“Our work is the presentation of our capabilities”. – Edward Gibbon

Jobs Update

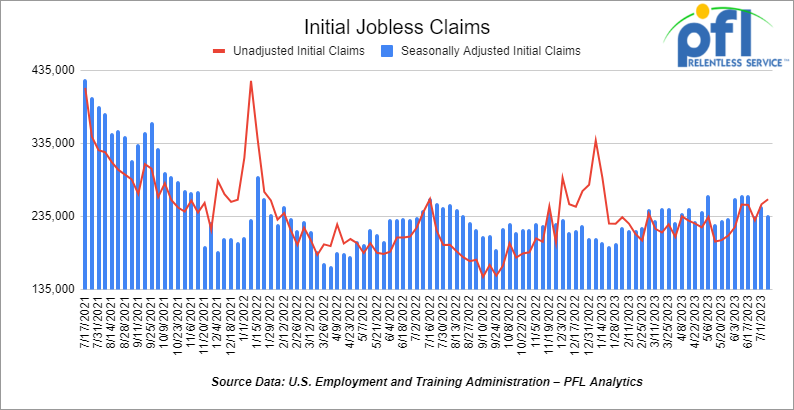

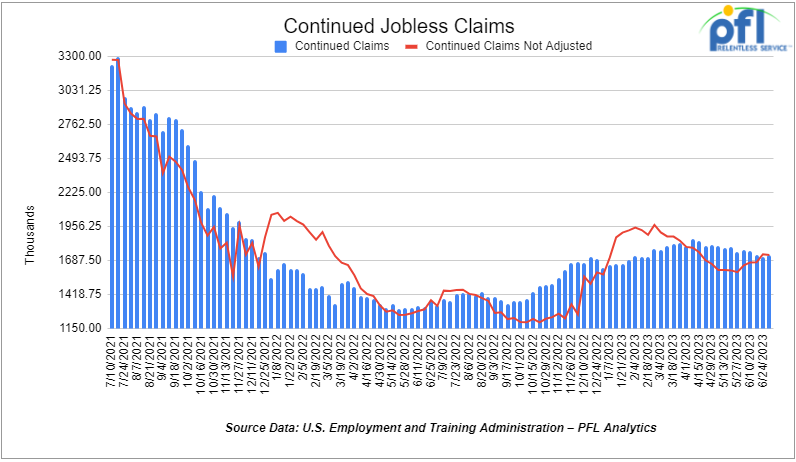

- Initial jobless claims for the week ending July 8th, 2023 came in at 237,000, down -12,000 people week-over-week.

- Continuing jobless claims came in at 1.729 million people, versus the adjusted number of 1.718 million people from the week prior, up 11,000 people week over week.

Stocks closed mixed on Friday of last week and higher week over week

The DOW closed higher on Friday of last week, up 113.89 points (0.33%), closing out the week at 34,509.03, up 774.15 points week over week. The S&P 500 closed lower on Friday of last week, down -4.62 points (-0.1%) and closed out the week at 4,505.42, up 106.47 points week over week. The NASDAQ closed lower on Friday of last week, down -24.87 points (-0.18%), and closed the week at 14,113.7, up 452.98 points week over week.

In overnight trading, DOW futures traded lower and are expected to open at ______ this morning down ____ points.

Crude oil closed down on Friday of last week, but higher week over week

Crude oil prices declined Friday as the U.S. dollar strengthened and traders took profits from a recent rally, with crude benchmarks on track for a third consecutive weekly increase. Profit-taking was attributed to renewed concerns about demand and the potential rebound of the dollar. However, many anticipate that the rally could resume next week due to easing inflation, plans to refill the U.S. strategic reserve, supply cuts from OPEC, disruptions in other regions, and reduced Russian oil exports in August. Last week revealed a weekly gain of more than 2% as supply disruptions in Libya and Nigeria raised concerns about tightening markets.

