“When you forgive you heal. When you let go you grow. “

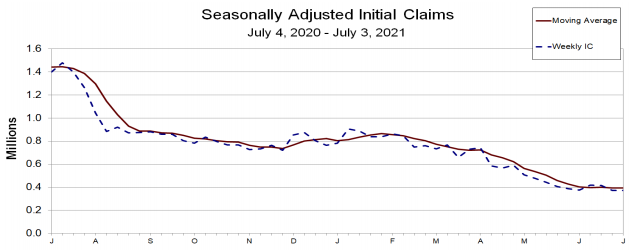

Weekly Jobless up Week over Week and higher than expected

- New weekly jobless claims unexpectedly ticked up higher last week.

- The Department of Labor released its weekly report on new jobless claims on Thursday morning last week as it does every week at 8:30 a.m. Eastern Standard Time.

- Initial jobless claims for the week ended July 3, 2021 came in at 373,000 versus the 350,000 people expected and a revised 371,000 for the prior week.

- Continuing claims for the week ending June 26, 2021 came in at 3.339 million versus the 3.350 million people expected and a revised 3.484 million during prior week.

Stocks up on Friday of last week and up week over week

The Dow closed higher on Friday of last week, up +448.23 (+1.33%) points closing out the week at 34,870.16 up+83.81 points week over week. The S&P 500 closed higher on Friday of last week, up +48.73 points (+1.13%) and closing out the week at 4,369.55, up +17.21 points week over week. The Nasdaq closed higher on Friday of last week, up +142.13 points (+0.98%) and closing out the week at 14,701.92, up +62.59 points week over week.

In overnight trading, DOW futures traded lower and are expected to open down this morning 152 points.

Oil up on Friday but down week over week for the first time in 7 weeks

Oil prices rose on Friday, fueled by strong U.S. fuel consumption data, but held back by continued uncertainty about the OPEC+ deal. WTI crude oil closed higher on Friday of last week up +1.62 a barrel to settle at $74.61 a barrel, down -$0.55 a barrel week over week. Brent crude oil for August delivery closed higher on Friday of last week gaining +$1.45 a barrel, and closing at $75.60, down -$0.57 a barrel week over week.

U.S. commercial crude oil inventories decreased by 6.9 million barrels week over week. At 445.5 million barrels, U.S. crude oil inventories are 7% below the five year average for this time of year.

Total motor gasoline inventories decreased by 6.1 million barrels week over week and are 2% below the five-year average for this time of year. Gasoline demand surged to a record high as Americans took to the road for the July 4th holiday weekend. Gasoline supplied, a proxy for demand, rose to 10 million barrels a day the week ended July 2, the highest since 1990 according to the EIA. Finished gasoline and blending components inventories both decreased last week.

Distillate fuel inventories increased by 1.6 million barrels week over week and are 6% below the five year average for this time of year.

Propane/propylene inventories increased by 500,000 barrels week over week and are 18% below the five year average for this time of year.

Total commercial petroleum inventories decreased by 9.9 million barrels last week.

U.S. crude oil imports averaged 5.9 million barrels per day last week, a decrease of 500,000 barrels per day week over week. Over the past four weeks, crude oil imports averaged 6.5 million barrels per day, 2.2% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) last week averaged 1.0 million barrels per day, and distillate fuel imports averaged 131,000 barrels per day.

U.S. crude oil refinery inputs averaged 16.1 million barrels per day during the week ending July 2, 2021 which was 184,000 barrels per day less than the previous week’s average. Refineries operated at 92.2% of their operable capacity last week. Gasoline production increased last week, averaging 10.6 million barrels per day. Distillate fuel production decreased last week, averaging 5.0 million barrels per day.

Oil is lower in overnight trading and, as of the writing of this report, WTI is poised to open at $73.32, down $1.24 cents per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were up 14.3% year over year in week 26 (U.S. +17.1%, Canada +5.0%, Mexico +13.4%) resulting in 2Q 2021 volumes that finished up 20.1% year over year and year to date volumes that are up 12.2% year over year (U.S. +13.7%, Canada +8.9%, Mexico +4.7%).

9 of the AAR’s 11 major traffic categories posted year over year increases with the largest increases coming from intermodal (+11.0%), coal (+37.1%), metallic ores & metals (+43.9%) and nonmetallic minerals (+21.7%). The largest decrease came from grain (-9.9%).

