“The best time to plant a tree was twenty years ago. The second best time is now.“

Weekly jobless claims up week over week and well above expectations

- New weekly jobless claims ticked higher last week.

- The Department of Labor released its weekly report on new jobless claims on Thursday morning last week as it does every week at 8:30 a.m. Eastern Standard Time.

- Initial jobless claims for the week ended July 17, 2021 came in at 419,000 which was well above analysts’ expectations of 350,000.

- Continuing claims for the week ending July 2, 2021 came in at 3.24 million, down by 29,000 week over week.

Stocks were up on Friday of last week and up week over week

The Dow closed higher on Friday of last week, up +238.20 (-0.68%) points closing out the week at 35,061.55 up +373.70 points week over week. The S&P 500 closed higher on Friday of last week, up +44.31 points (+1.01%) and closing out the week at 4,411.79, up +84.63 points week over week. The Nasdaq closed higher on Friday of last week, up +152.39 points (+1.04%) and closing out the week at 14,836.99, up +409.75 points week over week.

In overnight trading, DOW futures traded lower and are expected to open down this morning 121 points.

Oil up on Friday and up week over week

Oil prices rose on Friday of last week, after a volatile week and eked out a small gain week over week. WTI crude oil closed higher on Friday of last week up +$0.16 a barrel to settle at $72.07 a barrel, up $0.26 a barrel week over week. Brent crude oil closed higher on Friday of last week gaining +$0.31 a barrel, and closing at $74.10 up +$0.81 a barrel week over week.

U.S. commercial crude oil inventories increased by 2.1 million barrels week over week breaking a streak of eight weeks of declines, as imports surged to their highest in a year, the Energy Information Administration said on Wednesday of last week. At 439.7 million barrels, U.S. crude oil inventories are 7% below the five-year average for this time of year.

Total motor gasoline inventories decreased by 100,000 barrels week over week and are at the five-year average for this time of year. Finished gasoline inventories decreased while blending components inventories increased last week.

Distillate fuel inventories decreased by 1.3 million barrels week over week and are 4% below the five-year average for this time of year.

Propane/propylene inventories increased by 3.1 million barrels week over week and are 15% below the five-year average for this time of year.

Total commercial petroleum inventories increased by 4.4 million barrels week over week.

U.S. crude oil imports averaged 7.1 million barrels per day last week, an increase of 900,000 barrels per day week over week. Over the past four weeks, crude oil imports averaged 6.4 million barrels per day, 2.9% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) last week averaged 1.4 million barrels per day, and distillate fuel imports averaged 87,000 barrels per day.

U.S. crude oil refinery inputs averaged 16.0 million barrels per day during the week ending July 16, 2021 which was 87,000 barrels per day less week over week. Refineries operated at 91.4% of their operable capacity last week. Gasoline production decreased last week, averaging 9.1 million barrels per day. Distillate fuel production decreased last week, averaging 4.9 million barrels per day

Oil is lower in overnight trading and, as of the writing of this report, WTI is poised to open at $71.69, down .38 cents per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were up 4.6% year over year in week 28 (U.S. +6.6%, Canada -4.6%, Mexico +14.3%) resulting in quarter to date volumes that are up 1.4% year over year and year to date volumes that are up 11.4% year over year (U.S. +13.0%, Canada +7.6%, Mexico +6.1%). 7 of the AAR’s 11 major traffic categories posted year over year increases with the largest increases coming from metallic ores & metals (+38.8%), coal (+18.1%) and intermodal (+2.7%). The largest decrease came from grain (-14.9%).

In the East, CSX’s total volumes were up 7.4%, and the largest increases came from intermodal (+11.5%) and coal (+28.5%). The largest decrease came from motor vehicles & parts (-31.6%). NS’s total volumes were up 6.1%, with the largest increases from intermodal (+3.5%), metals & products (+47.2%) and chemicals (+16.9%). The largest decrease came from motor vehicles & parts (-15.7%).

In the West, BN’s total volumes were up 11.7%, with the largest increases coming from intermodal (+8.6%), coal (+27.3%) and metallic ores (+503.3%). The largest decrease came from grain (-8.8%). UP’s total volumes were up 2.8%, with the largest increases coming from coal (+17.9%), chemicals (+11.6%) and petroleum (+36.4%). The largest decreases came from intermodal (-1.8%) and motor vehicles & parts (-15.0%).