WTI traded down -$1.47 per barrel (-1.9%) to close at $75.42 per barrel on Friday of last week, up $1.56 per barrel week over week. Brent traded down -US$1.73 per barrel (-1.8%) on Friday of last week, to close at US$79.87 per barrel, up US$1.40 per barrel week over week.

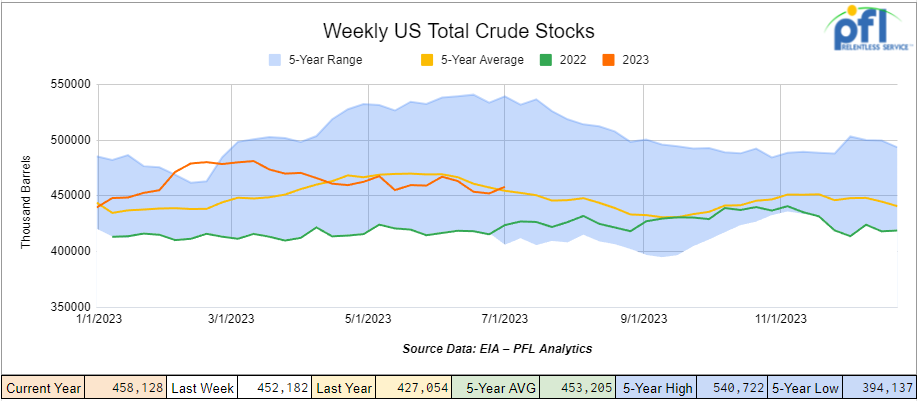

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 5.9 million barrels week over week. At 458.1 million barrels, U.S. crude oil inventories are 1% above the five-year average for this time of year.

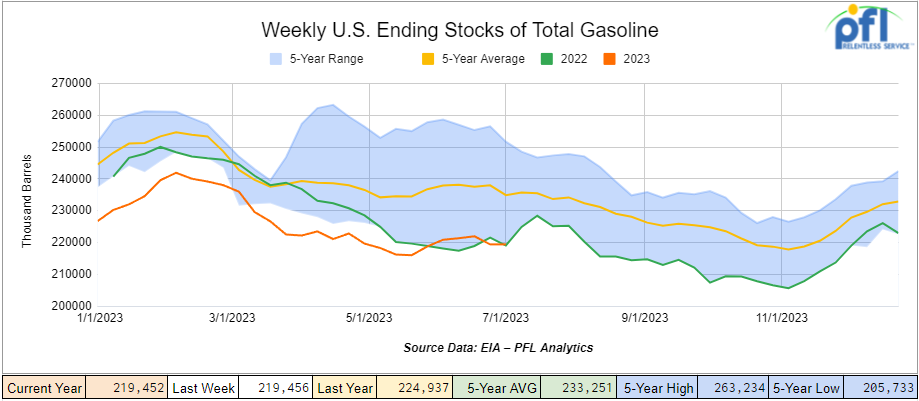

Total motor gasoline inventories slightly decreased week over week and are 7% below the five-year average for this time of year.

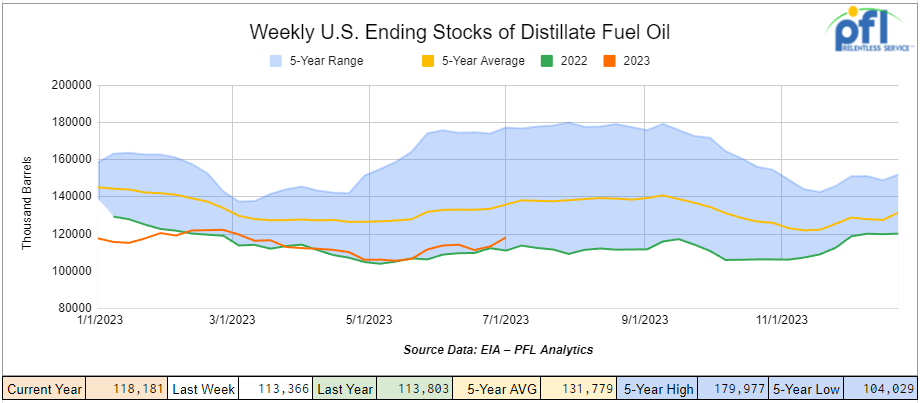

Distillate fuel inventories increased by 4.8 million barrels week over week and are 14% below the five-year average for this time of year.

