“Well done is better than well said.”

– Benjamin Franklin

Jobs Update

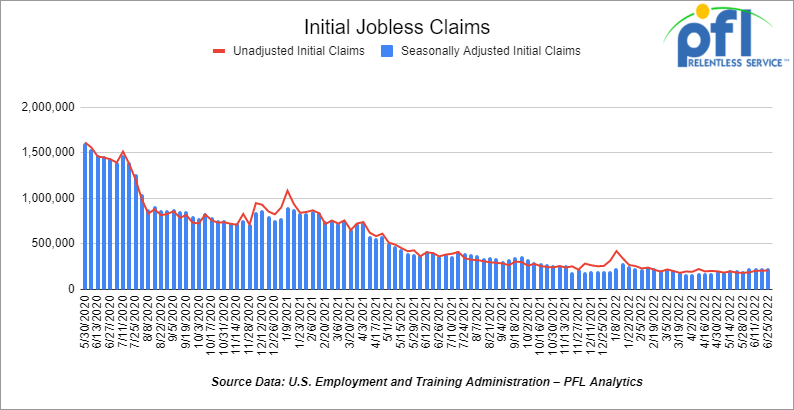

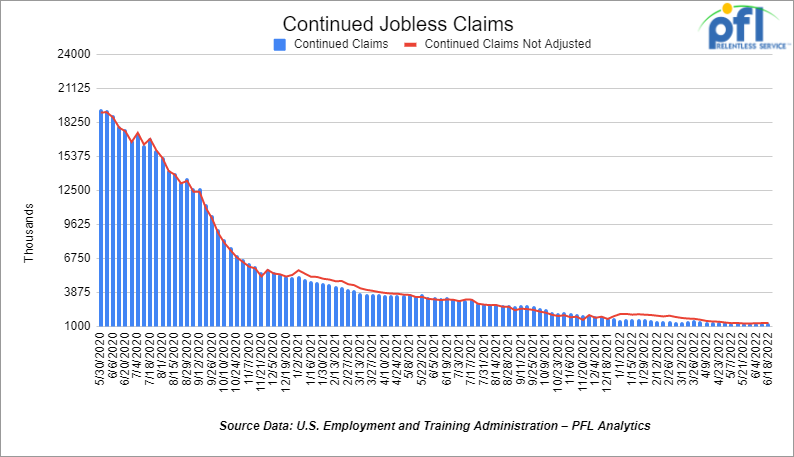

- Initial jobless claims for the week ending June 25th, 2022 came in at 231,000, down -2,000 people week-over-week.

- Continuing claims came in at 1.328 million people, versus the adjusted number of 1.331 million people from the week prior, down -3,000 people week over week.

Stocks closed up day over day, but down week over week.

The DOW closed higher on Friday of last week, up 321.83 points (+1.05%) , closing out the week at 31,097.26, down 402.74 points week over week. The S&P 500 closed higher on Friday of last week, up 39.95 points (+1.06%) and closed out the week at 3,825.33, down 86.41 points week over week. The NASDAQ closed higher on Friday of last week, up 99.11 points (+0.90%) and closed the week at 11,127.84 points, down 479.78 points week over week.

In overnight trading, DOW futures traded lower and are expected to open at 30,932 this morning down -129 points.

Oil settled higher day over day and higher week over week.

Prices rose on Friday of last week, despite the release of industry data showing U.S. manufacturing activity slowed more than expected last month, adding to evidence that the country’s economy was cooling as the Federal Reserve tightens monetary policy.

Still, low crude and fuel supplies supported the oil market even as equities slumped and the U.S. dollar, which typically has an inverse relationship with crude, rose.

A planned strike among Norwegian oil and gas workers on July 5th could cut the country’s overall petroleum output by 8%, shaking the already fragile supply side as Libya declares force majeure.

