“There’s a lot of difference between listening and hearing.”

― G.K. Chesterton

Jobs Update

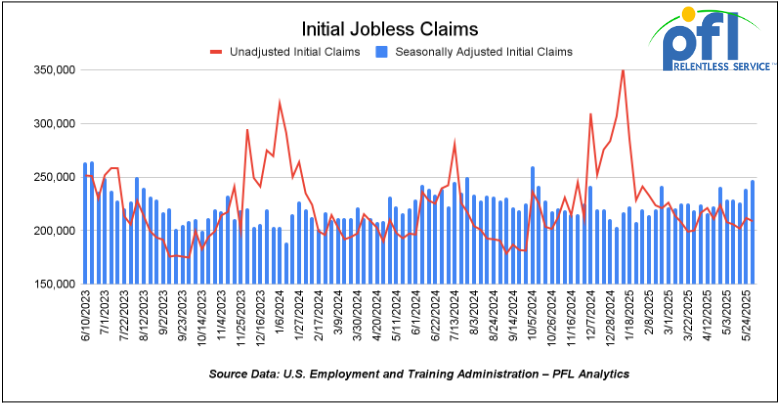

- Initial jobless claims seasonally adjusted for the week ending May 31 came in at 247,000, up 8,000 people week-over-week.

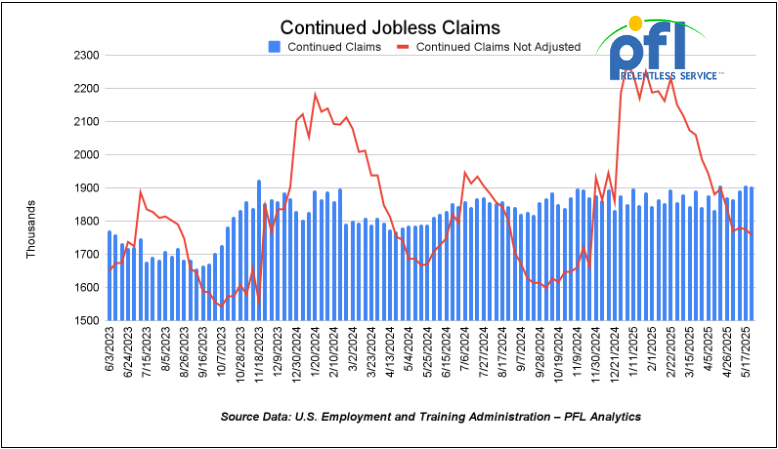

- Continuing jobless claims came in at 1.904 million people, versus the adjusted number of 1.907 million people from the week prior, down -3,000 people week-over-week.

Stocks closed higher on Friday of last week and higher week-over-week

The DOW closed higher on Friday of last week, up 443.13 points (+1.05%), closing out the week at 42,762.87, up 492.81 points week-over-week. The S&P 500 closed higher on Friday of last week, up 61.06 points, and closed out the week at 6,000.36 up 88.67 points week-over-week. The NASDAQ closed higher on Friday of last week, up 231.5 points, and closed out the week at 19,529.95, up 416.18 points week-over-week.

In overnight trading, DOW futures traded higher and are expected to open at 42,845 this morning up 36 points from Friday’s close.

Crude oil closed higher on Friday of last week and higher week-over-week.

West Texas Intermediate (WTI) crude closed up $1.21 cents per barrel (2.11%), to close at $64.59 per barrel on Friday of last week and up $3.80 per barrel week-over-week. Brent crude closed up $1.13 USD per barrel (1.96%) on Friday of last week, to close at $66.47 per barrel, up $2.57 cents per barrel week-over-week.

One Exchange WCS (Western Canadian Select) for July delivery settled on Friday of last week at US$9.10 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$53.12 per barrel.

