“Your own path you make with every step you take. That’s why it’s your path”

– Joseph Campbell

Jobs Update

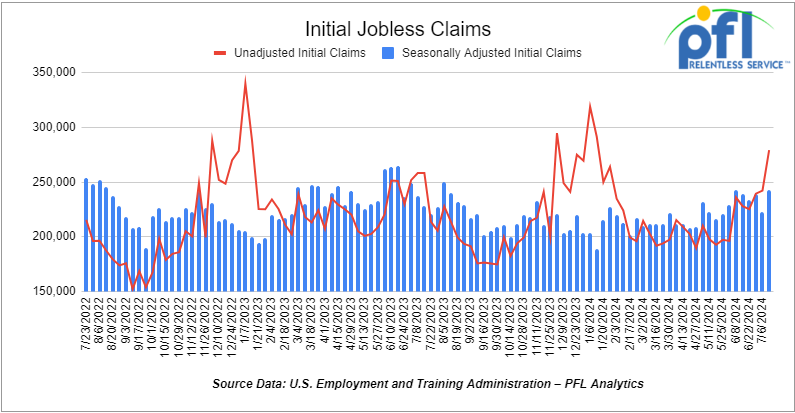

- Initial jobless claims seasonally adjusted for the week ending July 13th, 2024 came in at 243,000, up 20,000 people week-over-week.

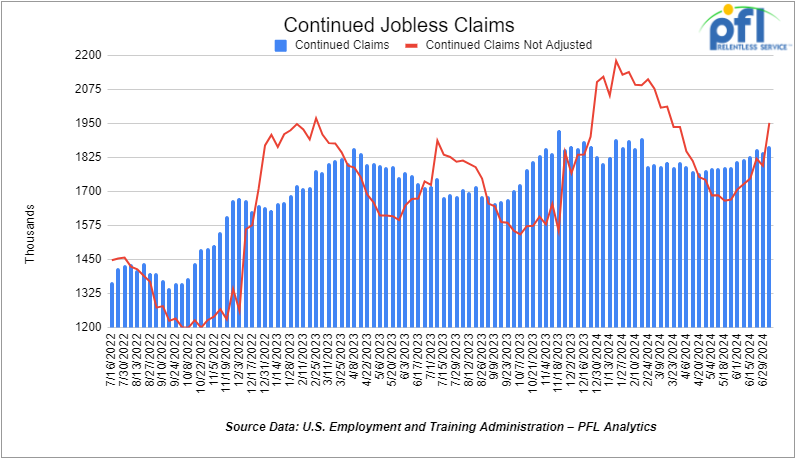

- Continuing jobless claims came in at 1.867 million people, versus the adjusted number of 1.847 million people from the week prior, up 20,000 people week-over-week.

Stocks closed lower on Friday of last week, but mixed week over week

The DOW closed lower on Friday of last week, down -377.49 points (-0.93%), closing out the week at 40,287.63, up 486.63 points week-over-week. The S&P 500 closed lower on Friday of last week, down -39.59 points (-0.71%), and closed out the week at 5,615.35, down -110.35 points week-over-week. The NASDAQ closed lower on Friday of last week, down 144.28 points (-0.78%), and closed out the week at 17,726.94, down -671.51 points week-over-week.

In overnight trading, DOW futures traded higher and are expected to open at 40,605 this morning up 43 points.

Crude oil closed lower on Friday of last week and lower week over week.

WTI traded lower -$2.69 per barrel (-3.3%) on Friday of last week, to close at $80.13 per barrel, down $2.08 per barrel week-over-week. Brent traded down -US$2.48 per barrel (-2.9%) to close at US$82.62 per barrel on Friday of last week, down US$2.41 per barrel week-over-week.

One Exchange WCS (Western Canadian Select) for September delivery settled Friday of last week at US$13.90 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$ 65.72 per barrel.