West Texas Intermediate crude (WTI) settled at $108.43 a barrel, gaining $2.67, or 2.5% percent on Friday of last week, up 81 cents a barrel week over week. Brent crude futures settled at US$111.63 a barrel on Friday of last week, rising US$2.60, or 2.4% up US$1.49 per barrel week over week

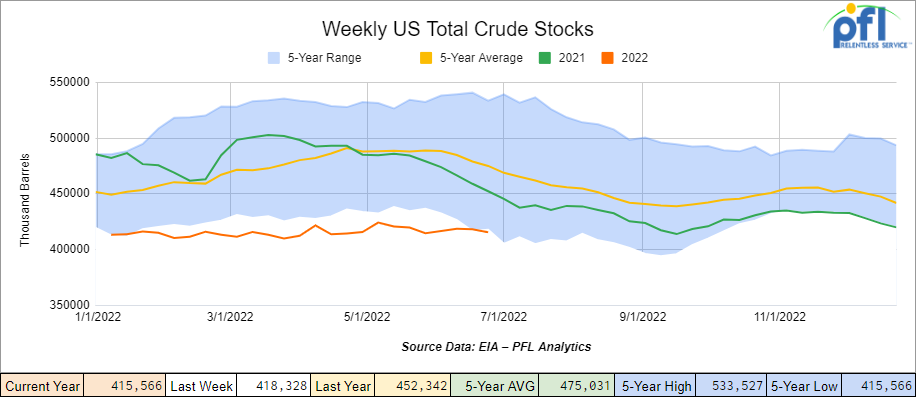

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 2.8 million barrels week over week. At 415.6 million barrels, U.S. crude oil inventories are 13% below the five-year average for this time of year.

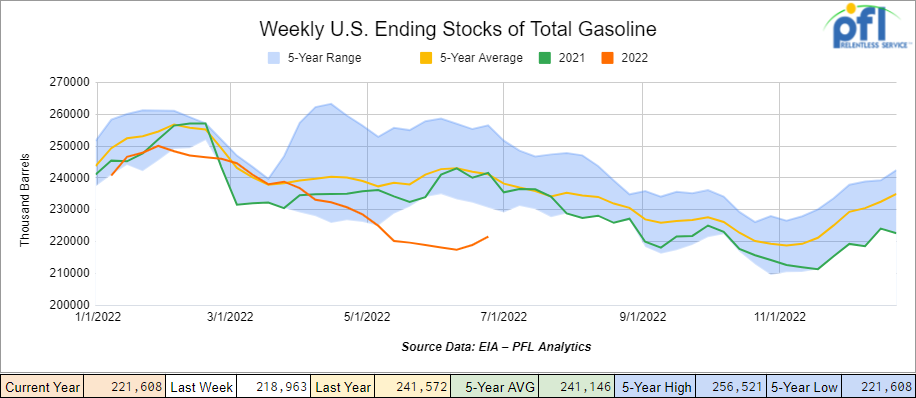

Total motor gasoline inventories increased by 2.6 million barrels week over week and are 8% below the five-year average for this time of year.

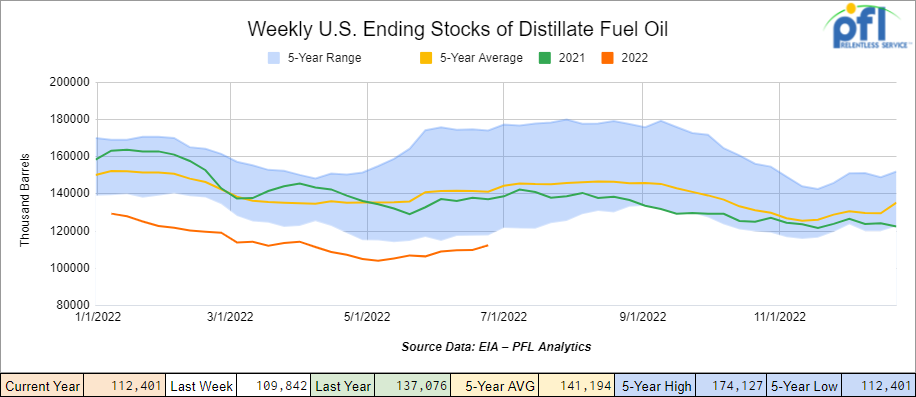

Distillate fuel inventories increased by 2.6 million barrels week over week and are 20% below the five-year average for this time of year.

