“The best preparation for tomorrow is doing your best today.”

– H. Jackson Brown, Jr.

Jobs Update

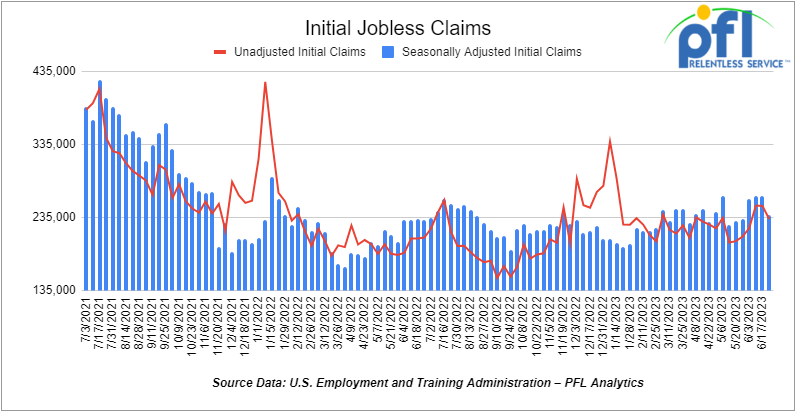

- Initial jobless claims for the week ending June 24th, 2023 came in at 239,000, down -26,000 people week-over-week.

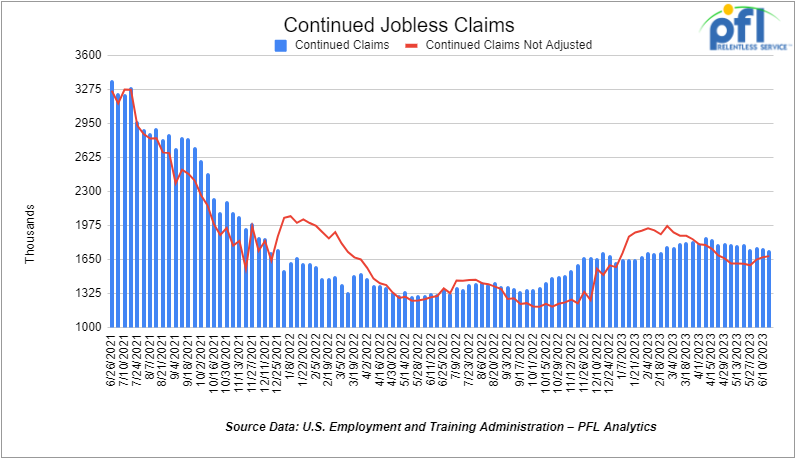

- Continuing jobless claims came in at 1.742 million people, versus the adjusted number of 1.761 million people from the week prior, down -19,000 people week over week.

Stocks closed higher on Friday of last week and higher week over week

The DOW closed higher on Friday of last week, up 285.18 points (+0.84%), closing out the week at 34,407.6, up 680.17 points week over week. The S&P 500 closed higher on Friday of last week, up 53.94 points (+1.23%), and closed out the week at 4,450.38, up 102.05 points week over week. The NASDAQ closed higher on Friday of last week, up 196.59 points (+1.46%), and closed the week at 13,787.92, up 295.40 points week over week.

In overnight trading, DOW futures traded lower and are expected to open at 34,585 this morning down 58 points.

Crude oil closed up on Friday of last week and was higher week over week

WTI traded up $0.78 per barrel (+1.1%) to close at $70.64 per barrel on Friday of last week, up $1.48 per barrel week over week. Brent traded up US$0.56 per barrel (+0.8%) on Friday of last week, to close at US$74.90 per barrel, up US$1.05 per barrel week over week.