In the East, CSX’s total volumes were up 23.5%, with the largest increases coming from coal (+146.5%) and intermodal (+16.6%). NS’s total volumes were up 14.1%, with the largest increases coming from intermodal (+8.8%), coal (+21.8%) and metals & products (+50.0%).

In the West, BN’s total volumes were up 17.6%, with the largest increases coming from intermodal (+16.4%), coal (+26.0%) and metallic ores (+945.0%). UP’s total volumes were up 11.5%, with the largest increases coming from intermodal (+11.2%), chemicals (+20.8%) and stone sand & gravel (+29.6%).

In Canada, CN’s total volumes were up 6.6%, with the largest increases coming from coal (+66.3%), intermodal (+5.2%) and metallic ores (+17.1%). The largest decrease came from grain (-26.8%). RTMs were up 7.7%. CP’s total volumes were up 6.8%, with the largest increases coming from coal (+60.1%), intermodal (+6.3%) and petroleum (+46.1%). The largest decreases came from farm products (-53.0%) and grain (-20.2%). RTMs were down 0.9%.

KCS’s total volumes were up 11.7%, with the largest increases coming from petroleum (+32.9%) and chemicals (+28.2%).

Source: Stephens

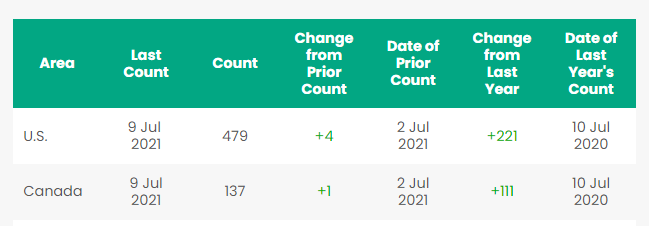

Rig Count

North American rig count is up by 5 rigs week over week. The U.S. rig count was up 4 rigs week over week and up by 221 rigs year over year. The U.S. currently has 479 active rigs. Canada’s rig count was up by 1 rig week over week, and up by 111 rigs year over year and Canada’s overall rig count is 137 active rigs. Year over year we are up 332 rigs collectively.

North American Rig Count Summary

U.S. shale producers continue to show discipline and promised investors they would keep a tight rein on spending in 2021 and the restraint on drilling has extended to their hedging strategies even as crude prices surged due to disarray among OPEC+. Hedging programs are expensive, especially in a rising price environment and your hedges turn against you – that’s when margin calls kicks in and ties up even more capital. Investors would rather see producers at this point boost production at higher prices than take a chance on additional hedging.

Things We are Keeping an Eye on

- Petroleum by Rail – The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 23,656, from 23,642 a gain of 14 rail cars week over week. Canadian volumes were lower – CN shipments declined by 2.5% while CP shipments fell by 4.4%. U.S. shipments were mixed. The NS had the largest percentage increase, up by 6.1% and the UP had the largest percentage decrease down by 12.7%.

- North Dakota is suing the U.S. government on claims the Department of the Interior and the Bureau of Land Management illegally canceled oil and gas lease auctions in the state. The complaint, filed late Wednesday of last week with the United States District Court for the District of North Dakota Western Division, said March and June auctions nixed by the federal agencies cost the state $80 million in lost revenues. “I have taken this action to protect North Dakota’s economy, the jobs of our hard-working citizens, and North Dakota’s rights to control its own natural resources,” North Dakota Attorney General Wayne Stenehjem said in a statement.

- Gasoline and Diesel railcars are getting backed up into the U.S. as exports into Mexico takes a breather. Mexican authorities are expected to continue their crackdown on private refined products imports in order to give state owned Pemex more market share, according to market experts and observers. “The government goals are very clear: they want all the hydrocarbons in the country to be supplied by Pemex, either through its own production or through its imports,” independent consultant Susana Cazorla said on July 7th. Cazorla was speaking at a virtual seminar on the current strategy of President Andres Manuel Lopez at which panelists agreed the government is unlikely to back down from its strategy despite the inability of the country’s production to meet demand and the inefficiencies linked to limiting competition. Kansas City Southern is the only railway company that imports liquid fuels into the country.

- The Biden Administration was busy last week signing more executive orders and this time taking aim at the shipping industry and railroads:

- The U.S. government took aim at the ocean shipping industry in a sweeping executive order that President Joe Biden signed July 9th that also targeted anti-competitive practices in the healthcare, internet service, and agribusiness sectors. The executive order specifically encourages the U.S. Federal Maritime Commission “to ensure vigorous enforcement against shippers charging American exporters exorbitant charges,” according to a fact sheet the White House released.