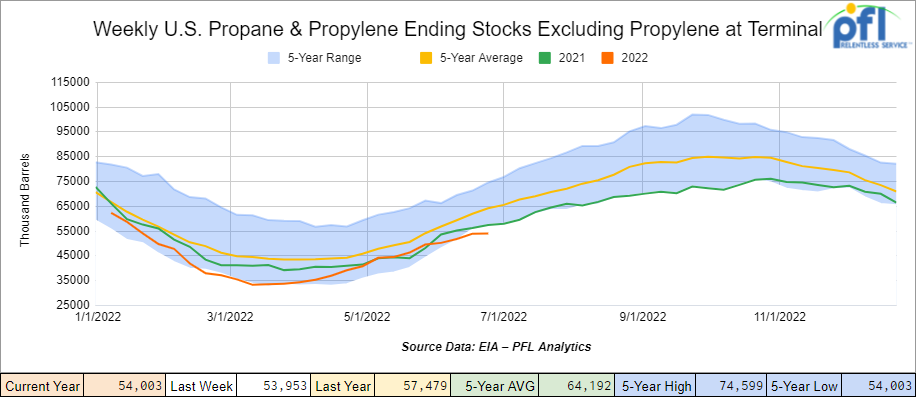

Propane/propylene inventories increased by 100,000 barrels week over week and are 16% below the five-year average for this time of year.

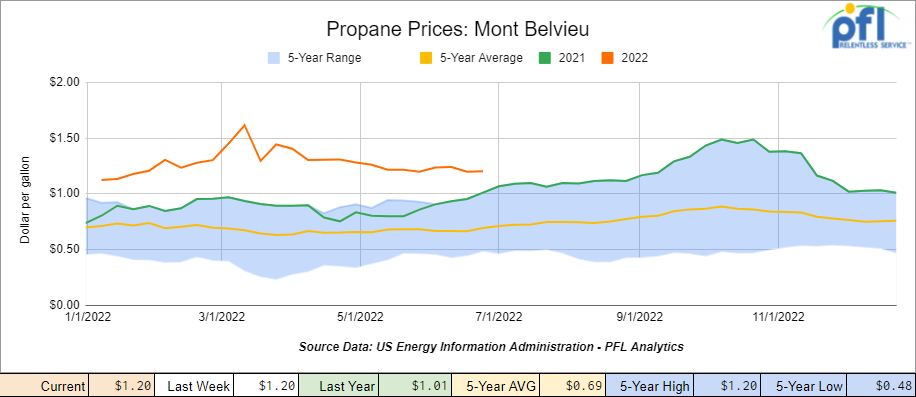

Propane prices were flat week over week settling out the week at $1.20 per gallon, still up 19 cents year over year, but closing.

Overall, total commercial petroleum inventories increased by 6.3 million barrels during the week ending June 24th, 2022.

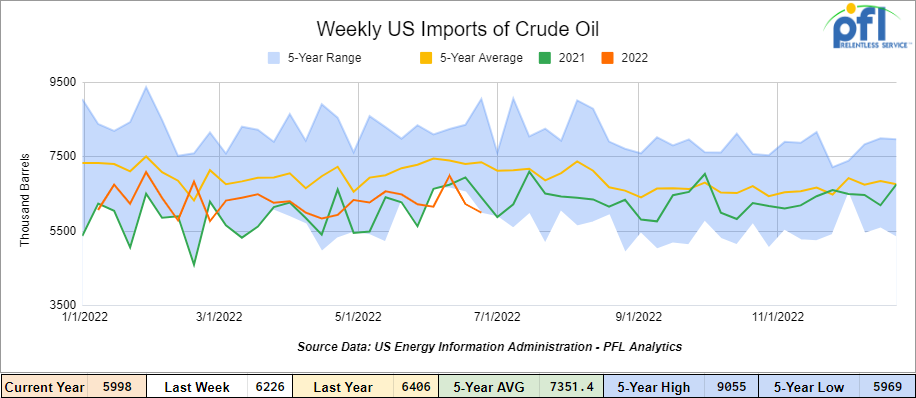

U.S. crude oil imports averaged 6.0 million barrels per day during the week ending June 24th, 2022, a decrease of 200,000 barrels per day week over week. Over the past four weeks, crude oil imports averaged 6.3 million barrels per day, 5.1% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 824,000 barrels per day, and distillate fuel imports averaged 97,000 barrels per day during the week ending June 24th, 2022.