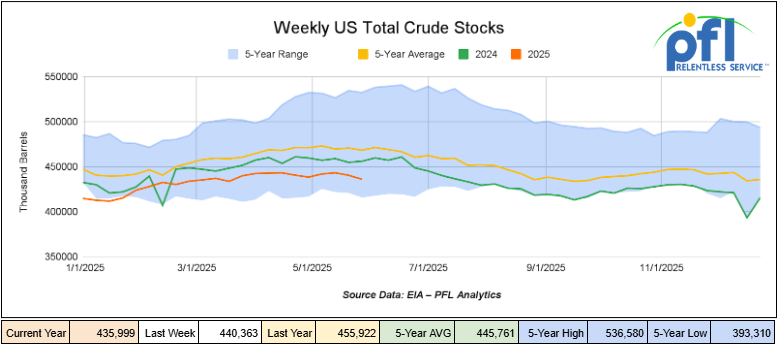

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 4.3 million barrels week-over-week. At 436.1 million barrels, U.S. crude oil inventories are 7% below the five-year average for this time of year

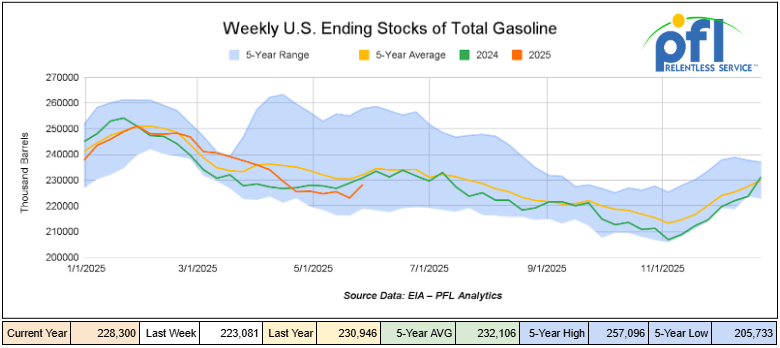

Total motor gasoline inventories increased by 5.2 million barrels week-over-week and are 1% below the five-year average for this time of year.

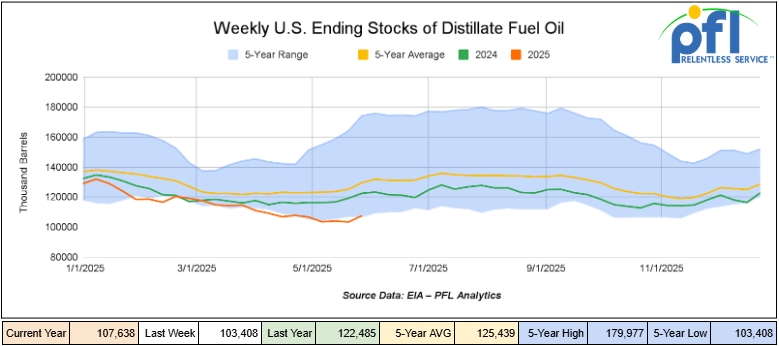

Distillate fuel inventories increased by 4.2 million barrels week-over-week and are 16% below the five-year average for this time of year.

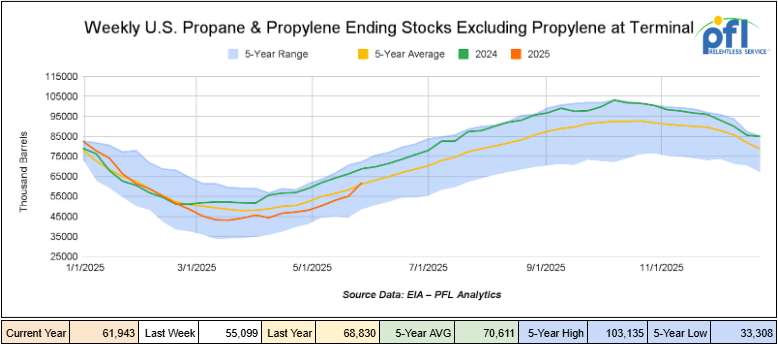

Propane/propylene inventories increased by 6.8 million barrels week-over-week and are 2% above the five-year average for this time of year.

