“There are no limits. There are only plateaus, and you must not stay there — you must go beyond them.” – Bruce Lee

Jobs Update

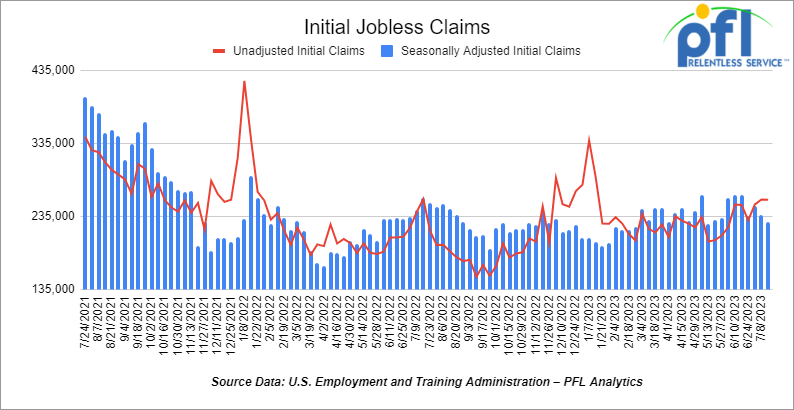

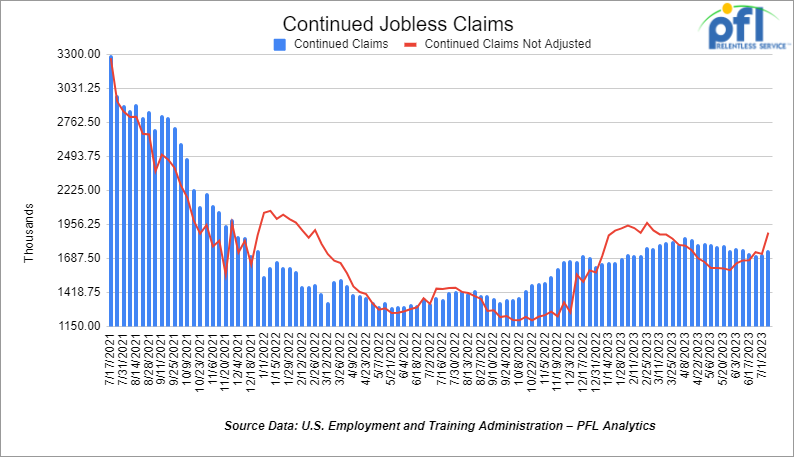

- Initial jobless claims for the week ending July 15th, 2023 came in at 228,000, down -9,000 people week-over-week.

- Continuing jobless claims came in at 1.754 million people, versus the adjusted number of 1.721 million people from the week prior, up 33,000 people week over week.

Stocks closed higher on Friday of last week and higher week over week

The DOW closed higher on Friday of last week, up +2.51 points (0.01%), closing out the week at 35,227.69, up +718.66 points week over week. The S&P 500 closed higher on Friday of last week, up +1.47 points (0.03%) and closed out the week at 4,536.34, up +30.92 points week over week. The NASDAQ closed higher on Friday of last week, up +27.49 points (0.19%), and closed the week at 14,090.8, down -22.9 points week over week.

In overnight trading, DOW futures traded lower and are expected to open at 35,460 this morning up 62 points.

Crude oil closed up on Friday of last week, and higher week over week

WTI traded up $1.42 per barrel (1.88%) to close at $77.07 per barrel on Friday of last week, up $1.65 per barrel week over week. Brent traded up US$1.43 per barrel (1.8%) on Friday of last week, to close at US$81.07 per barrel, up US$1.20 per barrel week over week.