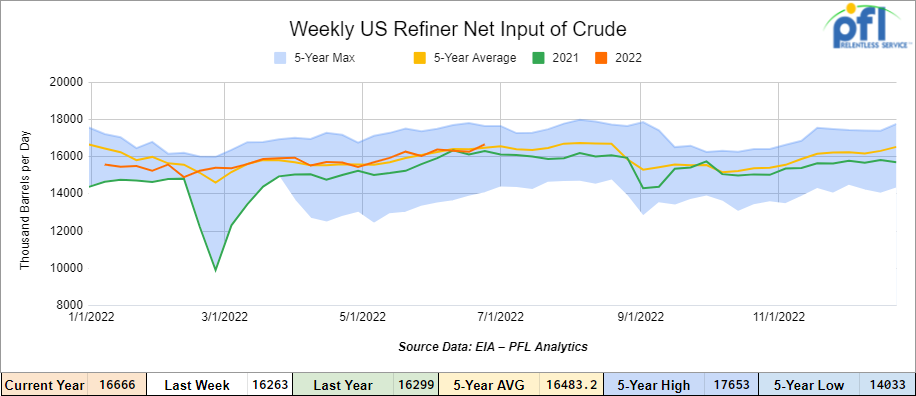

U.S. crude oil refinery inputs averaged 16.7 million barrels per day during the week ending June 24, 2022, which was up 403,000 barrels per day week over week.

As of the writing of this report, WTI is poised to open at $108.32, down $0.11 cents per barrel from Friday’s close.

North American Rail Traffic

Week Ending June 25th, 2022.

Total North American weekly rail volumes were down -4.6% in week 26 compared with the same week last year. Total carloads for the week ending June 25th were 324,963, down -3.8% compared with the same week in 2021, while US Weekly intermodal volume was 348,426, down -5.4% compared to 2021. 6 of the AAR’s 11 major traffic categories posted year-over-year declines with the largest decreases coming from Other (-17%), Grain (-12.7%), and Forest Products (-7.4%) The largest increase was from Petroleum and Petroleum Products (+5.2%).

In the east, CSX’s total volumes were down -0.8%, with the largest decrease coming from Petroleum and Petroleum Products (-24.09%) and the largest increase from Non-Metallic Minerals and Products (3.6%) Norfolk Southern’s total volumes were down -2.26%, with the largest decrease stemming from Metallic Ores and Minerals (-12.3%) and the largest increase from Grain (+12.34%).

In the west, BNSF’s total volumes were down -6.96%, with the largest decrease stemming from Forest Products (-12.93%) and the largest increase from Motor Vehicles and Parts (18.85%) UP’s total rail volumes were down -3.34% with the largest decrease stemming from Coal (-23.34%) and the largest increase from Farm and Food Products (+13.57%).

In Canada CN’s total rail volumes were down -1.22% with the largest decrease stemming from Coal (-23.69%) and the largest increase from Petroleum and Petroleum Products (+52.76%). CP’s total rail volumes were down 6.28% with the largest increase stemming from Farm and Food Products (+30.90%) and the largest decrease from Coal (-36.78%).

KCS’s total rail volumes were up 1.83% with the largest decrease from Other Products (-40.63%) and the largest increase from Motor Vehicles and Parts (+75.33%).

Source Data : AAR – PFL Analytics

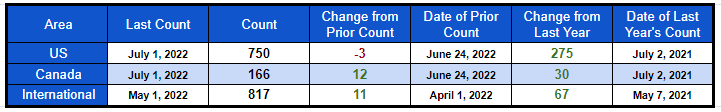

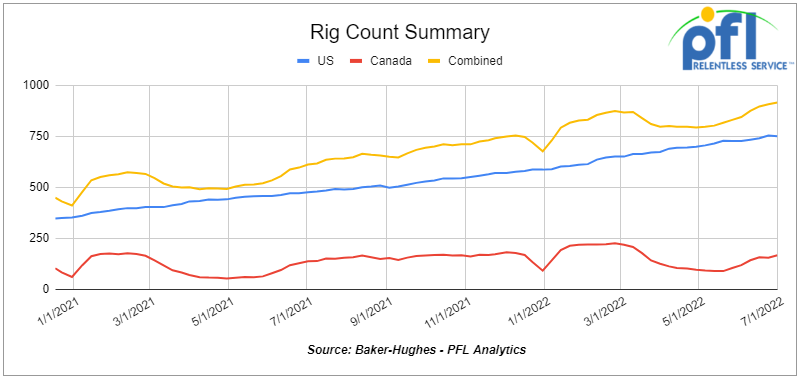

Rig Count

North American rig count was up 9 rigs week over week. U.S. rig count was down -3 rigs week-over-week and up by 275 rigs year over year. The U.S. currently has 750 active rigs. Canada’s rig count was up by 12 rigs week-over-week, and up by 30 rigs year-over-year. Canada’s overall rig count is 166 active rigs. Overall, year over year, we are up 305 rigs collectively.