In Canada, CN’s total volumes were down 4.7%, with the largest decreases coming from intermodal (-9.0%), grain (-42.9%) and motor vehicles & parts (-39.4%). The largest increase came from metallic ores (+35.0%). RTMs were down 1.1%. CP’s total volumes were down 0.9%, with the largest decreases coming from grain (-23.4%) and chemicals (-17.6%). The largest increase came from petroleum (+59.0%). RTMs were down 9.5%.

KCS’s total volumes were up 2.3%, with the largest increases coming from coal (+36.0%) and chemicals (+21.5%).

Source: Stephens

Rig Count

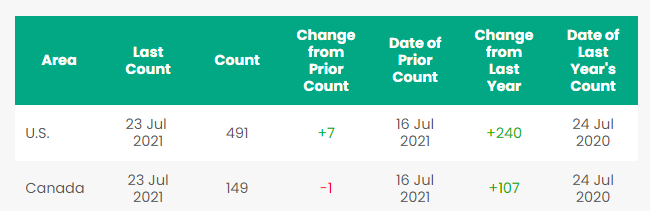

North American rig count is up by 6 rigs week over week. The U.S. rig count was up 7 rigs week over week and up by 240 rigs year over year. The U.S. currently has 491 active rigs. Canada’s rig count was down by 1 rig week over week, and up by 107 rigs year over year and Canada’s overall rig count is 149 active rigs. Year over year we are up 347 rigs collectively.

North American Rig Count Summary

Things We are Keeping an Eye on

- Petroleum by Rail – The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 23,527, from 23,506 a gain of 21 rail cars week over week. Canadian volumes were higher – CN shipments were up by 9% while CP shipments were up by 7.4%. U.S. volumes were mostly higher BN had the largest percentage increase and were up 12.3%. The NS had the largest percentage decrease down by 7.7%.

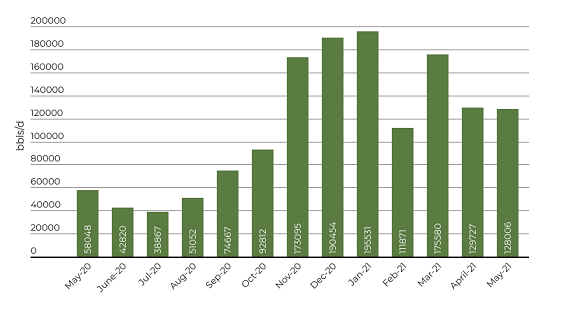

Canadian crude oil by rail exports were down slightly in May, as new data from the Canada Energy Regulator (CER) showed. Exports into the U.S. declined to 128,006 barrels per day from 129,727 barrels per day in April the previous month, which is up from 58,048 barrels per day from May 2020 but still a far cry from the peak experienced in February of 2020 of 411,991 barrels per day. Petroleum by rail out of Canada is expected to pick up significantly once the Gibson/ US Development Corp Diluent Recovery Unit comes online and becomes fully operational later this quarter.

Crude by Rail out Of Canada Declines Month over Month

- Pipelines still under siege despite progress on their side and billions of dollars spent on legal battles and delays.

- DAPL The U.S. Department of Transportation’s pipeline regulator on Thursday of last week put the operator of the Dakota Access Pipeline (DAPL), Energy Transfer, on notice for probable violations of safety regulations and proposed a civil penalty against it. The U.S. Pipeline and Hazardous Materials Safety Administration (PHMSA) notice listed probable violations ranging from the location of storm water drainage at six pipeline facilities and failure to follow assessment guidelines relating to possible incidents in sensitive areas where the pipeline operates. The PHMSA recommended a civil penalty of $93,200 against the company for the violations and said failure to correct the issues may result in further enforcement action. In June, a U.S. District Court closed a long-running case against the DAPL but allowed for Native American tribes and other opponents of the line to file additional actions against it.

Dakota Access Pipeline

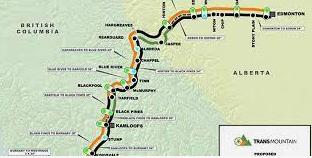

- Trans Mountain Pipeline ULC has filed its written argument with the Canada Energy Regulator (CER) for the alternate route in the Coldwater Valley. In the variance application, Trans Mountain requested a realignment of the approved corridor to accommodate the West Alternative, a Trans Mountain expansion project route along the west side of the Coldwater Valley that passes to the northwest of the reserve.