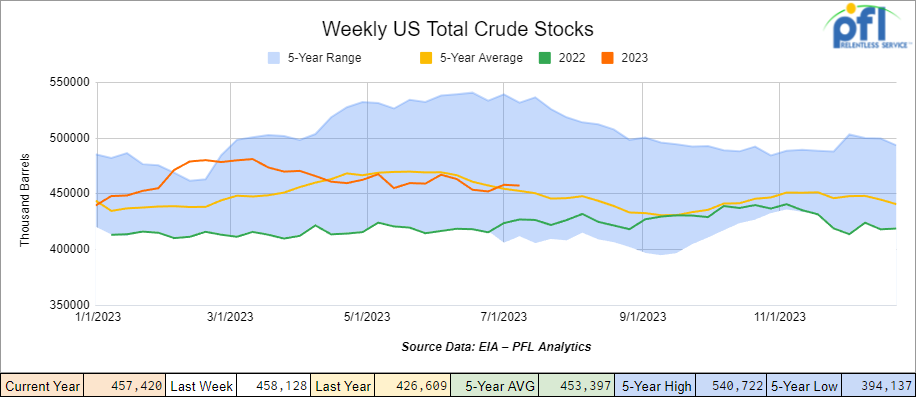

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 700,000 barrels week over week. At 457.4 million barrels, U.S. crude oil inventories are 1% above the five-year average for this time of year.

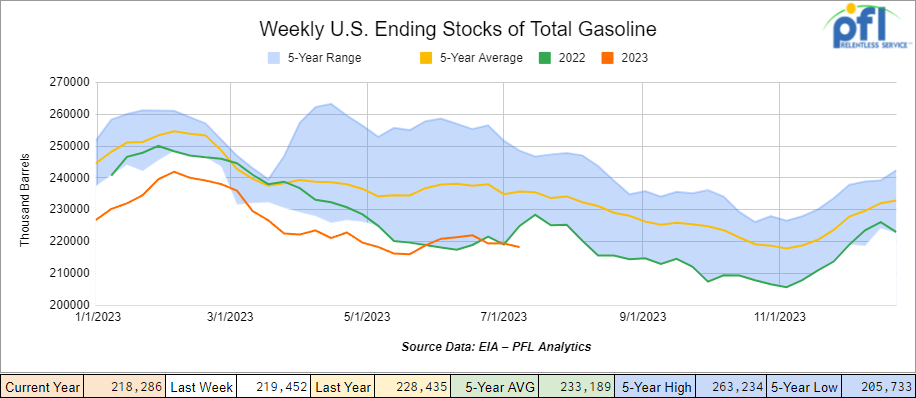

Total motor gasoline inventories decreased by 1.1 million barrels week over week and are 7% below the five-year average for this time of year.

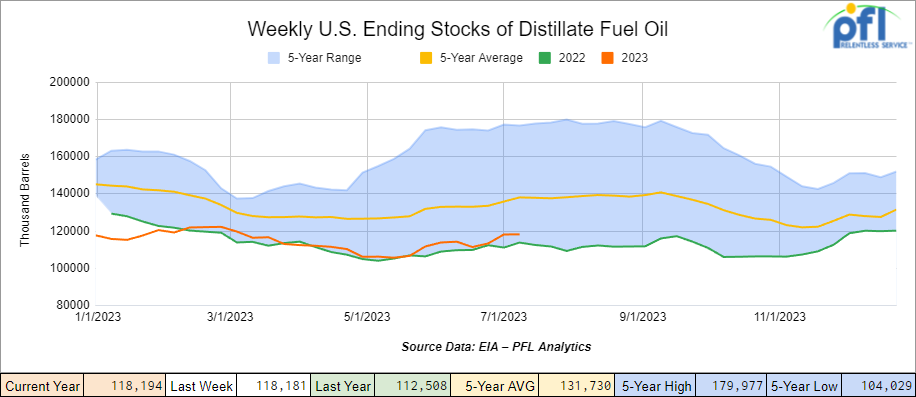

Distillate fuel inventories slightly increased week over week and are 14% below the five-year average for this time of year.

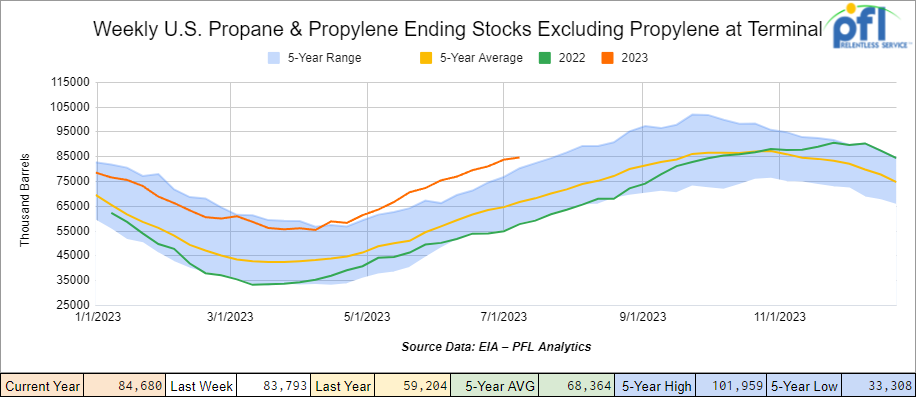

Propane/propylene inventories increased 900,000 barrels week over week and are 24% above the five-year average for this time of year.