North American Rig Count Summary

A few things we are keeping an eye on:

Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 24,058 from 24,209, which was a loss of 151 rail cars week-over-week. Canadian volumes were up. CN’s shipments were up by 15.5% and CP volumes were up by 4.5%. U.S. shipments were mostly lower. The UP had the largest percentage increase, up by 11%, and the CSX was down by 18.6%.

EPA Wings Clipped by The Supreme Court

The Supreme Court restricted EPA’s ability to go big on climate. EPA’s ability to curb greenhouse gas emissions from power plants was sharply curtailed, but not eliminated, by a Supreme Court ruling on Thursday of last week. In a 6-3 opinion on the most significant climate change case to reach the high court in a decade, the justices found that Congress did not give EPA the authority to impose sweeping emissions rules like the Obama-era Clean Power Plan. That leaves the Biden administration with fewer options to tackle what they feel is the country’s largest problem “climate change”. President Biden has set a goal for an emissions-free power sector by 2035 and yesterday said the ruling was “another devastating decision that aims to take our country backwards.”

NGFA Comments to STB on Private Railcar Proceeding

National Grain and Feed Association (‘NGFA”) and other stakeholders, including the North America Freight Car Association, the Chlorine Institute and the National Oilseed Processors Association, filed a petition for rulemaking in July 2021, after which the Board decided to open a proceeding on the matter, soliciting public comments in early April this year. In its April 1st decision, STB posed several questions relating to the proposed regulations, which were addressed in the opening comments submitted this last week.

The NGFA and the other petitioners have proposed that STB adopt regulations to allow private railcar providers to assess a “private railcar delay charge” when a private freight car does not move for more than 72 consecutive hours. The overall goal of the proposal is to “maximize the Class I railroads’ efficient use of private railcars without unduly infringing upon the railroads’ freight operations over their respective systems, recognizing that some level of service variability is inherent in any railroad’s operations.”

Class I railroads have established 24 hours as the maximum amount of time a railroad-owned railcar may be in the hands of a rail customer before they assess penalties on the customer. We guess this is a “tit for tat” approach to solving the problems. As noted in the opening comments, 73% of the railcars in service today in the North American rail network are private railcars for which shippers and other parties have spent tens of billions of dollars. The implementation of “precision scheduled railroading” and other measures to scale back employees and rail equipment assets and services have resulted in private railcars left idling for multiple days according to the NGFA and others. Stay tuned to PFL, we are watching this one.

