“Try not to become a person of success, but rather try to become a person of value”

– Albert Einstein

Jobs Update

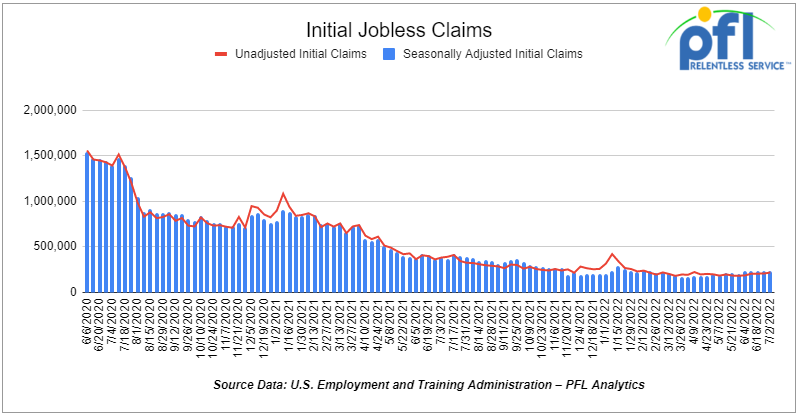

- Initial jobless claims for the week ending July 2nd, 2022 came in at 235,000, up 4,000 people week-over-week.

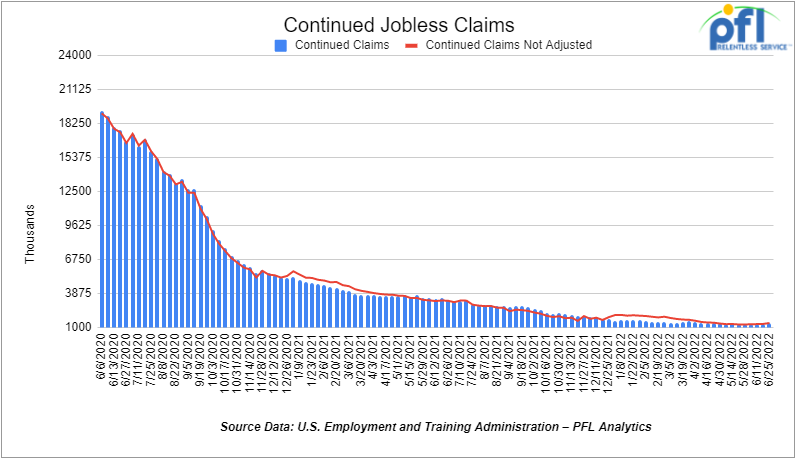

- Continuing claims came in at 1.735 million people, versus the adjusted number of 1.324 million people from the week prior, up 51,000 people week over week.

Stocks closed mixed on Friday of last week

The DOW closed lower on Friday of last week, down -46.40 points (-0.15%), closing out the week at 31,338.15, up 240.89 points week over week. The S&P 500 closed lower on Friday of last week, down -3.24 points (-0.08%) and closed out the week at 3,899.38, up 74.05 points week over week. The NASDAQ closed higher on Friday of last week, up 13.96 points (+0.13%) and closed the week at 11,635.31 points, up 507.46 points week over week.

In overnight trading, DOW futures traded lower and are expected to open at 31,207 this morning down -103 points.

Oil settled higher day over day and lower week over week.

Recession fears took hold of oil markets last week, with both WTI and Brent briefly slipping at one point below $100.00. Since then, Brent has rebounded above the three-digit threshold, while WTI has yet to recover. This has given rise to hopes that gasoline prices could also slip further after the national average inched down from an all-time high of more than $5 per gallon. It appears, however, that there is little hope for a significant decline at the pump.

A Tweet by President Biden made on the July 4 weekend became viral for calling on fuel station owners to lower prices.

“My message to the companies running gas stations and setting prices at the pump is simple: this is a time of war and global peril,” Biden wrote. “Bring down the price you are charging at the pump to reflect the cost you’re paying for the product. And do it now,” Biden

The responses that this Tweet garnered were not all positive, with some telling Biden that this is not how the retail fuel industry works, others noting that fuel station owners do not make the enormous sum of money Biden had suggested.