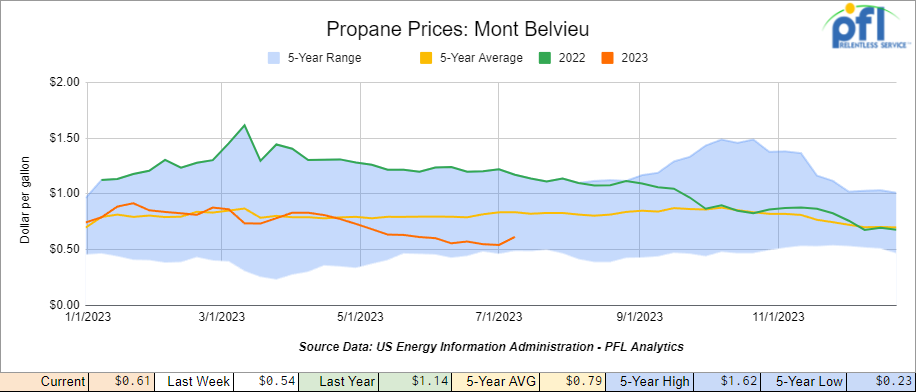

Propane prices closed at 61 cents per gallon, up 7 cents per gallon week over week, but down 53 cents per gallon year over year

Overall, total commercial petroleum inventories decreased by 1.1 million barrels during the week ending July 14th, 2023.

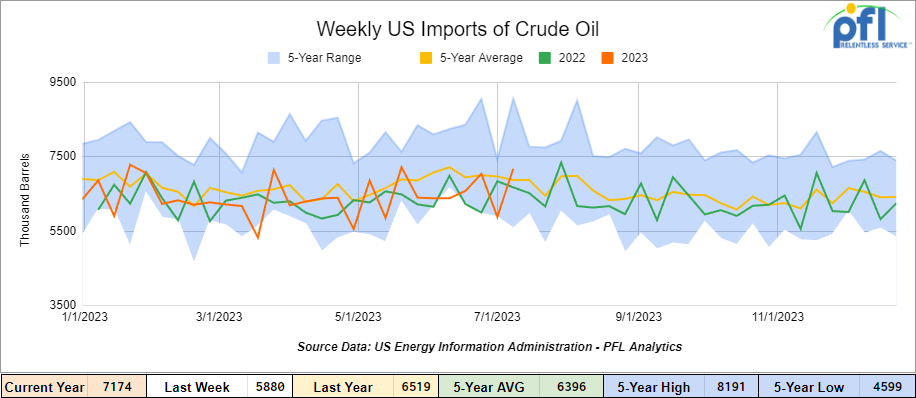

U.S. crude oil imports averaged 7.2 million barrels per day during the week ending July 14th, 2023, an increase of 1.3 million barrels per day week over week. Over the past four weeks, crude oil imports averaged 6.7 million barrels per day, 2.5% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 717,000 barrels per day, and distillate fuel imports averaged 63,000 barrels per day during the week ending July 14th, 2023.

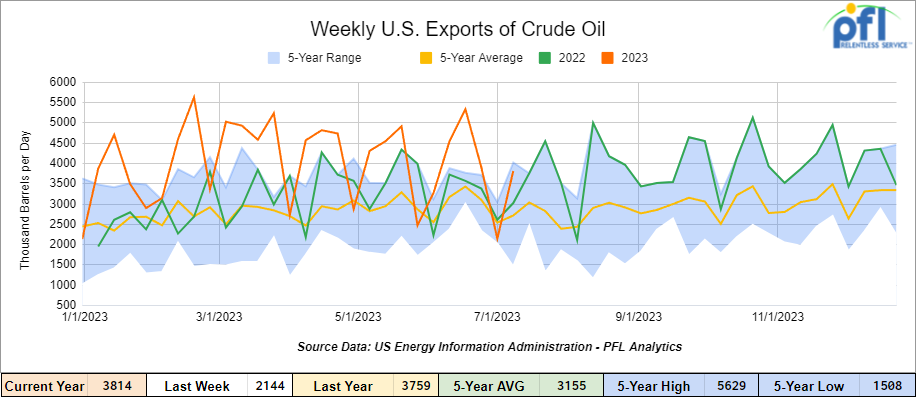

U.S. crude oil exports averaged 3.814 million barrels per day for the week ending July 14th, 2023, an increase of 1.670 million barrels per day week over week. Over the past four weeks, crude oil exports averaged 3.799 million barrels per day.

