US. Cars are needed for use in Fuels service.

- 5, 23,5K DOT 111 Tanks needed off of any class 1 in Texas. Negotiable

Lease Offers

- 200-500, 5200, Covered Hoppers located off of CN and NS in Moving on CN and NS. Cars were last used in Grain. Lease available until Fall.

- 50, ~5400, Covered Hoppers located off of NS, IORY in MI. Cars were last used in bean meal. 1 year+

- 53, 2 containers, Flats Double-stack rail transports located off of KCS in Texas. Cars are clean Lease or sell. (Intermodal Container)

- 15, 33K, 340W Pressure Tanks located off of All Class Ones in North America. Cars were last used in Propane/Butane. Up to 1 year.

- 100+, 29K, 117R Tanks located off of All Class Ones in St Louis. Cars were last used in Veg Oils. Up to 4 Years

- 100+, 29K, 117J Tanks located off of All Class Ones in St Louis. Cars were last used in Veg Oils. Returned by end of 2026

- 100, 30K, 117J Tanks located off of UP or BN in Texas. Cars were last used in Ethanol. Up to 1 year. Must go into ethanol service.

- 200, 25.5K, 117J Tanks located off of CPKC in Moving. Cars were last used in Crude. 6-12 Months

- 5, 25.5K, DOT 111 Tanks located off of UP in Kansas. Cars were last used in Veg Oils. 2 Year Term

Sales Offers

- 24, 5300CF, Plate C Boxcars located off of NS or CSX in Southeast.

- 100-300, 3400, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 19, 4400, Rotary Gondolas located off of UP and BN in California and Wyoming.

- 100, 28.3K, DOT117J Tanks located off of various class 1s in multiple locations.

- 7, 30K, DOT 111 Tanks located off of UP in TX, CA, NM.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|

PFL will be at the Following Conferences

- Where: La Quinta, CA

- Attending: David Cohen (954-729-4774)

- Conference Website

- Where: Hyatt Regency Dallas in Dallas, TX

- Attending:Curtis Chandler (239.405.3365), David Cohen (954-729-4774), Brian Baker (239.297.4519), Cyndi Popov(403) 402-5043

- Conference Website