Even Amazon’s Jeff Bezos lashed out at the president, effectively accusing him of either deliberately misdirecting attention or demonstrating “a deep misunderstanding of basic market dynamics.”

The exchange of tweets—which continued with White House Press Secretary Karine Jean-Pierre claiming oil prices had fallen by $15 over June – that was a blip in time and they picked their moment.

West Texas Intermediate crude (WTI) settled at $104.79 a barrel, gaining $2.06, or 2.01% on Friday of last week, down $2.27 a barrel week over week. Brent crude futures settled at US$107.02 a barrel on Friday of last week, rising US$2.37, or 2.27%, but down $3.03 per barrel week over week

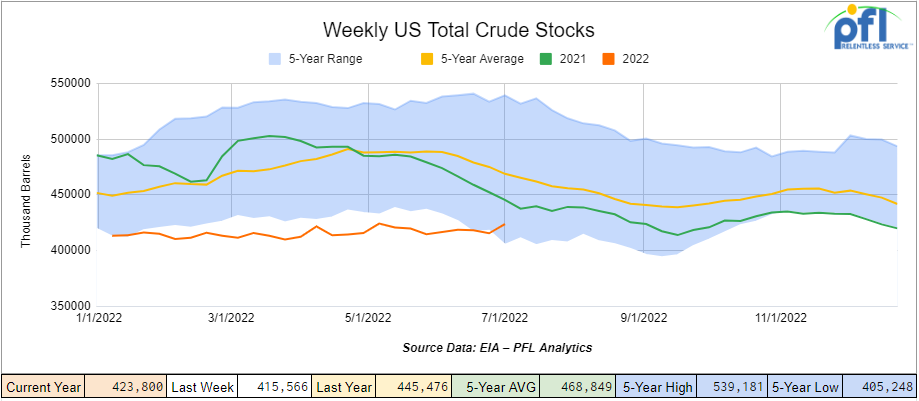

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 8.2 million barrels week over week. At 423.8 million barrels, U.S. crude oil inventories are 10% below the five-year average for this time of year.

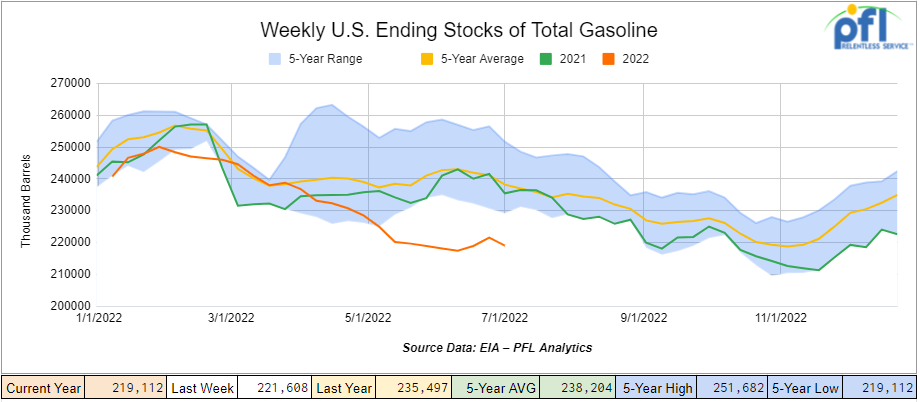

Total motor gasoline inventories decreased by 2.5 million barrels week over week and are 8% below the five-year average for this time of year.

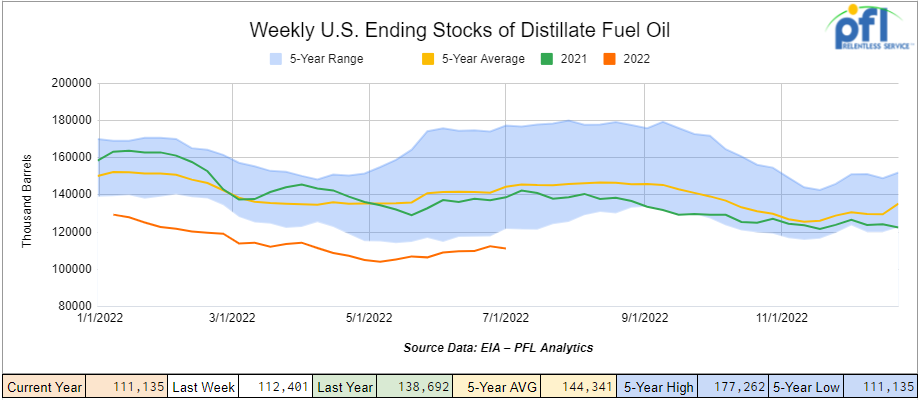

Distillate fuel inventories decreased by 1.3 million barrels week over week and are about 20% below the five-year average for this time of year.