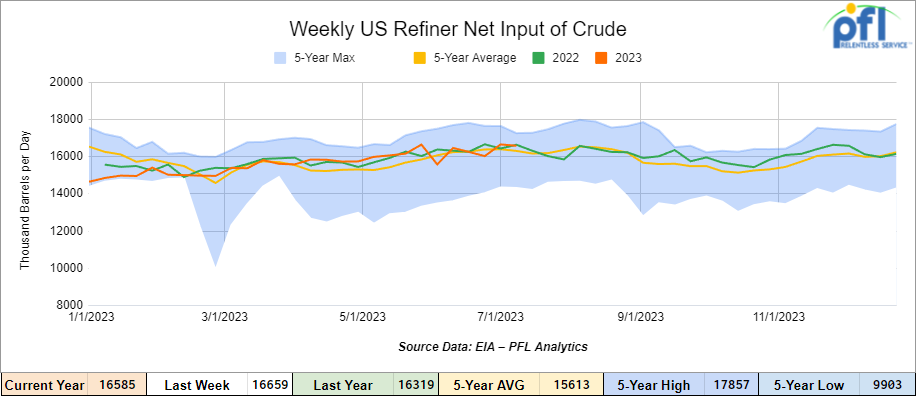

U.S. crude oil refinery inputs averaged 16.6 million barrels per day during the week ending July 14, 2023, which was 75,000 barrels per day less week over week.

WTI is poised to open at 77.45 , up 38 cents per barrel from Friday’s close.

North American Rail Traffic

Week Ending July 19th, 2023.

Total North American weekly rail volumes were down (-4.58%) in week 28, compared with the same week last year. Total carloads for the week ending on July 19th, 2023 were 344,755, down (-0.32%) compared with the same week in 2022, while weekly intermodal volume was 305,581, down (-8.98%) compared to the same week in 2022. 7 of the AAR’s 11 major traffic categories posted year over year decreases with the most significant decrease coming from Grain (-12.74%). The largest increase came from Motor Vehicles and Parts (+18.44%).

In the East, CSX’s total volumes were down (-4.16%), with the largest decrease coming from Grain (-21.69%) and the largest increase from Motor Vehicles and Parts (+23.4%). NS’s volumes were down (-1.66%), with the largest decrease coming from Petroleum and Petroleum Products (-23%) and the largest increase from Motor Vehicles and Parts (+11.32%).

In the West, BN’s total volumes were down (-3.79%), with the largest decrease coming from Grain (-10.42%), and the largest increase coming from Motor Vehicles and Parts (+29.30%). UP’s total rail volumes were down (-3.21%) with the largest decrease coming from Other (-22.71%) and the largest increase coming from Motor Vehicles and Parts (+13.48%).

In Canada, CN’s total rail volumes were down (-14.45%) with the largest increase coming from Metallic Ores and Metals (+12.22%) and the largest decreases coming from Grain (-44.80%). CP’s total rail volumes were down (-13.43%) with the largest decrease coming from Chemicals (-41.14%) and the largest increase coming from Farm Products (+44.10%).

KCS’s total rail volumes were down (-10.71%) with the largest decrease coming from Farm Products (-36.82%) and the largest increase coming from Motor Vehicles and Parts (+111.78%).