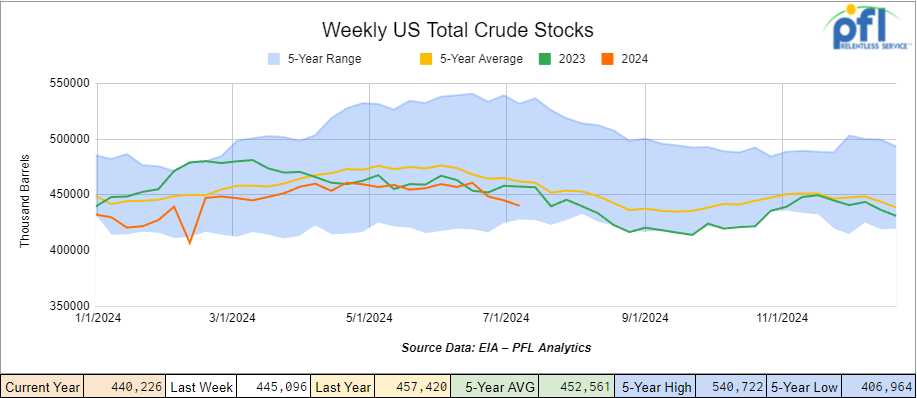

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 4.9 million barrels week-over-week. At 440.2 million barrels, U.S. crude oil inventories are 5% below the five-year average for this time of year.

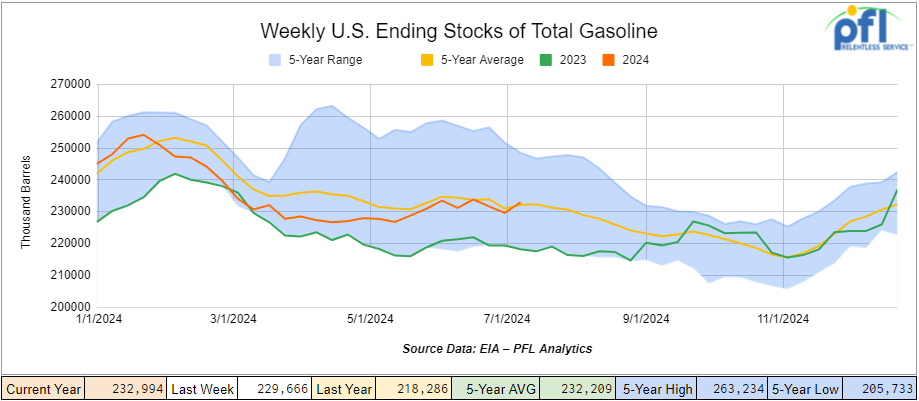

Total motor gasoline inventories increased by 3.3 million barrels week-over-week and are slightly above the five-year average for this time of year.

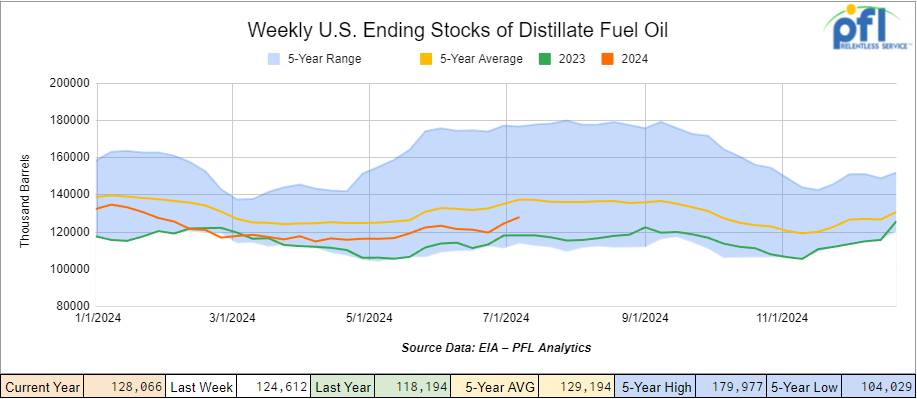

Distillate fuel inventories increased by 3.5 million barrels week-over-week and are 7% below the five-year average for this time of year.

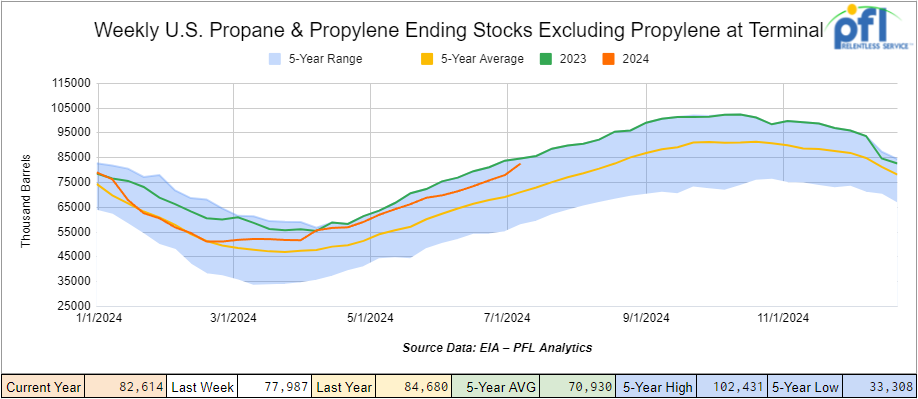

Propane/propylene inventories increased by 4.6 million barrels week-over-week and are 16% above the five-year average for this time of year.