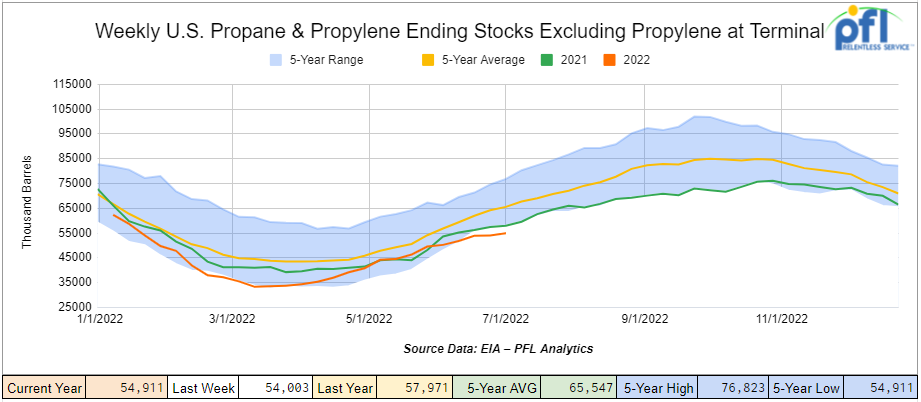

Propane/propylene inventories increased by 900,000 barrels week over week and are 16% below the five-year average for this time of year.

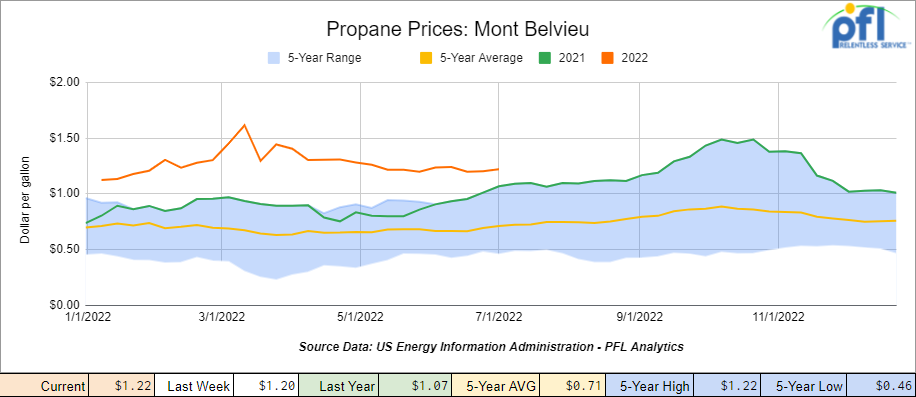

Propane closed out the week at $1.22 per gallon up 2 cents per gallon week over week and up 15 cents per gallon year over year.

Overall, total commercial petroleum inventories increased by 5.1 million barrels last week.