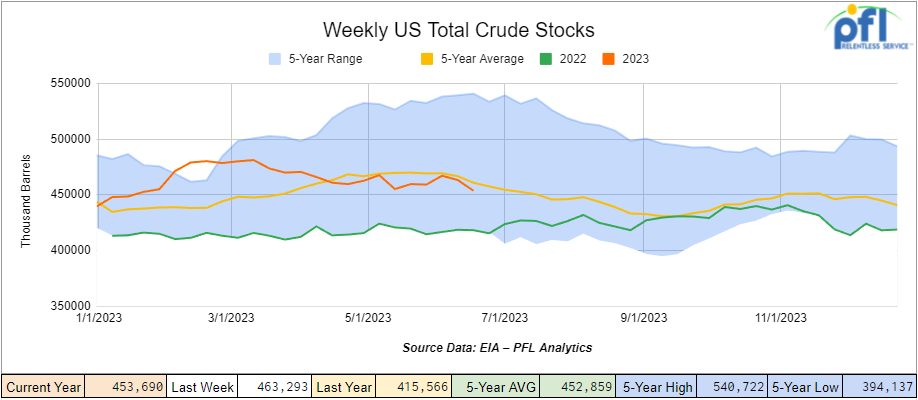

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 9.6 million barrels week over week. At 453.7 million barrels, U.S. crude oil inventories are 1% below the five-year average for this time of year.

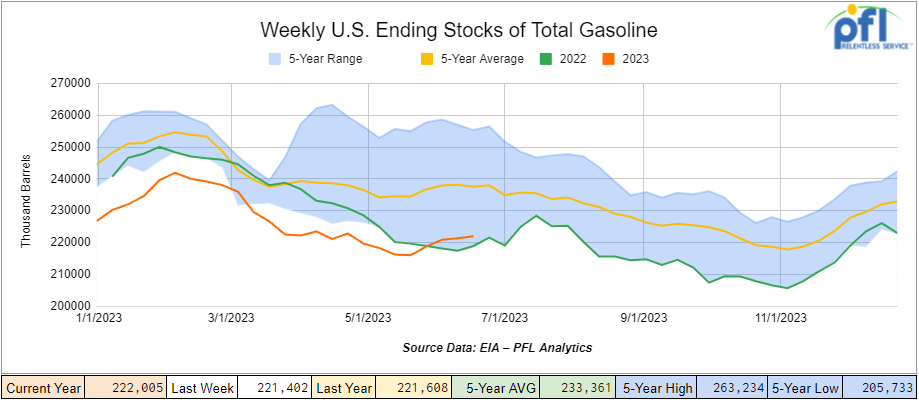

Total motor gasoline inventories increased by 600,000 barrels week over week and are 7% below the five-year average for this time of year.

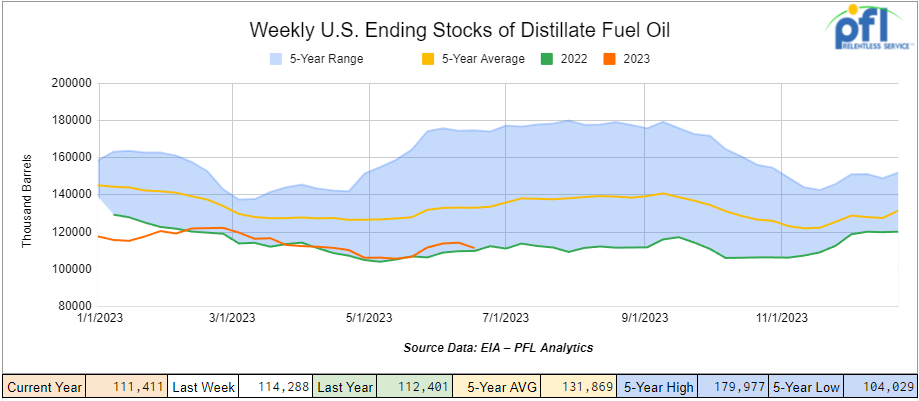

Distillate fuel inventories increased by 100,000 barrels week over week and are 14% below the five-year average for this time of year.