- President Joe Biden signed another executive order that same day on economic competition in which he called on the Surface Transportation Board (STB) to require freight railroads to provide rights of way to passenger rail and to strengthen their obligations to treat other freight companies fairly. The order includes 72 initiatives by more than a dozen federal agencies “to promptly tackle some of the most pressing competition problems” across the U.S. economy, according to a fact sheet the White House released.

- Folks, there is a “phantom pipeline” out there for Canadian crude to reach the gulf and it is already approved and is called “Capline.” Capline was designed initially to transport 417,000 bbls/d of imported crude from the Louisiana coast to the hub in Patoka, Ill., then to Midwest refineries, is about to have a reset. Its reborn status could be very good news for western Canadian oil producers. The 1,017-kilometer, 40-inch diameter line, originally called the Cajun Pipeline, went into service in 1967. Its capacity was increased to 1.2 million bbls/d in the 1980s. When imports of foreign oil into the U.S. slowed so did the Capline pipeline. Its owners, Plains All American, Marathon Petroleum Corp. and BP Plc. had other plans however and in 2019 they decided to go ahead with a project that will see its flow reversed, starting early next year. It will initially transport light crude from the Memphis area to St. James, La., where Plains and Marathon have invested heavily in storage and loading facilities. The following year heavy oil and bitumen will be able to flow from the hub of Patoka. Plains is doubling the capacity on its Diamond Pipeline to 400,000 bbls/d, while also building a 60-kilometer connection from Diamond to Capline, which will accommodate heavy crude transport

Capline Pipeline System

Analysts have said Capline could transport 600,000 to 650,000 bbls/d of heavy crude to the Gulf Coast, just about 200,000 bbls/d lower than what the ill-fated Keystone XL pipeline would have transported to the Texas coast. A headwind for crude by rail.

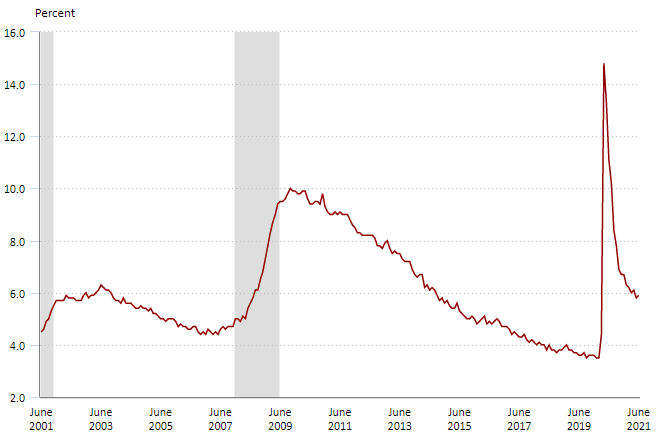

We have been keeping our eye on some key economic indicators as Q2 2021 officially winds down:

- The Bureau of Labor Statistics reported on July 2 that a preliminary 850,000 net new jobs were created in June 2021. This is higher than most economists expected, and a solid increase from May 2021 (583,000) and April 2021 (269,000). In March and April 2020, a net 22.4 million jobs were lost; since then, a net 15.6 million have been created, leaving a shortfall of 6.8 million. The official unemployment rate rose to 5.9% in June from 5.8% in May. Folks, we are back to September 2014 unemployment levels with seemingly a tremendous amount of jobs available.

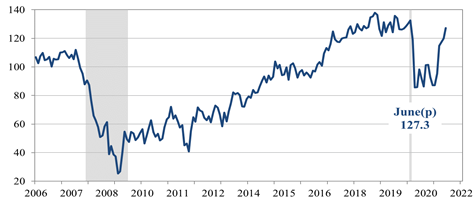

- Consumer Confidence – The Conference Board Consumer Confidence Index® improved further in June, following gains in each of the previous four months. The Index now stands at 127.3, up from 120.0 (an upward revision) in May. The Present Situation Index—based on consumers’ assessment of current business and labor market conditions—rose from 148.7 to 157.7. The Expectations Index—based on consumers’ short-term outlook for income, business, and labor market conditions—improved to 107.0, up from 100.9 last month. “Consumer confidence increased in June and is currently at its highest level since the onset of the pandemic’s first surge in March 2020,” said Lynn Franco, Senior Director of Economic Indicators at The Conference Board. “Consumers’ assessment of current conditions improved again, suggesting economic growth has strengthened further in Q2.