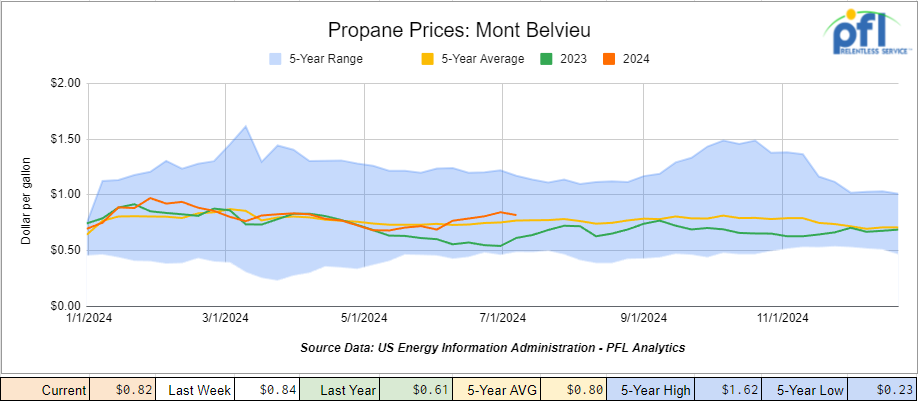

Propane prices closed at 82 cents per gallon, down 2 cents week-over-week, and up 21 cents year-over-year.

Overall, total commercial petroleum inventories increased by 10.4 million barrels during the week ending July 12th, 2024.

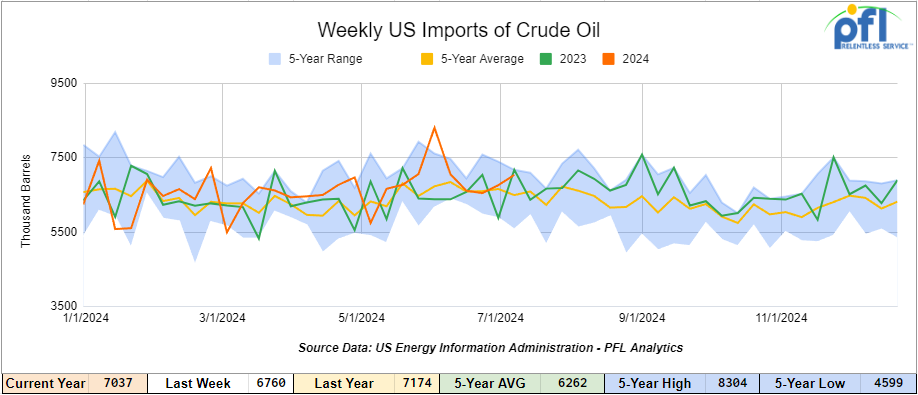

U.S. crude oil imports averaged 7 million barrels per day during the week ending July 12th, 2024, an increase of 277,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.7 million barrels per day, 1.1% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 728,000 barrels per day, and distillate fuel imports averaged 108,000 barrels per day during the week ending July 12th, 2024.

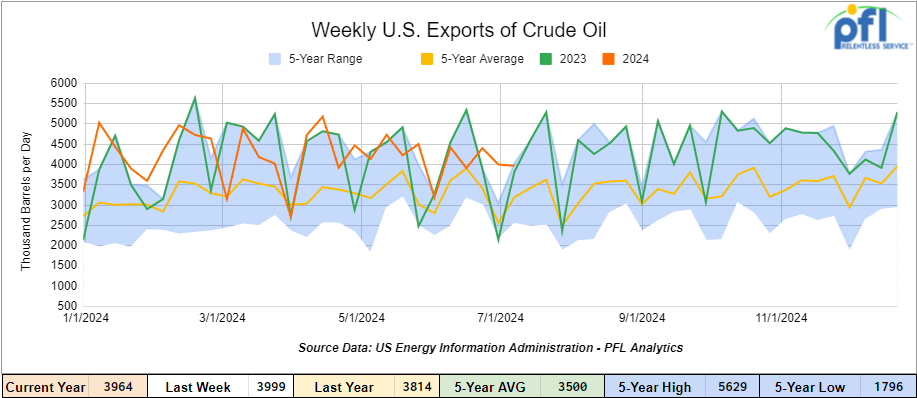

U.S. crude oil exports averaged 3.964 million barrels per day for the week ending July 12th, 2024, a decrease of -35,000 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 4.069 million barrels per day.