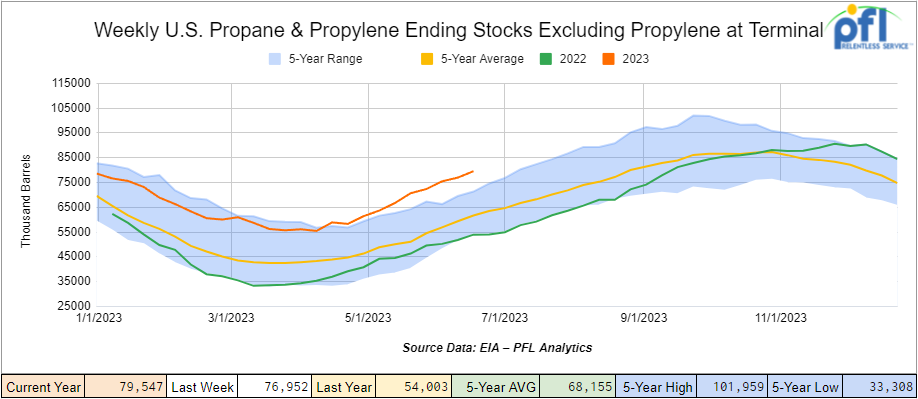

Propane/propylene inventories increased by 2.6 million barrels week over week and are 27% above the five-year average for this time of year.

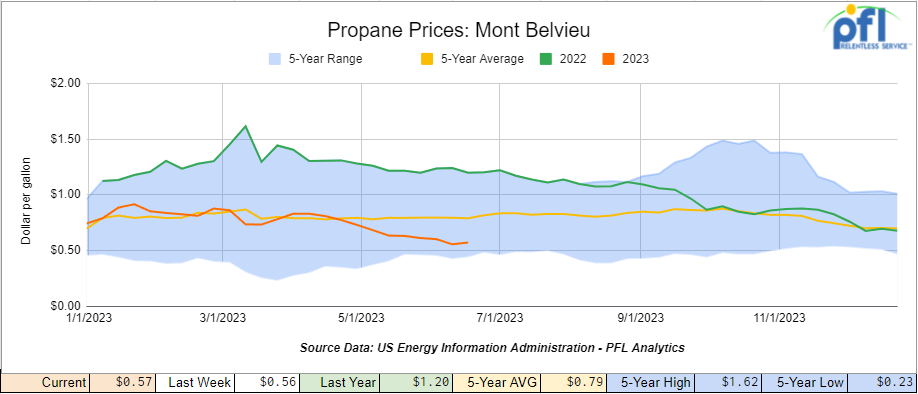

Propane prices closed at 57 cents per gallon, up 1 cent per gallon week over week but down 63 cents per gallon year over year.

Overall, total commercial petroleum inventories decreased by 5.2 million barrels during the week ending June 23rd, 2023.

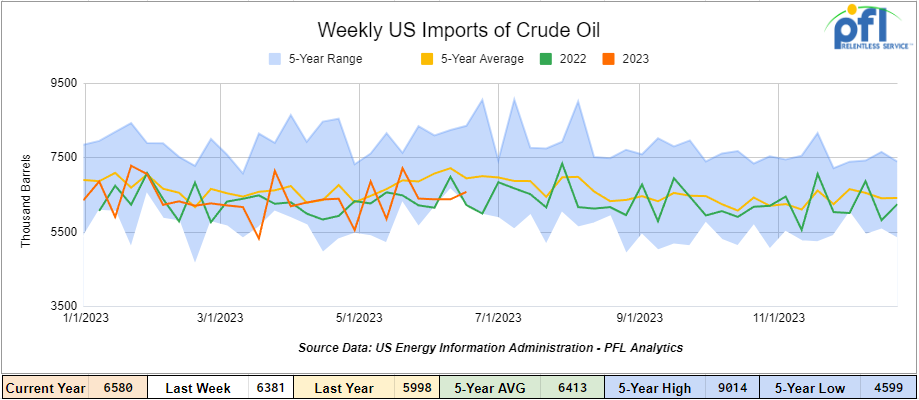

U.S. crude oil imports averaged 6.6 million barrels per day during the week ending June 23rd, 2023, an increase of 418,000 barrels per day week over week. Over the past four weeks, crude oil imports averaged 6.4 million barrels per day, 0.6% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 857,000 barrels per day, and distillate fuel imports averaged 119,000 barrels per day during the week ending June 23rd, 2023.