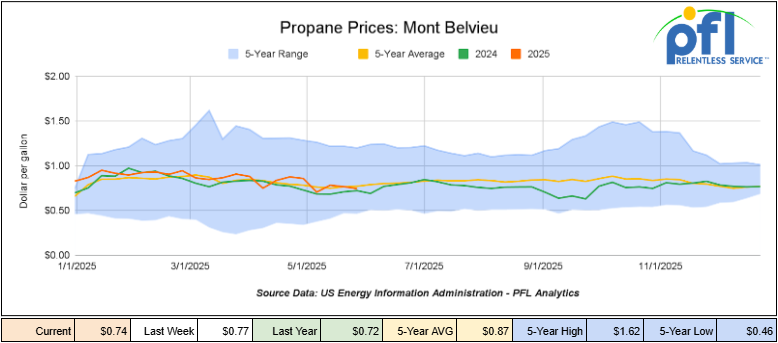

Propane prices closed at 74 cents per gallon on Friday of last week, down 3 cent per gallon week-over-week, but up 2 cents per gallon year-over-year.

Overall, total commercial petroleum inventories increased by 12.9 million barrels during the week ending May 30, 2025.

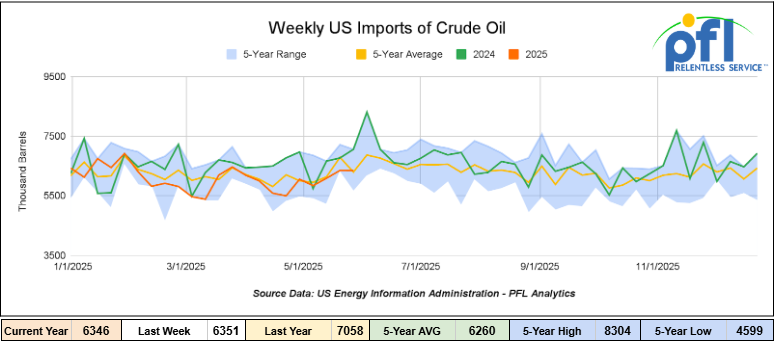

U.S. crude oil imports averaged 6.3 million barrels per day during the week ending May 30, 2025, a decrease of 5,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.2 million barrels per day, 9.6% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 845,000 barrels per day, and distillate fuel imports averaged 166,000 barrels per day during the week ending May 30, 2025.

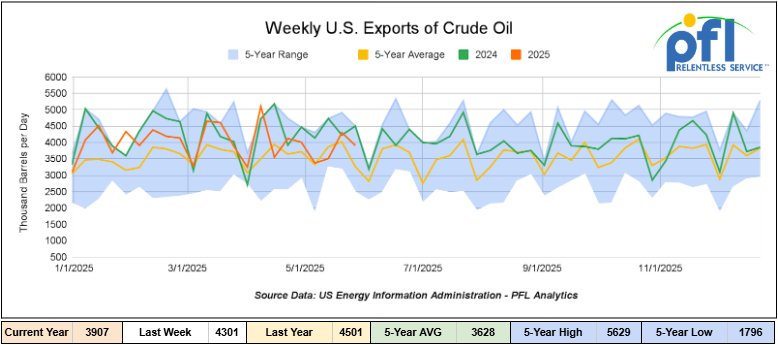

U.S. crude oil exports averaged 3.907 million barrels per day during the week ending May 30, 2025, a decrease of 394,000 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 3.771 million barrels per day.

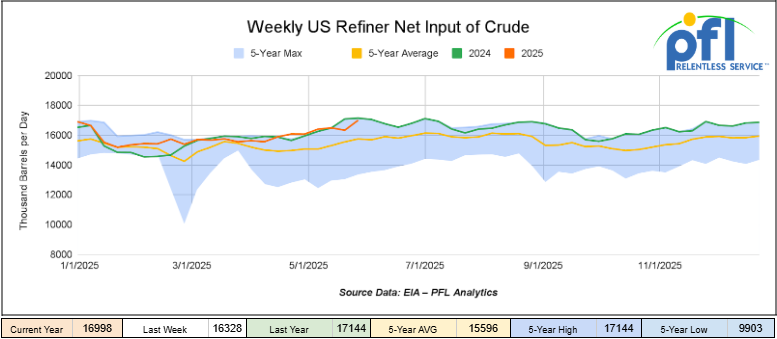

U.S. crude oil refinery inputs averaged 17 million barrels per day during the week ending May 30, 2025, which was 670,000 barrels per day more week-over-week.