Source Data: AAR – PFL Analytics

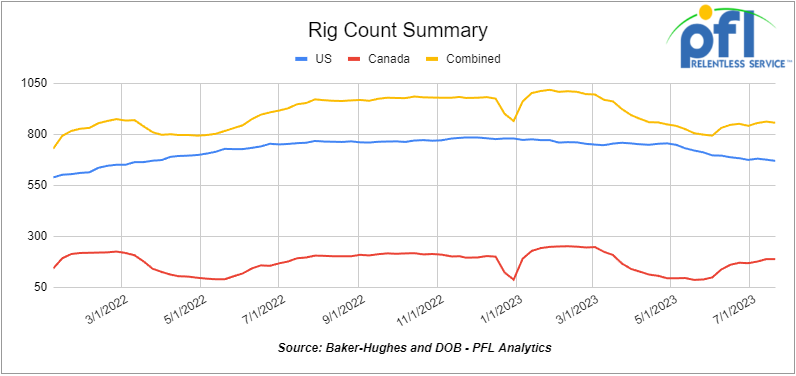

Rig Count

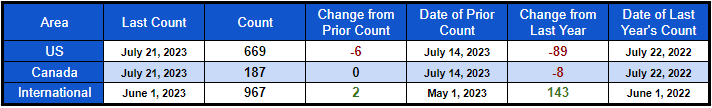

North American rig count was down by -6 rigs week over week. U.S. rig count was down by -6 rigs week over week and down by -89 rigs year-over-year. The U.S. currently has 669 active rigs. Canada’s rig count was flat week-over-week, but down by -8 rigs year over year. Canada’s overall rig count is 187 active rigs. Overall, year-over-year, we are down -97 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are watching The Biden Administration – DOE Attacking More Household Appliances

Don’t you just love late Friday news releases from Washington – well here we go again! The Biden administration unveiled a regulatory proposal late Friday targeting water heaters, the latest in a string of energy efficiency actions cracking down on home appliances. The Department of Energy (DOE) said its proposal would ultimately “accelerate deployment” of electric heat pump water heaters, save Americans billions of dollars and vastly reduce carbon emissions. If finalized, the proposed standards would force less energy efficient, but cheaper, water heaters off the market.

“Today’s actions, together with our industry partners and stakeholders, improve outdated efficiency standards for common household appliances, which is essential to slashing utility bills for American families and cutting harmful carbon emissions,” Energy Secretary Jennifer Granholm said in a statement.

“This proposal reinforces the trajectory of consumer savings that forms the key pillar of Bidenomics and builds on the unprecedented actions already taken by this Administration to lower energy costs for working families across the nation,” she continued.

In addition to water heaters, over the last several months, the DOE has unveiled new standards for a wide variety of other appliances including gas stoves, clothes washers, refrigerators and air conditioners. The agency’s comment period on a separate dishwasher regulatory proposal concluded Tuesday of last week. Consumers are having a tough time making ends meet as it is – how are they going to buy an electric car and all new appliances and stop cooking with Natural Gas? Your guess is as good as ours!

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 25,034 from 25,089, which was a loss of -55 rail cars week-over-week. Canadian volumes were mixed. CPKC’s shipments decreased by -5.9% week over week, and CN’s volumes were higher by +1.9% week-over-week. U.S. shipments were mostly higher. The NS had the largest percentage increase and was up by +15.8% week-over-week. The CSX was the sole decliner and was down by -1.8%.

We are watching Old Yeller and the Trucking Industry

The trucking industry has been severely impacted by an influx of operators during the pandemic, leading to an oversaturated market. As shipping rates surged in response to increased consumer demand and supply chain disruptions, many individuals rushed to start their own trucking businesses. However, the boom was short-lived, and as consumer spending eased and shipping volumes returned to pre-pandemic levels, competition among drivers intensified, causing shipping rates to plummet from around $1 per mile in profit to a mere 3 cents. To be sustainable, drivers typically need at least 40 cents per mile in profit to cover vehicle maintenance and repairs. Larger trucking firms that have contracts with retailers and shippers have also faced rate reductions but not as dramatically. As a result, around 15,000 trucking companies, including many owner-operators with single trucks, have been forced to shut down since October 2022.

Encumbered with debt, Yellow is the latest of major logistics firms to face economic devastation as labor strikes continue to sweep the continent. The internal conflict between the fifth-largest trucking carrier and the International Brotherhood of Teamsters is causing Yellow’s customer base to flock to competitors as they fear losing cargo in a bankruptcy. The company’s decision not to pay $50 million into the Teamsters’ pension fund is seen as a possible sign of their intention to file for bankruptcy soon.

The Teamsters union warned of an imminent strike after Yellow missed a healthcare and pension payment deadline, affecting 22,000 unionized workers. Yellow failed to secure a restraining order on Friday of last week to prevent the strike while the company tried to refinance its $1.3 billion debt, including a $700 million federal Covid relief loan.