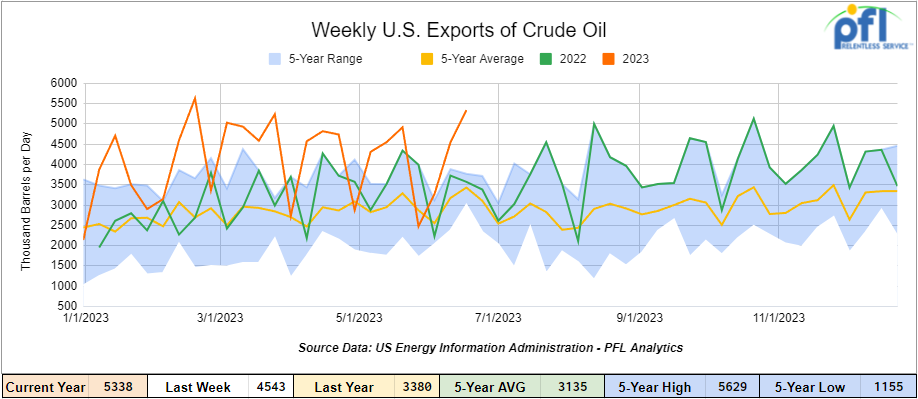

U.S. crude oil exports averaged 5.338 million barrels per day for the week ending June 23rd, 2023, an increase of 795,000 barrels per day week over week. Over the past four weeks, crude oil exports averaged 3.907 million barrels per day.

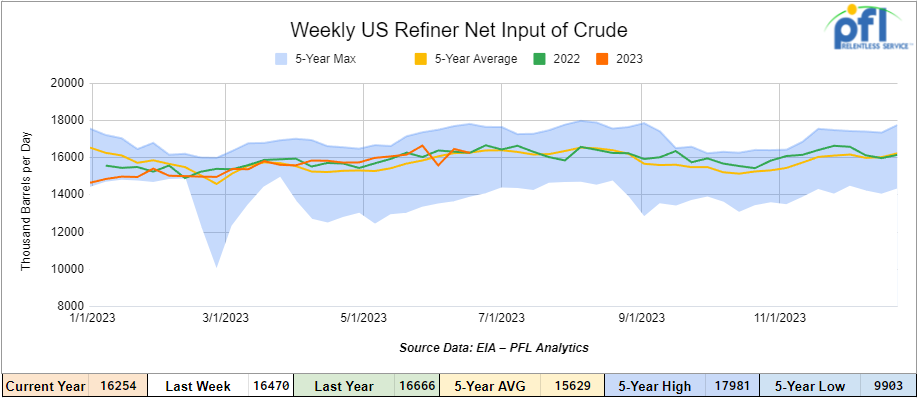

U.S. crude oil refinery inputs averaged 16.3 million barrels per day during the week ending June 23, 2023, which was 215,000 barrels per day less week over week.

As of the writing of this report, WTI is poised to open at $71.41, up 78 cents per barrel from Friday’s close.

North American Rail Traffic

Week Ending June 28th, 2023.

Total North American weekly rail volumes were down (-3.79%) in week 25, compared with the same week last year. Total carloads for the week ending on June 28th, 2023 were 340,531, down (-0.77%) compared with the same week in 2022, while weekly intermodal volume was 311,938, down (-6.89%) compared to the same week in 2022. 7 of the AAR’s 11 major traffic categories posted year-over-year decreases with the most significant decrease coming from Grain (-25.96%). The largest increase came from Motor Vehicles and Parts (+17.88%).

In the East, CSX’s total volumes were down (-0.84%), with the largest decrease coming from Forest Products (-10.22%) and the largest increase from Motor Vehicles and Parts (+24.66%). NS’s volumes were down (-1.64%), with the largest decrease coming from Petroleum and Petroleum Products (-24.31%) and the largest increase from Coal (+14.61%).

In the West, BN’s total volumes were down (-7.75%), with the largest decrease coming from Grain (-37.09%), and the largest increase coming from Metallic Ores and Minerals (+37.09%). UP’s total rail volumes were down (-3.65%) with the largest decrease coming from Grain (-33.47%) and the largest increase coming from Motor Vehicles and Parts (+21.47%).

In Canada, CN’s total rail volumes were down (-2.31%) with the largest increase coming from Coal (+32.46%) and the largest decrease coming from Grain (-55.14%). CP’s total rail volumes were up (7.44%) with the largest decrease coming from Forest Products (-26.36%) and the largest increase coming from Coal (+62.99%).

KCS’s total rail volumes were down (-10.09%) with the largest decrease coming from Nonmetallic Minerals (-23.27%) and the largest increase coming from Other (+32.67%).