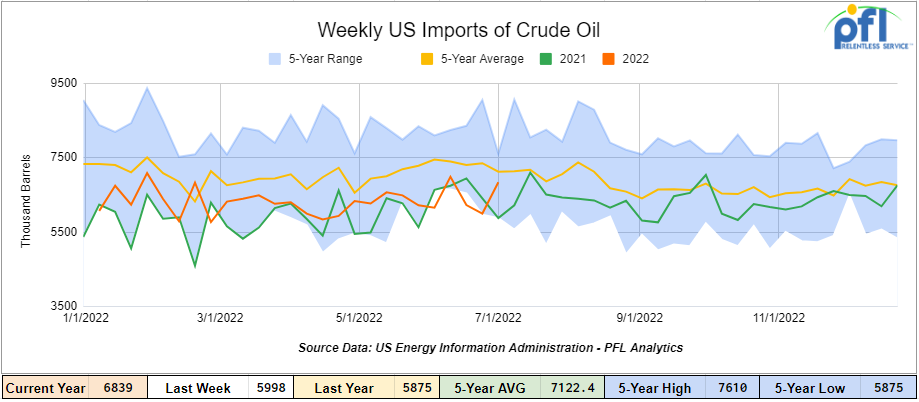

U.S. crude oil imports averaged 6.8 million barrels per day during the week ending July 1st, 2022, and increased by 800,000 barrels per day from the previous week. Over the past four weeks, crude oil imports averaged about 6.5 million barrels per day, 0.3% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 945,000 barrels per day, and distillate fuel imports averaged 104,000 barrels per day for the week ending July 1,2022.

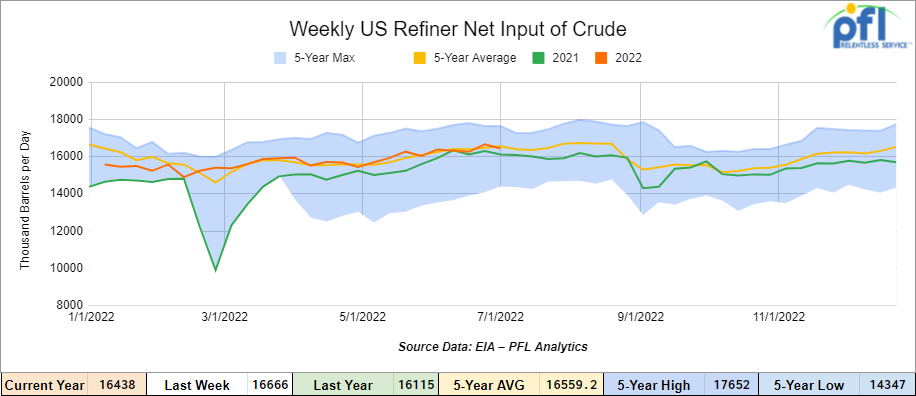

U.S. crude oil refinery inputs averaged 16.4 million barrels per day during the week ending July 1, 2022, which was 228,000 barrels per day less than the previous week’s average.

As of the writing of this report, WTI is poised to open at $102.58, down $2.21 per barrel from Friday’s close.

North American Rail Traffic

Week Ending July 2nd, 2022.

Total North American weekly rail volumes were down -3.6% in week 27 compared with the same week last year. Total carloads for the week ending June 26th were 330,619, down -1.1% compared with the same week in 2021, while US Weekly intermodal volume was 265,724, down -5.8% compared to 2021. 6 of the AAR’s 11 major traffic categories posted year-over-year declines with the largest decreases coming from Grain (-14.2%) and Other (-7.6%) The largest increase was from Coal (+4.7%) and Nonmetallic Minerals (4.5%).

In the east, CSX’s total volumes were down -1.39%, with the largest decrease coming from Coal (-9.3%) and the largest increase from Grain (+11.55%) and Petroleum Products (+11.51%) Norfolk Southern’s total volumes were down -1.65%, with the largest decrease stemming from Chemicals (-10.10%) and the largest increase from Farm and Food Product (+12.79%).

In the west, BNSF’s total volumes were up 2.02%, with the largest decrease stemming from Motor Vehicles and Parts (-11.07%) and Chemicals (-9.85%), the largest increase from Metallic Ores and Minerals (+7.67%), and Grains (+7.25%) UP’s total rail volumes were up 4.38% with the largest decrease stemming from Petroleum and Petroleum Products (-4.79%) and the largest increase from Coal (+23.18%).

In Canada CN’s total rail volumes were up 3.89% with the largest decrease stemming from Grain (-7.42%) and the largest increase from Coal (+29.41%). CP’s total rail volumes were up 0.4% with the largest increase stemming from Grain (+38.06%) and the largest decrease from Motor Vehicles and Parts (-21.17%).

KCS’s total rail volumes were up 10.35% with the largest decrease from Nonmetallic Minerals and Products (-32.14%) and the largest increase from Other (+67.01%).