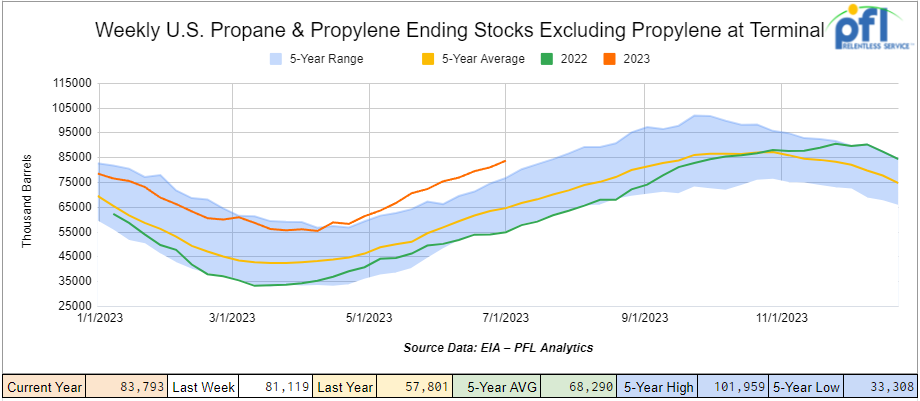

Propane/propylene inventories increased 2.7 million barrels week over week and are 26% above the five-year average for this time of year.

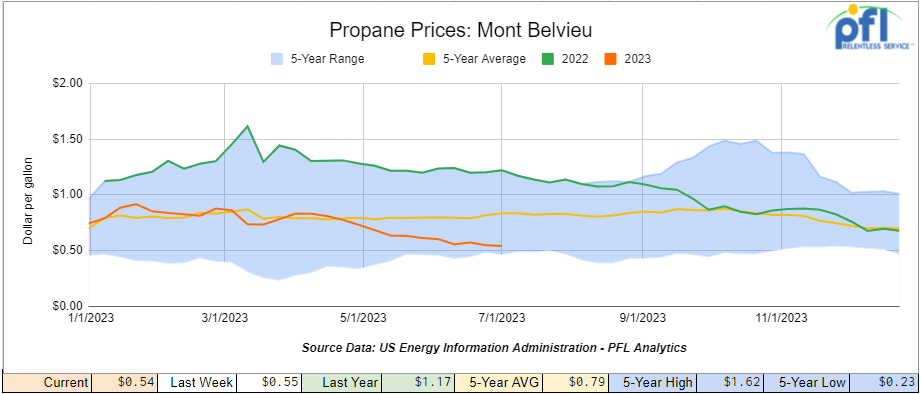

Propane prices closed at 54 cents per gallon, down 1 cent per gallon week over week and down 63 cents per gallon year over year

Overall, total commercial petroleum inventories increased by 17 million barrels during the week ending July 7th, 2023.