WTI is poised to open at $64.61, up 3 cents per barrel from Friday’s close.

North American Rail Traffic

Week Ending June 4, 2025.

Total North American weekly rail volumes were down (-1.57%) in week 23, compared with the same week last year. Total carloads for the week ending on June 4 were 314,983, up (1.67%) compared with the same week in 2024, while weekly intermodal volume was 293,845, down (-4.82%) compared to the same week in 2024.

7 of the AAR’s 11 major traffic categories posted year-over-year increases. The largest decrease came from Forest Products, which was down (-4.82%), while the largest increase was from Nonmetallic Minerals, which was up (+19.27%).

In the East, CSX’s total volumes were up (+0.14%), with the largest decrease coming from Forest Products (-10.06%), while the largest increase came from Coal (+13.91%). NS’s volumes were up (+1.12%), with the largest increase coming from Grain (+47.24%), while the largest decrease came from Forest Products (-9.28%).

In the West, BN’s total volumes were down (-3.35%), with the largest increase coming from Other (+22.25%), while the largest decrease came from Coal (-53.96%). UP’s total rail volumes were up (+5.54%), with the largest increase coming from Nonmetallic Minerals (+33.53%), while the largest decrease came from Forest Products (-10.7%).

In Canada, CN’s total rail volumes were down (-10.01%) with the largest increase coming from Forest Products (-53.96%). CPKCS’s rail volumes were down -27.82%, with the largest increase coming from Forest Products (-69.35%)

Source Data: AAR – PFL Analytics

Rig Count

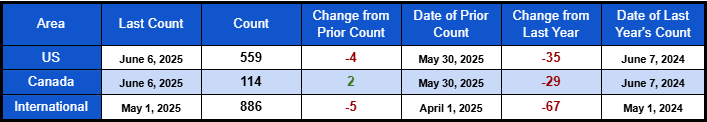

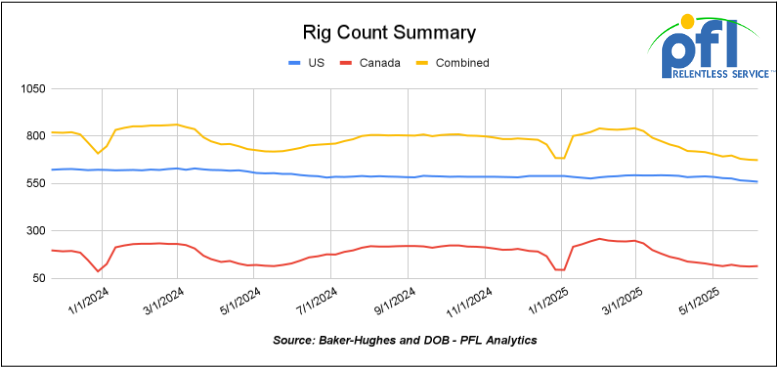

North American rig count was down by -2 rigs week-over-week. U.S. rig count was down -4 rigs week over week and down by -35 rigs year-over-year. The U.S. currently has 559 active rigs. Canada’s rig count was up 2 rigs week-over-week, but down by -29 rigs year-over-year. Canada currently has 114 active rigs. Overall, year-over-year, we are down by -64 rigs collectively.