Yellow holds about 9% of the less-than-truckload (LTL) industry’s total capacity, with a strong presence in the Midwest and the Northwest. If the carrier shuts down abruptly, it may take time for other carriers to absorb its volume.The direction of LTL contract rates over the next week will indicate the true capacity of LTL networks as they brace for the fourth quarter. LTL carriers may attempt to raise contract rates by 9% to 12% if Yellow’s capacity is removed from the market. We are watching this one folks, maybe we’ll see a shift to rail!

We are watching Labor Strikes across North America

Amidst a flurry of labor issues this summer, the ongoing strike of Hollywood writers and SAG-AFTRA, the union representing actors, is just one pressing concern. The labor movement in the United States is witnessing an unusually active moment, with several high-profile strikes on the horizon. The breakdown of negotiations between UPS and the Teamsters union, which are on the precipice of what could be an economically devastating strike as soon as August, could cost the company billions of dollars within a matter of days. Meanwhile, the United Auto Workers union is gearing up for negotiations with the Big Three automakers as their current contract is set to expire in September. In 2019, General Motors suffered a significant blow to its fourth-quarter profit when a 40-day UAW strike paralyzed U.S. operations, resulting in a staggering $3.6 billion loss. Unlike the Teamsters union who encourage the White House to “just keep walking” and not intervene with their efforts, the United Auto Workers union has made significant emphasis on gaining Washington’s support as a crucial element of their strategy to secure new labor agreements with the Detroit Three automakers. The automakers acknowledge their desire to reach an agreement, but they emphasize the need to adapt their companies to an electric vehicle-focused world. They anticipate that this transition will inevitably result in disruption for their current workforce.

The dockworkers’ union strike that initially closed the container ports of Vancouver and Prince Rupert, Canada, resumed after a tentative four-year contract agreement was rejected by the International Warehouse and Longshore Union (ILWU) Canada. The rejection prompted a renewed strike, impacting shipping activities in the ports once again. Intervention from the Canadian government forced workers to cease their strike because 72 hours’ notice was not given. The ILWU then stated that a tentative agreement had been reached with the B.C. Maritime Employers Association (BCMEA), and an “emergency contract caucus” will be held to decide whether to send the deal to the full union membership for ratification.

These ports are crucial to the American supply chains as containers pass through them and are shipped via rail to U.S. destinations like Chicago. Goods worth $6.5 billion were anchored offshore the Canadian ports this week and affected Canadian rail car loadings once again. During the previous strike from July 1st to 13th, there was a significant drop in container volume shipped out of these ports, and now with the strike back on, rail flows to the U.S. are expected to be affected yet again. On top of all this, we have UPS workers threatening the largest strike in history – We get it they want more money.