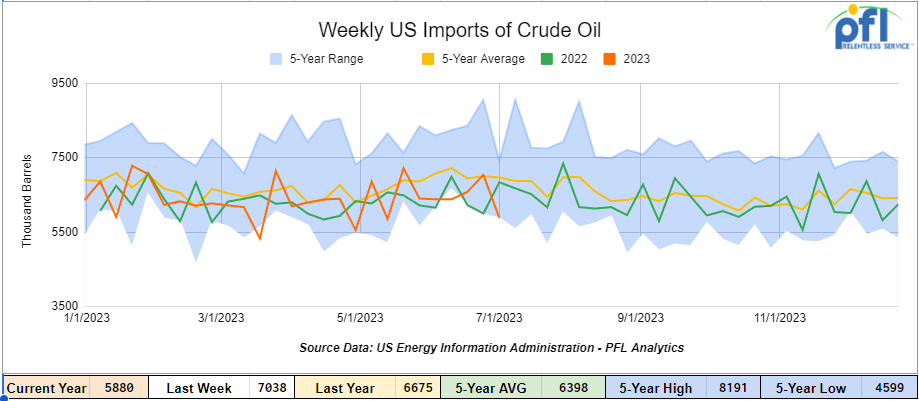

U.S. crude oil imports averaged 5.9 million barrels per day during the week ending July 7th, 2023, a decrease of 1.2 million barrels per day week over week. Over the past four weeks, crude oil imports averaged 6.4 million barrels per day, 0.3% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 779 thousand barrels per day, and distillate fuel imports averaged 71 thousand barrels per day during the week ending July 7th, 2023.

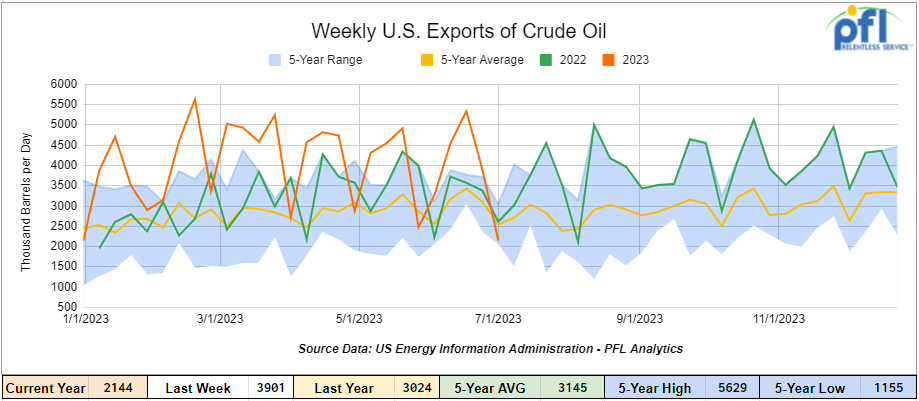

U.S. crude oil exports averaged 2.144 million barrels per day for the week ending July 7th, 2023, a decrease of 1.757 barrels per day week over week. Over the past four weeks, crude oil exports averaged 3.981 million barrels per day.

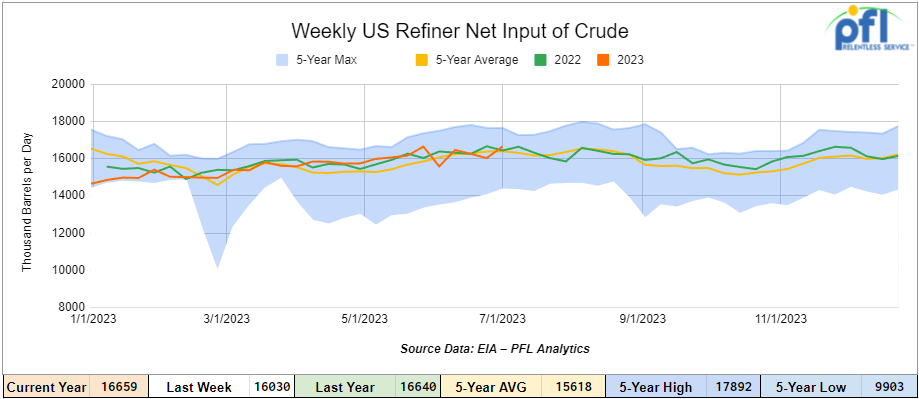

U.S. crude oil refinery inputs averaged 16.7 million barrels per day during the week ending July 7, 2023, which was 630,000 barrels per day more than the previous week’s average.

As of the writing of this report, WTI is poised to open at $74.12, down -1.32 cents per barrel from Friday’s close.

North American Rail Traffic

Week Ending July 12th, 2023.