Source Data: AAR – PFL Analytics

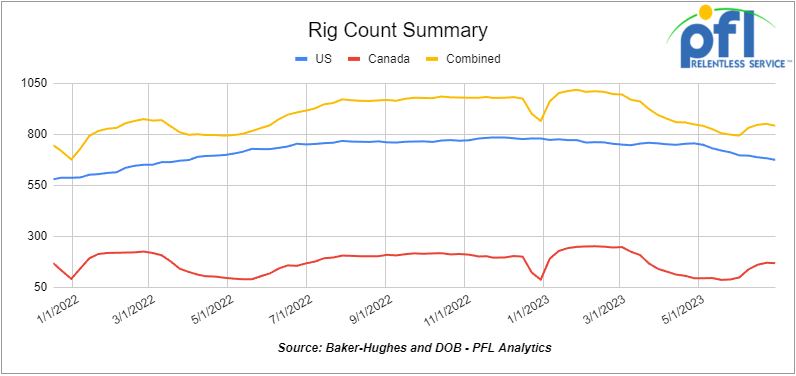

Rig Count

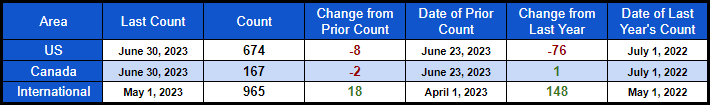

North American rig count was down by -10 rigs week over week. U.S. rig count was down by -8 rigs week over week and down by -76 rigs year-over-year. The U.S. currently has 674 active rigs. Canada’s rig count is down by -2 rigs week-over-week and up by 1 rig year over year. Canada’s overall rig count is 167 active rigs. Overall, year-over-year, we are down -75 rigs collectively.

North American Rig Count Summary

A few things we are watching:

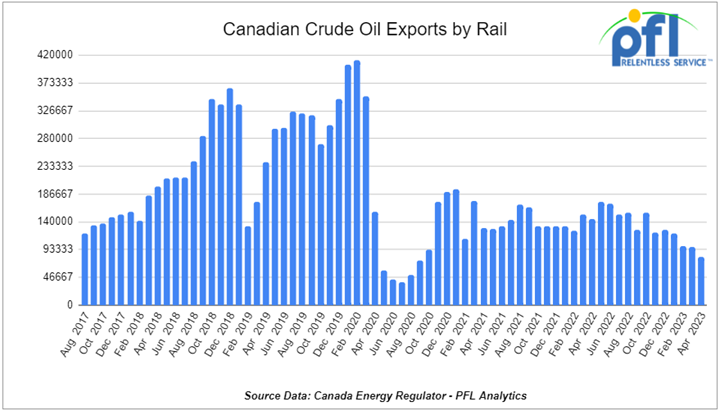

We are watching Crude by Rail Out of Canada

The Canadian Energy Regulator (“CER”) updated its monthly crude by rail numbers on June 26, 2023. For April 2023, Canada exported 80,612 barrels per day by rail (down by -17,205 barrels per day month over month); the weakest showing since September of 2020, another horrible month.

We were expecting to see volumes increase as we head into July, as the weather warms and producers build inventory, but that has not been the case.

Crude by rail out of Alberta and Saskatchewan is popular for raw Bitumen (no diluent added), as it can be shipped as a non-hazmat product resulting in lower shipping costs that are competitive with pipelines.

The decrease in crude oil shipped by rail out of Canada has had a negative impact on railroad terminal service providers such as USD Partners LP (USDP) and similar businesses in the industry. With reduced volumes, USDP’s rail terminal facilities have experienced lower utilization rates, leading to decreased revenue and profitability. This decline has created challenges in maintaining operational efficiency and maximizing asset utilization. Additionally, the market sentiment surrounding the energy sector has dampened, resulting in lower investor confidence and potential downward pressure on the stock prices such as USDP and comparable companies.

We are watching The Mountain Valley Pipeline

The FERC gave final complete approval for MVP last week. The Federal Energy Regulatory Commission has authorized the resumption of construction activities for the Mountain Valley pipeline, clearing the way for the natural gas project to move toward completion weeks after Congress ordered federal agencies to approve it. In a unanimous order issued Wednesday of last week, the commission said that all work on the 303-mile pipeline could proceed. That includes portions of the project that will run through the Jefferson National Forest and cross hundreds of waterways and wetlands in West Virginia and Virginia. The commission also authorized FERC’s Office of Energy Projects to approve any future modifications to the Mountain Valley project as proposed by its sponsors — as long as the director of the office finds them “to be needed to complete construction.”