“To Trans Mountain’s knowledge, no party opposes the variance application,” said the company in its filing. “Trans Mountain submitted the variance application to address Coldwater’s concerns regarding risks to the underground water supply at the reserve, as described in Section III of the variance application.

“Coldwater is the most proximate Indigenous community to the TMEP route through the Coldwater Valley, and Coldwater has confirmed that the West Alternative is its preferred routing option for the TMEP. Trans Mountain has also addressed the concerns of all private landowners along the West Alternative, including those who initially expressed opposition to the route.”

A decision was made Friday of last week by the energy regulator and while the Canada Energy Regulator (CER) approved the West Alternative Route variance application for the Trans Mountain expansion, the company is asking the regulator to file its reasons for decision by month-end due to tight construction timelines.

“The Commission’s reasons for its approval will be issued shortly,” the CER said in its letter decision.

In a subsequent July 23 letter, Trans Mountain said it faces tight timing constraints to execute the West Alternative Route. Due to safety risks and snowpack restrictions associated with clearing during the winter months, as well as an extended migratory bird window (mid-March to end of September), “Trans Mountain must commence clearing on the West Alternative Route by no later than November 2021 (sooner if possible) to complete clearing, stripping and grading prior to spring/summer 2022, which is when the pipeline must be installed to achieve completion in December 2022,” said the company.

Before clearing can commence, Trans Mountain must receive an Environmental Assessment Certificate (EAC) amendment from the BC Environmental Assessment Office (EAO), as well as 36 provincial permits that may only be issued after the EAO’s approval.

The EAO’s EAC amendment assessment will rely on the Commission’s reasons for decision in this matter, said the company. The EAO estimates that it will require 9-10 weeks following release of the Commission’s reasons for decision to issue the EAC amendment.

“For these reasons, Trans Mountain respectfully requests that the Commission provide its reasons for decision in approving the West Alternative Route as soon as possible, and preferably by no later than July 30, 2021,” the company said.

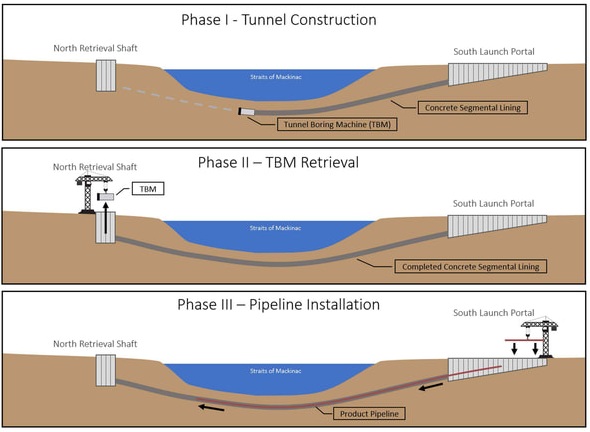

Trans Mountain Pipeline ULC

- Enbridge Line 5 most likely going to court the two sides in the ongoing dispute over the Line 5 pipeline say they expect their mediation efforts to conclude before the end of August. A court-approved mediator says in court documents that he will meet again on Aug. 11 with officials from the State of Michigan and Enbridge Inc. The documents, filed late last week in Federal Court in Michigan, offer no added clues as to the state of the dispute, which has been raging since November. That’s when Gov. Gretchen Whitmer, citing the risk of a spill in the Straits of Mackinac, where the line crosses the Great Lakes, abruptly revoked the easement that had allowed it to operate since 1953. Enbridge insists the pipeline is safe and has already received the state’s approval for a $500-million effort to dig a tunnel beneath the straits that would house the line’s twin pipes and protect them from anchor strikes. The company has made it clear it has no intention of shutting down the pipeline voluntarily.

Proposed Enbridge Tunnel Construction

- On Wednesday, Quebec rejected a liquefied natural gas export project for the Port of Saguenay, citing environmental concerns, in the latest blow to North American LNG development. Quebec Environment Minister, Benoit Charette, said the proposed Énergie Saguenay project will not come to pass due to concerns over its emissions. “This project has more disadvantages than advantages,” Charette told reporters. The C$9 billion (US$7.2 billion) project by privately held GNL Quebec had plans to export 11 million tons of LNG a year from western Canadian sources, according to the company’s website.