Total North American weekly rail volumes were down (-7.07%) in week 27, compared with the same week last year. Total carloads for the week ending on July 12th, 2023 were 315,630, down (-3.12%) compared with the same week in 2022, while weekly intermodal volume was 262,997, down (-11.41%) compared to the same week in 2022. 9 of the AAR’s 11 major traffic categories posted year over year decreases with the most significant decrease coming from Grain (-19.08%). The largest increase came from Motor Vehicles and Parts (+12.67%).

In the East, CSX’s total volumes were down (-4.92%), with the largest decrease coming from Grain (-35.85%) and the largest increase from Petroleum and Petroleum Products (+16.18%). NS’s volumes were down (-5.49%), with the largest decrease coming from Petroleum and Petroleum Products (-33.31%) and the largest increase from Other (+7.68%).

In the West, BN’s total volumes were down (-9.15%), with the largest decrease coming from Grain (-26.52%), and the largest increase coming from Motor Vehicles and Parts (+39.96%). UP’s total rail volumes were down (-2.46%) with the largest decrease coming from Other (-30.16%) and the largest increase coming from Motor Vehicles and Parts (+11.70%).

In Canada, CN’s total rail volumes were down (-15.92%) with the largest increase coming from Coal (+44.14%) and the largest decreases coming from Intermodal (-58.16%). CP’s total rail volumes were down (15.45%) with the largest decrease coming from Intermodal (-41.77%) and the largest increase coming from Motor Vehicles and Parts (+86.76%).

KCS’s total rail volumes were down (-14.81%) with the largest decrease coming from Intermodal (-31.48%) and the largest increase coming from Grain (+20.94%).