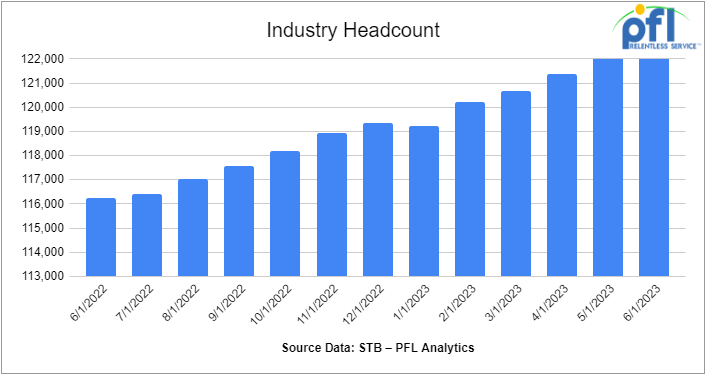

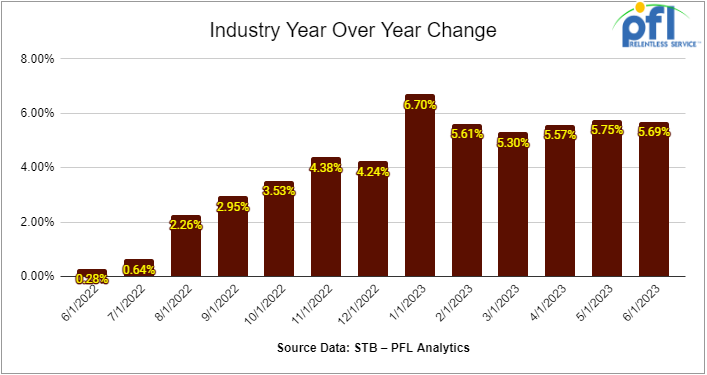

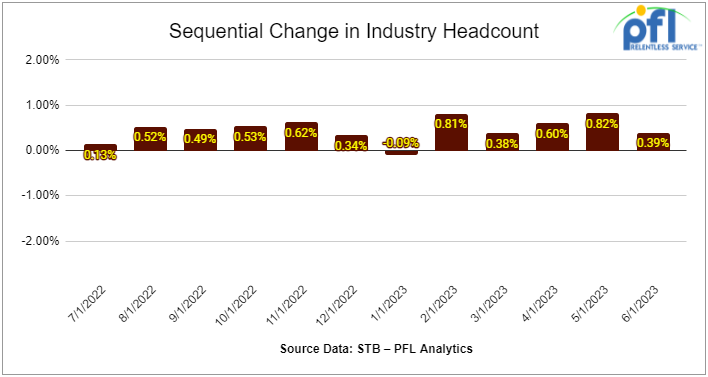

We are watching Class 1 Industry Headcount

Headcount at the Class 1’s continues to accelerate at the same time rail traffic continues to soften – we have seen increased levels of service and are expecting to see this trend to continue at least in the short term. Below is the latest and greatest:

We have been extremely busy at PFL with return-on-lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

Lease Bids

- 20-30, 14k Any Tanks needed off of BNSF, UP in Texas for 1-3 Years. Cars are needed for use in HCl service. Call for more details

- Up to 60, 5150cf Covered Hoppers needed off of CN, CSX, NS in the east or midwest for 3 years. Cars are needed for use in Fertilizer service. 3-4 hatch gravity dumps

- 30-50, 30K 117 Tanks needed off of any class 1 in Northeast or Midwest for 1 Year. Cars are needed for use in C5 service. Must have Magrods

- 10, any capacity Stainless Steel Tanks needed off of any class 1 in Canada for 5-10 years. Cars are needed for use in Alcohol service.

- 25-50, 5000CF-5100CF Lined Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in dry sugar service. 3 bay gravity dump

- 25, 20.5K CPC1232 or 117J Tanks needed off of BNSF or UP in the west for 3-5 Year. Cars are needed for use in magnesium chloride service. SDS onhand

- 25-50, 25.5K 117J Tanks needed off of NS CSX in NorthEast for 5 Years. Cars are needed for use in Asphalt/Heavy Fuel Oil service.

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

- 30-40, 286K DOT 113 Tanks needed off of CN or CP/ UP in Canada/MM for 5 Years. Cars are needed for use in CO2 service. Q1

- 30, 30K DOT 111 Tanks needed off of UP in Texas for 1-3 Years. Cars are needed for use in Diesel service.

- 5-7, 28.3K 117R Tanks needed off of NS or CSX in NC for 1 Year. Cars are needed for use in UCO service.

- 70, 32K 340W Pressure Tanks needed off of CP or CN in Edmonton for 3 Years. Cars are needed for use in Propane service.

- 25-50, 32K 340W Pressure Tanks needed off of NS or CSX in Marcellus for 1-2 Years. Cars are needed for use in Propane service.

- 25-50, 30K DOT 111, 117, CPC 1232 Tanks needed off of CN or CP in WI, Sarnia for 1-2 Years. Cars are needed for use in Diesel service.

- 10, 286K 15.7K Tanks needed off of KCS in Texas for 1 Year. Cars are needed for use in Sulfuric Acid service. Needed Next few months

- 150, 23.5K DOT 111 Tanks needed off of any class 1 in LA for 2-3 Year. Cars are needed for use in Fluid service. Needed July

- 100, 33K 340W Pressure Tanks needed off of CN in Canada for 3-5 Years. Cars are needed for use in Propane service.

- 30, 17K-20K 117J Tanks needed off of UP or BN in Midwest/West Coast for 3-5 Years. Cars are needed for use in Caustic service.

- 45, 3000 cf PDs Hoppers needed off of any class 1 in Texas for 3 years. Cars are needed for use in Any service.

- up to 50, 31.8K 117J, 117R, CPC 1232 Tanks needed off of any class 1 in Texas or Ohio for 1-3 years. Cars are needed for use in Diesel/Gasoline service.