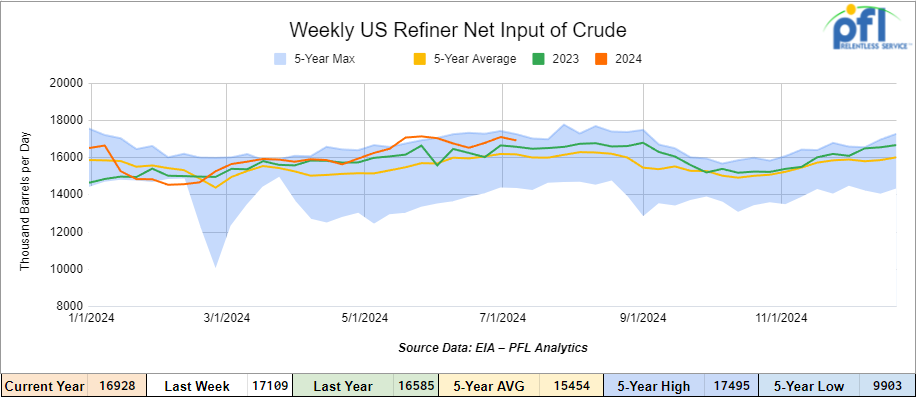

U.S. crude oil refinery inputs averaged 16.9 million barrels per day during the week ending July 12, 2024, which was 181,000 barrels per day less week-over-week.

WTI is poised to open at $79.94, down 19 cents per barrel from Friday’s close.

North American Rail Traffic

Week Ending July 17th, 2024.

Total North American weekly rail volumes were up (1.71%) in week 29, compared with the same week last year. Total carloads for the week ending on July 17th were 334,297, down (-0.03%) compared with the same week in 2023, while weekly intermodal volume was 327,148, up (+7.06%) compared to the same week in 2023. 7 of the AAR’s 11 major traffic categories posted year-over-year increases. The most significant decrease came from Motor Vehicles and Parts, which was down (-19.59%). The most significant increase came from Grain which was up (+30.48%).

In the East, CSX’s total volumes were up (1.85%), with the largest decrease coming from Motor Vehicles and Parts (-18.22%) while the largest increase came from Grain (25.55%). NS’s volumes were up (5.41%), with the largest increase coming from Other (+23.9%) while the largest decrease came from Motor Vehicles and Parts (-25.8%).

In the West, BN’s total volumes were up (3.87%), with the largest increase coming from Grain (50.87%) while the largest decrease came from Coal down (-24.98%). UP’s total rail volumes were down (-3.32%) with the largest decrease coming from Coal, down (-25.89%) while the largest increase came from Grain which was up (+20.27%).

In Canada, CN’s total rail volumes were up (5.51%) with the largest decrease coming from Motor Vehicles and Parts, down (-36.16%) while the largest increase came from Other, up (+47.22%). CP’s total rail volumes were up (6.13%) with the largest increase coming from Grain (+74.36%) while the largest decrease came from Motor vehicles and Parts, down (-36.91%).

KCS’s total rail volumes were down (-11.91%) with the largest decrease coming from Nonmetallic Minerals (-45.2%) and the largest increase coming from Farm Products (+92.19%).