Source Data: AAR – PFL Analytics

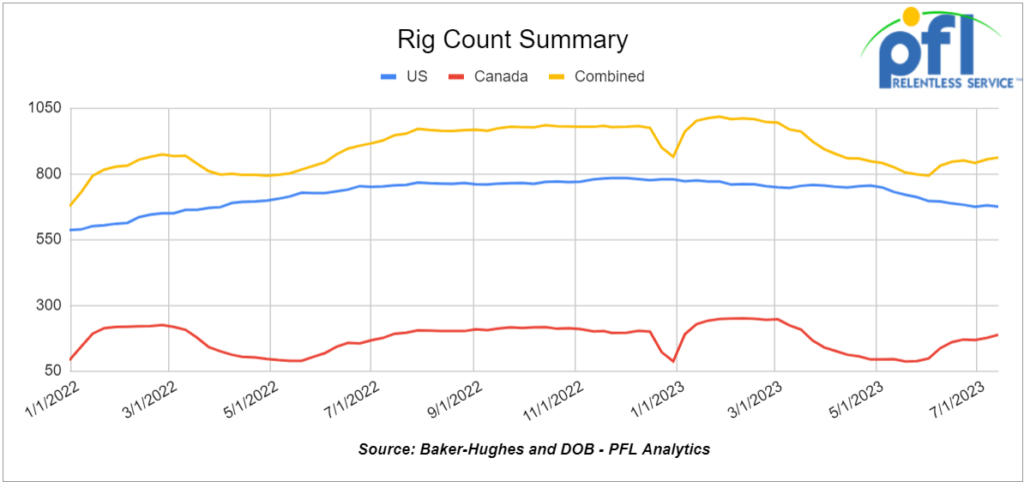

Rig Count

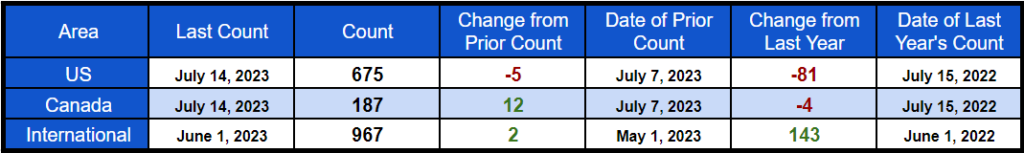

North American rig count was up by +7 rigs week over week. U.S. rig count was down by -5 rigs week over week and down by -81 rigs year-over-year. The U.S. currently has 675 active rigs. Canada’s rig count up by +12 rigs week-over-week and flat year over year. Canada’s overall rig count is 187 active rigs. Overall, year-over-year, we are down -85 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 25,089 from 25,473, which was a loss of -384 rail cars week-over-week. Canadian volumes were mixed. CPKC’s shipments increased by +15.70% week over week, and CN’s volumes were lower by -1.8% week-over-week. U.S. shipments were mostly lower. The NS had the largest percentage increase and was down by -21.3% week-over-week. The BN was the sole gainer and was up by +16.6%.

We are watching the Permian Basin

A recent proposal by the U.S. Fish and Wildlife Service to list the dunes sagebrush lizard as an endangered species has sparked opposition and outrage from supporters of the oil and gas industry in the Permian Basin. Rep. August Pfluger, a Republican representing the area, has introduced the Limiting Incredulous Zealots Against Restricting Drilling (LIZARD) Act to strike down the decision, arguing that it poses a significant threat to energy production, including oil, natural gas, wind, and solar energy, in the region. Pfluger contends that the listing is unnecessary given the conservation efforts already undertaken by the ranching and oil and gas sectors. He highlights that these industries have enrolled over 1.9 million acres and 2.23 million acres, respectively, in conservation agreements, Moreover, the financial contributions from these agreements have supported numerous reclamation and conservation programs while allowing for responsible resource development and maintaining human presence in the region.

The initial petition for the lizard’s protection was filed in 2002, and although a 2010 finding deemed protection warranted, the decision was met with resistance from members of Congress and communities reliant on oil and gas for jobs and tax revenue. In 2012, federal officials decided against protection, citing the “best available science” and existing voluntary conservation agreements. Currently, voluntary conservation agreements cover nearly 85% of the lizard’s range in New Mexico. The Fish and Wildlife Service asserts that the new determination for listing is based on a comprehensive evaluation of scientific and commercial information.

We are watching Canada’s West Coast Port Strike

The strike at Canada’s West Coast ports has ended after the labor union and port ownership reached a deal mediated by the federal government. While workers are expected to return to their duties, it will take weeks to undo the damage caused to the supply chain during the nearly two-week strike. Delays in port operations and vessel congestion will have lasting effects, with potential delays of up to two months for shipments heading to the United States. The strike disrupted the US supply chain, with significant reductions in Canadian rail intermodal traffic. Forest products, oil, minerals, and chemicals were among the sectors most affected. The strike caused billions of dollars in trade to be tied up, impacting the strong trade relationship between the U.S. and Canada. The British Columbia Maritime Employers Association expressed regret for the economic impact and called for collective efforts to restore operations and ensure supply chain stability. Vessels were diverted to U.S. ports, affecting the flow of goods. Key issues in the negotiations included work assignments and wages. The strike’s end coincided with the Bank of Canada raising its benchmark interest rate to combat inflation.

We Are Watching The EPA – Country’s Small Refineries Hit a Setback

The EPA announced on Friday of last week that it has denied 26 small refinery exemption petitions for those seeking relief from the Renewable Fuel Standard for compliance years spanning 2016 to 2023, according to an agency release.

The agency said the mass denial comes under a new interpretation of the provisions determining SRE issuance under the Clean Air Act.

This new interpretation stems from precedent under a January 2020 ruling on the program by the 10th U.S. Circuit Court of Appea in which the court established that SREs should only be granted when a small refinery’s hardship is caused directly by compliance with the program and has already been affirmed under similar issued denials last year, the agency said.

“After reviewing more than a decade of RFS market data and confidential information submitted by petitioning small refineries, EPA concluded that none of the 26 SRE petitions demonstrated disproportionate economic hardship caused by compliance with the RFS program,” the agency said in a release.

While that 10th Circuit ruling does only apply to the regions within that Circuit, the agency said in a Friday filing that it was electing to apply it nationally under “the complete discretion” afforded EPA Administrator Michael Regan in the Clean Air Act to do so.