North American Rig Count Summary

We are watching a few things out there for you:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 27,618 from 27,395 which was an increase of +223 rail cars week-over-week. Canadian volumes were lower. CPKC’s shipments were lower by -1.0% week over week, CN’s volumes were lower by -6.0% week-over-week. U.S. shipments were mostly lower. The NS had the largest percentage decrease and was down by -12.0%. The CSX was the sole gainer and was up by +8.0%

We are Watching Canada

Folks, there is a lot going on up there (a lot going on everywhere for that matter – almost impossible to keep up with the news cycle). Curtis Chandler and Cyndi Popov were at the Alberta Premier’s dinner on May 29th held in Calgary, Alberta. There were 2,000 people there to listen to her speech and it was the largest political dinner in Alberta’s history. PFL sponsored a table and sponsored three students from 3 different universities in Alberta to attend the event. We are not going to hide the fact that we have an interest in crude by rail and other petroleum products moving products on either pipe or rail, after all our name is PFL Petroleum.

We also know that Canada’s new Prime Minister, Mark Carney, is a net-zero left-leaning leader – he can’t hide it, although he tries his best. That ultimately leads to a reduction of oil and natural gas production, coupled with punitive attacks through the back door on the oil patch which he continues to pursue. He has agreed to meet and talk about the needs of each Province, but really has not committed to anything except to put a framework together to talk about it. The people of Alberta, Saskatchewan and British Columbia and to a lesser extent Manitoba are forcing his hand. It is the Premier of Alberta’s intention to work within the Canada they have, but if something doesn’t happen quickly she will have to pivot to satisfy her base and her province’s needs.

In other Alberta news, there is 344,000 barrels per day currently shut in because of Alberta wildfires close to production sites. The recently expanded Transmountain pipeline ran at 85% capacity last month as more and more Alberta producers are trying to diversify their markets as much as they can away from total reliance on the U.S. given unseen uncertainty.

Here is what the Canadian Government is now saying:

On Monday of last week, federal and provincial leaders met in Saskatoon, Saskatchewan, apparently aligning on a fast-track approach to energy and infrastructure.

On Friday of last week, the federal government introduced the One Canadian Economy Act, cutting major project approval timelines from five years to two years – should be 2 months in our opinion – projects that have been shelved years ago have been shelved because of continued regulatory red tape and lawsuits by environmental groups. Ottawa says Pipelines, ports, rail hubs – nothing is off the table. That is what they say, but time will tell.

With no thanks from Carney, already approved projects that are under construction are creating a frenzy of activity in the private sector. On Thursday of last week, CN launched a $1 billion debt offering to help fund infrastructure expansion. That builds on:

- $3.4 billion already committed to Western Canada

- $600 million announced for Ontario in May

- Key focus areas: Milton Logistics Hub, MacMillan Yard upgrades, and 225+ miles of new track

And the volumes to justify it. Canadian propane exports surged 9.2% in 2024, driven by strong demand from Asia. West Coast export terminals are ramping up to meet that need

- Ridley Island Energy Export Facility (REEF) – expected online by the end of 2026

- Trigon Pacific LPG Terminal – targeting 2028

That product has to move, and rail is the only connection from the field to tidewater.

This pivot doesn’t just affect Canada. It also reaches directly into U.S. freight corridors, where interchanges, equipment, and Gulf Coast access all come into play:

- More cross-border rail traffic as Canada scales west and south;

- Greater demand for storage, mobile services, and transloading;

- New opportunity for U.S. energy and rail players to support Canadian export routes.

Terminals are being built. Projects are funded. Trains are moving at this point, whether or not the Canadian Government wants it. It is going to come down to a deal on carbon. Whether that can be done, is anyone’s guess at this point. The Federal government have their hands out.

If you’re looking to position ahead of the curve, now’s the time to act. PFL offers flexible railcar solutions on both sides of the border—whether you need storage, mobile response, or strategy built for scale.

We are watching the Department of Energy

Two weeks ago, the Department of Energy (“DOE”) ordered Consumers Energy of Michigan to delay retiring it’s last remaining coal plant. On Friday of last week. The U.S. Department of Energy ordered Constellation Energy and PJM to delay retiring 760 MW of oil- and gas-fired peaking capacity in Pennsylvania. The DOE based its action on a PJM Interconnection warning that it may need to call on demand response resources to keep the lights on under extreme conditions this summer.