Source Data: AAR – PFL Analytics

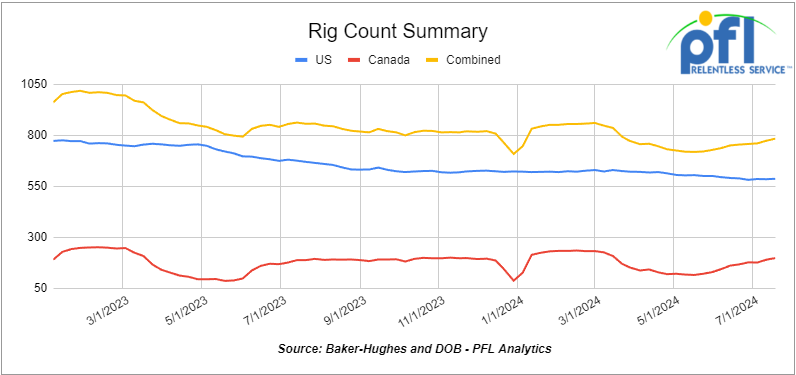

Rig Count

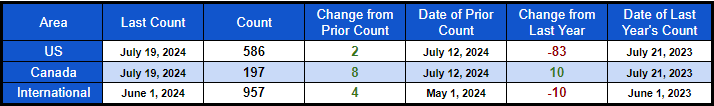

North American rig count was up by 10 rigs week-over-week. U.S. rig count was up by 2 rigs week-over-week, and down by -83 rigs year-over-year. The U.S. currently has 586 active rigs. Canada’s rig count was up by 8 rigs week-over-week, and up by 10 rigs year-over-year. Canada’s overall rig count is 197 active rigs. Overall, year-over-year, we are down -73 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 27,872 from 28,293, which was a loss of 421 rail cars week-over-week. Canadian volumes were lower. CPKC’s shipments fell by – 6.4% week over week, CN’s volumes were lower by -0.2% week-over-week. U.S. shipments were mostly lower. The NS was the sole gainer and was up by 20.4%. The BN had the largest percentage decrease and was down by -8.0%

We are watching the Biden Administration as it mulls over more Alaska drilling protections

The Biden Administration continues to target anything oil forcing us to buy more foreign-produced oil from countries that really don’t like us, resulting in higher prices at the pump and American jobs being sent overseas. The Biden administration is now seeking input on whether to add more areas for protection from oil and gas drilling in Alaska’s National Petroleum Reserve, the Interior Department’s Bureau of Land Management (“BLM”) announced on Friday of last week.

The BLM will take public comment on whether to update protected areas in the Western Arctic, including whether to create new protected areas and modify the existing boundaries of the NPR-A.

“With the rapidly changing climate, the Special Areas are increasingly critical to caribou movement and herd health, as well as other wildlife, migratory birds, and native plants,” BLM Director Tracy Stone-Manning said. We want to hear from the public to ensure we are managing the western Arctic’s significant resource values in the right ways and right places.”

Earlier this month, the state of Alaska filed a lawsuit challenging new federal regulations imposed for oil and gas leasing in the NPR-A in April.

Current regulations had blocked development on 40% of NPR-A to protect wildlife habitat and indigenous communities’ way of life, but did not affect existing oil and gas operations.

The NPR-A is a 23 million-acre (9.3 million hectare) area on the state’s North Slope that is the largest tract of undisturbed public land in the United States.

The comment period will last 60 days.

We are Watching Natural Gas

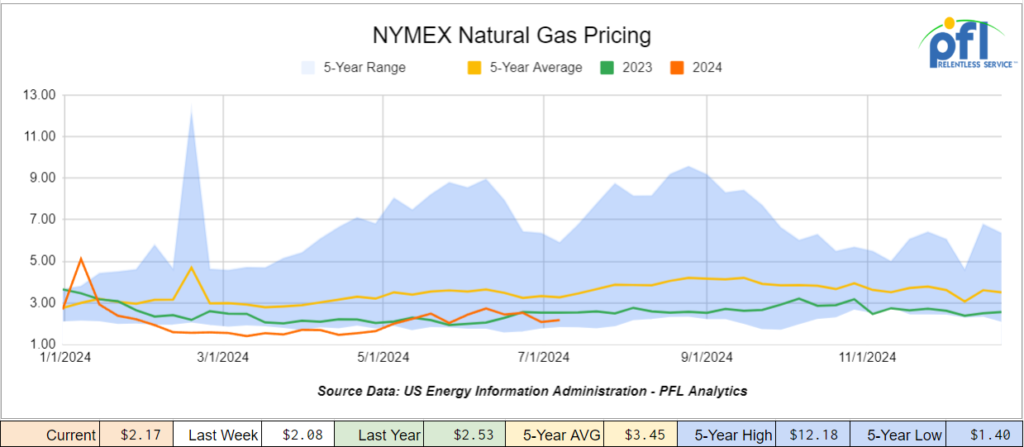

Despite high international prices in Europe and Asia, we are swimming in the clean-burning fuel here in North America. The average Liquified natural gas (“LNG”) price for September delivery into north-east Asia closed at roughly $12.20/mmBtu on Friday of last week. Meanwhile, natural gas here in the U.S. closed at $2.13/mmBtu for August delivery and $2.17/mmBtu for September. (See Chart below:)

Hurricane Beryl did not help the natural gas producer as Freeport LNG in Texas, just south of Houston, halted operations on July 7 before Hurricane Beryl made landfall. Beryle caused power outages and infrastructure damage to ports and energy companies in the area. Freeport LNG began to develop the liquefaction project in 2010. Freeport processes and exports and equivalent of 2 bcf per day utilizing three production units (or trains). An additional LNG train (Train 4) is under development.