After the mass denial late Friday, only two 2018 petitions remain pending on the agency’s online dashboard. These refineries now need to start blending more biofuels or pay more as obligated parties for costly RINS increasing operating costs.

We have been extremely busy at PFL with return-on-lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

Lease Bids

- 15, 30K 117 Tanks needed off of NS in SouthEast for 1 Year. Cars are needed for use in Diesel service.

- 25, 33K 340W Pressure Tanks needed off of UP or BN in Midwest for Oct-March. Cars are needed for use in Propane service.

- 20-25, 30K 117 Tanks needed off of UP or BN in Illinois for 5 Years. Cars are needed for use in Ethanol service.

- 10, 30K 117 Tanks needed off of NS or CSX in Marcellus for Trip Lease. Cars are needed for use in C5 service.

- 100, 28.3K DOT 111/117 Tanks needed off of UP or BN in Midwest/Texas for 5 Years. Cars are needed for use in Veg Oils/Biodiesel service. Need to be Unlied

- 25-50, 33K 400W Pressure Tanks needed off of CN or CP in Canada for Short Term. Cars are needed for use in Propylene service.

- 50-100, 4550 Covered Hoppers needed off of UP or BN in Texas for 5 Years. Cars are needed for use in Grain service.

- 10, 33K 340W Pressure Tanks needed off of CN in LA for 1 Year. Cars are needed for use in Butane service.

- 25, 20.5K CPC1232 or 117J Tanks needed off of BNSF or UP in the west for 3-5 Year. Cars are needed for use in magnesium chloride service. SDS onhand

- 25-50, 25.5K 117J Tanks needed off of NS CSX in NorthEast for 5 Years. Cars are needed for use in Asphalt/Heavy Fuel Oil service.

- 25-50, 25.5K 117J, 117R, CPC 1232 Tanks needed off of UP or BN in Texas for 1-2 Years. Cars are needed for use in Asphalt service.

- 30-50, 33K 340W Pressure Tanks needed off of any class 1 in any location for 6-12 Months. Cars are needed for use in Propane service.

- 60-150, 30K 117J Tanks needed off of TYR, UP in Corpus Christi, TX for 1 year. Cars are needed for use in Diesel service.

- 100, 30K 117J Tanks needed off of CN in Detroit for 1 Year. Cars are needed for use in Refined Fuel service.

- 15, 28.3K 117J Tanks needed off of any class 1 in any location for 3 year. Cars are needed for use in Glycerin & Palm Oil service.

- up to 50, 31.8K 117J, 117R, CPC 1232 Tanks needed off of any class 1 in Texas or Ohio for 1-3 years. Cars are needed for use in Diesel/Gasoline service.

- 45, 3000 cf PDs Hoppers needed off of any class 1 in Texas for 3 years. Cars are needed for use in Any service.

- 30, 17K-20K 117J Tanks needed off of UP or BN in Midwest/West Coast for 3-5 Years. Cars are needed for use in Caustic service.

- 10, 286K 15.7K Tanks needed off of KCS in Texas for 1 Year. Cars are needed for use in Sulfuric Acid service. Needed Next few months

- 150, 23.5K DOT 111 Tanks needed off of any class 1 in LA for 2-3 Year. Cars are needed for use in Fluid service. Needed July

- 25-50, 32K 340W Pressure Tanks needed off of NS or CSX in Marcellus for 1-2 Years. Cars are needed for use in Propane service.

- 25-50, 30K DOT 111, 117, CPC 1232 Tanks needed off of CN or CP in WI, Sarnia for 1-2 Years. Cars are needed for use in Diesel service.

- 10, 30K DOT 111, 117, CPC 1232 Tanks needed off of UP or BN in Beaumont, Houston, Sunray for 6 Months. Cars are needed for use in Diesel service. Dirty to Dirty

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

- 30-40, 286K DOT 113 Tanks needed off of CN or CP/ UP in Canada/MM for 5 Years. Cars are needed for use in CO2 service. Q1

- 70, 32K 340W Pressure Tanks needed off of CP or CN in Edmonton for 3 Years. Cars are needed for use in Propane service.