Source Data : AAR – PFL Analytics

Rig Count

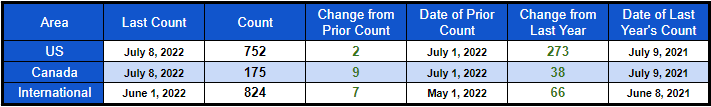

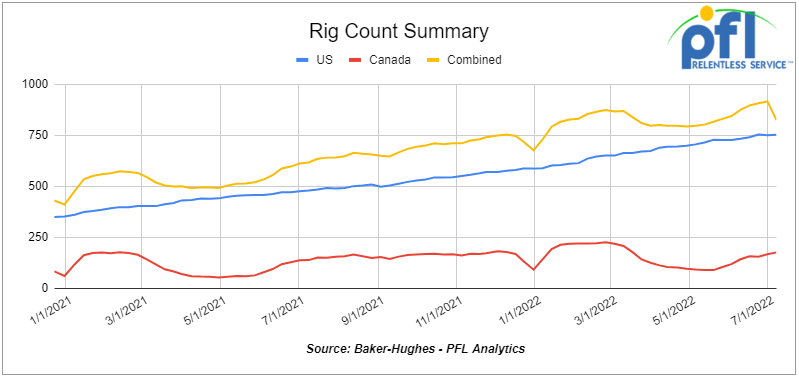

North American rig count was up 11 rigs week over week. U.S. rig count was up 2 rigs week-over-week and up by 273 rigs year over year. The U.S. currently has 752 active rigs. Canada’s rig count was up by 9 rigs week-over-week, and up by 38 rigs year-over-year. Canada’s overall rig count is 175 active rigs. Overall, year over year, we are up 311 rigs collectively.

North American Rig Count Summary

A few things we are keeping an eye on:

Some Key Economic Indicators

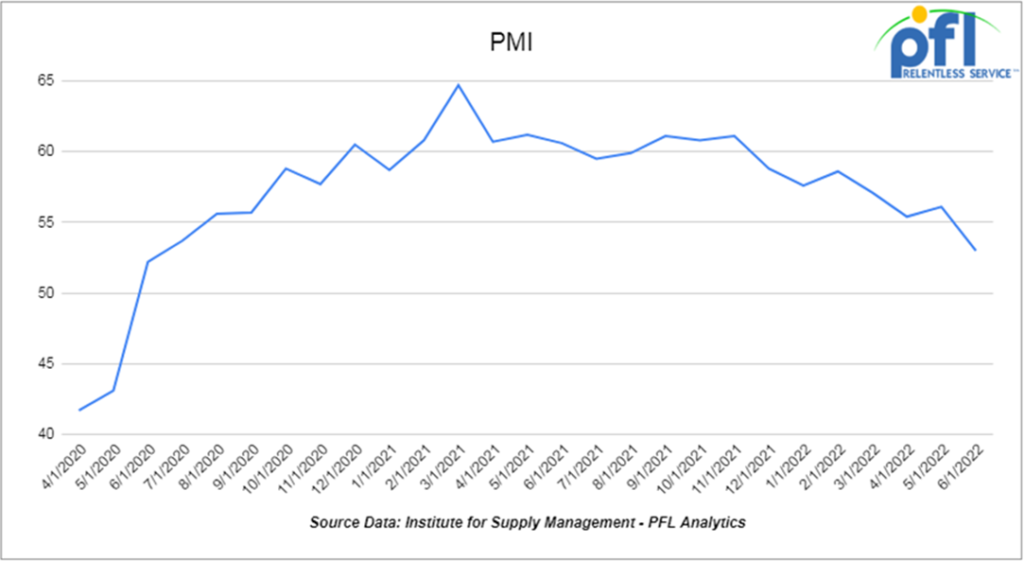

Purchasing Managers Index (“PMI”) – The PMI (which covers manufacturing) and the Services PMI (covering services) are both from the Institute for Supply Management. They are based on surveys of supply managers around the country. The surveys track the direction of changes in business activity. An index reading above 50% indicates expansion; below 50% means contraction. The more above or below 50, the faster the pace of change.