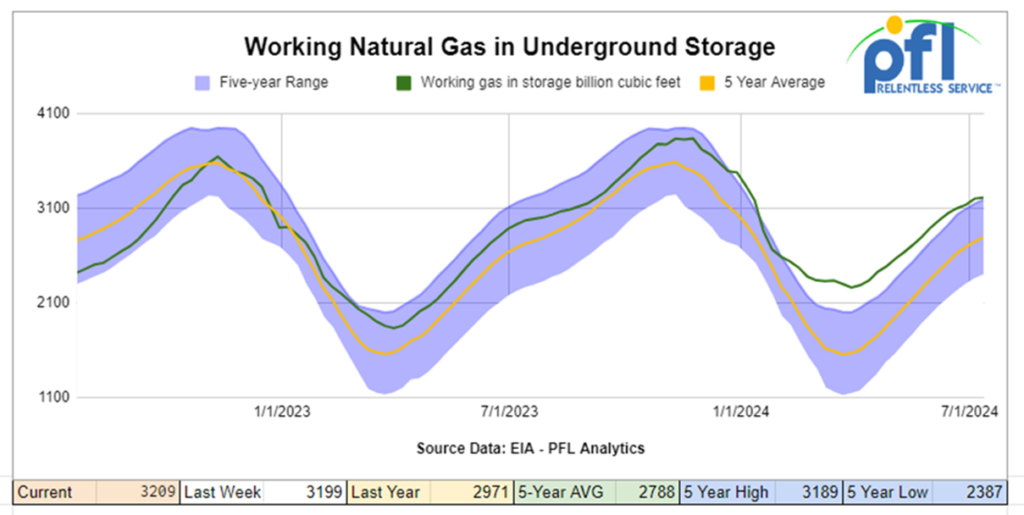

The Freeport LNG export terminal in Texas has canceled at least 10 cargoes for loading through August after Hurricane Beryl forced the facility to shutter, representing one months’ worth of production. That number is expected to keep rising as long as the facility is not at full capacity. Gas delivered by pipeline into Freeport was at less than a third of normal on Thursday of last week, indicating most of the terminal is still offline. Meanwhile, storage levels here in the U.S. continue to swell. Natgas in storage is above the five-year average for this time of year and well above last year’s levels. (See Chart below:)

Hope is not lost for clean-burning natural gas despite failed federal government policies here in the U.S. and Canada. Companies, States and Provinces are fighting back against the Green New Deal and climate activists and winning albeit slowly. Alberta will have an additional 2,700 MW of gas-fired electricity-generation capacity come online during 2024, and the state of Texas is about to embark on the largest natural gas generation program that state has ever seen. Canada will be adding significant LNG capacity in the province of British Columbia for export to Asia that comes online in 2026. There is a battle in Texas where proposed LNG facilities are continually being thrown back to the public for comment – this nonsense will end soon. The bottom line is we need increased electricity generation and there is no other way to quickly add it that can make everybody happy other than clean burning natural gas. Wind and solar are not going to do it – look at the latest regarding The Vineyard wind project off the coast of Massachusetts.

The Vineyard Wind offshore wind project off the coast of Massachusetts is shut down until further notice while authorities investigate a turbine blade failure that caused debris to wash up on beaches, a federal agency said on Tuesday of last week.

The U.S. Bureau of Safety and Environmental Enforcement (BSEE) said it was working closely with Vineyard Wind to determine the cause of the incident, which left potentially dangerous debris on beaches on the island of Nantucket.

“There were no injuries reported, but operations are shut down until further notice,” a BSEE spokesperson said in an emailed statement.

The incident is a blow to both Vineyard Wind, the first major U.S. offshore wind farm, and the nation’s offshore wind industry. The sector is regarded as “critical” to meeting President Joe Biden’s climate change goals but has been struggling with soaring costs and delays. Whales that were washing up on the beaches of the east coast in the area don’t seem to like the project, but no one really talks about that.