We are watching Crude Oil Prices Where Do We Go From Here

Where do oil prices go from here – according to Bloomberg the Saudis are tightening the screws on US oil shipments. When Saudi Arabia needs to quickly convince the oil market that supply is tightening, putting upward pressure on prices, nothing beats reducing its crude exports into the US. Riyadh has promised to slash oil production this month by 10%, a unilateral cut that would reduce output to just 9 million barrels a day, the lowest since 2011 — except for brief disruptions from Covid and the Yemeni attack on its facilities. Crucially, as important as the cut itself, is where it’s going to be felt: The signals point to the US and Europe. Focusing on the US would telegraph the reduction clearly to traders. We will see as the month unfolds a lot of dynamics on the supply-demand side at play. Stay Tuned to PFL for further details.

We have been extremely busy at PFL with return-on-lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

Lease Bids

- 20-25, 30K 117 Tanks needed off of UP or BN in Illinois for 5 Years. Cars are needed for use in Ethanol service.

- 10, 30K 117 Tanks needed off of NS or CSX in Marcellus for Trip Lease. Cars are needed for use in C5 service.

- 100, 28.3K DOT 111/117 Tanks needed off of UP or BN in Midwest/Texas for 5 Years. Cars are needed for use in Veg Oils/Biodiesel service. Need to be Unlied

- 25-50, 33K 400W Pressure Tanks needed off of CN or CP in Canada for Short Term. Cars are needed for use in Propylene service.

- 50-100, 4550 Covered Hoppers needed off of UP or BN in Texas for 5 Years. Cars are needed for use in Grain service.

- 10, 33K 340W Pressure Tanks needed off of CN in LA for 1 Year. Cars are needed for use in Butane service.

- 25, 20.5K CPC1232 or 117J Tanks needed off of BNSF or UP in the west for 3-5 Year. Cars are needed for use in magnesium chloride service. SDS onhand

- 25-50, 25.5K 117J Tanks needed off of NS CSX in NorthEast for 5 Years. Cars are needed for use in Asphalt/Heavy Fuel Oil service.

- 25-50, 25.5K 117J, 117R, CPC 1232 Tanks needed off of UP or BN in Texas for 1-2 Years. Cars are needed for use in Asphalt service.

- 30-50, 33K 340W Pressure Tanks needed off of any class 1 in any location for 6-12 Months. Cars are needed for use in Propane service.

- 60-150, 30K 117J Tanks needed off of TYR, UP in Corpus Christi, TX for 1 year. Cars are needed for use in Diesel service.

- 100, 30K 117J Tanks needed off of CN in Detroit for 1 Year. Cars are needed for use in Refined Fuel service.

- 15, 28.3K 117J Tanks needed off of any class 1 in any location for 3 year. Cars are needed for use in Glycerin & Palm Oil service.

- up to 50, 31.8K 117J, 117R, CPC 1232 Tanks needed off of any class 1 in Texas or Ohio for 1-3 years. Cars are needed for use in Diesel/Gasoline service.

- 45, 3000 cf PDs Hoppers needed off of any class 1 in Texas for 3 years. Cars are needed for use in Any service.

- 25, 30K 117 Tanks needed off of CN in Canada for 1 year. Cars are needed for use in Refined Products service.

- 30, 17K-20K 117J Tanks needed off of UP or BN in Midwest/West Coast for 3-5 Years. Cars are needed for use in Caustic service.

- 10, 286K 15.7K Tanks needed off of KCS in Texas for 1 Year. Cars are needed for use in Sulfuric Acid service. Needed Next few months

- 150, 23.5K DOT 111 Tanks needed off of any class 1 in LA for 2-3 Year. Cars are needed for use in Fluid service. Needed July

- 25-50, 32K 340W Pressure Tanks needed off of NS or CSX in Marcellus for 1-2 Years. Cars are needed for use in Propane service.