The emergency order directs Constellation to keep operating two units at its Eddystone power plant near Philadelphia until August 28th. The order can be extended, if the DOE deems it necessary.

PJM supports DOE’s order. “The department’s order is a prudent, term-limited step that will retain the covered generators for a 90-day period,” the grid operator said on Saturday. “This will allow DOE, Constellation Energy and PJM to undertake further analysis regarding the longer-term need and viability of these generators.” We like this one and are glad we are going to keep the lights on for our friends in Pennsylvania.

We are Watching the U.S. Department of Transportation

The U.S. The Department of Transportation (DOT) announced on Friday of last week that it’s pulling back on the Biden-era fuel economy rules – and that decision may affect freight movement across North America or be a disappointment for some of the anticipated freight volumes to come.

The original rules, set in June 2024, were designed to boost fuel efficiency for cars and tighten standards on heavy-duty pickups and work trucks through 2035. Some said it was really a push to force a switch to electric vehicles and DOT now says those rules went too far and broke the law by factoring in EVs where they legally shouldn’t have.

Here’s what the old rules were targeting:

- Light-duty vehicles:

– Required to reach 50.4 miles per gallon by 2032 - Heavy-duty pickups and vans:

– 10% annual fuel efficiency increase for model years 2030–2032

– 8% annual increase for model years 2033–2035

So, what’s changing?

DOT will now reset the fuel standards and leave EVs out of the equation, including for medium- and heavy-duty trucks – the same trucks used every day to move freight across the continent.

Why this matters for road and rail:

If diesel trucks become cheaper to run, some freight may shift off rail and back to the Interstate – especially on shorter or faster lanes where trucking already competes and truckers are as hungry as they ever have been. This could pressure intermodal rail volumes.

But, it’s not all bad news for rail. The rollback could also shine a spotlight on rail’s natural advantage: it’s still the most fuel-efficient way to move heavy freight long distances. As shippers juggle cost, reliability, and other goals, rail may come out ahead where it makes sense. Stay tuned to PFL, we are watching this one.

We are Watching Key Economic Indicators

Purchasing Managers Index (PMI)

The U.S. manufacturing sector continued its contraction in May, with the Institute for Supply Management (ISM) Manufacturing PMI declining to 48.5%, down from 48.7% in April. This marks the third consecutive month of contraction, attributed largely to the impact of tariffs, which have led to increased material costs, declining production, and reduced import and export volumes.

The services sector contracted in May, with the ISM Services PMI decreasing to 49.9% from 51.6% in April, indicating a modest contraction. This downturn reflects industry unease, partly due to ongoing trade tensions and import tariffs, which have disrupted supply chains and led to rising input costs.

Conversely, S&P Global’s U.S. Services PMI rose to 53.7% in May from 50.8% in April, marking the 28th consecutive month of expansion. This increase suggests that, despite market uncertainties, certain service sectors are experiencing growth, although rising costs in the service sector were widely blamed on tariffs.

Unemployment

In May 2025, total nonfarm payroll employment increased by 139,000, following revised gains of 147,000 in April and 120,000 in March. The unemployment rate remained steady at 4.2%, unchanged from April. Job gains were concentrated in healthcare (+62,000), leisure and hospitality (+30,000), and social assistance (+16,000). Federal government employment declined by 22,000 jobs. Despite ongoing economic uncertainties, including rising tariffs, the labor market continues to show resilience.

Lease Bids

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 50, 5000CF Covered Hoppers needed off of UP or BN in Houston for 6 Month. Cars are needed for use in Fertilizer service. Needed ASAP

- 30-50, 6000cf Steel Hoppers needed off of CSX or NS in East for 5 Year. Cars are needed for use in petcoke service.

- 50, 23.5-25.5 DOT111 Tanks needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

- 20, 25.5k CPC 1232 Tanks needed off of UP, BN, CSX, NS in OK, TX, Northeast for 3 Year. Cars are needed for use in Asphalt service.

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

- 15-20, 29K 117R Tanks needed off of NS or CSX in Ohio for 6-12 Months. Cars are needed for use in Ply Oil service.