The PMI declined to 53% in June from 55.1% in May. That’s the 24th straight month above 50% but is the lowest reading since September 2020. The new orders component was 49.2% in June, down from 55.1% in May and the first time it’s been below 50% since May 2020. Meanwhile, the ISM’s Services PMI fell slightly to 55.3% in June from 55.9% in May, the sixth decline in the index in the past seven months. June’s reading was the lowest since May 2020, but is still well into the above 50% “expansion” range. The new orders component of the overall index fell to 55.6% in June from 57.6% in May.

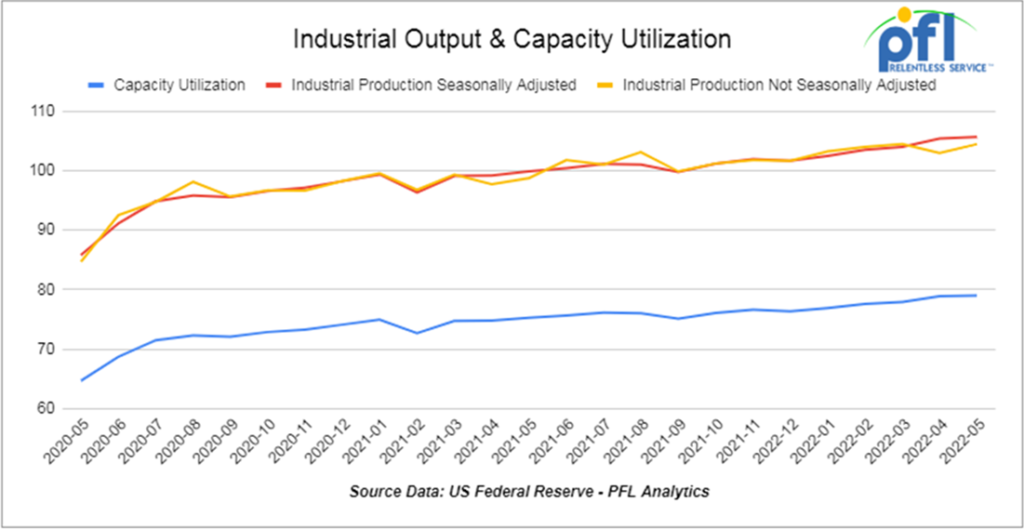

Industrial Output and Capacity Utilization – In May 2022, total seasonally adjusted industrial output was up a preliminary 0.1% over April 2022. That’s the fifth straight month-to-month gain, but it’s by far the smallest gain in those five months. One month isn’t a trend, but May’s result could be a sign of cooling economic activity in the face of higher interest rates and lower consumer confidence. Most economists expected a bigger gain in May. Manufacturing output, which is about 75% of total output (mining and utilities are the rest), fell a preliminary 0.2% in May from April, a big change from the 0.8% and 0.9% gains the previous two months.

In May, rail-relevant industries with output gains included nonmetallic minerals, petroleum, and iron, and steel. Industries with output declines in May included railroad rolling stock, wood products, and agricultural chemicals. U.S. motor vehicle assemblies in May were an annualized 10.5 million, down from 10.6 million in April, but otherwise the most since December 2020. Assemblies averaged an annualized 11.1 million per month from 2017 to 2019.

Overall capacity utilization was a preliminary 80.8% in May, down slightly from 80.9% in April. April’s reading was the highest since January 2008. For manufacturing, capacity utilization in May was 80.3%, down from 80.5% in April and the first sequential decline in four months.