Vineyard Wind said the turbine’s manufacturer, GE, would analyze the root cause of the incident. The turbine was in its commissioning phase and was still undergoing testing, according to a company spokesperson Craig Gilvarg.

“In some areas, significant sharp debris has been observed floating in the water and is often hidden beneath the surface. Small fragments along the shoreline can pose a considerable hazard to swimmers and beachgoers,” the statement said.

The incident came during the busy summer tourist season when the island’s population swells to 80,000 from its usual 14,000.

The outlook for natural gas demand is strong – 2025 could be a great year for the producer and the U.S. consumer. We think we hit bottom and common sense will raise its head in the not-so-distant future – stay tuned to PFL for further details.

We are watching Canada’s New Greenwashing Law

Bill C-59 in Canada is an attack on free speech, government overreach the likes of which we have never seen before and thought it important for our readers to know about. How we fight back against such an overreach is anyone’s guess. As many in the natural resources sector are all too aware, in late June, Parliament passed a new anti-greenwashing law as part of its amendments to the Competition Act buried in the Bill C-59 Fall Economic Statement Implementation Act.

The new misleading advertising provision targeting greenwashing creates significant risk for companies who want to make statements regarding their efforts to mitigate the environmental impact of their business. This law specifically targets enterprise-level environmental statements, including net-zero and carbon-neutral claims, among others.

As a result, companies are now grappling with how to comply with a broad, vaguely worded law that could give rise to potential monetary penalties for contraventions of up to three percent of gross worldwide revenues.

The new law applies to all of a company’s statements relating to the benefits of their activities for “protecting or restoring the environment or mitigating the environmental and ecological causes or effects of climate change.” The law further provides that such statements must be “based on adequate and proper substantiation in accordance with internationally recognized methodology.” Further, companies now bear the onus of proving that their environmental statements meet this vague new standard, which is not defined.

In addition to facing possible enforcement actions from the Commissioner of Competition, private parties will be able to bring cases to the Competition Tribunal as of June 20, 2025.

While the Commissioner generally makes sensible enforcement decisions and is prepared to settle cases on a reasonable basis, this is not likely to be the case for environmental activist groups or other private litigants who often have a strategic agenda. Although private parties will need to obtain leave from the Tribunal to have their cases heard on the merits, they must simply show that their case is “in the public interest” — another entirely new standard for this context and one that may be easily met.

What is interesting is that the Commissioner of Competition did not ask for this amendment. While the Commissioner raised the issue of preventing inaccurate enterprise-level environmental claims in his comments to the Standing Committee on Finance, he recommended that further study should be done to consider whether such a provision should be added.

Instead, this new provision was quietly added to the bill without study or thoughtful consideration of both its intended and unintended consequences. There was almost no consideration given to the cumulative effects of a vague new law combined with potentially significant fines, no delayed entry into force, and the creation of a private right of enforcement. The combination of these factors creates significant risk for companies increasingly pressured by governments, regulators and stakeholders to make statements regarding their environmental mitigation efforts. This is particularly the case for energy producers, several of whom have been targeted by environmental activists. Stay tuned to PFL we are watching this one – again hoping for common sense to come into play here at some point.

Lease Bids

- 25-50, 5000CF-5100CF Covered Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in Dry sugar service. 3 bay gravity dump, Hempel 37700

- 4, 6260 Covered Hoppers needed off of CSX in Bostick, NC for 2-4 Years. Cars are needed for use in Polypropene Pellets service.

- 20, 4750’s Through Hatch Covered Hoppers needed off of UP BN in USA West for 3 years. Cars are needed for use in Fertilizer service.

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 250, 4000 Rapid Hoppers needed off of BNSF in TX IL for 5 years. Cars are needed for use in Coal service. in rotary/rapid cars with the electric dumping shoe

- 150, 23.5K DOT111 Tanks needed off of any class 1 in LA for 2-3 years. Cars are needed for use in Fluid service. Needed July

- 30, 17K-20K DOT117J Tanks needed off of UP or BN in Midwest/West Coast for 3-5 years. Cars are needed for use in Caustic service.

- 15, 28.3K DOT117J Tanks needed off of any class 1 in any location for 3 years. Cars are needed for use in Glycerin & Palm Oil service.

- 25, 20.5K CPC1232 or DOT117J Tanks needed off of BNSF or UP in the west for 3-5 years. Cars are needed for use in Magnesium chloride service. SDS onhand

- 10, 30k any type Tanks needed off of UP BN in Texas for 1 year plus. Cars are needed for use in Fuel Oil service.