Consumer Confidence Index

Source: The Consumer Confidence Board Consumer Spending – Total consumer spending was virtually flat Month over Month for May according to the Bureau of Economic Analysis and according to figures released on June 25, 2021 which is down from a 0.9% gain in April and a 5.0% gain in March. Spending on services was up 0.7% in May, however, spending on goods was down 1.3%. May was the second straight month in which consumer spending on services grew more quickly than consumer spending on goods.

Typically, U.S. consumers spend about two dollars on services for every dollar they spend on goods. A decrease in spending on motor vehicles and parts was the leading contributor to the decrease in goods. As of May 2021 spending on services still had not returned to its pre-pandemic levels. Personal saving was $2.29 trillion in May and the personal saving rate – personal saving as a percentage of disposable personal income – was 12.4 percent. An improving job market, higher consumer confidence, and unprecedented levels of savings suggest that consumer spending, of both goods and services may have some legs.

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Railcar Markets

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 100 fuel oil cars in Texas dirty to dirty service

- 125 non coiled R’s or J’s clean or last in Jet Fuel needed in Houston

- 100 31.8k CPC 1232’s for the Use in Gas or Diesel service in Texas for 1 Year.

- 100 30K 117R or J’s for the Use in Gas or Diesel service in Texas for 1 Year.

- 110 117 J’s 28.3 for dirty to dirty service in Alberta for crude.

- 20 19,000 Gal Stainless cars in Louisiana UP for nitric acid 1-3 years negotiable

- 90-110 Pressure Cars 340s in Alberta on the CN 2-4 years Butane/Propane

- 10-15 Stainless 23.5 cars coiled and insulated in the East 1-2 years

- 5 Gondolas for Sale for aggregate in Texas any line

- 8 Hoppers for plastic pellets wanted to purchase

- 15-25 3915 CF PD Hoppers in Chicago any class one 3 year lease – negotiable

- 50-100 117Rs 30.3 gallon for refined products UP and BN Texas negotiable

- 18-25 5,200CF or greater covered hoppers needed in Illinois off the CN or NS.

- 20-25 30K 117Rs for the use in ethanol in the Midwest. Dirty to dirty service/

- 10 6,300CF or greater covered hoppers needed in the Midwest.

- 8 plastic pellet hoppers for purchase.

- 10 PD cars for cement service for purchase.

- 20 17K tank cars for purchase. Must be food grade.

- 50-100 C/I food grade tank cars needed for veg oil in the Midwest for 1 year

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js – Selection is Dwindling. Call Today!

- 50 29,188 US GAL EC&I CPC 1232s with Magnetic gage rods for up to 1 year starting ASAP

- 200 4300 Hoppers in Canada – Lined and dirty Negotiable

- 20 117R 30K plus tanks for ethanol in Wisconsin off the CN Negotiable

- 80 6350 Grain Hoppers in Nebraska on the BN Clean Negotiable

- 90 117Rs 30K located in Alberta CN or CP Refined Products Dirty – negotiable

- 37 BRAND NEW 5161 Sugar Hoppers in Arkansas UP – negotiable

- 205 117Js 29K BRAND NEW in Colo and Iowa off the UP, BNSF – price negotiable

- 99 340W Pressure Cars various locations Butane and Propane dirty negotiable

- 100 340W Pressure Cars Montana or Kansas LPG last in – negotiable

- 218 73 ft 286 GRL riser less deck, center part for sale,

- 19 auto-max II automobile carrier racks – tri-49 for sale – negotiable

- 10 food grade stainless steel cars

- 30 CPC 1232 25.5K Pennsylvania NS clean negotiable

- 20-30 29K C/I 117J cars for lease up to 1 year. Dirty in Biodiesel and can be returned dirty.

- 100-150 29K C/I 117J cars for lease. Dirty in Bakken crude and can be returned dirty.

- 100 29K C/I 117J cars for lease. Dirty in Heavy Crude and can be returned dirty.

- 100-200 LPG Tanks dirty to dirty up to 5 years – various locations – negotiable

- 100 117Rs 29K clean last used in crude Washington State – price negotiable sale or lease

- 21 111s 29K tanks last in alcohol dirty on the CN in Wisconsin for lease price negotiable

- 100 111s of various volumes and locations last in fuel oil dirty price negotiable

- Various Hoppers for sale and lease 3000-5800 CF 263 and 286 multiple locations negotiable

- 45 Boxcars 60ft Plate F’s Located in Tenn CSX – Lease Negotiable

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|