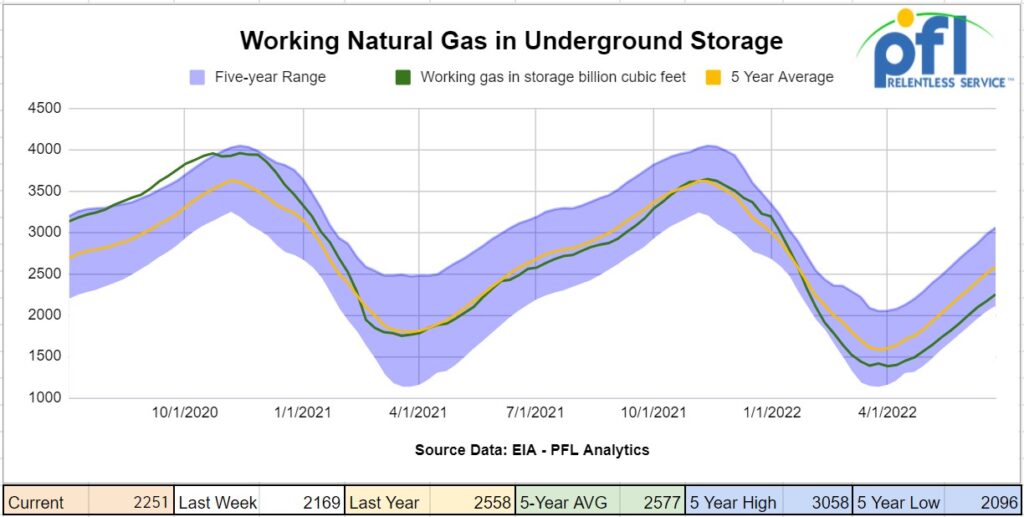

Freeport LNG Restart Blocked – Natgas Tanks

Freeport LNG Restart was blocked.by U.S. pipeline regulator – Pipeline and Hazardous Materials Safety Administration (“PHMSA”) who indicated a restart could not happen before September at least and said in a preliminary report “Continued operation of Freeport’s LNG export facility without corrective measures may pose an integrity risk to public safety”. The PHMSA said it found unsafe conditions at the Texas liquefied natural gas export facility and will not allow owner Freeport LNG to restart the plant until an outside analysis is complete. As reported by PFL previously on June 8th, a blast and fire knocked out Freeport LNG’s Quintana plant, which exports about 15 million tons per year (2 BCF a day of dry Natgas) of LNG. The news sent Natgas south on Thursday of last week as excess natural gas due to the facilities closure continues to head to domestic storage – a buying opportunity for utilities and end users who use natural gas storage in the summer to meet peak demand in the winter. A much needed price break for the American consumer in the short term. The August Nymex futures contract plummeted $1.074 to $5.424/MMBtu. September lost $1.101 cents to land at $5.392. The Energy Information Administration (EIA) reported another larger-than-expected 82 Bcf injection into storage, confirming looser balances as a result of an explosion at the Freeport liquefied natural gas export terminal. Broken down by region, the East led with a 31 Bcf increase in inventories, while the Midwest added 29 Bcf to stocks, EIA said. The South Central region added a net 11 Bcf into storage, which included a 16 Bcf injection into non-salt facilities and a 6 Bcf withdrawal from salts. Mountain inventories rose by 6 Bcf, and the Pacific increased by 4 Bcf. Total working gas in storage as of June 24 was 2,251 Bcf, which is 296 Bcf less year over year and 322 Bcf below the five-year average, according to EIA.

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- Up to 40 5500 Covered Gons 286 unlined CSX/NS preferred but will consider other

- 4 Lined tanks for glycerin to run from Arkansas to Georgia 1-3 years

- 30 boxcars on UP or CP for 3 years to run from TX to Edmonton – negotiable

- 6-10 Open top 4200 gons for hauling scrap NS in Ohio for 1-3 years

- 100, 2480 CU-FT Ag Gons needed in Texas off of the UP for 1-3 Years.

- 50, 30K+ Tank cars are needed in several locations. Can take in various locations off various Class 1’s. Can have prior Ethanol heel or Gasoline heel.

- 300 5800 Covered hoppers needed for plastic – 5-year lease – negotiable

- 50, 5800cuft or larger Covered Hopper for use in DDG needed in the Midwest for 3-4 years. Immediate need.

- 10-20 Covered hopper grain cars in the midwest 5200-5500 2-3 years

- 20-30, 19K Tank Cars for Caustic Soda needed in Texas off of the UP or BN.

- 100 Moulton Sulfur cars for purchase – any location – negotiable

- 50 Ag Gons 2500-2800cuft 286k GRL in the east CSX for 5 years negotiable

- 100 15K Tanks 286 for Molten Sulfur in the Northeast CSX/NS for 6 months negotiable

- 100, 5800 Covered Hoppers 286 can be West or East for Plastic 3-5 years

- 70, 117R or J needed for Ethanol for 3 years. Can take in the South.

- 50, 6500+ cu-ft Mill Gon or Open Top Hopper for wood chips in the Southeast for 5 Years.

- 20, 19,000 Gal Stainless cars in Louisiana UP for nitric acid 1-3 years – Oct negotiable

- 10, 6,300CF or greater covered hoppers are needed in the Midwest.

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js – Selection is Dwindling. Call Today!

- 200 Clean C/I 25.5K 117J in Texas. Brand New Cars!

- Up to 150 sand cars for sale at various locations and class ones – Great Price!

- 150 117R’s 31.8 clean for lease in Texas KCS – negotiable

- 31.8K Tank Cars last in Diesel. Dirty to dirty in Texas

- 200 117Js 29K OK and TX Clean and brand new – Lined- lease negotiable

- 100 117Rs dirty last in Gasoline in Texas for lease Negotiable

- 50 29K 117Js in Nebraska for sale or lease clean last in crude

- 100 117Rs 29K clean last used in crude Washington State – price negotiable sale or lease

- Various Hoppers for lease 3000-6250 CF 263 and 268 multiple locations negotiable

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|