- 20, 30K 117J Tanks needed off of UP or BN in Midwest for 5 Years. Cars are needed for use in Ethanol service.

- 100, 30K 117J Tanks needed off of BN in Montana for 2 years. Cars are needed for use in Crude service.

- 10, 25.5K Any Type Tanks needed off of CSX in Florida for 2 Years. Cars are needed for use in UCO service.

- 10, 25.5K Any Type Tanks needed off of Any Class 1 in Any Location for 3-12 months. Cars are needed for use in Asphalt service.

- 6, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Av Gas service.

- 10, 25.5K-30K 117R or 117J Tanks needed off of UP or BN in Texas for 1 year. Cars are needed for use in Dicyclopentadiene service.

- 70, 30K DOT 117R/ DOT 117J Tanks needed off of UP in Corpus Christi for 5 Year. Cars are needed for use in Gasoline service.

- 20, 28.3K 117J Tanks needed off of BN in Montana for 2 years. Cars are needed for use in Crude service.

Sales Bids

- 28, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Cement service. Cement Gates needed.

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

Lease Offers

- 60, 4750, Covered Hoppers located off of UP or BN in Eads, CO. Cars are clean UP to 5 Years, 3 Hopper, Gravity Gate, Trough Hatches

- 100, 6250, Covered Hoppers located off of UP in US . Cars were last used in DDG. 1 Year term. Dirty to Dirty. Free move on UP.

- 50, 33K, 400W Pressure Tanks located off of All Class 1s in US and Canada. Cars were last used in Propane. Summer or Longer Lease Available.

- 50, 29K , DOT 111 Tanks located off of CN in Hamilton, ON. Cars were last used in Biodiesel. 1 year +

- 20-25, 30K, 117J Tanks located off of BNSF in West Texas. Cars were last used in Ethanol. 1 year minimum

- 24, 25.5K-30K, DOT 111 Tanks located off of UP or BN in Texas. Cars were last used in Base Oils. 1-2 Year

- 25-50, 19.6K, DOT 111 Tanks located off of UP in US. Cars were last used in Molases .

- 10, 30, 117R Tanks located off of CN in Wisconsin. Cars were last used in Gasoline. Multiyear

- 33, 30, 117R Tanks located off of UP in Gulf. Cars are clean Multiyear

- 50, 30, 117R Tanks located off of UP in Gulf. Cars were last used in Diesel. Multiyear

- 120, 29.8K, 117R/117J Tanks located off of CPKC in MN. Cars were last used in Ethanol.

- 50, 20K, DOT 111 Tanks located off of UP or BN in Wichita Falls, TX. Cars were last used in HCL.

Sales Offers

- 21, 50′, Plate C Boxcars located off of various class 1s in NM. End of Life

- 3, 50′, Plate C Boxcars located off of various class 1s in multiple locations. End of Life

- 27, 50′, Plate C Boxcars located off of various class 1s in PQ. End of Life

- 100-300, 3250, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 5, 2740, Mill Gondolas located off of various class 1s in NC. End of Life

- 1, 2260, Mill Gondolas located off of various class 1s in AL. End of Life

- 30, 2740, Mill Gondolas located off of various class 1s in multiple locations. End of Life

- 21, 2740, Mill Gondolas located off of various class 1s in WA. End of Life

- 15, 4750, Covered Hoppers located off of various class 1s in multiple locations. End of Life

- 5, 4750, Covered Hoppers located off of various class 1s in multiple locations. End of Life

- 50-100, 31.8K, CPC 1232 Tanks located off of UP or BN in TX. Requal Due in 2025

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|

PFL will be at the Following Conferences

- Where: La Quinta, CA

- Attending: David Cohen (954-729-4774)

- Conference Website

- Where: Hyatt Regency Dallas in Dallas, TX

- Attending:Curtis Chandler (239.405.3365), David Cohen (954-729-4774), Brian Baker (239.297.4519), Cyndi Popov(403) 402-5043

- Conference Website