- 25-50, 30K DOT 111, 117, CPC 1232 Tanks needed off of CN or CP in WI, Sarnia for 1-2 Years. Cars are needed for use in Diesel service.

- 10, 30K DOT 111, 117, CPC 1232 Tanks needed off of UP or BN in Beaumont, Houston, Sunray for 6 Months. Cars are needed for use in Diesel service. Dirty to Dirty

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

- 30-40, 286K DOT 113 Tanks needed off of CN or CP/ UP in Canada/MM for 5 Years. Cars are needed for use in CO2 service. Q1

- 70, 32K 340W Pressure Tanks needed off of CP or CN in Edmonton for 3 Years. Cars are needed for use in Propane service.

- 200-300, 28.3K 117R or 117J Tanks needed off of CP or CN in Sarnia for 3 Years. Cars are needed for use in Fuel Oil service.

- 30, 30K DOT 111 Tanks needed off of UP in Texas for 1-3 Years. Cars are needed for use in Diesel service.

- 5-7, 28.3K 117R Tanks needed off of NS or CSX in NC for 1 Year. Cars are needed for use in UCO service.

- 25-50, 5000CF-5100CF Lined Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in dry sugar service. 3 bay gravity dump

- 10, any capacity Stainless Steel Tanks needed off of any class 1 in Canada for 5-10 years. Cars are needed for use in Alcohol service.

- 30-50, 30K 117 Tanks needed off of any class 1 in Northeast or Midwest for 1 Year. Cars are needed for use in C5 service. Must have Magrods

- 100, 33K 340W Pressure Tanks needed off of CN in Canada for 3-5 Years. Cars are needed for use in Propane service.

- Up to 60, 5150cf Covered Hoppers needed off of CN, CSX, NS in the east or midwest for 3 years. Cars are needed for use in Fertilizer service. 3-4 hatch gravity dumps

- 20-30, 14k Any Tanks needed off of BNSF, UP in Texas for 1-3 Years. Cars are needed for use in HCl service. Call for more details

Sales Bids

- 1-2, Any DOT 111, 117, CPC 1232 Tanks needed off of any class 1 in Texas. Coiled and Insulated

- 45, 3000 cf PDs Hoppers needed off of any class 1 in Texas. Negotiable

- 30-40, 30K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Iowa. Cars are needed for use in CO2 & Ethanol service.

- 20-25, 25.5K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Texas. Cars are needed for use in Veg Oil service. Coiled and insulated

- 15, 30K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Texas. Cars are needed for use in Veg Oil service.

- 2-4, 28K DOT 111 Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

- 100, Plate F Boxcars needed off of BN or UP in Texas.

- 200+, 5000cf Covered Hoppers needed off of any class 1 in various locations.

- 20-30, 3000 – 3300 PDs Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 100, 15.7K DOT 111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT 111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

- 20, 2770 Mill Gondolas needed off of CSX in the northeast. Cars are needed for use in non-haz soil service. 52-60 ft

- 10, 4000 Open Hoppers needed off of CSX in the northeast. Cars are needed for use in scrap metal service. Open top hopper

Lease Offers

- 70, 25.5K, 117J Tanks located off of UP in Texas. Cars are clean Call for more information

- 30, 23.5K, DOT111 Tanks located off of UP or BN in Texas. Cars were last used in Clean / UAN.

- 25-100, 17.6K, DOT111 Tanks located off of UP or BN in Midwest. Cars were last used in Fertilizer / Corn Syurp. Free move available

- 20, 20k, DOT111 Tanks located off of CSX in GA. Cars are clean

- 2, 20K, DOT111 Tanks located off of UP in TX. Cars are clean

- 5, 20K, DOT111 Tanks located off of UP in TX. Cars were last used in Sulfuirc Acid. Free move available

- 108, 28.3K, 117R Tanks located off of All Class 1’s in St. Louis. Cars are clean

- 25, 28.3K, DOT111 Tanks located off of UP in Texas. Cars were last used in Biodiesel. Free move available. Dirty to dirty service.

- 47, 6500, Covered Hoppers located off of UP and BN in Iowa. Cars are clean

Sales Offers

- 100-200, 31.8K, CPC 1232 Tanks located off of BN in Chicago. Dirty/Clean

- 100, 28.3K, 117J Tanks located off of various class 1s in multiple locations.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|