- 200-300, 28.3K 117R or 117J Tanks needed off of CP or CN in Sarnia for 3 Years. Cars are needed for use in Fuel Oil service.

- 30, 30K DOT 111 Tanks needed off of UP in Texas for 1-3 Years. Cars are needed for use in Diesel service.

- 5-7, 28.3K 117R Tanks needed off of NS or CSX in NC for 1 Year. Cars are needed for use in UCO service.

- 25-50, 5000CF-5100CF Lined Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in dry sugar service. 3 bay gravity dump

- 10, any capacity Stainless Steel Tanks needed off of any class 1 in Canada for 5-10 years. Cars are needed for use in Alcohol service.

- 30-50, 30K 117 Tanks needed off of any class 1 in Northeast or Midwest for 1 Year. Cars are needed for use in C5 service. Must have Magrods

- 100, 33K 340W Pressure Tanks needed off of CN in Canada for 3-5 Years. Cars are needed for use in Propane service.

- Up to 60, 5150cf Covered Hoppers needed off of CN, CSX, NS in the east or midwest for 3 years. Cars are needed for use in Fertilizer service. 3-4 hatch gravity dumps

- 20-30, 14k Any Tanks needed off of BNSF, UP in Texas for 1-3 Years. Cars are needed for use in HCl service. Call for more details

Sales Bids

- 1-2, Any DOT 111, 117, CPC 1232 Tanks needed off of any class 1 in Texas. Coiled and Insulated

- 45, 3000 cf PDs Hoppers needed off of any class 1 in Texas. Negotiable

- 20-25, 25.5K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Texas. Cars are needed for use in Veg Oil service. Coiled and insulated

- 15, 30K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Texas. Cars are needed for use in Veg Oil service.

- 2-4, 28K DOT 111 Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

- 100, Plate F Boxcars needed off of BN or UP in Texas.

- 200+, 5000cf Covered Hoppers needed off of any class 1 in various locations.

- 20-30, 3000 – 3300 PDs Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 100, 15.7K DOT 111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT 111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

- 20, 2770 Mill Gondolas needed off of CSX in the northeast. Cars are needed for use in non-haz soil service. 52-60 ft

- 10, 4000 Open Hoppers needed off of CSX in the northeast. Cars are needed for use in scrap metal service. Open top hopper

- 10, 6400 Open Hoppers needed off of CSX in the northeast. Cars are needed for use in wood chip service. Open top hopper, flat bottom

Lease Offers

- 70, 25.5K, 117J Tanks located off of UP in Texas. Cars are clean Call for more information

- 30, 23.5K, DOT111 Tanks located off of UP or BN in Texas. Cars were last used in Clean / UAN.

- 25-100, 17.6K, DOT111 Tanks located off of UP or BN in Midwest. Cars were last used in Fertilizer / Corn Syurp. Free move available

- 20, 20k, DOT111 Tanks located off of CSX in GA. Cars are clean

- 2, 20K, DOT111 Tanks located off of UP in TX. Cars are clean

- 5, 20K, DOT111 Tanks located off of UP in TX. Cars were last used in Sulfuirc Acid. Free move available

- 108, 28.3K, 117R Tanks located off of All Class 1’s in St. Louis. Cars are clean

- 25, 28.3K, DOT111 Tanks located off of UP in Texas. Cars were last used in Biodiesel. Free move available. Dirty to dirty service.

- 47, 6500, Covered Hoppers located off of UP and BN in Iowa. Cars are clean

Sales Offers

- 100-200, 31.8K, CPC 1232 Tanks located off of BN in Chicago. Dirty/Clean

- 100, 28.3K, 117J Tanks located off of various class 1s in multiple locations.

- 110, 25.5K, DOT 111 Tanks located off of UP and BN in Moving. Dirty, Food Grade

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|