Meanwhile, Asian spot prices for LNG jumped last week to a more than six-month high, as warm temperatures drove up demand for the fuel used in electricity generation, driving up prices here in the United States.

The average LNG price for September delivery into Northeast Asia was estimated at about $14.45/mmBtu, up $1.15 from the previous week, and the highest since mid-January, the sources said.

Temperatures in Tokyo, Seoul, and Beijing — among the top consumers of LNG — are expected to stay above average over the next two weeks. Natural gas prices in the United States and Europe are also high amid hotter weather.

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Railcar Markets

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 100 fuel oil cars in Texas dirty to dirty service

- 125 non coiled R’s or J’s clean or last in Jet Fuel needed in Houston

- 200 117Rs or Js needed for gas and diesel in Texas dirty preferred BNSF service

- 10 open top hoppers 2400 C FT in Texas needed for stone on the UP 3-5 years

- 100 31.8k CPC 1232’s for the Use in Gas or Diesel service in Texas for 1 Year.

- 100 30K 117R or J’s for the Use in Gas or Diesel service in Texas for 1 Year.

- 110 117 J’s 28.3 for dirty to dirty service in Alberta for crude.

- 20 19,000 Gal Stainless cars in Louisiana UP for nitric acid 1-3 years negotiable

- 90-110 Pressure Cars 340s in Alberta on the CN 2-4 years Butane/Propane

- 10-15 Stainless 23.5 cars coiled and insulated in the East 1-2 years

- 5 Gondolas for Sale for aggregate in Texas any line

- 8 Hoppers for plastic pellets wanted to purchase

- 15-25 3915 CF PD Hoppers in Chicago any class one 3 year lease – negotiable

- 50-100 117Rs 30.3 gallon for refined products UP and BN Texas negotiable

- 18-25 5,200CF or greater covered hoppers needed in Illinois off the CN or NS.

- 20-25 30K 117Rs for the use in ethanol in the Midwest. Dirty to dirty service/

- 10 6,300CF or greater covered hoppers needed in the Midwest.

- 8 plastic pellet hoppers for purchase.

- 10 PD cars for cement service for purchase.

- 20 17K tank cars for purchase. Must be food grade.

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js – Selection is Dwindling. Call Today!

- 50 29,188 US GAL EC&I CPC 1232s with Magnetic gage rods for up to 1 year starting ASAP

- 200 4300 Hoppers in Canada – Lined and dirty Negotiable

- 20 117R 30K plus tanks for ethanol in Wisconsin off the CN Negotiable

- 80 6350 Grain Hoppers in Nebraska on the BN Clean Negotiable

- 90 117Rs 30K located in Alberta CN or CP Refined Products Dirty – negotiable

- 37 BRAND NEW 5161 Sugar Hoppers in Arkansas UP – negotiable

- 205 117Js 29K BRAND NEW in Colo and Iowa off the UP, BNSF – price negotiable

- 99 340W Pressure Cars various locations Butane and Propane dirty negotiable

- 100 340W Pressure Cars Montana or Kansas LPG last in – negotiable

- 218 73 ft 286 GRL riser less deck, center part for sale,

- 19 auto-max II automobile carrier racks – tri-49 for sale – negotiable

- 10 food grade stainless steel cars

- 30 CPC 1232 25.5K Pennsylvania NS clean negotiable

- 20-30 29K C/I 117J cars for lease up to 1 year. Dirty in Biodiesel and can be returned dirty.

- 100-150 29K C/I 117J cars for lease. Dirty in Bakken crude and can be returned dirty.

- 100 29K C/I 117J cars for lease. Dirty in Heavy Crude and can be returned dirty.

- 100-200 LPG Tanks dirty to dirty up to 5 years – various locations – negotiable

- 100 117Rs 29K clean last used in crude Washington State – price negotiable sale or lease

- 21 111s 29K tanks last in alcohol dirty on the CN in Wisconsin for lease price negotiable

- 100 111s of various volumes and locations last in fuel oil dirty price negotiable

- Various Hoppers for sale and lease 3000-5800 CF 263 and 286 multiple locations negotiable

- 45 Boxcars 60ft Plate F’s Located in Tenn CSX – Lease Negotiable

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offer Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|