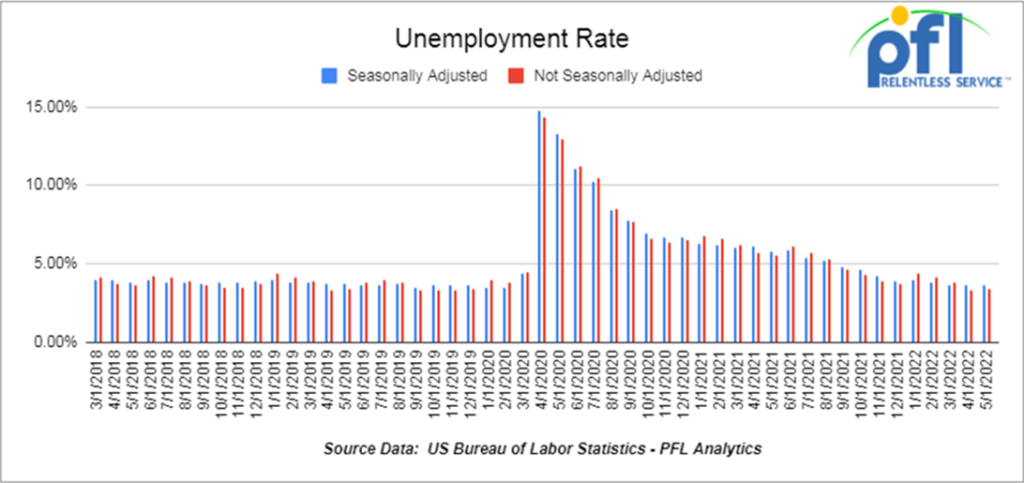

U.S. employment A preliminary 372,000 net new jobs were created in June 2022, according to data released by the Bureau of Labor Statistics (BLS) on July 8. That’s roughly the same as the past four months. The official unemployment rate in June was 3.6%, the same as it’s been for four months and near the low.

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- Up to 40 5500 Covered Gons 286 unlined CSX/NS preferred but will consider other

- 4 Lined tanks for glycerin to run from Arkansas to Georgia 1-3 years

- 30 boxcars on UP or CP for 3 years to run from TX to Edmonton – negotiable

- 6-10 Open top 4200 gons for hauling scrap NS in Ohio for 1-3 years

- 100, 2480 CU-FT Ag Gons needed in Texas off of the UP for 1-3 Years.

- 50, 30K+ Tank cars are needed in several locations. Can take in various locations off various Class 1’s. Can have prior Ethanol heel or Gasoline heel.

- 300 5800 Covered hoppers needed for plastic – 5-year lease – negotiable

- 50, 5800cuft or larger Covered Hopper for use in DDG needed in the Midwest for 3-4 years. Immediate need.

- 10-20 Covered hopper grain cars in the midwest 5200-5500 2-3 years

- 20-30, 19K Tank Cars for Caustic Soda needed in Texas off of the UP or BN.

- 100 Moulton Sulfur cars for purchase – any location – negotiable

- 50 Ag Gons 2500-2800cuft 286k GRL in the east CSX for 5 years negotiable

- 100 15K Tanks 286 for Molten Sulfur in the Northeast CSX/NS for 6 months negotiable

- 100, 5800 Covered Hoppers 286 can be West or East for Plastic 3-5 years

- 70, 117R or J needed for Ethanol for 3 years. Can take in the South.

- 50, 6500+ cu-ft Mill Gon or Open Top Hopper for wood chips in the Southeast for 5 Years.

- 20, 19,000 Gal Stainless cars in Louisiana UP for nitric acid 1-3 years – Oct negotiable

- 10, 6,300CF or greater covered hoppers are needed in the Midwest.

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js – Selection is Dwindling. Call Today!

- 200 Clean C/I 25.5K 117J in Texas. Brand New Cars!

- 150 25.5 111’s in the midwest for sale – Negotiable

- Up to 150 sand cars for sale at various locations and class ones – Great Price!

- 150 117R’s 31.8 clean for lease in Texas KCS – negotiable

- 31.8K Tank Cars last in Diesel. Dirty to dirty in Texas

- 200 117Js 29K OK and TX Clean and brand new – Lined- lease negotiable

- 100 117Rs dirty last in Gasoline in Texas for lease Negotiable

- 90 117Rs 30K located in Alberta CN or CP Refined Products Dirty – negotiable

- 99 340W Pressure Cars various locations Butane and Propane dirty negotiable

- 100 29K C/I 1232 cars for lease. Dirty in Heavy Crude and can be returned dirty.

- 50 29K 117Js in Nebraska for sale or lease clean last in crude

- 100 117Rs 29K clean last used in crude Washington State – price negotiable sale or lease

- 100 111s of various volumes and locations last in fuel oil dirty price negotiable

- Various Hoppers for lease 3000-6250 CF 263 and 268 multiple locations negotiable

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|