- 14, 23.5K DOT111 Tanks needed off of UP in Morrilton, AR for 1 year. Cars are needed for use in Turpentine service.

- 8, 28-30K any type Tanks needed off of UP BN in Texas and Gulf for 5 years. Cars are needed for use in Chlorobenzene service. Need Magrods

- 10, 28.3K 117J Tanks needed off of UP or BN in Texas for 3 Year.

- 25-30, 23.5K or 25.5K Dot 111 or CPC 1232 Tanks needed off of UP or BN in TX, OK, or AR for 3-5 Years. Cars are needed for use in Asphalt service. Needed ASAP., Lined or Unlined. Splash Load

- 10, 25.5K-28.3K DOT 111 Tanks needed off of UP or BN in Houston for 2 Year. Cars are needed for use in Resin service.

- 30, 29K 117J Tanks needed off of BN or CN in Houston or Edmonton for 1-2 Year. Cars are needed for use in Biodiesel service.

- 100, 25.5K DOT 111 Tanks needed off of Any Class 1 in Texas for 3 Years +. Cars are needed for use in Asphalt service.

- 20, 25.5k CPC 1232 Tanks needed off of UP or BN in OK, TX for 3 Year. Cars are needed for use in Asphalt service.

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

- 50, 30K 117 Tanks needed off of BNSF or UP in TX for 3-6 Months. Cars are needed for use in Crude service. will look at smaller cars. Prefer short term would look at longer term. Domestic use only

- 100, 15.5K DOT 111 Tanks needed off of Any Class 1 in USA for 1-3 Years. Cars are needed for use in Molten Sulfur service.

- 80, 25.5K-29K any type Tanks needed off of NS or CSX in Northeast for 1-5 Years. Cars are needed for use in Crude service.

- 200, 30K any type Tanks needed off of UP or BN in Texas for RD. Cars are needed for use in Dirty service.

- 15-20, 29K 117R Tanks needed off of NS or CSX in Ohio for 6-12 Months. Cars are needed for use in Ply Oil service.

- 25, 25.5K DOT 111 Tanks needed off of UP in LA for 1-5 Years. Cars are needed for use in Lubricant service.

- 30, 33K Pressure Tanks needed off of Any Class 1 in Any Location for 6 Months. Cars are needed for use in Propane service. Needed for Winter

- 50, 23.5-25.5 DOT111 Tank s needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

- 10, 25.5 117J Tanks needed off of All class ones in Chicago for Epoxy Resin. Cars are clean 5 years

Sales Bids

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Sand service.

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 20-30, 3000 – 3300 PD Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 20-30, Open Top Hoppers needed off of NS or CSX in Northeast. Cars are needed for use in aggregate service. Gravity dump

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 2-4, 28K DOT111 Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

- 100, 15.7K DOT111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

- 5, 30K DOT 111 Tanks needed off of in US. Cars are needed for use in Fuels service.

- 5, 23,5K DOT 111 Tanks needed off of any class 1 in Texas. Negotiable

Lease Offers

- 200-500, 5200, Covered Hoppers located off of CN and NS in Moving on CN and NS. Cars were last used in Grain. Lease available until Fall.

- 50, ~5400, Covered Hoppers located off of NS, IORY in MI. Cars were last used in bean meal. 1 year+

- 53, 2 containers, Flats Double-stack rail transports located off of KCS in Texas. Cars are clean Lease or sell. (Intermodal Container)

- 15, 33K, 340W Pressure Tanks located off of All Class Ones in North America. Cars were last used in Propane/Butane. Up to 1 year.

- 5, 25.5K, DOT 111 Tanks located off of UP in Kansas. Cars were last used in Veg Oils. 2 Year Term

Sales Offers

- 24, 5300CF, Plate C Boxcars located off of NS or CSX in Southeast.

- 100-300, 3400, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 19, 4400, Rotary Gondolas located off of UP and BN in California and Wyoming.

- 100, 28.3K, DOT117J Tanks located off of various class 1s in multiple locations.

- 7, 30K, DOT 111 Tanks located off of UP in TX, CA, NM.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|

PFL will be at the Following Conferences

- Where: La Quinta, CA

- Attending: David Cohen (954-729-4774)

- Conference Website

- Where: Hyatt Regency Dallas in Dallas, TX

- Attending:Curtis Chandler (239.405.3365), David Cohen (954-729-4774), Brian Baker (239.297.4519), Cyndi Popov(403) 402-5043

- Conference Website