- 100, 30K 117J Tanks needed off of CN in Detroit for 1 Year. Cars are needed for use in Refined Fuel service.

- 60-150, 30K 117J Tanks needed off of TYR, UP in Corpus Christi, TX for 1 year. Cars are needed for use in Diesel service.

- 30-50, 33K 340W Pressure Tanks needed off of any class 1 in any location for 6-12 Months. Cars are needed for use in Propane service.

- 15, 28.3K 117J Tanks needed off of any class 1 in any location for 3 year. Cars are needed for use in Glycerin & Palm Oil service.

- 25-50, 25.5K 117J, 117R, CPC 1232 Tanks needed off of UP or BN in Texas for 1-2 Years. Cars are needed for use in Asphalt service.

- 10, 33K 340W Pressure Tanks needed off of CN in LA for 1 Year. Cars are needed for use in Butane service.

- 50-100, 4550 Covered Hoppers needed off of UP or BN in Texas for 5 Years. Cars are needed for use in Grain service.

- 25-50, 33K 400W Pressure Tanks needed off of CN or CP in Canada for Short Term. Cars are needed for use in Propylene service.

- 100, 28.3K DOT 111/117 Tanks needed off of UP or BN in Midwest/Texas for 5 Years. Cars are needed for use in Veg Oils/Biodiesel service. Need to be Unlined

- 20-25, 30K 117 Tanks needed off of UP or BN in Illinois for 5 Years. Cars are needed for use in Ethanol service.

- 10, 30K 117 Tanks needed off of NS or CSX in Marcellus for Trip Lease. Cars are needed for use in C5 service.

- 25, 33K 340W Pressure Tanks needed off of UP or BN in Midwest for Oct-March. Cars are needed for use in Propane service.

- 15, 30K 117 Tanks needed off of NS in SouthEast for 1 Year. Cars are needed for use in Diesel service.

Sales Bids

- 1-2, Any DOT 111, 117, CPC 1232 Tanks needed off of any class 1 in Texas. Coiled and Insulated

- 45, 3000 cf PDs Hoppers needed off of any class 1 in Texas. Negotiable

- 20-25, 25.5K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Texas. Cars are needed for use in Veg Oil service. Coiled and insulated

- 15, 30K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Texas. Cars are needed for use in Veg Oil service.

- 2-4, 28K DOT 111 Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

- 100, Plate F Boxcars needed off of BN or UP in Texas.

- 200+, 5000cf Covered Hoppers needed off of any class 1 in various locations.

- 20-30, 3000 – 3300 PDs Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 100, 15.7K DOT 111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT 111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

- 20, 2770 Mill Gondolas needed off of CSX in the northeast. Cars are needed for use in non-haz soil service. 52-60 ft

- 10, 4000 Open Hoppers needed off of CSX in the northeast. Cars are needed for use in scrap metal service. Open top hopper

- 10, 6400 Open Hoppers needed off of CSX in the northeast. Cars are needed for use in wood chip service. Open top hopper, flat bottom

Lease Offers

- 70, 25.5K, 117J Tanks located off of UP in Texas. Cars are clean Call for more information

- 30, 23.5K, DOT111 Tanks located off of UP or BN in Texas. Cars were last used in Clean / UAN.

- 25-100, 17.6K, DOT111 Tanks located off of UP or BN in Midwest. Cars were last used in Fertilizer / Corn Syurp. Free move available

- 20, 20k, DOT111 Tanks located off of CSX in GA. Cars are clean

- 2, 20K, DOT111 Tanks located off of UP in TX. Cars are clean

- 5, 20K, DOT111 Tanks located off of UP in TX. Cars were last used in Sulfuirc Acid. Free move available

- 108, 28.3K, 117R Tanks located off of All Class 1’s in St. Louis. Cars are clean

- 10, 6500, Covered Hoppers located off of UP and BN in Iowa. Cars are clean

- 5, 6300, Covered Hoppers located off of in Across US.

Sales Offers

- 100-200, 31.8K, CPC 1232 Tanks located off of BN in Chicago. Dirty/Clean

- 100, 28.3K, 117J Tanks located off of various class 1s in multiple locations.

- 110, 25.5K, DOT 111 Tanks located off of UP and BN in Moving. Dirty, Food Grade

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|